Showing results for tags 'april'.

-

Here are the current court fees which take effect from today 22nd April 2014. http://hmctsformfinder.justice.gov.uk/courtfinder/forms/ex050-eng.pdf http://www.consumeractiongroup.co.uk/forum/showthread.php?421493-Court-fees-increase-from-22nd-April-2014 http://www.legislation.gov.uk/ukdsi/2015/9780111127490

-

I wonder if someone can help me. My car has been in the garage since April 2016. I have been given all different dates when it will be ready. I have whatsapp messages to say it would be ready in February this year. Let me explain because I really need to understand what my legal right is as I though garages had to carry out repair within a reasonable period of time. In April last year my BMW 325i broke down. I was told it was the head block. At first I tried with no success to find a head block and then decided to opt for a part worn engine. I ordered the engine but unfortunately they sent the wrong one which caused delays. However a head block became available in August 2017. Since this time I was told that they had to await pistons. I threatened to take the car back in February but was told that I would need to pay for the work that had already been carried out and they have ridiculous excuses. I have left my car with them but up to today my car is still not ready, they have caused extensive dents in the car which they said they would repair. However it has been well over a year and I am still without my car. Can anyone tell me what my legal position is. I have already paid them £500 up front. Mark

-

This has been kept pretty quiet, hasn't it?) Based on vehicle emissions there is a 3 tier band with the zero emissions paying nothing and the highest paying... lots! https://www.saga.co.uk/magazine/motoring/cars/using/2016/ved-car-tax-changes-2017

-

Hi all, I'm on a similar path to a lot of posters on the site - having received a PCN back in April 2011, which was ignored as well as the various red letters that followed, I was surprised yesterday (3rd Dec) to receive the recovery letter from BW Legal. It was a notification that 'your account has been passed to our legal team', usual £120 PCN + fees of £54. This one was for Gallowgate, Strawberry Place, Newcastle upon Tyne. I have read a lot of posts and much appreciate the advice, takes the worry away, but just to confirm, what do I do now? Ignore pending further letters or write back with the simple letter along the lines of: "Dear Sir/Madam Your Ref: **** I refer to your letter dated ***. I have no intention of paying the money demanded by your client and any court proceedings will be vigorously defended. You should note that this charge is disputed and you must now refer this matter back to your client and cease and desist all contact with me. I will not respond to any further communication on this unless it comes from a court. I trust I have made myself clear. Yours faithfully" Obviously the 6 years statute of limitations will arrive next April 2017, and as it is pre POFA per other posts part of me would love the chance of a day in court. But confirmation of next steps would be much appreciated. PS - I moved house a few years back yet the letter has come to my new address. From reading other posts about default CCJs and old addresses I suppose I should be pleased it has? Thanks

-

Hi there folks, just wondering about the upcoming change to the ESA WRAG group from April this year. As you know I am in N Ireland, been in the WRAG group since June 2013, no reassessment in all that time and only one WFI in more than three years. As I understand, the new rules only apply to new claims after April 2017, or are they likely to move the goalposts again, you just don't know with this government.

-

I have discovered that ALL new televisions sold by Tesco in April 2014 were on a special promotion for the world cup. As such they were all sold with a free 5 year warranty with square trade. So, if you have a TV from Tesco that has packed up, check your purchase date carefully. It does not matter if you have the receipt still if you paid by card they can confirm the purchase date as long as you can say which store and the date purchased. I hope this helps at least one person out!

-

I took out a Unsecured Personal Loan with Halifax online in December 2011. I was NEVER asked questions like, can you afford the payments, are you employed/unemployed, and I certainly was not asked about my income. This have got so bad I am currently on an IVA - Halifax increased the IVA from 5 years to 6 years forcing me to pay for longer. I am now wondering if bankruptcy is the best option. Do I have a claim that Halifax lent to me irresponsibly without going through my finances first?

- 217 replies

-

- 2007

- adjudicator

-

(and 45 more)

Tagged with:

