Showing results for tags 'cash'.

-

Name of the Claimant - Motormile Finance Date of issue – 28/04/2017 Date to acknowledge - 16/05/2017 Date to defence - by 4pm 30/05/2017 What is the claim for? 1.the defendant owes the claimant £100.00 under a regulated loan agreement with ariste holding ltd t/a cash genie dated 30/05/2014 and which was assigned to the claimant on 27/04/2016 and notice of which was given to the defendant on the 27/04/2016 (debt). 2.despite formal demand for the payment of the debt the defendant has failed to pay and the claimant claims £100.00 and further claims interest theron pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8.00% per annum amounting to £8.00 What is the value of the claim? £183.00 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Payday loan When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim? Motormile Finance Were you aware the account had been assigned – did you receive a Notice of Assignment? Not that she remembers. Did you receive a Default Notice from the original creditor? Not that she remembers. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Not that she remembers. Why did you cease payments? Couldn't afford the repayment What was the date of your last payment? No payments ever made. Was there a dispute with the original creditor that remains unresolved? No. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No I am assume its another case of Acknowledge service and send out a CPR and CCA? Ahoy, Well, after fending off two Lowell cases this year already she has now had one for Motormile Finance. Not a good year for her. I wonder what has made them all come out of the woodwork and try shenanigans. She claims to have no recollection of this particular debt although she had a few payday loans and I know the same companies trade under various different names said she had a letter or two from MMF and it made no mention of the original creditor. I looked into this one (Cash Genie) and see they ceased trading 3 months before this debt was assigned and there are a lot of debtors making claims against them and getting refunds from them (the website for them listed how to claim). I struggle to see how anyone with a degree in Law can have such bad grammar and presentation when it comes to these claims or if its done by random spods how they can allow them to do so in their name.

-

Hi, I August I went to a local camera shops and brought a Sony camera. In the shop it was advertised at £239, when I went to pay it came up at £279 I asked why this was and was informed that the price advertised was with a £40 cash back that I had to claim back from Sony after 30 days. When the 30 days had passed tried claiming the cash back and the camera was not listed. Spoke to the shop and they are not doing anything about this, sent them a formal complaint saying I was not happy about the service I received and have not heard nothing back. I paid via my credit card. Is there a way or seeing what a web site was displaying a couple of months ago, to see if they had the camera advertised then with the wrong information. Thanks JJ

- 15 replies

-

- advertised

- camera

-

(and 2 more)

Tagged with:

-

Had 250ltr of our hot water tank leak through the ceiling recently. There was a little damage there before (shower leaked a few years ago) but it was too much hassle to fix. Now the damage is much much worse. The insurance are paying for the flooring but are refusing to pay for the ceiling saying I've not experienced any financial loss because it was damaged already? Is this normal? Surely its like saying you can't have a new carpet if its wrecked because there was a fag burn on one corner?

-

Hello, i have had a loan with cash on go ltd peachy loans in August 2012, i didnt pay it back and they defaulted it on 07/11/2012 , this was showing on my credit file up until about a month ago when it just suddenly stopped showing on there. It has now reappeared in November but they have set the default date to one in 2016, when i have proof it was defaulted on 07/11/2012. Why would they do that? I have emailed the CRAs to tell them is there anything else i should be doing? Should i contact Peachy direct. I'm not 100 percent sure if it is it stat barred as i may have paid something in a payment plan but i am trying to find out yeh just to confirm its not stat barred- as i made payments in july 14

-

Hi All, I purchased a Galaxy S7 at the end January 2018 from Cash Converts for 250. It has been in a case since buying it with screen protector. Last night the screen has got a line through it . I looked at receipt and spoke with Cash Converters and they only offer 6 months warrant - No help at all. I am aware there should be a less expectation regarding the quality of second hand items and the fact warranty is optional. I am more interested in my rights under the CRA. A 250 pound phone should last longer in my eyes than 8 months! I have no experience with civil law. I just wanted to get a feel from people on here whether it is worth the effort pursuing this? With the fact it is a second hand phone. Thanks

