Showing results for tags 'sent'.

-

Hi Guys, Was contacted by erudio last year about the change of ownership. i didnt want to sign the deferment letter. Came on here read up and decided to request my CCA for the loans back in October. No response only threatening letters. i sent a second response and no reply. They eventually wrote to me in december saying they will look into my request. I heard nothing until today - they have actually sent me a copy of all my CCA's, signed. Wondering what are my options here? They did not comply to the 14 days from my request. The date of the loans are 97, 98, 99 and 2000 HOWEVER - of all the CCA's, there is a few things: - only 1999 and 2000 are signed the others are blank - 1998 only has the DD section ignored - only 1999 is signed by an official from student loans They are photo copies though. but the others do look completely blank Thanking you in advance

-

Hi All, Was on here some time ago (7 odd years) and received some incredible help. Sadly 2 years ago i fell into some issues and couldnt work at the time. Thus accumulating some debts. One of them is a credit card with Halifax , approx £5500, that had been passed to Moorcroft. I have sent them a 'prove it' style letter They have replied to me with 1 page which is a personal details page and 1 page which is the signed CCA, from Halifax (photocopies) I am happy to settle this debt but want to know peoples advice, opinions and the best way about it. i do remember a fair bit and have been reading up. Seen the settlement letters, but also conscious the debt seems no longer with Halifax or is do Moorcroft just act on the clients behalf as opposed to buying the debt? I aslso have 4 others than are with Capquest, but rather than making this post complicated, i'll post a new thread. Thanking you all in advance again

-

Hi all, I started a previous thread to share my general issues, but am posting in this section for specific advise relating to First Direct. Previous forum address here if anyone is interested: http://www.consumeractiongroup.co.uk/forum/showthread.php?458839-Low-income-6-year-old-debts-and-worrying-about-the-possibility-of-future-court-action I had an account with an overdraft, credit card and loan with First Direct (all pre Apr 2007). I defaulted on payments for the credit card and loan back in 2009, at which point, they closed my account, merging the credit card and overdraft together as one debt, and the remaining loan as another. Since the default in 2009, I have been making token £1 monthly payments to Metropolitan Collection Services; I have since moved house a few times and hence had no contact with them. Aiming to sort things out once and for all, I joined this site, and under some much appreciated advice, sent out a CCA request to Metropolitan last week. First Direct have responded, sending back my CCA letter (but keeping the postal order???), saying: The letter is not signed (didn't think I needed to) - they want me to provide a specimen signature My current address does not match their records (it wouldn't as I have moved, but my credit file address is up-to-date) - they want me to provide the old address to match their records. From this, I gather that FD still own the debt as Metropolitan did not write to me. As mentioned, my credit file is up to date with all addresses. Does anyone have any advice on how I should proceed? Are they trying to delay and does the time limit of 12+2 days still apply? Or, are they valid in their requests? Any help much appreciated Thanks AM

-

Good evening, I have received a letter from MET Parking Services starting that a fine is now overdue, the problem is, no initial letter was sent. They are demanding payment within 14 days, what is the best way forward. I go to Stansted a lot and I'm not 100% sure the charge is genuine as it was from a few months ago. Date of incident is the first week of November and this is the first letter I have received regarding this (today).

-

Hi, Wifes parents recently moved house and a parcel was sent to them but the wrong house number, £50+ food hamper tracked by my hermes. it was signed for on the on the 20th but didn't find out till 2 days ago it was sent to the wrong house. He's been round to the house and they have denied all knowledge of having it. Just wondering where we stand legally on this as the parcel wasn't in the persons name who signed for it. is it a case of tuff luck or can the police be contacted for theft?

