Showing results for tags 'set'.

-

Good evening everyone, I have a CCJ for a debt that has a default date of Sept 2011. The CCJ date is March 2015. I understand that the CCJ will remain on file for 6 years. However, make yourself comfortable, I was out of the country when the CCJ was issued. I have rarely worked in the UK for the last 10+ years and when I don't work I travel/survive. I can clearly show that for several months before and after the CCJ date I was not in the UK. Based on this I want to have the judgement set aside. If I wait a month and if this is successful, will the debt be too old and drop off my file? I have had other debts removed from my file as I had no contact with them for over 6 years. Honestly, I'm a little giddy, I can't believe it. Post was with binned or not at the place I stayed. I would stay in the UK for a few days before leaving again. So there are two outcomes? If the court upholds the judgement I have to pay the debt. If the court sets the judgement aside will the limit have passed and the debt removed from my file? Your thoughts and advice please warmly appreciated. B

-

I am a homeowner who moved to Canada last year. I had a tenant at the property and set up temporary redirection which ended in a February 2017. I missed a January service charge / ground rent payment and within a week or so, my account was referred to solicitors. I became aware of this because I received a redirected mail from the solicitors. I immediately called the solicitors, informed them on the phone that I was now resident in Canada but would make immediate arragements to pay. I requested a breakdown of charges as well as the option to pay in instalments. They asked for my email address and sent me a breakdown 2 days or so later. I responded to the email requesting for a payment plan and fee waiver and they wrote back insisting that though no longer resident in the UK, I still owed them the full amount ( I never disputed this). I accepted to pay the full amount we negotiated by email - I proposed, first 7 monthly instalments which they rejected, and then 4 monthly instalments, but they insisted on either 3 monthly instalments or permission for them to approach my lender, for a fee. I insisted on my proposal as it was what I could afford. A few weeks after they rejected my payment plan and said they would 'now take legal action', a default ccj was entered against me. I found this out shortly after I returned to the UK in April. I applied for a set aside on the basis that I was not resident in the UK when the claim forms were sent and never received them and hence couldn't put in a defence. More importantly, the claimant was already aware that I was not resident in the UK at the time. The hearing was held between myself and the claimants solicitor, and the judge rejected the set aside request saying that while he could set it aside, he did not agree that I wasn't properly served, and as such he would not set it aside. Rather, he said he would allow instalmental payment - the same monthly amounts that the claimant had previously rejected.. Given that I had informed the claimant that I was no longer resident in the UK as required by law, and that knowing this, the claimant had the forms sent to an address that they knew I was not residing at, it does not appear that the judge gave this consideration the seriousness it deserved. I would like to know if there are any chances of successfully appealing this.

-

Here's a good one. I send a letter of claim to the Defendant, a company, on the 5th of December 2016 which is ignored. I sent a follow up letter on the 31st of January which is ignored. I issue proceedings on the 27th of February which are deemed served on the 3rd of March. The Defendant files an acknowledgement of service saying they will file a defence within 28 days of service. They fail to file a defence. I apply for judgment on the 4th of May and judgment is issued on the 5th of May. Defendant pays judgment on the 22nd of May. Defendant writes to me on the 22nd of June saying that they want to overturn the judgment as they always intended to file a defence. Defendant says they will sue me for the judgment money unless i accept their offer of paying them back 75% of it and the entire thing is wrapped up in a Thomlinson Order. Incidentally, despite all this, the Defendant continues to do the wrongdoing I sued them for. What do people suggest I do?

