Showing results for tags 'urgent'.

-

In August this year I received a letter from Ross & Roberts saying that I owe council tax to Gosport Borough Council , As I left Gosport over 12 years ago I was taken aback by this. As far as I was aware the rent and c/t was all up to date. I wrote to R&R to tell them that I was disputing the claim. I sent a letter about not knowing about the debt and also about CPUTR 2008 and guidance on debt collection , also I have requested from GBC, under the FOI anything to do with this. What I want to know is: Can they still visit if its in dispute! Can they still add on any charges! Can they force entry to where I lodge and remove property (non of it I own). I ask this as Someone has been round and put a note through the door when no one was in. Two days latter they were back when my landlord was here and they have threatened him with forcing entry and remove goods . He was in such a panic about it that he gave them £500. Can they do this!!! Until the information from GBC turns up I don't know if I owe it or if they have mucked up some where. Thanks in advance

-

Hi everyone, I'm really hoping you can help me. My wife has recently informed me that she has received letters from the court, stating that she owes over £8k to Hoist portfolio holding 2 ltd. She has not had the capacity to deal with any post etc due to our third child being born a few weeks ago. First, a letter asking for a defence - not completed because she was not at our address up to the hearing date and did not see it until after the hearing. Second, a letter requesting statement of means. Not completed due to giving birth to our third child. It has been a stressful pregnancy. A lot more consuming than the other two. She just hasn't had the energy to deal with anything other than the baby. Third, we received a communication from the court with her name on the envelope, but someone else's documents inside from somewhere in Liverpool. Finally, it was transferred to our local court, who hand delivered a letter to my wife entitled Order for Production of Statement of Means. Now she has finally had time to think about the debt, I fear it is all too late to defend. She remembers having an account with Barclays, but does not recall a large debt. Is it at all possible to submit a request for information from Hoist, asking to see proof of the credit agreement? Should it be the original document? Is this all too late? My wife is a wreck already with the baby only weeks old. And I'm here tearing my hair out wondering how on earth it has got this far. I appreciate it is a real mess, but there have been exceptional circumstances happening when the dates and requests have been issued. The deadline for the order was this Friday gone, and I'm now concerned because the court is threatening a £250 fine and/or 14 days in prison. My wife doesn't know what to do. I wish I had this info sooner, but I now need some important advice as to how we can challenge this default judgment. And if that is even at all possible. She is thinking of just filling out the statement of means and sending it off. But I've said that's crazy if they can't prove ownership of the debt and that it legally exists. Many thanks.

-

I am trying to pursue a company in Scotland via small claims court, I have received the paperwork back today Subject : Claims Issued Out Of Jurisdiction Please find enclosed claim forms returned to you for service, As this is a claim form to be issues out of the jurisdiction of the court. Money Claims Centre no longer servers the claim form direct to the defendant. The money Claims Centre has received this guidance from Court Business Support and as directed by a District Judge. Rule 6.4b of the cilic Procedure Rules only refer to general service by first class post to a jurisdiction within England and Wales and does not apply to foreign process. There is no provision to serve papers to addresses outside England and Wales I have rang PSU in Liverpool who in my opinion wasn't overly helpful in the pack returned I have :- Notice of issue (Duplicate) - I believe I keep this and fill in the missing dates of when sent, when it was received and date to reply Copy of claim form and submitted evidence - which I send to defendant N510 form - do I send that to the defendant ? Response form - which I assume the defendant needs to ? I need to know if I can put all the paperwork in the post and send via recorded method ? I need to know how many days I have to give the defendant to reply ? I know this is urgent and need to deal with it ASAP thanks for your support

