Banker2020

Registered UsersChange your profile picture

-

Posts

34 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Banker2020

-

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

Thanks. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

Ok but they will have to show which companies they shared my data with? It is passport, qualifications etc.. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

Just thinking when i request a SAR will they have to supply the companies whom my details have been forwarded to. i.e the clients emails addresses? Fckers cause a headache for me i can return the favour. Edit - the item i was supposed to be inspecting need checking every 6 months for corrosion, it was past 6 months when this job got delayed. Just to annoy them i can contact Lloyds register/DNV. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

I wouldn't work for a client who doesn't pay and messes contractors about, so i couldn't care less about that. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

No i dont hire equipment. Ive just lost Labour. If i do a SAR to this company and to the client it may come up with something and will put them in poor light with their client. They will have charged for the contact not going ahead. Theyd have a Purchase Order which they would get paid for. |Theyd have charged for me and the equipment. They will be getting paid. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

I turned down other work, for £3500 Would a SAR at their clients company be of use. Could then see the situation with timesheets and what they got paid for me. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

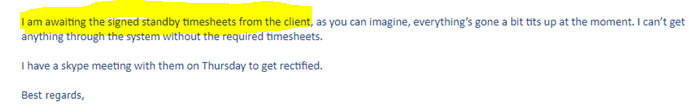

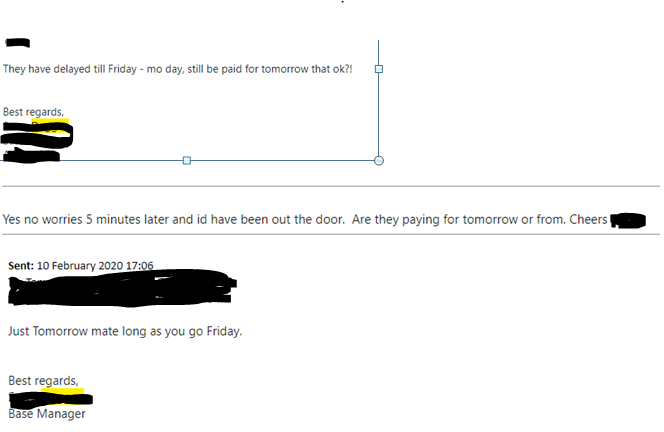

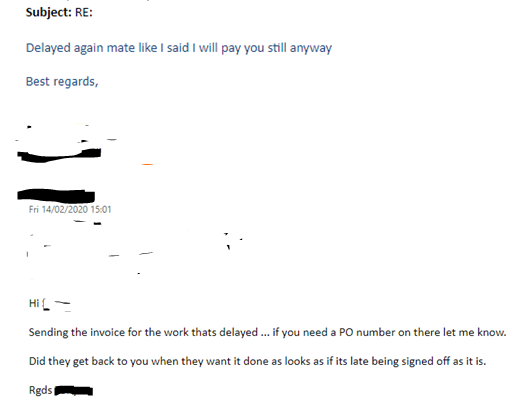

Yes, they called on Monday it got delayed until Friday ... they asked me to stay on standby until then and would pay for the Tuesday ... then on Thursday it got delayed but i was told i'd get paid for the 4 days. They will have been paid by the client, as it involve hiring expensive equipment that'd need paying for. Jobs getting delayed like this is the norm in the oil industry. It would seem that in April if he had the timesheets i'd have been paid. The in May if he could have got me on the computer system i'd be paid. If i put in a small claims application then they are not going to pay. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

Uploaded the pdf of application Yes seems like ive made a schoolboy error, i called in and they said this is the procedure. Spending most my time dealing with NW. claim-form-claimant-use.pdf -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

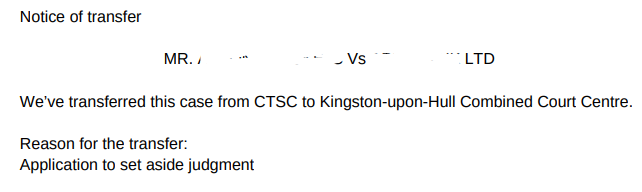

I got this today ON the 6th August i got a "Judgement for claimant" letter. At which point i believe i did enforce it, but was told they had 30 days to pay to avoid a CCJ. Hence i waited until this time was over. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

