-

Posts

23 -

Joined

-

Last visited

Reputation

1 NeutralRecent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

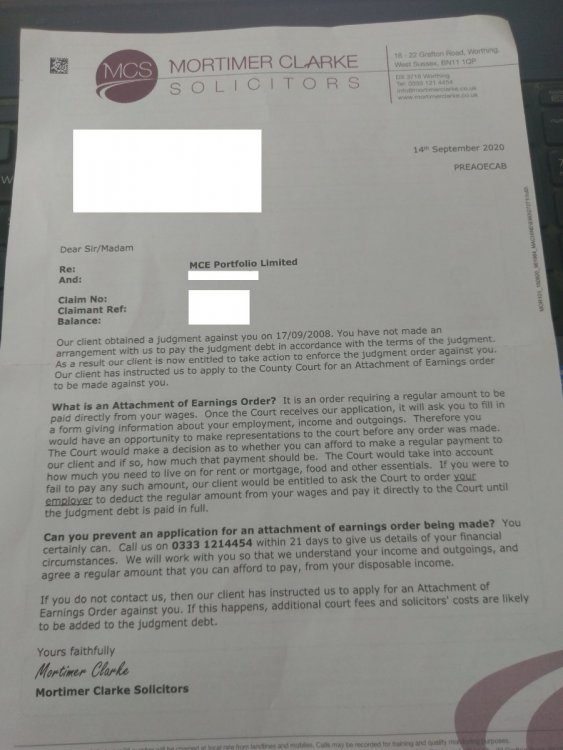

Hi, and thanks dx100uk for opening the thread Well another year passed and another letter has arrived. Just to recap the CCG is now 12 years old and for the first 6+ years I heard not a peep from these guys. Then in 2017 they suddenly popped up having realised they might have missed the boat. I have diligently refused to discuss this with them despite various threats. The latest arrived today and takes the form of a threat to seek an attachment of earnings order. So I think I know what the answer you guys will give, but I'd just like to make sure on that.

-

Yet another letter arrived today, this time from Engage (part of Marston) I will as always ignore this one too, although I do like the referrence to a CCJ having been obtained. Yes, it was 11 years ago. But before I go I'd like to run something past the wise and sage on CAG. It's now 11 years this month since they got the CCJ. They did nothing with it in terms of enforcement, I suspect because they mistakenly thought they had a charging order. Now they could go back to the court and ask for permission to enforce the CCJ but would have to explain both why they took no enforcement action within the 6 year limit, and then left it another 5 years before coming back to the court for permission to enforce. I'm not one to say 'never' but in my assessment they dont have much chance of convincing a court to excuse their oversight/incompetence and grant permission to enforce. However, I'm a little stubborn and would like to see them write-off the amount. Would it serve any purpose to engage a solicitor to put pressure on them to capitulate and write this off? If so can anyone suggest a solicitor who would be willing to take this on. Past experience is that most solicitors dont understand exactly whats going on here, either with the time since the CCJ or the restriction K. Or should I just put up with them adding to my ever growing pile of polite but meaningless letters. engage.pdf

-

Ho Chi Min changed their profile photo

-

Thanks Bank Fodder Well, MCE/Mortimer have popped up again for their 2 yearly round of banter. This time they are threatening to send Marstons round to visit me. I'm planning on sending a letter rescinding any express or implied permission to enter my property. Does anyone have any comments or further suggestions. Thanks as always.

-

It wasn't backdoor I defended it but had a somewhat biased Deputy District Judge. They then went on to get a charging order but the Judge at that hearing was more on the ball and made it clear that certain conditions around who owned what % of the house needed to be sorted before the order could be enforced. We own the house as tenants in common so the charging order is only on my share of the equity, whatever that is as it could easily be 0% up to a max of 50%. There is evidence in wills made at that time that we intended my equity share to be 0%. That was the last I ever heard from them. Since then I've moved but still own a percentage of the house with the charging order. So they've always had the means to get in touch with me. CCJ was for around £17k

-

Hi In short:- CCJ Granted. No contact for 9 years then I get a letter asking me to kindly call them to discuss payment. Does section 24 of the Limitations Act cover this? Does the creditior need Court permission to enforce? Would a Court be inclined to grant such an order? Thoughts much appreciated.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.