-

Hi, Just had a visit from a debt collector from Chandlers pursuing a council tax or rent debt for my eldest daughter who stays here with me as my carer. I told him that my daughter was out at work, that she could not be contacted at work due to it being a care home and he told me he would be back with a warrant of entry and the police. I explained to him that this was a ministry of justice protected property due to my mental and physical disabilites as I am a prescribed vulnerable person and he said that did not matter, I explained that my daughter had no tenure at this property and that a written address on a form did not constitute proof of residence and was told this did not matter. My poor angina is really playing up and I am in pieces and don't know what to do, I rang up daughters work and they said they would not entertain a phone call whilst she was on duty unless it was a medical emergency so am clueless what to do next. Apart from PTSD, clinical depression I also have a bad heart, angina, progressive peripheral arterial disease, severe frozen shoulder, high blood pressure, diabetes and a fair bit more wrong with me. Can they force their way in and take stuff that isn't theirs? Most of the stuff I have is ages old and god knows where the receipt for such is and I can't find my qualification certificates as my computer is prob worth quite a bit of money to them and it is "tools of the trade" I am sure. Any help really appreciated Ian

-

Please can I have the opinion of some of the CAGERS on here for the attached agreement. I CCA'd MBNA and received a letter with the attached agreement with the T&C's on the reverse, along with the current T&C's and my current statement. I am unsure if a credit card needs to show the credit limit and the interest rates are only shown as APR for a set amount of credit. Your opinion would be really appreciated. [ATTACH]13015[/ATTACH] [ATTACH]13016[/ATTACH]

-

Hello you lovely lot, hoping for some advice on my options , quick summary , I had a vanquis account a few moons ago (not enough for SB Defence), eventually I think Cabot bought the debt and are now claiming it through Drydens. Claimant - Cabot Address for sending documents- Drydens LTD POC as written on form, Claim Number Defendant Details XXXXX XXXXXX ( My name) xxx xxxxx xx ( My address) 1.the claimants claim is for the sum of £1644.80 under and agreement regulated by the consumer credit act 1974, between the Defendant and Vanquis Account Number xxxxxxxxxxxxxxxx and assigned to the claimiant on 16/03/2016, notice of which has been provided to the defendant. 2.The defendant has failed to make payment in accordance with the terms of the agreement despite requests for such payment. 3.And the claimant claims the sums of £1644.80 together with costs. Ammount claimed- 1494.80 court fee- 70 legal rep costs- 80 total ammount £1644.80 i do recall a few letters of generic threats from cabot, not sure if any of them were notice of assignement. I do not think I have been sent any satements showing what I alledgedly owe and how its come to this figure. Issue date on claim form is 29th Sept 2016 yet it only arrived on friday. What should I do now, acknowledge the claim? Thank you for your help Jay

-

Can someone please help me. i have received a letter off BW legal. I pulled up for a few seconds to let me friend in and like you received a fine. I ignored the letters and now am upto BW legal stage. And saying about court proceedings if I don't pay can someone please tell me what to do? Do I pay up? I shouldn't ignore it but don't know what to do.

-

Hi My daughter's ex registered a car at our address - we didn't know he did it at the time and he didn't have our permission. I remember him chasing her for a log book but don't know if he ever got it. He has since had a penalty notice from a borough council which has been referred to Newlyn bailiffs. The bailiff posted a letter through my door just now saying he will be back in 24 hours to take an inventory and I have to prove that none of the goods belong to this lowlife. I rang the bailiff (big mistake probably) and explained the situation but he doesn't want to know. I told him that my daughter has two kids with this man but doesn't have that much contact with him and isn't sure where he lives. She just knows his mum's address. The bailiff said it doesn't matter. Ours is the address he has and that is the one he will attend for taking an inventory. He said he will give me 7 days to get the lowlife to contact him and arrange payment. Lowlife will not pay because he's a lowlife. He pays nothing. I am at my wits end and don't know what to do. Please, any advice would be welcome. thanks PS there is another penalty we sent back to council (different council). Does "not at this address" mean anything anymore? Is this going to happen again? Update: I've spoken to my daughter and it turns out a similar call was made to his mum's house (must be for a different car?) and she showed them her tenancy agreement and they went away. This bailiff said he wanted proof that he didn't live here but also said I had to prove my/my daughter's goods are not his. How can I do that? I don't want the bailiff in my house at all. I feel violated enough already. Lowlife seems to think we can all just make this go away for him!!!

