zhanzhibar

-

Posts

584 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

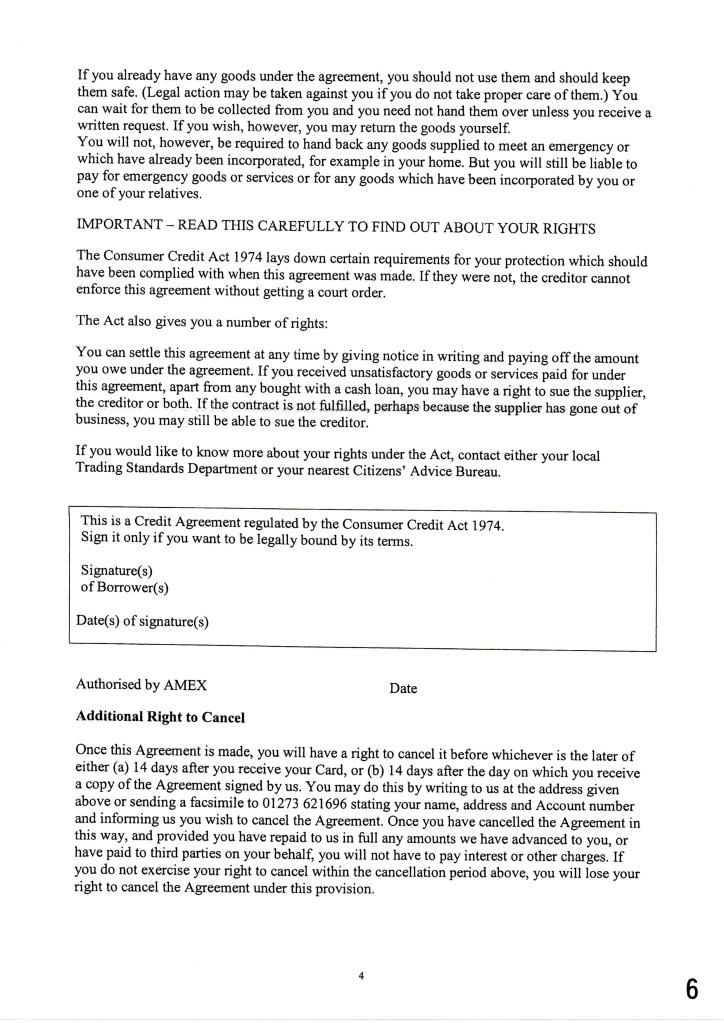

Keywords

Posts posted by zhanzhibar

-

-

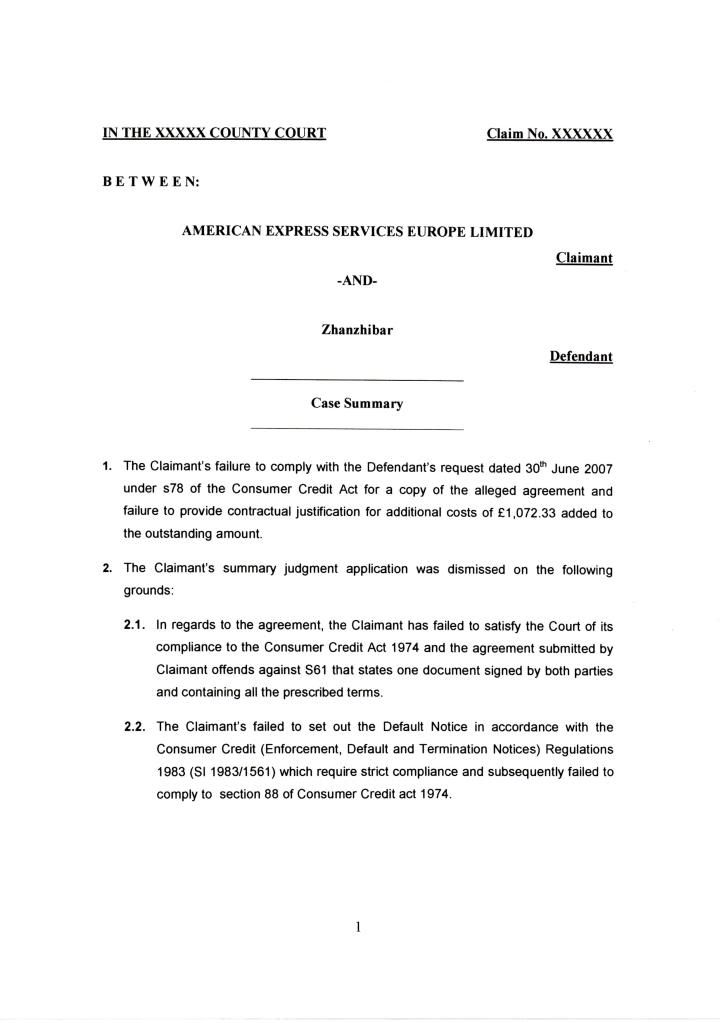

Am going to put a point number 3 for my case summary.

3. The Claimant disagree with the judgment in 2 above

-

TQ Bazaar for your input. might have to rethink my case summary & schedule of issue.

In the meantime would appreciate it if somebody could comment on my queries below re the listing Q itself

Queries:

