Showing results for tags 'dro'.

-

I forgot to notify them of change of address and stopped deferring so they're now chasing for the full amount of my 1998 loans. I've been a stay at home mum since 2013 so no income at all. They've passed it on to Link Financial which I'm assuming is their debt collection agency. They've said my last deferment ended 2014. Which might be right as I moved that year. They've also said I've breech the terms ie cannot defer anymore and loan won't end at 50 I can't declare bankruptcy or do an IVA. Unless I win the lottery there's no way I can pay this and don't want a ccj. What are my options if any? Thanks

-

Hi My husband has been advised by StepChange that a DRO would be suitable for him and they requested a copy of his credit file from Noddle. We didn't realise his mobile phone would be on the credit file but it makes perfect sense as he pays part airtime part device per month. The problem is because the device is on the credit file it bring his debt over £20,000 by £400. I spoke to the insolvency service today and asked what could be done about this and although they confirmed they could not object to myself or another family member making equal payments to his debts to bring it below the threshold they did not state whether the DRO may or may not be rejected. My husband and I are unsure what to do?

-

For years I have been struggling with debt but I got in contact with payplan and applied for a DRO. All the paperwork was set up with all my debts on. Council tax is with Marstons. I then received a letter from Rundles saying they were recovering council tax. I thought the council and changed agents and now everything was with Rundles. I informed payplan and they amended the paper work. I was just about to pay the £90 fee when last week while I was in bed asleep after a nightshift. An Enforcement guy...tapped on the front door and walked in scaring the life outta my partner who was in the living room. He demanded that I pay £420 or he would take my living room items away (tv dvd player units ect) Tried to explain that I was paying my DRO fee at end of week. He was having none of it. I was scared and shaken up...I did not receive notice that he was coming. I didn't have the cash and he was adamant he was not leaving till I paid £420 or take my goods. I made some calls and manged to get about a months wages from my boss.( Agreement from boss that I pay from my wages straightaway which means at the moment i don't have money coming in to live on) Anyway I paid him and got a receipt. He was now arranging a payment plan for the rest. I told him I couldn't afford anything but he was insistent...All I wanted to do was to get him outta my house so I agreed to 20 a week. He made me sign what I thought was the payment plan but in fact was a control of goods I later noticed after he left. He also left an envelope on table which had inside a notice of attendance letter dated that same day in pen with a stamped date of the warrant for the following day. I got back k in touch with payplan who advised me that now that I had signed a control of goods order the council tax can not be included in the DRO. I am mortified as council tax is the main debt. I am now ready to pay the fee but holding back as I don't know what to do or where I stand. Oh and to add it,2 days ago I've received a letter from Marstons warning of a notice of attendance... Now I thought everything was with Rundles. I have checked the reference numbers and it's all from different years. Confused and scared is not the word!!! I don't know what to do. I am finally facing my debts and this happens a week before my DRO is finalised

-

Hi, Just wondering if anyone has any advice or help. I completed a DRO that commenced on the 21st of April this year, all the details of the debt companies i owed were up to date and placed into the DRO, which was approved. Today, the 29th, i received a letter from a debt collector i have never heard of, telling me they have been passed one of the debts that went into my DRO. Surely they have bought a debt that doesn't exist now, as it went into the DRO, A friend told me to send them the DRO details and forget about it, as they can't do nothing about it now...

-

I've been a customer for a year with BrightHouse and pay around £70 a week which I could afford at time since my daughter has now decided not to carry on with college I'm not getting tax credits so my money has gone down to £110 per week which now means I can't pay what I was paying before to them . I'm not prepared to hand my stuff over as I've paid a lot on them and want to pay what I owe at a cheaper payment until paid off. I don't have thelr insurance or dlc just this 5 star thing which seems to cost you more for the product and takes longer to pay. Do you think if I went into store and offered to pay £40 per week Until My circumstances change this will be accepted. I just want some arrangement in place to what I can afford to pay . I'm absolutely dreading the harassment from them as others seem to get. I suffer seriously high blood pressure which I'm on medication for and just couldn't cope with it. Appreciate all the advice I can get before I go into store tomorrow, many thanks.

