fmc001

-

Posts

44 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by fmc001

-

-

Vonn

I have attached a spreadsheet detailing the following:

PPI Amount = £31.05

11 Payments starting December 2003

Statutory Interest applied @ 8%

Grand Total = £511.67

FMC

-

Hi exasperated

I am in a similar position to yourself. I had loans and credit cards with RBS dating from 1992 until approx 2002. I sent off a SAR but they replied stating that as the accounts have been closed for over 6 years they no longer had any information on file.

However if you have any of the loan agreements, with the PPI and repayment figures on them, or any of your credit card statements displaying PPI payments, then this can be used as the basis for your claim and to work out how much was paid and how much can be reclaimed.

Just to clarify about the six year limit. A lot of the banks are using this as the limit for how much information / statements they are willing to provide. eg they will not provide information on any transactions older than 6 years. However if you have documentation for PPI over 6 years in age this can still be claimed. Only this morning I received a refund for PPI on a bank loan dating from 1997.

Good luck

FMC

-

I am about to submit a claim for PPI on Credit Cards to RBS.

I have a couple of questions that I was hoping someone might be able to offer some advice on:

1) The accounts in question date from 1994 until approx 2001. I submitted a SAR but no information was supplied by RBS. They state they do not hold any info as the accounts were closed more than 6 years ago. I however have statements dating from 1994 till 1998. Should I submit a claim and provide copies of statements and estimate the remainder of PPI between 1998 and 2001. Or will I only be able to claim the figures that I can prove?

2) When calculating interest I believe the correct method should be: Original PPI figure + contractual interest + 8%

However should the contractual interest only be applied until the account was closed and 8% charged until settlement of claim?

Any advice and thoughts on the above would be welcome.

FMC

-

Just a quick update on this thread.

I submiited a request to claim back my PPI to Abbey National for a loan that was taken out in 1997 and finished in 2001.

My SAR was sent on 14th March 2010 and I received a copy of the original loan agreement dated July 1997.

I sent my first letter requesting a refund on 09 April 2010. This was delivered on the 14th April 2010. After waiting a few weeks I contacted the bank who denied ever receiving the letter.

I sent my second letter on 19th June. I received confirmation in the post of receipt from the bank.

Today I received in the post confirmation that my complaint has been upheld and that they will refund my premiums (£801.12) and 8% Interest (£705.11) making a total of £1506.23

I have got some forms to sign and return before the refund is released.

I would just like to say a big thank you to everyone that has helped and a donation will be made to CAG when the cheque is received.

-

Hi folks

Took my eye off the ball slightly with my SAR's and I have let this drag on slightly.

I have a quick question I was hoping someone might be able to answer.

The accounts I require information on were closed over 6 years ago. The bank state they do not hold any info. I pressed them for proof of destruction and they replied:

"It is not bank policy to provide any information in relation to data deletion or destruction processes or procedures"

Must the bank provide a certificate of destruction or other suitable documentation?

Thanks in advance for your help.

FMC

-

Helpingfriend

I am in a very similar position to yourself. I had credit cards with Lloyds dating back to approx 2003 / 2004.(This is when they were closed)

I only discovered the numbers after receiving my SAR for another bank.

My first letter SAR letter to Lloyds resulted in them denying any knowledge of me or the accounts ever existing.

I then contacted them again, asking them to recheck and also including details of my previous addresses.

This time they refused my SAR and sent my £10 PO back stating my previous address does not match the one on their records.

I wrote back a third time, enclosing a tick sheet of everything I needed (basically an idiots guide for them) stating if they cannot provide the information, I want to know the reasons why and if information has been destroyed a copy of the destruction certificate. I also threatened legal action if they did not comply.

I then received a letter stating they have found the account and all the details will be sent to a branch of my liking. What I will get and when I will get it is anyone's guess.

The point to my long winded post is do not give up. They will try their best to fob you off but do not take no for an answer. Keep at them.

I will of course let you know how I get on and what I get back in due course.

Good luck.

FMC

-

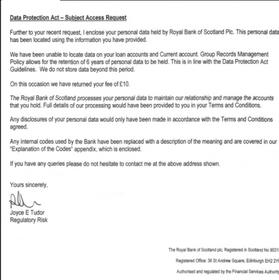

I finally received a reply from RBS, with regards to my SAR delivered on 16/03/2010, regarding my loans and current account dating from 1992. (The last loan finished in 2000 and I cannot ever recall closing the current account)

In their reply, which I think was laughable at least and very frustrating at most, they state all data older than 6 years will be destroyed in line with Group Records Management Policy. (Copy of reply attached)

I am now going to submit a complaint to the ICO but I cannot download any forms from their website.

Does any one have a copy of a complaints form, and if so could you let me know.

Many thanks

FMC

-

Hi Guys

I sent my SAR to EGG under the Data Protection Act 1998 clearly marked Subject Access Request. It was a template letter from the stickies basically asking for all information. The account in question is a Credit Card and has been closed for the last few years.

I received a reply in the post today stating:

Thank you for your request for an executed copy of the Credit Agreement for XXXX under Section 78 of the CCA 1978.

As the account is now closed Egg are under no obligation to comply with a request for a copy of the executed agreement as we no longer have a contractual relationship.

The right to be provided with this information from Egg ended with closure of the account. They go on to quote Section 78 (3a) of the CCA 1974.

I never submitted a request under CCA 1974 my request was under the DPA 1998.

Can anyone give any advice?