- 5 replies

-

- cash

- converters

-

(and 2 more)

Tagged with:

-

I ordered a 2 x sofas and 1 x armchair from Sofology on 30/08/2018 (cost inc delivery, furniture protection) £3783.50 of which £400. 00 deposit was paid by bank cheque card, the balance is due prior to delivery which I intend to pay by credit card. Due to the numerous complaints now noted with this company, as well as other high st furniture retailers, I want to be aware of what my consumer rights are if I encounter any of the complaints already noted eg, sagging sofa, poor quality construction, poor quality leather in terms of wearing excessively. I am sorry for the hypothetical question but I want to be forewarned as to what steps I should take in such circumstances and under what act etc. Many Thanks

-

https://www.theguardian.com/society/2018/feb/28/gps-offered-cash-to-refer-fewer-people-to-hospital I thought GPs were already finding it hard to cope with the workload? This sounds an odd way to try and fix the system. HB

-

Im thinking of transferrig my daughters government child trust fund to a junior isa which also cannot be touched untill 18 years of age. Will this not affect my benefits too? Just want to double check as government website only says ctf wont affect benefits doesnt mention about junior isas which work the same too. I only claim housing benefit btw

-

I wonder if anyone could answer a query about tips. My brother in law is working this weekend at a famous racecourse parking cars for the attendees of the racing. He is working as a temp for an agency. He was told he would get an hourly rate plus he could receive tips. Whilst working the supervisors (not from the employment agency) have told him any cash tips must be handed in and will be given to a charity. He wants to be honest and has sometimes been given tips of £20 in cash but has to hand in. Is this legal? It is virtually minimum wage and the tips (which really was part of the bargain when he accepted the job) would have made doing this worthwhile. Any advice would be appreciated. Thank you

-

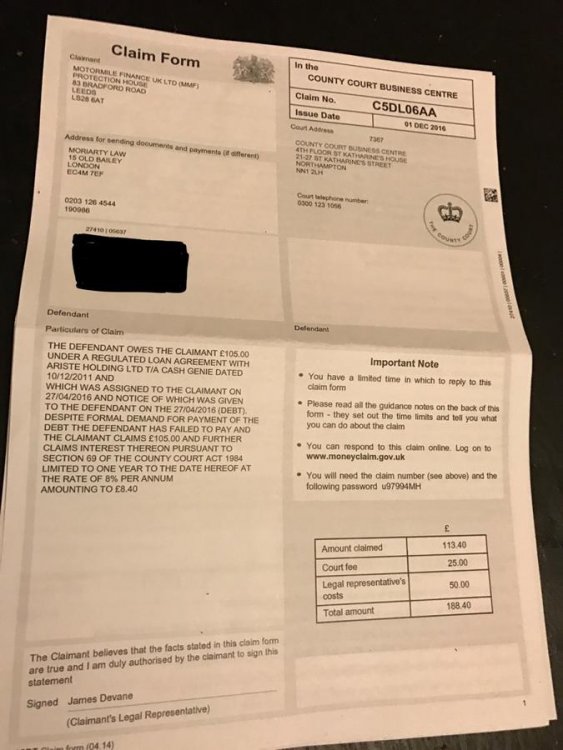

I was gong through bad time financially few years ago and I built up some debts using payday loans such as Cash Genie. Or Motormile finance. I received a letter from Moriarty Law saying they're sending me county court papers for £105 I still owe Cash Genie from 2011. I also received county court claim form and I attached a copy. My main problem that I work for financial institution so if I get CCJ I'll be forced to quit my job. Can they really take you to county for only £105??? Now they increased it to £188 with court fees and theirs. This is looks serious and I'm worried! Any advice is appreciated guys! Thanks in advance Angela.

-

Is it illegal to pay people using the GetCash service? Say they can't do bank transfers, or just for transactions in general? I recently got a call from the fraud department after carrying out a transaction with GetCash, but they just wanted me to confirm some recent transactions, specifically asking about the GetCash ATM transaction twice where i lied and said it was me. I think flags were raised because it was in a location far from me though. All was fine after and they unlocked my account, didn't specify why they called though. Anyone have any information on this subject? Can't seem to find much online. Thanks.