- 14 replies

-

- absolutely

- omg

-

(and 1 more)

Tagged with:

-

Hi All, I'm new here and after reading so many helpful posts I was hoping someone could help me. I have received claim forms and wondering what to do next, please find the information I have completed below as I have filled out the questions asked: Name of the Claimant ? 1st Stop Recoveries Date of issue – 11th Feb 16 What is the claim for – 1.1st Stop Recoveries Ltd claim this amount in respect of an unpaid loan funded by Uncle Buck Ltd. The defendant failed to abide by the terms of the contract. 1st Stop Recoveries purchased this debt from Uncle Buck and subsequently sent a notice of assignment to the defendant to advise. 2.The defendant has failed to respond to any correspondence or communication from the Claimant this denying the Claimant any opportunity in assisting the Defendant in attempting to bring the matter to an amicable conclusion. What is the value of the claim? £493.88 + £35.00 - Court fee Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? A Payday loan When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. 1st Stop Recoveries Were you aware the account had been assigned – did you receive a Notice of Assignment? I don't know, Did you receive a Default Notice from the original creditor? No Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? I don't think so. Why did you cease payments? I don't believe any payment has been made at all. What was the date of your last payment? I'm unsure, sorry to be vague but I want to be as honest as I can and I don't know. Was there a dispute with the original creditor that remains unresolved? I have been on my Uncle Buck account and it shows I owe £0.00. Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No. no default notice is showing from Uncle Buck, Plan deal collections or 1st stop recoveries at all. I have a noddle account and check this almost weekly and have also in the last 2 weeks got my experience credit report. There is no default showing for this amount or from these companies. It's was either over 6 years ago or I suspect it was maybe 2 years ago maximum. Definitely no default registered with these companies. Any help at all would be appreciated! I absolutely cannot get a CCJ and I haven't done anything yet apart from recieve the forms. They went to my parents house and I have only got them this morning, my time is running out and I am beginning to panic! Please help!

- 90 replies

-

- recoveries

- stop

-

(and 1 more)

Tagged with:

-

Apple have issued an urgent iPhone and iPad software update (iOS 9.3.5) that included a patch for a serious security vulnerability. The vast majority of iPhone owners are probably on iOS 9 right now, but you should check and install that version right away The malware in question, which was detailed in a report from Citizen Lab and Lookout security, is a serious compromise that’s never been observed against iOS devices before. But you can guard your devices and your personal data against the latest security threat simply by heading to settings and hitting the update button. http://www.theverge.com/2016/8/25/12651206/apple-iphone-security-threat-update-now

-

Hello, I have been called several times by a number 02086100150. This is apparently the number PayPal use when they are chasing people for a negative balance. The story behind this is a case of fraud. I have recently believe to have been a victim of fraud where I was told that I would receive a PayPal payout. I found this through a facebook group which is a selling page. The advert said that people could receive money as long as they met the certain criteria. In addition, it said that there would be no fees involved (and to me as a 19 year old this meant minimal risk of losing money). This involved being sent money through PayPal which would be transferred to my bank account and some of this would then be sent to another bank account as what I believed would be fees for this service. I was told to download a programme which would be used to create a meeting where the other person who was helping me to do this, would be able to take control of my screen and do what was needed. I was told to sign into my PayPal account and also my online banking (stupid mistake)... I had £300 added into my PayPal account (from different people) which the person then withdrew to my bank account. From there, they went into my online banking where they typed in the bank account of the person to send the money too. They then withdrew £200 from my bank account which was as expected. This was supposed to be repeated several times so each time I would keep the £100 remaining. However, on the next occasion £300 was added into my PayPal account (also from different people) which was then withdrew to my bank account. From there, the person typed in all of the bank account details as before. However, this time they typed in to withdraw £800....this was not what I expected and stopped the meeting instantly so they could not take control of my bank account and PayPal any longer. Several of the different people whose accounts were used to send money to mine (i'm not sure if they had the money fraudulently taken from them or if they were part of the company doing this) have then requested to have their money returned. However, I closed the PayPal account that all of these transactions happened on and now I have PayPal ringing me. I'm assuming they are questioning the negative balance on my account and are wanting the money back.... However, as a student I have no regular income and I dont know what to do. If they are chasing for the money then I will be placed even further in my overdraft. I have already been placed into my overdraft from having lost £400 (£600 in total added to my account and £1000 taken from my bank) and now they are chasing me for the £600 added into my PayPal account. This will mean that in total I would have lost £1000 if they get the money back. I have contacted action fraud but they have 28 days to get back to me. The original case of fraud happened several weeks ago. I'm not sure what to do... I don't have the funds to pay the money back and I feel like I have been scammed so bad (p.s. im only 19) Can anyone help???