- 2007

- adjudicator

- agency

- agreement

- agreements

- april

- cca

- collection

- complied

- disappeared

- dispute

- don

- enforceable

- evidence

- financial

- found

- halifax

- harassed

- has

- incorrect

- irresponsible

- lending

- letters

- limited

- moorcrof

- ombudsman

- personal

- recovery

- reply

- response

- rossendales

- say

- section

- service

- shows

- sign

- space

- stance

- still

- stitched

- template

- unaffordable

- unenforceable

- was

- waste

- whats

- write

-

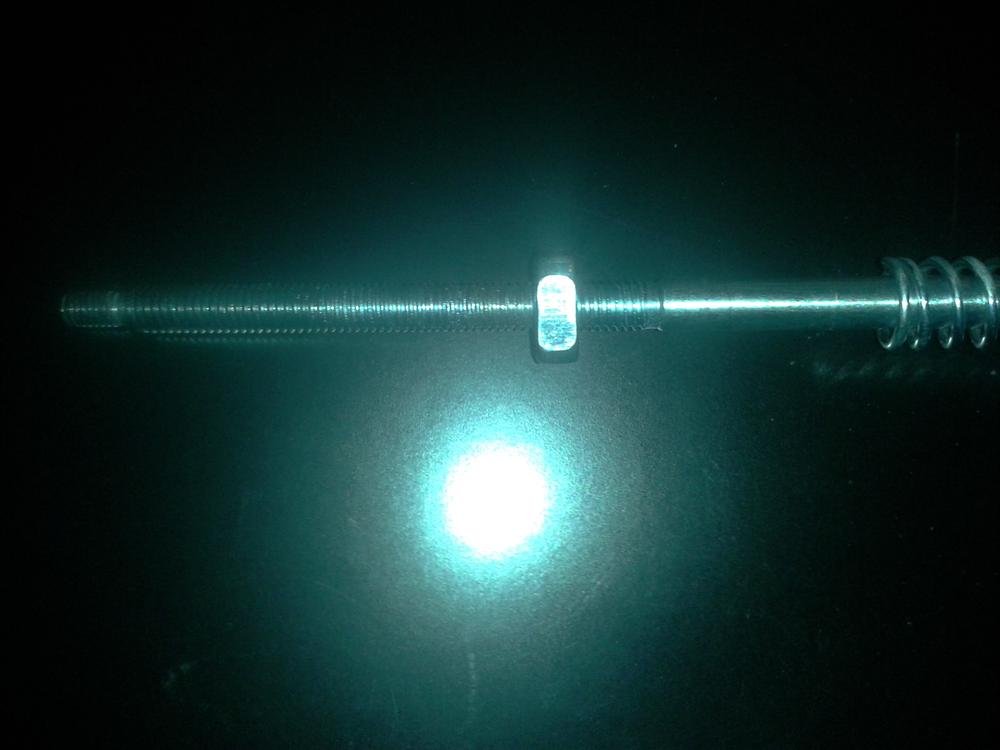

Hi all, I bought an exercise bike last April online from Amazon using a 3rd party seller. The braking system has developed a fault which means now the bike is useless as pressure can no longer be applied to the spinning wheel using the friction pad. I have unscrewed the braking system today, it is an extremely simple mechanism using a bolt and a nut and a couple of springs. I have discovered that the nut that screws onto the bolt which you turn to control the tension is slipping which means that no pressure can be put upon the brake pad. Here is a vid I have made today showing the nut slipping along the bolt which clearly shouldn't be the case:- sendvid.com/d459adnc And a pic showing the nut and bolt:- I am currently awaiting reply from the comapany after sending them the video this morning. So the question is am I protected by any consumer law? as I believe this to be a manufacturing defect as in my eyes a metal nut and bolt should not become loose like that in such a short amount of time with. Thanks

