Showing results for tags 'subject'.

-

If you book a place i.e a room in a hotel, a caravan pitch etc and on arrival it can provide the services advertised but is nowhere near anything you read up in the brochure and you have to look elsewhere to stay, are you entitled to a refund under the distance selling act?

-

Firstly a bit of background. I have a secured loan with blemain finance (we all make mistakes:-x) It was taken out in may 2007 and is for £10K also it is cca regulated. They have added over £4K in charges in just 2 years, I have requested the charges back and after lots of letters i have they're final bog of letter. so i am now debating whether to take then to court for unfair credit agreement or go to the fos, i have phoned the fos and they have taken details and sent me out the forms to carry on with my complaint,but as yet i have not sent them back.so i have all options open to me and some advice in which way to go would be appreciated. Also i have a suspended possession order after they went for repossession, now the thing is i think when they took me to court they first sent out a default notice, but i think that it is non compliant and would like a second opinion,and some advice on how to deal with a suspended position order that they got on the back of a dodgy default notice. my issues with the default notice are a]That they didn't give me 14 clear days to rectify. b] No specific date to remedy (they say 14 days from date of letter) c]The paragraph saying that if you dint understand this then seek advice from CAB is missing the following is word for word what it says on the default notice and the only date on the notice is at the top of the page. 1] To remedy the breach you must pay the total arrears of £xxx within days of the date of this letter. 2] If the action required by this notice is taken before the 14 days, no further action will be taken in respect of the breach. 3] if you don't take the action required by this notice before this date then the further action set out below may be taken against you. 4] FURTHER ACTION: on or after the date shown above we shall apply to the court for an order for possession and sale of the mortgaged property. so any advice on how to proceed with this would be greatly appreciated and thanks for looking. welshperson (from bridgend:-))

-

Happy New Year to all! I have contacted HSBC using their online contact form about PPI that i took out with an old Marbles credit card. They have replied giving a credit card number and the start date, the also confirm PPI was paid. Reading other posts I see its best to start with a SAR request, can anyone advise the current address for making SAR requests or is it the standard complaints address : HSBC UK Bank plc, Complaints Department, POBox 5207, Coventry, CV3 8FB Thanks in advance

-

Hi we recently asked our landlord for recognition of our tenants association. We received the below late reply, after formally requesting recognition. Would this be grounds to send them a SAR as they say they have evidence on file? Also what would the best way to go about this, we have years of email trails so they shouldn't need to ID us. Thanks in anticipation Desamax Dear M ********, Upon receipt of your email dated **.**.18 I discussed the matter with our solicitors who confirmed that with the evidence we hold on file neither yourself or M****** are fit to be part of this proposed association. This is irrespective of our own views on the matter generally. I will pass on your email dated 13th instant to our solicitors for their perusal.

-

I recently purchased a tenanted property with a leasehold of 125 years. As there are 3 other flats and a commercial premises as part of the building there is a managing agent in charge. It is a first floor premises and the agent recently requested access to the property for a bi annual inspection. The tenant was unhappy about this (as there had been a historical bad relationship between tenant and agent - which I inherited) so instead photographs were supplied. The agent is now insisting that going forward they are allowed access to the premises for such inspections. My tenant is still refusing access, I am happy to support this (for the sake of positive relations) but wonder where we stand legally on the matter? Do I have to allow access considering I own the property?

-

Santander have rejected my PPI claim (store card) from 17 years ago on the grounds they believe it was sold in a proper manner (over the phone - which it wasnt - as I signed-up in-store with an agreement the assistant ticked for PPI) and was offered as optional and appropriate for me etc etc - which I absolutely disagree with. I have issued a SAR - but already do have copies of Agreement and statements etc. Unsure of whats best as next move - do I escalate issue with FOS (that I'm not hearing good reports about!) or small claims action? The amount of money involved is probably fairly small (circa £200 in PPI premiums?) Any thoughts appreciated!

