Showing results for tags 'previous'.

-

My son paid £6k for a car last week, a 2010 golf with 77k miles. He bought it from a motor dealer in London. His wife drove it down to my family in Wales, and on the 2nd day the car wouldn't engage D or R (auto-box) He contacted the dealer, relaying the issue from his wife. Unfortunately the issue has only worsened, and he decided, rightly in my view, that he was rejecting the car under the consumer rights act 2015 as it was less than 30 days old, and informed the dealer of this via email and phone-call. I am driving the car back to the dealer in London on Saturday morning - exactly 7 days since the purchase. Since looking at the paperwork with the car, please see link https://drive.google.com/open?id=19FvkpDbBqEgJe39jH6HFTnSi_Ddvb2XF It seems the previous owner also had a the same fault. My question is, does this piece of paper go in our favour as proof the fault already existed, or against us as he took the car with that paper in the service book, therefore accepting the fault. Basically - Do I wave that under the dealer's nose, or hide it? Thanks in advance.

-

Today in the post I received a claim form from TM Legal Services for a debt that I owed to payday loan company Lending Stream. The original address on the claim form had been crossed out in red pen and my current address was hand written in the box to the right of this. The date on the claim form is 10/10/2018, the date that is marked on the franking stamp on the envelope is 07/11/2018. I called the court and they advised I have received a judgement by default on 06/11/2018. I had started an affordability complaint with the original lender Lending Stream via letter on 01/10/2018. In this letter I gave them my current address. They are the only lender I had to send a letter to as the rest I have done via email. Unfortunately, I sent this by first class post and not recorded delivery. I have not had an acknowledgement from the lender to this letter. I called the company TM Legal Services who initially advised it was the court that sends out claim forms. When I pointed out that the envelope that the claim form came in had a return address of their company and was posted the day after the judgement was obtained they put me on hold. They came back and said that they received the original claim form back as undelivered and had done a trace on me to find my current address to send out the claim form. I called the court back and explained this and they said I can apply to get the judgement set aside at a cost of £255. I have sent a further letter of complaint to the original lender and advised the financial ombudsmans office of the situation, however they say that when the complaint comes to them if referred (29/11/2018 is 8 weeks) they are unable to instigate the removal of the CCJ even if my complaint is upheld. I now don't know what to do. Should I apply for the judgement to be set aside now or wait for the reply from the lender/complaint to the financial ombudsman's service? At the time of the loan I had 6 defaults for various utilities and loans in my recent credit history as well as an outstanding balance of over £3500 with other short term lenders. The original debt was for £850 but now with court costs and interest stands at £1780. If I apply for the judgement to be set aside, is that there is an ongoing affordability complaint a valid reason, along with the fact that it was sent to a previous address? Is the fact that it was sent to what the company alleges is my last known address and not my current one enough of a reason to get it set aside or will I have to show that there is a chance I will win the hearing? Will the 30 day period after the CCJ to pay reset if the judgement is set aside? I work in an industry regulated by the FSA so a CCJ will likely cost me my job. Apologies for the long post. Thanks a lot for reading if you got this far.

-

I have been living in my current flat for approximately 5 years. Firstly with a partner and recently by myself. During this whole time I have had a pre payment meter taking debt every time I top up for a previous tenant. Through my own laziness and stupidity I didn't pursue the issue. I tried to at first but couldn't figure out where to start and about a year or so ago the 'debt' being taken off was a negligible amount (approximately 50p-£1 for every £10 I topped up). However, recently the rate that the debt is added seemed to have escalated to £2-£3 per £10 topped up. I should have pursued this much sooner I realise this, but I would really like them to stop charging me for a debt that has never been mine and to recover some or all of the money that I have paid towards this debt that is not and never has been mine. Is anyone able to advise who I should contact and how I should go about this?