-

It is easier to read it here:- http://www.legislation.gov.uk/uksi/2014/874/made “SCHEDULE 1Fees to be taken Column 1 Number and description of fee Column 2 Amount of fee (a) The CPR is defined in the Civil Proceedings Fees Order 2008 S.I. 2008/1053 as meaning the Civil Procedure Rules 1998. (b) 1974 c.47 as amended by section 177 and Part 1 of Schedule 16 of the Legal Services Act 2007 (c. 29). © 1985 c. 6. (d) 2006 c. 46. (e) 1986 c. 45. (f) Schedule B1 to the Insolvency Act 1986 was inserted by the Enterprise Act 2002 (c.40) section 248(2) and Schedule 12. (g) Schedule A1 to the Insolvency Act 1986 was inserted by the Insolvency Act 2000 (c.39) section 1, Schedule 1, paragraphs 1 and 4. (h) 2012 c. 10. (i) S.I .1993/2073 as amended by S.I 2001/1386. (j) 1878 c.31. (k) 1882 c.43. (l) 1996. c.23.” 1 Starting proceedings (High Court and County Court) 1.1 On starting proceedings (including proceedings issued after permission to issue is granted but excluding CCBC cases brought by Centre users or cases brought by Money Claim OnLine users) to recover a sum of money where the sum claimed: (a) does not exceed £300; £35 (b) exceeds £300 but does not exceed £500; £50 © exceeds £500 but does not exceed £1,000; £70 (d) exceeds £1,000 but does not exceed £1,500; £80 (e) exceeds £1,500 but does not exceed £3,000; £115 (f) exceeds £3,000 but does not exceed £5,000; £205 (g) exceeds £5,000 but does not exceed £15,000; £455 (h) exceeds £15,000 but does not exceed £50,000; £610 (i) exceeds £50,000 but does not exceed £100,000; £910 (j) exceeds £100,000 but does not exceed £150,000; £1,115 (k) exceeds £150,000 but does not exceed £200,000; £1,315 (l) exceeds £200,000 but does not exceed £250,000; £1,515 (m) exceeds £250,000 but does not exceed £300,000; £1,720 (n) exceeds £300,000 or is not limited. £1,920 1.2 On starting proceedings to recover a sum of money in CCBC cases brought by Centre users, where the sum claimed: (a) does not exceed £300; £25 (b) exceeds £300 but does not exceed £500; £35 © exceeds £500 but does not exceed £1,000; £60 (d) exceeds £1,000 but does not exceed £1,500; £70 (e) exceeds £1,500 but does not exceed £3,000; £105 (f) exceeds £3,000 but does not exceed £5,000; £185 (g) exceeds £5,000 but does not exceed £15,000; £410 (h) exceeds £15,000 but does not exceed £50,000; £550 (i) exceeds £50,000 but does not exceed £100,000. £815 1.3 On starting proceedings to recover a sum of money brought by Money Claim OnLine users where the sum claimed: (a) does not exceed £300; £25 (b) exceeds £300 but does not exceed £500; £35 © exceeds £500 but does not exceed £1,000; £60 (d) exceeds £1,000 but does not exceed £1,500; £70 (e) exceeds £1,500 but does not exceed £3,000; £105 (f) exceeds £3,000 but does not exceed £5,000; £185 (g) exceeds £5,000 but does not exceed £15,000; £410 (h) exceeds £15,000 but does not exceed £50,000; £550 (i) exceeds £50,000 but does not exceed £100,000. £815 Fees 1.1, 1.2 and 1.3. Where the claimant is making a claim for interest on a specified sum of money, the amount on which the fee is calculated is the total amount of the claim and the interest. 1.4 On starting proceedings for the recovery of land: (a) in the High Court; £480 (b) in the County Court, other than where fee 1.4© applies; £280 © using the Possession Claims Online website. £250 1.5 On starting proceedings for any other remedy (including proceedings issued after permission to issue is granted): in the High Court; £480 in the County Court. £280 Fees 1.1, 1.4 and 1.5. Recovery of land or goods. Where a claim for money is additional or alternative to a claim for recovery of land or goods, only fee 1.4 or 1.5 is payable. Fees 1.1 and 1.5. Claims other than recovery of land or goods. Where a claim for money is additional to a non money claim (other than a claim for recovery of land or goods), then fee 1.1 is payable in addition to fee 1.5. Where a claim for money is alternative to a non money claim (other than a claim for recovery of land or goods), only fee 1.1 is payable in the High Court, and, in the County Court, whichever is greater of fee 1.1 or fee 1.5 is payable. Fees 1.1 and 1.5. Where more than one non money claim is made in the same proceedings, fee 1.5 is payable once only, in addition to any fee which may be payable under fee 1.1. Fees 1.1 and 1.5 are not payable where fee 1.8(b), fee 1.9(a), fee 3 or fee 10.1 applies. Fees 1.1 and 1.5. Amendment of claim or counterclaim. Where the claim or counterclaim is amended, and the fee paid before amendment is less than that which would have been payable if the document, as amended, had been so drawn in the first instance, the party amending the document must pay the difference. 1.6 On the filing of proceedings against a party or parties not named in the proceedings. £50 Fee 1.6 is payable by a defendant who adds or substitutes a party or parties to the proceedings or by a claimant who adds or substitutes a defendant or defendants. 1.7 On the filing of a counterclaim. The same fee as if the remedy sought were the subject of separate proceedings No fee is payable on a counterclaim which a defendant is required to make under rule 57.8 of the CPR(a) (requirement to serve a counterclaim if a defendant makes a claim or seeks a remedy in relation to a grant of probate of a will, or letters of administration of an estate, of a deceased person). 