Showing results for tags 'regulations'.

-

We have found a car that we have been looking for and noticed one at a major dealer 420 miles away. Called the dealer and asked if i could get a video of the car and also asked if they offered a delivery service but they said that i would need to visit the delaership in person due to the distance selling regulations. I have previously bought bikes blind and turned out fine with no problems. Some might say Im crazy buying something that ive not seen but im happy to do this with a major dealer and take the risk and the car is only 2 moths old. So is this just down to individual dealers not willing to sell to someone who cant physically get to their showroom or is this the way things work now? I bought a bike from a dealer around 3 years ago who sent me a video, pointed out and chips etc and i emailed stating i was happy to proceed. Thanks

- 5 replies

-

- distance

- regulations

-

(and 1 more)

Tagged with:

-

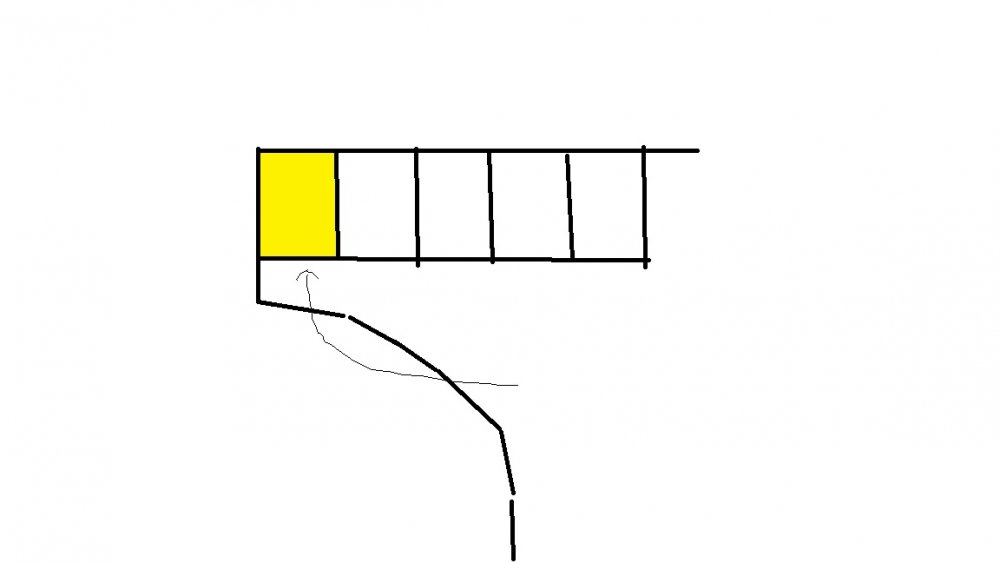

Hi Our property is located at the end of T-shaped cul de sac. In front of our property council have converted large disabled parking bay into two normal parking bays. However access to the parking bay in the corner (highlighted in yellow) is so limited that to park there you have to drive over the grass in front of it. Now the grass is so damaged that the mud is spilling onto the road plus it looks ugly. I was wondering what are the regulation for this. What are the minimum dimensions for access to a parking bay etc. Thanks. Joe

-

Hi Just wondering if the Consumer Protection from Unfair Trading Regulations 2008(amended 2014) covers business to business transactions? Meaning that the consumer can be a business? A friend has been misled by a salesman about a service they've bought in their business and we're trying to put a complaint forward. Any pointers to some helpful legislation would be appreciated. Thanks in advance.

-

I've just been glancing through a worksheet provided by my local council on the new GDPR rules. One of the guidance notes states that: "You must tell people in a concise, easy to understand way how you use their data." It also states that "consent" for your data to be used in different ways must be freely given, pre-ticked boxes will not be sufficient. i.e. a seperate consent is needed for each type of use the data is intended to be used. So...where the DVLA is concerned I am quite happy to give my consent for a record to be kept of when my car is taxed, insured and MOT'd. However I do not give my consent for any personal details, such as registered keeper, to be given to any third party. I wonder how this would stand up when the new regs become law on 25th May 2018?

- 12 replies

-

Does a cancellation period apply to goods and services on line ?.

