Showing results for tags 'fast'.

-

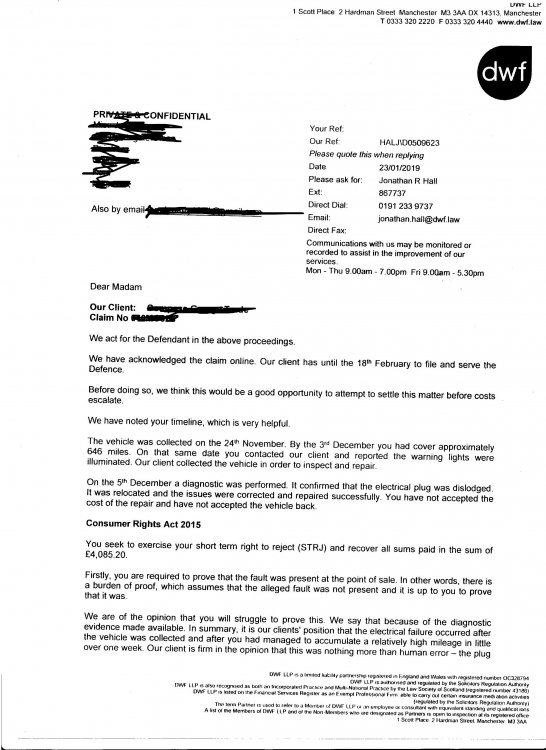

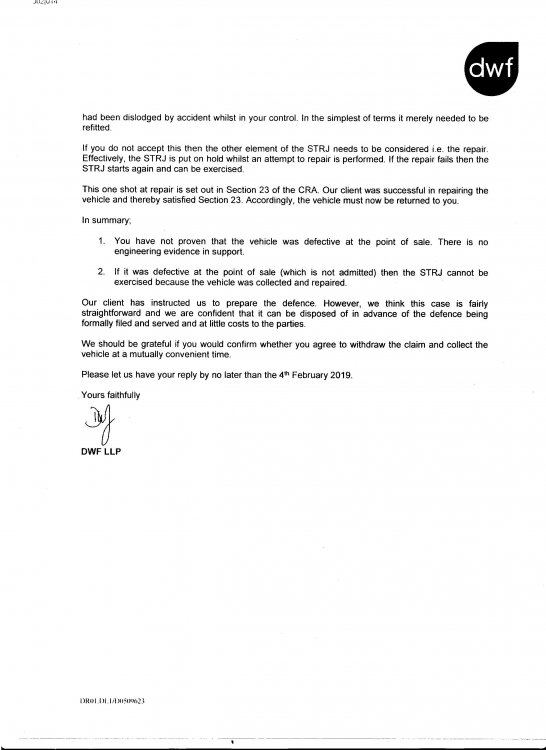

Good evening We would appreciate your advice please. A friend bought a second hand car from a dealer and as she drove it away, she noticed a smell of burning but initially dismissed it because it was apparent that the car had been valeted inside and out and she believed it to be the heated seats drying or the engine maybe drying off from a clean. Over the next few days, the smell remained and the lights, heated seats, rear wiper and other electrical things started to fail. She contacted the dealer who requested she fetch it back but as the issues deemed the car unfit for the road and potentially dangerous to her kids; she requested he collect it. He recovered the vehicle and later advised her that it was due to an electrical plug being 'kicked off' under the glove box and blamed my friend for this and then attempted to charge her for the recovery plus the repair. Having sort some advice; she advised him that under the Short Term Right to Reject under the Consumer Rights Act; she wanted her money back as she had lost faith in him and the vehicle but he has declined and has only offered to pay the recovery as he believes this is all her fault! To date she has advised the DVLA that the vehicle is not hers and the garage (as far as we are aware) still have the vehicle. She bit the bullet and has commenced small claims proceedings to which he is trying to go for mediation because it's free (which we don't believe it is) and she has now received a letter from his solicitor which appears to be designed to scare her. I attach a copy and would respectfully ask for your comments please. Many thanks Lambo