1.8(a) On an application for permission to issue proceedings. £50 (b) On an application for an order under Part 3 of the Solicitors Act 1974(b) for the assessment of costs payable to a solicitor by a client or on starting costs-only proceedings. £50 1.9(a) For permission to apply for judicial review. £140 1.9(b) On request to reconsider at a hearing a decision on permission £350 Where fee 1.9(b) has been paid and permission has been granted at a hearing, the amount payable under fee 1.9© is £350. Where the court has made an order giving permission to proceed with a claim for judicial review, there is payable by the claimant within 7 days of service on the claimant of that order: 1.9© if the judicial review procedure has been started. £700 1.9(d) if the claim for judicial review was started otherwise than by using the judicial review procedure. £140 2 General Fees (High Court and County Court) 2.1 On the claimant filing a pre-trial check list (listing questionnaire); or where the court fixes the trial date or trial week without the need for a pre-trial check list; or where the claim is on the small claims track, within 14 days of the date of despatch of the notice (or the date when oral notice is given if no written notice is given) of the trial week or the trial date if no trial week is fixed a fee payable for the hearing of: (a) a case on the multi-track; £1,090 (b) a case on the fast track; £545 © a case on the small claims track where the sum claimed: (i) does not exceed £300; £25 (ii) exceeds £300 but does not exceed £500; £55 (iii) exceeds £500 but does not exceed £1,000; £80 (iv) exceeds £1,000 but does not exceed £1,500; £115 (v) exceeds £1,500 but does not exceed £3,000; £170 (vi) exceeds £3,000. £335 Fee 2.1 is payable by the claimant except where the action is proceeding on the counterclaim alone, when it is payable by the defendant: or within 14 days of the date of despatch of the notice (or the date when oral notice is given if no written notice is given) of the trial week or the trial date if no trial week is fixed. Where a case is on the multi-track or fast track and, after a hearing date has been fixed, the court receives notice in writing from the party who paid the hearing fee that the case has been settled or discontinued then the following percentages of the hearing fee will be refunded: (i) 100% if the court is notified more than 28 days before the hearing; (ii) 75% if the court is notified between 15 and 28 days before the hearing; (iii) 50% if the court is notified between 7 and 14 days before the hearing. Where a case is on the small claims track and, after a hearing date has been fixed, the court receives notice in writing from the party who paid the hearing fee, at least 7 days before the date set for the hearing, that the case has been settled or discontinued the hearing fee will be refunded in full. Fee 2.1 is not payable in respect of a case where the court fixed the hearing date on the issue of the claim. 2.2 In the High Court on filing: £240 an appellant’s notice: or a respondent’s notice where the respondent is appealing or wishes to ask the appeal court to uphold the order of the lower court for reasons different from or additional to those given by the lower court. 2.3 In the County Court on filing: an appellant’s notice, or a respondent’s notice where the respondent is appealing or wishes to ask the appeal court to uphold the order of the lower court for reasons different from or additional to those given by the lower court: (a) in a claim allocated to the small claims track; £120 (b) in all other claims. £140 Fees 2.2 and 2.3 do not apply on appeals against a decision made in detailed assessment proceedings. 2.4 On an application on notice where no other fee is specified. £155 2.5 On an application by consent or without notice where no other fee is specified. £50 For the purpose of fee 2.5 a request for a judgment or order on admission or in default does not constitute an application and no fee is payable. Fee 2.5 is not payable in relation to an application by consent for an adjournment of a hearing where the application is received by the court at least 14 days before the date set for that hearing. Fees 2.4 and 2.5 are not payable when an application is made in an appeal notice or is filed at the same time as an appeal notice. 2.6 On an application for a summons or order for a witness to attend court to be examined on oath or an order for evidence to be taken by deposition, other than an application for which fee 7.2 or 8.3 is payable. £50 2.7 On an application to vary a judgment or suspend enforcement, including an application to suspend a warrant of possession. £50 Where more than one remedy is sought in the same application only one fee is payable. 