No But even without all that would you see my claim as strong? I suspect they may claim their offices were closed due to CV19 and didnt get court papers. -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

No -

Company not paying an invoice £2500

Banker2020 replied to Banker2020's topic in General Legal Issues

Ive not got a N244 And Ive called to ask what are their reasons for setting aside and they weren't on file. Does the above case look strong ... to me its water tight, but anything can happen in the courts. Once i got the judgement, they have 28 days to pay to avoid getting a CCJ. Seems they can also set aside during this time according to the woman i spoke to. -

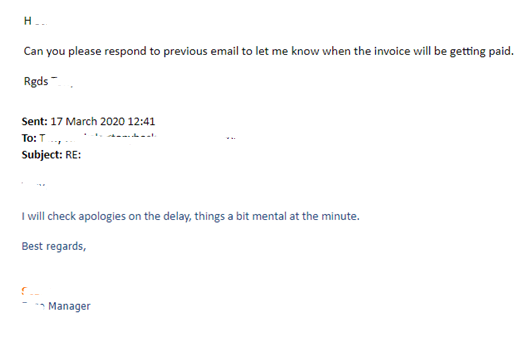

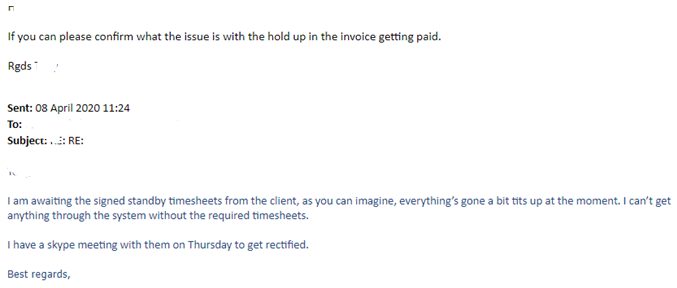

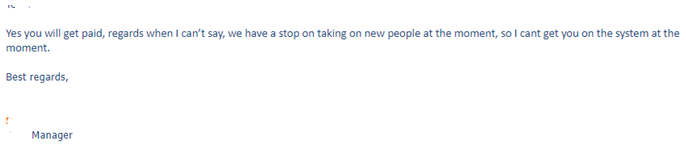

Hi I work in the oil industry as a contractor. on Monday 10th February i was contacted by a large oil services company for a short job offshore, it was to get to Norwich the following day. Just as i was getting in my car to drive down, i got a call saying its delayed until Friday but if i wait on standby they will pay me for the 11th at full day rate. on the Thursday afternoon i got an email saying the job has been delayed again but i will be getting paid for the job which would have been 4 days Mon-Fri. (see email 2) i put my invoice in for the 11th and the 4 day weekend for £2500. 1 month later its still not paid, but im promised that i will get paid. This keeps on going on for another 3 months with lots of promises of payment but no cash in the bank. i put my application into the small claims court and to my surprise they are contesting it. (they put in an application to set it aside on final day, almost the month from judgement in my favour) here are some of the emails sent between us; to me it seems like they've no case as they've admitted they owe the money and just give reasons not to pay .. . but other opinions are appreciated. The excuses were constant as to why they were delaying paying and were contradictory in 25 years of contracting i've never known a billion dollar oil company behave in such a way. It could be they are going bust as they're riddled with debt. Email chain 1

