Showing results for tags 'questioning'.

-

When I was caught using my mom's freedom pass, 'the caution' was read to me AFTER I answered all the questions and was asked to sign the notes. I was NOT asked to review the notes just to sign. Is it how it is supposed to be done? After the questions and my signature the caution followed and I just felt sick. The officer offered free legal advice but I refused because I was mentally and physically unable to continue. Can I still request free legal advice should I go to court? I think I wasn’t informed that I DID NOT have to answer the questions WITHOUT legal adviser. My mind is pretty fuzzy on the above but this is what I remember. In hindsight I would have answered everything with a free lawyer but to be honest I think I answered everything truthfully anyway... but: Was the caution read to me legally in this order? Should I mention it in my apology letter? With a case number saying to fill in the form on the reverse of the letter with plead guilty or not guilty within 10 days – no intention to prosecute yet. I intend to plead guilty because I did commit this offence. If I accept committing the offence I need to provide any exceptional reasons as to why they should not prosecute me. They stopped me just after I crossed the tube gates at Northolt station so I didn't have a chance to actually make any journey. After all the questioning they let me out and I went back in using my credit card. I only have 4 days to reply as I only received it today (I was checking the post ever since the incident – it took them only 4 days to write it to me – is it a bad sign?) so I only have a week to reply L. So please can you help me understand: What the legal consequences will be? I am talking about worst case scenario. I am pretty sure I will be prosecuted, will be given a criminal record, huge fine (how much do you think?) but will not be jailed as this is my first offence? Or am I wrong and can get to prison? Will my employer need to know? Will I get fired? If this happens can I appeal and how? [*]My exceptional reasons (I guess these are the mitigating circumstances) is my mental illness. I have suffered from depression, anxiety, associated disorders and side effects caused by being on antidepressants for about 10 years – all is GP documented. As a result I have suffered from frequent serious disorders – just imagine the worst for a depressed person as I don’t feel like providing such details. In addition I recently started a therapy to stop smoking and the side effects of the medicine are severe and are not helping my mental state. Especially the last 2 years have been very hard for me, I lost my job, my person life crumbled, I had difficulty getting out of bed and so on… and finally 3 weeks ago I found a job (which again added a lot of stress as I want to keep it at all costs) and I was caught only after 2 weeks of working. [*]I was asked if it was my first time: I honestly don’t know and this is what I answered. My mom and I keep exchanging bags and stuff and I have been too stressed out to check which card I had in my bag – they have the same cases. So the worst case scenario is that I have been using it since January/February this year but irregularly like 1-3 times a week or weeks of not using it at all. [*]‘the caution’ Was read to me after I answered all the questions and was asked to sign the notes. I was not asked to review the notes just to sign. Later came the caution and I just felt sick. He offered free legal advice but I refused because I was mentally and physically unable to continue. I think I wasn’t informed that I didn’t have to answer the questions without legal adviser. My mind is pretty fuzzy on the above but this is what I remember. In hindsight I would have answered everything with a free lawyer but to be honest I think I answered everything truthfully anyway but: Was the caution read to me legally in this order? I.e. after I answered all the questions and was asked to sign the notes without reviewing them? [*]Apology letter I intend to write everything that happened, the card/bag mix up, my mental issues, plead guilty, apologise, ask not to be prosecuted, not to get a criminal record, settle out of court, offer the payment of all the associated fees and penalty etc. Does it sound right? Should I add something about the caution that to me should have been read at the beginning? Should I add anything else to help my case? Thank you very much for reading this! As you can imagine I am losing my mind, I am scared, terrified I overmedicate so that I don’t have to think… any words of wisdom will help so please, I am begging you help me if you can.

-

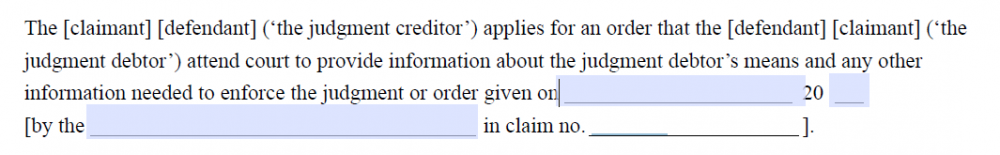

Hi folks, i need somebody to inform me what the empty spaces are needing as ive re read this block several times and its not clear to me.