-

Ken

I am in a similiar position to yourself.

I have loans going back to 1992 with RBS. I have the original paperwork for 5 loans but submitted a SAR so as I have as much detail as possible before submitting my POC.

One thing I have learned, and with advice from alanalana, is to be patient.

However I will keep the site updated with my progress and I will watch with interest to see how you get on.

Best of luck

FMC

-

I submitted a SAR to MBNA looking to see if any PPI was attached to my credit card. To my surprise I received full details, dating back 8 years, including my signed copy of what appeared to be the original agreement

However much to my surprise and disappointment there was no PPI applied to the card.

However on the SAR paper work, at the account opening, I discoverd I transferred the balance of two old credit cards to MBNA. One for Lloyds and one for Morgan Stanley. The full credit card numbers were on the paperwork also.

As a result I sent a SAR to Lloyds but they say it is not one of their accounts and provided details of two other insurance companies to try.

I did a bit of research on line about the credit card number and the prefix, 546780 is definitely Lloyds.

Anybody any advice on this one!?!??!!

Thanks in advance

FMC

-

alanalana

You must have read my mind.

Thats exactly what I put in my letter. If they are unable to provide the documents requested the I require proof of destruction, as per DPA.

I will let you know how I get on.

Cheers

fmc

-

alanalana

Thanks very much for your reply.

I decided to send them a follow up letter highlighting a few of the key points stated in my original SAR. I will put the letter in the post on Monday, however I have given them 14 days to comply and supply information previously omitted.

If they still fail to comply I will go to the ICO.

Cheers

FMC

-

Hi folks

I submitted my SAR to RBS on 14th March 2010.

I have had loans and credit cards all with PPI applied and I have some of the original statements and loan agreements but not all. Hence submitting the SAR. My credit cards and loans all ran between 1992 and 2002

I received a reply today from RBS in respect of the credit card statements.

They state "as the accounts have been closed for more than 6 years, we no longer hold information".

They did not provide any proof that the records have been destroyed even though I requested it in the SAR.

Is there anything else I can do or just accept that its out of time!!

Cheers

FMC

-

Thanks DX

I have put my first letter of complaint in the post and I will keep you updated on my progress.

Cheers

-

Landy

Thanks very much for your advice.

I think I get a better idea now on how to calculate single premium PPI.

As the £16.69 monthly payment for PPI already includes the contractual interest you simply add 8% statutory interest to each of the 48 payments. Then add together £16.69 + 8% interest for each of the 48 payments to get your final figure.

I just received through my CCA from Abbey National so I am in the middle of putting together my first letter to claim my refund.

I have another question though. I have tried Google andthe forum but to no avail. Does anyone know if Abbey National were fined for miselling of PPI as I would like to include this point in my letter if appropriate.

Many thanks

FMC

-

Hi

While I am waiting for my SAR's to be processed I am currently trying to work out a figure for what I should be claiming.

I have attached an extract from my loan agreement stating the loan amount, interest, PPI amount and APR.

The loan was taken out in July1997 and the first payment made August 97 and there after for 48 months.

Can I claim Contractual Interest @ 17.9% and then 8% on top on the PPI Premium and the interest payments made.

By my calculations this would be in excess of £8000.

Can anyone confirm if this is correct??

Many thanks

-

Hi Landy

The loan is not running any longer and the last repayment was made on the loan in January 2001.

I have 6 loans in total.

5 have been with the RBS and date from 1992 to 1997 and the one highlighted in this thread is with Abbey National that ran from 1997 till 2001.

I also have some credit cards (in fact many over the past few years that I need to do a bit further research on) that I would like to pursue PPI claims against.

Unfortunately I can only remember the Credit Card company however I do not have and of the credit card details.

Does anyone know if I send an SAR request without account details does the CC company still need to comply???

For the time being I am going to have a go at calculating reclaim figures for the Abbey loan.

When complete I will copy them to here and I would be very grateful if someone could cast an eye over them to make sure that I am on the right track.

Cheers

-

Hi folks

First of all can I start by saying what a fantastic site this is.

I was quite sceptical about trying to reclaim PPI as I did not think that I would have much of a chance in succeeding. However after reading a few posts from various members I realise that my personal circumstances are very similar to other members who have launched and succeeded with their claims.

At this moment in time I have submitted to RBS and Abbey National a Subject Access Request. I also have other financial providers that I need to contact and will do so in the near future.

However as I await the outcome of the above I was hoping that someone would be able to provide some advice and guidance on what I am actually claiming for.

The breakdown of the loan was as follows:

Loan 4000.00

Interest 1498.40

Total Amount (A) 5498.40

A is payable by 48 monthly instalments of £114.55 (APR 17.9%)

Credit Protection Premium 582.69

Interest 218.43

Total Amount (B) 801.12

B is payable by 48 monthly instalments of £16.69 (APR 17.9%)[/font]

Total monthly payment = A + B = £131.24

In the above scenario is the correct amount to claim for equal to:

Amount B (Total cost of PPI including interest)* Compound Interest (8%)* Date Loan Issued (July 1997)

Any help advice or guidance that I am on the right track would be very much appreciated.

PPI Letter confusion

in Payment Protection Insurance (PPI)

Posted

Just to add to the comments above.

Only yesterday I received confirmation from Abbey National that my complaint for mis sold PPI dating from 1997 was being upheld.

The 6 year limit comes into force when you became aware of the mistake. Not necessarily when the PPI policy was sold.

FMC