-

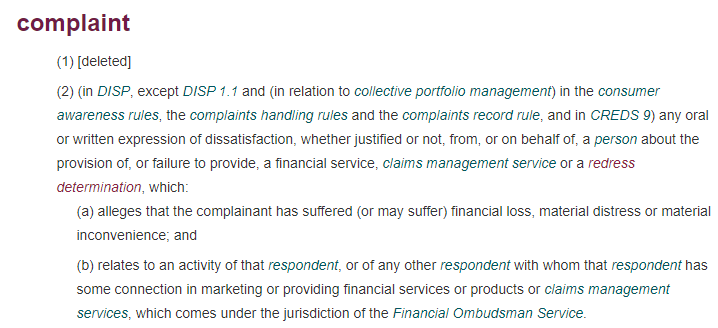

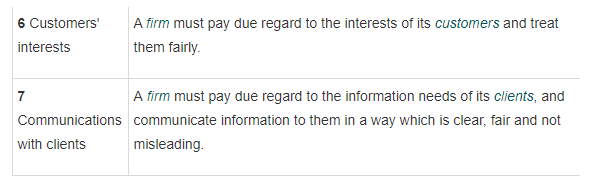

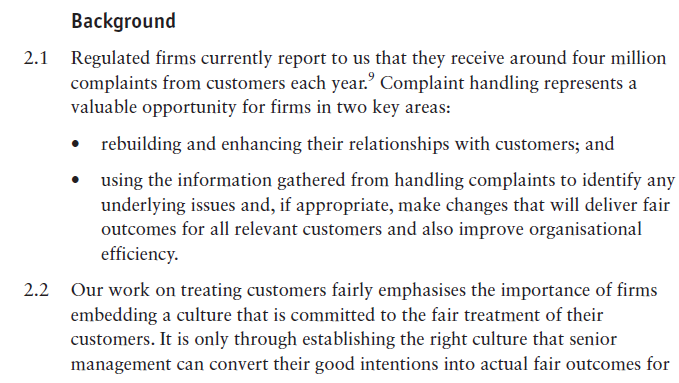

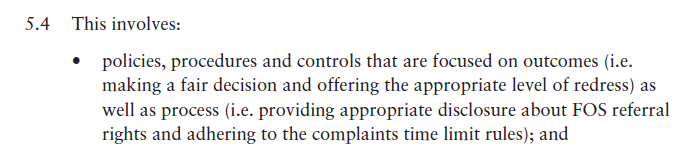

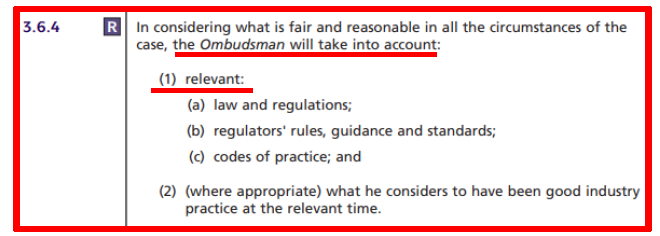

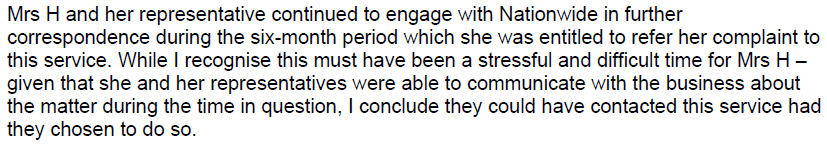

DISP states this is a complaint. Now the above falls into that category, and after spending the last few hours reading DISP, PRIN and a multitude of FSA and FCA reports on complaint handling and recommendations, there is nothing to suggest a person cannot make multiple different complaints. I called the FCA and they highlighted Principal 6 and Principal 7 Ignoring a legitimate complaint is not paying regard to the interests of its customer or treating them fairly. Found points such as this in the FSA report into complaint which obviously still apply.

-

Cheers, id not long retyped them IN the other topic you stated its possible just to raise different points to get new referral rights, do you have more info on this? I'm looking through this old FSA report (pdf attached) on complaints which still must apply and all i can find is something that states in DISP as to what a complaint is. ... nothing about being able to send multiple complaints and getting new referral rights. My MP is writing to them about this. fsa-review-of-complaint-handling-in-banking-groups.pdf

-

Is it possible to move them over ... if not i will copy and paste them.