-

NRAM can i send an SAR to NRAM for details of a repo from 2011?

lisadp1970 replied to lisadp1970's topic in General

Hello I need to make a Subject Access Request to NRAM regarding the house repossession we went through back in 2011. I've looked on their website and it's very vague what I need to include. The mortgage and property was joint with my ex husband so does he have to agree to me doing this? I need these details urgently as my local council won't let me go on their housing register until I can prove the house was repossessed and not sold for profit. Thanks for any help Lisa -

NRAM can i send an SAR to NRAM for details of a repo from 2011?

lisadp1970 posted a topic in General

HI I had my house repossessed in March 2011 and have lost all the documents from the mortgage company and court with the details on and urgently need these so I can go on my local councils housing register. The annoying thing the homeless prevention team at the same council were given copies of this at the time so they could help me and my family in getting a new home but the part that deals with putting you on the housing register says they can't speak to that department to get these details, they need to see the documents for themselves (just being bloody awkward if you ask me!) Would I be able to obtain these from the court or the land registry or do I need to get in touch with my old lender (Northern Rock?) Thanks -

We have had numerous issues with a caravan purchased from a dealership in less than a year we have had approximately 44 issues with the caravan with several issues being serious. Four of the issues resulted in the front and rear panels being repaired and then replaced. The advice I got from a lawyer was as follows; Although I appreciate you approached XXX Caravans to supply you the caravan, as you took out a hire purchase agreement with Black Horse, they are the retailer of the caravan. T herefore any rights you have under consumer law are to be exercised against Black Horse and not XXX Caravans. Under the Consumer Rights Act 2015 Black Horse have an obligation to ensure the goods supplied to you under a contract are of satisfactory quality. This means they should be fit for their purpose, free from minor defects, safe and durable. For the problems you have described in your email it would appear this is not the case, as a result Black Horse are in breach of the contract between you. I have always been under the impression that the supplier is the retailer and that the contract is between the consumer and the supplier and if there are any issues I need to approach the supplier and not the finance company although the finance company do have a responsibility. As we have had so many issues with this caravan which appears to be a Friday afternoon lemon made from left over pieces of other rejected caravans, we are considering rejecting the caravan even though we have had it since July 2016. The £1000 deposit was paid using a credit card with the balance financed by a trade in and HP. The caravan cost in excess of £30000. We have had approximately 100 days usage from the caravan. The question is whether the advice from the lawyer is correct or not? Thanks.

-

In October 2015 we ordered a new Buccaneer Cruiser caravan and paid a deposit of £1000. The caravan is due to delivery within the next few days. We chose this caravan as it is wider and has self levelling making it easier for me as I have rheumatoid arthritis and therefore mobility problems. Between the time we paid the deposit and now we raise a few issues about the rear panels on these caravans as there was an issue with some developing cracks. The caravan is advertised with a 10 year water ingress warranty and one would assume that this covers the outside panels however on reading the owner's manual which cna be obtained online I found out that the panels only had a 1 year warranty. I emailed the dealer on a few occasions with our concerns about the rear panel and they replied and gave us re-assurance and I left it at that however on Saturday someone went to take delivery of their 2016 Cruiser and foudn crazing on the rear panel. I raised this with the dealer as we were have 2 units fitted onto the caravan and requested if we coudl view the caravan when it was delivered and before they did any fitments to the caravan. This was their response; Martyn is on holiday at the moment and won’t be back for a few weeks .I have just been looking through your email with the concerns you have with the buccaneer cruiser 2016. I then started to look though the rest of the emails you have sent us over the past few months. You have great concerns with the caravan . On a personal level ,this occasion we feel this would cause you a great deal of stress to yourself and the company if a problem was to happen in the future with the buccaneer cruiser. with this in mind on this occasion I obliged to return your deposit and cancel your order. we feel this is the best course of action for you .can you please call us to return your deposit asap . Can they cancel the order and issue a refund bearing in mind that they have had our deposit for 5 months plus I have had to paid £425 for the air con on our current caravan to be transferred and another £99 deposit for a Paintseal treatment? The wife is absolutely livid as she has been looking forward to us taking delivery of the caravan.

