Debtfreedad

Registered UsersChange your profile picture

-

Posts

9 -

Joined

-

Last visited

Reputation

1 Neutral-

Before i make any attempt to pay I want to explore every avenue to ensure this debt has to be paid back. I get that I have the refund back but I was unaware at the time and my situation is now different some 2 1/2 years later that I cannot just pay it back. I will look up what part of the fos and the ICOBS they may have breached before I reply to them. Thanks uncleB

-

I made a complaint to Go Skippy as I did not have any facts or proof about the refund, This is the email I received today by a manager. Would appreciate everyone's advice on what to do next. Thank you for contacting us, Your complaint has been passed to me as part of the Customer Journey Department. The contents of which I was concerned to note. I have attempted to call you on the contact numbers provided however I was unable to reach you but left a voice mail message. Firstly, Go Skippy aim to provide excellent customer service at all times, and I am sorry that you do not feel we have done so in this instance. Having checked your policy, I can see that it started on the 22/02/2014 and lapsed on the 22/02/2015. I do understand that you made a payment of £281.08 for your car insurance policy however on the 26/11/2014 this amount was refunded back to you in error. Our accounts department has only identified this error on the 02/03/2017 therefore we began our debt collection process and issued the attached letter to you. We acknowledge that the refund was issued in error and therefore we can offer to waive £50 of the debt reducing this amount from £281.08 to £231.08. Please note that we have provided you with insurance for entire 12 month duration from the 22/02/2014 to the 22/02/2015 therefore the payment is due and will need to be paid. I do understand that we are chasing this debt more then 2 years later however please note that we are allowed to request this payment and chase a debt outstanding provided it is within 5 years. I appreciate that this may not be the response you were anticipating, but I do hope that I have provided a clear explanation as to why are chasing this debt. Please note that we follow a strict debt collection procedure which means that we will issue out 3 debt letters and if there is no response from yourself and no payment plan arranged to clear the balance then the debt will be passed to our debt collection company, the Insurer Collections Bureau who will contact you in due course. Once again my offer will be to waive £50 of the debt reducing it from £281.08 to £231.08. We can then set up a payment plan. Please confirm if you are happy to accept my offer in resolution to your complaint. I await your response. Kind Regards,

-

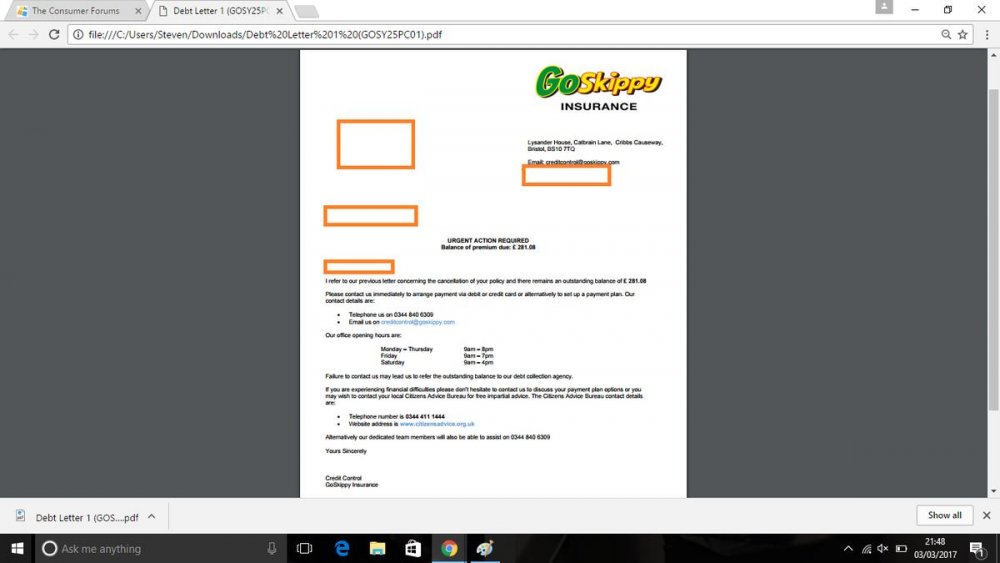

Evening all, Sorry for the late reply to your questions, I have hopefully attached the letter sent to me by Go skippy.. Ericsbrother- I dont understand your suggestion that I am being fatalistic, I have answered the questions that has been asked of me? If you explain your comment So i can better reply to you Unclebulgaria67- Go Skippy have terrible reviews online I have read a simple google search does not show them in good light,