-

Hi Guys, Need your advice on this unusual problem. Sorry story is a bit long. I’ll spilt it by bullet point to make it easier to read: 1. 23 Dec 2016 – went to the store made small purchase requested £50 cashback. Was deep in my thoughts. Felt a bit awkward at the end of interaction with cashier who started behaving strangely by completely ignoring me and started chatting with colleague. After packing few purchased items I was waiting patiently not realising what for. Felt as something did not finish - no eye contact from cashier, no thanks / goodbye. I’ve felt a bit strange and waited for much longer that socially acceptable in such situation and then left the store without exchanging a word with cashier. 2. Few day later realised I did not had my cash. As I was not out of the house since visiting store I could not have spent it or lost somewhere. 3. Waited for store to open again and went to speak with manager on 27 Dec 16 to ask them for my cashback and checking CCTV to confirm it was not given. Duty manager said he cannot view CCTV but checked till for that day and there was no extra cash in the till. He also found small receipt with my signature that confirms I’ve received cash. Signature seemed to be mine but I do not remember signing it nor receiving cash. 4. I’ve got my receipt with cashback on it. I am guessing I was asked to sign small slip confirming I was given cash and then was given my store receipt. That triggered me into thinking I got what I needed and made to forget about my cash by cashier starting to completely ignoring me. 5. I’ve spoken to customer services and same manger again who were pointing at each other saying I need to request CCTV footage and pay for it and that only store manager / area manager can view CCTV. 6. 6 Jan 16 spoke to customer services who then spoke to store manager who then checked till records again stating no extra cash was reported on that day. 7. Managed to speak to store manager in person on 6 Jan 16. Did not get much was just fobbed off making it sound it was my fault and I should have checked cash in store and they conducted their investigation. This person was quite elusive did not wanted to talk. Said nothing I can do. Both managers felt a bit arrogant almost as if they were saying good luck with that! If you know what I mean. 8. 6 Jan 16 stated electronic communication with customer services sending all above information via web form. Starting message with I am making formal request for CCTV footage under Data Protection Act 1998 confirming I am happy to pay for it. Providing all relevant details timing till number etc. 9. 18 Jan 17 sent them all above information in registered letter. 10. Did not get any response for around 10 calendar days and called them again to chase up for reply. 11. Received reply on evening of 20 Jan 17 (Friday) stating they passed for investigation to area manager. Provided instructions for requesting CCTV and how payment should be made. Advised that I need to contact police if I felt there was theft. 12. 20 Jan 17 I replied via e-mail and asked to place hold on the footage to ensure it is not overwritten as I’ve read somewhere that their retention period is 30 days. 13. 21 Jan 17 (Saturday) send request for footage as per their instructions. 14. 26 Jan 17 received letter stating request is outside of system storage capacity. 15. Chased them up for finial outcome of area manager investigation knowing what they will say. 16. 16 Feb 2016 Received response stating CCTV has now been overwritten they conducted till review and no extra cash was found. Nothing else they can do and I can contact the police. My view on that is that they ignored my initial request under Data protection act sent to them on 6 Jan 17. Purposely delayed providing instruction for requesting footage and timed it so that I have 0% chances of making it successfully and that it reaches them before 30 days retention period to cover up for their employees. I’ve seem to exhausted my option to get this resolved with the company and looking for advice on taking this further. I feel up to taking them to small court claiming for postage, petrol cost for number of trips inconvenience and original cashback. Just wanted to get your views on chance for success and some help with small court procedures if will be going that way. Thanks for reading!

-

Hi there I have noticed on my credit report a default on in July of this year for an old cash genie payday loan, this account started in Nov 2011 and there was no payment since 2011 how is it possible for MMF to issue a default date of 2016, a full 5years after the last payment? Is this possible ? Any advice on this Thanks

-

I would like to know how much help you would expect from a bank if cash was paid into an account found to be a fraudster. I thought they made enquiries into the receiving bank account over a certain amount of money.

