afcdebt82

Registered UsersChange your profile picture

-

Posts

13 -

Joined

-

Last visited

Reputation

0 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

I've been informed by my parents that I've received more letters/phone calls but this time from Moorcroft, and much more aggressive with the calls, multiple times in a row. The letters say they are acting as collection agents. Is the status any different now or does it still belong to Link? Should I also be sending letters to Moorcroft about my address change? -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

Not 100% sure what you mean. I haven't paid anything since they defaulted, so then they won't be owed as long as I don't pay anything between now and then? -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

Thank you all for your responses. I've sent a registered letter to Link for each of the accounts. Hopefully they will arrive shortly. I could have got my mum to send them from the UK and got them there quicker, but I thought it's more proof to send from here that i'm not there. I noticed that each of the debts that Link took over have now appeared on my credit report. I don't know if this matters, but is it standard practise? As long as I don't deal with them they will remove after 6 years like the original accounts? -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

Thank you. Should I mention I informed the previous creditors of the address change, or just send exactly the same letter but to them? Should I also ask for confirmation of receipt, or anything else? Thanks -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

I wrote to the original creditors back in April and it looks like it's been passed to this lot recently. I haven't contacted them at all, as it's the first I've heard of them. Yeah, I got 3 separate letters for Bank of Scotland, Lloyds and Halifax, which are the ones that have officially defaulted according to the recent credit report. -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

Hello, thanks for taking the time to read this. I posted previously back in April about having approx £45k unsecured debt in the UK, but I live abroad and unable to pay. I followed the instructions and sent registered letters (from abroad) to each of my creditors with my current address, which were all ignored. Letters and phone calls were still going to my previous address (my parents). I have no assets in the UK and have lived outside the EU for many years. I have been passed letters from my mother that some of my debt has defaulted (roughly half) and been passed on to LC Asset. At this stage I'm concerned about my parents being hounded. If I'm in no position to pay, what's the best approach to inform about living abroad and that the contact address is incorrect? What can they do if I'm not in the UK, and I've tried giving correct contact info? I just don't know what steps to take at this stage. Thanks -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

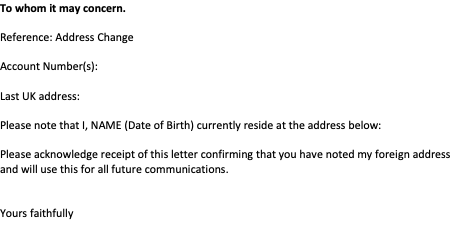

Ah that's weird, i copied it from word. My problem still remains that I was residing abroad whilst getting the credit (even though i was located in the UK when applying), so I thought it would be a problem if i put the year before the credit agreement? If that's the case, should I just leave it off of there, or do you have another suggestion? Sorry, misread what you wrote. That makes sense. Editable below with your comments. Let me know how that looks...thanks so much! To whom it may concern. Reference: Address Change Account Number(s): Last UK address: Please note that I have for a number of years resided at ..... and will remain so. Please acknowledge receipt of this letter confirming that you have noted my foreign address and will use this for all future communications. Yours faithfully -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

Thanks for the response. Much appreciated. So my letter basically looks like this. If anyone has any suggestions of improvements, things I missed please let me know. I was also wondering if I should update a phone number? Anything I missed, or good to go? Thanks all -

Defaulting when living abroad

afcdebt82 replied to afcdebt82's topic in Overseas Debt/Overseas Account issues

i applied for the credit when i wasn't a resident in the UK. I was there to apply, but was already living abroad, so i'm not sure if that would be a good idea. Stupid i know, but i have kept up with payments up til now. In that case what would you suggest? Anyone can recommend what I should put if I applied for the credit when I technically wasn't living in the UK? Should I just leave the move date out? Want to get the letters sent out asap as I stopped the direct debits and am now getting the messages through the app. Thanks a lot. -

Hi all, I'll try and summarise this mess briefly. I have approximately £45,000 in credit card debt from the UK. I moved abroad a number of years ago (outside of EU). Up until now I was making minimum repayments, and had never missed a payment. It's got to a point where I can no longer continue making the payments, and I never told them of my address change (the address listed is my last UK address, which is my parent's home). I was using one of the cards with money available to pay off the other minimum payments using Revolut, and now of course i've run out of money. I have no spare money available, nor anyone that can help, so I believe my only choice of action is to stop paying. My CC accounts are with Lloyds Group, Tesco & HSBC. From asking a different forum, my understanding is that if I do not intend to make payments I should cancel the direct debits first of all, then eventually all the accounts will default. I also was recommended to send letters with proof of postage to the creditors regarding my address change so they don't hound my parents, and have my correct contact info. I managed to find the address to use for Lloyds & Tesco, but I cannot find a postal address for HSBC anywhere. Is anyone able to help me with that please? To answer some questions, I don't plan to return to the UK anytime soon. I don't have any assets in the UK, my bank account that had the direct debits is not connected to the creditors, does not have an overdraft, and the only money that was in there was to cover the payments. Also, I've been out of the country longer than the amount of time bankruptcy would be an option. I'm not particularly proud of what i'm doing, but feel like the only option is to have a fresh start from the worry of my UK debts. Does anyone have any advice, or suggestions on my plan, and if i've missed anything? When the phone calls/letters/emails start should I respond/respond in a particular way/ignore? I guess at this stage without missed payments, this month will be the 1st time anything is noted, so i'm not sure when the messages will start. Thanks for your time.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...