Showing results for tags 'creditcorp'.

-

HI all, I'm new to the forum and have been doing some reading around this. I'm a dual citizen who returned to the UK in 2016, originally I kept up with payments but then found myself unable to do so. I have recently received an email from Credit Corp demanding payment for a debt or nearly $9k which they are offering to accept $8k for if I pay in the next 7 days etc etc... They have phoned an old contact in Australia who I haven't seen since 2010, my guess is they googled her after she left a comment on my facebook profile pic - all my FB settings are private except the profile pic which you can't do anything about. They have phoned my work a few times, I guess they googled me and found my work info as I'm on the work website, but of course they can't be 100% sure it's me...my colleague said I didn't work there and then I spoke to them and said they had the wrong person of that name, I had never lived in Aus. I guess they will keep on calling! I don't have the means to pay this debt - if I could, I would do so now!! How should I respond to the email? From looking on the forum I have some ideas around privacy. We have a house with a mortgage here but with a little equity in it. There are no other assets apart from my car. I'd really appreciate some help as this is very scary and I don't want to make the wrong response at this point. Thank you in advance.

-

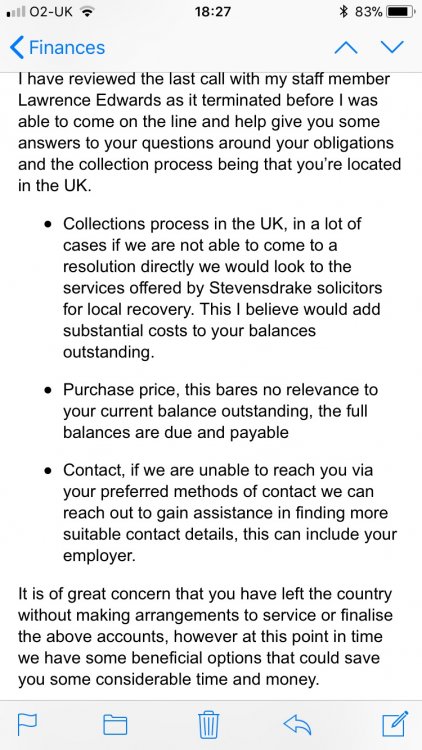

Hi everyone, I received a phonecall out of the blue at work last week regarding an ‘important business matter’. He said they had been sending emails with no response, and sending by post to Victoria with no response. I told him I hadn’t received any emails or the mail, which is true. He asked for my uk email address , I told him to send an email to the one he has on record. I told him not to contact me at work twice and gave him my mobile number instead. 31.01.18 - They rang my mobile, asked to confirm full name DOB and address, I said no due to data protection/privacy. I denied owing anything, and asked how they were going to recover the money. He flustered & couldn’t answer. I said not to ring my employer as it will jeopardise my job as I’m currently on probation. I got the attached email back threatening Stevensdrake. I apparently owe $43k, they’ve reduced it to $37k if I settle in two weeks. I left Australia nearly two years ago. Please see attached email from CreditCorp... There are 3 credit card debts. I’ve received assignment letters for the two smaller debts via email after the phone call, but not the main CBA debt for $27k. I suppose I’m in for the long haul reading about this company & some of the posts on here, just wondering what my next move should be? I told them they could lose me my job if they persist contacting me at work, don’t they realise it’s counterproductive?!! I’m assuming they can’t enter a judgment in Oz while I’m not in Oz anymore, and if not, surely there’s nothing to enforce in the U.K.? Thank you so much for any advice you can provide xxx

- 5 replies

-

- creditcorp

- has

-

(and 2 more)

Tagged with:

-

Hi everyone, I'm new here and have read threads about Austrlalian credit card debt etc but cant see any current ones open. I am being pursued by Stevensdrake. They were acting for credit corp. I left Western Australia in March 2009. My husband & I parted and he went to live in Asia. Our farm was sold last year and everything was paid off apart from my credit cards. The main one was with the National Australia bank with whom we had all our borrowings. I don't now why mine wasn't included as my husbands was settled from proceeds of the sale. I am guessing mine wasn't secured by the property. Credit corp wrote to me, I ignored it.Then I got a letter from Stevensdrake. I got advice from Citizens advice who advised me that they didn't think they would pursue it as it would be costly for them. The next thing was a court summons on 30th October last year. I asked for the original agreements which I received just before xmas and the terms and conditions of the agreements. I have spoken to two solicitors here but neither of them could help. Can anyone advise me as to the best course of action? I don't want a CCJ against me but I can't afford to pay either. I could offer a small amount to settle but the debt has increased so much from the original amount that there's no way I can pay the whole lot. Please, can anyone help!

- 194 replies

-

- australian

- creditcard

-

(and 2 more)

Tagged with:

-

G'day Guy's, I hope you all can help. It seems the Barcleyshark has sold a load of old debts to a company here in Australia. They are utilising unlawful methods to try and collect on these debts by relisting them an our australian credit files. We utilised a couple of forums including expat and an aussie lawyers site, and recieved some great advice. Unfortunately this company has threatened these sites with libel or such and therefore they have removed the threads and banned most of the posters for naming and shaming the company involved. I was hoping you may be able to host a thread for us as this possible affects a hell of a lot of expats over here who face the same crappy debt collection practices as you are facing in UK. While I appreciate the difficulties in providing advice it is my understanding that the terms and conditions of the original contracts, (or lack of them) have to be abided by in any assignment of debt. You cannot change those terms just by buying them. I suppose we are looking for some advice on the paperwork Barclays send as we have all CCA'd, SAR'd etc them etc and would like to know if they are enforceable agreements etc. I haven't named this company yet, would like your sites approval first, but people need to be aware of what laws they are breaking here over and the better understanding of the UK laws. I have received a lot of info from a great poster on expat, and have used the information you guy's have posted to great effect so far. Any help you would be able to provide would be much appreciated. Regards Bodgit PS: I've read here that you guy's love a challenge

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.