-

Hi guys need your help and advise, i had been claiming ssp when i was employed on my July wage slip there was a discrepancy of X amount short, had a chat with the employer he admited it was his error, he paid this back via Bacs in August, when i recieved my last wage slip September he had taken it back and marked as a deduct pay advance, when i asked about and said it wasn't an advance it was what you had miscalculated it his words where it is correct and inline with HMRC guidlines. which now brings me to another question i went on to the Gov site where you can see your wage slips from employer, the wage slip i have has a different amount paid to what is on Gov site which is a higher amount. Surely they should match.

-

Today I received a large pile of documents from Prestige Finance, with whom I have a second mortgage. I have identified 10 unlawful charges of £35 each. But this account was previously held by lenders GE Money. Either they went into administration and "became" Prestige Finance, or GE Money simply sold my account to Prestige Finance. I have identified seven unlawful "administration charges" of £40 each while the account was with GE Money, before I found my account being handled by Prestige Finance. So my question is in two parts. 1. Am I entitled to recover the £280 unlawfully charged to me by GE Money before Prestige Finance aquired the account (and if so, who do I get the money from? Prestige? Or GE, who may no longer exist?) I had always assumed that if a going concern such as a lender was aquired by another going concern then the buyer going concern would also be buying the seller's liabilities as well as its assets (in which case Prestige would be liable to refund me the money that GE had stolen from me). But I may be wrong in this case. 2. How do I get my money back from Prestige Finance? Do I just ask for it back or do I need to take them to court? Can I charge interest at the statutory 8% and how can I calculate that? Can I add on anything else such as the time it has cost me and also the stress? Thanks in advance.

-

On 25th March 2016 I purchased a van to be used for my business. I carried out an online HPI check before agreeing a deal which was clear of finance. Unfortunately this was on my phone at the time and no longer have a trace of it as it was 20 months ago. I paid £5000 cash and received the log book on the day of sale. Today I had a note posted at my home address from a bailiff company. On ringing their office they informed me they had attended to reposses the vehicle. They told me to ring another company called Varooma to whom explained the situation and have now sent a new keeper questionnaire to them detailing the sale. They have said that I will be liable to pay the debt owed or the van will still be repossessed however at this stage have not told me what the amount is. They said there will be a meeting with a manager tomorrow and they will then inform me. Problem is this vehicle is my lively hood but will also affect the jobs of 3 other staff if this vehicle is taken away. Any help or ideas would be appreciated. I have also now got the Bill of sale registration number which I will check with the high court that it is valid.

-

Hi all, This is a weird weird situation. I recently found to my delight my previous employer had overpaid salary, basically I was only due (and given) a week's notice, of which I have proof (submitted at the start of claim), and I started my claim for JSA IB and HB at THAT point, yet I now find they paid a month's notice. I was posted a payslip which shows the excess AND with it, a P45 which also erroneously shows my leaving date as if I were given a month's notice!! So, a strange one, I think you'll agree. I have outright proof - a letter from my employer, signed by my line manager - of the 1 week's notice. While I imagine there is little or no way for the employer to clawback the overpayment, I am concerned that : 1) the DWP will now want to clawback the JSA and HB payments made in respect of the excess period; 2) Despite my making my claim in all good honesty the DWP will ask whether I knew of this 'change in my circumstances', and regardless of my answer, question why I did not inform them. I have no past lack of disclosures whatsoever, but as you can imagine, I don't want an investigation in which I have to attend meetings, I already spend too much time in the JC office! Would appreciate advice from those in the know here, thanks.

- 4 replies

-

- overpayment

- previous

-

(and 2 more)

Tagged with:

-

Could anyone please give advice on taking the CMS to court. I have been paying maintance and have gone above and beyond by paying the same volume of money whilst my daughter was not in school for a year. she came to tell me as she lives with her mum that she was 3 months pregnant and was keeping the baby at the age of 15. despite me not agreeing with this in any way she still went ahead and had the baby. whilst she was out of school for a year I still paid the full amount agreed even when I was not required to do so. since then my daughter has not contacted me at all despite me paying for items for the baby and paying full money for a year. to top this off her PWC opened a claim against me many years ago which has now come to light despite me paying her what we had agreed and not missing a single payment. The CMS have now sent me a letter stating that I owe over £9000. I have contacted the CMS and since this has happened myself and the PWC came to an agreement. this I have stuck to despite my disagreement with this being claimed but according to the CMS I have no choice. This has now gone a step further as the PWC has no choose to go back to the CMS for the outstanding money even though she contacted them and so did I and I was confirmed on the phone that this had be closed and she only had 30 days in which to change her mind. 120 days later after keeping up with the agreement that we had and both signed they are now saying that they can reopen the case despite telling me that this was not possible and wouldn't happen. they are saying that although she called in and cancelled on the 7th july and only had 30 days to change her mind she then phones in on 1st November for them to tell her she can now claim all of the £9000 supposable owed due to the fact that they had said I was closed and all the paper work had been done there end they had simply not sent out a letter to state that it had been closed. there error not mine. due to this they are now saying that the 30 days was from the letter and the case was still open. can someone please advice as it has taken them a grand total of 2 hours to contact me to tell me I owe money and have said that I will receive this in writing in 5 working days. yet I have waited 120 days for them to send me a letter to say the case is closed and to date I have still not received this. How can it be that they can send a letter in 5 days yet I wait for 4 months and still no letter. there must be something within the law that says this is wrong and needs to be changed as the fact that they didn't follow procedure and didn't send me the letter even after 4 months showing me their level of incompetence that this letter or lack of has now cost me £9000 purely due to there incompetence. can any one please help any information would be appreciated.

-

Hi, Everyone, Need help on my NCB. I involved in an accident with pedestrian which eventually proved using CCTV and by Police that I am not in fault. Now anyone claims for the money to insurance till 3 years from this insurance company. Because of that reason, my previous car insurance company reinstate all my 3 years NCB, and I have to pay extra for my car insurance renewal. This three years time frame will be ending soon. Is there any way I can claim back all my lost no claim bonus from my all previous car insurance company? Thank you,

-

Hello, Looking for a bit of advice. My husband owns a car and a van and insured in his name. I am a named driver on the car and in 2016 i crashed into the rear of another car. The claims process went well with no problems and his no claims bonus was protected. When we renewed the car insurance it only increased £45. My husband went online to get a quote for the van but it wouldnt take the payment and said that he would need to call. when he called they said that their system flagged that there was a claim that he didnt disclose (The one i had in the car) He said to them that he didnt think he needed to as it was me who caused the accident on his car policy. I am not named on the van policy. So the quote online jumped from £236 to £519 When i had the accident he phoned his van insurance to tell them and they said that because i was no on the van policy there would be no increase in the policy Thanks

-

HI I applied for the PPI from Monument and i had an outstanding debt which was very old, they sent out an letter to claim PPI and i have applied online. Now i have received an response from the they will be adjusting the money towards my debt, I have attached a copy from them, can you please guide and advise what would be the next best step to get the Ppi PDF uploaded monument reply.pdf

-

Hey, I apologise if this does not belong in this particular sub forum! More than likely I can't do this, but if you've previously accepted a 'gesture of goodwill' payment to settle a complaint... can you actually turn around and say I no longer accept this as a settlement, return the payment to the creditor? Some of these payments made to me are now quite old, but I did accept a recent payment only a week or so ago... This was/is mainly connected to payday loan companies... as i've already raised the issue of unaffordable lending, continued borrowing etc and settled they won't investigate. I made a massive mistake accepting small 'gesture of goodwill' payments, and now the FOS will not investigate updated complaints because of this! It certainly is another lesson learned!

-

Apologies in advance if this is a dumb question. I worked for a company from approximately May/June 1990 to around March 1992, during which time I had contributions into their pension scheme deducted from my pay. I've just reached 65 and am now receiving my state pension and idly wondered what happened to those contributions, whether it would be possible to get those back, or if I could now legitimately claim a pension (however tiny) from that company? Or is it the case that I've effectively kissed that money goodbye? Any assistance or pointers in the right direction would be gratefully received.