-

Hello all, Just need advice, My ex employer who i have left 4 months ago called me. my ex manager phoned me yesterday to ask me if i can write something down regarding an accident that happened to an employee when i was on shift and it was me who wrote the accident report backed by photos of injury and location where it happened in the employer's place. That employee has taken the company for a claim and ex manager called me to ask me if i can write my version and has provided me with email of a person from an insurance company who i should send my brief email to regarding our discussion on the phone. The thing is I wrote a thorough accident report on this accident when the person who had the accident reported it couple of days after the injury at work. My question is why am i called to send a brief since i have already written the report and do not work for the company anymore. Is something i should be aware of, by sending a brief am i putting myself into something unknown, is it advisable. what do you think. Thanks in advance. regards,

-

Hello Everyone, I had few hundred pounds stuff ordered from shop direct in 2013 . I didnt like the stuff and sent it back , I got email confirmation that shop direct will refund in my account which they never did . I have more then 25 emails which I sent them and their replies that they have received the goods back and they will credit the account they never did. Three years later I got latter from Lowell demanding £3182 and its going higher day by day. I requested CCA AND CPR on 11/12/15 . I requested , 1. Agreement / Contact 2. Default Notice 3. Assignment 4. Formal Demand But instead I received the Lowell made documents today which they will present in court. I have attached here. ( PLEASE HELP i have never been to court and dont know what to do ? There are more documents here... Thank you Andy ..I haveattached court documents here. docs1a.pdf

- 156 replies

-

- county court

- direct

- (and 5 more)

-

Hello I had a few letters from bw legal saying I had until 6th August to resolve outstanding parking pcn charges before court action, I've been away for a few days and phoned them today to sort it (defend) and they said they have already issued court proceedings on 2nd August! Ten mins later I've received court claim papers. The amount they are claiming is £1950 for 19 alleged offences. There is no way I've parked on their car park and not paid 19 times and I've not had loads of letters either. Some dates go back to 2013 Is it too late to defend this now? I'm totally new to this forum and don't understand a lot of the jargon and I'm on my phone so limited access. If anyone can please give me any advice I'd really appreciate it. I feel sick with worry.

- 13 replies

-

- county court

- excel

- (and 5 more)

-

Hi all, and first off thanks for your time in hopefully helping me out with a Welcome Finance matter. My partner had a loan with Welcome Finance which he took out in February 2006 for about £2500 he got into financial difficulties a couple of months after taking it out and only ended up paying a couple of payments, he never heard anything back from Welcome until last November (2012) when he received a letter from Mackenzie Hall Group, i knew that the debt was statute barred and so sent off the letter to them and never heard anything for months, he then received a letter last month from IND Ltd chasing up the debt and so yet again i sent them the statute barred letter recorded delivery, that was on 23rd May 2013. We have returned from a few days away today to find a claim form from Northampton County Court from Hegarty LLP claiming on behalf of Welcome Financial Services, the form is a form N1CPC and comes with a response pack where i have to fill in either an admission page or a defense and counterclaim page. I am totally out of my depth on this one and how to proceed and how to fill in the forms, I believe the debt is definitely statute barred as they have not received payment or admission of the debt for 7 years, what i cannot understand is why they would have issued the court papers if they knew they did not have a case ?? I would be extremely appreciative if somebody could point me in the right direction of where to take this and how to fill in the claim forms (it says they can be submitted online if needs be). I only have 14 days to respond and the forms are dated 5th June therefore i need to be quick. Thank You

