Showing results for tags 'country'.

-

Now the UK has decided to leave the EU, what is the time scale to activate article 50 of the Lisbon treaty ?..

-

A man goes into a bar and says can I have an orange juice and lemonade please? The waiter says – no, we don't do that. The man says do you sell orange juice? Yes. Do you sell lemonade? Yes. Then simply take a glass and put in some orange juice and some lemonade. I'm sorry we can't do that. Then bring me a glass of lemonade and a glass of orange juice and I'll mix them myself. Yes Sir. Which country are we in?

-

'LET DOWN BY MY COUNTRY' Hero war vet, 50, who was Prince Charles and Diana’s driver left homeless sleeping in bushes and feeding off scraps READ MORE HERE: https://www.thesun.co.uk/news/5551197/hero-war-vet-50-who-was-prince-charles-and-dianas-driver-left-homeless-sleeping-in-bushes-and-feeding-off-scraps/

-

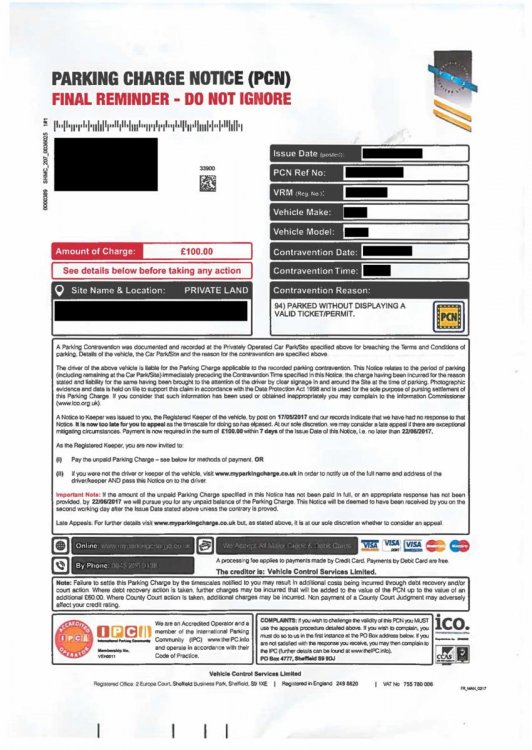

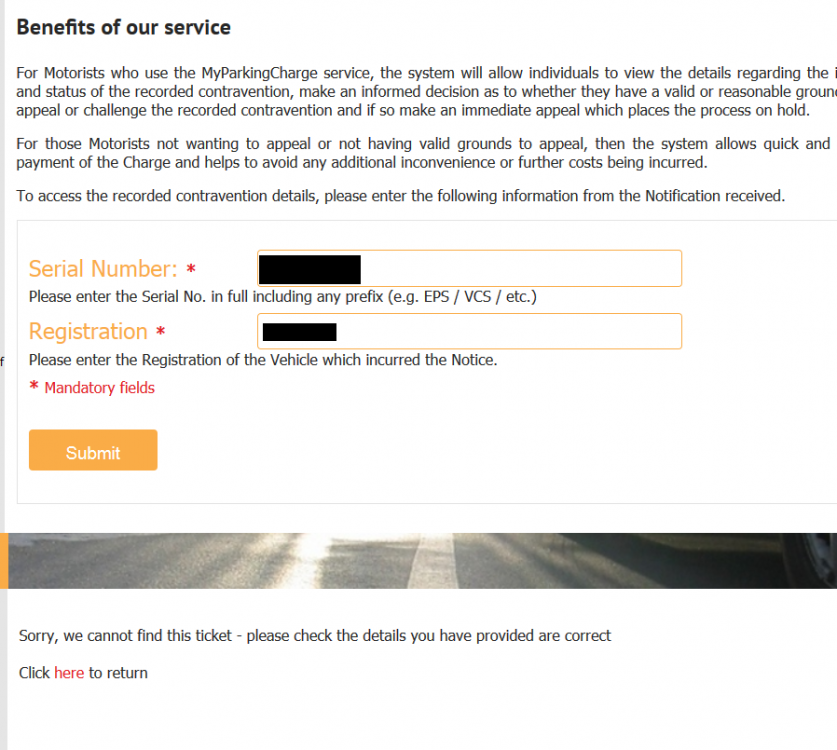

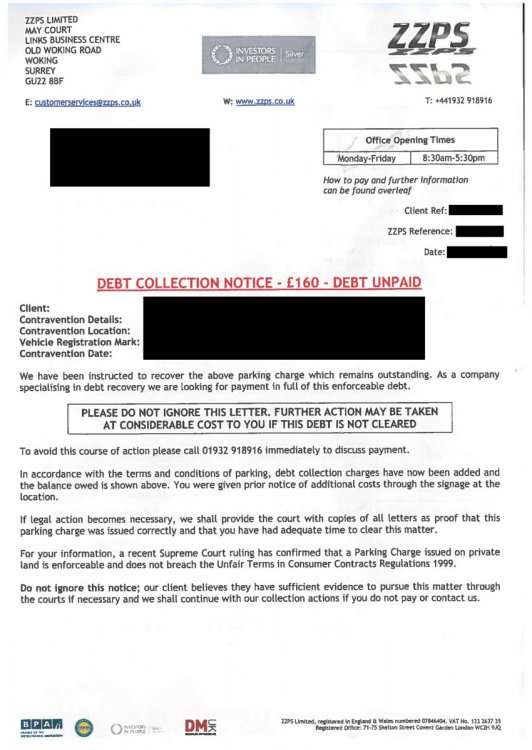

Hi all, First time here so please let me know if anything in this post should be changed. Backstory: I was in Bulgaria on business in June/July and had no knowledge of my PCN before leaving (turns out my mate moved my car out of his drive into the parking area for a couple hours where I received this PCN). Upon arriving home I find two letters, one being a final reminder sent mid June by VCS and then a debt collection notice sent by ZZPS in mid July. As I was out of the country and couldn't access my mail, I had no idea any of this was happening in my absence and had no chance to appeal the ticket in the allotted 28 days. The ticket was for £100, to be reduced to £60 if paid within two weeks and is now at £160 due to the