AHMTHSSN

Registered UsersChange your profile picture

-

Posts

7 -

Joined

-

Last visited

Reputation

1 Neutral-

Hi CitizenB, Yes, it was one of those leaflets that came out of the magazines/newspapers and i sent it off at the beginning of 2005. I am not sure as to what i should do now. i'll do some more searching on this forum to see where I stand. If anyone has been in a similiar situation to me, i would be very grateful for any advice. Thank You Adam

-

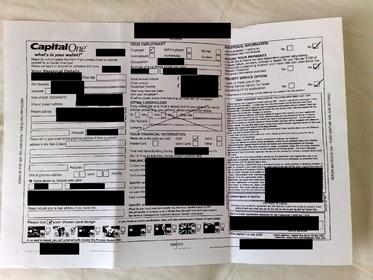

Hi AC, The picture is 5MB but it got resized when i uploaded it. I have added it here Capedited.jpg picture by adanand355 - Photobucket Cap2ed.jpg picture by adanand355 - Photobucket Its an application form asking for my personal and employment details and amount i wanted to transfer from other credit cards. The box where the signature is has the following written: CREDIT AGREEMENT REGULATED BY THE CONSUMER CREDIT ACT 1974 Please issue to me a Capital One credit card and PIN. I confirm that all the information i have given is true and complete. I understand that this information will be checked with fraud prevention agencies and if i give you false or inaccurate information and you suspect fraud you will record this. I authorise Capital One to search the files of any credit reference agency for my application and to help you manage my account. The credit reference agencies will record details of Capital One's search and your application. Information held about you by the credit reference agencies may already be linked to records relating to one or more people with whom you have a financial association. For any searches Capital One makes you may treated as linked to them and you will be assessed with reference to their records. We may also add to your record with credit reference agencies details of how you conduct your Capital One account (including defaults). Capital One and other organisations may use and search these records about you and those to whom you are financially linked to: * help make decisionsa about credit and credit related services such as insurance for me or members of my household* *trace debtors, recover debt, prevent fraud and to manage my accounts* *check my identity to prevent money laundering, unless we are satisfied about your identity* Fraud prevention agency records will also be shared with other organisations to manage insurance polocies and help make decisions on motor, household, credit, life and other insurance proposals and insurance claims for me and members of my household. The credit reference agencies and fraud prevention agencies will also use the records for statistical analysis about credit and fraud. I have read the terms and conditions setting out the agreement with Capital One and, if my application is accepted, i agree to be bound by these terms and conditions as amended from time to time. I am 18 years of age and over. Credit scoring. Capital One usea a technique known as 'credit scoring' in deciding whether to open an account in your name and if so, what credit limit you will be given. Capital One will also use this technique throughout the life of this agreement to assess your credit limit and the interest rate and other charges to be applied to your account, all of which may be varied. Your information and marketing, 'important' please read ' use of information' overleaf (section 23 of the agreement) which sets out how your information will be used. By signing this application, you agree that information about you may be used (xxxx xxx xxx unreadable) of whetheror not your application is accepted. One of the ways your information will be used is to send you information or phone you about other products or services offered by Capital One or other companies. Your name, address and phone number may be give to those other companies for that purpose. If you do not wish to receive marketing information please tick box. This is a Credit agreement regulated by the Consumer Credit Act 1974. Sign it only if you want to be bound by its terms. Thanks Adam

-

Hi All, I finally received a reply from Link a couple of days ago after requesting a CCA a couple of months ago and this is what they sent me. 1 single page with my details and the date hand written on it. It was done just after New Year 2005 and from what i can remember it was one of those leaflets that came out of the newspapers/magazines. I thought they were going to send me "proper" letters with all the terms & conditions. I haven't paid any money directly to Link since they took over my debt and my account is on hold till I get in touch with them. Any suggestions as to what i should do?? Thanks Adam

-

Hi All, I sent Link a request for copies of the CCA 77/78 and got a letter from them yesterday and this is what they had to say: You have recently made a request under Section 77/78 for copies of various documents. As you are aware LINK FINANCIAL purchased your debt from CAPITAL ONE BANK (EUROPE) PLC on xx xxxxxxxxx 2008 and as such we do not always hold this documentation. We have requested a copy of the agreement and the most recent terms and conditions your account was operated under from CAPITAL ONE BANK (EUROPE) PLC and look forward to sending this to you in the near future, however please be advised that this can take up to 30 days to provide. No administration charge has been applied to your account at this time and therefore any payment made with your request has been applied to reduce your outstanding debt. However where cost is incurred by Link for the provision of any statements by the Vendor we will pass these charges on to you. Your account has been put on hold for the next 14 days for you to contact this office with further details as requested above. Link Financial Limited I was making a monthly payment of £20 to Capital One (i havent made any payments to Link so far) before the debt was bought by Link. Should I continue making that payment or just wait for the CCA. Adam

-

Hi, Thanks for the responses. I have always paid the £20 per month to Capital One on time and never missed a payment. Method of payment was with cash via a payment slip at Lloyds Bank (i have an account with Lloyds and they dont charge me for doing this). Reading some posts on here I realise I made a mistake of speaking to Link on the phone. I will send them the letter "N" template and see what they respond with. Thanks again and i'll post updates on what happens next. Adam

-

Hi All, I came across this site while doing a search on Link Financial Ltd, as I too have received a letter from them about my Capital One Credit Card account and would be very grateful for some advice. I owe Capital One £1400 and have been on a payment plan of £20 per month for just over 2 Years. Last week Link Financial sent me letter (and called the same day) telling me that they are the current owner of the outstanding balance of my agreement with Capital One. Also included was a seperate sheet from Capital One telling me that they had sold my account to Link and that all contact should now be with Link. The person from Link told me to make the £20 payments to them and gave me a bank account number over the phone to set up a standing order. Can they do this and what can/should I do? I have done a search on here and found some letter Templates (Letter N), Should I print that off and send it to them or does anyone have any other advice. Thanks Adam

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.