weymouthuk

Registered UsersChange your profile picture

-

Posts

39 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Everything posted by weymouthuk

-

Illegal Eviction

weymouthuk replied to weymouthuk's topic in Residential and Commercial lettings/Freehold issues

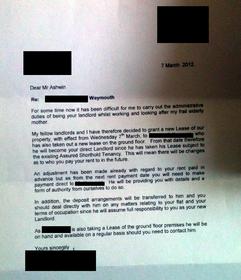

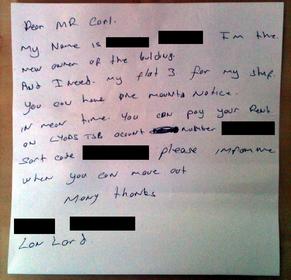

Can one of you advise me what should have happened regarding deposits? To recap then, all I have had in terms of correspondence about this whole thing (indeed all any of us have had) are the two letters below. -

Illegal Eviction

weymouthuk replied to weymouthuk's topic in Residential and Commercial lettings/Freehold issues

Thanks stu007. It's all tenants in the building. "I'll give you 28 days and two weeks rent free". Stinks to high heaven this whole thing. -

Illegal Eviction

weymouthuk replied to weymouthuk's topic in Residential and Commercial lettings/Freehold issues

Blimey this is a complicated business isn't it? But hey, regardless of who should be giving the notice, I am correct in saying it should be a section 21 notice giving at least two months to leave from the next rent due date? This guy has told me, if I go within the next 28 days, he'll give me two weeks rent free. Yeah right!!!! -

Illegal Eviction

weymouthuk replied to weymouthuk's topic in Residential and Commercial lettings/Freehold issues

Gents. There is some confusion here. The new Landlord is NOT the new Owner. The Owner has leased the building to the new Landlord but the Owner (who I originally leased the flat from) is still the Owner of the building. -

Illegal Eviction

weymouthuk replied to weymouthuk's topic in Residential and Commercial lettings/Freehold issues

Hi Yes I did pay a deposit way, way back. I've been told tonight that the only person that an issue the Section 21 notice is the person I have a contract with, in this case, the original owner of the building as I do not have any contract whatsoever with the new Landlord. Carl. -

Dear All I really need your help right now. I live in a building which consists of a shop on the ground floor and three properties on the above three floors. On Wednesday of this week, all of us in this building were given a letter by the owner of the building and (at the time) current landlord explaining that as of that day, the lease for the building was now in the control of the shop owner on the ground floor. The following day I came home to find a hand written letter from the new landlord as per the attachment below. I am not in any debt with my landlord of any kind. Today he has visited telling me I have 28 days and if I got within that time, he will give two weeks discount on my rent. I was on an Assured Shorthold Tenancy with the previous landlord (and the overall owner of the building) which has since lapsed into a monthly rolling periodic tenancy. The new landlord is claiming I have no contract with him and therefore he is only required to give me 28 days notice to leave. Is this right? All of us in the building are being subjected to the same version of events and we are all pretty frightened right now. Carl. PS: If you are unable to read the letter, the text is as follows: Dear Mr. Carl My name is X X. I'm the new owner of the building. And I need my flat 3 for my stuff. You can have one months notice. In mean time you can pay your rent on Lyods TSB account number x Sort code X. Please inform me when you can move out. Many thanks.

-

Hi Folks, I'm back again and need some advice. I'm totting up my latest set of figures (statements arrived within a week!). In the early parts of my statements there is a recurring 'Service Fee'. Can I claim this back? Also later on, the 'Service Fee' seems to dissapear altogether and is replaced by an indentical monthly amount simply listed as 'Charges'. Can I claim this back also?

-

Whats really hilarious is that Green & Co are based in the same bulding as NatWest Collections. Same address and everything!.

-

Hi All Quick update for you. Sent the letter above by Special Delivery. Lo and behold I received a letter back, actually signed by a human being saying that they accept my offer of £75.00 per month for the next 6 monts at which point I will need to contact them again. So all good.... Then, a few days later I receive a letter from Green & Co Solicitors saying that Natwest have instructed them to issue proceedings against me but that they would like to offer me the chance to put forward a payment proposal in order to sort the matter without court. So what do I do now? I have a letter from Natwest accepting my offer and then a letter from Green & Co. I get the distinct impression that NatWest are really disorganised. Should I just copy the letter Natwest sent me and send it to Green & Co? Carl.