-

I applied for a Cash Genie loan on 23/12/13. The application was accepted. The loan amount was £200, duration of credit agreement 8 days, loan ID xxxxxx8493, to be repaid in 2 simultaneous instalments of £60 (interest), and £200 on 31/12/13, total amount repayable £260. I ensured there were sufficient funds to repay the loan in full on the due date. I was therefore surprised to receive an email from Cash Genie on 27/4/14 reminding me of my "upcoming payment" for my loan ID xxxxxx4039. I checked my bank statements and discovered that payments had been taken from my debit card as follows: 30/12/13 £60 03/02/14 £60 03/03/14 £60 02/04/14 £60 Total £240 The total amount repayable under the loan agreement was £260. Cash Genie had rolled the loan over on 4 successive occasions entirely of their own volition and contrary to the terms and conditions of their own loan agreement. As the balance of the original loan agreement was £20, I repaid this on 01/05/14 and considered the subject closed. I then received an email from Cash Genie 01/08/14 containing a default sum notice for yet another loan ID xxxxxx7101 (I can only assume Cash Genie generated a new loan "agreement" every time they rolled over the loan). "The following default sums have been incurred and are now payable under the agreement referred to above: Amount Description Date £0.00 Sent Letters 01/08/2014 This Notice does not take account of default sums which we have already told you about in another default sum notice, whether or not those sums remain unpaid. The total amount of all default sums included in this Notice: £0.00." On 31/08/14 I received a second default notice via email with the exactly the same wording but the following default sums: "Amount Description Date £0.00 Sent Letters 01/08/2014 £0.00 Sent Letters 31/08/2014" This is the only correspondence I have received regarding a default notice. I am unaware therefore of any other alleged default sums. I immediately responded to these notices by paying the default sums (i.e.£0.00!). My credit record shows the following information: "Account start date: 30/05/2014 Opening balance: £260 Regular payment: £ 140 Repayment frequency: Monthly Date of default: 30/06/2014 Default balance: £260" Every line of data is complete nonsense! Furthermore, the status markers show the account being 1 month late in July 2014 (2 months after I paid it off) and in default in October 2014 (not 30/6/14 as shown above). My questions are: 1) I believe I am entitled to redress - what do I claim, and how do I calculate/ claim it? 2) Most importantly, I need this ridiculous default removed from my credit record. How? Thanks in advance!

-

Went to the local Post Office today to pay in the cash I have received from items I recently sold on Ebay. They refused to allow me to put the money in my Santander bank account due to the laws on money laundering. They said if they took the cash and credited my account, then my account would be frozen pending an investigation on where the money came from. I don't have receipts because the buyers of my items paid cash on collection. I give up with this crazy country. Paying the cash in would result in my account being frozen until I prove where the money came from. Having my account frozen would prevent me from being able to access my pension. Not having receipts from the items I sold on Ebay implies that my bank account would be frozen for ever I would loose my pension and have nothing to live on. Who brought in these stupid laws that assume honest people who sell honestly obtained second hand items are drug dealers?

-

I've had similar emails as the above. Is this still the advice you would give if they have emailed "If we do not hear from you within the next 7 days we will be left with no alternative but to refer your account to Moriarty Law LLP." Still the same nonsense?