- 51 replies

-

- county court

- ind

-

(and 3 more)

Tagged with:

-

I got this form a few days ago and I need to return it by the 22nd (less than a week from when I received it). And I'm really not 100% certain how to fill in the box. It does say 'briefly' but I'm worried that if I don't put in enough information that it may go against me when I fill out the actual PIP forms when my son is 16... My son has a diagnosis of ASD and had been getting high care and low mobility (the welfare officer at cab several years ago advised that I should appeal for higher mobility but I was just happy to get something and didn't want to go through an appeal even though he wasn't the only person to advise that). My son has no concept of the value of items at all and there is no way he could manage his own finances but I really have no idea how to explain that. Any help/advice greatly appreciated

-

Hi, I am looking for some help/advice regarding a court claim for an historic credit card debt with Capitol. I put in a defence to their claim and just had a notice of allocation. It needs sending tomorrow as it need to be served by the 28th of this month. It seems that their solicitor as written to the court and asked them to progress this to an hearing which seems to have been granted.

-

Hi, would appreciate advice/comments on my situation. I have lived in the USA for over 3 years and have no plans to return to the UK (except for holidays). I own a house in the UK that has mostly been rented out but this year I have attempted to sell it - 5 months ago I accepted an offer and its been a long an protracted sale but I thought it was going to finally complete but have now been told that my buyer has been refused insurance due to the properties flooding history (last flooded in 2007!). Now I am faced with the very real possibility that I stand no chance of selling the house - yes I could rent it again, but will surely be faced with the same issues in the future and I thoroughly dislike renting long distance. There is a little equity in the property but that is meaningless with no prospect of selling it. What would happen if I just walked away from it, considering I do not live there and have no intention of returning permanently? Thanks.

-

Hello, Ive used this site before and got great advice. I now need it again. I have a Conditional Sale Agreement with Moneybarn, taken out in February 2015. I have had a few arrears, agreed a payment plan but missed one of the payments on that plan, now they have issued a termination notice. I originally complained about it as I was able to pay all of the arrears off on the 25th May, and the default required them to be settled by the 6th May. The complaint letter I received stated that they would investigate and put the default on hold until they had responded. I have sent all details such as ability to pay, evidence to them etc in, and I asked them if I should just clear it now, to which I was advised "only if it wouldn't put you in financial hardship". Since then, the termination notice has come through, and their asset management team has passed my details onto a repossession company. What are my options here? Its less than 1/3 paid off, I do have the ability to clear all the arrears, but I am also not happy with the way they have conducted themselves. I have tried to call the person managing my complaint today 4 times and had no success. The car is on my driveway, so I don't think they can take it ( having read up on that), but should I go down the court order route? Should I hand it back and just get another car? Any advice greatly received

- 14 replies

-

- moneybarn

- repossession

-

(and 1 more)

Tagged with:

-

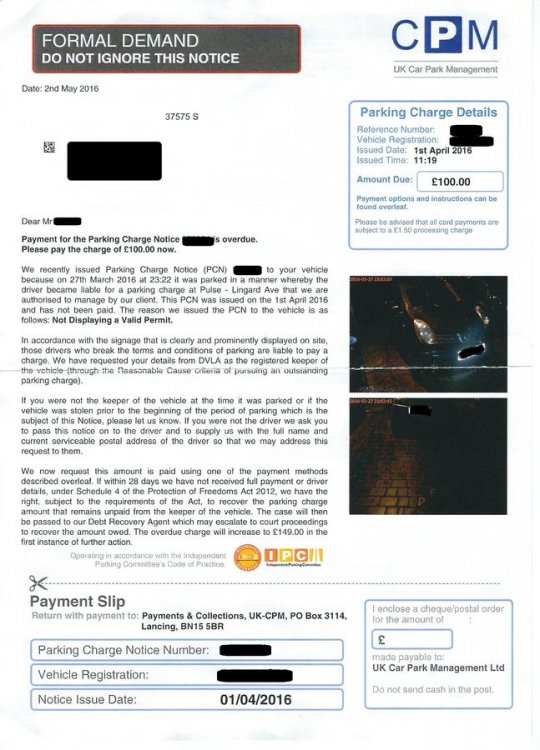

HELP With parking charge notice from CPM

Chimpata posted a topic in Private Land Parking Enforcement

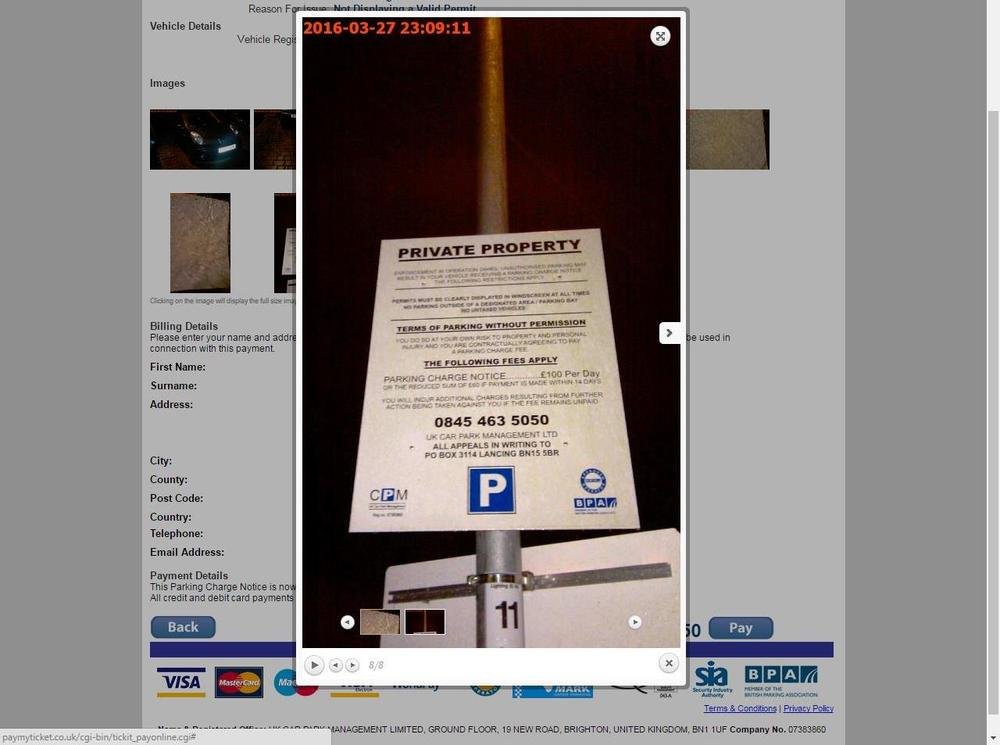

Hi Guys I need some help with Private parking charge ticket. I am the registered keeper of the vehicle but was not driving the car and the car was been driven by another family member who does not reside in this country as the live abroad. I was shocked to get a parking charge notice from CPM letter saying formal demand notice as I have never received any notice or parking charge ticket on the vehicle. So having done some research, here is what I have noted. 1) According to the formal demand they states that they have issued the PCN to the vehicle because on 27/03/2016 at 23:22 it was parked where the driver became liable for a parking charge. I have checked photographic evidence on their website it shows photos were taken from 23:02 and the last photo was at 23:09 but nothing to show the time 23:22 2) PCN issued on the 1/04/2016 for not displaying a valid permit – Their letter states time issue as 11:19 (Confusing) 3) According to the photos of the signs they have taken they have indicated that they are member of BPA, This is also confirmed on their website but their letter shows that they are a member of IPC. Does this make a difference? I noticed that CPM is under UK Car Park Management Ltd which they are a member of IPC and not BPA . 4) Payment on their website states that ; “Payment Details This Parking Charge Notice is now 26 day(s) OVERDUE. All credit and debit card payments are subject to a £1.50 Processing Fee.” Are they allowed to charges processing fee for debit card. Can someone please help me to draft a letter for these people. I m stuck and I don’t know what to do…

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.