-

Have you ever tried to make a subject access request to Lloyds bank and been told that they don't keep data longer than six years? Well basically it's a lie – but you wouldn't expect anything else from Lloyds bank. They use an archiving service in Andover and you can get data going back at least 2001. Their address is: – DSAR Unit Lloyds TSB Customer Service recovery Charlton Place C46 Andover SP10 1RE And they even have a telephone number: – 0345 0707124 Although I don't know whether people are prepared to speak to you. Apparently the same archiving service is used to store data relating to TSB, Lloyds TSB, RSP, Halifax Bank of Scotland. In other words all the usual suspects who have ripped you off over the years and then try to obstruct you from getting a full data disclosure. You should still contact their head offices or your branch for your data disclosure, but when they come back to you and say that there is only six years then that is the time to start objecting and to make complaints to the information Commissioner. You can make an SAR request directly to the data centre as well, of course.

-

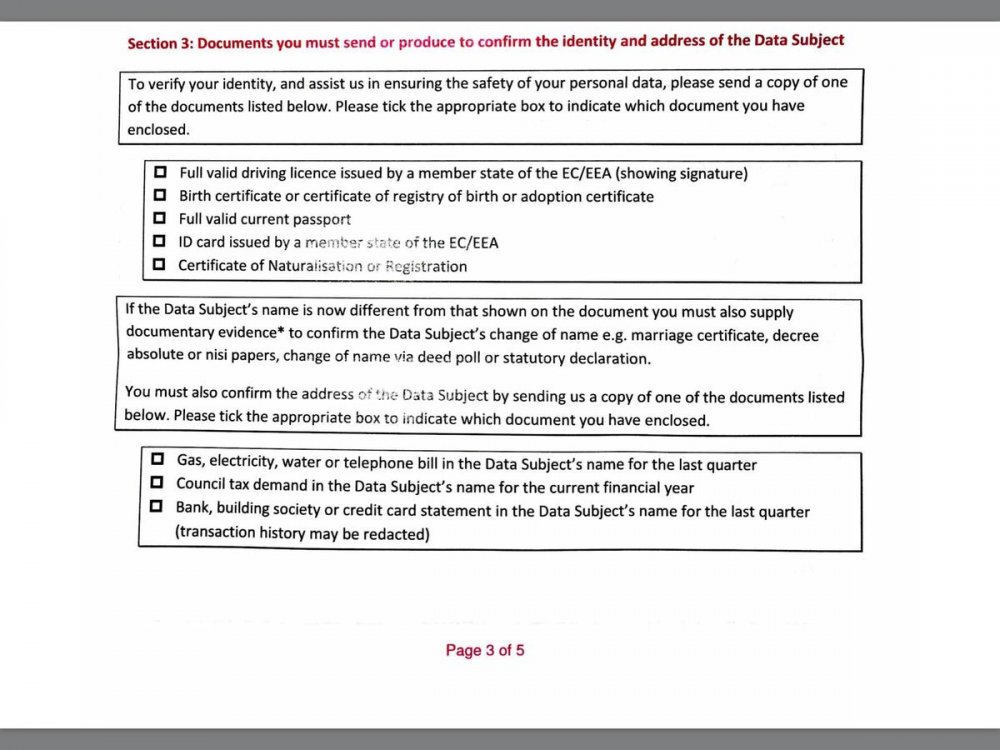

I've just sent off (with the £10 postal order) a Formal DSAR request to 1st Crud. All info required to be supplied, including a signature was provided in my formal and detailed letter. I've just received one of their 'please fill out this 5 page form' before we are obliged to do anything, however I'm not happy with what they are requesting I provide. There is no way I am ever going to provide them a copy of my driving licence, or bank statements and I'm back on here for some advice. I've been completing DSAR requests for approx 10 years, and apart from (almost) starting legal action with BC whilst some have been a struggle to get all info from and in a timely manner most have been compliant and not made me jump through too many hoops. (Oh apart from the DWP completely ignoring me for over 2 months! Still ongoing - but I class them in a different category to the CC companies and DCAs etc). Have the rules changed? I am now legally obliged to provide any of the following on the attached picture? Considering I've lived at the same address for over 10 years, and they've contacted me for 3-4 different companies at this same address, and threatened legal action to me at the same address, and supplied alleged CCA agreements, I would think that they should be fairly confident of my identity? Can I take this route, or will they likely play up and delay provision even though I don't (I think) have to legally provide the documents they have requested I send? Thanks ME_TOO