2.8 Register of judgments, orders and fines kept under section 98 of the Courts Act 2003: On a request for the issue of a certificate of satisfaction. £15 3 Companies Act 1985, Companies Act 2006 and Insolvency Act 1986 (High Court and County Court) 3.1 On entering a bankruptcy petition: (a) if presented by a debtor or the personal representative of a deceased debtor; £180 (b) if presented by a creditor or other person. £280 3.2 On entering a petition for an administration order. £280 3.3 On entering any other petition. £280 One fee only is payable where more than one petition is presented in relation to a partnership. 3.4(a) On a request for a certificate of discharge from bankruptcy; £70 (b) after the first certificate, for each copy. £10 3.5 On an application under the Companies Act 1985©, the Companies Act 2006(d) or the Insolvency Act 1986(e) other than one brought by petition and where no other fee is specified. £160 Fee 3.5 is not payable where the application is made in existing proceedings. 3.6 On an application for the conversion of a voluntary arrangement into a winding up or bankruptcy under Article 37 of Council Regulation (EC) No 1346/2000. £160 3.7 On an application, for the purposes of Council Regulation (EC) No 1346/2000, for an order confirming creditors’ voluntary winding up (where the company has passed a resolution for voluntary winding up, and no declaration under section 89 of the Insolvency Act 1986 has been made). £50 3.8 On filing: £50 a notice of intention to appoint an administrator under paragraph 14 of Schedule B1 to the Insolvency Act 1986(f) or in accordance with paragraph 27 of that Schedule; or a notice of appointment of an administrator in accordance with paragraphs 18 or 29 of that Schedule. Where a person pays fee 3.8 on filing a notice of intention to appoint an administrator, no fee is payable on that same person filing a notice of appointment of that administrator. 3.9 On submitting a nominee’s report under section 2(2) of the Insolvency Act 1986. £50 3.10 On filing documents in accordance with paragraph 7(1) of Schedule A1(g) to the Insolvency Act 1986. £50 3.11 On an application by consent or without notice within existing proceedings where no other fee is specified. £50 3.12 On an application with notice within existing proceedings where no other fee is specified. £155 3.13 On a search in person of the bankruptcy and companies records, in the County Court. £45 Requests and applications with no fee: No fee is payable on a request or on an application to the Court by the Official Receiver when applying only in the capacity of Official Receiver to the case (and not as trustee or liquidator), or on an application to set aside a statutory demand. 4 Copy Documents (Court of Appeal, High Court and County Court) 4.1 On a request for a copy of a document (other than where fee 4.2 applies): (a) for ten pages or less; £10 (b) for each subsequent page. 50p Note: The fee payable under fee 4.1 includes: where the court allows a party to fax to the court for the use of that party a document that has not been requested by the court and is not intended to be placed on the court file; where a party requests that the court fax a copy of a document from the court file; and where the court provides a subsequent copy of a document which it has previously provided. 4.2 On a request for a copy of a document on a computer disk or in other electronic form, for each such copy. £10 5 Determination of costs (Senior Court and County Court) Fee 5 does not apply to the determination in the Senior Courts of costs incurred in the Court of Protection. 5.1 On the filing of a request for detailed assessment where the party filing the request is legally aided, is funded by the Legal Aid Agency or is a person for whom civil legal services have been made available under arrangements made by the Lord Chancellor under Part 1 of the Legal Aid, Sentencing and Punishment of Offenders Act 2012(h) and no other party is ordered to pay the costs of the proceedings. £200 5.2 On the filing of a request for detailed assessment in any case where fee 5.1 does not apply; or on the filing of a request for a hearing date for the assessment of costs payable to a solicitor by a client pursuant to an order under Part 3 of the Solicitors Act 1974 where the amount of the costs claimed: (a) does not exceed £15,000; £335 (b) exceeds £15,000 but does not exceed £50,000; £675 © exceeds £50,000 but does not exceed £100,000; £1,005 (d) exceeds £100,000 but does not exceed £150,000; £1,345 (e) exceeds £150,000 but does not exceed £200,000; £1,680 (f) exceeds £200,000 but does not exceed £300,000; £2,520 (g) exceeds £300,000 but does not exceed £500,000; £4,200 (h) exceeds £500,000. £5,600 Where there is a combined party and party and legal aid, or a combined party and party and Legal Aid Agency, or a combined party and party and Lord Chancellor, or a combined party and party and one or more of legal aid, Legal Aid Agency or Lord Chancellor determination of costs, fee 5.2 will be attributed proportionately to the party and party, legal aid, Legal Aid Agency or Lord Chancellor (as the case may be) portions of the bill on the basis of the amount allowed. 