-

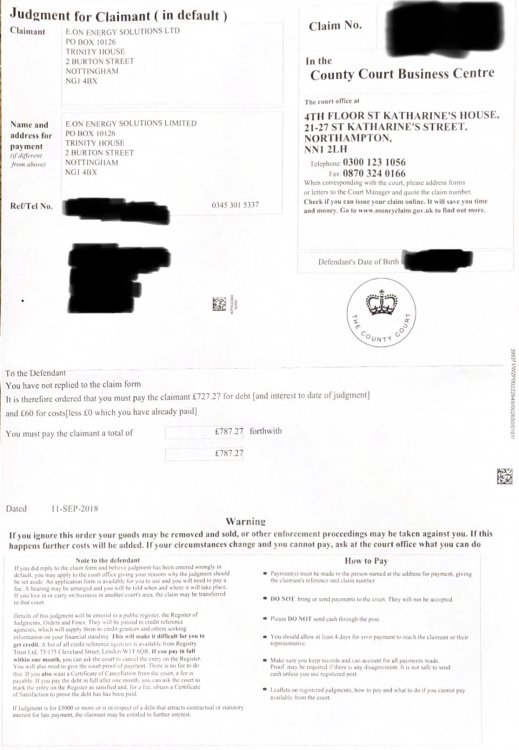

Hi everyone My brother has received a letter today from the county court business centre that was headed Judgement for Claimant (in default) It says you have not replied to the claim form (never received anything from the claimantt E-On) It is therefore ordered that you must pay the claimant £727.27 for debt and interest to date of judgement and £60 for costs. My brother has never received any court papers or even letters threatening court. But now he’s had this in the post. I’ll upload a scan of it but I’m not sure how to respond to the court document. Any help would be greatly appreciated Thanks Andrew

-

First post so Hi and thanks for any advice offered. Had some windows/doors installed by a local firm in a self build property. There’s been issues since the start, leaking sliding doors, bay window out of square, no keys for window locks, runners corroded. The company haven’t been the most helpful in rectifying anything. I moved into the house I was building in March 2016 and I’ve had visits from the companies employees whilst I was living there, the last one about April/may. I still owed 10% of the £15k for the full job which I told them I would pay when my concerns were sorted. 2 weeks ago I settled the outstanding amount as I am going to take it to the small claims court. The guy I sold the house to works away and he dropped a handful of letters off last week from solicitors, ccj and bailiff visits with extra charges, all dating back to July/August. This was the first knowledge I had of a ccj and a writ. Thanks in advance.

-

Hi, would appreciate any advice regarding the situation of a relative who is a single Mother. She had an outstanding housing benefit overpayment which was being repaid monthly over a payment plan for the last few years. At the beginning of this year the council got in touch to say that they needed to increase the amount paid each month; following a review of her income and expenditure a significantly higher amount was agreed to be paid which she has paid without fail. The council also stated that they would review the payment plan after 3 months, however they sent a letter 4 months later with a means statement saying she needed to respond within 10 days. She was out of town and didn't see the letter until she returned 11 days after it was dated; she called the council who said that they have now passed the debt onto a debt recovery agency and she has to deal directly with them and that there is nothing they can do now. She is now very worried and has been sent letters by the debt collection agency. I think the councils behaviour is unfair and unacceptable, she has always made the payments agreed and was compliant with the agreed payment plan, they sent the means review later than they had indicated but are punishing her by handing her over to debt collectors because she did not respond to their late letter within 10 days. Does any one have any advice as to how she should deal with the council and the debt collectors? She is willing to repay the debt within her means and doesn't think it is fair to have to deal with bailiffs and risk losing her possessions or work to their aggressive repayment plans.

-

Sent a SAR to Barclays bank on behalf of my father who signed the letter. He has been with the bank for over 60 years. They send his cards and statements to his address. Got a letter to say that they will only send him his details until they phone him up to prove his identity. It's been over thirty days and we have received no phone call. Why should he have to phone them. We thought it would be straightforward. Had mortgages and credit card with them for years. What should we do now?

-

Hi, I'm currently waiting to be assessed by Maximus - I've sent my ESA50 back and am waiting for them to decide if I can have a home assessment. I've been sent a P60U today - is this normal? It shows how much I've received in ESA, but nothing under "taxable income" - presumably because I'm on Income Related ESA? Just wondering why I've been sent this. Is it normal?

-

hello, I have a problem, how to sort it out.. Around half year ago, received response pack from county court. sent them back defence N9B form, but they haven't received and i lost a case. I know I should send registered mail..but unfortunately. Now received notice of debt recovery from DCBL £261 + £75 recovery fee for parking ticket. The thing is I have a proof that vehicle on date of issue been sold already. Should I go to nearest court or any other ways?