-

Hello All I made this SAR request to the Energy Ombudsman (E-O) as I wanted to see what Npower submitted to them as evidence to back up their response to my complaint with them. Npower are reknowned for saying they have done everything correctly but not substantiating anything with hard evidence. My questions are: 1) There are some emails between Npower and the E-O where the NPower's persons details (name number email etc) have been redacted. Is this permitted? Why? 2) The E-O hasn't sent me any evidence from Npower to substantiate their response to my complaint (but they did include the emails I sent them as evidence) . Should they withhold this from me in SAR request? As this was the purpose of me making the request in the first place. 3) Can I do anything about the above to get the info I was after in the first place? Many thanks in advance Jimbo

-

I know that my telecommunications provider has been overcharging me but not by how much and over what period (they acknowledge as much but are being awkward in (not) helping me arrive at the amount they have overcharged, for me to reclaim and have said they will arrive at "an arbitrary sum" of their own if I am unable to provide them with full details of dates and amounts). So I sent them a properly worded SAR but they have replied with an in-house "SUBJECT ACCESS REQUEST FORM" for me to fill in (which suggests they receive a few requests) and told me I must return it to their "Legal Team", directly. 1) Do I have to complete their form or can I insist they respond to my formal SAR, as already provided to them? 2) Is it for me to approach their legal team or is it for them to pass the request over to it? Thanks in advance for any help and advice.

-

Made a subject access request to Santander. One of the acknowledgement letters they sent says this (in bold): If anyone here has made a subject access request to Santander, can you please check the Acknowlegement letters to see if it says the same. If it appears can you include a scanned copy of the letter on this forum. The ICO has told me: Santander acknowledgment letter also says this about call recordings: Santander did send me call recordings, but one of the recordings had a bit missing from the dialog. I've reported it to the ICO. They've just got back to me after 2 months and said I need to ask Santander for the missing data. I'll probably do that, and let everyone know if Santander does locate the "missing data". BTW, about storing call recordings under telephone advisor's login (and not by customer name or account number). I'm pretty sure the Data Protection Law says if a living individual can be identified from the data, then it's classed as personal data. Here's the quote from the ICO website:

- 2 replies

-

- access

- acknowledgement

-

(and 7 more)

Tagged with:

-

Our landlord is revenge evicting us after we pushed for repairs to the property. On reviewing our tenancy documentation it is clear the agent he used did not provide all the prescribed information required. We want to sue for the deposit return plus penalty award. We are aware the landlord is ultimately responsible but the agent signed the deposit scheme forms and managed the process. We feel the landlord may suggest it was therefore not their fault and minimise the penalty whilst the agent deals with many properties and our expectation of going thru them was for due diligence and process to be followed which warrants a higher penalty. So we want to sue both parties . Is this advisable and if so, how would any award by the judge be applied? As a relevant factor, we are suing in respect to the original deposit against a tenancy agreement for 12 months in 2013-2014. We signed another 12 months 2014-2015. From what I've read elsewhere it appears we can sue twice ie for the failure to comply with the PI of the 2007 Order for the first agreement then again for the second agreement . Indeed that 2nd agreement then rolled over to monthly renewable so is that a 3rd instance of noncompliance? So the deposit amount is£1200. We wish to apply for the maximum penalty of 3x 1200 being 3600 plus the deposit of 1200 making a total of £4800. And if this apples for both 12 month terms then the total settlement is £9600. Is this correct?