- 99 replies

-

- bayv

- brighthouse

-

(and 2 more)

Tagged with:

-

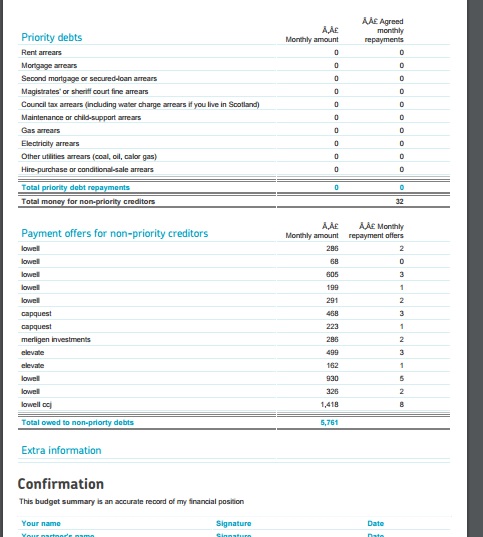

Hi i just filled in a budget assessment form on NDL website and i have uploaded them to here for advice on whether i should engage in applying for a DRO or go some down some other route? for the ccj i pay i agreed to pay £50 pcm via the court but now i am receiving weekly letters regarding other debts. seems like lowell have attempted to purchase my wallet!

-

Hey, I currently have a DRO in place. The conditions say that I have to notify any creditor that I have a DRO if it's for more than £500. My phone contract is coming to an end, and I want to upgrade my handset. I can either stay with my current provider, or go with another. But my question is - do I need to tell them about my DRO? Either if I stay with my current provider or move to a new one. I can get a phone for about £30 per month, on a 24 month contract. So that means I'd spend £720 over 2 years. Does this count as a £720 loan? I don't want to jeopardise my DRO, that's more important than a new handset. So just wanted to get some advice, thanks.

-

Good Afternoon I've had a very sketchy past involving a lot of borrowing and struggling to repay, was also suffering from depression at the time but have since overcome all of that and now the debt is catching up on me and I am starting to panic! I am currently unemployed as my recent employer has decided to sell his business! There are approx 7 - 8 debtors chasing me for debts between £170 - £950. One of those being at about £2500 (118118 money) that one is currently marked on my credit file as CCJ. I have had a visit from Fidelite Debt Collections so far, as well as various letters from other companies. I am currently living with my partner who lives with her parent. I have no assets apart from a finance car (which she is making payments for me at the moment due to me being laid off!) Bottom line is, what is the worst case scenario that can happen? I am living in someone else's house, nothing is mine apart from car. . so what will happen? As soon as I am back in employment I will start contacting them to start paying it off, but at the moment I am stuck. Thanks for help Karl

-

I have a letter from CSS.. They want money for DWP, not sure what it could be, I had a DRO that went through and i think it could be related to that? I know that it's best not to call them or speak on phone, what do I do now? Could they be potentially messing my credit score up (what's left of it)?? Thanks.

-

Hi, sorry if I've posted in the wrong place, but I checked my credit file on clearscore.com today - that tv advert with the girl shoving her smelly feet into the bloke's face on the laptop with the dog between his legs! Ha! I love that advert. I gave in and logged on - it showed I had a Debt Relief Order back in October 2011. Sure enough. But about 3 of the debts which were included in the DRO were showing as not being defaulted until late 2012. I was discharged from the DRO in October 2012, but these 3 debts will not clear my credit file until at least 2019 due to the way they registered the default. I'm confused. 2 Questions if I may please - 1. Does my DRO drop off my credit file from when it was granted, or when it was fulfilled. 2. Any debts included in my DRO, can a company individually default them AFTER they were originally included in said Debt Relief Order. I'd really appreciate some direction to legislation on this please. thanks.