-

Thanks for your reply, So i really cannot afford to repay this and if it is proven by my old bank that a refund was in fact given to me then I think to expect me to then pay is some 30 months later is unreasonable and add that to the letter of sction agajnst me without even a phone call to me or even a letter explaining a mistake has happened makes me want to ensure that I only pay the amount if it effects my credit score/credit file. I have always payes my debts but this one really leaves a bad taste.

-

Thanks for your reply, I'm miffed that they have taken soon long to claim the money back, They do not know why it has happened and they said the reason for the refund is not known. I assume that they can demand this money back and there is no time limit if re claiming the money? With the SAR just confirm what they have told me? Thanks

-

So I'm minding my own business watching my credit score slowly going up and today out of the blue I have had a letter from "Go Skippy" car insurance threatening me with legal action for non payment of £284. Now I haven't had insurance with them since 2015 so this was a bolt out of the blue and with only 4 months left of my 6 year default this is the last thing I need. Anyway I have made some calls today and this is what has happened Feb 2014- I paid £284 for my insurance Nov 2014- They refunded me £284(apparently) They didn't even ring to explain just send me a debt letter So today some 2 and half years later they now want me to pay back the mistake they have made by refunding me in November 2014. They offered me a payment plan where I pay them over 3 months or if I pay whole amount they will knock £50 off... This sounds off to me and I really need to know where I stand legally? Thanks Steve

-

6th year of default

Debtfreedad replied to Debtfreedad's topic in Debt management and Debt self-help

This is great to know thanks, When I first defaulted i thought I was doomed for 6 years but you know it was a blessing as I'm now 30 and I owe £250 on my credit cards, With all my debt although I never paid back the full amounts which was likely full of charges I payed all my creditors with a full and final settlement and never neglected my debt. With the help of another site I also managed to prove one default was illegal and got it removed and compensation. What I like at the moment is the credit companies offering to tell you the chance of being accepted without effecting your credit report, Game changer for someone like me that does nit want to harm my score at all. -

Hello, After some advice/information please So I am now in the last year of my two defaults which has been a long time coming, July this year is one(Store card) and September for the other(unsecured loan) So 6 years ago I found myself in a bad situation with my debt and found myself defaulted on accounts and also managed to reduce my debt by getting involved in 3 full and final settlements which I do not regret as I just wanted rid of the debt hanging over my shoulders, I did get lucky with two of my credit card with MBNA and Virgin(same company but different accounts) as although I made a full and final settlement with them they never actually registered a default and marked my credit report as settled rather than satisfied like my two default accounts say at the moment. In these 6 years I have managed to have a credit card that I paid on time every time and just used it once or twice a month just so I could show I can be trusted, in last two years I have started to get accepted for more of the better cards like Barclaycard and I now get some great deals and also with Tesco credit card with a good apr rate, My bank I've Bank I've been with for 3 years won't touch me mind won't give me an overdraft nothing! Strange how credit works. Anyway back to what I'm asking 1. The two cards I defaulted on will they every accept me again or do I have a black mark for ever with them? 2. When these defaults leave my credit report should I expect to see a rapid increase I my score as I've been working for 5 years on getting my cards paid on time every time but what holds my score back in those dreaded defaults 3. I live with my partner and arm the mortgage is in her name and has been for 4 years and early next year we are looking to move house, Would it be safe to say I would be able to make a joint mortgage application that would not hinder our chance of getting a high street mortgage deal? Sorry to go on Debtfreedad

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.