-

EDF energy debt-Previous address

confusedbunny posted a topic in Utilities - Gas, Electricity, Water

Dear Cagger's, I need advice on a letter i received from EDF energy (to my new address), stating that i owe them £3500 for electricity at my previous address and if i do not contact them then they are instructing debt collector's. I was living in my previous property (private landlord) for 2yrs and 6 months, during this time, i assumed my electricity was included in my rent. I never once received a bill from EDF during the whole 2.5 years and my electricity was never cut off! Since receiving this letter, i have checked my old TA and it doesnt say my rent included electricity, just water rates. I am shocked to recieve this huge debt and i guess i am responsible for it, however, i never once took a meter reading, so i am not sure how they have calculated my useage. What can i do to dispute this debt please? Why didnt they cut my supply off after non-payment of the first bill? I didnt even recieve any red bills either. Isnt it very irresponsible of them to let it accumilate to such an extortionate amount. If they had sent bills or even cut it off after non-payment, then i would have realised that the electric wasnt included in my rent but i received not a single bill in 2.5 year's. -

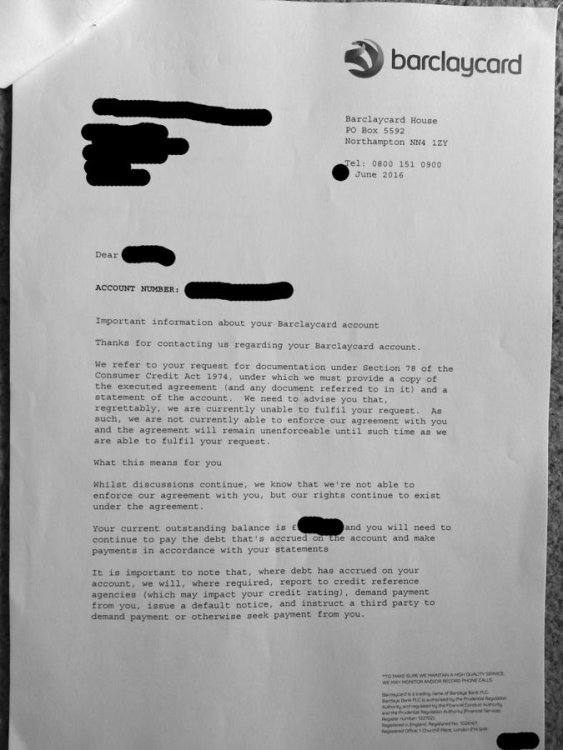

Good afternoon I have received the attached response following a CCA letter. Is this contact or not as they are now saying the debt has become enforceable. If not correct what do I need to do now. Below is my original post re this Many thanks http://www.consumeractiongroup.co.uk/forum/showthread.php?467679-Unable-to-pay-DMP-as-now-unemployed CCA return.pdf

-

Hi there, Just wondering if anyone can help. We moved into our previous house in 2011. We paid a management company each year for the communal service charge as instructed. Not an issue. However, when we were in the process of selling in 2015, our solicitor found that the accounts for the previous four years had not been completed and filed by the management company. We were advised that our buyers wanted to hold a retainer of £200 in case of an underpayment, which we agreed to. Just before we exchanged contracts, the management company emailed to advise that for the first year (2011-2012), we had actually OVERPAID them by £144.45. Following this, we emailed them the following: ----------------------------------------------- From: ***** Sent: 08 June 2015 18:08 To: ***** Subject: Ref ****** Good afternoon ****, I have received communication from you regarding a credit to my account for the period 06/07/2011 - 30/06/2012 to the value of £144.45. As the charges for each year are paid in advance, I would not like this credit applied to any future bill, instead I would like to receive the amount direct to myself in form of a cheque or bank transfer, due to the fact that I have sold the above property and will be moving at the end of this month. Please can you confirm that this will be actioned as per my request, and the same applied to any further credits that may be due for any charges up until 30th June 2015. I look forward to hearing from you. I can be contacted via this email or on the mobile number below. Regards ****** ------------------------------------------------------ The management company then replied with the following stating that once ALL years accounts were finalised, they would return any overpayments to us: On Tuesday, 16 June 2015, *********** wrote: Good Morning Thank you for your email I note your below instruction however at this stage the credit it unable to be returned to yourself. Any overall credits can of course be returned to yourself following the production of all outstanding accounts. Kind regards **********- MIRPM AssocRICS Acting Branch Manager, Estate Management ------------------------------------------------- We have since been advised by our solicitor that the overpayments are for the following amounts: 2011-2012 - £144.45 2012-2013 - £185.41 2013-2014 - £110.83 2014-2015 - £83.80 Total overpaid - £524.49 However, the management company have gone against what they have agreed to and credited the accounts, meaning the buyers have now had this money and they are refusing to refund us. Our solicitor has not been overly helpful and the management company have now said they won't speak to us as we are no longer the owners of the house. What rights do we have? Are we able to fight this in small claims? Any know how would be good. Thanks in advance.