-

Hi Goldlady, Andy & WendyB Thanks all for your words of encouragement. I have been with another bank for a while now so the NW account is basically frozen and no longer in use. This letter is more of a tactical move on my part as it puts an extra little something into the mix for a judge to see if it goes that far. I don't assume for one moment that NatWest have become reasonable but at least I can demonstrate that I have made every reasonable effort to engage them in a mature and decent way, something I think any judge would note and something which I feel would stand in my favour. It's not like I'm telling them I don't accept the debt and they should go take a Flying F~~~. Believe me the temptation is strong though. I will send special delivery, thanks Wendy. I don't mind paying the extra to ensure it is received and signed for. By the way Wendy, check out www.richersounds.com for a good selection of turntables. Thanks all Carl.

-

Zoot, No chance of pawning the records. The bailiffs will have to prize them out of my hands first......the swines!! Carl.

-

Hi Andy I don't think it would hurt, do you? Carl.

-

Zoot Thank You! At last some positive encouragement which leaves me feeling all relieved. I hope you are right regarding the crossed letters but I will send this anyway. Who knows, maybe if this gets through to them I may not need pawn my Rolex after all Carl.

-

Oh, forgot to say. My priority is agreeing a repayment plan with them. I cant put reclaiming charges that will likely be stayed pending OFT as a priority, that would be suicide.

-

Hi Folks I've just had a read through my thread and something doesn't sit right for me. I feel it would be prudent to make the effort to engage with Natwest if only to get something other than a template letter out of them. To this end I have drafted a much less aggressive letter than my previous attempt and your comments would be appreciated. Come what may, if I've sent this, surely it shows I've done the best I can? Carl. Dear Sirs I write further to your letter of 27/11/07. I am aware of the outstanding balance on my overdraft and am willing to pay this balance off. I have visited your website (www.natwest.com/paybycard) and set up an instruction to pay £75.00 per month against this debt. Unfortunately your most recent letter does not acknowledge this at all. Under my current level of income, £75.00 per month is the absolute maximum I can afford. That said, I am soon moving to a new job with a higher salary and I will be pleased to increase this amount as the funds become available. I would however advise you that, for now, the £75.00 per month instruction I have set up with you is the most I can afford. This will be the third letter I have written to NatWest in relation to this matter in an attempt to enter into a sincere dialogue. The previous two letters I sent were not acknowledged at all. Both detailed my offer of £75.00 per month. I visited your paybycard website as instructed and set up an agreement. I have however received no personal response from you indicating that you are not satisfied with this amount or that you wish to come to an arrangement without the neccesity of involving the courts which I have attempted to do twice already and a third time with this letter. Instead I have been sent what I can only assume are standard template letters, and I hardly think this can be considered sincere. I am in full time employment and in a position to make regular payments against the outstanding amount and let me assure you, it is my absolute intention to pay off this debt and I feel confident that I have made the necessary effort to address this matter suitably, courteously and in a timely manner. Taking these points into account, the commencement of legal proceedings could be counter to the ‘Overriding Objectives’ of the new Civil Procedure Rules. You will be aware that the Overriding Objectives underpin everything the court does. Moreover, paragraph 4 of the Protocols Practice Direction states that in cases not covered by an approved pre−action protocol, the court will expect the parties “to act reasonably…….. in trying to avoid the necessity for the start of proceedings”. I would respectfully suggest that your failure to respond to my letters, to not enter into a sincere dialogue and not accept my offer could be viewed as unreasonable and (if necessary) I would ask the court to consider these matters with reference to the Overriding Objectives. The offer of £75 per month is of course still open to you to accept and I eagerly await your personal response in this matter accordingly. Yours faithfully

-

Hi All Just really wanted some opinions on what my next course of action should be. Do I: 1. Keep up the repayments and risk the court papers landing on the doorstep and then defend the claim? or 2. Go ahead with the claim for charges myself and keep up the repayments I'm already making?

