UnderWater

Registered UsersChange your profile picture

-

Posts

4 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by UnderWater

-

Halifax visa debit card chargeback - How long?

UnderWater replied to erodingzip's topic in General Consumer Issues

I think in addition to the operating procedures of the various credit card associations, you also have issues with reading comprehension. Nobody said it was not possible to use a Visa / MasterCard / American Express card product for the purchase of virtual goods. The fact is that merchants have much less recourse for virtual goods transactions when a chargeback is initiated. American Express: American Express Inquiry & Chargeback Policy and Procedure Guide for Merchants Full Recourse Chargebacks/Non Compliance Chargebacks In certain circumstances American Express debits disputed charges without sending an inquiry contact. For example, Merchants with high inquiry rates or conducting transactions in what are considered risky business environments may be required to accept full recourse on all inquiries. No inquiry is sent to you and all Cardmember disputes are immediately charged back. Internet Electronic Delivery If a dispute arises involving a Card-Not-Present charge that is an Internet Electronic Delivery transaction, we will exercise immediate Full Recourse. Certain types of transactions are prohibited on the Card. These transactions include: • Gambling services, gambling chips or gambling credits as well as online gambling. High Risk Mail, Phone and Internet Procedures Any time you process a transaction in which the Card is not present — you run a greater risk of fraud. American Express has designed safety procedures specifically for these situations. When processing Card not present transactions, always ask for: • Card billing address, as well as the shipping address (if different from billing address). American Express recommends shipping to the Cardmember’s address. Shipping to the billing address is necessary to avoid Full Recourse based on a Cardmember’s dispute of the Charge. * Or you can actually call AmEx. You do have an AmEx card, right? And a telephone? ===== Visa Operating Regulations. Volume 2 (Disputes) Visa chargeback reason code 30 Chargeback Condition 2 Cardholder or authorized person did not receive ordered merchandise. Chargeback Rights 1. For an Electronic Commerce Transaction, prior to exercising the Chargeback, Issuer must verify that Cardholder attempted to resolve the dispute with the Merchant. Representment Rights None ===== MC Chargeback Guide 3.28: Message Reason Code 4855—Nonreceipt of Merchandise The following sections describe the proper and improper use of message reason code 4855. Second Presentment: Condition The acquirer can substantiate that the merchandise was delivered. Supporting Documents Proof that the cardholder or person that the cardholder authorized received the merchandise. For example: • A signed and imprinted sales slip, invoice, or terminal-generated point-of-interaction (POI) receipt showing that the cardholder, or a person that the cardholder authorized, picked up the merchandise. This documentation proves that the card acceptor did not ship or deliver the merchandise. • Proof that the cardholder received the merchandise or a person authorized by the cardholder received the merchandise. For example, the card acceptor provided proof of a United Parcel Service (UPS) receipt. It is important to note that proof of shipping is not suffieient. Delivery must be proven by signature to prevail in an arbitration chargeback. A lot of people are not well versed in how credit card operations are carried out and they come here looking for truthful, solid advice. Those of us who are clued, have the duty to steer them in the right direction. Those of you who are clueless should try to get a clue before spewing misonformation. -

Halifax visa debit card chargeback - How long?

UnderWater replied to erodingzip's topic in General Consumer Issues

Amazing. Your denial of the truth shows no bounds. Is this an integrity issue or one where you are just completely ignorant of the facts? I have shown two actual chargebacks. Unlike you, I am not confused. I specifically included these two examples of chargebacks with my credit & debit cards since I am well aware that the original poster's issue is a debit card chargeback. So to reiterate, on one hand we have you -- and only you -- claiming there is no right to chargeback with PayPal transactions. On the other hand we have, Visa, my bank, original poster's bank, PayPal and >6,500 Google hits documenting untold thousands of PayPal users who have had their funds taken back by PayPal because of credit & debit card chargebacks. Visa, Inc.: November 8th, 2008: Visa Debit Chargeback process initiated. MasterCard Chargeback Manual: Message Reason Code 4855 - Nonreceipt of Merchandise For a Debit MasterCard purchase with cash back transaction, an issuer can submit this chargeback only for the purchase amount, or a portion thereof. The issuer must submit the First Chargeback/1442 message with a Function Code of 453 (Partial Amount). An issuer must not submit a chargeback for the cash back amount, or any portion thereof, using this reason code. ------- Feel free to refer to Visa & MasterCard directly -- as I have done -- to har their response that: - Although timeframes may be unequal (i.e. shortened), debit card products with the Visa logos have the same chargeback rights as credit card products. - MasterCard debit card products have long enjoyed the same chargeback rights as our credit card products. Due to operational considerations, there may be differences in time frames for certain chargeback categories. Please look up the definition of the terms delusional, incompetent and dishonest. Do you even have a credit much less a debit card? -

Halifax visa debit card chargeback - How long?