-

Help needed on lowells fastrack 14th sept '18. lowells are chasing me for £15,500 for a non secured lloyds loan. i defended a lowell ccj in northampton ccbc via mcol and aos, i have received notice of assignment but not deed of assignment, lowell are going for the jugular and i have had enough, not just of lowell but the depression i am suffering is stopping everything but work and worry. I have redacted copies that will give details of everything and my poorly advised (i think but not sure) fast track response denying debt which I'll upload either in pdf or jpeg format as needed and an other info prior to the upcoming case. needing best advice available on cag in the final stages please. jazz.

- 11 replies

-

Sent my appeal off with some brief details of why i was appealing , Had a Letter from DWP confirming that they received my appeal, and about how much ESA i will get until it's heard, But so far over 1mth since requesting the full written statement of the Atos wca Form IB /ESA85, But so far i have not been sent it, The person that i recently spoke with from DWP ,Confirmed that they could see that i had previously requested it, but could not understand why i had not yet received it, What can be done to force them to supply this info,(assuming it actually exists) ?

- 389 replies

-

- abolition

- account

-

(and 80 more)

Tagged with:

- abolition

- account

- against

- answer

- appeal

- appeals

- asked

- atos

- been

- call

- center

- chda

- claimants

- cofirmation

- complete

- current

- diaries

- discriminate

- dla

- does

- doom

- duplicate

- dwp

- esa

- esa50

- ever

- evidence

- fast

- few

- gave

- has

- hasn

- hmtcs

- hold

- ineptness

- information

- issue

- jsa

- know

- legistlation

- mandatory

- maximus

- med

- mislaeding

- pip

- plan

- points

- possibilty

- programe

- questions

- recent

- recieved

- reconsideration

- record

- regarding

- regs

- report

- request

- results

- rules

- say

- scale

- scored

- sending

- some

- sor

- stictched

- stopped

- template

- them

- thinking

- tracked

- transferring

- tribunal

- tribunals

- tribuneral

- virtual

- visit

- wca

- wrag

- written

- zero

-

Hi all Firstly I'm going to apologise for not making a proper introduction post, however I will eventually get around to it. I was just wondering if anybody can clarify if Fast Track collection orders (where payment is made online before visiting the store) are covered by the Consumer Contracts regulations (formerly distance selling regulations)?

-

- collection

- dsr

-

(and 2 more)

Tagged with:

-

We have received a N149B (notice of proposed allocation to the Fast Track) from the county court business centre with a questionnaire attached to complete and return. We must reply by the 27th April, the debt is for a Sandander Loan taken out in Oct 2006, but we have received a Claim from Hoist Portfoilio Holding (Solicitor Howard, Cohen and Co). I replied to the Claim on moneyclaim, and also wrote to Howard Cohen with the Status Barred letter. How to I need to act as regards to the N149B??? I am completely in the dark now Thank you Molley

- 51 replies

-

- allocation

- fast

-

(and 6 more)

Tagged with:

-

MKDP Barclaycard debt - used CCA £1 for payment?Pulling a Fast One......

Guest posted a topic in Barclaycard

Hello.... I think I''m being duped and am hoping you can advise on the following please....... Back on March 26th last year I CCAd MKDP regarding an outstanding debt on my credit file... Since then they have regularly written to say that they don't have the information and are liaising with the original creditor... Today I received a letter headed "Statement in relation to the below agreement governed by the consumer credit act 1974". It lays out details of the debt under query with the addition of a transaction made on the 28/2/2014 of £1 - plus another transaction on 2/4/2014 entitled "miscellaneous charge" of £1. That £1 can only be the fee related to the CCA letter. Are they effectively trying to prove a tacit agreement and re-activate the account - if so what steps should I take next? My initial reaction was to send a letter pointing out their "mistake" but then decided to council your opinion first. I've attached their letter and my CCA letter to make things a bit clearer... - which appear to have dropped off so added in later post... Kind regards and thanks - Andy -