-

Hi and thank you for taking the time to read my post, I believe I may have an issue with my Landlord supplied electricity. I am posting here in the hope that you kind folk may give me advice on my maths, assumptions and possible action, The situation: I live in a building that is subdivided into 9 self-contained flats. The Landlord is responsible for paying the electricity bill for the whole building, there is a regular usage meter on the outside that records the usage for the whole building. The Landlord has installed payment meters into each flat, in order to credit these meters we have to purchase £5 disposable cards from the Landlord which are inserted into the meter to credit it. The rates: The meters are currently set to charge 55p for every kWh of electricity used. I do not know what supplier, per unit price or standing charge the Landlord is paying as I have not yet confronted him about this as I would like to make sure I've not made any mistakes or overlooked something. The problem: I believe I am paying over double the price I should based on my usage. I have kept a tally on the amount of cards I have bought over a 3 month period and I have spent £265 on electricity cards. This works out to a usage of about 482 kWh per quarter. If I were getting my electricity directly from a supplier, say British Gas for example, using their Standard Tariff information on their website it quotes 12.28p per kWh with a standing charge of 26.01p per day. A quarter is 91.25 days on average so that's a standing charge of £23.73 per quarter and £59.19 of usage making a total of £82.92 with VAT that comes to £99.50. I figure this means I'm paying roughly 250% more for my electricity than if I were getting it direct. The concessions: Many of the tenants of this building are quite old. They do not use modern devices like computers and the like and I imagine have quite low electricity usage. This being the case, the Landlord would have to increase the price per unit in order to cover the standing charge he is paying. But seeing as I don't actually have the information regarding the other tenants and the Landlord's billing I am only speculating here. In any case this arrangement would be very unfair on a higher user like myself. I also understand that payment meters are generally more expensive than straight billing, but 250% more expensive seems somewhat overkill. Issues: If I confront the Landlord about this, and he is overcharging for profit, he would have been doing this for a long tome and has gotten used to the extra money by now. If I drop this on him and force him to lower the rates on the meters, he is not going to be particularly pleased about it. Yes he may be stealing money from me, but human nature being what it is, he's been doing it so long he probably believes he is entitled to do this. It's going to cause bad blood. Resolutions? Ideally I would like to do away with the Landlord meter and have my electricity supplied directly. I've tried to look into the laws on this but I can't really find anything that is specific or even related to my situation. The only things I tend to get when I do a search is for switching electricity suppliers. Also having the meter reduced to a more reasonable rate, say, 22p per unit would be ok. Or even, I would be willing to pay the landlord a flat fee per month to cover my share of the standing charge and have the meter set to the actual price per unit with VAT that he is paying. What do you think? I am going to ask the Landlord to look at his electricity bill soon. If he does show it to me, then I can explain this issue to him with actual irrefutable numbers and math. But what should I do if he refuses to show it to me? Anyway, thank you again for reading this and thanks in advance for any replies. Regards Col

- 8 replies

-

- electricity

- installed

- (and 5 more)

-

Greetings. Making a PPI claim on an old loan that was repaid in full. Wondering if I succeed, will the original creditor be allowed to use this to offset an outstanding (statute bared) debt (overdrawn current a/c and assume the original creditor still owns the debt). I noticed post #4 by dx100uk and specifically in bold: "if the original creditor still owns the debt then they can offset but not the 8% stat int part of any refund." in this thread: http://www.consumeractiongroup.co.uk...BC-credit-card I've seen on the FOS website: compensation for being deprived income etc.. http://www.financial-ombudsman.org.u...tment-loss.htm and various scenarios on PPI redress: http://www.financial-ombudsman.org.uk/publications/technical_notes/ppi/redress.html#_Where_the_consumer Does anyone have any further info or legal precedent about the 8% SI part of a PPI claim not being allowed to be used by a creditor to offset an existing debt and as such should go to the claimant ? Many thx

