Undeclared123

Registered UsersChange your profile picture

-

Posts

15 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by Undeclared123

-

Wow that template is amazing. I will send that over ASAP. As soon as I have heard back I will let u know. Thanks again.

-

Ok do I send this via email to go skippy itself or to Somerset bridge the underwriter? This might be a silly question but what template? Thanks you for trying to help me i really appreciate It. But I am truly rubbish when it comes to stuff like this. Writing letters etc. So apologies in adavance.

-

And like I said I didn’t pursue it because I just gave up. I wasn’t getting anywhere with it. I’m not clued up with all this. I just saved for a new car and started again.

-

No I just googled insurance lawyers. I don’t know what you mean by put a copy? There is no copy. I asked for it over the phone

-

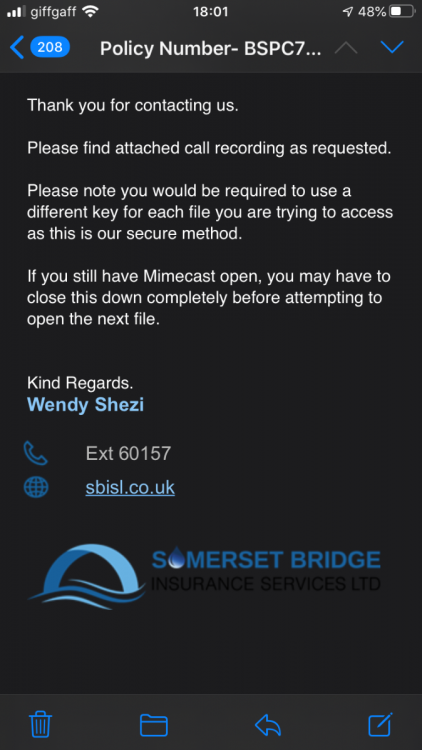

They are the insurance lawyers I contacted about the claim. I just told them I wanted to do an SAR for the call over the phone. I asked for 3 separate calls to be sent to me. One for the renewal call and 2 others. They sent me 2 calls which I asked for via email. The only one they didn’t send me. Was the call of my renewal. Where I apparently said yes to all details remaining the same on the policy.

-

I didn’t go through with it as the lawyer from indemnity legal told me I never had a leg to stand on. I sent them the SAR for the Supposed call of my renewal, where when asked if everything on my policy was Still the same. I apparently replied yes. Now I can’t remember anyone from my insurance even calling me at all. I was told by indemnity legal that if I said I had spoken to my brother and he told me everything was fine. Basically lie. I would of been paid out. I phoned a few different Insurance lawyers after that to try get further advice. One got back to me and said they work with go skippy so can’t advise me on it. so yeah I just gave up in the end.

-

Trying to cut this short. My car was stolen and found burnt out. My insurance refused to pay out because I had my brother as a named driver and he was banned. My policy renewed with him still on it. I didn’t take him off. (I know my fault) so I lost my car. 3.5k Lesson learned. Now I owe them £568 for recovery and storage of my car. They have told me once that’s paid I can have my 2years NCB back. but when taking out a new policy I’ll still have to put it down as a claim. And in the meantime I’ll have to get quotes with no NCB. They told me whoever insures me. With no NCB once the £568 is paid just ring them and say I’ve now got 2years no claims. Wrong if u ask me. Also apparently they phoned me on the renewal date and asked me if everything on my policy was still correct. To which I replied yes. I did a gdp subject access request for that call. To which they still haven’t sent me. They refused me indemnity and cancelled my insurance. I was advised to cancel my policy before they’re set date. I didn’t have cancelled insurance in my name. My brother drove my car once in the whole 2 years. And wasn’t driving it anywhere near the date of the claim.

-

She did say if I cancel then the claim would still be going until settled. Ie them chasing me for recovery cost of the vehicle etc. But I just wanna be 100% sure to cancel it before I do.

-

Yes I will speak with my lawyer first, but more then likely I will cancel before they do. Also I definitely 100% will not be putting anyone on my policy in the future. I have learnt my lesson there. Thank you for giving me a way out this whole I put myself in. Been depressed since all this happened. You’ve took a lot of weight off my shoulders. Just want this nightmare to end.

