turnedworm

-

Posts

57 -

Joined

-

Last visited

Content Type

Profiles

Forums

Post article

CAGMag

Blogs

Keywords

Posts posted by turnedworm

-

-

They are RECC accredited; might give them a call.

Also part of the install (a gateway to my mains board) is not very level at all, might get them back to sort that at the same time as well. Would take a lot longer to make good than the grill, but doable in a morning. That would be at their cost - looking at their terms and conditions.

-

I've had no other quotes, but they have contacted Tesla to check the specification of the adhesive to be used. To ensure the 10yr Tesla guarantee (of the battery) isn't compromised.

-

Thanks for the reply. Yes the installer is also the supplying company.

-

I hope this is in the correct place.

In January this year we had a solar and home battery (Tesla Powerwall) installed. After a few weeks I found a piece of side trim on the battery was loose - not affecting the function of the battery. I raised this with the installation company and they referred it to Tesla.

After a couple of months I had an email saying that I could have the battery replaced, and it would cost me £600+VAT for them (the installation co.) to fit. I pointed out that as the function of the battery was fine, they could just re-stick the grill as it's ridiculous to scrap it! They contacted Tesla and have identified the correct adhesive.

They now want to charge me £150+VAT to come to fit it. Does this seem reasonable regarding consumer protection etc?

-

The account was defaulted in Oct 2010. Does it come off my credit file even if not paid in full?

UPDATE -

re-reading the letter from B/Card / Capquest, it seems B/Card have made an error. The account number at the top of the letter is for another C/C account I had with Egg (being handled by another collections company!), but with the correct amount due!?!

I spoke to Capquest yesterday and lodged a complaint about data protection..... I have also requested the correct information...

-

who is the owner ?

look on your credit file?

it reads to me in that letter that BC are

and CQ were only 'collecting? for BC their client?

Cap quest are collecting on behalf of Barclaycard. Just checked my online credit file.

-

I did not send a CCA - I requested a copy of the original credit agreement form on the phone to Capquest.

The CC was defaulted in 2010.

-

I have an old Egg credit card which went into default a number of years ago after I had to close my business. I have been paying £1 per month for a couple of years now. The payments are going through Capquest. Last time they asked for a financial update i asked for a copy of the original loan agreement.

As I understand it Barclaycard took over Egg cards a number of years ago.

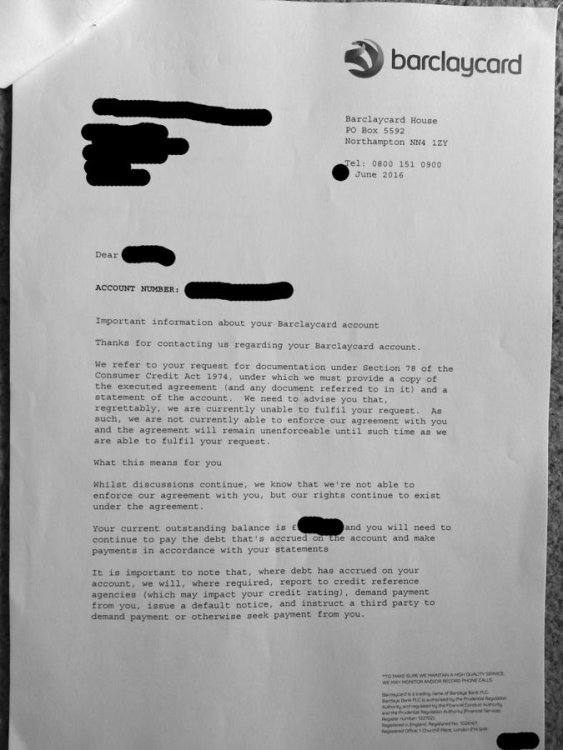

I have attached a copy of the letter with details blanked out - the outstanding is around £3000. In the letter B/card state that they cannot currently fulfil my request, and as a result the outstanding is unenforceable. What should I do now?

Should I stop payments until they can prove the liability?

Should I offer them £100 in full and final?

The default obviously still shows on my credit file.

Many thanks

TW

-

Following my visit to the local branch yesterday I had a call from their complaints department this afternoon. I discussed it with the chap and he now says I need to go back to the PPI department!

I have put all the charges and dates onto a spreadsheet dating back to 2001 ready to send them. Just another 6 years of business statements to go.

-

Well sorry for the delay in getting back.

I have had the cheques sent and these are now in my account.

Today I phoned the PPI dept about the penalty charges, associated interest etc etc.

I now have to lodge a complaint with the branch which I shall do tomorrow.

I have a list of all transactions on a spreadsheet.

There are about £7000 of penalty charges dating from about 1997 to 2010.

Also some charges for returned items.

I have about another 3 years of statements to look at - currently in the roof!

There is at least something to be said for keeping records longer than the required time!!

-

Very interesting article. Makes me angry about all the sleepless nights stressing about it all......

Should I photocopy all the statements and send with a letter of complaint stating that the amount due should fall between the penalty charges (c£12k plus interest) and the total bank charges I paid for the period (£30k + interest)?