-

Hello. First post to the forum and well, what a mess. I think I've posted this in the right forum as there is no mortgage involved in this. When I found myself in the incredible situation I'm in, which I will expand on in a moment, I had a look on various help forums to see what information I could find on what happens when a property sale fails to complete after contracts have been exchanged. I found lots of posts along the lines of "in 20 years of conveyancing/being an EA I have never seem this happen" etc. So... Let's see what the experts here make of this. It's quite a lot to get through, but I suspect the devil is I the detail. Around Feb this year I was selling my house due to separating from my partner who wanted her share of the house. The only way to finance this was to sell and downsize so reluctantly I did what I had to do. My estate agent, ill call them SW, found me a buyer, an offer was accepted. After looking around, I found a park home property that I liked which I could buy outright with my proceeds and the thought of being mortgage free rather appealed. I then discovered that you were supposed to be fifty to live in this residential park, and I was just about to turn 49. I should stress at this point, I have not viewed any property, spoken to anyone or made any offers, I was simply aware of the property and the rule. The next thing I did was to office at the front of the park to enquire about how flexible this rule actually was. I spoke to a lady in the office who thought it probably was flexible but she said I needed to speak to someone with more authority than her. So I made an appointment to come back a couple of days later and on a scorching hot day, i spoke to a gentleman we will refer to as Brian. Brian introduced himself to me as the park manager. We discussed my age and the fact I was interested in the two properties that were for sale, and he told me the age limit was arbitrary and was there to make sure that no young people with children etc moved in, and having met me he was perfectly happy. A few days later, I went to the vendors estate agent, ill call them FS and explained that I was interested in the properties, that I was aware of the age limit, that I had been to the site and spoken to Brian the manager and he was happy. Estate agent FS arranged a viewing of the two properties and said he would confirm the age issue. I went to view both properties about a week later one very dark rainy evening and a few days later went back to FS and made an offer. Unfortunately, my first choice was then at this point taken off the market due to illness, so I made an offer on the second property. FS subsequently informed me the offer had been accepted by the owner, Ill call the owner Mr I from here on, and that he (FS) was now happy with the age issue. In May, when I was expecting to exchange i was suddenly informed out of the blue by FS that Mr I was looking at a different property and the whole process had to be started again at his end. I found out through a third party that Mr I has done this before. I made it clear that I was unhappy with this as I was part of a chain. Mr I switched again back to the original property, but for reasons unknown to me other than it was something to do with his ongoing purchase related to the fact he had switched twice, it was still taking an age. It was now June My own buyers were becoming impatient and threatening to pull out if we had not completed by the end of June, and not wanting to lose my purchaser, I put everything I own into storage, put my dog with a dog sitter and planned to move onto a friend's sofa for a few weeks. My completion came and went at the end of June, so I said goodbye to my home and I began to sofa surf. All the paperwork for my purchase was in place at my end, everything was signed and ready and all of my money from the sale of my house plus the difference which I had borrowed from my family was in the solicitors client account. We were still waiting for Mr I. In the first week of July I was informed that we would be ready to exchange contracts the following day. The following day it never happened and I was told that it was due to some important documentation that had been forgotten by the vendors solicitor. Exchange was now a few weeks away again... In the last week of July we finally exchanged contracts and set a completion on Thursday the 4th of August. I was getting excited, looking forward to a new home in a new community and getting my dog back. What happened next is well... Words fail me.. Luckily I have recently installed an app on my phone that records all incoming and outgoing phone calls. Every single one of the following phone calls is recorded in its entirety. Wed 3rd August. 