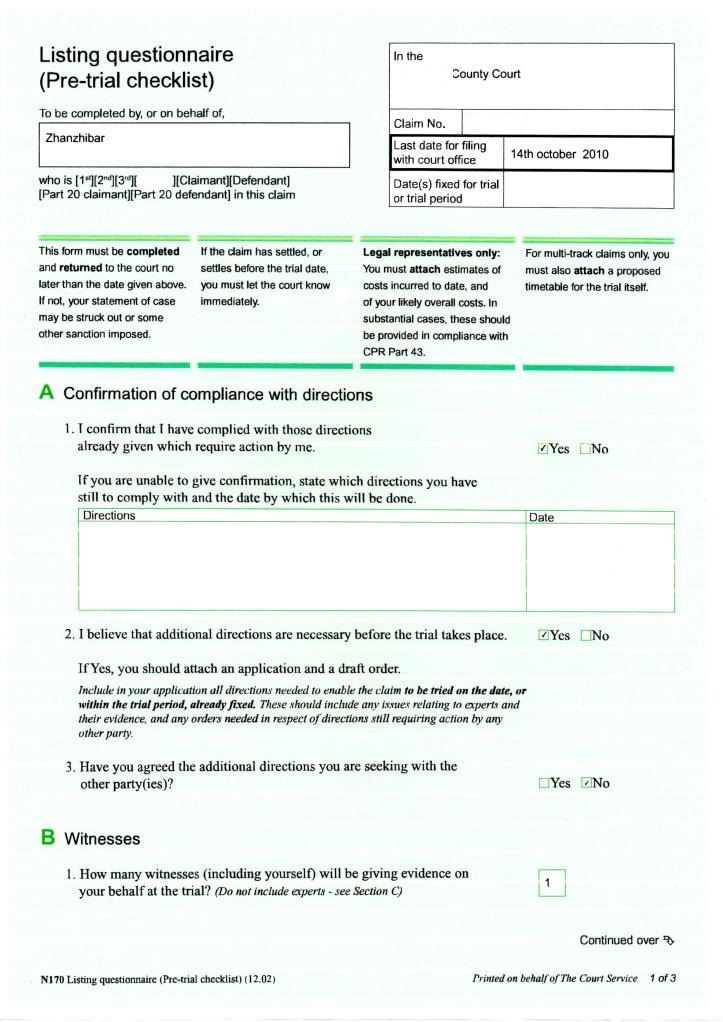

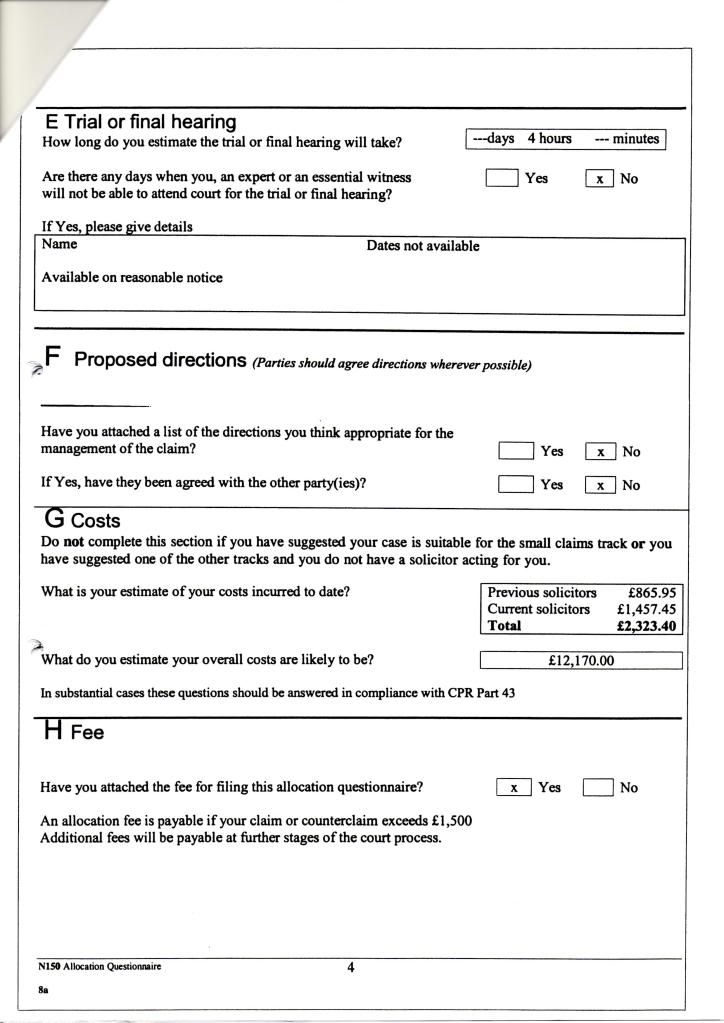

1) on A(1) I said yes because its about directions that are already given but what about A(2) additional directions? I said Yes on this mainly on the basis of the STAY application that I put through which the hearing is next week on the 22nd. Shoudl A(2) be a yes or a no & if it a YES what shall I direction shallI write.

2) In section F, if the answer is yes to A(2) above does that mean that I have put an application and pay fee for additional directions even though I have already paid for STAY application? At the moment I just ticked draft order & the estimate costs.

Help! Comments please on the above

Submitting these to Mishcon via e-mail this morning.

.

Might have to rethink about the 2 schedule above after putting kids to bed. Would appreciate any pointers...