-

Hello, Long time lurker here looking for some help please. Thanks to the advice to others I have read here I have learned sooooo much! I defaulted on three credit cards in 2008 and have been paying £1 per month to each since then. They have all been sold on multiple times. Current situation: MBNA £17000 now with Capquest HSBC £3000 now with Robinson Way MORGAN STANLEY £8000 now with Cabot. I know I've been an idiot and it's all my own doing. I sent all three Cca requests on monday, unsigned with POs. What happens now? My token payments are due on 17th - do I keep paying? Thanks so much for any advice. This site is brilliant! Gettingmyselftogether (I'm giving it a shot anyway!)

-

Hi there, heres the story, I paid for an early upgrade online with ee. the cost was £251 including the early upgrade fee to buy out the rest of my contract and the upfront cost of the new handset. Now I ordered this the same day my new bill was generated, however my payment date for this bill is the 10th of each month, it was not due for another week so I didnt see a problem. in the after morning after ordering I checked the ee tracker to find news of my delivery only to find it `timed out` it couldnt find any record of the order number in other words. I phoned ee to find out what was going on, the rep told me for some reason the system had taken my upgrade fee but then straight away refunded it and it was on its way back to my account, she apologised and said if I wanted it back quicker I could get an indemnity on the direct debit with my bank asking them to cancel it and I should recieve payment that same day. Since then I found a better deal with another provider on the same handset (vodafones 32gb of data v 8gb ee were offering for the same price as I was paying now monthly!) I decided id use the refund to pay off my contract with EE and go with that one instead of upgrading. I contacted the livesupport on the ee website just to ensure the upgrade hadnt been put through again and to make sure it was indeed cancelled before going with the other network. I was then told that I was not being issued with a refund, the funds instead had been put towards my account balance and it was now in credit (this was presented as something I was apparently meant to be happen with) Now I wanted the refund, my bills not due till the next week and I didnt want to pay it till my next payday which falls before my payment date anyway. I was told I couldnt be refunded as the payment had already been put towards my bill and id just have to get a refund of the credit after paying my bill the next week. My issue is I never authorised this, the payment was sent as part of the early upgrade service it was payment for the early upgrade fee and the handset it was never authorised by me to be used as payment for my bill. EE have just gone ahead and done this without my permission then used that as a reason for not refunding me, I dont see how this is legal to use a payment in a way it wasnt intended without asking esp when the payment is taken as payment for a specific. product and service such as an upgrade. Not happy as not only was my payment used for something not intended by me and without my permission but the woman on the phone in the morning was obviously utterly using me. What I think has happened is ee have sneakily used the fact I made a payment for this upgrade as a way to have me pay my bill off early and just cancelled the upgrade so they can use the payment for this. Obviously very dodgy practise if so! Im just wondering if my misusing my payment in this way ee may have broken any part of their contract, id love to get a bit of revenge by using it as a reason to tear it up. Latest update got in touch with my bank, they say I cant get an indemnity anyway as the payment was by card (so the ee rep was totally using me this morning it appears!) but that the payment is still pending so it shouldnt take any time at all for EE to refund as they can just cancel it.....lets see if they choose to or see if they choose to `keep the money` on my account balance against my will......what they do will decide if I take further action im guessing, EE rep claiming they dont have the ability to cancel a pending payment......utter rubbish! I will be taking this further! luckly ive saved the chat transcripts. anyone else experienced this kind of thing?

-

Major crackdown on abuse of 'debt' judgement by rogue parking and utility firms is announced Ministers will pledge action on abuse of county court judgments by rogue firms Anyone who has had a CCJ without their knowledge will have it removed The Govt plans to immediately set aside all backdoor CCJs for those who can prove to a judge that they did not know about it when it was passed. http://www.dailymail.co.uk/news/article-5214075/Action-debt-judgement-rogue-firms-abuse-announced.html

-

I bought an item on Ebay, which the seller claimed had only been used 1 time and was in excellent condition, the only reason why i bought the item. The item arrived damaged, i requested a return as item not as decribed and arrived damaged. Seller refused to accept a return, instead she blamed me for the damage, saying i had caused the damaged and had swapped item and the pictures I had shown of the damage were fake. Seller claimed she has a witness who saw her send the item in mint condition, but i told her it arrived damaged with a dent/chipped, with scratches etc and obviously not used the 1 time as seller claimed. Anway the seller then made a threat take me to smalls court (when she had my money and sent me a damaged item) and is still refusing to take the item back and still blaming me and now claims she can get a witness statement to say she sent the item in mint condition - if thats the case as seller claims, why it did arrived damaged!! In the email exchange with the seller, she is trying to make herself look the victim in all of this. The item is of over £250 Raised return request on Ebay, but seller is blaming me for the damage, how crazy is that, she sent an item not as described, anway time to escalate to Ebay and get Ebay involved because the seller is not admitting the item i received is damaged, even after showing pictures and still blaming me, what do I tell Ebay when I escalate item not as decribed, arrived damaged, seller not accepting responsibility, blaming me for the damage? As for the sellers witness statement to say she sent the item in mint condition, that doesn't count because my pictures show the damage, please please help