-

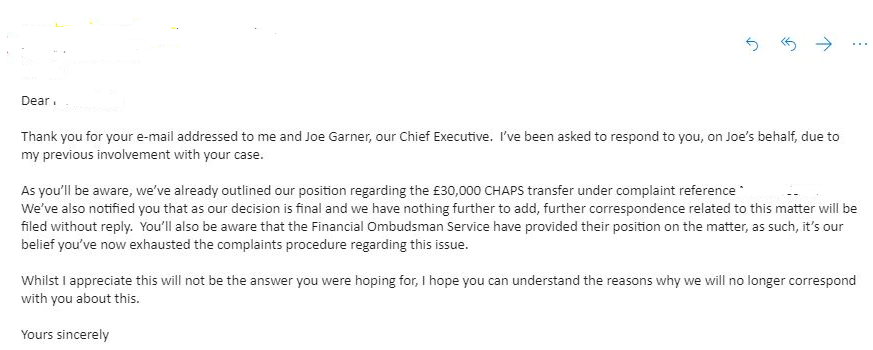

This is the response from NW refusing to answer the legitimate question i asked. So if you can direct me to any regulation that specifies they cannot ignore questions please do so. As if not its very bad advice. I am aware the FCA have been fining banks for not replying, but that hardly helps me. I will be making a complaint about the FOS, as they in essence told NW thay they will not be looking at my case for where NW are liable. Truly remarkable really.