- 10 replies

-

- distant

- regulations

-

(and 1 more)

Tagged with:

-

DWP recently lost two upper tier tribunals on planning and following journeys and taking medication, so they've now changed the regulations so that claimants with mental health difficulites in particular are still unlikely to get any award for mobility. http://www.legislation.gov.uk/uksi/2017/194/made These regulations can apparently be made without any debate in parliament etc, so no chance for anyone to disagree.

-

Ebay and consumer Contracts Regulations 2013

robthebuilder posted a topic in General Consumer Issues

Hi guys. Here is an interesting one for you that I would appreciate any help in clarifying. In short, I purchased a buy-it-now item on Ebay. The seller is a business. Before I paid the seller contacted me to increase the cost of the postage (I do not live in Highlands or anywhere like that). I did not agree with this and when he followed up with a rude message, I chose to not proceed. So, I messaged the seller and politely told them I would not proceed and requested they simply cancel the sale. They refused. They then re-listed the item immediately AND subsequently opened a non-paying bidder case. Now this is where I would like clarification. Unless I am mistaken, the Consumer Contracts Regulations 2013 allows me to cancel within 14 days following the day of delivery. There is no beginning point, just an end point - 14 days following the day of delivery. So I could cancel now, tomorrow or any point up to that end point. I chose to cancel immediately as said. There was no payment made and thus the item was never sent. Again, unless I am mistaken it is an offence for a business to attempt to discourage a consumer from cancelling. Indeed I successfully sued Plusnet last year when they tried just that. And this is where it gets interesting - Ebay happily open the unpaid case, which by definition puts me under pressure to pay even though I do not want to proceed. Do not worry, I will not pay but some would. So, can anyone please confirm if Ebay business sellers are exempt from the CCRs (I don't expect for a moment that they are) or if Ebay are technically aiding and abetting breaking the law by allowing business sellers to try to talk consumers out of cancelling by threatening detrimental action on their buying accounts if they do not pay. Whilst Ebay do think they are a law unto themselves, business sellers in the UK must comply with CCRs and do not have exemption when using Ebay. Unless you know otherwise? Many thanks Rob -

A thread to explore what is and isn't working, and highlight issues where the old problems are rearing their head again, like charging multiple fees, refusal of all offers until visit and £235 garnered, application of Sales Fee before even a controlled Goods Order is in place etc.

-

Very little point posting anything in the Black Hole area of CAG. In the old days there would be hundreds of Caggers on here every night until the early morning, doing what they could for others and everyone congratulating successes and encouraging others. Those days are long gone, the brave, clever, self taught legal rottweillers who humbled the biggest banks in Britain, wiped the floor with slimy DCAs and helped thousands out of debt all now cast to the wind. Makes me so sad to see this place now, with just a handful of members logged on along with hundreds of guests desperate for the small piece of information which will give a little hope.

- 40 replies

-

- distance

- regulations

-

(and 3 more)

Tagged with:

-

I am hoping to a better response in this forum than the other forum I riginally posted in. In May 2005 we purchased cash a Blue Dorema all seasons awning suitable for a seasonal site with a one year guarantee from a dealership nearby. Three months later we had to have all the steel poles replaced. In December 2006 we had to send the awning back to the dealer for the stitching to be redone in places as the stitching was right on the edge and it did not take much for it to come apart. This was done free of charge as I quoted the Sale of Goods Act. Now 7 months down the line from the repair in February 2007, the same stitching has come apart again making it difficult to zip up the awning in the front. However more importantly just over two years from date of purchase the awning has gone from Blue to Green! We specifically chose Blue to match with the curtains etc. Our one neighbour who has the identical awning has also changed from Blue to Green a colour they specifically did not want. It is almost as if the manufacturer had a load of green canvas left over from a run which they then dyed blue which is why we have a green awning instead of a blue awning. Our other neighbour has a proper green awning and you cannot tell the difference in colour between the three awnings that is how bad it is. Do you think I have much of a chance pursuing this through the small claims court using the following arguments; a) Wherever goods are bought they must "conform to contract". This means they must be as described, fit for purpose and of satisfactory quality (i.e. not inherently faulty at the time of sale). b) Goods are of satisfactory quality if they reach the standard that a reasonable person would regard as satisfactory, taking into account the price and any description c) Aspects of quality include fitness for purpose, freedom from minor defects, appearance and finish, durability and safety. d) For up to six years after purchase (five years from discovery in Scotland) purchasers can demand damages (which a court would equate to the cost of a repair or replacement). The dealer has already said no ways are they going to consider it therefore as I purchased from the dealer, I have to pursue any action through the dealer. I appreciate that it is up to me to prove non-conformity but I think that the awning which costs nearly £750 no longer conforms to the colour it was when purchased and neither does the workmanship stand up to conformity considering the price paid. I am not interested in getting a refund, but rather a repair free of charge or a replacement. What are your thoughts on this one? Thanks