-

Hi Andy The Default note overdraft termination date is definately numbers. Does this have a major impact? This letter came from the NatWest Birmingham Collections Centre. The letter that followed came from Tamarisk Debt Management, also in Birmingham, part of Royal Bank of Scotland. The latest letter (27/11/07) is from Telford Credit Management Services and on Natwest headed paper. Carl.

-

Perhaps I should send another Data request letter and get the most up to date set of figures?

-

Hi Andy Thanks for your advice. My answers to your questions are as follows. The D/N is headed 'Notice served under sections 76(1) and 98(1) of the Consumer Credit Act 1974' It is to this letter and notice that I first responded by letter sent recorded delivery with my offer which was completely ignored. The latest letter is My address and the branch address are on it along with my account number and sort code. The termination date is in numbers '07/10/07', not letters. The outstanding or 'Principal' amount is shown along with 'Interest to the date shown above' and this has a small Crucifix next to it which later on the notice indicates 'Interest will continue to be applied to the account and the Total Amount Outstanding will increase accordingly, if payment is not made by the date shown above'. The Principal amount has an asterisk next to it which later on in the notice indicates 'Principal includes the £30.00 fee charged for this notice while will be applied to the account before the date shown above'. It is to this letter that I responded by Recorded letter with my offer which was completely ignored. The latest letter dated 27/11/07 reads. Please telephone us immediately on the number quoted in this letter to arrange repayment of your unsatisfactory debt, as the full balance is due immediately. Telephone lines are open from 8.00 am to 9.00 pm Weekdays and 9.00 am to 5.00pm on Saturdays and Sundays. We are able to accept debit Debit and Credit card payments. You can make payents into your account via our Internet payment facility. Log on to www.natwest.com/paybycard to make direct payments for your credit/debit card into your accounts. Failure to respond will result in us either commencing legak action or instructing Debt Collection Agents to recover the money due. As a result we may:- - Secure the debt against your property by way of a Court Order. Should a charge be obtained over your property, then we may take repossession proceedings and sell the property. - Pass your debt to a firm of debt collectors. - Commence court action to secure payment from your employer direct from your income. - Apply for bankruptcy/sequestration. Yours sincerely The amount now outstanding is £1681.47 which is clearly down following my previous payment only a week earlier when I set up an instruction to pay them £75.00 monthly. I am now with a different bank and I do believe charges have indeed frozen. To be honest even after I cancelled all Standing Orders and Direct Debits on the Natwest account they still continued to charge me. As I said earlier, I'm open to go to a CCJ. I know it's not the best thing to have against my name but I would rather put the bastards in front of a judge who can see that I'm doing the best I can. On the other hand Andy, I'm fired up to take them on as you suggest. Your comments would be much appreciated. Carl.

-

Hi Andy I calculate £2645.00 precisely in charges I could claim back which more than covers my overdraft. Having said that, this figure was gained from statements calculated about a week before the OFT case started, since then there have been more charges piled on so it will likely be higher now. What do you need to know about the Default Notice? Let me know and I will tell you. Thanks Carl.

-

Northern Soul? Im a DJ myself, I play Indie, Mod and hey, Northern Soul too!!

-

Hi Wendy Thanks again for your guidance. A tweaked version would be a great help but of course I understand your busy. Thanks Carl.

-

Do you thinks its too much Wendy? I'm really just at the end of my tether with these people now. I draw the line when it starts to make me feel ill opening these letters. Surely it's not right? I do want to put my point across as forcefully as possile because I really do mean business with them. I'm quite happy for this to go to a CCJ if it has too because I know that any judge is going to look at my income and conclude that £75.00 per month is actually more than I can afford.