-

Hi Guys, I am new to website. But i have really big problem with hsbc. let me explain. I have small property investment business. Due to this when we pay some of builders they take out money without my authority each time i have to cancel my card and bank sent new one this things happen 7 to 8 times we told number of time banks about this and finally came to point when we thought its best to close a/c and all matters. At that time i have one credit card, bank a/c and personal loan on my name. Bank has closed current a/c and credit card straight way but loan they told me if i can not afford to pay they will keep open as it is and i have to keep paying them monthly arrangement. i have setup arrangement with them by direct debit and till date everything upto date i did not miss any payment. During december time my father passed away and i have to go out side country, during this period hsbc suddenly decided to close my loan a/c they sent out letter which i was not aware. After few days later another letter came for default notice and final demand. I came back last week and i have seen these letters. I been told by HSBC staff not to worry and they will sort out everything . I been given collection number which i called number of time but they have given one answer as my loan account is active and its up to date. Letter i received from hsbc clearly confirmed they will pass my details to credit reference agency and it will affect my credit rating. I have made full payment to HSBC but they refused to do anything. I have explained them as i was out side country and i did not received any phone call but they did not listen. As well they have notes on system march 2017 confirming person previously dealing in back office (customer relations manager) place note confirming account keep open and customer will maintain monthly payment as agreed when opened loan account. HSBC in march 2017 told me they will keep my loan a/c opened as far as i will keep paying my instalment but in december they have decided to close my a/c. Branch even give me wrong information as they told me nothing to worry my a/c is up to date and no action required. I really need serious help as my business on credit and if something goes against my credit file it will be end of my business. I need serious help as bank not helping me out at all neither branch already made complain to bank but i am not hoping any good response.

-

I have been in writing to Drydensfairfax Solicitors back in March 2016. They are acting on behalf of their client Max Recovery Limited who purchased a debt. I had previously asked them for a credit agreement and copy of the deed of assignment. Back in March 2016, they wrote to me in reply. They provided me with a basic office copy of a credit agreement. They claimed that their client, Max Recovery, had provided them with a copy deed of assignment, and that they had attached this to the document for my perusal. Upon checking the documentation, this assignment was not present as stated in the covering letter. For the past year, I have had no response from Drydensfairfax. Today, I checked my credit agreement, and I am horrified that they have placed a default on my credit file on the 30th May 2017. Under section 87(1) Consumer Credit Act 1974, I have NOT been provided with a written default notice prior to this default being placed. Can anyone please advise me what to do next as I feel that the default is illegal!? The other concern is that Drydens should not have put the default in their name as the debt belongs to their client Max Recovery Limited. Am I correct in thinking Drydens have done this default incorrectly it should be their client!?

- 142 replies

-

- drydensfairfax

- legit

-

(and 7 more)

Tagged with:

-

Hi I have sent my mobile phone to a shop in Nottingham to be repaired, and they have sent it back to the wrong address , the bloke is claiming that is address that i sent him, which is total .. as the address it was sent back to is 400 miles away, he has said theres nothing he can do, is this right ?

-

From their website: "Charged to cover the administration of issuing an arrears chase letter." - Outgoing arrears letter I'm not condoning missing mortgage payments, but surely £27.50 is a lot for a one-page (presumably computerised) letter and envelope being sent out? I think this has been covered previously (in 2011) but I'm not sure of my best course of action. Or whether I have a claim at all? Can anyone help me? I have received 2 of these letters in the last fortnight alone. £55 is hard to take for 2 sheets of paper and 2 envelopes! This figure is clearly exceeding actual administrative costs, and I find them unfair and therefore unlawful. Are they well within their rights to charge such a figure? Sometimes I have had these letters without even a prior phone-call to chase/remind me to make payment.