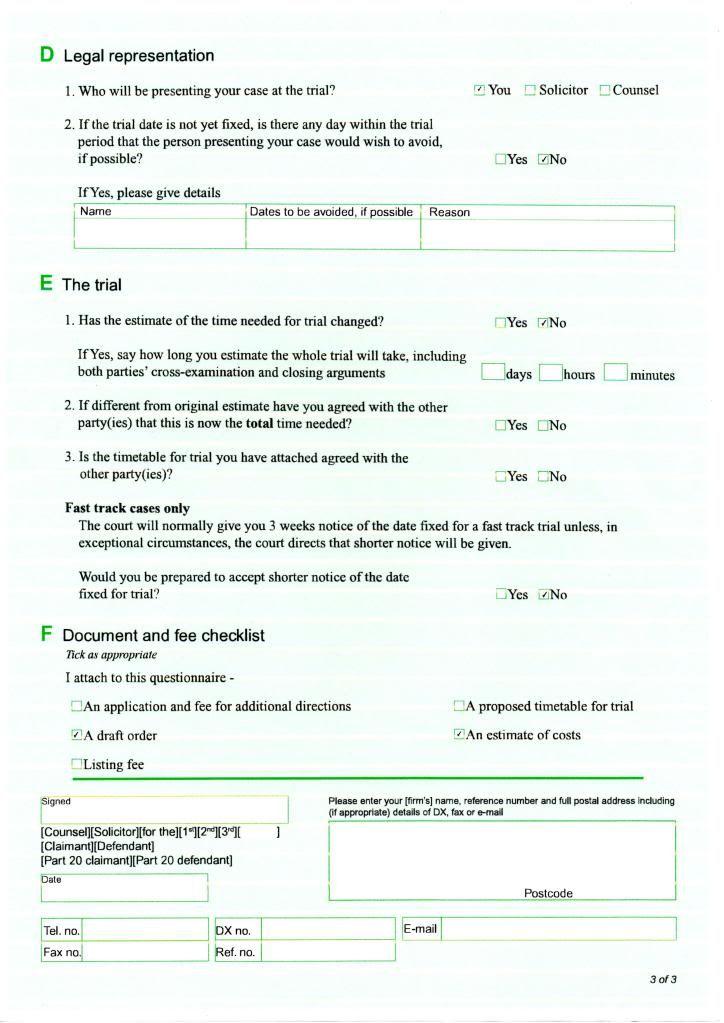

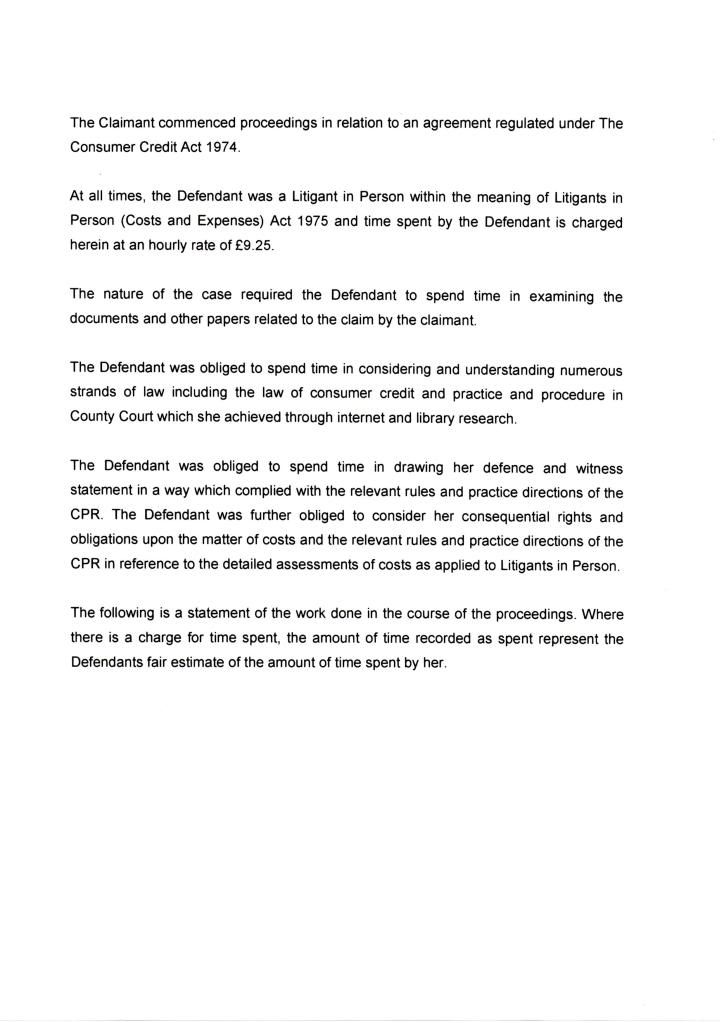

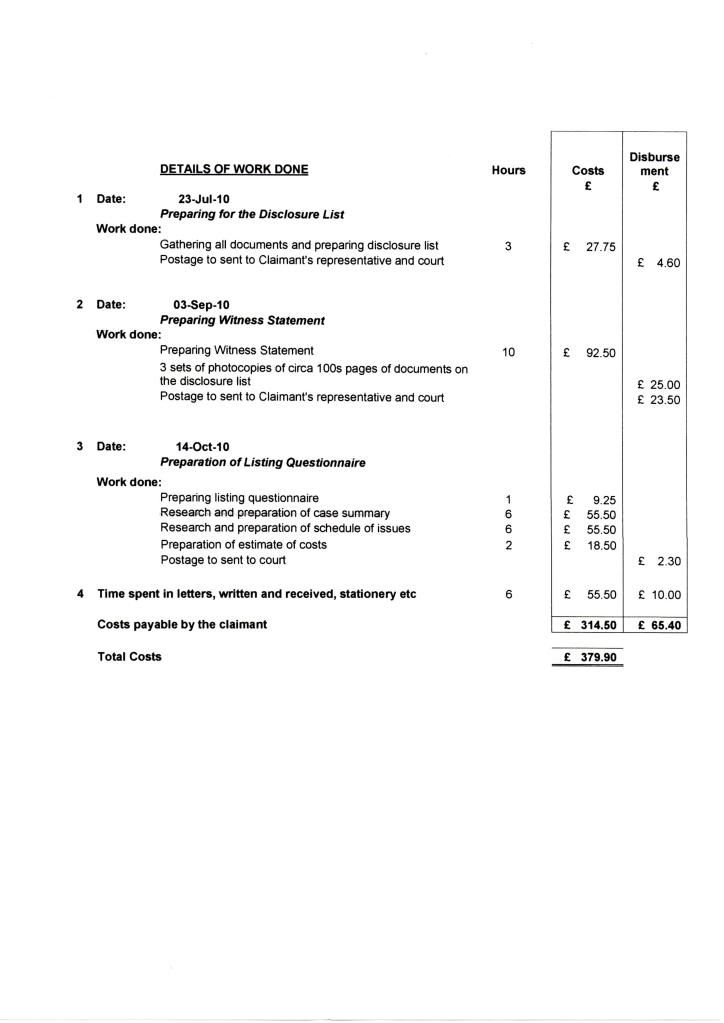

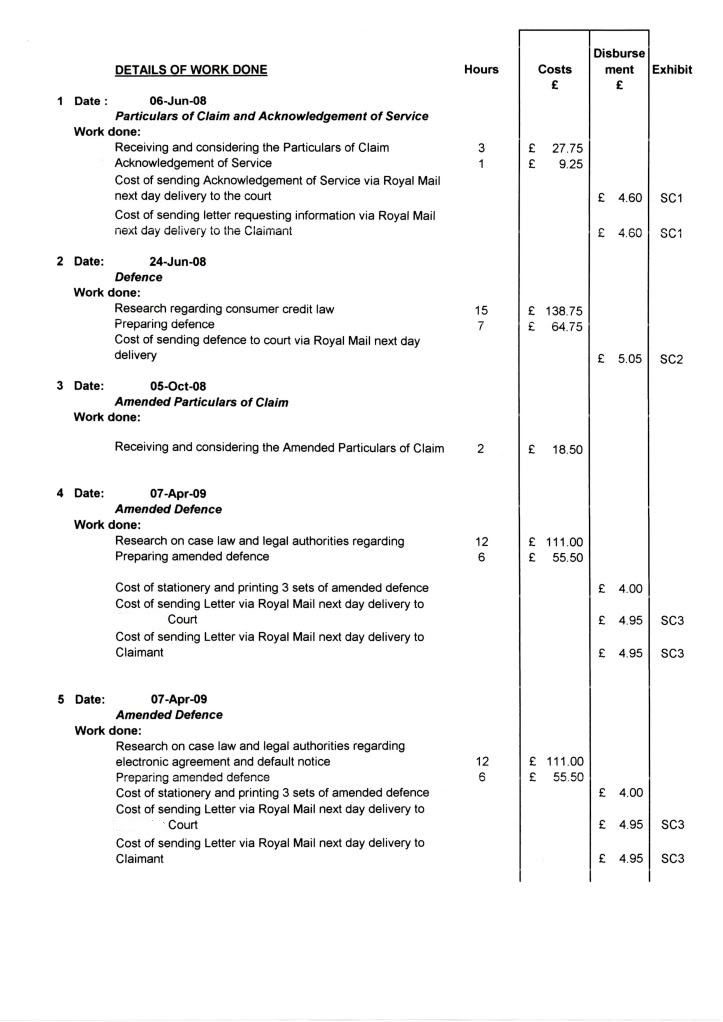

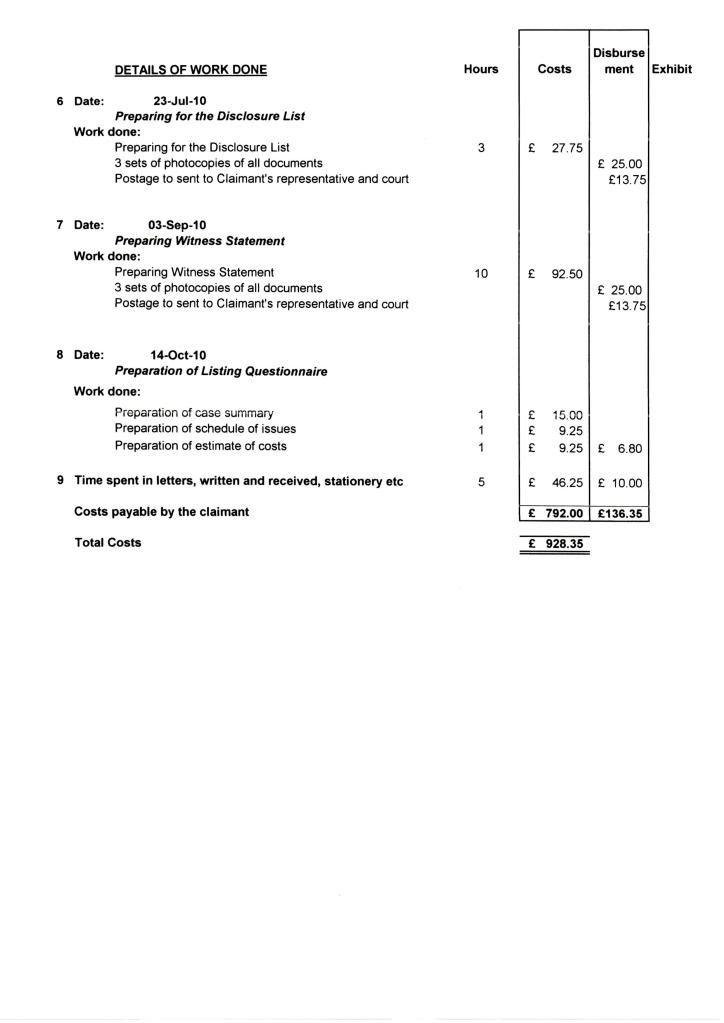

and here's my estimate of costs.. is this ok do you guys think? Looks fair unlike theirs

-

I've e-mailed them twice after their e-mail asking the wording to be more non-partisan:

Dear Sir

In that case I believe to be non-partisan

Schedule of issue

1) Is there an enforceable agreement as prescribed under Consumer Credit Act 1974 between the Claimant and the Defendant? - this should replace your point 1 and 1.1 as it is more general

More to come

Dear sir,

In the spirit of non-partisan, point 1.3 of your sch of issue should be replaced by these

1.3) Does either party have the right to terminate the contract at any time pursuant to the purported Agreement being at all times a Consumer Credit Agreement (plus perhaps and consequently regulated by the Consumer Credit Act 1974 and amendment etc)

1.4) In the event of 1.3 being proven then DID the Claimant issue a Default Notice compliant to the processes required in the CCA1974

They don't like to change their "non-partisan view" of course & reply

Dear Madam,

For the sake of efficacy, please send all of your suggested comments at the same time rather than on an ad hoc basis.

Regarding your comments:

Para 1 - In our opinion, the question for the Court to answer is not whether there is an enforceable agreement, but whether or not the Claimant may actually enforce the agreement. It would be pointless if the Court did, for example, decide that the agreement was enforceable but made no comment as to whether the Claimant was entitled to actually enforce it. The question are to whether or not you signed the agreement is therefore a live issue for the Court to consider.

We appreciate your comment regarding the generality of your proposed wording, however, the purpose of these documents is to assist the Court in pin-pointing relevant issues without being too specific so as to litigate the claim on paper. We do not therefore agree with your proposed wording.

Para 1.3/1.4 - Your proposed wording suggests that you do not agree that either party had the right to terminate the agreement at any time. We do not agree with this suggestion; the Claimant maintains that it is entitled to terminate the agreements. In our view, the question is whether the Claimant was required to serve a Default Notice prior to termination, however, in view of your comments we would suggest:

"Did both parties have the contractual power to end the Agreement at any time? If so, was the Claimant required to serve a Default Notice before terminating the Agreement and if so, did the Claimant serve a valid Default Notice on the Defendant?"

Although not ideal, given the imminent deadline to send these documents to the Court, we would suggest that, if the proposals are not agreed, each party send a separate version to the Court.

Yours faithfully

& This is Pishcon V3

So now what do I do?

-

OK I think I am in trouible now... Mishcon replied..

Dear Madam,

Your comments are noted.

Please note that the purpose of these documents is to assist the Court in identifying the issues to be determined. They are not intended to be pleadings or arguments as to the merits of the claim. Further, the Court intended for the parties to agree the documents and file a single version rather than a copy for each party. With this in mind, the drafts we proposed were intentionally non-partisan in nature and set out the facts and issues to be determined by the Court rather than the history of the claim. We do not therefore agree to your proposed drafts.

