Showing results for tags 'bw legal'.

-

I have a CCJ from BW Legal / Lowell Portfolio that I was issued 2 years ago. It is for around £2000 from an old credit card debt. I'm not sure if there were any PPI payments made for the card, but there were probably some 'unfair' charges on there. I'm pretty skint at the moment, I'm trying to get a business off the ground can't get any funding due to this CCJ (my credit is fine apart from this). I'm thinking of offering them maybe £200-400 as a full and final offer, I wondered if anyone would be able to answer a few questions first... How likely is it that they'd accept 10-20% as a full and final payment? Would this mean that the CCJ was marked as 'satisfied'? Would this actually improve my credit score? Thanks, for any help.

-

Hi everyone, I parked my car at the Peel Centre in Stockport to pickup an item which was reserved for me in Argos. Its my first visit at the Peel Centre and no doubt will be the last. Upon arrival there were no visible signs or parking machines around the perimeter so I gathered the parking was free. I went to the store to pickup the item but was told it was reserved by their other store just around the corner. The staff asked if I parked my car here, I replied yes and so she advised me to leave the vehicle here and its only a 5 minute walk. I took her advice but didn't return until an hour later after experiencing a small queue at the store and receiving a phone call from a friend. When I returned back, there was no ticket on my windscreen and so I left the Peel Centre. 12 days later I received a PCN from Excel parking via post demanding payment of £60 within 14 days. I contacted Argos and asked to speak to the store manager but was told there was nothing could be done which was disappointing. Since then, following the advice I received from my friends after the experience they've had from other parking companies, I continued to ignore all letters and correspondence relating to Excel. Currently I'm at the stage in which I received a letter from Wright Hassall solicitors demanding final payment of £180 within 14 days or else a CCJ will be imposed upon me which will have impact on future loans and credit rating. I have searched a lot of forums relating to this matter and the majority of the people on here suggest to keep ignoring them since Wright Hassall has no grounds to issue a CCJ since their client is ZZPS Ltd who are debt collectors and not Excel Parking. Although it might sound crazy but do I continue to ignore Wright Hassall if this is the case? Any advice would be appreciated. Thanks.