-

Just on the phone to them now they said if I cancel the policy before they do it won’t go down as cancelled insurance on my name. Still unsure whether to do that though. I have until the 12th to decide. I have got a lawyer ringing me on Monday from indemnity legal I’ll speak to him 1st see what they have to say. Just done a subject access request for the call of my renewal I will send that to them also. She also told me it won’t go down as a claim if I cancel before they do. So buzzing either way. I’ll log the date of that call I just made so I can get her to send me that in the future if need be. Thanks for all help everyone much appreciated.

-

There was no accident. Think they are just talking about the recovery cost of the vehicle. I honestly never knew he was banned. I wouldn’t of kept him on my policy else. We haven’t spoke for over a year. Until this. He works nights and just keeps his self to his self. Still to this day it’s hard to get him to answer the phone. we don’t see or speak to each other. He lives in a completely different area also. I have a family my eldest is 10 think he’s seen her once twice at the very most. He has never been to my address either. It’s just one of those things I guess. My own fault. I’ll just have to deal with it. I just bought another car for £400 to get me a to b. So I’ll cope. Insurance is Going to be £3400 a year tho. Not gunna let it get me down. Life goes on. Wish i was a bit more clued up on this sort of thing. But I’m not. So guess I’ll just have to take it on the chin. Thanks anyway everyone.

-

I am writing with reference to your GoSkippy Car Insurance, incepted on 18th May 2019. Following an investigation into your claim dated 7th April 2020, it came to light that you have failed to disclose the following motoring conviction for your named driver DR30 – 11/11/2018 SP30 – 06/06/2018 When renewing your policy over the phone with a GoSkippy agent to commence on 18th May 2019, you were asked ‘Can you confirm from me that all the details from your current policy are still correct”? to which you responded by saying ‘Yeah”. This was not entirely correct. Had you disclosed these convictions, prior to inception, an offer would not have been made to you. Under the Consumer Insurance (Disclosure and Representations) Act 2012 insurers have remedies made available to them if a misrepresentation was careless. If we, as the insurer, would not have entered into the consumer insurance contract, on any terms, we may avoid the contract, refuse all claims and issue you with a full refund of premium monies paid. If the qualifying misrepresentation was deliberate or reckless, we, as the insurer, may avoid the contract, refuse to pay claims and retain premiums. We consider you made the misrepresentation recklessly not caring whether it was true or otherwise. Somerset Bridge Limited (No. 10427946) is an Appointed Representative of Eldon Insurance Services Ltd. As a result of this misrepresentation we put you on notice that we will not be indemnifying you for any claim that has arisen as a result of motor accident dated 7th April 2020. It is our intention to ask our claims handlers to pursue you for recovery of any payments we are obliged to pay by law in connections with this accident. I trust that this has been clearly explained. just got this email today. Great

-

Correct

-

Stolen from outside my house don’t know how they didn’t have keys. It was found the next day burnt out. Insurance company is go skippy. Underwriters are Watford insurance company Europe ltd. yes was reported to police got crime ref. Car was valued at £3500 the 7 day notice was given today 05,05,2020

-

Hi all, Just looking for some help or advice. My car was stolen and burnt out a month ago. I contacted my insurance to make a claim. They asked me to send all drivers that are on the policy licence details etc. I had my brother as a named driver who I haven’t spoken to for over a year. My policy renewed with him on it from the year before. I went to his address to ask for his details so I could carry on the claim. Only for him to tell me that he’s disqualified. Now the underwriters have cancelled my insurance and are not going to pay out. This is what it states in the email. Under Section 1. "Cancellation" point "g" states: "Where We believe that continuing to provide cover following a known breach of any Policy Term, condition or Endorsement presents an unacceptable risk to us." This has left them with no alternative but to invoke their right to cancel in accordance with the above mentioned Policy Section and therefore we are hereby giving you notice that your Policy will be cancelled as from 7 days after the date of this letter. Any help or advice much appreciated.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.