-

I was thinking of sending them this, its only a draft but any pointers/advice would be much appreciated. Dear Sir/Madam ACCOUNT: SORT CODE: I enclose various correspondence received from NatWest recently in relation the above account. In response to the letter of (DATE) I wrote back to NatWest via Recorded delivery offering £75.00 per month to clear my overdraft. I received no response whatsoever to this letter. I know it was delivered and I know it was signed for but apparently, simply ignored. In response to the letter of (DATE) I wrote back to the Debt Collection agency, again via Recorded delivery and again offering £75.00 per month to clear my overdraft. I received no response whatsoever to this letter. I know it was delivered and I know it was signed for but apparently, once again, simply ignored. In response to the letter of (DATE) I visited the website NatWest - Pay by card - Welcome to the Online Repayment Service and arranged, on-line to pay NatWest £75.00 monthly. The amount was taken from my account, accepted and not returned. And so to the latest letter (DATE) not only demanding the full amount but also again advising me to visit the same website I have already been to and already set up a payment plan along with a very succinct little Bullet Point list of threats for remedial action. You will no doubt be aware of the current case in the High Courts which Royal Bank of Scotland have entered into along with other High Street Banks to ascertain the fairness of bank charges. Obviosuly NatWest are unsure of the fairness of these charges or RBS wouldn't have agreed to take part in this case. I urge you to look at the percentage of my existing overdraft that is made up of these charges. I also urge you to look back some 6 years and add the whole amount of charges and interest whereby you will see that, under the current state of the law on these charges, NatWest are in fact in debt to me and it is I who should be sending the threatening letters. I am lodging a complaint with the Financial Ombudsmen as I believe this matter will be of interest to them. I will be enclosing this letter along with copies of your letters and a full explanation of how I have been ignored & threatened. I am also declaring to you formally that I have now had enough of this regime of threatening letters and I am writing today to tell you that I find your conduct unacceptable, unprofessional and I am formally asking you to stop this immediately. I have offered £75.00 per month which is more than I can comfortably afford but I am eager to pay off the overdraft. This is my final offer in the matter. If this is not acceptable by NatWest then I will gladly hand my collection of letters along with the facts of my own experiences detailed above over to a Judge if this matter should go to court. I have made several attempts to settle this matter amicably, which you yourselves are bound by law to do. Your letters and conduct in this matter fly in the face of this law and I therefore believe you to be guilty of breaking the law on this matter. In addition you have applied charges upon charges to my account, all of which are unlawful and so again, I believe you to be guilty of breaking the law in this matter also. I have broken no laws by having a debt, by responding to your letters promptly and by setting up a regular payment with yourselves. Yours sincerely

-

Get this: They've sent me a default notice so I wrote them a letter and sent it to them Recorded delivery offering them £75.00 a month to clear my overdraft. I received no response. Then I get a letter from Natwests Debt Collection agency threatening all the usual stuff so I wrote another letter with the same offer, sent it Recorded delivery, received no response. Then a further letter from Natwest, this time telling me to visit NatWest - Pay by card - Welcome to the Online Repayment Service and make payments against my balance that way. So I set up to pay £75.00 a month and the payment was taken from account. So I assumed all Okat. Then today, a further letter from Natwest saying the amount is now due in full and failure to comply will lead to any of the following: -Secure the debt against your property by way of a court order. Should a charge be obtained over your property, then we may take possession. (I rent so, good luck to em). -Pass your debt to a firm of debt collectors (already been that route with them) -Commence court action to secure payment from your employer direct from your income (I'm a temp so again, good luck to em) -Apply for your bankruptcy/sequestration (what the hell is sequestration?) Ive really now had enough of this regime of threatening letters. I've offered them what I can, in fact actually its more than I can comfortably afford and still they threaten me. What do I do?? Who do I write too and what do I say?? The T&C's from their 'Pay By Card' Site mentioned above are: Terms and Conditions Please allow up to 5 working days for payments to reach your account. Please note that interest and penalties may continue to accrue or be applied until the payment reaches the designated account. (Please ensure that you have sufficient funds in your account to meet the payment). Please note that our acting on a single payment or recurring payment instruction received from you will not mean that we have agreed to accept that payment and/or future payments in place of your payment obligations to us as set out in the relevant contract between us or as may have been varied from time to time by written agreement. If you give us a recurring payment instruction which you wish us to accept as changing your agreed payment obligations, you must submit a request to your usual contact point and your request will be considered. You are free to end a recurring payment instruction at any time. Can anybody point me in the right direction cos at the moment I'm tempted to right back and tell them that if they want to see me in court then I'll be there!

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.