-

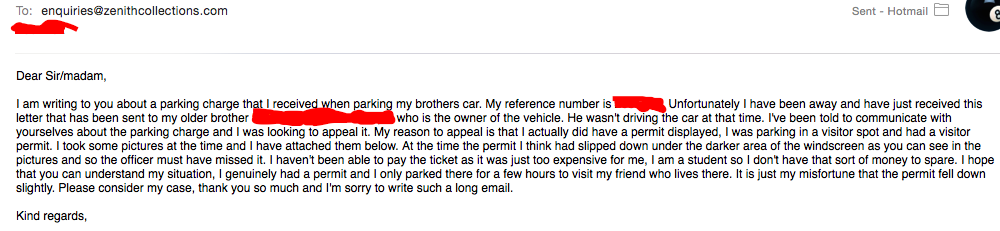

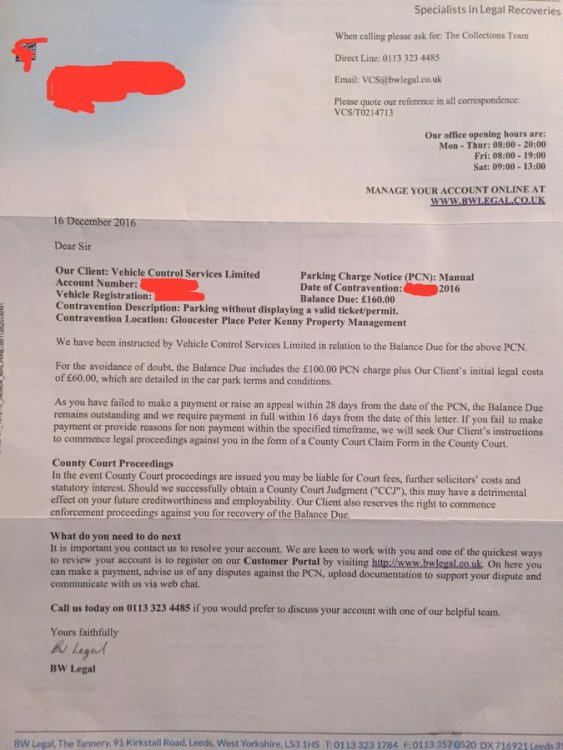

Hi, I've been reading a lot on the forum about parking charges and what is advisable to do in the situation you get a ticket. However because everybody's story is slightly different I feel its probably appropriate I post mine. So here's my story: I parked my car in a visitor spot in my friends apartment car park. It is a private gated car park and has signs everywhere warning about parking without a permit. I was visiting my friend who lived there at the time and he gave me a visitor permit. However due to the permit being quite small it slipped underneath the black area of my windscreen and thus was quite hard to see. I then received a ticket from Vehicle control services for a sum of £60. Being a student I thought this was ridiculous and unfair as I had made a simple mistake and I did have a permit all be it difficult to see. I was driving my brothers car at the time. I was advised by a few people to just ignore it as they are people who just try and take as much money off people as possible and so after researching online I decided to save my money and not pay. I then received a lot of threatening letters directed at my brother who is the registered keeper of the car. I received the ticket at the start of April 2016. After receiving quite a few letters I decided to email them in August hoping they would understand the situation and forgive the parking charge. I then received a reply completely ignoring my reasoning and instead asking me to pay in instalments to pay back the £160 I now owed. I then ignored it and didn't hear back. Now I have received a letter from BW Legal for a balance of £160, 100 for the PCN and 60 for 'initial legal costs'. I will attach the letter to this post and also attach my email I sent in august, and the reply I got in august. They are still sending it to my brother even though I told them in the email that he wasn't driving at the time. My brother is now quite worried as they mentioned a CCJ. My thoughts are to carry on ignoring them as I have no intention of paying them £160! What is the advice in this situation? My only worry is I don't think I have a leg to stand on as they do have signs everywhere in the car park? Thank you so much for any help in advance!

-

Hello I parked my car at the Peel Centre in Stockport on 18/06/2015 without realising I had to pay to do so. On 29/06/2015 Excel Parking sent me a parking charge notice saying I had to pay them 60 pounds for breaching the car park's terms and conditions by not paying. I smelled a rat, Googled Excel Parking and found lots of evidence to suggest they are opportunists who should be ignored. So I duly ignored them. Since that first letter I have had another letter from Excel, and about four letters from Rossendales Collect. All ignored. When I got a letter from BW legal dated 3 March 2016 I took notice as they threatened me with a CCJ unless I paid a new figure of 154 pounds. After visiting this excellent site I was reassured that the letter should be ignored like all the others. However, I've just had a second letter from BW legal in which they cite the ParkingEye Limited v Beavis [2015] UKSC 67 case, stating: "...the Supreme Court held that parking charges serve a legitimate commercial interest and are neither extravagant nor unconscionable. This case eliminates the main defence that you will have should the matter go to court and will be relied upon by Excel in any County Court proceedings." This has me rattled. I thought we could ignore all these threats because the case would never stand up in court, but it seems it does. Any advice would be gratefully received here. Thanks.

- 68 replies

-

- beavis case

- bw legal

-

(and 1 more)

Tagged with:

-

Evening everyone, Looking for peace of mind and advice on whether to send a short, firm letter back or continue ignoring. I received a ticket in February 2014. I had purchased a 24 hour ticket from 15:24 - 15:24 for £1.50 but received a ticket at 08:21 the following morning (Still have original ticket). As I have done successfully in the past I continued to ignore the letters. Received around 6 letters over the course of the next 12-18 months but then they stopped. Around a month ago I received my first letter from 'BW Legal'. They have now sent a final notice letter as mentioned by others in the forum asking for £154. Shall I continue to ignore this or send a response? Anybody had any dealings with these beyond the final notice? Am I likely to receive a court order? Thanks guys, really appreciate any responses I receive.