debt collection agency add on. I haven't received any other letters regarding this claim. What I've tried: I have tried to go through the various appeals process, but when searching my ticket ref on the provided websites (namely myparkingcharge.co.uk as noted at the bottom of the VCS letter and the IPC website itself) it comes back with nothing, meaning that I couldn't have appealed it regardless. I even tried POPLA, and they can't find the ticket either. After contacting an ombudsman, they suggested to complain through the companies. VCS said that it was to go through ZZPS as they now were in charge of the debt , ZZPS replied as follows: "We must inform you that you have now passed the time frame in which an appeal can be made as appeals can only be made within 28 days of the Parking Charge Notice being issued, our client maintains that all correspondence received has been actioned accordingly and that the correct procedure has been followed. The balance of £160.00 remains payable on our systems, please refer to the back of our letter for the payment options available to you. In the absence of payment this matter will be referred to solicitors to resolve and further fees may be incurred." What do I do? If none of the appeals agencies even agree that the reference number matches any ticket, has a ticket even been issued against me? The collectors are refusing to provide evidence. I am not exactly inclined to pay this "debt" until the relevant parties prove their claim. Any advice would be appreciated as I feel like I'm about to get strong armed out of £160 Attached are the letters received, along with the website response when I search the reference. Personal info along with refs blacked out for obvious reasons.

