vix2000

-

Posts

344 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by vix2000

-

-

-

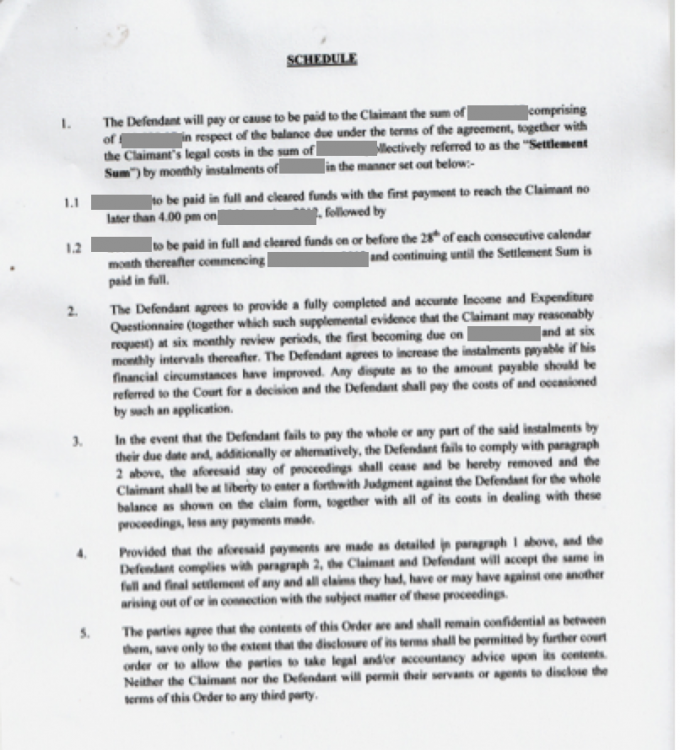

Sorry for the delayed reply. Thank you for all the advice and help. Is it OK to put the tomlin order minus details on here with it being confidential?

-

i have a long standing tomlin order for an old MBNA debt. I have recently been diagnosed with cancer and will not be able to work, therefore unable to pay the monthly payment. This is worrying me and I wondered if anyone can advise me if there's anything I can do about the agreement? Thank you.

-

Well done Robert and Bankfodder. Excellent interviews. The lady banker didn't sound very convincing to me. Made a few ambiguous statements. The threat of account closures was very clear though, wasn't it?

-

Thanks. Have pm'd him quite a few times since the telephone call last wednesday but I know he gets loads and I never quite know if he's missed them or is very busy, and I really don't want to hassle him, but he has told me we must not do anythink without checking in with him first, which is why last time I tried to contact him urgently I made the new post 'FAO Bankfodder' which did the trick but got me in trouble with you, so I now have to try other methods to contact him and pm'ing and emailing are my only option, but dont seem to have worked. I know that as the days go by if it has been missed the further down the pile it goes and the less chance there is of it been seen. I really dont know what sort of time I should get a reply in, so I usually wait 2 or 3 days before sending another message. We have recieved another letter from court today and don't know if we need to reply.

-

-

sent letter dictated by BF to solicitors asking them to clarify that they had made a mistake in assuming they had a judgement and that they would accept the £100 admitted and to send the 9 missing statements, also sent BFs letter to court withdrawing said admission. Had telephone call last weds asking what the letter was for. Said we needed the missing statements before a decision to accept the offer was made. They said they coudn't supply the statements, which was why they accepted the admitted £100. This was never mentioned before. We stressed that they had a duty to supply the last 6 years transaction details but he said they had written to court with their offer and our next contact would be from court, so it appears they won't be putting their mistake in writing. As we don't know when they wrote to court I don't know if this will affect our withdrawal of addmission. Need advice what to do next, please? Thanx.

-

does that mean you won?

-

Hi Bankfodder.

Just a quick reminder if you happen to read this that I sent you a pm on wednesday about the ge capital/howard cohen case against my daughter. You asked us not to do anything without checking in first.

(Can't do a new post to attract your attention as I get nasty messages from mod and to be honest I can't cope with the upset.)

-

Hi Bankfodder. Strange telephone call from solicitors yesterday. Have pm'd you details.

-

hi Alicole. Any progress yet?

-

Hi Mickey, hope you don't mind me asking but how long after making the court claim did they defend, as on other threads it was the day before their time was up, and how long from then did you recieve the dosh? Thanks and congrats.

-

yes, the templates are fine to use. Good Luck.

-

No, not at all, just that the OFT recommendations in the letter refer to credit card charges (see oft report below) and the oft are only suggesting that the banks follow them at present. Don't worry, and as Don Quixote says, get sending your letters. We'll all be here if you have any problems.