-

Hi everyone, We paid to park for two hours at Gosforth Shopping Centre in Newcastle on 28/03/15 , were literally about 4 minutes late back to the car as the little one needed the toilet at the last minute before leaving a party, and caught the Excel Parking Inspector ticketing the car (he refused to let it go, obviously). Got the usual letters which we ignored without acknowledging or appealing (Following outdated advice, our fault I know). We thought they'd given up, recently had a couple of letters from BW Legal demanding £154, the Final Letter threatening county court action, we have to assume at this point they're serious. Not sure about the best course of action here, I've put together a letter to the landowner, any advice would be great on contents or alternatives. The 'each component' section in bold is my own addition to the advice I've picked up through browsing forums, though not sure if it's inadvisable for any reason? 14 June 2016 Dear Sir/Madam, In response to a letter threatening legal action from BW Legal regarding the above reference, dated 6 June 2016, acting on behalf of Excel Parking Services, who claim in turn to be acting on your behalf: I do not believe I owe your company, or Excel Parking Services, any money. Firstly, can you please confirm that you have given authority to Excel Parking Services to act on your behalf in the administration of your car park, and to pursue legal action against your customers, by providing me with a copy of the contract between landowner and client that assigns the right to enter into contracts with the public. If Excel Parking Services are acting on your behalf, before I can consider your demand can you also please provide me with a reference number for the planning permission for Excel Parking Service’s signage and ticket machines at the site in question. Can you also please provide me with a breakdown of the figures you are demanding and an explanation as to how the sum claimed represents your respective administrative costs and/or losses incurred by the claimed infraction. Further, can you please provide an explanation as to why you consider me liable and responsible to pay each component of your claimed costs. Can you please provide me with the above information before any claim is sent to the courts on your behalf, or within 14days, whichever is the sooner. If you can provide me with the requested information, I may be willing to consider your demand. I will send a copy of this letter to Excel Parking Services and BW Legal and await your reply. Yours faithfully,

-

Hi All, I need some advice please on how to deal with this: I received a PCN for overstaying in Manchester on July 22 2015, it was left on my window. I ignored it waiting for the NTK to arrive but it never did. I then started to receive several letters from Rossendale Collects, the last one to arrive was mid/end November 2015. Last week I received 2 letters in the same envelope. The first was from VCS Ltd saying the 'account balance' has been sent to BW Legal and to contact them about the charge. The second letter from BW states they will 'take our clients instructions to commence legal proceedings against you in the form of a county court claim form in the county court'. It seems really odd that 2 separate organisations would use the same envelope, maybe a way of cutting down on costs maybe? Is this something I can file under 'trash' or do I need to contact POPLA? Or has that window of opportunity closed? To be clear, I have never corresponded with any of this companies. Any help would be gratefully received. Many thanks!

-

Hi, firstly thanks for reading my post. The reason for urgency is that today I received a letter giving me 7 days to reply. It is dated 1st May, today is the 8th! Lowells/ BW Legal originally tried to get money from me and I sent them the official template letter saying 'prove it'. They ran out of time. They have now started something different saying 'Notice of allocation to the Small Claims Track'. I am required by the court to complete Directions Questionnaire regarding settlement/Mediation. They have included in their letter a copy of my alleged Littlewoods account statement. And a credit agreement that is UNSIGNED!!! They STILL have not proved that I owe this debt. (The questionnaire also asks if I believe the small claims track is the appropriate track, if that is of any help) I need to email today. (its too late to post to court). If it helps here is some further information: -I last submitted my online defence on 3rd March 2015. They did not comply. No signed copy of agreement, no proof of debt being sold etc -There was no further contact between us until 8th April. -They are attempting to mediate. I don't know whether I should to the hearing or mediation or reject the small claims track attempt. I don't know what to put on the form Please help me! Thank you