6pm: I receive an email from my solicitor stating that the vendors solicitor had found out I have a dog and a car, do they have my permission to pass on my personal details. This seems odd to me. I am allowed to have a dog and a car, I don't know why this is an issue and everyone has had all my information, in writing, on all forms since day one. Amazingly the lady who sent me the email is still in the office, I manage to contact her and give my permission. I kind of detect from the way she is talking to me there is something she is not telling me. Thursday 4th August, 10.34am: I receive an email from my solicitor stating they have confirmation to proceed, they have a final completion statement from the other side. There is an outstanding payment of just over £150 for the months ground lease which I need to pay as the lease is being transferred to my name. I transfer the money, I ring them to confirm and thank them. Thursday 4th August 1pm: I go to the estate agent to see if they have heard anything and to hopefully collect the keys. They have heard nothing and can't hand the keys over yet. Thursday 4th August 1.30pm: I get a phone call from my solicitor telling me the park owners have put a stop on completion. I am advised to go to the residential park and speak to Brian the manager. On arrival at the park I ring Brian the manager and get through to someone else who tells me Brian has resigned. Over the course of the next few hours I end up speaking to my solicitor numerous times and a gentleman ill call Mark, who is a South England regional manager for the company who owns the residential park who from this point forward is the official spokesman and point of contact for the park owners. In these conversations, which have all been recorded, I learn the following catalogue of errors and points of information as I understand them. - Brian the manager and Mr I, who was desperate to sell his property as its been on the market for a considerable time, are one and the same person. - Brian I, was not a manager, he was a gardener who had no authority at all. He has misrepresented his position to me to assist selling his property. - The lady in the office was another resident who has never been employed by the park owners and should not at any point have been I the office. - The email I received the previous evening was a result of the fact that Brian I, or more correctly his solicitors, were legally bound by the lease agreement to inform the park owners of the sale and the park owners would then process my information and application along to take over the lease and move into the property. This process legally takes a minimum of 21 working days so should have been done at the very least a month beforehand. What had in fact happened was Brian I's solicitor never have the park owners this notice or any information about me until just before close of business on the 3rd of August. Less than 24 hours before we completed. - Both my solicitor, and the vendors solicitor should not have exchanged contracts without this vital step of the lease purchase/transfer being carried out. - Both my solicitor and the vendors solicitor are at fault for ignoring the fact that the age limit for the sale is not arbitrary, is stated on the lease documents and the fact that I am only 49, not fifty. - The park owners are not prepared to be flexible on the age limit, I am 7 months too young. Mark the area manager makes it very clear to me that, and I quote, "if this has anything to do with me, I will not allow this to happen because you are too young and it is wrong". - I am not going to get the keys, the sale is not going to complete the park owners are going to take their full 21 working days to process my application, after which they will accept or decline. - I am told that no money has changed hands officially, but it has been transferred and the vendors solicitors actually have all my money in their account. (£143000) - There has been a suggestion that Brian I's solicitor is going to sue me... After a very sleepless night, as soon as the offices open im on the phone to my solicitor. My solicitors is a very very large company and over the last 8 months my purchase has been dealt with at different stages by at least four separate people and now I find its been passed to a gentleman called Nick who I am told is a senior partner. Friday the 5th 9am: I'm on the phone to Nick. He tells me (and again all my calls are recorded) and I quote, "that I have been shafted by Brian" I and I have a massive strong case for legal misrepresentation but leave it with him to see what he can salvage. The park owners are exercising their legal right to take 21 days because contracts should not have exchanged without this. The vendors solicitor still currently holds all my money and he is going to see if he can get it back, however there is a huge question mark over this because there is a possibility the sale could be forced through and I would then own a property to which I have no right of entry, but then I can sue for costs... This nightmare just keeps on giving. After a very sleepless weekend, on Monday morning I went to the CAB who advised me that my best course of action was to go and ask for my money back and then if it wasn't forth coming make a complaint to the independent ombudsmen. Around 11.30 Monday 8th august, I walked into my solicitors and asked to speak to Nick. He took me into an interview room and we discussed the situation. I put my phone on the table and the whole following conversation was recorded. He kept pursuing the point that I have a case against Brian I for misrepresentation and against his solicitor for not following due process and only giving the park owners