- 10 replies

-

- collectors

- come

- (and 10 more)

-

http://www.lep.co.uk/news/health/nhs-computers-down-after-virus-patients-told-to-avoid-hospital-and-walk-in-centre-unless-absolutely-necessary-1-8540798 Just spoke with someone at our local hospital and servers ate all being shut down - confirmed

-

Good evening everyone, I have a CCJ for a debt that has a default date of Sept 2011. The CCJ date is March 2015. I understand that the CCJ will remain on file for 6 years. However, make yourself comfortable, I was out of the country when the CCJ was issued. I have rarely worked in the UK for the last 10+ years and when I don't work I travel/survive. I can clearly show that for several months before and after the CCJ date I was not in the UK. Based on this I want to have the judgement set aside. If I wait a month and if this is successful, will the debt be too old and drop off my file? I have had other debts removed from my file as I had no contact with them for over 6 years. Honestly, I'm a little giddy, I can't believe it. Post was with binned or not at the place I stayed. I would stay in the UK for a few days before leaving again. So there are two outcomes? If the court upholds the judgement I have to pay the debt. If the court sets the judgement aside will the limit have passed and the debt removed from my file? Your thoughts and advice please warmly appreciated. B

-

Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue: 29 Feb 2016 defence due by 4pm 1st april What is the claim for – 1.The claim is for the sum of £11,028 in respect of monies owed under an agreement with the account no. 4929… (16 digit ref) pursuant to the Consumer Credit Act 1974 (CCA). The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 2.The defendant has failed to make contractual payments under the terms of the agreement. A default notice has been served upon the defendant pursuant to s.87(1) CCA. 3.The claimant claims. 1. The sum of £11028. 2. Interest pursuant to s69 of the country court act 1984 at a rate of 8 percent from the 29/07/2010 to the date hereof 2035 is the sum of £ 4919 - [How can they make a claim to 2035?] 3. Future interest accruing at the daily rate of £2.42 4. Costs What is the value of the claim? £16,765 Is the claim for a current account?: Barclays Credit Card When did you enter into the original agreement: 25th April 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. HPH2 Did you receive a Notice of Assignment? Yes, from Hoist Portfolio 2 Limited, stating MKDP LLP has assigned rights to them on 01 Oct 2015 and HPH2 appointing Robinson Way Limited to manage the account. Did you receive a Default Notice from the original creditor? No, not heard from them since Feb 2012, they did write in 2011 assigning MKDP LLP Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Business went bust, leaving me with £70k worth of personal card, loan and HMRC debt, I’ve never recovered from it, finished therapy less than a year ago, I’d struggle to pay them all £50 a month combined at the moment. What was the date of your last payment? Nov 2009 – Account defaulted 29 July 2010 Was there a dispute with the original creditor that remains unresolved? I paid Moment Networks £5k to handle all debts, as advised by the administrator of the business (who was wound up themselves) and Moment was wound up as well, turns out it was a con and this company also went bust. Barclays don’t recognise them and this left all the debts with me and a lot of grief from the business side as well. Did you communicate any financial problems to the original creditor and make any attempt to enter into debt management? I never made a plan with Barclays, I communicated that Momentum Networks was taking over the account, but obviously that fell through, I then disputed ownership. All my debts are in the sixth year, is it correct they're removed from my credit file as well? Obviously getting a county court judgement now would not be helpful either. Looking for a way to defend myself and to progress, would love to finally clear my name up. Today I received the following claim, I'm looking for guidance on how to move forward. I had 8 debts,, some of which are now settled (not by me), three remain and this is one of them.

- 349 replies

-

- barclaycard

- country

-

(and 4 more)

Tagged with:

-

I have read the thread Received-a-Court-Claim-From-A-Private-parking-Speculative-invoice-How-To-Deal-With-It-HERE***Updated-Aug-2016 am keen to use the template there as my defence, however my situation is "interesting" so would be keen to hear what you all think I can do/change in that defence template to adjust it to my situation: I received a claim via post from County Court Business Center, whereby Parkingeye are claiming £175 against me for overstaying in a services center (South Mimms). Claim date 10 Oct 2016 and I replied with Admission on 13th Oct. How it all started: I went to meet up with people I had never met before to go off road motorcycling. I drove my vehicle and trailer from where I live in Aldershot to the meeting point in the South Mimms services area. At no point did I notice signs about having to pay for parking inside the shops after 2 hours of free parking as I never went near the shops. I guess I was focused on where to go, where the people I was meeting were and where I could park the car out of the way. In any case, I met them, got all geared up and left, expecting to be gone only a couple of hours. I returned after almost 8 hours due to various reasons. Mainly that I ran out of fuel on my offroad bike, so had to push and splutter it to get back to the South Mimms services. Saying this, it would've only added maybe 2 hours at most to my returning time, so I would've clearly still been gone for 6 hours. However I did not know how long we were going to be gone in the first place. When I eventually got the bike back to the car, I packed up and left. Again, never having come close to the shops. A few weeks later I got a letter which looked well dodgy from a DCA. I looked online and everyone said don't pay them they are [removed]. I ignored that letter and maybe 2 or 3 more that came in the post. I then heard no more thinking good riddance. Now, a few months later, I got this court claim and have to go to court to pay this fee. I have read up on this a bit and it seems to me that if I just admit guilt, I could get a CCJ regardless if I pay now or not. I've decided to defend against the full claim. Not sure this will make any difference as I guess I am pretty much guilty for not being more pro-active in looking for signage. On google maps you can see signs in various places. However at the time I didn't notice them as I wasn't focused on that at all. I've lived in the uk for 7 years now and in that entire time I've used services areas perhaps 5 or 6 times. I never knew that there would even be parking fees as I've never seen machines dotted around like you get in council parkings. Again I guess this was a bad assumption on my part. Now I've gone into moneyclaim.gov.uk and completed the Acknowledgement of Service. However, I am unsure what to do next. I don't know if I should dispute the whole claim or part of the amount. Either way, I need to ask if any of you know how to proceed now, ie: Do I write a letter to parkingeye asking to pay a discounted fee, or do I just write up a defence and submit it via the website? I have bought the parking prankster's amazon book and tried to read as much of it as I can but it's very intimidating with information overload. I found the template he provides for a defence and thought I might start with that and try change it to cater for my situation but since your defence template on the thread I linked above seemed better, I thought I'd use that one instead. I'd like to attach a scan of the claim form but since my posts are less than 10, I am unable to. Any help would be welcome on how to proceed next

- 18 replies

-

other Parking Eye Court claim - help

blondshavemorefun posted a topic in Private Land Parking Enforcement

I am hoping someone can advise me on what to do next. I have read lots of posts on sites where they say ignore everything as these private companies have no legal right to fine you on private property etc etc but then I received a Court Summons. I parked and my husband paid for a ticket at 12.14pm (taking us to 14.14pm) in the old BlockBuster in Car Park in Darlington on the 4th July 2015. Husband returned to re-ticket the car but did not have the right money (only euros) and had left me with his wallet to pay restaurant bill. Returned to ticket machine where there was a massive queue (machine playing up with £1 coins) as car park was heavily in demand that day (the sun was actually out). Subsequently there was a 12/13 minute gap in the tickets. Second ticket took us from 14.27pm 15.27 and we actually were on camera leaving the car park at 15.02 meaning that every minute of our parking was actually paid for. I contacted ParkingEye as I had no idea there were cameras and explained the situation as I believed they just thought we had only purchased the first ticket. They came back to me and said I could either pay the £60 and not appeal to Popla or appeal and pay £100 if the appeal was lost. I thought I had such a good case that I downloaded the Popla form, filled it in and wrote and attached more info and uploaded it to their site. I had not heard anything back from anyone and thought that it must have been quashed until the 18th January 2016 when I received a Court Summons for £175. Astonished, I called Popla to see why they rejected my appeal but they could not find me on their system. They cannot use the fine ref etc and could only go on name and then car reg. After a while she asked me when it was sent in and I said around the 10th September 2015 to which she said that the administrators had changed since London Borough Council lost the contract and it was now the The Parking Ombudsman who dealt with it and the changeover date had been the 1st October 2015. She then said that they had had problems with the changeover, the systems were completely separate and that some people had fallen through the net as they could not see anything appeal from before that date. They then gave me the number of the old administrators and I called them - the lady was sick. I cannot believe that they only have one person who deals with this and I am expected to hope that my case is being dealt with fairly. I have contacted Popla (the Parking Ombudman) and they are going to ask ParkngEye if I can get another Popla Code but it seems to me that the general public are on a wing and a prayer. Does anyone have any advice - feel mugged!!!!!!!- 22 replies