- 19 replies

-

- access

- information

-

(and 5 more)

Tagged with:

-

We further requested recording / true copy of a particular transcript of telephone conversation giving date and exact time from a Loan Broker. Previously received some sort of print / scratchpad notes of conversation with SAR but important part of dialogue seems to have been omitted. Now my OH was told it was being recorded and she said that the person at the brokers was talking to her and typing up notes at same time. They have now refused our further request and stated that they are not obliged to provide any other format / CD or telephone call transcriptions. Can someone kindly confirm if this is correct ? Thank-you

-

To cut a long story short.... I worked as a freelance contractor for a firm for 6 months in 2015. The long term contract was eventually cancelled by mutual consent and in October. In December I was sent a letter from my client stating that they strongly believed that I had not fulfilled any of my duties under the contract and wanted £4,000 withn 30 days or were threatening to take me to court for £12,000 + I spoke to a solicitor who advised me that unless it was a letter from a solicitors on the clients behalf, then I should not respond as the client was probably "fishing" to see if I would pay up. I received another letter in March, stating the same thing, at which point I requested a Subject Access Request (I did this as everything I did was controlled by work email I had no access to, including my contract and other personal documents) I received the SAR response as a set of transcripts of emails and other documentation (which according to the SAR code of practice is totally acceptable), HOWEVER also included was personal notes inbetween the emails, one of which states that due to a situation that occured the client thought I was going to use certain information to blackmail them. Yes they actually wrote that on the SAR response paperwork, twice, in two different places among the 36 pages of response I received. Now, my question is, are they allowed to comment with personal opinion and notation on an SAR response or should it be just the facts taken from documentation? I cannot find anything in my searches and thought one of you fine people on here would know. If not, what would be my next step in responding to it other than to ask for the information without the notation? Thanks in advance

-

Came to work a few days ago and my boss pulls me to one side and shows me a direct attachment of earnings she has received from DWP for £1750. This is the first i knew about it as they had apparently written to me at an address I left in November 2014, I have had this job since April 2015 so if they can find out where I work they can find out where I live due to real time. Called the number on the letter which got answered by the most obnoxious nasty women to have ever walked the planet telling my I had apparently made a claim for incapacity benefit from 1997! I asked if she was having a laugh as its 19 years old and she proceeded to me it was no laughing matter and couldnt see why I would find it funny. That was the most polite she was during the whole conversation. I asked why the letters had been sent out to an old address this is my fault as I didnt notify them I had moved?? How is this my fault when I have no knowledge of a debt from 20 years ago who would I notify exactly? To top off the conversation the women told me I had been interviewed under caution as this was a fraudalent claim - I think this would be something I would remember. If I owed this money I would pay it. Quoted statutue barred apparently for DWP it doesnt count and have asked for copies of all the evidence they have which I have been told can take up to four weeks to send to me, in the mean time they are claiming 11% of my wages. Other than the letter my boss has received I have had nothing regarding this so called debt in 20 years. Is there anything I can do would be grateful for any ideas, thanks.