-

Hello I am having an issue with a debt collector who is pursuing a debt which is older than 6 years. This debt collector cannot supply a County Court Judgment for the debt. Recently, I provided the debt collector with my credit report which was free of any Judgment debt. The DCA ignored the credit report, and stated "Judgments are deemed to be active until settled." these people cannot supply any Judgment or Notice of Assignment. Then, completely out of the blue, I received a Statement for the Account which had a balance of £0.00. I have paid an awful lot of money to these people, and I am now pursuing my would be pursuers, Can I use the CPUT Regulations, as these people have repeatedly threatened to enforce the fictitious Judgment? Notsofamous

-

In April 2014, significant changes were made to the way in which bailiffs can enforce debts. Most importantly, the fees that can be charged are fixed and transparent. The following page is an overview of the new regulations. Terminology The Taking Control of Goods Regulations 2013 modernise terminology. The terms levy, distress or distrain are now known as the process of ‘taking control of goods’. A walking possession agreement is now called a Controlled Goods Agreement and bailiffs are now known as enforcement agents (although they can still be referred to as bailiffs). Warrants of execution (in particular for road traffic debts) and warrants of distress (for Magistrate Court fines) have been renamed warrants of control. With debts enforced via the High Court, the centuries old term of a writ of fieri facias (writ of fi fa) has been renamed a writ of control. Enforcement Agent Fees The Taking Control of Goods (Fees) Regulations 2014 also came into effect in April 2014 and with the exception of ‘writs of control’ (enforced via the High Court), the following fees apply to all debt types (council tax and non domestic rate arrears, local authority issued penalty charge notices, magistrate court fines, child support agency arrears and rent arrears). Compliance Stage Fee: £75 Upon receipt of an instruction from the client, the enforcement company must send a Notice of Enforcement to the debtor. The notice must provide the date of the notice and the date and time by which full payment or a payment arrangement must be set up. This strict period of time is referred to as the ‘compliance stage' and must by law provide a minimum period of seven ‘clear days’ before an enforcement agent may visit the property. The compliance fee of £75 is payable for each Liability Order or Warrant of Control. Enforcement Stage fee: £235.00 (plus 7.5% of the value of the debt that exceeds £1,500.00). If full payment or a payment arrangement is not made during the Compliance Stage (or a previous payment arrangement is broken), the case will progress to the ‘enforcement stage’ and an individual enforcement agent/bailiff will attend the property for the purpose of ‘taking control' of goods. This fee becomes payable at the time of attendance. If the enforcement agent is enforcing more than one Liability Order or Warrant of Control against the same person, he may only charge one enforcement fee (of £235). He cannot apply ‘multiple’ charges. Sale stage Fee: £110.00 (plus 7.5% of the value of the debt that exceeds £1,500.00). This fee shall be charged when an Enforcement Agent attends the premises to remove goods and makes preparations for the sale of goods. It is important to note that additional charges may also be applied relating to the removal. These include storage and locksmith’s fees. Forms and Documentation The new regulations provide a series of statutory forms that must be used by the enforcement agent. Full details of all forms and the information that must be provided on them can be viewed here. Making a payment proposal The legislation provides a strict period in which to make payment or to negotiate a payment arrangement without the need for a bailiff attendance. This is referred to as the ‘Compliance Stage’ and begins with receipt of the Notice of Enforcement. If full payment cannot be made within the strict time period outlined in the notice, (a minimum of seven ‘clear days’) then it is vitally important to contact the enforcement company to make a payment arrangement. Most companies will readily agree to accept an arrangement over a period of 3 months (and possibly even 6 months) depending on the individual circumstances. Providing the enforcement company with a simple Income and Expenditure calculation at this stage may be of assistance. Failure to make payment (or to agree a payment arrangement) during the compliance stage will lead to a bailiff making a personal visit to ‘take control’ of goods. This visit will incur an enforcement fee of £235 as outlined above. Vulnerable debtors Far better protection is given to vulnerable debtors under the regulations. One example being that a vehicle displaying a disabled badge is now exempt from being taken by a bailiff. Secondly, and most importantly, Regulation 12 of the Taking Control of Goods (Fees) Regulations 2014 makes provision to protect vulnerable debtors who may have been unable in the early stages to seek advice (from the local authority, magistrates court, debt counsellor/debt charity etc) about the debt. If a bailiff makes a personal visit (which incurs an enforcement fee of £235) and identifies a debtor as ‘vulnerable’, then Regulation 12 provides that he should give the person a chance to seek advice prior to removal of goods. If he fails to do so, the enforcement fee of £235 is not recoverable. An enforcement agent will not know in advance whether a person is ‘vulnerable’. It is therefore vitally important to make the enforcement company aware of any ‘vulnerability’ at the earliest possible stage (during the compliance stage) and where possible, to provide some form of documentary evidence. Times of day when a Bailiff/ Enforcement Agent may visit The enforcement agent/bailiff is allowed to visit the property seven days a week (including Sunday) between 6.00 a.m. and 9.00 p.m. He is not allowed to visit on Bank Holidays and Christmas Day Items that are exempt from being taken by a bailiff As outlined above, if full payment or a payment arrangement is not set up during the ‘compliance stage’, the account will progress to the ‘enforcement stage’ and a personal visit will be made to ‘take control’ of goods (hence the name of the regulations). In reality, the enforcement agent will be seeking full payment of the debt. If this is not possible, then he may ‘take control’ of none exempt goods. The regulations provide a list of exempt items that cannot be taken into control by the bailiff. The following are the most important: Items or equipment (for example, tools, books, telephones, computer equipment and vehicles) which are necessary for use personally by the debtor in the debtor’s employment, business, trade, profession, study or education, except that in any case the aggregate value of the items or equipment to which this exemption is applied shall not exceed £1,350; Clothes, beds, bedding, furniture, household equipment, items and provisions as are reasonably required to satisfy the basic domestic needs of the debtor and every member of the debtor’s household. Cooker or microwave, fridge, washing machine, dining table and dining chairs to seat the debtor and every member of the debtor’s household. Land line telephone, or a mobile phone. Domestic pets and guide dogs. A full list of items that are exempt from being taken into control by a bailiff can be viewed here. NOTE: Motor vehicles are the most common item to be taken by bailiffs. A separate post is provided below on this subject.

-

I am not clear on some aspects of the regulations and placing a deposit on an item at a show where the business has a temporary stall i.e. NEC show. If we place a desposit for instance on a caravan and then change our minds later i.e. 10 days later, are we entitled to our full desposit back as the caravan has not been delivered and is not even built and we have paid over £100 deposit using a credit card? Secondly, if I place a deposit and the caravan is built and delivered to the dealership, but before I take delivery, there is a change in circumstances and we need to cancel the order, can we get back our deposit which will be over £100 and paid using a credit card? Just to add, we are not in either position at this time but would clarification on this aspect of the law. Thanks.

-

Hello, first post here and apologies if you've seen my post on other forums, but I am in need of help to claim my Permanent residence certificate as a EEA citizen in UK. Hello, the original formulation of article 6(2-3-4) of the The Immigration (European Economic Area) Regulations 2006 were as follows: The amendment introduced 3.12.2013 have modified the interpretation of retained worker status and jobseeker: and: For the purpose of counting periods of unemployment as exercising treaty rights matured before 2014 (and only for that period), will the new regulations apply or the old one? Looking forward to your valuable feedback.