Hi Please help OPOS are threatening me for a debt I had with access fast money. I borrowed 175 from access fast money 18 months ago with a total amount payable of 227.50.. I have made payments of 55 pounds to them via step change. I have sent several email letters of complaint to access fast money but they just ignore etc. they have now sent a final demand for 448 pounds. I have also told them to stop harassing me. They want 488 pounds off me. The original debt access fast money and Opos aren't on any of my credit files at all. I sent a cca and got an unsigned copy of an electronic agreement. What do I do now thanks

-

Well today my new JC adviser had a bad start. Just completing rapid reclaim. During the Claiment Commitment session she tried to force me onto UJM and giving her access using the line "Everybody will have to log their activities on this as we are doing away with the paper sheets" After holding my ground and telling her under no uncertain terms is that correct I demanded she produce the legislation and guidance saying everyone had to use UJM and give access. Then She went to her manager and then came back 5 minutes later saying that they will have to check the guidance and legislation. She said her manager said it was available to vie won the government website. I replied with "I know, Ive read it" I said I would make my own paper sheets to record activities in. Then was the same attempt with the workplan booklet that ended the same way. Just hope I pass this interview thing on Monday, I can see this being a running battle.

-

Hi 18 months ago I borrowed £200 from Getapaydayloanfast (ONESYS), but before I could repay it, I took advice from a Debt Management Company and decided to enter into a DMP. I had about £20K of debt and told ONESYS my position immediately. I set up the plan and all creditors accepted it, apart from ONESYS. They took my payments from the DMP and continued to add interest and charges, until the outstanding amount reached well over £2000! They took me to court, stating that they had email, called and written to me (a lie as they had only emailed me) and that they had received no payments. I contested it, and showed the payments from the DMP and stated that the charges were excessive, but the court naturally sided with ONESYS. They are now looking to get a judgement (no doubt so they can sell on the debt) and I have offered a one off payment of £250 or £20 pm. They did not accept this and want either £650 or £100pm for 28 months! Remember I only borrowed £200. I cannot afford this but do not want a CCJ, can anyone help? I don't know how people work for companies like this, or how we allow them to act this way with the protection of the law! I hope someone can help. Charlie

-

Hi i wonder if you wonderful people would be able to help, my legal knowledge does not stretch this far. Last year we were sued by a customer in the small claims court which we lost.We had a date with which we were supposed to pay the claimant but he avoided our payment. I informed the court on every level and wrote and called them several times to inform them we had tried to pay. Eventually it went back to court and the judge said we had to pay within 7 days, we were given bank details and paid the amount. In the original case the judge said that when payment was made we were allowed to recover our property.(this was why the claimant delayed us paying). The claimant informed the judge that he had disposed of our property and the judge said we would have to take him back to court to recover the costs of the property. This being less than 5000 pounds. I applied to the small claims court and filed the relevant documentation. I asked for the case to be heard in the small claims court where the costs are smaller and the original case was heard, but they have allocated it to fast track and the costs are so much more. Sorry to beat around the bush, but i was wondering if any one new how i can change from fast track to small claims. Many thanks for any help

- 3 replies

-

- allocation

- case

-

(and 3 more)

Tagged with:

-

Well recently posted to seek support for an SD served by BW Legal for a large debt and followed all the advice on here and then today another debt letter arrived, this time from Hamptons for an old bank overdraft of circa £1300. The letter threatens CCJ or SD. Phoned Hamptons today to ask what the debt related to ( I know I shouldn't have phoned them, but was a bit annoyed). I challenged the need for them to ask me my DOB for data protection purposes.... Anyway, Is there anything I can do with this overdraft in terms of challenging the amount or do I bite the bullet? Any help would be appreciated.

