Showing results for tags 'correspondence'.

-

My partner has a CCJ against her which we found out about when applying for a mortgage recently. The CCJ was created by Vehicle Control Services Ltd. PCN at St Andrews Retail Park because she alledgedly parked incorrectly or for too long. We still don't know which. She changed address a month after the parking occurred in November 2014. She didn't receive a ticket at the time (in fact we think she was in her shop at the time of the 'incident' and not even in the St Andrews retail Car Park), she hasn't had any communication about being taken to court and she hasn't had any notification of losing the case either. We think all correspondence must have gone to her old address. The 'offence' occurred on a Monday at 4.19pm. Her shop is a mile away and doesn't close until at least 6pm. BW legal must have sent the forms to her old address and not bothered to check if the address was still valid even when they took her to court in September 2016. I'd be grateful to hear how to remove this CCJ without paying the £255 to contest it. Surely a person can't be issued with a CCJ without any written information whatsoever? That can't be legal can it? There was no parking ticket issued either.

-

An investigation has come to light into missing correspondence about patient care. https://www.theguardian.com/society/2017/feb/26/nhs-accused-of-covering-up-huge-data-loss-that-put-thousands-at-risk?utm_source=esp&utm_medium=Email&utm_campaign=GU+Today+main+NEW+H+categories&utm_term=215114&subid=7192694&CMP=EMCNEWEML6619I2 HB

- 2 replies

-

- correspondence

- deliver

- (and 7 more)