-

Hi, I've recently had a debt relief order granted. However I have seen that creditors get 30 days to appeal the order, but they can only do it under certain grounds. What I'm worried about is one particularly spiteful ex landlord trying to pursue matters further. Is there anything at all that they can do now that I have a DRO in place? For example, can they drag me into court with an "order to obtain information"? Or am I completely protected from any court proceedings related to this debt? I don't think there will be a problem, but just wanted to double check. I know they use a law firm and there may be angles that I'm not aware of that could stop my DRO.

-

Hello there. I just received a letter from IND regarding a debt I had with Arrow Global from a few years ago and IND was involved as well. The debt was for 4900 pounds and was subject to a ccj. It was placed under a DRO in December 2013 and the debt was discharged in December 2014 when the DRO was over. Both IND and Arrow were informed of the DRO and were sent letters telling them to go away. I have not heard a thing from either since early 2014. Now all of a sudden I get a letter dated this week asking me for payment and that they will knock 488 pounds off as an incentive to pay up. The letter is photo copied and clearly not an original. I know that they have no leg to stand on if they attempt to pursue this further but should I write a rather unpolite (ish) letter or preferably an email to so I do not have waste money on postage to them or just ignore it as failed fishing expedition on their part.

-

Changes to Bankruptcy and DRO limits from 1st October 2015 https://www.gov.uk/government/news/improved-help-for-people-struggling-with-problem-debt

-

- bankruptcy

- changes

-

(and 3 more)

Tagged with:

-

we are in a real mess financial due to tax credits claiming about a repayment from 6 years ago , now i am having an attachment of earnings crippling my wages, looking at going down the dro route going to make an apointment to see my local cab but what happens to the payments being taken from my wages for previous council tax and also there is a suspended reposseion order on my rent arrers which we are paying back currently, how are these effected by a dro

-

- attachments

- dro

-

(and 1 more)

Tagged with:

-

Hello, Let me first explain the story, Couple of years ago I got myself in a bit of a pickle. Since then I was able to start and have completed a DRO with the TIS. I then contacted the TIS and asked for a letter showing all is done and completed. I then waited 4 months for system to be updated and applied for a fresh credit report. I then made a list of all my debts who hadn't updated their information and managed to find a clean up letter and sent it recorded to all my creditors that didnt update there systems. After a month or so i re checked everything and 8 of my creditors updated and removed everything off my report. The problem I have is only 1 has not done as requested, they have refused to update and remove anything and are currently still marking my report as Default even though that account was included in the DRO. So now i wish to tackle the issue yet again, I have seen been told that the account and debt in question is natwest bank and CMS is dealing with it. I have rang them up and told them all what has gone on and they said there is nothing they can do and i have risen a complaint. Where do i legally stand if all other creditors have removed the debt and have stopped marking me except this natwest. I mean the account is only a Current Account £917 and was opened 23/06/2008, date of default was 30/09/2010. My DRO finished on 7/6/2014.

-

I have a DRO dated 22nd July and will fall of my file this year. Should I be checking my file in August or September to see this change. Also should all the defaults as part of this DRO fall off at the same time, not all have the same date: 22/07/2009, 29/09/2009, 26/09/2009, 01/01/10 Should I be contacting companies now to get them to correct the date or just leave if as they will fall of this year anyways.

-

Hi. I am currently going through with a DRO (debt relief order) and it's taking longer than I would wish, plus the guy from Citz Advice is not really helping at all. I get back tonight and 2 letters. One is from Collectica, saying I now owe them £215, £140 of the remainder of the fine and £75 for their BS fees. I have been paying this weekly, missed a week here and there but generally up to date, it was for a motor fine with courts. This is not in the DRO as fines can not go in dro. However the 2nd letter is off CCS Collect. Saying I owe upto £300 for variou HMRC stuff. This fine is in DRO. They have 'threatened' with action if I do not pay them etc. They say 'our clent hmrc has authed us to recover full amount due. we regret that if no payment in 7 days or an offer to pay etc we will advice cliebnt to litigate amount due with court costs and court fees. This is in the DRO so what's going on? Can anyone shed light on these 2? I have been working in the library on new business ideas all day and the last thing I want to come home to is this ****!