-

Well I spoke to the bank this evening and the offer doesn't take penalty charges into account.

I have been told that would be a separate complaint - but would use the same ref number to connect the two.

Just scanning through statements the penalty charges alone are £12k plus.

That's only going back to 2001 at this stage.

There wouldn't be so many before this time as it was around 2005 that I struggled most.

I've not looked at the interest on this money.

The total charges for this period ('01-'09) were around £30 - that would also include legitimate charged items,

but by the time you take interest on MY money into account then I think I have a good case to argue.

I shall check the wording on the cheque they are sending for the PPI settlement to make sure it doesn't exclude me from further complaint.

What really upsets me in all this is that if I was that much money better off I'd still be in business.

I'm now doing my teacher training - best thing I've ever done though!

-

Many thanks DX.

I'm speaking to them today - they are to explain why their letter of 9th Jan didn't reach me. Neither did the last letter they sent in November!!!

They say the letter makes an offer of just short of £18k - this is across 8 products for my old business account.

They only have the records for the most recent 4.

I shall look out my spreadsheets for the whole period and see if the estimated figures look accurate or not!

I guess I need to add the principle PPI lumps, penalty charges levied and all interest charged on the two?

Then work out the interest that I could have received for the lump of money for the periods they fall into.

What rate of interest should I apply?

-

Lloyds flat rate was £1200 if memory serves me

they could get off lightly here if you are not careful.

did you fwd the info you have?

Did send the figures as I didn't have the specifics to hand at the time.

-

For the older loans I think they are offering £2679 each (on the four) - not sure what they base this on. I'm looking out my old spreadsheets from this time to see what charges were applied.

-

I have all statements dating back to about 1998. Just glancing through them now.

Once I see the offer letter I shall fond out what they have based their figures on.

I think they have given a flat rate on some of the older loans as they no longer have the information.

I'm amazed they have back dated so far on the basis that the loans all ran into each other over that period of time.

-

I have been pursuing my old business account with LTSB.

I had a series of business loans and OD facilities.

As one loan paid off the previous one I have had an offer from the bank dating back to a loan I took out in about 1994

- the result is a large offer from them.

Great news indeed!!

Now along the way there were a significant number of charges for my going over my OD limit.

I would guess around £7-10k.

On the basis that they charged me for the PPI which they have now effectively said was wrong,

can / should I pursue these bank charges which are effectively as a consequence of them taking money for a mis-sold product?

Does anyone have experience of this?

I should get the offer letter from the bank so can check to see if they have taken this into account.

Many thanks.

-

Many thanks guys!

I have worded a suitably strong letter and am considering sending them a Sesame Street DVD box set so that the bailiff can learn the difference between the number 2 and the number 5!!!

-

Thanks for the reply. The bailiff is employed directly by the court - when I phoned the court they confirmed this.

I'm just astonished that there was a mix up between the number 2 and 5!!! AS you can imagine my friend and her son were very shaken up by this!

-

I am posting this question for a friend of mine.

Her son opened a hand delivered letter this morning - it was a WPO on his car against a county court order issued by Bristol County Court. He phoned the number and spoke to the bailiff and was told that he would need to prove that he is not the person who owes the debt.

It turns out that the bailiff visited No 2 Acacia Avenue and not number 5 (road name changed!)!!!! The bailiff later phoned to say there had been an admin error. There was no apology what so ever.

I have drafted (after phoning the court) a letter of complaint for her and just want to ensure I have some details correct - by writing a WPO on an asset of a third party has the bailiff done anything illegal? I assume that had he removed the car it would have been theft? Also on the basis that the WPO has the defendant's name and financial details on it is there a data protection case too?

Any suggestions?

Many thanks.....

-

The other week I requested a statement from a Debt Collection Company for an old credit card. A few days later I received a brief 3 line statement and 25 pages of Lloyds TSB statements for a complete stranger!

My old account was with LTSB and this was then sold to a third party company and given to a collection company to recover. I pay £1 PCM as this is all I can afford for now.

I have lodged a complaint with them and am worried that my information may have been sent to the wrong person too! They have written to me explaining that it was a clerical error and their client had sent them the statements in error and requested that I send the statements to them. I suggested that it might be better to send them to the name at the top of the letter.

I am amazed that they can handle data in such an incompetent way. Should I repot the matter to the ICO / Information Commisioner? I'm not looking for any compensation as it seem's I've not been wronged but the other guy has. I don't know if they have written to him toexplain their error.

Any advice gratefully received.

Many thanks

A/time

-

Above is the Particulars of claim. The Issue date was 16 Mar - hence 21 March is the date of service.

Cheers

-

Sorry - acknowledge!

Have to do so by Wednesday. So not so long!

TW

-

Gezwee.

I don't have the data for PPI (+interest) for either the full term or Nov'08 onwards.

What is the ack claim?

Cheers

T/worm

Tesla Home battery and Solar Powerwall installed Jan 2021 - I found a piece of side trim on the battery was loose

in General Consumer Issues

Posted · Edited by turnedworm

Here's a copy of the warranty they sent me. Not sure about section 8 - disputes?!

Screenshot 2023-11-15 at 17.14.54.pdf