-

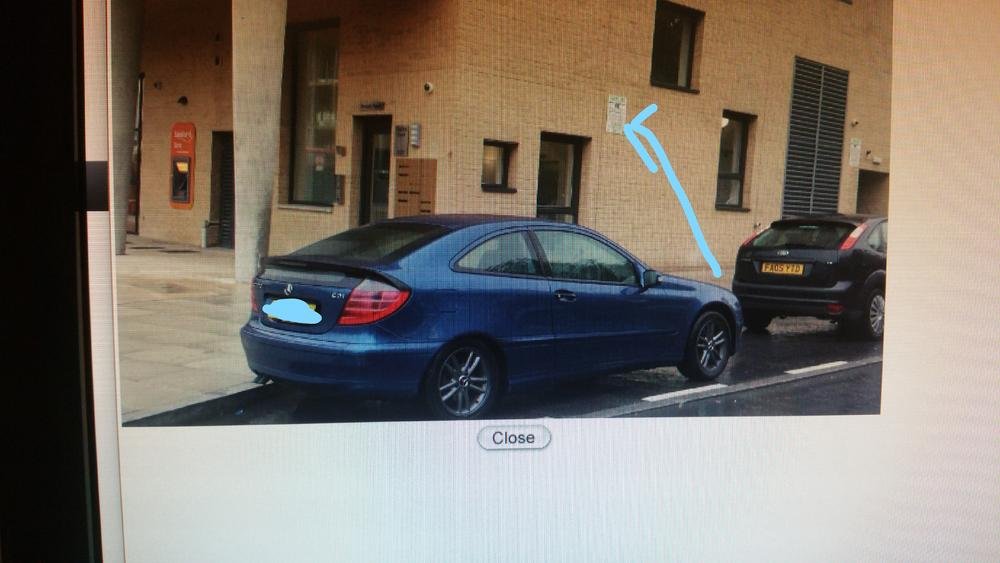

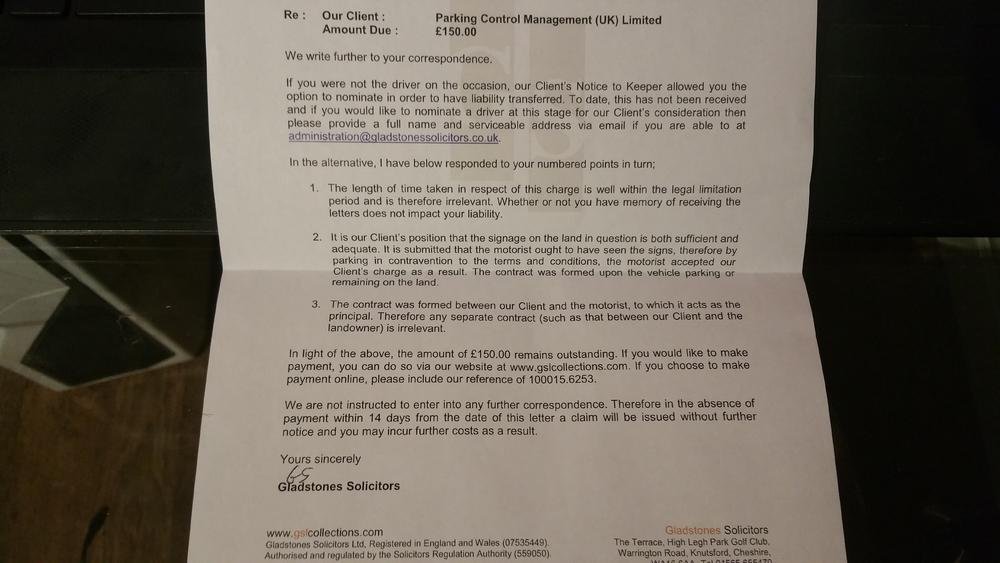

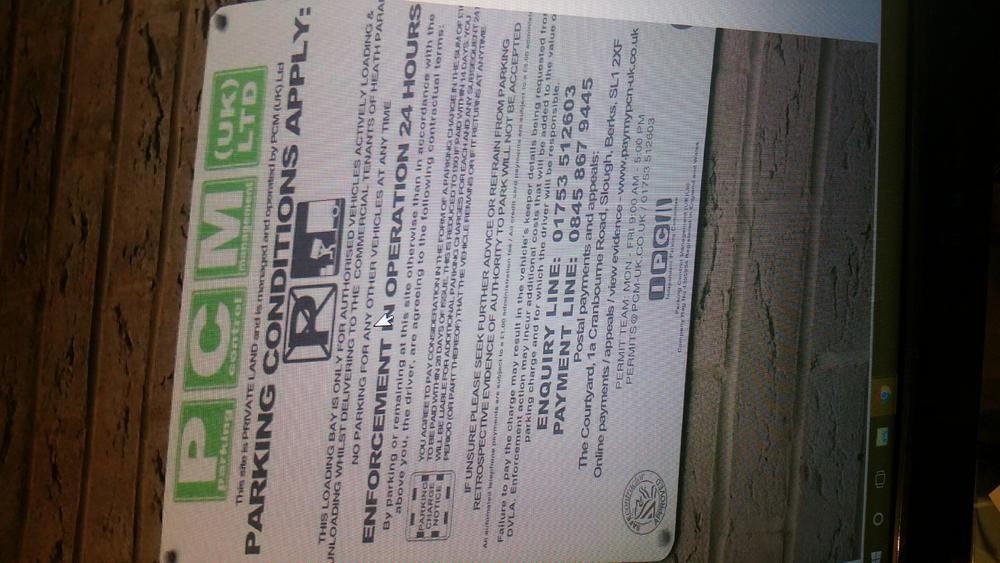

Hello everyone, thank you in advance for any help and guidance you can give, it is very much appreciated. Following receipt of a Letter before claim from Gladstones Solicitors I have responded to them disputing the claim, following a quick back and forth, I have received another letter from them stating that "they are not instructed to enter into any further correpondence...if payment is not made within 14 days - a claim will be issued without further notice" The initial parking charge notice was issued to me by post, although i have no recollection of receiving this as the alleged contravention was in September 2015, I then received the letter before claim in December 2016. 1) Details of the letter before claim are as follows: * Client - Parking Control Management (UK) Ltd. * Charge amount - £150 * Date of charge - 09/2015 * Location - Heath Parade NW9 then the usual comments about paying it 2) My initial reply to this letter is attached as parking letter 1 (after a few days research) 3) I then received the usual threat that they'd take me to court in response, not commenting on any of the points i made in the first reply - i will attach this once i find it as gladstone 1 4) i then sent another reply again making note of my points - this is attached as parking letter 2 5) Today i have received another letter disputing my points made in parking letter 2, stating that they will not discuss it with me anymore and that i should pay within 14 days or a claim will be made - this is attached as gladstone 2 Please could any of you lovely people provide me with some guidance as to how to proceed, My main argument is that the signage is inadequate and that no contract was formed, I have attached photos of the signage (photo 1) and the location of the car in relation to the sign on a wet day (photo 3) [another viewpoint is available] (Sorry for the quality, unfortunately cannot save the evidence as) A massive thank you to all that spend the time to read this, Kind regards, A rather annoyed "keeper" Parking ticket letter 1.pdf Parking ticket letter 2.pdf

