console_2002

Registered UsersChange your profile picture

-

Posts

8 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by console_2002

-

Have you made any applications for car insurance on line? I have regular searches registered and it seems to be done by one or two insurance companies when using comparison sites.

-

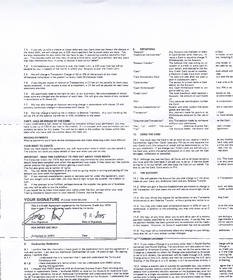

I like many others hit financial difficulty and was unable to keep up with my amex payments, at first I ignored the letters from amex and various collectors then after about 9 months of paying nothing I was in a position to borrow some money from family and in July 2010 I made there collector at the time an offer of full and final settlements for around 40pence in the £ I heard nothing back other than template collection letters from other agents, then in January this year I received a letter from Vilcollections stating that as i have made no attempt to correspond or make any payments they would unless I paid in full or a substantial amount within 7 be recommending my bankruptcy. I responded to Vilcollections with the following letter. Dear Personal Bankruptcy Unit RE: American Express Services Europe I write with reference to the money which you are claiming on the above account. On the 15th May 2010 I received a letter from Brachers LLP informing me they are acting on behalf of American Express Europe Limited, I complied with the letters request for a personal financial statement and at the time made an offer for full and final settlement of the account on the provision that American Express supplied me with a statement of the account along with a copy of the original signed agreement, Brachers LLP has failed to respond to my letter dated 17 July 2010. I have received no notification of the debt being passed on and I have not received any communication of my offer for full and final being refused or any supporting documents asked for from Brachers or American express. The OFT Debt Collection Guidance 2003 makes it quite clear in section 2.6 f that pressurising debtors to pay in full, in unreasonably large instalments, or to increase payments when they are unable to do so is unfair practice, however your letter clearly states that unless I make a substantial payment within seven days to your company you will be advising the Client to send a statutory demand and continue to bankruptcy. Section h also states ignoring and/or disregarding claims that debts have been settled or are disputed and continuing to make unjustified demands for payment is also an unfair practice, As this alleged debt stands I am dealing with Brachers LLP who have I have made a substantial offer to but who have failed to respond to my requests to settle the account. I would ask that you refer the case back to where you purchased it as you have incomplete records and should not be pursuing this debt when Brachers and American express have failed to provide details I have asked for despite being made a substantial offer. This is clearly covered in section I, failing to investigate and/or provide details as appropriate, when a debt is queried or disputed, possibly resulting in debtors being wrongly pursued. Yours sincerely I received a response from both Vil and amex stating they would investigate the case. I today received a letter from Amex stating that the investigation is complete and they have no records of me making any offers of payments to the account and that i should pay vilcollections in full. They also included the following which is part of the information I requested back in July 10 from the agent collecting. This is not a poor quality scan on my part this is exactly what I was sent, on two single sided pieces of A4 the poor quality is there scanning. My question now is how do I follow this up, they say they have no records of my offer, I am no longer in a position to settle this or make any payments, however I can not go bankrupt as it will prevent me from working in the industry I am trained and seek work in. I am now prepared to fight this as much as I can as Amex simply do not play ball, I have the copy of the letter I made as an offer and i have copies of the letters they have sent from there collection agents. I was thinking my next step would be to wait to hear from vilcollections and then hit them with faults in the credit agreement to stop them pushing for a bankruptcy, my credit rating is already shot so I have no issues about defaults. (£12K on card) I have never disputed the debt I only offered a full and final on the condition they proved it. Please advise on what my next move should be / points or defects I should quote from the agreement I was sent. The first point i noted was it does not contain my address and it has no authorisation signature by them. all comments on this would be welcomed. Regards Console

-

I am not refering to consumer credit agreements no. I refer to fees which people have paid up front to loan brokers in order to be procesed for a loan. Many loan brokers refuse to refund and issue terms and conditions which try to remove there obligation to the consumer. I only require data protection registration in order to do this. I cant post the website here but if you PM me ill send you the link which explains in full. Regards James Higgins

-

Thanks for your response, my reason for asking is I have recently set up a new business which involves claiming back fees for people who have paid loan brokers, the response so far has been a complete sucess however all of the brokers have returned the monies direct to the client obviously in the hope ill give up and go away. I am constantly reading consumer credit law in order to get all my legals correct some of the latest replies have been that goods/services paid using a credit or debit card must be refunded to that card, obviously I need to get one into court and make an example. Regards James Higgins

-

Hi, If a person pays for goods or services by a card credit or debit and subsequently requires a refund from the service or goods provider is there any law to state that the refund must go back to the card the payment was made on? or can they pay the amount back by cheque, cash? This question is not related to claiming for payments against the card provider, simply if a supplier agrees to refund are they under any law to refund to the card used to pay. If there are laws relating to this an someone point me in the right direction eg consumer credit act section xx Regards Console

-

I forgot to ask, if they fail to respond to the timescale for a cca, 14 days (2 days for postage and 12 working days) what do i send? subsequently if they fail to respond to A Subject Access Request, 42 days (2 days for postage and 40 calendar days) what do i send? once again thanks for you help. Jim

-

Thanks for your prompt response. I am very interested in why it is HSBC have not reported the credit card, it is obviously not just my file i have had this card over 5 years. I am very interested in finding out if they can subsequently report a default if they have not been reporting prior. If the account can not be enforced and they cant subsequently add a default record then the debt would be as good as deleted. write to me begging all you want you cant make me read it I will follow the process you have outlined, my intention is to not damage my credit file in the proocess. regards Jim

-

Hi, I have been a browser here for many months and finally decided to take the plunge and take some "consumer action" I have a HSBC Gold credit card with £6800 on it, I have never missed a payment on this and it is not at present in any dispute. Having fallen out with HSBC in regard to there dealings with a business account I would like some help with the enforeability issue of this card (revenge is sweet). My first question is this.......... 1/ I have a copy of my credit file frrom all 3 agencies and it does not show the HSBC credit card on any of the 3 reports, having had the card over 5 years i am a little confused as to why it is not listed at all on my file? 2/ If i challene the enforceability of the agreement and the bank default the account, can they then register the default on my file if they have never made an entry before? 3/ I am slightly confused with what to send and when in order to challenge the agreement, can someone give me a step by step guide with timescales? 1. send sar then wait ? how long 2 send ? wait how long? 3. send ? I have seen the templates for SAR but i have also become a little confused with what i am requestinfg as some posts mention the data protection act 1988? Many thanks for any help. Jim

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.