-

see my thread vix v halifax - settled in full

-

this is the oft press report. Tried posting link but wouldn't work.

Current credit card default charges unfairOFT sets threshold for intervention

68/06 5 April 2006

Credit card default charges (see note 1) have generally been set at a significantly higher level than is legally fair, said the OFT today. The OFT estimates that across the industry this has led to unlawful penalty charges currently in excess of 300 million a year.

Download Calculating fair default charges in credit card contracts (203 kb).

Download guide for consumers (64 kb).

The OFT now expects all credit card issuers to recalculate their default charges in line with the principles set out in a statement published today and to take urgent action where needed to reduce the level of credit card default fees. The industry has until 31 May to respond to the statement. These principles also apply to default charges in other consumer contracts such as those for bank overdrafts, store cards and mortgages.

Where credit card default charges are set at more than 12, the OFT will presume that they are unfair, and is likely to challenge the charge unless there are limited, exceptional business factors in play. A default charge is not fair simply because it is below 12. Setting a threshold for intervention is a pragmatic pro-consumer action that is designed to give the industry the opportunity to change its practice without litigation. It is supported by detailed guidance to the industry as to how to reduce the likelihood of public enforcement (see note 2).

A default charge should only be used to recover certain limited administrative costs. These may include postage and stationery costs and staff costs and also a proportionate share of the costs of maintaining premises and IT systems necessary to deal with defaults (see note 3). Exceptional business factors which may affect the level of a fair charge may include policies to prevent casual defaults as operated by issuers such as Egg (see note 4).

Only a court can finally decide whether a charge is unfair or not. The OFT has today set out a statement of its view of the law. This has not generally been accepted by most of the eight credit card issuers.

John Fingleton, OFT Chief Executive, said:

'Our statement of principles provides practical guidance to banks which increases their incentives to compete vigorously while protecting consumers from being charged unfair amounts. Our threshold approach is a spur to changes in market practice. We expect credit card issuers to adjust their default fee levels quickly. We have not ruled out future legal action if the market does not respond positively.'

NOTES

1. These are charges in standard credit card contracts for a failure to pay a minimum payment on the due date, exceeding a credit limit or a failure to honour a payment made.

2. This reflects the OFT's duty to target its resources on serious consumer detriment as a priority over cases involving less harm to consumers. Card issuers are required to confirm their response to the OFT statement by 31 May 2006.

3. A fair default charge should not exceed a reasonable estimate of certain limited administrative costs which the credit card issuer reasonably expects to incur as a result of default.

4. The OFT is not proposing that default fees should be equivalent to the threshold, and a court will certainly not consider that a default fee is fair just because it is below the threshold. Where there are exceptional business factors, so that the presumption that a default charge over 12 is unfair is not applicable, this does not necessarily mean that the current level of the default charge is consistent with the OFT's interpretation of the requirements of unfair contract terms legislation. But for example, where a card issuer has a policy of requiring customers to pay minimum monthly repayments by direct debits, such as that operated by Egg, and offers credit cards only to customers that satisfy a relatively high scoring requirement it may be able to set a fair default fee at a level above the threshold.

5. The OFT has published a short guide for consumers and consumer advice agencies setting out the principles on which default charges should be calculated. This can be downloaded above.

-

see above

-

Is it a credit card account you are claiming from?

-

No probs. Hope you get your soon. Good Luck.

-

Don't know about that. Have got my charges back today and they were paid into the current account that I claimed them from.

I would think the quickest way to close an account is to go into the branch. I have done this before and they close it straight away.

Hope this helps.

-

Thanks Bankfodder. Letters all ready to post tomorrow. Will keep you informed.

-

As far as I know you can claim if you have cashed in the policies.

I did try to sell mine first, and a company advertised them within the financial community, but there was no interest. To be honest, if they're worthless to us they're not going to be much good to anyone else either.

-

Thanks all. So you think its related too? Thought I was being paranoid.

-

Sorry, just noticed another cash deposit of £85.37. Thats the interest and charges, so all paid up!!!!! Brilliant.

On another subject, I know, but went in last week to request my od be raised from £100 to £250 for a few weeks as had a lot of dd's going out. Bearing in mind they're usually throwing loans, cc's etc at me as, according to them, I'm a 'good customer' ( I have mortage, car loan, insurance, savings accts with them, all always paid on time, salary goes through acct etc) and they refused!!!

Could it have anything to do with this claim, do you think?

Donation on its way!!!

old Moorgate Tomlin order for MBNA debt- changed to Idem

in Financial Legal Issues

Posted

Thank you very much, I will get a letter off as soon as possible.