the lease application the day before completion and then exchanging without this process complete. I chose at this point in the conversation not to point out that surely both parties are equally as guilty for exchanging contracts before due process was complete? I should stress that at this point I have not yet asked for my money back, but I was about to. However before I do, and without any prompting, Nick tells me that late on Friday he asked the vendors solicitor for my money back, and they instantly returned it by bacs payment and that it will be returned to me in full on Tuesday. I asked him about the fees for his company that I thought I was arguably being unfairly charged thousands of pounds given the series of mistakes, and he offered me fifty % of all fees back. As I was trying to clarify exactly what this included, he said "you know what? I'm a nice guy, all costs, 100% will be waived and refunded. We should have the money back tomorrow as its coming by bacs, and we can pay it straight into your account." He then told me that I have dodged a bullet because if he was the vendors solicitor he would have forced the completion through as an associated purchase because he had the money, so I was very l lucky to have had such a lucky escape and the vendors solicitor had chosen to refund my money. He also told me that now I've been given all my money and all my costs back, i have the option to walk away from this now. If I do, Brian I may try to sue me but it's unlikely because 1. he basically doesn't have a leg to stand on due to his misrepresentation and 2. The exchange of contracts should never have taken place given the incomplete documentation and so these contracts wouldnt stand up in a court of law. Tuesday the 9th mid morning I've an email and a subsequent recorded phone call confirming my money has been returned and all of it, including all refunded solicitors fees have been paid to me via bacs so will be in my account by Friday. Tuesday 9th 12.00 I've just had a phone call from Mark the residential park area manager saying to me that he's found out some further information on me and wanted me to confirm whether I own a certain type of commercial vehicle (a taxi), I confirmed I do. And he's found out that I own 7 motorbikes and would I confirm this. I don't. I own two. One is a road touring bike, the other is a restoration project and I confirm this to him. He's told me that in addition to clearly breaking the rule on age, I'm also breaking the rule on not being allowed commercial vehicles, I haven't told them I own a motorcycle, Im not allowed to own a motorcycle, apparently I'm only allowed 1 vehicle, I have 4 (1 taxi, 1 private car and 2 bikes) and the more he looks into me the more rules I'm breaking. I find this odd because at no point have I been made aware of the fact that I'm not allowed to have a taxi. My job has always been a taxi driver and its never been a secret. At no point have I seen any rule that says I'm not allowed to own a motorcycle and no one has ever asked me if I own one. I find it interesting that he's obviously looking into me and my affairs from some unknown source, and finding out half truths. It would be interesting to know where on earth he got the idea that I own 7 motorbikes, or actually even why he's looking into things like this anyway. Tuesday 9th August 4.45 I phoned my solicitor to double check my money has been transferred i am told that that the bacs payment was changed and I am told "Well, there was a bit of a fuss in the office about getting this money to you. I don't know what you've done, but whatever it is you've done it right. Your money is coming into your account tomorrow morning by TT and we are refunding literally everything including waiving all transfer fees" I then her and ask "so where does this now leave me. Can I just now walk away from this farce and am I free to start looking for a new home?" She answers "yes you can. Enjoy." So as a final summary, after the catalogue of cock ups: The vendors solicitor has refunded all my money in full without question. My solicitor has refunded 100% of all fees without question. Both of these things suggest to me that they know they have done something wrong and I can almost hear them in the office trying to get rid of me. It's looking fairly certain that my application for the lease on this property isn't going to be accepted, I've already broken the age rule, the no taxis rule, the no motorbikes rule and the number of vehicles rule and I haven't even completed yet. But bearing in mind that so far I've been lied to and misled by the vendor, messed around by the vendor with his switching of properties, had the completion blocked by the park owners who have made it pretty clear that my 11th hour application is going to fail and given that all my money and fees have been refunded from the solicitors on both sides and I still homeless, I'm ready to just walk away from this mess. In fact I think my mind is made up So if anyone has made it through this far, there are a number of lessons to learn. Always get things I writing. Don't complete on a sale without a purchase. And if anyone has any advice for me, I'm all ears because I'm worried this isn't over yet.