-

Hi all, It would be literally life changing if you can help with this one! Last year I checked my credit file and found I had a CCJ. The claimant was the managing agents for a flat I owned, the amount £1314 and it was registered in November 2012. Being a bit worried about the word CCJ I paid it immediately (Dec '14) and then set about investigating it. It turned out that despite notifying them of a change in correspondence address (I moved out and tenant moved in), they had been writing to the flat to notify me that my standing order for ground rent wasn't set up properly (I think after changing bank accounts). The tenant, I'm sure thinking he was being helpful, kept my post safe for me until he moved out!! The pile was nearly 1m high when I eventually reclaimed it! After a bit of internet investigation I figured I had grounds to have the Judgement Set Aside by Consent - I spoke to the claimant and they agreed to have it set aside they got their solicitors to issue a "Consent Order". I sent this with the correct forms and my own explanation of events to the courts along with £50. After 10 days or so I received a letter back from the courts telling me that my application had been rejected as the judge felt my application amounted to "credit repair". It went on to say that the judgement was paid and would be marked satisfied on my credit file. Fair enough I thought... That was until I recently applied for a mortgage and the underwriter informed me that I was "out of policy" until the debt had been cleared for at least 3 years. You can imagine how frustrated I am now with hindsight that the judge had felt it necessary to reject my application. Why would ANYONE want a judgement set aside if it wasn't to repair or reset their credit?! Surely he should of considered the facts rather than base his decision on opinion?! I paid a debt as soon as I found out about it and I've ended up with a 3 year sentence - you'd get as much for aggravated assault! I've spoken to the court again and despite it being longer than 7 days, I can apparently fill in a different form and send another £50 to appeal the judgement. My question, albeit a little long-winded, is: what chance have I got of winning an appeal? I don't want to throw another £50 at this and end up with the same result BUT if I knew I could get it set aside, I'd happily pay a hell of a lot more! If someone thinks they might be able to help, I'd happily pass on any documentation I have. Thanks.

- 18 replies

-

- application

- aside

- (and 5 more)

-

Hi - asking for my sister who is a disabled adult (mental Health). She has received a judgment by default CCJ from Home Direct, she doesn't remember receiving the court pack, nor is it something I have seen when visiting - as she usually gets me to read through things for her. Now she owes the money, no doubt about that. And up to 2016 was making regular monthly payments to a DCA when the agency changed to the current one. She has tried twice to set up the plan again, only for them to not reply, and send a standard letter again a few months later. She phoned the new DCA after receiving the default judgment notice, and they were not sympathetic at all - went through an income and expenditure with her - and included her PIP payments (and those of her daughter who has ASD) as income. They wanted a massive £800 per month, the debt is £2400. So: 1 - Can they include PIP payments as income? 2 - Would she have grounds to set aside as she says she didn't get the court paperwork (although from the sticky thread it mentions you would have to show a defence to the claim as well for that?). 3 - Would setting aside mean they would be more likely to accept a reasonable payment plan anyway? Any help is very much appreciated - thanks

-

I am really encouraged after reading many posts on various debts. I had a Store card with Creation and I did have an arrangement to pay but they told me it was not enough and through Drydens got a CCJ. They told me that if I were to pay the full outstanding balance that they requested no court case. Somehow I managed to find the money nearly 2k and paid them. Yet somehow I got a CCJ. I did not go to the court or had a defence. That was in 2011 and it will be SB'd in May this year. I read it somewhere if I paid the full amount I should not have had the CCJ. Is this correct? My question is that if it is possible to remove this judgement because I was told that if I were to pay in full no court case? Any advice would be greatly appreciated.

-

My Dad got work done at his house where I live 4 years ago. The electrician didn't do something he asked for so he cut of £500 from a £20,000 bill. Today I get a update from Experian that I have a CCJ under my name issued yesterday. Having spoken to the court it turns out that the Electrican issued a CCJ at our old address where we moved from 4 years back. I never got any of the letters or did I get any intimation from the court AND I am not a part of this at all. I only live at my dad's house and the claim should be between these two. I have nothing to do with the bills for the building of my dad's house. My Credit score just dropped from a 5/5 to a 1/5 for something I am not involved in or knew anything about. Spoke with the court who have suggested I pay £150 and do a application to set aside the judgement. Also spoke with Experian who say they will put this down as fraud as it has nothing to do with me but they will need to investigate and can't guarantee that this will clear my record. Also the claim is issued under a misspelt surname. Does that make any difference? What should I do????? Some guidance would be highly appreciated. I have worked hard to keep my Credit history good and one wrong swipe has just ruined it.