5.3 On a request for the issue of a default costs certificate. £60 5.4 On commencing an appeal against a decision made in detailed assessment proceedings. £210 5.5 On a request or application to set aside a default costs certificate. £110 6 Determination in the Senior Courts of costs incurred in the Court of Protection 6.1 On the filing of a request for detailed assessment: (a) where the amount of the costs to be assessed (excluding VAT and disbursements) does not exceed £3,000; £115 (b) in all other cases. £225 6.2 On an appeal against a decision made in detailed assessment proceedings. £65 6.3 On a request or application to set aside a default costs certificate. £65 7 Enforcement in the High Court 7.1 On sealing a writ of control/possession/delivery. £60 Where the recovery of a sum of money is sought in addition to a writ of possession and delivery, no further fee is payable. 7.2 On an application for an order requiring a judgment debtor or other person to attend court to provide information in connection with enforcement of a judgment or order. £50 7.3(a) On an application for a third party debt order or the appointment of a receiver by way of equitable execution. £100 (b) On an application for a charging order. £100 Fee 7.3(a) is payable in respect of each third party against whom the order is sought. Fee 7.3(b) is payable in respect of each charging order applied for. 7.4 On an application for a judgment summons. £100 7.5 On a request or application to register a judgment or order, or for permission to enforce an arbitration award, or for a certificate or a certified copy of a judgment or order for use abroad. £60 8 Enforcement in the County Court 8.1 On an application for or in relation to enforcement of a judgment or order of the County Court or through the County Court, by the issue of a warrant of control against goods except a warrant to enforce payment of a fine: (a) in cases other than CCBC cases; £100 (b) in CCBC cases. £70 8.2 On a request for a further attempt at execution of a warrant at a new address following a notice of the reason for non-execution (except a further attempt following suspension and CCBC cases brought by Centre users). £30 8.3 On an application for an order requiring a judgment debtor or other person to attend court to provide information in connection with enforcement of a judgment or order. £50 8.4(a) On an application for a third party debt order or the appointment of a receiver by way of equitable execution. £100 (b) On an application for a charging order. £100 Fee 8.4(a) is payable in respect of each third party against whom the order is sought. Fee 8.4(b) is payable in respect of each charging order applied for. 8.5 On an application for a judgment summons. £100 8.6 On the issue of a warrant of possession or a warrant of delivery. £110 Where the recovery of a sum of money is sought in addition, no further fee is payable. 8.7 On an application for an attachment of earnings order (other than a consolidated attachment of earnings order) to secure payment of a judgment debt. £100 Fee 8.7 is payable for each defendant against whom an order is sought. Fee 8.7 is not payable where the attachment of earnings order is made on the hearing of a judgment summons. 8.8 On a consolidated attachment of earnings order or on an administration order. For every £1 or part of a £1 of the money paid into court in respect of debts due to creditors - 10p Fee 8.8 is calculated on any money paid into court under any order at the rate in force at the time when the order was made (or, where the order has been amended, at the time of the last amendment before the date of payment). 8.9 On an application for the enforcement of an award for a sum of money or other decision made by any court, tribunal, body or person other than the High Court or the County Court. £40 8.10 On a request for an order to recover a sum that is: a specified debt within the meaning of the Enforcement of Road Traffic Debts Order 1993(i); or £7 pursuant to an enactment, treated as a specified debt for the purposes of that Order. No fee is payable on: an application for an extension of time to serve a statutory declaration or a witness statement in connection with any such order; or a request to issue a warrant of control to enforce any such order. 8A Service in the County Court 8A.1 On a request for service by a bailiff of an order to attend court for questioning. £100 9 Sale (County Court only) 9.1 For removing or taking steps to remove goods to a place of deposit. The reasonable expenses incurred Fee 9.1 is to include the reasonable expenses of feeding and caring for any animals. 9.2 For the appraisement of goods. 5p in the £1 or part of a £1 of the appraised value 9.3 For the sale of goods (including advertisements, catalogues, sale and commission and delivery of goods). 