-

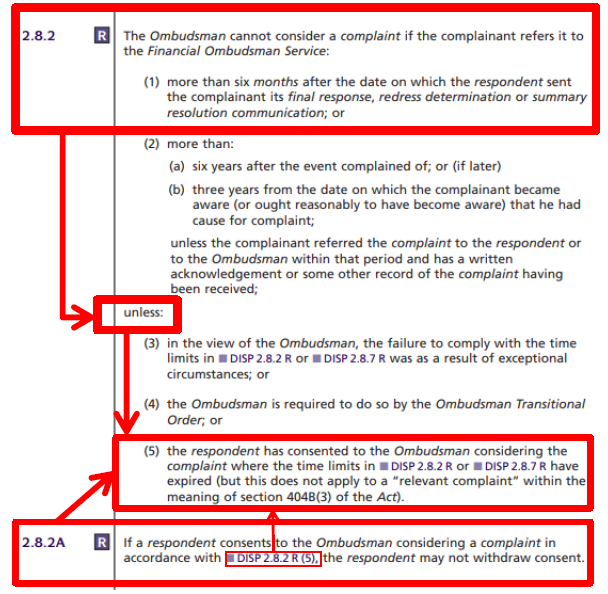

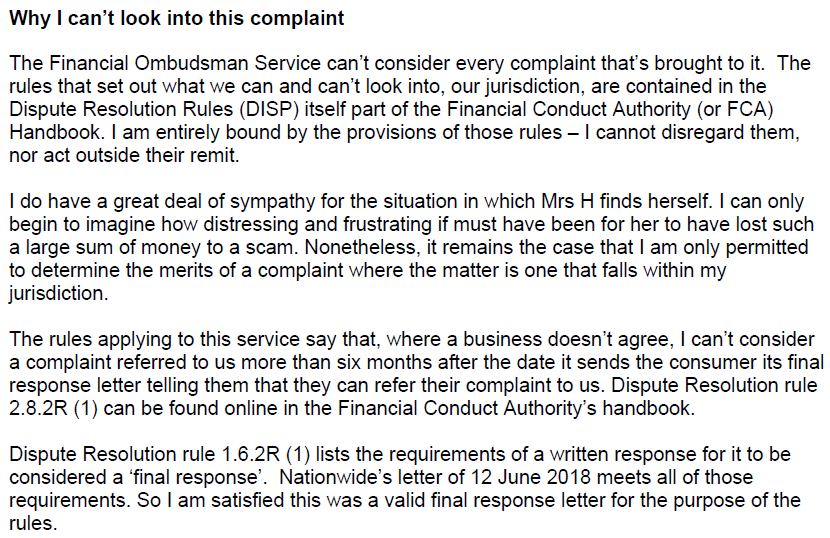

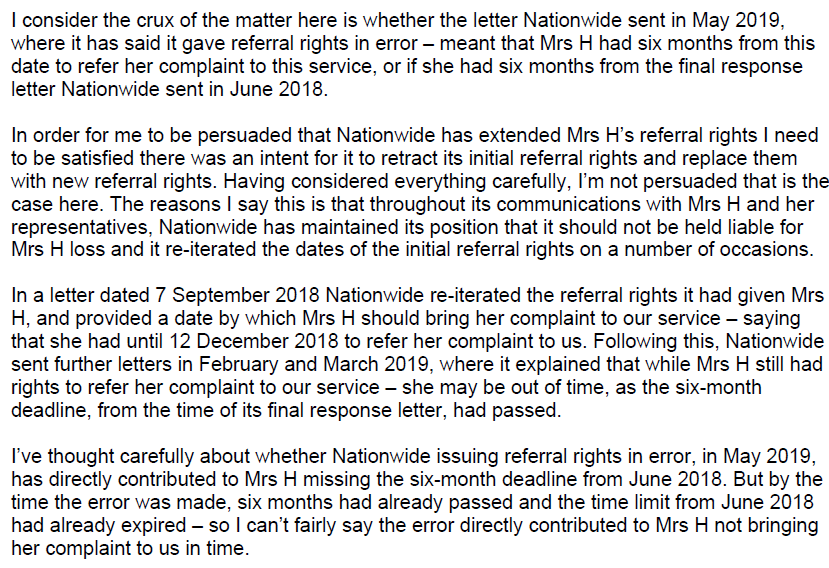

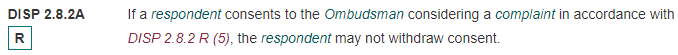

I had a totally new complaint for NW to get the 6 months open and it didnt work despite them issuing new referral rights as they then claimed it was sent by accident. I have recently sent another new complaint - "This payment was “a sudden increase in spending”, “payment for a large amount” and “a payment to a new Payee”. What actions did the bank take in respect of the provisions of section 5.3.1 of BSI PAS 17271 to ensure that Mrs## was not at risk of becoming a victim of fraud? 1. The Data Protection Act 2018 refers to “the prevention or detection crime” [Part 1, paragraph 2(1)(a)], so it appears to me that the receiving bank could have confirmed or denied that the Payee name was #### #### because if it was not #### #### then not proceeding with the payment would have prevented a crime. 2. The new Confirmation of Payee system works on a simple Question and Answer of: [Q] “Is this the Payee name that is associated with this sort code and account number? [A] “Yes, no or maybe.” The DPA2018 has not, as far as I know, been changed to allow for CoP so you could have asked the receiving bank “Is the name on this account #### ####?” within the provisions of the act. It appears to me that this would have prevented the fraud. And they have sent a letter back refusing to answer it. Is there a rule/regulation that says they have to answer further questions.

-

The points i raised throughout were FCA and BoE regulations. The FOS decision has been based on a mans feelings and opinion as to whether it was sent by error, when regulations state once referral rights are issued they cannot be withdrawn. Anyway time to move on from that and get NW another way, cheers for your help so far.

-

They've been a disgrace, to issue referral rights and then claim its an error is a complete fabrication. When its an elderley woman in her 70s that obviously cannot earn this sum of money again. If you read the footer issuing the new referral rights they have added the word "already" thus referring to the previous outcome. FOS had more than enough to look into the case, can't but help think they're vindictive by not doing so. The Ombudsman has just backed his adjudicator colleague up, and he was as thick as mince.

-

They keep on referring to it, in all correspondence as what they must adhere to. Says so on their website i believe. Along the lines of. Could you please give me every email and correspondence where (mother name) is mentioned.

-

Thanks for the SAR suggestion, i just never thought of it. Will do it right away. I presume they have to keep all emails on file for a certain amount of time. Shall i just ask for every email in reference to my mother, how would i put it? Thing is this case has been dealt with by seniority so presumably they will hold certain email back. Yes i'm thinking the BCOBS route is the way to go .... but i have no idea what to reference or how to go about it.