-

- â£175

- blockbuster

-

(and 10 more)

Tagged with:

-

Dear All, i really would appreciate help and advice on how to deal with my situation. I visited a country on three occasions from last year to date. On each occasion i notified my bank the dates i was going to be away and the country to which i was visiting so that the Halifax knows exactly which country i would be visiting and how long i would be away. On each occasion of my travel i phoned and advised Halifax but more than that, i specifically asked them if it would be possible for me to use my debit card in that country. On each occasion, the Halifax said there was no problem and i could use my debit card there. On the last occasion i met with my account manager on 18 Nov and explained quite specifically that i shall be visiting this country and shall definitely be using my debit card there. he told me that there was absolutely no problem. Whilst i was away on 08 Dec. my account was closed by the Halifax I found this out by chance because someone gave me some money which my partner tried to pay into my account. She was unable to credit my account when she asked the bank, she was told that my account was closed down because i used my debit card in a sanctioned country. As soon as i learnt of this, i phoned Halifax and spoke with a manager there. I explained my situation and explained that i have to pay a hotel bill and i needed to use my debit card. I explained that i advised the Halifax etc. but the key thing was i needed to pay my hotel bill. The manager said he will see what he can do and will call me back. He never kept his promise. I had to settle the bill in cash which my relatives in the country lent me. Had i not been able to pay the hotel bill i would be in prison now. This country is pretty strict. I had banked with the Halifax for 20 years. I have not defaulted on my account. rarely do i go over my credit limit. i returned to UK over the weekend. i have no idea what to do. Will some one please advise me.? What can I do? How can i get my account re-instated? How do i claim compensation against the Halifax? this is rather urgent because, i now have no bank account. (I am trying to see if i can open an account with another bank) but these things take time. Already, my standing orders are effected. please advise me on what i can do thank you Wrecked.

-

Now that it look's clear that a conservative government is going to be running the UK, I am very concerned for my future. I cannot work and have been unable to for four years now, and housebound for much longer than that. What I would like to know is am I likely to be treated more fairly and be more welcome in an other EU country. Or any other country for that matter! I understand this is not the usual topic, but I'm just wondering if anyone knows about this. I don't have enough ties here to stop me moving, and I imagine everyone in my situation is just going to suffer here.

-

Hi , I have an unsecured credit cad debt with banks in south east Asia country two years ago. I moved to Scandinavian country and living here. I made last payment two years ago. For one and half year, I had no contacts with the bank as the bank did not know where am I? But due to social network the bank traced me out and in last November I received a call on my work place . Initially I could not understand the situation and made a payment plan with the bank on telephone for repayment of the deb. After that I received a letter through e-mail containing the payment plan which I did not reply and I have not made any payment yet. The debt amount with out any interest is 1896 GBP for credit card and 1896 GBP for ready credit. The bank has added about 1000 GBP interest to each account. I have done some research and came to know that the south east Asian country does not have any reciprocal agreement with the country where does I live now. But that country has agreement with UK. Here are my questions: 1)- What is the possibility that bank will chase the debt through international DCA? 2)- Is debt enforceable where I live as there is no reciprocal agreements between two countries? 3)- The south east asian country is not member of Hague convention but has agreement with UK. Can the bank come to Scandinavian country through UK? 4)-Why bank is still keeping the debt and has not sold my debt to DCA or has not taken tax relief? 5)- I understand that to chase a debt the bank must have a CCJ. Is it correct? Thank you in advance for kind replies.