-

hi i am with barclays bank, need to know how to freeze interest, stop cpa and setup repayment plan with wonga(have read and researched but still dont understand template letters etc.. or where they are or where to send them), beggining to spiral out of control now, have a letter that benefits stop as i am single dad in 2 days because my boy turns 5 will only have tax credits to live on which gets paid into same account

-

I had appeared in court today and lost a fast track claim, unfortunately for whatever reason a costs order was party granted to the other side. The costs order is for £13,500 - as I was leaving the court I was approached by the other sides council and was told that they will enforce it and take it all the way to bankruptcy. In terms of background I only have two assets, my home and my car, nothing else and I don't have any money to pay the claim whatsoever as I haven't paid any court fees either. I just wanted to find out what I could do? Any suggestions?

-

- action

- bankruptcy

-

(and 3 more)

Tagged with:

-

Not sure if this is the right forum for this but they were offering a Payday Loan so I have put it here. Got a phone call from an unknown number on my mobile today, a foreign gentlemen telling me he was phoning from Fast Cash about the £2000 loan I had applied and been approved for. I had done no such thing. He knew my name and that I lived in Glasgow. When I said I hadn't applied for a loan and didn't want it, he started to tell me that because I now wanted to cancel the application I had to pay £50. At this point I asked him why I could hear cars beeping their horns and zooming by in the background. He ignored me and said I had to go buy a UKash voucher for £50 and give him the voucher number so that he could cancel the agreement. Knowing it was now certainly a [problem], I told him I had won the lottery and was going to buy his company so I could fire him. His reply "I know your bank details Mr Millionaire and I am going to take as much money as I want you f****r" I am posting this just to let people know not to give ANY details to these people - he was trying to find out if I was single/married and what my occupation was. He informed me before hanging up that I will get a phone call every day until I pay up - to which I replied cheerily "Oh good, I like getting calls, speak tomorrow, mwah!" I have searched this so called company online and have read some stories of people being duped into paying hundreds to receive a guaranteed loan and never ever getting it - and as they insist on UKash vouchers there is not much can be done. Be careful folks!

-

Hi, Me n mi girl move in last year! she purchased a house, we went on hols, and then move in when we got back. Straight away we informed the council, of dates etc, and they gave us a discount while we was on holiday, Great. We move in, realised she can not cook - (but that a new thread), and every thing else ok. Paid all bill etc on time. One year on-- Today received a letter from council they done a land registry search, Is this legal?. And decided to charge council tax for week we was on holiday! We did not ask for a discount - they just gave. And now they want the money, are they at fault and should they forfeit the bill? And is it legal?

-

I am writing in the hope that someone else has experienced this and may be able to clarify things for me. I can't seem to find any information about this anywhere. I have taken out 5 loans in total with Next credit. I can't remember the exact application process I went through with the first loan but all other 4 loans were applied for using their "fast-track SMS service" where you text the word LOAN followed by your surname to a certain number. You then get a reply asking you to send another text containing the word LOAN followed by the amount you want (100, 200, 300 or 400). Then you get another text about 5 minutes later saying that the money had been transferred meaning the loan is active. Now the last loan I took out is in default and has escalated from the original £400 to £1374 within about 6 weeks (a complete joke I know). I have CCA'd them and they have responded with something that vaguely resembles a credit agreement. Along with the document they wrote that: "You should note that you have demonstrated acceptance of the published terms and conditions by virtue of the compliant digital signature (double email) inherent in the audited application process (as per the 2006 European Commission Electronic Signatures Directive)." The thing is I never entered my email twice anywhere during any part of the application process (for this loan). I just sent the 2 text messages as described above. Do they mean the possible double signature I gave them for my first loan? Surely they have to get a new double signature for every new loan that's taken out, correct? I'm in no way trying to get out of paying them back but I want the upper hand when I negotiate what I am prepared to pay them back (certainly not £1374!) This way I can say that, should this go to court, they don't have a leg to stand on without a properly executed credit agreement and that any offer I make them is is purely to close the account once and for all. Either that or we can slug this out in court (which I am getting more and more prepared to do). Of all 7 creditors I'm currently dealing with this lot are by FAR the most difficult to deal with. Sorry that this post is so long winded but I hope that someone else could make use of this information (should I get a response ) Thanks guys

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.