After considering your comments we have made the following amendments to the documents we proposed:

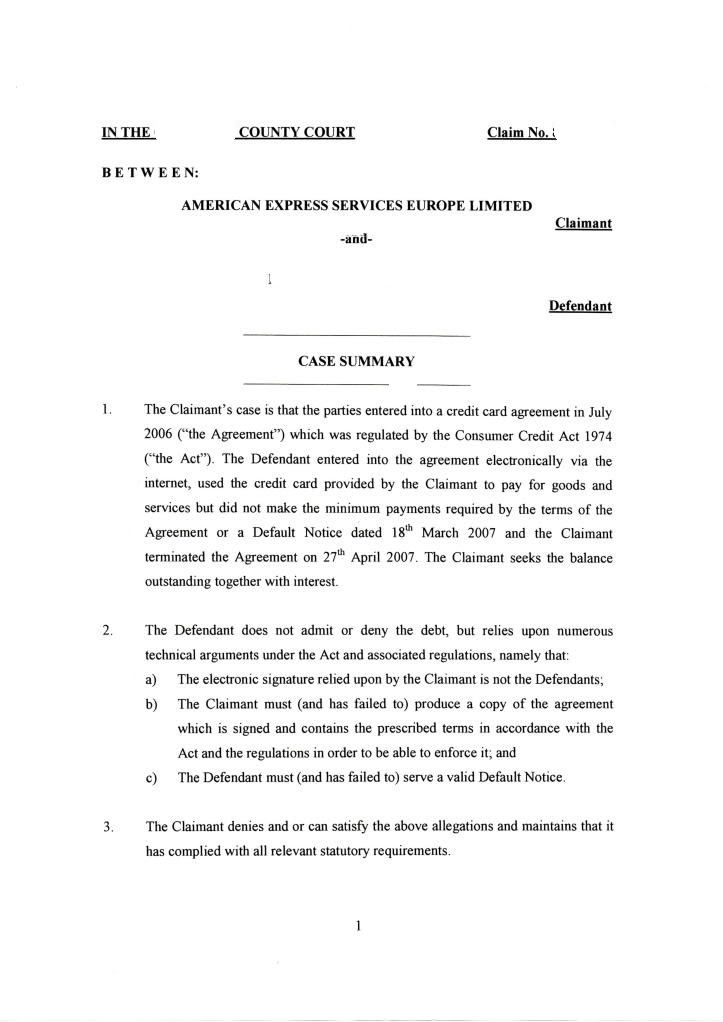

Case Summary

Paragraph 1 - the relevant sentence now reads: "The Defendant entered into the agreement electronically via the internet, used the credit card provided by the Claimant to pay for goods and services but did not, towards the end of the Agreement, make the minimum payments..."

Paragraph 2© - reference to the "Defendant" has been replaced with reference to the "Claimant".

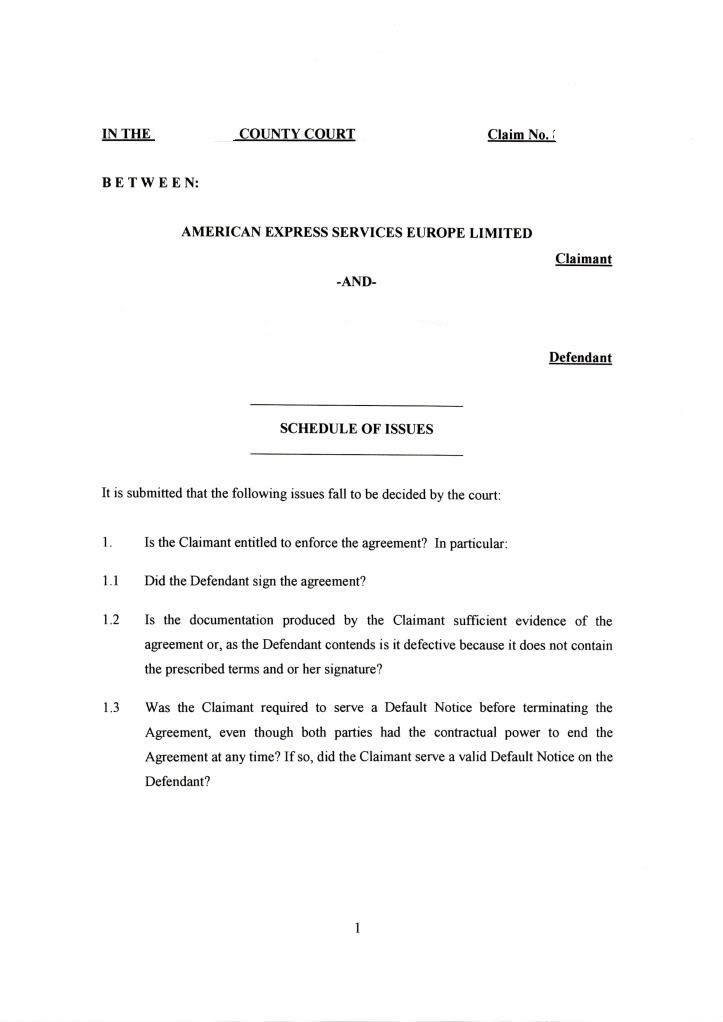

Schedule of Issues

Paragraph 1.2 has been amended as per your request.

Revised copies of these documents are attached.

Please confirm if you now agree to these documents.

Please note that, in order to file these documents with the Court by the required deadline, they will be sent to the Court by 3pm today.

Yours faithfully

So what if I disagree with their issue & case summary?

-

Submitting these to Mishcon via e-mail this morning.

Should I leave point 3 to be skeleton argument rather than issue..owh well.. I'll wait & see what they say 1st this morning.

-

I am not sure whether to put it here now or to leave it as skeleton argument for later. What do you all think?

I got till 10 this morn to decide becoz I told Pishcon I let them know whether I agree with the issue & sent them mine. I might just sent it to them & see whether they agree or not with that 3rd issue.

I think I have to read up Carey v HSBC & Amex v Brandon case for next week STAY hearing.

-

OK this is what I am going to send them tomorrw:

Have I misssed anyhting? What do you all think?

-

Hiya,

I am going to put the WS of Fiona again here coz I think that's where I am going to raise my Schedule of issue:

Para 2 from the above: can I include this as one of the issue?

para 3 from below: another issue; I never received copy of ALL docs in FT1, para 7 ; pages 3-15 i never seen nor received before this. How can this be statement oftruth?

para 10.10: The abridged terms is on page 47 to 51 ... I didn't notice until today..

Para 10.11: are they allowed to recon an agreemment as evidence? Page 52-56

Para 24: They blatantly lie as they did not issue the Claim until 29 may 2008. For nearly a year I have been harassed by Newman when I have been requesting the agreement under s78 but they never delivered. How can I use this against them?

Para 30 below: Can an executed copy be without signtatures from both parties?

-

Just checking my other e-mail address & Mr Chik of Mishcon has been contacting me. Here are the attachments to the e-mail

Have to say looking at the issues, it basically sums it up but my brain is a bit tired as it is now 3.30 am. I have e-mailed Edwin & told him I can't give any answer till Wed 13 b4 10. Would appreciate some comments on these please.