-

Hi I know it's Christmas but really hope someone can help me out urgently, I've had a claim through from cabot financial with 'right hassle' acting on their behalf for a very old Egg account. I submitted the AOS now need to put together a defence in the next 2-3 days and submit by thursday next week (i think that's the deadline having used the 33 day from service calc). Claim details/points Claimant - CABOT FINANCIAL (UK) LIMITED Address for docs & payments - WRIGHT HASSALL LLP Date of issue – 24/11/14 POC - POC ATTACHED but I can type this out if need be. [ATTACH=CONFIG]54992[/ATTACH] - Not sure if important but POC seems to include a mistake or two: using # symbols instead of £, also they quote a #19,***.** balance for the debt (far in excess of the c14K at close of account!?) and then go on to ask for interest of exactly the same total: "The Claimant therefore claims the sum of #19,***.** interest under s89 County Courts Act 1984 and costs." surely this is wrong and a basis to defend/strike out? Claim Value - ALMOST £20,000 Original Creditor - EGG (Card Account closed 2006) Type of Account - CREDIT CARD ACCOUNT Agreement entered pre-2007? - Yes 2004 Account assigned by Debt Purchaser? - Yes, by CABOT (bought from Egg 2009) Notice of Assignment? NOT SURE if I have a properly worded NOA: - had a letter from EGG (OC) late 2009 stating "We hereby give notice of the transfer of the debt due to us by you.. ..On XXX 2009 your account was sold to Cabot Financial.. .Any further communications and payments must therefore be addressed to Cabot...etc." -had a "Welcome to Cabot" letter stating similar (is that acceptable as an NOA) Default Notice from the original creditor? - YES 2006 but not sure if correct Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? - YES BUT NOT EVERY YEAR (not in 2011 & 2012) Why did you cease payments? - BUSINESS IN TROUBLE SO SEVERE FINANCIAL DIFFICULTIES What was the date of your last payment? - to the OC May/June 2006 (can check exact date if needed) - to the DCA not sure either late 2008 or very early 2009 Was there a dispute with the original creditor that remains unresolved? Possibly - PPI charged when not asked for, this was refunded (2004) but can I use this? - CCA request to ARC in early 2009 recorded post, responded with a copy of a signed Egg Agreement but not the entire terms, very brief 2 pages - pretty sure I wrote back "account in dispute" as requested docs not supplied but what if I can't find letter/postal proof? Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? YES, I wrote to them saying that I had severe financial issues asking for account to be put on hold, that I had been in touch with National Debtline (gave them the ref number) and had been making recent smaller payments, They wrote back saying no can do. PPI - as mentioned above never requested/applied for but charged at the start of the account, I lodged a complaint and was refunded the 2 charges. Interest - The interest has been accruing since the account moved on and has grown from c£14k to almost £20k, surely this is wrong when there are no details as to how they have come by an interest rate, what terms do they rely on etc? Can anyone help me out with some advice please, am I on the right track with some of my thoughts above? Most urgently I'm not sure if i should send any further CCA requests to Cabot or WH or even Egg? Too late for a CPR31.14? If i can get the letters into the post tomorrow morning they will reach the DCA/OC by Monday morning recorded delivery which gives almost a week - but I need to send them by 12pm tomorrow so if anyone is out there please advise. Many thanks. GF2k

-

Hi I would like to put a SAR in finding out what information my employers hold about me (I work for my local council). In particular interest are some emails which a colleague who left under a compromise agreement sent about me. My employer has email archives dating back ten years so I know they are still available but wasn't sure how to word the request to make sure that these are included. Any ideas Thanks

-

So the report is out and as expected it puts the blame on Putin. Home Secretary Theresa May said the murder was a "blatant and unacceptable" breach of international law. But does Russia or Putin give a damn, of course not, they lie and cheat all over the world and don't give a damn about anyone, not even their own subjects.

-

Hi all please can anyone give me some advice before i contact them. I got a new boiler from b/g in 2007 and they financed it with w/f i was paying £68 pm but now i pay £80 pm. I have been paying every month but now my hours have been cut at work and i cannot afford the monthly payments and i was going to get in contact with w/f to see if i could reduce my payments to £20 pm but i have read all the horror stories from people who try to deal with them. my question is can i reduce my payments and ask for the interest to be frozen and can w/f add other cost on to my loan like missed payment fees and fees for sending a letter. any help will be most appreciated kind regards michael Just a bit more information for you. I got a statement from from them in November and it had default sum interest on it. i did miss one payment about four years ago but i increased my payment and it is well payed off so i dont understand why i am still paying default interest. i did phone them up and they said i will still be getting interest on the loan as i defaulted on it.my monthly payment was £69 pm i have been paying them £88 pm for the last three years i keep getting phone calls from them asking me to increase my payments so i dont think they will accept a reduce payments even if i cannot afford to pay them the full amount. one more thing when i took out the loan they said my last payment will be on november 2017 now they say it will be march 2018.

-

Hi Everyone I needed all my data connected from all my accounts due to HMRC pointless investigation I sent my SAR request over 60 days ago and heard nothing It was sent recorded delivery and it was signed for with my £10 postal order What is my next action ? I assume i need to send a follow up letter ? Anyone know of a good template and what my chances are Thank you

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.