15p in the £1 or part of a £1 on the amount realised by the sale or such other sum as the district judge may consider to be justified in the circumstances 9.4 Where no sale takes place by reason of an execution being withdrawn, satisfied or stopped. (a) 10p in the £1 or part of a £1 on the value of the goods seized, the value to be the appraised value where the goods have been appraised or such other sum as the district judge may consider to be justified in the circumstances; and in addition (b) any sum payable under fee 9.1 and 9.2. FEES PAYABLE IN HIGH COURT ONLY 10 Miscellaneous proceedings or matters Bills of Sale 10.1 On filing any document under the Bills of Sale Act 1878(j) and the Bills of Sale Act (1878) Amendment Act 1882(k) or on an application under section 15 of the Bills of Sale Act 1878 for an order that a memorandum of satisfaction be written on a registered copy of the bill. £25 Searches 10.2 For an official certificate of the result of a search for each name, in any register or index held by the court; or in the Court Funds Office, for an official certificate of the result of a search of unclaimed balances for a specified period of up to 50 years. £45 10.3 On a search in person of the court’s records, including inspection, for each 15 minutes or part of 15 minutes. £10 Judge sitting as arbitrator 10.4 On the appointment of: (a) a judge of the Commercial Court as an arbitrator or umpire under section 93 of the Arbitration Act 1996(l); or £2,455 (b) a judge of the Technology and Construction Court as an arbitrator or umpire under section 93 of the Arbitration Act 1996. £2,455 10.5 For every day or part of a day (after the first day) of the hearing before: (a) a judge of the Commercial Court; or £2,455 (b) a judge of the Technology and Construction Court, so appointed as arbitrator or umpire. £2,455 Where fee 10.4 has been paid on the appointment of a judge of the Commercial Court or a judge of the Technology and Construction Court as an arbitrator or umpire but the arbitration does not proceed to a hearing or an award, the fee will be refunded. 11 Fees payable in Admiralty matters In the Admiralty Registrar and Marshal’s Office: 11.1 On the issue of a warrant for the arrest of a ship or goods. £225 11.2 On the sale of a ship or goods Subject to a minimum fee of £205: (a) for every £100 or fraction of £100 of the price up to £100,000; £1 (b) for every £100 or fraction of £100 of the price exceeding £100,000. 50p Where there is sufficient proceeds of sale in court, fee 11.2 will be payable by transfer from the proceeds of sale in court. 11.3 On entering a reference for hearing by the Registrar. £70 FEES PAYABLE IN HIGH COURT AND COURT OF APPEAL ONLY 12 Affidavits 12.1 On taking an affidavit or an affirmation or attestation upon honour in lieu of an affidavit or a declaration except for the purpose of receipt of dividends from the Accountant General and for a declaration by a shorthand writer appointed in insolvency proceedings: for each person making any of the above. £11 12.2 For each exhibit referred to in an affidavit, affirmation, attestation or declaration for which fee 12.1 is payable. £2 FEES PAYABLE IN COURT OF APPEAL ONLY 13 Fees payable in appeals to the Court of Appeal 13.1(a) Where in an appeal notice, permission to appeal or an extension of time for appealing is applied for (or both are applied for): £235 on filing an appellant’s notice; or where the respondent is appealing, on filing a respondent’s notice. 13.1(b) Where permission to appeal is not required or has been granted by the lower court: £465 on filing an appellant’s notice, or on filing a respondent’s notice where the respondent is appealing. 13.1© On the appellant filing an appeal questionnaire (unless the appellant has paid fee 13.1(b), or the respondent filing an appeal questionnaire (unless the respondent has paid fee 13.1(b)). £465 13.2 On filing a respondent’s notice where the respondent wishes to ask the appeal court to uphold the order of the lower court for reasons different from or additional to those given by the lower court. £235 13.3 On filing an application notice. £235 Fee 13.3 is not payable for an application made in an appeal notice. EXPLANATORY NOTE (This note is not part of the Order) This Order amends the Civil Proceedings Fees Order 2008 (S.I. 2008/1053). It increases fees payable in civil proceedings as set out in the Explanatory Memorandum, which is published at www.legislation.gov.uk. If the fee has been paid for a request to reconsider at a hearing a decision on permission to bring a judicial review and permission is subsequently granted at a hearing, only half of the judicial review fee is then payable. Fee 2 (General Fees (High Courts and County Court) has been changed to remove fees payable on filing a directions questionnaire, receipt of a notice of allocation and filing a pre-trial checklist. References to the county courts have been changed to reflect the introduction of the single County Court. This Order replaces the entire schedule of fees payable in civil proceedings in the Court of Appeal, High Court and County Court. A full impact assessment is also annexed to the Explanatory Memorandum. (1) 2003 c.39. Section 92 was amended by sections 15(1) and 59, paragraphs 308 and 345 of Schedule 4 Part 1 and paragraph 4 of Schedule 11 Part 2 to the Constitutional Reform Act 2005 (c.4) and sections 17(5) and 17(6), paragraph 40(a) of Schedule 9 Part 2 and paragraphs 83 and 95 of Schedule 10 Part 2 to the Crime and Courts Act 2013 (c. 22). (2) 1986 c. 45. (3) S.I. 2008/1053. Schedule 1 was substituted by S.I. 2013/1410 and amended by S.I. 2014/590. Previous Next Back to top All content is available under the Open Government Licence v2.0 except where otherwise stated