- 2 replies

-

- application

- attend

-

(and 3 more)

Tagged with:

-

Hi Everyone , i was hoping for some advice , after looking through documentation it seems i was REALLY naive when i took out the credit for my car , i had finance on 10.12.2014 for a renault megane 2007 1.9 DCI To cut it short they charged me £2,350 for the car and the loan amount by credit for cars was £5500 !! i was paying £150 a month , ive paid £2,300 off it , but with all the numerous problems ive had to pay for with the car from the start i stopped paying last month last payment i made was on 17th june and i had to pay via "[email protected] a Guy from avelo emailed me 10th june saying i needed to contact them urgently to discuss arrears (he was a negotiations case handler) i gave him a email back and told them when id make a payment he replied saying "sorry our systems have not been updated and could i ask how you will be making a payment ? and can we have your current phone number" i didnt give him my number but id updated them with my new address and he replied back "thank you ive updated our systems and "are you willing to continue paying £175 per month starting from next month?" i never replied then today i had a different person who was "Trainee Case Handler" asking me to contact the office to discuss arrears (the same like before) The reason i am not making payments is because i cannot afford to , the advice im looking for is Can they take the car away from me ? (on the documents i signed it stated that they could not take the goods if payments totalling £1997 have been made then they may not take the goods back against my wishes unless we get a court order) this is the Credit4Cars agreement i signed 2 years ago , also i have noticed that they charged me £375 for a "Stronghold Protector payment assurance system" they said they can disable my car with it as they reckon a device has been attached , the reason why i say they reckon because when i was late with a payment with C4C they threatened me they were going to disable it , i was not in a good way then and snapped back and replied "be my guest as i dont care" (they did this 3 times to me but never disabled it and also when i asked a mechanic to look for it he said he couldnt see anything , when i chose the car the people at trade center where i bought the car said because i have a tracking device my insurance would go down now when i queried with them what make it was for my insurance they would not tell me so i was paying a LOT more than i should have for my insurance , sorry to have gone on and on its just that the cars wheel bearing has gone and it will cost me £200 tomorrow and if they are going to take back the vehicle then i wont get it fixed , thanks for your time any advice appreciated

- 10 replies

-

Hi, and here we go with my welcome story. I purchased a car and the loan was through welcome finance - the original agreement was taken out in May 2006. Payments were made as agreed then I had some financial difficulties and they agreed to reduce the payments to £150 per month - again these payments were met. A short time later I missed payments again (2 I think) and received a default notice. I telephoned welcome and he said payment needed to be made otherwise they would take steps into repossessing the car. I said on working my figures out we had paid over the required amount and did not have any right to repossess - the answer to this was that I had signed a new agreement in August 2008 when reduced payments were made and therefore with this new agreement, with added interest and extended terms! not enough money had been paid - my reply what new signed agreement, I did not sign a new agreement!? - please send me a copy. Eight weeks later no cop sent telephoned were I was told they could not find this agreement (surprise, surprise) my question was what happens now he replied that I needed to write to head office with my complaint. I also asked so what happens now surely you cannot revert back to my old agreement because as far as you are concerned this was revoked and a new one was signed to which you cannot find? - answer I think you need to contact Head Office! I have uploaded my agreement for anyone to look at, but my questions are this 1. What letter do I need to send 2. Where do I stand with regards to any payments to be made 3. Does my old agreement still stand Thanks for any help in advance

- 75 replies

-

- attend

- county court

-

(and 2 more)

Tagged with:

-

Last night (no doubt in preparation of Barry Beavis's Court of Appeal case in a few days times) the RAC Foundation issued a 64 page statement from a highly respected QC questioning the legality of private parking tickets. The document is stunning and is a 'must read' for anyone with an interest in these dreadful private parking tickets. http://www.racfoundation.org/assets/rac_foundation/content/downloadables/RACF_Private_Parking_Public_Concern_John_de_Waal_Jo_Abbott_February_2015.pdf

- 1 reply

-

- foundation

- legality

-

(and 7 more)

Tagged with:

-

I lost an appeal in November last year and costs were applied £750 - I appealed and this hearing was heard within another hearing Civil Case on Jan 4th 2014 - The Judge awarded the claimant £7,123 - off which £5,000 of this was costs. He mentioned something about only allowing certain sum of costs. I could not pay - single parent on benefits and offered £5 a month - this was refused so I applied for a redetermination hearing which was heard in March 2014. I informed Judge I had a caravan old tower 1997 that I could sell worth about 2k. Advertised on 8 sites including Ebay and no interest. Went back to court on Monday 23rd June to update situation and offered £25 a month (payable by my BF) this was again rejected - again given another 3 months to sell caravan then other party intends to get a high court writ. The upshot is unbeknown to me this debt has gone up - I thought the £750 for previous hearing was already added to final judgement of £7, 123 - the other party have now added interest and further costs on both amounts. I managed to sell some furniture and jewellery and paid £1,000 in April - thinking the debt was now £6,123 but the debt has now increased to £7,300 thereabouts. Impossible situation. My question would be - how do I query this £750 additional ? no mention of this in the final judgement so assumed £5,000 in costs was total. Can I question the interest side of things? if I managed ( family member) to pay off some and get it under the £5,000 does interest cease? The Judge mentioned any debt over £5,000 interest becomes payable. So would it be worth my while loaning the funds from a family member. Thank you for your help in this matter it is all very confusing.

-

I hope this is the right place to post I have a school fees debt dating back 4 years ago. My daughter was there for two terms. I paid for a whole term and part of the other and then had to pull her out as my partner and I were separating he was going bankrupt and we couldn't pay the fees. At the time I was a housewife and he was the main breadwinner. The fees per term were £1800. I signed the credit agreement only I received a CCJ for this in 2011 Yesterday I received a letter dated April 24th to attend court for questioning on the 18th June The debt is now £10k I intend to be at court I am in full time work but with many debts including bank debts, HMRC and credit cards 1. Should I dispute what has been added to the original debt? If I do should I send this direct to the creditor? In terms of bringing proof of other debts what should these be? Should they be credit agreements which I don't have? 2. What is the likelihood of an attachment of earnings being made? I don't have any assets or own my own home , I rent Any help greatly appreciated Thank you

- 3 replies

-

- attend

- county court

-

(and 1 more)

Tagged with:

-

Hi , I have only just found this site ,hoping someone here can help or advise me . My Husband and I were in receipt of benefits IS SDA DLA and CA along with Housing and Council Tax benefit . I was advised by lady in social security that I could work for 16 hours a week without it affecting our benefits , because my husbands illness was terminal going out to work for a few hours was a break for me ( even though I took a job in a nursing home as a carer ), this is what I did . I worked 2 days a week from 2002-2003 my wage after tax and insurance contributions was roughly £70 . In 2003 I stopped working when my husband became so ill I had to care for him full time Then in 2004 after receiving a letter from the DHSS stating that they wanted to speak to me about working while claiming . I attended an interview where I admitted that Yes I had worked over that period ,but I had only taken the job after speaking to staff at the local DSS office who advised me that I could do this without it affecting our benefits . I was told that I was liable to pay back all of the benefits we had received over the period I had worked this totalled almost £16,000 . 10 years on and I am still paying back all of these benefit overpayments admittedly at reduced rates because of hardship but its still a struggle . My question is should I still have to pay back Housing and CT benefits when I was only earning £70 a week ? Surely I would have received some help from these benefit sections . My husbands illness is in its final stages and I am in poor health myself , my worry is when he dies I'll end up in prison because I can't afford the repayments .

- 1 reply

-

- overpayment

- questioning

-

(and 1 more)

Tagged with:

-

I have just received (yesterday) a Court Order for Questioning and the date is Monday coming! my question/query is: the debt is against me personally, I have a personal bank account that has about £2 in it! My husband and I run a business and money from clients all goes into the business account and I dont draw a salary. If the debt is personal, do I have to take the business statements etc..... The debt is not against the business, it's me personally. Or am I clutching at straws Thank you in advance x

-

Hello all, I am delighted to have stumbled across such a delightful forum and I am hoping someone will be able to help me with my situation. In 2004 I took out a loan for £5k with HSBC for a family member who was down on her luck (silly I know). The agreement was for her to pay the monthly repayments which she did for a while. I moved from my area towards the end of 2004 and thus was unaware that the account had gone into arrears as the family member assured me that she had been paying religiously. I know I should have taken a more proactive approach in dealing with this debt but I didn’t think it would have come to this. A few weeks ago I received a letter informing me that this debt has been transferred to my local court for enforcement, Arrow Global is the claimant. When I rang the court I was told that I am due to attend court on 24th September 2013 for an order for questioning. Also a CCJ was registered against my name in November 2007. I have contacted Arrow Global to see whether I could make an offer for payment, they transferred me to IND who isn’t willing to negotiate and expect me to attend court on the 24th September to discuss my financial affairs. Given that I have had no correspondence regarding this debt is there anything that I can do to avoid attending Court. I have made a SAR to Arrow Global so I am just awaiting the information to see how much money was paid over the years. The debt now stands at £5360.76 Any help will be appreciated.