-

Inaccurate credit files If you believe your file contains inaccurate or out-of-date information, you can ask for it to be amended, under the Consumer Credit (Credit Reference Agency) Regulations 2000. Write to the agency giving your full name and address. It may also help to give your credit reference file number. Clearly explain what information you think is wrong and why. Provide any proof you have to show why the information is wrong. Keep a copy of any letters you send. By law the agency must tell you within 28 days of your letter if it has: • removed the entry from your file • amended the entry; or • taken no action If the entry is amended, the agency will send you a copy of the amended entry. The agency will also send the details to any lender that has searched your credit reference file in the last six months. http://www.legislation.gov.uk/uksi/2000/291/made

-

Can anyone tell me what the law is on planning application time limits are? Do the council have to place a notice on the building that is the subject of the planning application and if so do they have to allow a certain amount of time between posting the notice and actually making a planning decision? Thanks in advance.

-

This may be of some use to consumers when dealing with complaints made to their energy suppliers: http://www.legislation.gov.uk/uksi/2008/1898/contents/made

-

- 2008

- complaints

-

(and 6 more)

Tagged with:

-

The new bailiff enforcement regulations came into effect on 6th April 2014 and a short while later an individual made a Freedom of Information request to the Ministry of Justice seeking clarification on the legal basis for court fines to be covered by the new regulations. On 1st July 2014 I posted a copy of MOJ’s response on the forum and that thread received a lot of views. Unfortunately, there continues to be significant misunderstanding about bailiff fees for Magistrate Court fine and yesterday yet another video was uploaded onto YouTube regarding a debtor who filmed a visit from a Marston Group bailiff regarding two Magistrate Court fines and where the debtor had sought advice from the Beat the Bailiffs and the Banks Facebook page that paying the amount only of the court fine to the court (minus bailiff fees) would clear the warrant (which of course it does not). For public interest sake it may assist if I post the Ministry of Justice’s response once again together with some further useful information.

- 9 replies

-

- bailiff

- county court

-

(and 6 more)

Tagged with:

-

Hi all, I bought a pair of trainers off Sole Heaven via their online store with a discount code through my debit card on paypal. However I would like to return them, I went to speak with the sales assistant via phone regarding processing the return to be referred to this on their website: "DISCOUNT CODES If you have used a discount code on your order all sales are final. We do not accept any exchange or refund on items relating to that order. Please refer to specific terms relating to each individual code." Is this definitely 100%? I ask because of distance selling regulations and things relating to that. If it is right I will let it go and will sell them via ebay, however this is the first time i've come across a refund policy like this. Thanks in advance

-

I have purchased a used Vauxhall Corsa from Arnold Clark but all I have had is problems and lies ever since I walked onto their forecourt. First off, my incompetent car salesman has entered 3 car finance agreements onto my credit report. These got accepted then cancelled, one after the other. (Not searches these got accepted!) The only reason he had to cancel them was down to his lack of reading skills. First one he put wrong information on the application, the second agreement had to be cancelled as i did not have a guarantor and the third I was not the main policy holder of the insurance (however this was not listed in my copy of the terms and conditions, so obviously they just made this up). he applied for a personal loan in my name without going through any pre-contract information with me. I had also driven the car away when I signed the second finance agreement with them there was an issue of whos car it was as there was no finance attached to it! I have another issue with this car salesman when I saw this car it looked too good to be true, i asked him who owned the car before me. He gave me the line "just a managers car that they have traded in for a newer one", however, on receiving my V5 it states that a hire car company owned it. Now i'm sure he has breached the Consumer Protection from Unfair Trading Regulations as stating something which is untrue? and hiding the fact it is an ex-rental. What should I do about this? The manager dealt with us after that and tried to sell us another car! Even though the finance of the car we just bought was not resolved. He offered us money to take this new car but we declined. He also tried to entrap me by recording a phone call we had without my knowledge or permission. I have complained to head office with a very long list of complaints for them to say that we have sorted out your third finance agreement so have set your complaint to resolved. The manager from the garage we bought the car from rang me and said I can have a full tank of petrol for my inconvenience and he then added £100 on top of that after I started telling him everything they have done wrong. This didn't come from head office so i'm not sure what to do. I have put in a complaint with the Financial Ombudsman and I'm going to write to my local Trading Standards. Do you think that I'm being fussy or should I not have to put up with this having an effect on my ability to obtain credit, the fact that they have breached the regulations according to Trading Standards, breached their code of conduct set out by the FCA and have lied to me throughout this process making me feel stressed and upset. (sorry for such a long post!)