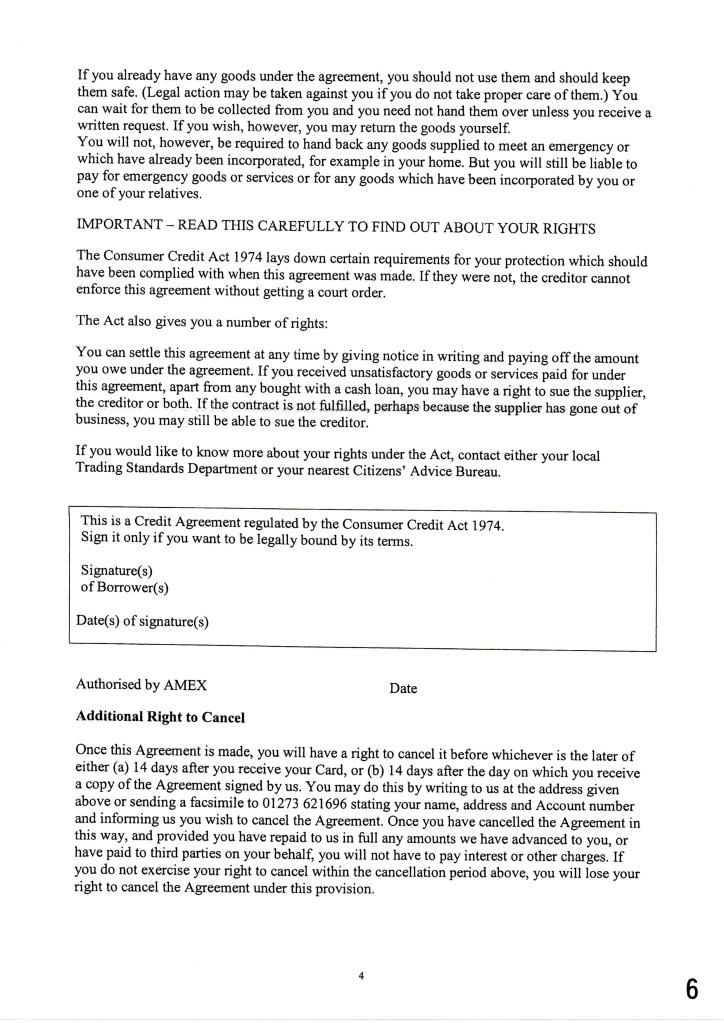

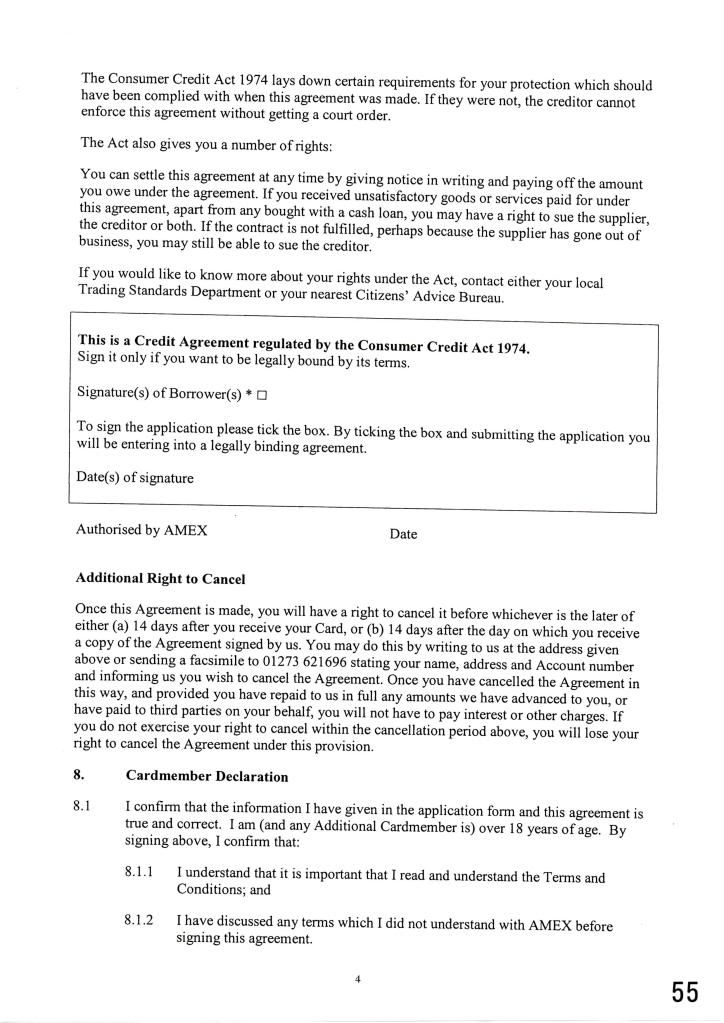

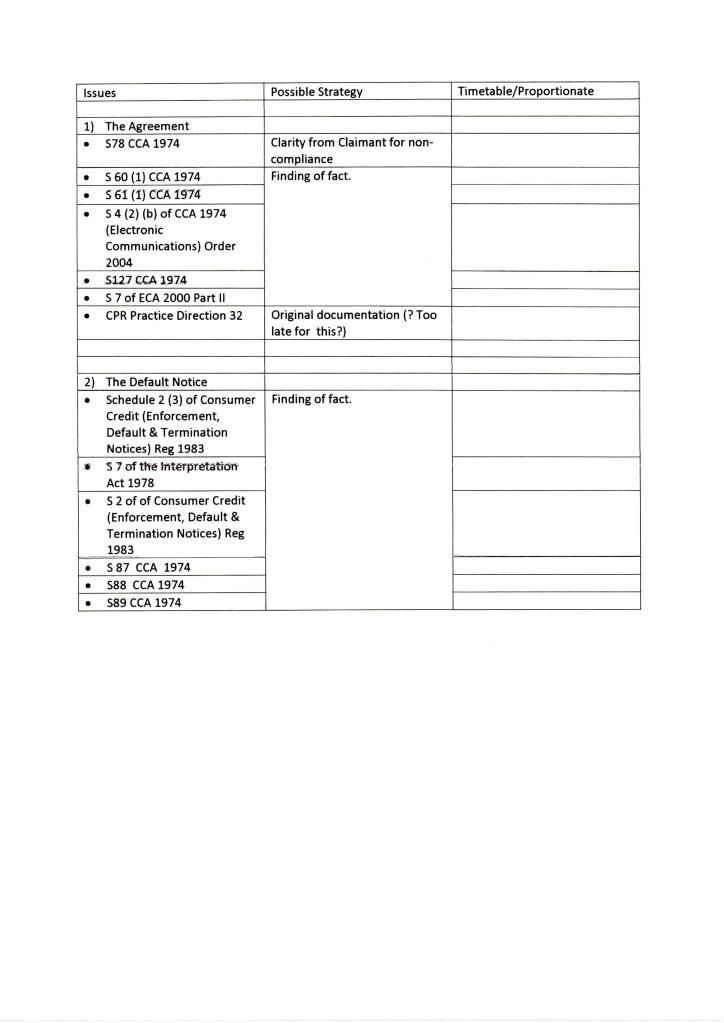

I also noticed something when I went through Exhibit FT1 of Miss Fiona which consist of 100 pages of all sorts of documents tonight. Amongst these 100 pages, there are 3 sets of agreement with terms and conditions;

1st Set

a 12 pages long of T&Cs Clause 1- 25 (inc Clause16(2)).All the copies oft he agreement that Brachers gave me before is only up to Clause 8 so this is the first time I've seen Clause 16(2). No names, no signature ...all blanks

2nd Set

is the set that Brachers gave with me with only T&Cs up to Clause 8. No name nor signature ( the signature page looks like above)

3rd Set

is I think the one that they called the abridged set that got my is my signature although

a) I've never seen the agreement in this form before which I did argue in the SJ & my amended defense

b) it's still not ticked so its an unexecuted agreement as far as I know

c) on the first page where there should be my name as the cardmember is still blank..

My BIG question is, is this allowed in the court of law? Can they just do what they like & bring up evidence as & when they like and we can't say anything? If I have just accepted that I owe the money when they issued the POC,

a) that extra cost of £1,143 on top of the outstanding amount I will just paid it. Only just before the hearing of SJ that they decided to change their claim & take that out.

b) I would never know whether there is CCA between me & them, i.e an enforceable one at that. As at the moment, I still don't..