- 16 replies

-

- correspondence

- enter

-

(and 4 more)

Tagged with:

-

My partner too has now received two letters from Lowell, the first from "Lowell Portfolio 1" and the second from "Lowell Financial". They are citing a debt they have purchased from JD Williams, the original account having been opened in 2002. My partner has never heard of JD Williams, let alone purchased anything from them. They said that they had used a credit reference agency to find her address (we have lived at our current address for over 20 years), but having paid for a £2 Experian report (a company they advertise on their letters), there is no reference to a search by anyone other than the Identification Generic Check by Experian themselves. Interestingly Lowells have addressed her as Mrs, when all mentions of her in the credit check are Ms. She subsequently sent them a letter (electronically signed) stating that she has no knowledge of any debt owed to JD Williams and that unless they could provide evidence of liability for the debt in question, they should make no further contact. This letter was sent by recorded delivery and delivered on 7th October 2015, the date of the second letter from Lowells. I am interested that the wisdom of the replies is that this is a fishing attempt and that it should be ignored. Unfortunately this situation is causing my partner some anguish and telling her to ignore it is proving difficult. My intention is to ignore this second letter and should further correspondence be received, send a letter based on the CAG "You know nothing of the Debt / Prove It" template, but I would appreciate advice as to this being the best course of action. Best regards, squill

- 12 replies

-

- correspondence

- financial

-

(and 2 more)

Tagged with:

-

Hi! As there was some confusion in a recent Oyster Card thread as to whether a prosecution notice came from TfL or a Court, it's useful to be aware that TfL have a fixed "House Style" for all letters and correspondence, and anything *Directly* from TfL themselves will be written in a distinctive typeface called New Johnston - the same style of lettering you see used on all signage, posters, leaflets and publicity material. Compare the lettering of anything received with something like a map or leaflet from a Tube Station, etc., if the lettering is identical then it *IS* TfL produced, in which case read it carefully and find out what they are alleging or requesting! However if it's Times New Roman, Helvetica or Arial, etc., it could be from TfL *OR* a Court, *in which case you must read it even more carefully* and follow any directions on it to the letter! Hope this helps a bit!

-

- correspondence

- identifying

-

(and 1 more)

Tagged with:

-

Morning All, Not totally sure if have posted in the correct place so apologies if not. Thought I'd share with you an extract from correspondence received direct from the FCA today: General information on the Consumer Credit Act Copy of credit agreement Under section 77 and 78 of the Consumer Credit Act, a lender is required, at the request of a borrower, to provide a copy of the executed credit agreement and information in relation to outstanding amounts within the 12 working days of receiving the request. If the lender fails to comply with this request, it is not entitled to enforce the credit agreement until the request is fully complied with. While the credit agreement remains unenforceable, the lender is still entitled to take a number of actions, including demand repayment of the debt. To meet the requirements of these sections, the lender is not required to provide an exact copy, photocopy or microfiche copy of the signed original. This is reflected in the CCA which requires the copy of the credit agreement provided under sections 77 and 78 to be a “true copy”. Under the Consumer Credit (Cancellation Notices and Copies of Documents) Regulations 1983, a “true copy of the credit agreement may omit the signature and date of the credit agreement. The “true copy” of the executed credit agreement may be reconstituted from sources other than the actual signed credit agreement following Carey v HSBC [2009]. However, if the lender provides a reconstituted copy of the credit agreement, it should explain to the borrower that this is what it has done. The Purposes of these sections The purpose of sections 77 and 78 of the Consumer Credit Act 1974 is to provide a borrower with the relevant information about his or her contract, in particular the contract terms and the current state of the account. Parliament appears to have recognised that consumers may lose documentation, or may not keep clear records of payments, and may be unable to ascertain accurately what their contractual rights and obligations are, or how much has been paid and what is still owed. This is particularly important if there is a dispute over what is owed, or an alleged default. In those cases, preventing a creditor or owner from enforcing the contract until clarification is provided is an important and reasonable protection for the consumer. At the same time, it’s important to remember that the purpose of this legal provision is to provide information to the consumer; it is not to provide a method for consumers to avoid paying their debts. Unenforceability is merely the sanction where there is a continuing failure on the lender's part to provide the information.