-

Hi, My partner has been paying off a nominal monthly amount to Link Financial since the card debt was sold to them by MBNA. Sent Link a CCA in June but have had no reply. Sent a SARN request to MBNA and had a reply with only the attached request form copy and a second page with the terms and conditions. From reading other posts I think that this is invalid and therefore unenforceable. Would one of you more experienced people be good enough to have a look at give me your opinion. It seems to refer to paragraphs that don't exist and there is no lending limit or interest rate shown. We have since (last week) written to Link re their failure to supply a valid CCA and await their response! What is our next move please? L CCA Request Load.pdf

- 3 replies

-

- application

- mbna

- (and 4 more)

-

Hi all, I received a letter yesterday from Rossendales saying I had to pay almost £3300 within 7 days due to HMRC saying I owe for overpaid Tax Credits from 2009-2010. I disputed the overpayment at the time, as HMRC wanted proof of my childcare costs and I was in dispute with my childminder at the time for an incident with my daughter where I removed her from their care and they refused to give me receipts, saying their paperwork was with their lawyer as they were going to do me 'for slander'.... I explained this to HMRC and said I couldn't provide the receipts. Haven't heard anything for at least 4 years now, and all of a sudden I have this letter from Rossendales saying they are collecting it. My personal circumstance has changed massively since the dispute, I am now married and a homeowner, however I am currently on maternity leave which will become unpaid after the end of February, where my only income will be my child benefit (my husband wants me to stay at home). Question one - if I have no income myself, what can I say to Rossendales? Question two - will they take my husband's wage into consideration? I wasn't living with him at the time of the supposed overpayment and the debt would not be his. Thanks in advance

- 31 replies

-

- credits

- overpayment

-

(and 4 more)

Tagged with:

-

Name of the Claimant Hoist portfolio Date of issue – 19th may 2016 What is the claim for – 1.the claim is for the sum of £ 1653.22 in respect of monies owing under an agreement with the account no 4929xxxxxxx pursuant to the consumer credit act 1994 (CCA) the debt was legally assigned by MKDP llp(Ex Barclaycard) to the claimant and notice has been served. 2.the defendant failed to make contractual payments under the terms of the agreement, a default notice has been served upon the pursuant to s.87(1) cca 3.the claimant claims 1.the sum of 1653.22 2 interest pursuant to s69 of the county court act 1984 at a rate of 8.00percent from the 01/06/11 to the date hereof 1810 is the sum of £655.76 3 future interest accruing at a daily rate of £.36 4 costs What is the value of the claim? 2500 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? 20/09/2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. assigned i think Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? no Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? no Why did you cease payments? i was made redundant What was the date of your last payment? aug 2010 Was there a dispute with the original creditor that remains unresolved? not sure Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan?yes yes I have just been sent a claim form for a Old BC credit card. The card was with Barclaycard but went into default in Jun 2011 and the debt has been taken over by mkdp llp or hoist portfolio holding 2 ltd. total amount is £2500 I have submitted a acknowledgement of service I have a couple of weeks to get a defence, A claim was issued against you on 19/05/2016 Your acknowledgment of service was submitted on 22/05/2016 at 13:27:17 do I have any grounds to defend this. Any help here would be much appreciated as I really don't no what to do and cant afford to pay it Many thanks for your help on the MCOL site i done the acknowledgment part .. but was stuck on Response Forms Start Defence If you dispute the whole claim or wish to make a claim (a counterclaim) against the claimant, complete the defence form. Start Part Admission If you admit part of the amount claimed, complete the Admission and the Defence form. View Instructions If you admit all of the amount claimed, complete the Admission form. i did not know what part to do next Thank you Rob.