-

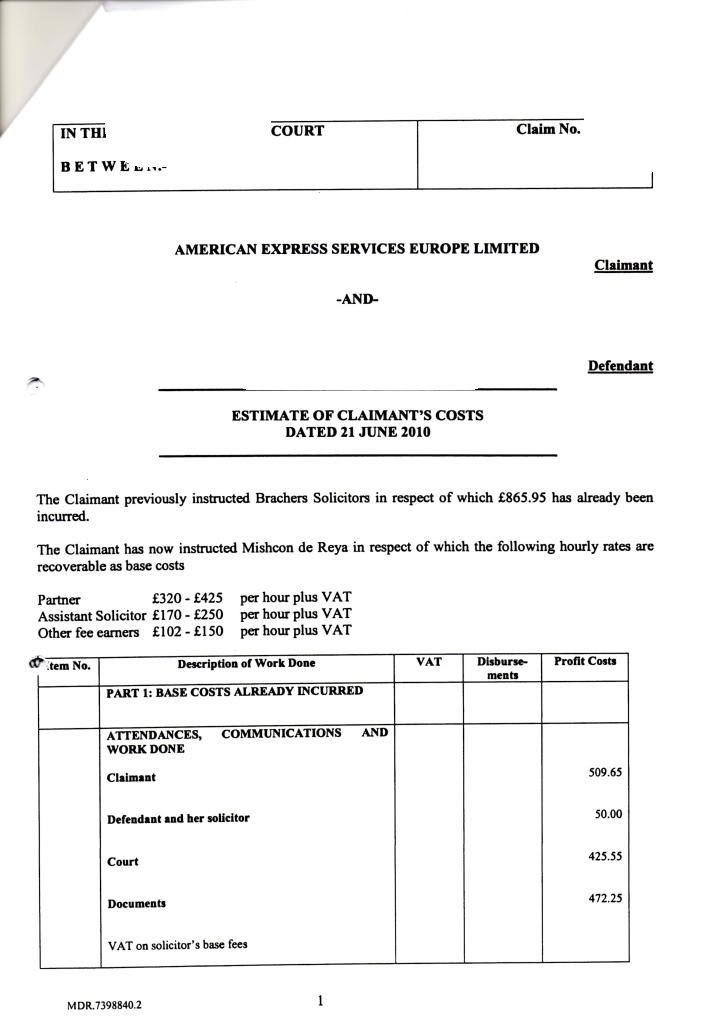

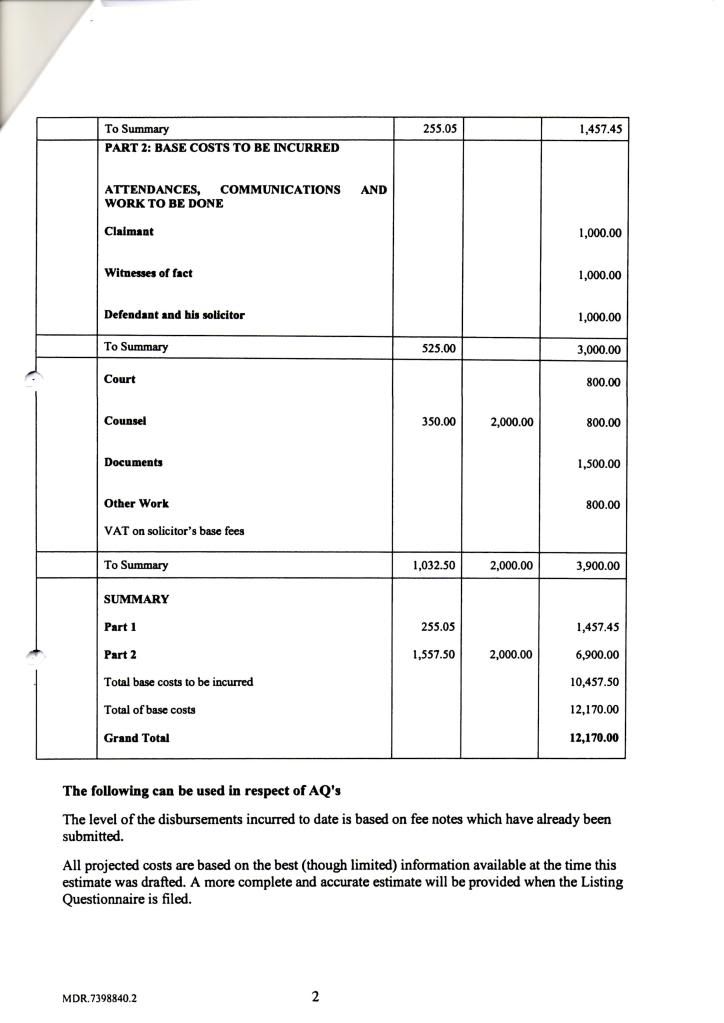

TQ shadow. I am updating my case summary at the mo to include this. I am also preparing an estimate of costs and was going through what they sent me.

The cost they estimating is c £12k.

Here is my estimate of cost

My £928 looks quite ridiculous next to their £12k, am I missing something here relating to fast track cost estimate? And what is that estimate costs re Defendant and his solicitor of £1000? Anybody familiar with these sort of thing?

Furthermore, am wondering why is Bracher's costs in there too as we already settled that costs following the SJ being thrown out. The cost that was granted to me then include everything from the filing of defense till the SJ hearing so I am actually not quite sure whether I am entitled to claim it all again. What do you all think?

-

TQ for that clarification, Shadow. I think I understand now.

So

Hi allI am trying to get this argument re Clause 16(2) in my head in simple English. So am I right in thinking that

a) in para 20 of their WS, Clause 16(2) of T&Cs give Claimant the power to end the agreement by giving notice to the defendant and vice versa.

b) we are saying that Amex cannot do this because CCA is the regulation overriding here specifically s87/88 CCA 1974 so without a proper default under s87 they shouldnt be able to terminate the agreement early.

c )so what we are saying is that the Clause 16(2) they relied upon from their T&C is void i.e invalid/ cannot be used becoz of S173(1) (as above)

d) we are saying that the insertion of Clause 16(2) in the T&Cs is unfair and under the Unfair Relationship regime the court may find a credit agreement to be unfair to the debtor due to any one or more of the following:-

1) Any of the terms of the agreement or any related agreement

2)the way in which the creditor has excercised or enforced any of his rights under the agreement or related agreement ( this is the one applied to my case i think!)

3) any other thing done (or not done) by or on behalf of, the creditor either before or after making the agreement.

So the result of the points above being only the court can determine whether the agreement is enforceable?

So should I include this point in my case summary or shall I wait till I need to prepare skeletal argument?

-

Hi all,

can somebody explain to me why miss fiona said in para 31of Amex WS that the agreement "did not have a definite duration" hence s98 does not apply?

-

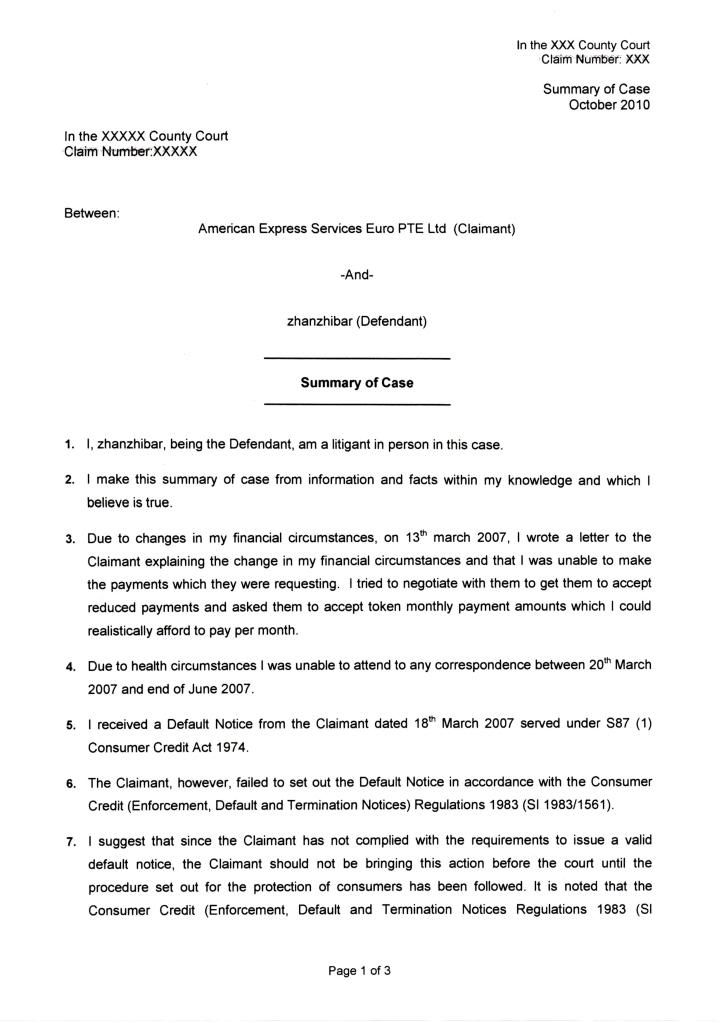

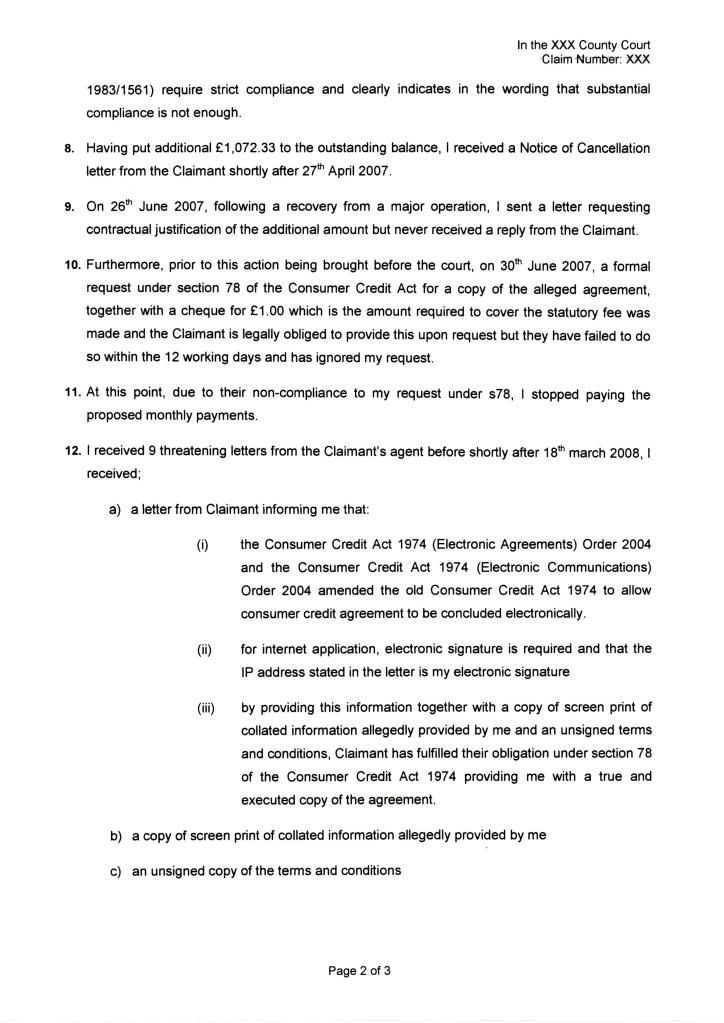

Ok here is my case summary

I need to do the listing questionnaire together with Summary of case & schedule of issues and submit yo court by 14th Oct; can anybody/somebody let me know whether

a) the way I do my schedule of issues above is correct and perhaps give me a few pointers what else to write there

b) whether my case summary above is the way to do it or whether case summary=skeleton argument hence I need to put all issues now

c) whether I need to say sthg about the application to stay in the listing questionnaire part A?