-

hi there im asking this for a friend whos in a sticky situation. Wanting to do a debt relief order but has a car to her name. it is this pictured. After some research i no cars have to be under £1000 but 1 valuation comes way over for her. what should she do? thanks a lot. [ATTACH=CONFIG]55697[/ATTACH]

-

I got a DRO in December last year so of course not been making payments to creditors. One of the creditors was Arrow global for a ccj. Today I received a letter from the local county court saying there has been a variation made on January 23 and I am ordered to make a payment of 1 quid a month which was the original agreement prior to the DRO and I did make the two payments I was supposed to prior to the DRO coming into effect. The court document says nothing about the DRO. Just that I am to pay 1 pound a month or else deal with bailiffs. Obviously I have to make some phone calls to the court and the official receiver but I was wondering if anyone had any advice so that I am forearmed! Arrow is aware of the DRO so if they have lied to the court and are attempting preferential treatment can I use this against them in any way? One would think that if the DRO was involved it would be mentioned in the court order would it not?

-

Hello there. I have just been granted a DRO on december 12th. So breathing a sigh of relief on alot of fronts. However I do have a concern that I need to find out about and hoping someone on here can answer! One of my debts included in the DRO is with barclaycard for 2k. I have two bank accounts with barclays..a basic one and a current account with 100 quid overdraft. Will barclays freeze/close my bank accounts? I am in no debt at all with my bank accounts so see no reason why they would but I have read elsewhere they might as they are all under the barclays umbrella. Its a big concern as my disability pension and housing benefit go into my current account and cannot afford for that to be frozen.

-

Hi guys, I've just made the first steps to fixing my financial mess and am arranging a DRO. However, I need to arrange statements of each debt with account numbers and total amounts owing. Now after spending a while being chased by the delightful folks at companies like MMF, Red Castle, Fredricksons and Lowell, I previously changed my mobile number and requested that the ones I've been in contact with only contact me by email. However, now I need these statements I'm going to have to go to them, but I don't want to give these people my current address (and the endless stream of threatening junk mail to begin again) so my question is: Would emailed statements be acceptable as evidence in a debt relief order application? Thanks for any and all advice!

-

What happens if my circumstances improve, will my DRO get revoked or will I have to make payments to my creditors? can someone tell me what will happen?

- 4 replies

-

- circumstances

- dro

-

(and 2 more)

Tagged with:

-

Hello, Just a quick question, can a loan taken out with Mobile Money be included in an IVA or Debt relief order? Thanks.

-

Hi, Looking for a bit of advice and possibly an explanation .... So ... on 22 :|November 2010 I was granted a Debt Relief Order with a moratorium period of one year during which all listed accounts would be frozen and then at the end of this period they would be wiped/settled. Lloyds TSB were listed on this DRO (2 accounts). I have since discovered, after looking at my credit report, that these two accounts (and it is only these two Lloyds accounts) are still listed as 'open' and 'defaulting' - although I have not had any contact with them since the DRO was put into place. Even weirder is the fact that when I looked into these accounts a little deeper it turns out that they both have a 'date of default' of 10/01/2012 and that one of the accounts accrued around £200 of interest/charges during the DRO moratorium period and during the middle of this same period the balance dropped by nearly £1000 for one month and then went back up again. The last three months of this year it appears to have dropped by £15 !!!??? .... all of this is just strange but ultimately these accounts should not be listed as open anyway!! I did inform the credit agencies who advised me to contact Lloyds. I have been in touch with Lloyds to no great avail. Can anyone shed any light on this and advise me the best path to take? Regards

-

Been advised by Stepchange to apply for a DRO over 2 credit card debts and an old utility company gas bill all of which I am unable to pay and in the case of the credit card debts have been trying to for last few years. My advisor at Stepchange advised me not to let my creditors know i'm applying for the DRO. I'm in the process of paying, by instalments, the £90 fee and this should be paid in full within the next 6 weeks. Been receiving threatening letters from EDF Energy over the gas bill to be included on DRO which is just under £61. Threats of referral to debt collection agency and court action with the prospect of added costs. Would really appreciate some advice as I can't stop worrying.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.