UnderWater replied to erodingzip's topic in General Consumer Issues

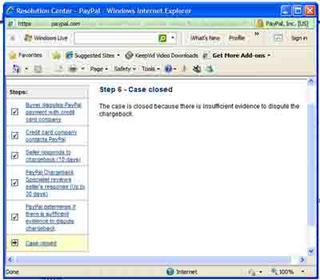

Yes, really. Your assertions are false ... totally false. First of all, when you enter into a transaction with a merchant and pay with a credit card funded PayPal payment, the merchant of record is PayPal, not the original merchant. If the original merchant does not complete the order, it is PayPal that has the ultimate responsability for the transaction. If PayPal can then obtain recourse with the original merchant, so much the better. If, however, PayPal cannot, then they bite the bullet as a cost of doing business as they are the merchant of record for credit card acceptance purposes. Let's surf on over to www.paypal.com. Click on the link at the bottom of the page entitled and then further click on the link entitled . PayPal's User Agreement specifically and unequivocally validates the facts as I have presented them. 1. Preamble: "Please note the following risks of using the PayPal service: Payments received in your PayPal account may be reversed at a later time for example, if such a payment is subject to a Chargeback, Reversal, Claim or otherwise invalidated. This means that for some of our sellers, payments received into their Account may be returned to the sender or otherwise removed from their Account after they have been paid and/or delivered any goods sold." 2. Clause 13.9: "Relationship between PayPal’s protection programs and Chargebacks Credit card chargeback rights, if they apply, are broader than PayPal’s protection programs. Chargeback rights may be filed more than 45 days after the payment, may cover unsatisfactory items even if they do not qualify as SNAD, and may cover intangible items. You may pursue a Dispute/Claim with PayPal, or you may contact your credit card company and pursue your chargeback rights. You may not pursue both at the same time or seek a double recovery. If you have an open Dispute or Claim with PayPal, and also file a chargeback with your credit card company, PayPal will close your Dispute or Claim, and you will have to rely solely on your chargeback rights. If PayPal does not make a final decision on your Claim until after your credit card issuer's deadline for filing a chargeback, and because of our delay you recover less than the full amount you would have been entitled to recover from the credit card issuer, we will reimburse you for the remainder of your loss (minus any amount you have already recovered from the seller). Before contacting your card issuer or filing a Dispute with PayPal, you should contact the seller to resolve your issue in accordance with the seller’s return policy as stated on their auction or website." Not only are your assertions shown completely false, but also the logic you used to reach those false assertions can be found -- should you delve a little deeper into the PayPal user Agreement -- is defective. I have personally had two chargebacks against PayPal merchants that were ultimately resolved in my favor. I will attempt to attach screen shots of the PayPal Resolution Center to document this. Meanwhile, you should apologize to the original popster for providing such a negligent answer. Regarding my statements concerning virtual goods, I shall return shortly after locating relevant excerpts from Visa, MasterCard and American Express' chargeback manuals. -

Halifax visa debit card chargeback - How long?

UnderWater replied to erodingzip's topic in General Consumer Issues

This is totally false. When you use a credit card to fund a PayPal transaction you do not -- in any case -- lose your original chargeback rights with your card association. You have several choices with a credit card funded PayPal transaction gone wrong: 1. You can refuse to go through the PayPal claim process and directly file a chargeback with your card issuer; 2. You can go through PayPal's claim process and, if successful, there is no need for a chargeback; or 3. You can go through the PayPal claim process and, if unsuccessful, then file a chargeback with your card issuing bank. According to Visa, MasterCard and American Express, chargebacks can take up to 6 months or longer to be finally resolved depending on whether PayPal contests them or not. A relatively simple chargeback that PayPal does not contest can take approximately 1 - 2 months before you see a permanent credit to your card statement. I seriously doubt that PayPal will contest a chargeback for virtual goods since all card associations' rules specify that merchants have no recourse with virtual goods transactions.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.