-

Hi All, Just been recommended this site from a friend so I'm looking for some advice. We have moved from the UK to Australia and fell into some debt in the UK. Mainly credit cards which have all now been passed onto debt collectors (any advice on these is greatly appreciated, but the main thing we seek advice on is the mortgage) We are in £12000+ of arrears on the mortgage. We originally rented the property to some friends who basically left the property in a bad state, stole from us and owed rent. We have struggled to rent again and have now had an offer from a neighbour which will leave a shortfall on the mortgage of £5k. If we agree to sell at this price will the house be legally his? and will the bank chase us for the shortfall? We are up in court in on the 14th but obviously won't be attending due to the logistics and cost of getting there. We have a friend who is willing to attend court and explain our situation. Will the courts allow this? I look forward to everyones advice.

-

Does anyone else find this really annoying? Amazon adverts do not say on the main ad page where the goods are coming from and some advertisers even lie on their business info page where they are. LG Supply for example. Looks like a UK company with a UK address but goods come from China. You don't find out till the goods don't arrive promptly and you check the feedback and find someone else's goods came from China hence the long delay. I did complain about this to Amazon as this had happened before and they said 'check the business page for small print'. The despatch country should be clearly displayed on the original ad, not hidden away somewhere, and those sellers deliberately misleading buyers like the one above should be take to task. If ebay can do it why not Amazon, and what''s wrong with having a search option of 'UK ONLY'? Do you think that if enough of us demand at least despatch country on the main ad they will take any notice? I'm not that optimistic.

-

Received a PCN today which I would just ignore but it has something about Protection of Freedoms Act 2012 Schedule 4 stating that as I am the RK if I don't tell them who was driving I am liable. Is this correct or just another piece of law they are bending to suit their own end?

-

Hi all, I will soon be departing these shores and wanted some advice about some existing 'debts'. For some time now I have been requesting various bits of information from certain DCA's so I can verify the validity of the alleged debts but on each occasion what I have got is just rubbish. My concern is that I currently have a house under my name along with my parents (I dont live there nor do I pay the mortgage) and I wanted to know could these DCA's get any sort of court order to go to the house and start removing any goods? Everything in the house belongs to my parents with the exception of a bookcase and a few books which I purchased. I will be writing to all the DCA's to inform them that I will be leaving the country, should I tell them that any mail sent to me will be either binned or sent back to them? And also how do I make sure that they dont try anything sneaky while Im not here? I dont want anyone turning up at my parents house and scaring them into letting them in or making them sign/do anything. Perhaps I could remove their implied right of access to the property? Thanks in advance for any advice.

-

Just had a "Notice to Owner" from these clowns. I will generally speaking, ignore them but I want to put them on notice that I won't take any cr*p from them. I've therefore drafted this email. I would appreciate any comments, particularly whether the DPA Section 10 notice is relevant: Dear Sir I acknowledge receipt of your “Notice to Owner” reference TCX. I do not acknowledge any liability to company. Your document is no more than a speculative invoice. Despite your reference to a “writ” and a “summons”, your only means of enforcement is through the county court. To do this you would have to establish that there is a contract in existence, that I am the person that you have contracted with and that the “amount outstanding” is not a disproportionate penalty. I do not believe that you are able to satisfactorily establish any of these things. If you believe that you have a legally sound basis on which to proceed with this matter, then you are at liberty to commence proceedings in the county court. The address for the service of papers is **EDIT - PERSONAL ADDRESS ** I am aware, of course, of your company and how they generally deal with these matters. Rather than court proceedings I am expecting to receive an increasingly hysterical series of letters from you, debt collectors acting on your behalf and then solicitors before you give up. Please note the following: 1) I specifically deny you consent to process my personal data under Section 10 of the Data Protection Act (1998) or to pass my personal data to any third party. If you do so, I will make a complaint to the Information Commissioner and I reserve my legal rights in this matter. 2) I will not pay your invoice unless ordered to do so by a county court. In these circumstances, I regard any referral of this matter to a debt collection agency as harassment and I will deal with this accordingly by means of complaints to statutory and regulatory bodies and I reserve my legal rights in this matter. Please note that I will deal with this matter in writing only as I require a written record of any communications between us. Yours faithfully

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.