-

Hi, I would be thankful of some advice please. In 2012 I defaulted on a Studio account and my debt was sent to a debt collection agency/solicitor dept due to low earnings due to illness a £10 a month payment plan was set up, this went without fault for nearly 3 years and I used to make payment by phoning up every month and paying via debit card over the phone. The company name I used to pay the £10 a month to now escapes me however for the final month I phoned up to pay there was an answer phone message stating that the company no longer operated due to being removed from some kind of authority to practice in the collection for debts, I forget the exact terminology but when I googled the company it seems they had been struck off for some kind of illegal practices. There was a phone number of a company that were now dealing with this struck off companies affairs and when I contacted them they could not find a record of my debt on their system and advised me to speak to the original creditor, I called Studio to ask them for information regarding the outstanding debt and was told the debt had been sold and they no longer had any recourse on the funds that were owed. I felt I was going round in circles and could not do any more so I forgot about the debt assuming when somebody wanted the money they would write to me. In November of last year (2 months ago) I received a letter from Restons solicitors demanding the full balance of a little over £600 by way of a "letter before action" I called them immediately and explained the situation regarding the struck off company and the payment plan I had in place and was told if I wanted to set up the same payment plan I had to complete an expenditure form on their website to show affordability which I did just before Christmas. I expect to receive some kind of response when they had analysed it but not the response I did get: Today I have received a claim pack from Northampton county court, This is new to me and after a bit of research I figure this is the start of a CCJ they want to get put on me. Now I have a few questions. Firstly how do I resolve it at this stage so I dont get a CCJ, Its only for a relatively small figure inc fees a total of £800 and if possible I dont want to get a CCJ for this amount, I have read if I pay the balance within 30 days It does not get recorded on my credit file, is this 30 days from the date on the claim form or from date of judgement against me? I have tried calling Restons to get some answers as to why they did this, however i get through to an answerphone message that states they will call me back but they havnt yet and Id like to be informed of my next moves before I do actually get to speak to them, thank you in advance for any help. I would like to add on the claim form it shows Cabot as purchasing the debt in march 2016 yet the first I heard about this was November from Restons, Cabot had not even wrote to me to try and get a payment plan set up.

-

@PANDORA_UK Hi there, I would like some advice please. Last week I purchased a 'Abundance Of Love' ring from Pandora UK on their online store for my daughters 16th birthday which is this coming Thursday. The cost in the sale was £19 plus £5 delivery. Today I received a parcel from Pandora. In the parcel is my invoice for the ring at £19 and delivery £5. However in the parcel there were two jewellery boxes. One had a necklace and pendant in. The other had 5 x Pandora charms in. After looking on the website I estimate the cost of this order around £300-£350. I like to think I am an honest person and although my dispatch note only said the ring I thought its only fair I ring and tell them about their error. I called and explained I ordered a £19 ring and have received over £300 of jewellery. They said once I send the jewellery back to them they will dispatch my ring. I said is there anyway around this as I would like the ring for my daughters birthday on Thursday. (ok its only £19 but should have been £45 - money is tight at the moment and this was going to be a special present for her) He put me on hold and said he spoke to his manager and no they couldnt do anything until I sent the parcel back. I said ok is a courier coming to collect it. He then said no you need to take it to the post office tomorrow and send it back to us recorded delivery! I kept very polite and said I rang you and was 100% honest when I could have just kept quiet and kept all this jewellery and now you are telling me that I have to take time out of work tomorrow to go into town to the postoffice and I have to pay to return it. He said yes or we cannot send out your original ring order. I asked to speak to management but suddenly no one was available. He said someone would call me right back but no one has. Am I right in being extremely angry that this is their mistake yet I have to pay for it? Can they make me? Am I within my rights to refuse to post it back at my expense? I am more then happy to have a courier come and collect it but I work from home and cannot easily get out to town for the postoffice during the week. I am so upset that I did the honest decent thing and now I am going to be out of pocket and my daughter will not have her birthday present. Any advice is appreciated. thank you

-

I am the owner of a car and my wife the driver. On 31/03/15 my wife met her friend on for a meal one evening and parked side by side with her on what they thought was a free car parking space at the side of the Croma Italian restaurant in Prestwich , Manchester. neither of them saw any signage and plus it was about 7:30pm in the evenings wasn't expecting to pay parking. Apparently there were signs according to excel? After now numerous letters from excel parking, zenith, rossendale (all ignored). We have a letter from BW legal - a final notice saying that as i have ignored the last letter offering a discount of £80 they now have been instructed to commence proceedings in county court if i do not pay with 10 days of the letter date . The letter is dated 9th may 2016 and I received it on the 14th may. The letter states i have to pay £54 excel costs plus £100 fine. - Remember i am not the driver (I'm the owner). I have never corresponded to parking charges before and they always stop after a year or so but these seem more "legal" and possibly I'm now entering a reality whereby they will take court action? Q. has anyone had this "final notice" letter and when or how did you deal with it?

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.