-

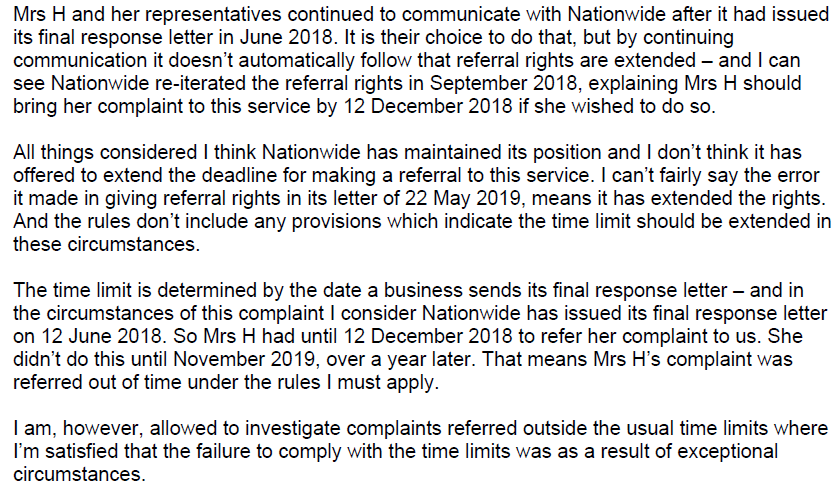

I'm looking into a Judicial Review as the Ombudsman is not following the FCA Handbook; in my appeal to him i used the same DISP 1.6.2 to show the letter NW sent in May 22 2019 was a final response. Here is how it should be read. In essence once they've issued referral rights there is no opportunity to change their mind or claim an error. As you can see the FCA Handbook DISP 2.8.2A is a regulation to stop companies changing their mind

-

No i've not sent NW a SAR what would i need a SAR for? The bank the money went to was Fidor Bank, someone has been arrested but they claim to have been a victim of identity theft. Its a disgrace that the FOS have backed NW, quite simply once they've issued referral rights they cannot claim it is an error. The Ombudsman has made a decision on his feelings as opposed to following the FCA Handbook to the way its intended. Below is part of the Ombudsmans letter.

-

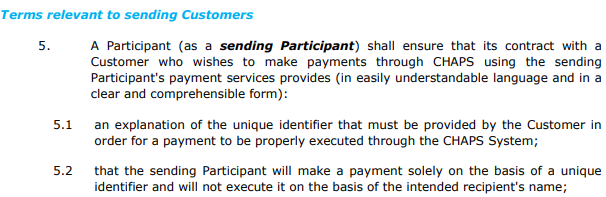

Hi I've come across this article on the BBC website about taking a bank to court. https://www.bbc.co.uk/news/business-19511542 In June 2018 my mother was tricked into transferring £30,000 that was intended for her eldest son to a fraudsters account. Then did not take it to the FOS within the 6 month time frame as there was an ongoing police investigation, and being told she had no case. In February 2019 i took over the case after being sent an email from someone at the BoE showing Nationwide were not adhering to the CHAPS Transfer Manual regulations (see below), so i sent a formal complaint .... then in May 2019 the replied denying this but gave new referral rights to contact the FOS. Anyway after sending my complaint to the FOS, Nationwide then claimed the new referral rights were sent in error and despite DISP 2.8.2A making perfectly clear they cannot withdraw their consent, the Ombudsman has sided with Nationwide. So it now seems court action is my only option as a Judicial Review is seemingly very expensive. There are other aspects to my complaint to the FOS that i could take to court, but i am thinking the point about Nationwide failing to adhere to CHAPS Manual regulations is the best one, as i believe should a judge agree with me it opens all banks up to being liable to all people who have lost money when using CHAPS payments. This is Nationwide's absurd response which does in no way show that they told my mother "in easily understandable language and in a clear and comprehensible form, that NW will make a payment solely on the basis of a unique identifier and will not execute it on the basis of the intended recipient's name. My mother like almost everyone else presumed the name gets checked when sending. (as it does now) [edit]S RENEGED ON THE ABOVE.. So i ask would you believe my case to be a strong one? What Banking: Conduct of Business sourcebook (BCOBS) regulations would i need to raise .... or better still is there anyone on here who could assist me in taking NW to county court. My belief is should i prove NW have failed to adhere to this regulation, then it could be extremely expensive for all the banks as CHAPS payments total £365 bln per day. https://www.bankofengland.co.uk/payment-and-settlement/chaps

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

- Create New...