-

Hi all

I am trying to get this argument re Clause 16(2) in my head in simple English. So am I right in thinking that

a) in para 20 of their WS, Clause 16(2) of T&Cs give Claimant the power to end the agreement by giving notice to the defendant and vice versa.

b) we are saying that Amex cannot do this because CCA is the regulation overriding here specifically s87/88 CCA 1974 so without a proper default under s87 they shouldnt be able to terminate the agreement early.

c )so what we are saying is that the Clause 16(2) they relied upon from their T&C is void i.e invalid/ cannot be used becoz of S173(1) (as above)

d) we are saying that the insertion of Clause 16(2) in the T&Cs is unfair and under the Unfair Relationship regime the court may find a credit agreement to be unfair to the debtor due to any one or more of the following:-

1) Any of the terms of the agreement or any related agreement

2)the way in which the creditor has excercised or enforced any of his rights under the agreement or related agreement ( this is the one applied to my case i think!)

3) any other thing done (or not done) by or on behalf of, the creditor either before or after making the agreement.

Is this the argument re Clause 16(2) of the T&Cs?

-

HI DebsCongratulations...How did you manage to do it? I just lost my case against them last Friday exactly the same issues.In my case although hard evidence of the change of terms from store cards to credit cards was not brought in by Claimant, the judge rely on the OFT report and in so doing found the case against me on these basis:1) that the change to crdit card from the Deb store card agreement that has my signature

is a VARIATION of the agreement and not MODIFYING the agreement hence the agreement hold.2) the unilateral terms within the store card agreement that allowed GE capital to change T&C as & when they want it is fair3) the assignment is equitable (this is the bizarre one becoz I did ask there & then that if its equitable so they can't take me to court on their own without the original creditor which was met in silence & yet still the judgment stands against me!)Do you think I could appeal?

is a VARIATION of the agreement and not MODIFYING the agreement hence the agreement hold.2) the unilateral terms within the store card agreement that allowed GE capital to change T&C as & when they want it is fair3) the assignment is equitable (this is the bizarre one becoz I did ask there & then that if its equitable so they can't take me to court on their own without the original creditor which was met in silence & yet still the judgment stands against me!)Do you think I could appeal? -

HI Debs

Congratulations...How did you manage to do it? I just lost my case against them last Friday.

In my case although hard evidence of the change of terms from store cards to credit cards was not brought in by Claimant, the judge rely on the OFT report and in so doing found the case against me on these basis:

1) that the change to crdit card from the Deb store card agreement that has my signature

is a VARIATION of the agreement and not MODIFYING the agreement hence the agreement hold.

is a VARIATION of the agreement and not MODIFYING the agreement hence the agreement hold.2) the unilateral terms within the store card agreement that allowed GE capital to change T&C as & when they want it is fair

3) the assignment is equitable (this is the bizarre one becoz I did ask there & then that if its equitable so they can't take me to court on their own without the original creditor which was met in silence & yet still the judgment stands against me!)

Do you think I could appeal?

-

Sorry to be the bearer of bad news Monty but I have just lost against CL finance on this very issue (Debenham store card to Credit card) Friday just gone. However, having said that I think it all depends on the kind of judge you have on the day and the defense that you have. In my case I think I might have shot myself by including a report from trhe OFT Jan 2004 about the unfairness of changing frm store card to credit card. In my case although hard evidence of the change of terms from store cards to credit cards was not brought in by Claimant, the judge rely on the OFT report and in so doing found the case against me on these basis:

1) that the change to crdit card from the Deb store card agreement that has my signature is a VARIATION of the agreement and not MODIFYING the agreement hence the agreement hold.

2) the unilateral terms within the store card agreement that allowed GE capital to change T&C as & when they want it is fair

3) the assignment is equitable (this is the bizarre one becoz I did ask there & then that if its equitable so they can't take me to court on their own without the original creditor which was met in silence & yet still the judgment stands against me!)

-

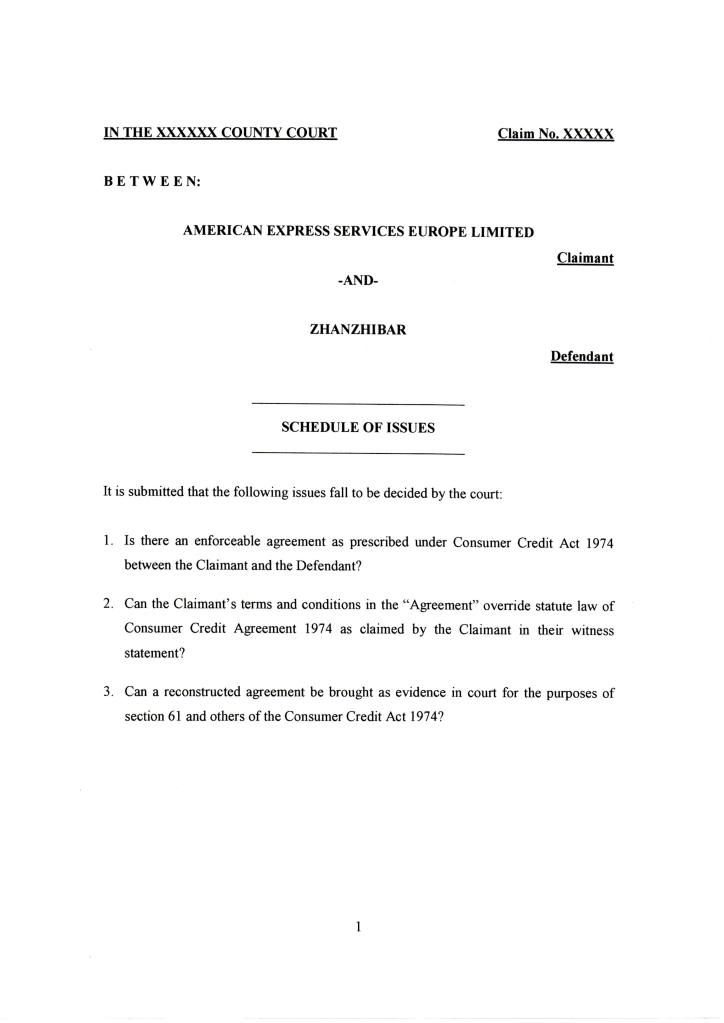

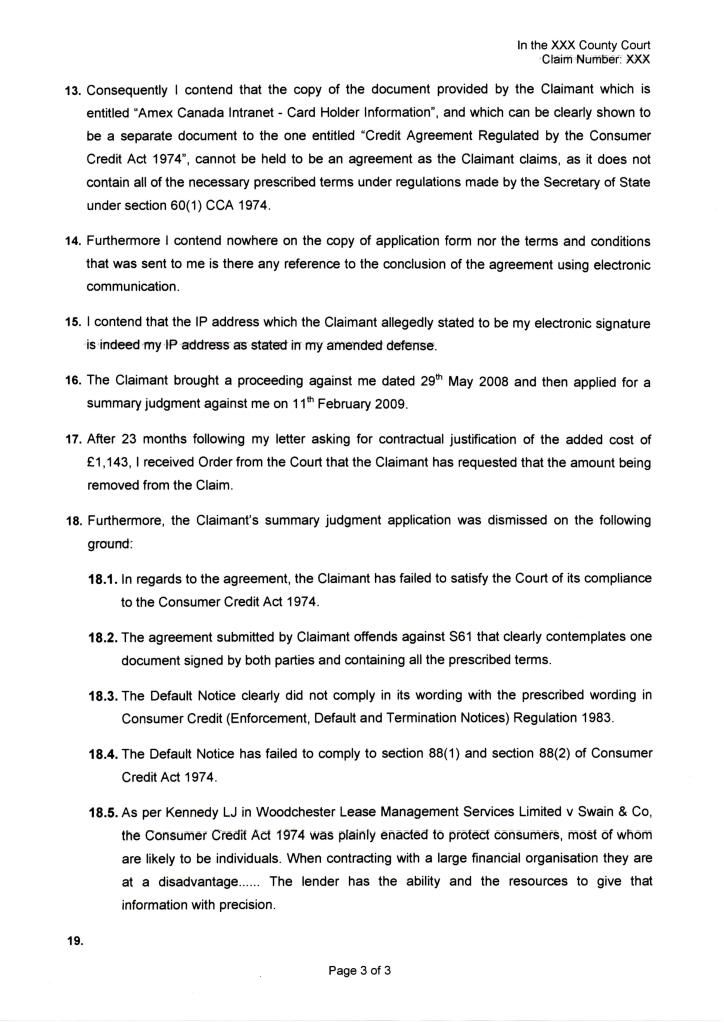

Hi everyone is this what schedule of issue supposed to look like?

