St1973

-

Posts

125 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by St1973

-

-

My IVA is 100p in the £ and I have already made payments.

The RBS agreed to the IVA so what are they expecting?

Does this make my IVA invalid?

If I pay the RBS through the IVA for 100% and my wife pays when do I get the surplus back?

Surely some sense needs to be seen here.

My wife doesn't work so what can she offer as our income has been assessed

so we can give the maximum IVA payment.

I can't afford anymore and the RBS agreed that by accepting the IVA.

-

I appreciate that but my point is that why are they not satisfied with the IVA?

They agreed to it and given its a 100p in the £ agreement they are acting unreasonable.

I've seen a few cases in the FO website of similar circumstance

and the FO has upheld the complaints and made the banks back off and remove defaults.

Maybe that's a line I should try?

-

Thank you. I just think it is unreasonable to pursue the debt twice when an agreement has been reached already.

-

Hopefully someone can give me some advice and help as my IVA supervisor wasn't very helpful.

I have recently entered an IVA, which includes a 6k overdraft debt with the RBS. My IVA is 100p in the pound so they will receive the full amount. Since my IVA has started, the RBS have been vigorously chasing my wife for the FULL amount. I lodged a complaint as such and they responded simply by stating procedure.

How can they claim a debt in full twice? Surely I can reason with them if reasoning is in their vocabulary!

Any help would be appreciated as she is physically stressed about this as the repercussions threatened could have her sacked.

Thanks

-

I called the court and explained. They asked me to put it all in an email and they would sort it out and rearrange the date.

-

Hi all. Thank you for the advice. I have asked the court to postpone the hearing as a dear family member has been rushed into hospital with a brain bleed and is sadly dying. Hopefully the hearing can be adjourned until a later date. Again, thank you for your advice to this complete novice.

-

HI, I have a Set Aside hearing set for tomorrow (9th Jan) and have had a reply from Wright Hassall who are contesting it. My N244 form states that I need a set aside so I can prepare an effective IVA that treats all my creditors fairly. I have stated previous mental health issues and problems with my previous business which is now liquidated and how my new career is going well and has a very brght and lucrative future.

Can I ask two things:

1: Do I need to attend?

2: Do I need to send in a counter statement to Wright Hassall who have basically said that I owe the debt and that there is no garuntee that I could put an IVA together that they would agree too (I have many creditors and only need 75% to agree)

-

Its on hold at the moment as by Business is being wound up and the IP wants to wrap liabilities up from both the business and personal into one IVA. I just need a way to keep these guys at bay so I can get this finalised.

-

Some information for you.

Hi,

How do I go about doing this?

Cheers

S

-

Thanks Citizen, I have already emailed my IVA admin and informed them. What can I do in the interim to address the 16 day period? Surely they must embrace the IVA?

-

Hi,

About three weeks ago I received a County Court Claim form from Cabot Finance (from Wright Hassall LLP) for a debt from my Virgin Credit Card from 2007.

I filled in the form to say that I would be repaying the debt,

but under an IVA that is being constructed due to my business being wound up.

Today I received a CCJ that said the claimant had rejected my proposal, without any negotiation,

and a CCJ has been entered against me (disaster!).

They are demanding repayment within 16 days of 10570 pounds.

Can I appeal this under the IVA?

Should they have listened to my IVA proposal as it is a formal mechanism to repay debts etc?

Any advice would be appreciated

Thanks

S

-

Thank you so much...I will edit/amend and send off accordingly.

I will post the reply

Thanks again

-

Its a difficult decision. Two things;

1. If I accept the offer, I then acknowledge the debt and thus, in my opinion, wave any notion of it being unenforceable

2. If I dont, a court may take a dim view (if they can do that given that the CCA was written by a 3 yr old)

Thoughts?

-

I am concerned that this is a way of catching me with a 'you have recognised the debt officially' now pay up and you have no defence on the agreement being unenforceable...

Hmmmmmmm....something to ponder. Its a nice offer, but again, long term, the consequences could be bad.

-

I did wonder because there appeared to have been other DCAs skulking around before HCohen appeared from under a stone !!

TBH, I dont know what you should be doing next. It would appear you are still minus an agreement that is acceptable and now you have a Default Notice that is wrong..

Do you have any charges for default/late payment on the account? was there ever any PPI on it ?

What made you stop payments in the first place ?

What do you want to achieve ?

Well, I am sure there will be charges levied on the account as the total amount did increase quite a bit. As for PPI I am not sure.

The reason why I stopped paying was simply due to affordability as I couldnt meet payments. I am hoping for a resolution whereby they end the futility of the enforcement without proper agreement and write it off.

-

Never received any notice of assignment at all......so I assume they are acting on behalf of Co-Op.....

-

Sorted!

-

-

Hi Guys,

I have recently been flooded with threats from DCA's/Solicitors regarding this debt, each one fobbed off accordingly with the standard "Please produce a valid CCA"...

Now, this crowd have made me a strange offer of paying £23 a month to clear a 8 grand debt. Now, I know they buy the debt at a lot less than what it is, but is this a good move for me, or another one to 'fight'...advice would be appreciated

Thanks

St

-

Thanks....

-

Whats the link?

-

I have an ongoing CCA dispute with the Co-Operative bank (see thread http://www.consumeractiongroup.co.uk/forum/showthread.php?197087-ST1973-V-Co-Operative-(Smile-bank)

After repeated Account in Dispute letters to Moorcroft who have obv been sold the debt, they visited my home earlier tonight while I was working away.

Could someone help please as this is unacceptable

Thanks

-

Moorcroft Debt Recovery calling at my home!

Hi Guys, after repeated letters etc, Moorcroft sent someone to my home this evening. I would be grateful if anyone had any advise on how to stop this. They are clearly ignoring my 'Account in Dispute' claim and im furious for them doing it (I suppose thats the reaction they want).

Please guys, I need help!

-

Hi All,

I wrote to Rossendales/Arrow making an offer as described above. They have not responded until now but with an added letter from mr carter solicitors. Should I reiterate the offer that I made previously, or should I do something else?

I need help on this as I am about to go through employment screening (credit Check) for a really top job and would like to have a settlement to this issue to show I am managing this.

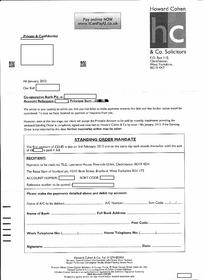

I have attached Uncle Bryans Letter for reference

Thanks

Response to an intention to Default from RBS

in Royal Bank of Scotland

Posted

HI,

I have received a 'Formal Notice of an intention to file a default' from the RBS with the 28 calendar days running out TODAY!

I have been in the middle east for 5 weeks and have just seen this letter.

Can I ask for an extension to respond? If so, do any templates exist to help?

Thanks