-

The Taking Control of Goods Regulations 2013 take effect on 6th April and from the many posts made by the regular contributors on the forum it is clear that there are many concerns as to how these drastic changes will affect debtors. The local authorities (and enforcement companies) are confused with the regulations and naturally the regulars on here must be the same. Over the next few days I have offered to put together simple Practice/Guidance Notes over different threads and these may then be used as the basis for STICKY's. To try to avoid threads going 'off topic' I think that it would be a good idea to start this thread so that we can share our views and ask questions.

- 233 replies

-

- general discussion thread

- regulations

- (and 1 more)

-

Hi all, My freeholder is being an ass (to put it lightly) as I am pushing his hand to attend to urgent external repair works which have caused damp to come into my home for well over a year. He is trying to make my life difficult by enforcing random lease clauses he has never bothered with in 7 years. One is in relation to him being able to inspect my property and ask for repairs to take place. I live in England – so if any of you lovely people know the law and could help me out I would be ever so grateful. I have done some research online and found some answers. His demands and my notes below. 1. The windows do not have window restrictors fitted, therefore causing a serious safety risk. Window restrictors must be fitted to all windows. ------I believe current regs only apply to new builds – if you know otherwise, please do let me know? Windows are double glazed with a handle you turn – the bottom half of the window then tilts out to approx. 45 degrees max. (we are on the first & second floor above commercial premises) It is not stated as a requirement in the lease. 2. On the day of the inspection we were unable to see the spur switch to the oven. All appliances should meet the health and safety standards. We require the gas and electrical certificates. ------I need to try and find the spur over the weekend Am I obligated to provide him with gas & elec certificates? It is not stated as a requirement in the lease. 3. The electric meter and main fuse switch box are also not positioned as per the legal height requirements. They should not be higher than eye level and should be easily reachable without the aid of a ladder ------ I already know current rules and regulations are only applied to new builds as it would be impossible to retro-enforce the law Am I still required to alter though? 4. Remove the key operated door locks from the bedroom doors and replace locking mechanisms which do not require a key to open the door from the inside in order to aid escape in the event of an emergency. ------ Re: Internal flat locks - all rooms in the house have door handles with a key that turns a look (where the key can be removed from the lock). Aside from the WC & Shower Room we don’t actually use the locks, however is there any legal regulations on whether or not I can have these on internal doors (including the WC?) ------Re: the Lock on main door / communal entrance - Ironically this door to the building which is within the freeholder’s remit does not have a snib lock and requires a key to open. It’s the only escape route so if there was a fire and we couldn’t find the key we would be unable to leave the building. Are there any rules & regs regarding external / communal doors and the lock required? Thanks in advance, won’t let the bugger bring me down!

- 3 replies

-

- freeholder

- law

-

(and 3 more)

Tagged with:

-

We need to have this act repealed. By we I mean CAG, MSE, TPUC, PePiPoo members all need to unit and organise to repeal this abusive piece of legislation. Cameron states he only wants a 100,000 signatures to look at a law. Lets give him a million signatures with as much social network pressure as we can mount to force the corporate controlled press to take up the issue. What do you CAG members think?

- 21 replies

-

- goods

- regulations

-

(and 2 more)

Tagged with:

-

I don't know if anyone can cast light on this. I have several friends who have issues with the CSA. The CSA have gained CCJ's against my friends' partners, but they simply do not follow through in terms of enforcing them. One of these CCJ's is now well over 4 years old and there is no sign of one penny being forthcoming under the judgment. With the new regulations coming in, is there anything HCEO's can do that would enable the likes of my friends (there must be many others in the same boat) to get the CSA to enforce the judgments? It seems very unfair that these Mums (though they could also be Dads in this situation I guess) are struggling financially because a properly formed organisation (the CSA) is doing nothing whatsoever to get judgements enforced.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)