-

Hi all, Very new to this forum but have read dozens of the threads and hope I have followed the correct protocol. I have sent a CCA Request to the claimant and BW Legal, no response yet I have sent a CPR31.14 request to the solicitor named on the claim no response yet I have done the AOS via the online portal stating I will be defending all of the claim. ************************************** Name of the Claimant ? Lowell Portfolio 1 LTD Date of issue – 15th Jan 2015 What is the claim for – the reason they have issued the claim? The claimant’s claim is for the sum of £1648.00 being monies due from the Defendants to the Claimant under a Home Shopping agreement regulated by the Consumer Credit Act 1974 between the defendant and JD Williams & Company limited under account Wxxxxxx and assigned to the Claimant on 04/01/2013 notice of which has been given to the defendant. The Defendant failed to maintain the contractual payment under the terms of the agreement and a default notice has been served and not complied with. The claim also includes statutory interest pursuant to section 69 of the county courts Act 1984 at a rate of 8.00% per annum (a daily rate of 0.30 from the date of assignment of the agreement to 04/01/2014 being an amount of £109.80 What is the value of the claim? Amount claimed 1498.00 Court Fees 70.00 Solicitor’s costs 80.00 Total amount 1648.00 Is the claim for a current account or credit/loan account or mobile phone account? Home shopping Catalogue When did you enter into the original agreement before or after 2007? 01/07/2002 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Lowell Were you aware the account had been assigned – did you receive a Notice of Assignment? NO Did you receive a Default Notice from the original creditor? Not Sure but probably Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? NO Why did you cease payments? Account dispute, erroneous charges added for items not received What was the date of your last payment? December 2009 Was there a dispute with the original creditor that remains unresolved? Yes Did you communicate any financial problems to the original creditor and make any attempt to enter into a dept management plan? NO Background An “account” was set up over the internet in 2002, no CCA was ever received or signed by myself. The account was operated frequently for a period of 7 years with no issue, with the credit limit increasing over this time to £3,500. In Dec 2009, ordered items failed to be delivered, Fashion World failed to accept this despite there being no proof of delivery. At the time Fashion world used HDNL as their couriers who were well know to misplace parcels and leave them on door steps etc. Months of arguing perused, with me refusing to make any further payments until the errors on the account were corrected. Lots of threatening letters and harassment phone calls over most of 2010, resulting in me having to change our phone number. Throughout this I maintained if the account was corrected I would recommence the payments. Balance at this point was around £500. Eventually letters stopped. In early 2012, as a result of having a credit application refused, I checked my Experian credit file. It was at this point I found out that Fashion World had marked a default on my file on Dec 2012. At this point I became aware that the dept may be unenforceable due to the manner that the account had been set up. I wrote to again to Fashion World advising them that despite my believing the dept to be unenforceable, I was prepared to pay off the original amount on the proviso that they removed all record of the default from my credit file. I also at this point requested a copy of my agreement. This letter was not responded to. No other correspondence was received in relation to this account until I got the Court Claim on 20th Jan 2015 followed by a letter the next day (dated 19/01/15) from BW Legal advising “we have now issued legal proceedings”. I understand that I now have until 16/02/15 to submit my defence, which is where I need some help. From what I have read, I believe the agreement was not properly executed so cannot be enforced through the courts. Is this correct and if so what parts of the law should I be citing in the defence. Would it also benefit to state that the assignment had occurred whilst the account was in dispute or would that be acknowledging validity of the agreement. Any Help would be appreciated, Thanks

- 19 replies

-

- bw legal

- fashion world

-

(and 3 more)

Tagged with:

-

Late last year those nice people (touch of irony there) at BW Legal began to chase me, on behalf of my friends at Lowell, for what they claimed was outstanding charges from a mobile broadband account - I won't bore with the details. I asked, by e-mail, for lots of information - they didn't respond as I refused to speak to them. Then in January they issued a claim for just over £200 plus costs. I immediately made a faxed request for further information (no reply). As I couldn't be bothered with the hassle of drafting a defence I made a generous and without prejudice offer - on the basis of no admissions of anything (no reply) so I filed a properly argued IGNM five page defence. I also faxed it to BW and sent them a pdf of the fax by e-mail (no reply). I had the letter from the court telling me that if they claimant didn't do anything in 28 days that the claim would be stayed. Guess what nothing happened and the claimant did nothing. Then today I get a call from our heroes at BW Legal asking me what is happening on the claim??? Well...I was sort of waiting to hear from them Is it me or are they a tad annoying...

-

First of all I have read a similar thread about this but I thought it best to start a new topic for my experience. Received the letter last Saturday (22nd Feb) it reads: ------- The Claimant's Claim is for the sum of 708.11 being monies due from the Defendant to the Claimant under a non-regulated Communications agreement between the Defendant and Vodafone Limited under account reference ********** and assigned to the Claimant on 31/03/2013 notice of which has been given to the Defendant. The Defendant failed to maintain the contractual payment under the terms of the agreement and a default notice has been served and not complied with. The claim also includes statutory interest pursuant to section 69 of the County Courts Act 1984 at a rate of 8.00% per annum (a daily rate 0.35 from the date of assignment of the agreement to the date of issue (17/02/2014) being an amount of 38.88. --------- The history is that I did have an account with Vodafone but I told them verbally that I wanted to end the contract due to poor service signal in my area. I paid the first 3 months prior to this. I can't remember exactly what happened next, I did stop using the phone. They continued to bill me which I just kept ignoring (In Hindsight this was a poor thing to do) So they passed it onto Lowell. I spoke to lowell on one occasion telling them the story above but they didn't seem interested & were demanding money. I ended up putting the phone down on them. They continued to harrass me by phone for the next 11 months, each time I ignored them saying it wasn't me. I was hoping the problem would go away which again in hindsight was a stupid thing to do. So if you were me what would you do? I have absolutely no defence by way of letters, so is it worth defending or not? Thanks in anticipation.