-

Hi Zhan, just been having a shufty through her WS, now on point 31, they deny that the act is relevent.

Has the 'agreement' copy youve got, showing any period of duration? it doesnt have to be a fixed date, just go through it and see if there is anything that states for instance, 'this agreement will remain active blah blah,'

Or is there THIS statement? The Consumer Credit Act 1974 lays down certain requirements for your protection which should

have been complied with when this agreement was made. If they were not, we cannot enforce

this agreement without getting a court order.

OR This, English law governs this agreement etc.

AND general law (for example, about banking or consumer protection) applies to this agreement.

Its obviously going to have the standard regulated by the cca 1974 stuff

If you do not cancel your Agreement, your Account will remain open until your Agreement is ended in accordance with this Condition ( THIS is from an Egg CC)

Hiya, this is what it says on the blank T&Cs. I can't say what is in the abridged one they been referring to in para 28 of the WS (that has my signature) as I don't have a copy of that..

-

Thanks, Zhan, hopefully as Shadow says it should be hypothetical, but just in case, did they ever write to you quoting termination under clause 16 (2) prior to issuing proceedings? If not they can't use that excuse (IMHO) as they did with Brandon.hmmm, but it doesnt give any indication of why they would end the agreement, If it were executed correctly of course.

there are certain rules in the statutes, so i think this clause might be negated within the CCA. and thus, will be an unfair term if my mind is working correctly today

14 Unfair Relationships

14 .1 New regime to replace extortionate credit bargain regime

On the 6th April 2007 the 2006 Act replaced the extortinate credit bargain regime with the new regime of unfair relationship.A bargain was extorinate if ,at the time an agreement was made, it required the debtor to make payments which were grossly exorbitant or otherwise grossly contravened ordinary principles of fair trading.

14.3 Transition

After 6th April 2008 a court may:-

A. Find a relationship to be unfair by reference of events or conduct predating predating the regime.

B. Order the repayment of payments made before the regime

14.4 Unfair Relation Test

Under the Unfair Relationship regime a court may find a credit agreement to be unfair to the debtor due to any one or more of the following:-

A Any of the terms of the agreement or any related agreement

B the way in which the creditor has excercised or enforced any of his rights under the agreement or related agreement

C any other thing done (or not done) by or on behalf of, the creditor either before or after making the agreement.

In some cases unfair contract terms may be sufficient to give rise to unfair relationship

14.7 Burden of proof

If the Debtor alleges that the relationship is unfair its the Creditor to prove the contrary,the burden of proof is on the creditor.

Hi all, Thanx for the input. As this is only came up in the WS, is this sthg I can use in my summary of case? Or shall i just wait till skeleton argument which I belive I need to prepare nearer the trial date. Is my understanding correct or is summary of case & sekeleton argument one & the same?

-

I am currently preparing my schedule of issues and summary of case which i will put up here later for feedback please but having read again ms Fiona WS I am getting slightly worried that I missed the date to asked to see evidence particularly what she said on para 28 on the abridged terms signed by me. I have never seen it & this is only came up in this fsattrack proceeding, so am I too late do you all think? I don't actually know what this abridge T&Cs is & how they got my signature... Worried now..very worried...

-

Thanks, Zhan, hopefully as Shadow says it should be hypothetical, but just in case, did they ever write to you quoting termination under clause 16 (2) prior to issuing proceedings? If not they can't use that excuse (IMHO) as they did with Brandon.

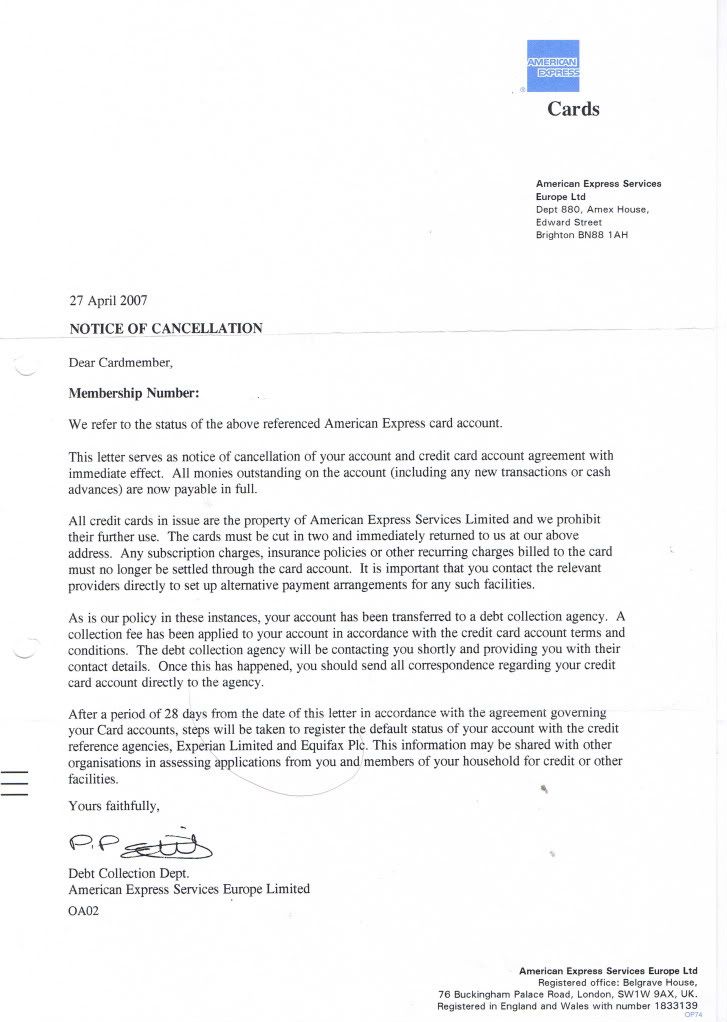

Hiya, OK I am not eaxctly sure what you mean by them writing to me about the clause 16(2). I did receive this though

-

Re their argument that Clause 16 (2) allows them to terminate, which they claim negates the need for the DN to be correct..

what does clause 16 (2) of the T&C's actually say, Zhan? What process does it state should be followed, and did they ACTUALLY follow that process?

If not then surely they have chosen to terminate for breach, and must still follow that course if they haven't taken the required contractual steps to terminate under "clause 16 (2)"

Just a thought...

Elsa x

Hiya , clause 16(2) of the T&Cs

-

zhanzhibar vs Amex/AIC/Newman/ Brachers Solicitors

in Financial Legal Issues

Posted · Edited by zhanzhibar

TQ for your advice PB. They are noted. Rather than talking about DN which we can only talk about if there is a validly executed agreement, I would appreciate it if you can comment on whether or not I do have an agreement/contract in the first place because all I know is my so-called agreement is made of these

a) an intranet e-application form where even their 2 legal firms cannot agree as to when allegedly I applied for the card

b) a blank T&Cs with none of my name nor address

c) an IP address which as we all know is always changing

d)and now suddenly in the disclosure of evidence toegther with their WS, they also introduced another reconstitute T&Cs which is also blank, the only difference is that it has a box on the signature ( for ticking as oppose to signing) which is also blank i.e not ticked.

So now, let's forget about the DN or about the termination for a while and focus on this issue.. can anybody tell me

1) How they can suddenly bring in a new evidence i.e the recobtsruct T&Cs with still no names, no signature. not even a tick

2) Whether or not I have an agreement?