Dazza75

Registered UsersChange your profile picture

-

Posts

169 -

Joined

-

Last visited

Reputation

6 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

No. On the pdf documents. There is a copy of my claim form and it says ‘For reference only’ so I guess the court has sent a copy of it via email to the solicitor. They are saying that the bank never received my claim form.

-

No they were not provided by Barclays Bank. They were provided by the solicitor yesterday. As soon as she made the set aside application she sent all of this to me. it looks like she has rang them and they have forwarded the claim form onto her. There is an email in those files from the court to the solicitors.

-

Their only half valid claim is that I sent it to Barclays and not them. They state in their paperwork here that they are ‘Instructed’ to receive it. They have never used that word in the emails sent to me. Also as stated you cannot send it directly to them. Money claim online doesn’t allow it so I have done nothing wrong. I did exactly what money claim online told me to do. What their solicitors wanted me to do was impossible so it wasn’t done. As for not receiving the claim, if they received judgement then they received the claim. Someone obviously didn’t action it or give it to a person that could deal with it.

-

All documents attached. Doc_20200506_180421.pdf Doc_20200506_210503.pdf Draft order (1).PDF draft order 2.PDF EXHIBIT_CM01.PDF Letter to Claimant 06_03_2020 (1).PDF N244.PDF n434 form.PDF WS of CM01.PDF

-

Her application to have it set aside. It looks like whatever she sent to the courts, she also sent to me. I mentioned it yesterday when I sent you a message.

-

I sent the email to her last night that you wrote for me. Added a few little bits more to give some meat to the things you brought up and they haven’t bothered to acknowledge or reply. She has sent an email yesterday with all of those documents you mention. She actually had a copy of my claim as it’s in part of her claim documents so I don’t understand why she is asking me for it. Will the county court now send me a copy of the claim and and give me an opportunity to dispute the set aside? I have been googling how to go about it and to be honest I’m not finding much info at all so I’m not sure how it progresses from here. If it looks like they will win the set aside and I’d be looking to pay their fees I’d rather instruct a solicitor and pay them to fight it then give them a penny. Do you want me to upload the documents she sent? It’ll take me a little while but I can do it. There are a few.

-

Not yet, I have copied and pasted it onto an email for me, I thought I would wait a little while in case you needed to make changes

-

Also, that email she sent to me at 2.13pm - what if I didn't even see that email until tonight or tomorrow? She would have taken all this action without me having any awareness of it whatsoever. That hardly seems fair does it. They should have to do things like that as a hard copy letter sent in the post. Had I read that email at 5.30pm this evening, I would have already been 2 hours too late to do anything she had requested.

-

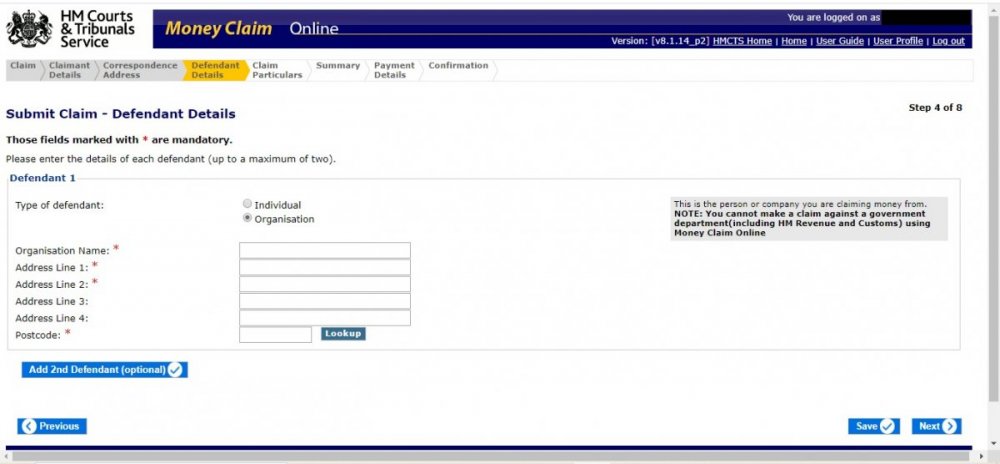

Would it be worth fighting them on this? I am really up for it. Their main point of contention is that I served it to Barclays head office instead of the solicitors, and that I addressed it to 'Barclays Bank' which according to them is an entity that doesn't exist. They are saying it should have been served to 'Barclays Bank UK PLC' however it was sent to the correct address which is the head office in London. As we now know, it is not possible to serve a moneyclaimonline claim to a representative. You have to serve it direct to the defendant so that point has to be mute. Secondly, if a claim is made against Barclays Bank at the head office address, how much can that differ to Barclays Bank Uk Plc at the head office address? Bearing in mind I am a layman and not a law professional and that moneyclaimonline is there to be used by people like me, a layman who isn't a law professional? I have a few thousand pounds saved up so if its worth a shot then I'm willing to take a risk.

-

I would be more than happy to send the letter, it would be nice if it all came to an end where the issues were dealt with. One concern is that she has already applied for the set aside, so does that make any difference? I assume fees etc have already been paid by them which they want to push onto me? Also, as you say, it is not possible to serve the papers to the banks representative so how could they have the judgement set aside when the governments own portal would not let me issue the papers to the solicitors directly? Surely a judge couldn't hold that against me, as it is entirely not possible to do as they 'suggested'? It isn't a case of I decided to be awkward by serving them to Barclays head office instead of the solicitors, I did it as it is the only thing you can do and there is no alternative.

-

This is the only page where you can enter any details for the defendant. The next page is particulars of the claim.

-

We didn't discuss who the claim is served against no. I will run through a claim on the site now and see what happens.

-

There is one on the 25th March. I can’t see one for the 6th March. I will look again when I’m home but running through the emails on my phone there was no correspondence at all on 6th March.

-

When I emailed Barclays to inform them I was taking action I gave my email address to them as a means of communication. They passed this onto the solicitors. I don’t recall agreeing to the service of documents in email with the solicitors.

-

On the money claim online form it says to serve to the business at the business address so that is what I did. My last 2 emails to the solicitors in March went unanswered and there has been no correspondence since even though they were supposed to confirm Barclays had amended my credit record. How could I be sure they were still representing the case? I sent the claim to Barclays as that was the only way I would know for sure that it would be received by Barclays.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.