-

Hi everyone, I'm a new member and can I start by saying what a great job I think you all do on this site. I have gleaned some invaluable information in the past for other matters, and have gained some good information for this matter as well from other threads. Unfortunately cannot find a situation that exactly matches mine, but please bear with me if the info I'm asking for has already been covered elsewhere. Arrived home from a week away on business this morning to find a County Court Claim Form (Northampton CCBC) with the issue date 24/01/14. By my reckoning, that gives me just a couple of days to decide what I'm going to do and acknowledge. The Claimant is Lowell Portfolio, via BW Legal solicitors, and the claim is for an old Telefonica O2 mobile phone contract I had some years ago (2008 or 2009), and is for over £2000(!). The history of the debt is that I had been with O2 for around 5 years when I received a bill of approx £800 one month, where my usual monthly bill was in the region of £35. I obviously called O2 at the time and was told it was due to excessive use of premium rate and long distance numbers, which I assured them I had not used. Anyway, they refused to reduce the bill or look at spurious charges, and I refused to pay the bill under those circumstances until they got back to me. Unfortunately that entire conversation was by telephone, and I never followed it up in writing. To add to the vagueness of my situation, I was in the process of being made redundant at the time and had so many other things to worry about, so over the course of the next year or so I just forgot about the O2 contract - which had been cut off after non payment of that bill anyway. Adding to this, I had to move back to the family home after the redundancy, and have moved a couple of times since, so I have absolutely no idea where any of the original paperwork would be for the contract or the renewals, or any of the statements/bills for that period. Due to everything that was going on at the time, I cannot even remember exactly when it happened, but it would have been late 2008 or early 2009 at the latest. The figure of £800 (approx) is something that sticks in my mind though from the bill in question, so I'm unsure why the claim is now for over £2000 - even taking into account the added fees on the claim. Anyway, I'm in need of some extensive advice please on this matter, as I have to admit I have very little knowledge at all of any of the processes or available options involved here, and I think most of the threads I've read seem to deal more with credit agreements rather anything like this. Is it worth even defending the claim as I have such sketchy recollection of it and no paperwork? Or is it worth contacting Lowells at all with a view to a settlement? And if I decide to defend it, what should my next actions be after acknowledging (ie which letters to send etc.)? I really hate to admit to such ignorance, but as much help and advice anyone is able to give will be greatly appreciated. If you use small words and speak slowly, I should just about get it . I have attached a scanned copy of the claim form (personal details removed) to this post, to show exact wording etc. Thanks to anyone who has ploughed through this, and thanks in advance for your help. [ATTACH=CONFIG]49178[/ATTACH]

- 9 replies

-

- bw legal

- ccbc claim form

-

(and 2 more)

Tagged with:

-

Hi all, I need some advice. I have sent letters plus £1 postal orders to ask my creditors for a copy of your credit agreement under the Consumer Credit Act 1974. 2 letters to Capquest who have taking CCJs against me and 1 to BW Legal who have threatened to force me into bankruptcy/CO. The Recorded letters were signed for on the 22/10/2013 by Capquest and BW. I had a reply from BW Legal on the 31/10/13 and from Capquest on the 24/10/ 13. Both saying they're referring my request to the original creditors? So this means that they don't have the signed contracts? From Monday the (11th Nov 13) it will be 21 days and I have not had these credit agreements. What is my next step? Thanks Jez

- 19 replies

-

I have relatively no experience with dealing with these type of affairs so i would like to humbly ask those with more experience to check if I'm doing this correctly. I received a Statutory demand from BW legal, which was served personally by a woman who came to my door, explaining that she didnt know what was in the envelope that she gave me. It turned out to be a statutory demand. Following the advice on this forum, i went to my local court yesterday and submitted an application to have the demand set aside. I am now waiting for the court to contact me. In 2012, i submitted a CCA letter and a £1 to Westcot Credit services asking for all the documentation, they replied stating that the £1 be made payable to the creditor HBOS. I subsequently replied with another £1 made payable to HBOS. No reply was received so i sent a reminder. 2 months later i wrote again by recorded and sign for mail, this time stating a CCA non compliance letter. I heard nothing after that. This year in June 2013 it appears that Lowells Portfolio 1 and BW legal (who i think are the same company) have purchased the alleged debt from HBOS, which i believe is not allowed as the debt was in dispute? I have applied to the court to set aside the statutory demand and given copies of all the correspondence given to the original creditor HBOS and their DCA Westcot. Have i done everything right and is there anything else that i need to do? My apologies for coming across as a noob, but the truth is I am