-

Hi there I took a car out on a PCP contract for 4 years with Mercedes in August 2014 I took a seizure on 4th April 2015 still no sign of getting my licence back but I've never missed a payment on the PCP agreement this has nearly been a year since I took the seizure and still paying every month I can't see a way out or put a plan together as Mercedes aren't interested although I've informed Mercedes of my situation but there not interested as long as they are getting paid every month,if anyone could give me some advice on what to do I would be most greatful especially in finding out how soon I could possibly VT the car back to them as I'm partially disabled and struggling to get by with having to pay for this car every month it's seriously effecting me and my family at this moment I can't just hand the car back because it would blacklist my name. I think I need to pay at least half of what is owed on the agreement but I just can't keep this up its having devastating effects on my life having to worry about raising the money every month for something that I can't even drive,if anyone can help or point me in the right direction it would be so much appreciated with kindest regards Scott thanks in advance

-

If you're a dog owner , 2016 marks a change in how you register your pet. It becomes the law this year for ALL dogs to be microchipped under Government plans announced three years ago. From April 2016, every dog in England and Scotland will have to be microchipped in a move which the Government says will help reunite people with lost or stolen pets and track down the owners of vicious or illegal dogs. http://www.mirror.co.uk/news/uk-news/dog-microchipping-laws-what-changes-7113932 Free microchipping Free microchipping is available throughout the year at all Dogs Trust rehoming centres (by appointment) as well as at their free chipping roadshows, as well as participating vets http://www.chipmydog.org.uk/have-your-dog-chipped-for-free/

-

From 1 April 2016, the living wage will commence for all employees 25 years or over; and your employer will have to pay you £7.20 per hour Asking in my work place we cant get a direct answer, now hoping someone here can confirm the government position on this; Asda have not made any comment on this https://www.livingwage.gov.uk/ Apart from what is said on the government web site So from the 1 April 2016, is the living wage actually law, and your employer has no choice but to pay £7.20 a hour

-

http://www.csa-uk.com/assets/documents/compliance-and-guidance/code_of_practice.pdf

-

I too have stupidly done the same thing Scotia39. I had my partner move in April of this year and been claiming as a single parent. He earns less than me 14,000pa and has been paying the rent on the house. Had a letter today from HMRC and they want bank statements, bills etc....everything in my name still but just so wish id told them. Feel ashamed of myself .

-

Hi i have been trying to find the actual legislation allowing taxpayers the right to choose to pay over 12 months instead of 10 if you notify your local authority before the start of the financial year. does anyone know what regs this ruling comes under? i want to be able to quote it in correspondence to my LA who are blatantly ignoring my right to make this choice myself. they are operating on the old system whereby they use their discretion as to whether or not you are allowed the 12 month method.

-

I signed up to Easy Gym on 20th of March this year. Then on the 17th of April, they sent an email out to everyone to say the showers are going to be refurbished starting the next day without giving a completion date. I haven't been to the gym since as we don't have showers in the office, and I can only go in the mornings to the gym. I am client facing so defiantly not a good idea to spend an hour at the gym, without washing. I have canceled my membership, as of this morning, but they are refusing to refund for the time I haven't been able to use the gym. Do I have a case for a refund since the gym is advertised as with shower facilities, but haven't provided them. They told me I am still free to use everything else in the gym so they won't refund. 20 March 2015: Signed up 17 April 2015: Easy Gym sent email to say showers going to be refurbished 18 April 2015: Showers out of action 24 April 2015: "Unfortunately we have discovered that this is a much bigger job than anticipated" 13 May 2015: I sent an email to ask about the refurbishment. 20 May 2015: Reply "Due to reasons outside our control we are currently unable to specify a date in which the works will be completed." 03 June 2015: "we were forced to shut down the showers by the landlord over alleged leaks. " 04 June 2015: Emailed requesting my account to be closed, my email was ignored. 08 June 2015: "We are writing to give you an update on our male shower room refurbishment. We have now received approval to continue our work and all being well, the new shower block will reopen on Monday 15th June. " 08 June 2015: Reminded them about my previous email, Also emailed another department about my closure request. 09 June 2015: They closed the account, but won't refund me.

-

https://denbighshiretoday.wordpress.com/2015/05/14/derek-acorah-to-sue-rhyl-town-council-after-getting-beaten-up-by-a-yobbo-ghosts/

-

I apologise if there is a sub forum on this issue but I couldnt find it. I have two pensions an excellent Company one with a considerable pot available which I dont intend to touch and another one from a company I worked for over 20 years ago. It is run by Standard Life. I have about 14k in there and when I spoke to them they said on April 6th I could apply to have it transfered to my bank account. So far so good. My yearly pre-tax income is about 20k but I keep reading conflicting information about how much tax I would have to pay on my cash in. Is there anywhere I can find a calculator ( I have looked) or can give me some advice. Thanks.

-

From 1st April 2015, Single Lower Limb Amputees with 40% War Disablement Pension or more are entitled to receive War Pensioners Mobility Supplement. More Information at this link: https://www.gov.uk/government/publications/war-pensioners-mobility-supplement Please be aware that you need to click on "War Pensioners’ Mobility Supplement change from 1 April 2015" in that link to download the PDF which contains the information and how to claim.

-

I applied last year in November but the letter went missing and so I applied again online. It's been backdated to mid-July. I have written to them giving them good reason why I was late in applying for this, mainly because I didn't realise I had to. If they are going to send a bill for the full amount at the start of the year before I have earned anything as a first time sole trader then surely it was dealt on the basis that we would all wait until my earnings were clearer before any adjustments? Anyway, I'm thinking about writing to them and Scot & C. saying that I am withholding any further payment until they rectify this. How far is that likely to get me? I have also told them that irrespective of whether they backdate it I will not be paying them any more than I owe and they can take me to court and dispute the amount if they disagree.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.