-

I have an old Egg credit card which went into default a number of years ago after I had to close my business. I have been paying £1 per month for a couple of years now. The payments are going through Capquest. Last time they asked for a financial update i asked for a copy of the original loan agreement. As I understand it Barclaycard took over Egg cards a number of years ago. I have attached a copy of the letter with details blanked out - the outstanding is around £3000. In the letter B/card state that they cannot currently fulfil my request, and as a result the outstanding is unenforceable. What should I do now? Should I stop payments until they can prove the liability? Should I offer them £100 in full and final? The default obviously still shows on my credit file. Many thanks TW

- 8 replies

-

- barclaycard

- egg

-

(and 1 more)

Tagged with:

-

Hi New member here, i am hoping i get some advice here. My Wife had started a job at a medical spa which does botox , skin facials. She worked there in May 2016, my wife started work but they were paying her such a low wage , she was reluctant to take the position, but she took it. The woman in charge had no idea how to run a medical spa at all and started to use the 12plus years knowledge my wife has . Before my wife had started work the woman had said to my wife that if my wife leaves within two years she would have to pay back any training costs. My wife started work but never signed any contract stating that she would have pay anything back , even the offer letter had no reference to this. My wife went on two half days of training for laser training but never got a certificate of any sort. This woman boss would contradict any ideas my wife brought up, my wife after a month wanted to discuss her wage as it was just not satisfactory of the work and experience she has. So my wife called a meeting with the woman boss and presented this to her, the woman boss did not even entertain the prospect of raising her salary at all. So my wife decided to leave before all her ideas were going to be used, the woman boss has now sent a letter asking my wife to pay back training costs for the two days, but nothing was signed and not even a job description was given to my wife. I think personally this woman is bitter that my wife had the guts to leave and she is now asking for money to feed her own ego. Any advice would be helpful, thanks

-

I recently switched gas and electricity (together, dual fuel) suppliers. The switch completed a couple of weeks ago, on 13th May. I was on a fixed monthly DD tariff with my previous supplier, and my account had built up to be significantly in credit (should be over £400 after my final bill, going by my calculations). I provided meter readings to the new supplier on the switch over day, and I was told (by at least one of the suppliers) that the new supplier would forward these on to the old one, in order for the final bill to be raised. My online account with my previous supplier isn't showing any updates yet, I contacted them to be told that it takes up to 28 days from the switch to produce the final bill, and I'll be refunded sometime after that. Is this normal? Sounds like there's nothing I can do to speed it up. I did raise the issue of the relatively large credit on my account with the supplier some time ago, but they gave some waffle about how it could be wiped out by my next bill, even though my usage history didn't suggest that at all.

- 8 replies

-

- getting

- overpayments

-

(and 3 more)

Tagged with:

-

I am currently opening a FlexBasic account with Nationwide - got the letter to ask for ID I provided this and they are asking for stuff from my previous address. I have been living at my current address for nearly 2 years and nothing with my previous address is valid as its out of date. I have P60's and various letters from people but nothing thats on thier list.