-

On 2nd May this year I received a letter from Rossendales, dated 30th April 2015, at my parent's address. The letter was concerning council tax owing Liverpool City Council from July 2014 for an address I moved out of. I'm guessing the council tax is covering the short period between that last month's council tax I paid and the date I moved out of the residence. I thought I notified the council of my forwarding address (my parent's) but can't find evidence of this and they told me this past month that I never. This correspondence was the first of any kind I have received via phone, email or mail from both the council and Rossendales. I called Rossendales 2 weeks ago on my lunch break (after attempting (and failing) to contact them via email and their website contact form) questioning the enforcement fee and previous correspondence this letter refers to, to which they replied that they were sending letters to my old address, the one passed to them by the council. My question to them is, if they had my parent's address why is it only now, almost 1 year later are they sending mail there. No enforcement agent has been to my parent's address. No mail has been sent to my parent's address. I paid the man on the phone (Rossendales) the council tax fee of 54.80 making sure I stated that it was only for the initial debt and that I am disputing the enforcement costs [calls are recorded, right?]. My question is, has this been seen before where they are claiming correspondence that has not taken place? and/or know if I can argue these so called charges? I have contacted the Council on several occasions over the past month and they've just told me I need to contact Rossendales while the man I spoke to at Rossendales told me I need to get the council to dispute those extra enforcement charges. I've never had to deal with anything like this before and have a spotless credit rating, I'm scared that I'm going to be screwed when looking to buy my first house next year for the sake of a stupid 50 quid :'( but I also can't afford to pay those costs. Council Tax due: 54.80 Enforcement Costs incurred: 310 Paid: 54.80

- 3 replies

-

- correspondence

- falsely

-

(and 2 more)

Tagged with:

-

Hello. I have a long ongoing battle with EE which I have issued a small claims action for. To cut a long story short, I only got a response from them after calls, Emails, letters sent recorded, Email to CEO and finally an LBA. That worked and I got two letters from the correspondence department. The trouble was when I spoke to their head office switchboard the lady I spoke to was quite embarressed as she went through to the department with the two names that were on the letters, but came back and told me that no one of those names worked in that department! I have been searching around and I have come across a couple of other people on other sites say that this is another one of EE ruses - fake people to send out generic letters to make it seem like they are taking an interest in your issue! I was trying to find out if any CAGgers have had experience with this being done by EE as I believe this is reprehensible and hopefully I will mention this during a small claims or mediation hearing (should it get that far - They sent a court bundle on the flimsiest 12 points I had come across - I ripped all their points apart which I was quite proud of!) as I know this sort of behaviour from a company is frowned upon. Companies who offer appalling service need to be taken down a peg or five! Anyway, thank you for reading this. Regards Rob

- 4 replies

-

- correspondence

- department

-

(and 3 more)

Tagged with:

-

Hi there, I have a Lloyds TSB Credit Card debt. Until 3 months ago, they were happy to recieve payments via my DMP Payplan. Despite that, they havent actually written to me for 2 years. No sign of being passed to a DCA. Now my PayPlan account is closed as I have decided to deal with all my creditors myself. Not sure if I should just wait to hear from them or take some other course of action? The outstanding balance is confusing because of PayPlans shoddiness, and my over-reliance on them. For example, I have another bank a/c debt with Lloyds. Payplan said the outstanding was £179. Since stopping with PayPlan, the debt has been passed to Wescot, who say the debt is £451. (This is on a separate thread). So back to the Credit Card debt - I am unsure of the amount outstanding, and wouldnt CCA request them because - as far as I know - Lloyds themselves are still dealing with it. Thanks again in advance

- 3 replies

-

- any

- correspondence

-

(and 6 more)

Tagged with:

-

Hi All, I from time to time check my credit report on Noddle (just in case) and a few days ago I noticed that my file has been marked by Arrow Global for an ancient debt that was thought resolved. About 3 years ago I cancelled an Orange broadband dongle which was always paid on time. Orange continued to charge for about 3 months despite the cancellation. After spending a long time on the phone to Orange, they admitted this was a mistake and would be cancelled. After this I received a letter from a collector and they marked my file. I wrote to the collector explaining what had happened with Orange and they never contacted me again and the mark disappeared from my credit file. Fast forward 3 years and a default for the same amount from a "Telecommunications Supplier" has appeared from nowhere on my file. I cannot remember the original collectors name but I don't know that it was Arrow, and being so long ago I cannot locate any of the original correspondence. Also I have not been written to by Orange or Arrow or anyone about this. What can I do about this? I have not contacted them yet as I am unsure what the best course of action is to take. Any help is appreciated. Screenshot of the mark: [ATTACH=CONFIG]51661[/ATTACH]

- 5 replies

-

- arrow

- correspondence

-

(and 1 more)

Tagged with:

-

Hello All - Ist time post. In seeking further disclosures from the Respondent prior to ET, is the correspondence to and from them able to be discussed at the ET hearing?

- 21 replies

-

- correspondence

- dates

-

(and 9 more)

Tagged with:

-

Hi I've been having a clear out and came across an old Capital One statement. The statement is from 2000 and I closed the account years ago. Is it possible to claim back mis sold PPI on an account this old? I've probably got no end of charges on this too. I think the account closed in 2006/2007 not 100% Thanks

-

Can anyone throw some light on whether or not email correspondences can be used as evidence in court. The emails clearly show the sender and recipient thanks

- 5 replies

-

- cases

- correspondence

-

(and 1 more)

Tagged with:

-

When checking my bank statement this payday, I noticed that the regular monthly payment that I have been making against my outstanding Self-Assessment debt had not been taken this month, and, in fact, they had refunded the £25 payment made last month. Having had a serious nightmare in a similar vein with the CSA some time ago, I rang DF immediately to find out what was going on, as I don't want a) a nasty surprise later in the year or b) the debt to increase more than it does already with the interest added to the account. I was told by the agent for DF that HMRC had "taken back" the account on 10th December 2013. I have received no correspondance from either DF or HMRC about this, and have spent quite some time on the phone trying to get through to someone at HMRC to find out what this means to me, to no avail so far (waiting times of over 30 mins on 3 calls today...). Can anyone tell me what they think is going on here, and what I should be prepared for? Many thanks, Paul:???:

-

- correspondence

- drydensfairfax

-

(and 3 more)

Tagged with:

-

Hi All I have 12 serious outstanding debts to various major credit companies and banks which have now been sold on to various DCA's and some have been sold on again. After getting advice from the CAB and National Debtline, I wrote to them all offering a token payment of £1.00 per month, all of which were accepted. But, I now need to send a budget statement review and renew the offer of £1.00 per month as my circumstances have deteriorated. My problem is, I have since moved out of my house and onto a boat, but the mooring I have does not provide an address or mailbox facilities. I have had my mail redirected from my old address to my In-Law's address for the past 18 months, but this is getting unreliable. I can't give the DCA's my In-Law's address directly as it may affect my In-Law's credit or they may get harassing letters/calls etc. Can I tell the DCA's that I can only correspond via email? And can I get them to send CCA requests to an email address? Thanks in advance

-

Are these separate in the eyes of the Local Authority ? In requesting a response from the local authority over a PCN, I am up against a time limit where they could shortly go for a charge certificate, and my suspicion is then issue an execution of warrant immediately afterwards. I have requested detail over the original PCN twice without a response that covers the actual circumstances, the LA have simply replied that I have contravened something on their long list of regulations and must pay. Obviously I would like to hold out until they do provide an answer that relates to a line including a mitigating circumstance, but the charge certificate will add another 50% to the money they claim I owe them. A charging certificate appears to have no financial risk to the LA, but can they legally terminate any future communication based on the issuing of one ?

-

I have received quite alot of pages from Studio!!! These include listings of orders, returns, charges, payments, telephone calls - no agreement! The long and the short of it being - I now have to reclaim these charges - do I reclaim using Statutory or Restitution interest! Am I missing anything else that I should be doing? Thanks in advance

- 72 replies

-

- correspondence

- reclaiming

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.