-

Need Help please Received a letter today from a company called BPO collections acting on the behalf off cash choice uk limited . MCO Capital sold my account to cash choice. I have never received any letter from MCO or cash choice about this debt . I got a payday loan for £400 from MCO IN 2011 but I got into trouble and asked for a payment plan which they refuse and I never heard from again. In the letter a received today the original loan was £400 and now the current outstanding amount is £1155 in the letter as a gesture of goodwill cash choice have given Bpo permission to accept the original loan amount of £400 in settlement of my account. I have not got £400 and there no way I can set up a payment plan for £1155 Can anybody please help

-

Hi all, Just in case any one is looking to make a complaint about irresponsible lending to cash convertors- I was helping a friend, follwing advice from here- and I have to say, they are the easiest company i have dealt with so far. The statement of accounts was there within an hour of requesting, and following an email complaint on Thursday, a final response has arrived today, with an offer of almost £1500. She is more than happy with that figure, and looking at the loan history, although she has paid more over the years, I really dont think she would do much better with FOS, so she is happy to accept it. The contact details i have incase anyone is struggling getting a reply- Without the spaces- Im not allowed to post email addresses yet! Good luck

-

New to this forum and got a bit of a long winded story so please bear with me as any help or advice you could give would be greatly appreciated. In 2012 I had £400 loan through the speed credit website and like most had issues paying it back. This in turn made me seek help through Step Change (CCCS at the time) who helped me set up a debt management plan to pay off all of my various debts to other payday lenders,credit cards and bank overdraft. The loan from speed credit has caused me many issues over the past few years and even though I was in a debt management plan the original outstanding balance of £400 quickly accelerated to £2570 at the point of last contact via Marshall Hoare. I have always made payments through step change to this debt. Last debt collection company I had contact with was Digital Financial service. Payments to DFS suddenly stopped and after a few months step change advised me that I had to contact Wilson Field regarding the outstanding balance. Wilson Field informed me that DFS had gone into liquidation and they were to collect all outstanding balances. This was all done over the phone and I have never received any paper work from Wilson Field. Payments have continued to be made via step change again. In March this year I got a letter from a company called BPO stating they had been passed my account from cash choice uk ltd who had bought the debt from the original lender MCO capital. The letter offered me the chance to clear the outstanding balance of £3100 (unsure as to why the amount owed has increased so much!) if I paid a one off payment of the original loan amount £400. According to BPO, cash choice had passed the account onto them in December 2015. I phoned Wilson Field to see if they still had my account in their control as they have still been cashing the monthly cheques sent by step change and to tell them about BPO claim that they owned the debt. According to Wilson field they are still due the payments each month until the balance is cleared but they said they don't hold any details on their systems relating to individual cases. I decided to contact the Financial Ombudsman regarding the matter. Two days ago I got a letter from BPO confirming contact from the Ombudsman and in turn they had returned my account to Cash Choice uk and all further contact should be made to them. I am at a loss as to who actually legally owns this debt. To date I have repaid nearly £650 towards the debt to the various companies who have passed it about between them. I feel I am not getting the help needed via step change so looking on hear to see if anyone is in the same or similar position. Once again any help is greatly appreciated many thanks Paul

-

Hi all Unfortunately, last sunday I had my first ever car accident and I accept that it was my fault. My car sustained some damage on the front i.e. bonnet, bumper and atleast a headlight. I have claimed on my policy. The insurance company have arranged their car repair partners to pick up the car for repairs. I wonder if I can get advice for following questions please?. 1. How do I know if the insurance company will repair the car or write it off? 2. If the insurance company decides to repair the car, do I have the right to ask for the cash in lieu settlement? I would prefer cash in lieu settlement so either I can just sell my car and top up the settlement cash with my own money and get a new car. Alternatively, i can get it repaired at a lower cost and then keep the remainder of the settlement money for next years increased insurance premium. Thanks

-

Mortgage taken out in joint names 25 years ago with endowment. Partner did a runner within weeks of exchanging contracts and due to financial problems the matter was never resolved and all bills got paid by the remaining partner. Role on 25 years and the mortgage is due in a few weeks but I have been informed both parties need to sign the endowment release papers. I have tried online tracing services and no records of the missing partner exist within the last few years, the last known address was 2 years ago on electoral role. Where do I stand as I obviously need the endowment funds to pay the mortgage?

-

One for the news books, Im affected by this, you should reclaim ASAP! It would appear they are also withdrawing from the UK market, although claims should still be supported by the FOS.

-

I recently paid for a uniform for a club that my daughter attends with cash and did not get a receipt. The uniform has not been given to us and she has now left the club. I have emailed the club and asked for a refund but have not heard back. I have no idea what my rights are, if any. Any advice would be gratefully received.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)