-

Hello Guys, I am new toi CAG but I have been servered with SD just yesterday by PS on behalf of BW Legal/Lowell. They are calims I owe them a debt of over 10k from two HBOS credit card debts (combined). I use the HBOS card is the past but not any more and as far as I can remenber have paid all the balance has all been paid but they are claiming the is a debt and I am in default so they have now bought the debt from HBOS and demanding a claims asap as they will bunkrupt me and sell my house. to make sure they have proof of the debt.I dont think I owe them any debt and have told in writting via the CCA that I am in dispute of their claim. Now I have 18 days to set aside the SD and need help from you guys. I have been told there good advisers on this CAG forum so please help. I need to write a witness statement to dispute the claims before the dealine but I have not done one before. Do I need A lawyer to do this for me ? thanks guys if can help.

- 23 replies

-

Hi everyone, I could really do with getting some help. I've spent the best part of the last 24 hours reading various different threads on this forum about Statutory Demands and now my head is spinning, so thought it would be best to see if I could get some advise based on my exact situation. The SD was hand-delivered to my house yesterday. It relates to a loan that was apparantly held with HBOS PLC thatwasi took out about 7 years ago. The default date on the letter is January 2008 (apologies in advance as I left the document at home so don't have the exact dates but can get these later) but I am pretty confident that I would not have made a payment for about 6 months before the debt defaulted - I had my Daughter in March 2007, which is when my payment issues started. I don't have any paperwork relating to the inital debt and I have moved house 3 times since, if I ring HBOS would they be able to confirm information to me still or would I have to request this for through Lowells/BW Legal? I understand I need to contact Lowells to let them know that it's my intention to dispute their demand, what information do I need to put in there? Is it sufficient to say that I belive the last payment was made more than 6 years ago? Do I also need to send something to the court as well? Apologies if these questions have been asked on multiple occasions before, and thank you in advance for any help that you can provide me with.

-

Hi I was out today and a friend was looking after the house. He had a knock on the door from 2 people in a BMW who asked for me. He was suspicious and said he had no idea who I was. they went away then 2 mins later posted a hand written envelope through the door. I opened on my return to find a Statatory demand from BW Legal on behalf of Lowell threatening bankruptcy. The debt is for just over 4k with SAV credit and states a default date of early 2008. I have not contacted Lowell or BW Legal at any point and am unsure who SAV credit are. I was paying a CC payment to MBNA that year but the number does not correspond with my account number. I do recall having a Marbles card, but I have gone through all my bank statement as far as 2006 and no payment has been made to them in this time. I did ignore the letters which wasn't clever as I assumed the lowells letter was regarding a CC debt with another provided that CCj'd me for even though they never had direct contact with me. What can I do?

-

I received a statutory demand from BW legal in February 2013 that was posted through my door. They said in the letter that they had tried to serve the demand on a few occasions but I was not in so they pushed it through my door. Based on the advice I read on this forum I decided to try and have it set aside based on the following reasons: 1. The claimant had failed to provide a copy of the original agreement. 2. The claimant had failed to provide copies of any valid default notices. 3. The claimant had failed to serve a Notice of Assignment. 4. The claimant had failed to provide any statements for the duration of the disputed agreement. I also sent a CPR 31.14 Request to BW Legal, SAR to MBNA and a CCA to The Lowell Group. I attended court in March and the Judge decided to allow BW legal a further 28 days to get the paper work together to assist in their case. The 28 days went by and BW Legal had not provided the court or me with the paper work ( any of the 4 points above). I sent a letter to the court making them aware that BW legal had failed to comply with the order and requested the matter to be set aside. A week later I got a letter from the court stating that BW Legal had another 7 days to get the paper work over to me or the case would be closed. On the seventh day the paper work arrived with their new witness statement. They have sent me a copy of an agreement that looks like it could be for anything, it has my name and address on it but I have not signed it and it does not say exactly what it is for. It gives financial info etc. How would I know if this is a genuine agreement and if it’s acceptable? They have also sent what they say is a Notice of Assignment, I’m not sure if and how I know if this is a true and acceptable Notice of Assignment? They have send several copies of letters stating that I owe them money and I can get the amount reduced if I make them an offer. They have sent statements over a 5 year period but a lot are missing, one full years statements are missing and a few months are missing from most of the other years so it’s impossible to see how I have come to owe this exact amount as the expenditure is missing! These is also a lot of interest and late payment charges. Please can anyone help me as I have to respond with my second witness statement this week. What should I do now? Many thanks

- 30 replies

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.