- 6 replies

-

- asking

- nationwide

-

(and 2 more)

Tagged with:

-

Hi guys, Wonder if you can help with a couple of questions I have regarding our housing situation. We have been renting the same property since 2002 via a private landlord and rent payments were made direct to them as well as arrangements for any issues that arose with the property. During this time the rent has remained the same so no increases as our relationship with them was very good. Sadly due to ill health they have now instructed a Letting Agent to manage the property as they do for others they own (ours stayed a private arrangement up till now) and I'm a little unsure what to expect having never dealt with one before. The rent having not been increased in over 13 years will now clearly be under market averages (probably by around £150) so I guess my question is can the agency increase it by a large amount with immediate effect? The tenancy was an AST to start but reading around this would have changed to periodic if I am correct so what does this mean and are there any differences? Also I know agencies charge for things like tenancy renewals would we need a new agreement under these circumstances or if they increased the rent? They has also asked if the deposit was protected however our tenancy was prior to this requirement and was not but would they do this now retrospectively and provide us details of this? Thanks in advance

-

Child diagnosed with a disability at age 4, made a claim for DLA a few years later and has been receiving it to date, child now 16 and has made a claim for PIP after being invited to. With an unrelated issue, contact was made to GP to ask proof of disability, GP's can't find medical notes so were unable to help, all records computerised, there are notes relating to his disability though not an actual diagonsis - child has very rarely seen GP and his difficulties have been dealt with by his family. Fast forward with regards claim for PIP, child would not go to an assessment so Atos writing to GP. we understand its going to be very hard to get PIP, so are not holding out much hope - it's not a problem. Now to my question, if GP can't provide confirmation of diagnosis, can Atos/ Decision maker ask that previous DLA awards by repaid? Forms have always been filled in correctly and child has never been asked to attend an appointment for assessment prior to this, we assumed DLA would have already contacted GP, especially given the amount of times the award has been issued.

-

I've been filing self assessments for several years now due to renting a house out and would like to view my previous submissions, the gov.uk site only seems to allow me to view the last two and in different formats, one being every field available regardless of whether I entered anything. is there a way to view more & in a consistent format? Thanks

- 3 replies

-

- assessment

- calculations

-

(and 3 more)

Tagged with:

-

Hi All, This is for a friend. My friend was running her own business. Her telecoms providers were chess telecom. At some point Chess rang the business and spoke to a member of staff and sold the member of staff a new contract for the telephone services including broadband. They then entered another 2 new contracts with same member of staff all the time extending the term of the contract. They never contacted the account holder at any point to advise or welcome to new contract etc. In Feb 2014 my friend sells the business and contacts all suppliers advising of notice and asking for final accounts etc. Chess do not respond. Needless to say Chess then stopped receiving payments. They then after a few month write to the member of staff who took out the contracts. I have heard the recordings of the contracts and the member of staff does say that he is the owner of the business. After letters back and fothr they sue the member of staff and take him to court. He convinces the court that he took out the new contracts for his employer. Despite the employer knowing nothing of it. The court dismiss the case and chess leave with nothing. Now chess start chasing my friend the employer. As far as she is concearned the only contract that existed was one she signed physically with a sales agent about 2 years prior. Chess are threatening to sue her for £2200 in termination fees. They are using the contracts agreed to by the employee ( in which he said he was the sole trader ) as reason to sue her for leaving a 2 year contract early. A contract of which she had no knowledge. Chess are refusing to send to an Alternative Dispute Service as the case has already been to court albeit in a different name. This is a really messy case. Chess have increased the monthly charge without notice which in my opinion under ofcoms rules forms a material detriment so even if she were liable she should have had an exit option on these contracts. She had 2 phone lines at £10.89PCM and broadband at £38.99 PCM they have billed her as termination fees £60 PCM for the broadband and £20 PCM for the phone lines. She has tried contacting company directors and they simply ignore her letters. Apologies for the long post any advise would be greatly appreciated

- 48 replies

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.