-

I have a ccj that is more than six years old I agreed a payment plan of £100 per month with marsden 3.5 years ago and I have never missed a payment but in Feb 2013 I received a letter from ind ltd saying that I now need to pay them instead of Marsden as they were now collecting the debt as they were the original creditor I called ind ltd but they didn't allow me to pay via standing order like I was paying marsden only via dd that I couldn't do, I agreed with ind ltd that I would continue to pay marsden but in March 2013 I received a letter to attend for questioning due to non payment. I called ind ltd straight away as I didn't understand why they had sent me this and i reconfirmed what was previously agreed but they said they wanted me to pay them, I spoke with my bank a arranged the dd for £100 and cancelled SO to marsden but ind ltd are still insisted I attend court, any advise would be welcomed. I am finding very difficult dealing with ind ltd and every time I call the balance is different between £2200-£3600 depending who I am speaking too even the covering letter and statement have different amounts on, however I had the manager confirm it was the lower amount of £2200 so I offered a settlement of £1500 but ind ltd rejected it saying they want full payment.

-

Hi I've received an order for questioning at my local county court and the creditor is 1st Credit Ltd. I have no idea what this alleged £3,800 debt is for as I have never to my knowledge had any dealings with them and never owed or had any credit above £1,500 apart from a mortgage. Apparently they got a judgement back in November 2008 at Northampton county court but at that time (September 2008) I had to leave my home after I was attacked with an axe handle and received threats to kill by anti-social drunken thugs and my home was invaded by the thugs. I'm attending court tomorrow 24th April 2013 and just wondered if anyone had any good advice on how to tackle this firm and it's claims. Since the attack my health and mental state of mind hasn't been the best and I've pretty much lost everything else I owned, house, car, business and pretty much all my belongings of any worth. They've spent £50 on this court order so they must feel I owe the debt and have means to pay, but sitting here I can't see them getting anything back as I have nothing more to give.

- 5 replies

-

- county court

- limited

-

(and 1 more)

Tagged with:

-

In two weeks I have to go to County Court for questioning, here is the background, sorry in advance it long. My property was repossessed in sep 2006, prior to this I was running a small business and had the property rented out, my business partner pulled out Aug 2005, just prior to this I had taken a secured loan on the property for £15k. So without my business partners support and a downturn in business, I placed the property for sale to pay off loans etc, in Jan 2006, just as I went into arrears. I accepted an offer in Feb 2006, however by Sep 2006 contracts were not exchanged despite two judges recommending that this should happen, it seems the secured loan company messed me around (kept changing their mind on a monthly basis) forcing me into negative equity. Leading to their own solicitor apologising (crying on the phone) for their vindictive behaviour. By this time I had been sleeping on my office floor, and shortly after my ex business partner threw me out of the building so nowhere to trade. Note the property was repossessed on behalf of the original mortgage company not the loan company, the loan company apparently were happy to take their chances that the value of the property had increased to they would get more back than what I had offered. So after 2006 I heard nothing until May 2011 when I had a statement from them which I ignored followed by a letter apologising for sending the statement and their IT dept would investigate, Then a letter in Oct 2011 asking to confirm their database details. Again I ignored this. A few weeks ago I was issued with a county court summons for questioning regarding a debt of £25k with the secured loan company due on the 20th June. I was diagnosed with ME/CFS in 2007 due to events of 2005-2006 etc. and was on income support from 2007 to 2012 but lost my claim for ESA when I was moved to Jobseekers. I live in my mothers rented property and have few possessions left. Also I have 2 other debts £1800 with monument credit card via Capquest which I pay £14 a month. £7300 remaining with Lloyds TSB which I was paying £48 a month, but stopped paying when my debit card expired and had a nasty letter from the debt collection agency dealing with it, so I wrote back wanting to know what accounts the debt related to as believe it or not I had never been informed, Threatened them with trading standards, and they started been nice. I have just received a letter stating that Lloyds TSB have recalled the account from the debt collectors. Has the loan company already issued me a CCJ, should they have issued a notice of proceedings. What could the courts ask me to pay back per month, and would I have to inform them of any changes in my circumstances, and how long would I have to pay it for? Would I be better being bankrupt as this is something I have thought of as I have no credit or mortgage anyway, I could raise the £525 but probably not the cost if these could be waived. I would like some thoughts please on which way to proceed.

-

- county court

- creditor

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)