-

Good evening, I am not sure if this is the right place to be asking for advice about this but I thought I would post a thread. I recently ordered a sofa set, I paid them via online banking, the first payment was the deposit and the second payment was the remaining money due, they are clearly not what I ordered. The sofas were delivered today and it was all a farce, as I live in a flat I had to pay an extra £20 for them to carry them up to my first floor flat which I already did, I had to argue with them for sometime before they rang up the company to get it confirmed. They pretty much took all the packaging off before bringing them up and then just dumped them in my tiny hall way when they should have brought them in to my living room first and then unpacked them. Now, heres the issue, when one of the couriers brought the cushions up I thought they were the right ones but after taking the last of the packaging off from the smallest sofa it turns out the sofa does not match the picture on their website, the colors do not match etc. (See images attached). I have spoken to the manager over the phone and over email and he insists the correct sofas have been delivered and that I shouldn't have signed the delivery receipt if something was wrong and that he's willing to accept a return at my cost of £89 I shouldn't have to pay £89 if the sofas are not what I purchased, no where on their website does it say if you want to return them, it will cost £89. On the receipt it says the couriers should have unboxed them in my living room not outside, it also states no price in the box where it says how much it would cost if the items needed returning. It's states nothing on their website regarding returns as well. Where do I stand legally with this as a consumer? (I can't add pictures)

-

I had a card from HSBC in 2002. In 2010, I had difficulties paying so I went through the sar process, discovered that I had never signed a contract and tried to negotiate a lower settlement on this basis. In 2011 I missed a deadline to acknowledge a claim from Northampton as so received a ccj via default. I only missed the deadline by one day, spoke with the court and sent in a n244. However, the case was assigned to Uxbridge and so the n244 was lost in the system. So I sent another n244 to the new court and understood that this was in place. I have now discovered that the ccj is in place. I have contacted the court but they are saying there isn't a lot they can tell me but they can confirm there was a set aside hearing but are now telling me it should have been transferred to a court local to myself. It is a little complex for me, can anyone offer any advice please?

-

Hi, I am currently representing my daughter on the McKenzie friend basis in her claim for unfair dismissal on the grounds of discrimination ( pregancy ) We have followed all the procedures through ACAS and we are currently taking her employer through the Employment Tribunal, which has taking about seven months to get to a Trial which has been listed for next week 4/5th February 2016, this was after a previous hearing. Today i receive a letter from the Tribunal stating that the trial might be postponed on the grounds that despite knowing for a number of months that in any event, the trial would be considered by a panel rather than a single judge because it is a discrimination case, to use this as a reason, and so late in the day does not add up, they would have known months in advance that a panel would need to be assigned, so in using this has delayed even further. The Tribunal are also aware that the Respondents are in abuse of process as they have failed to abide the previous order for them to provide a trial bundle, witness statements and further and better particulars in readiness for the trial next week? Because of this we made an application for the Tribunal to make an unless order for this evidence to be giving as all of it is central to the claim and it had been previously ordered. We have also written to the other side and in anticipating the Tribunal not making the unless order, which seems very reasonable, by stating that we would provide our own trial bundle and giving them seven days to object. Since all of this has happened in the last couple of days, the Tribunal as it would appear are bending over backwards in allowing the previous orders be breached and ignored and they have also giving the Respondents more time to defend a claim that evidently cannot be defended because of the circumstances which led to my daughter being dismissed. Whilst i am not legally qualified as to adjudge it would a appear that (a) she has been denied the right to a fair hearing because her opponents have abused orders which if followed would have allowed the trial to proceed and ( b) the Tribunal could have not only made the request for that evidence to be disclosed, in postponing the trial next week, giving those facts and the excuse of needing a panel, which would have been knowledge as soon as pleadings were made, i feel this is unequal and unfair as the Tribunal are not only allowing orders to be breached, they are also giving the Respondents more time to further breach the orders. My daughter i feel has a very strong case and my theory is that because of the strength of her case, the opponents and the tribunal are doing everything in their power to keep this matter out of court. It is hard enough and most times financially impossible for pregnant woman to establish unfair dismissal claims because they are pregnant, the Tribunal who should protect, if my experiences are anything to go on make it even more difficult by allowing employers the right to ignore orders and as in this case give further encouragement for this to happen again by postponing without reason or justification. Any help would be greatly appreciated by this angry dad:mad2:

- 312 replies

-

- agreements

- application

- (and 20 more)

-

Hello I am new to the forum and am hoping for some advice on behalf of my brother. I am hoping for some guidance on the process for applying to the courts to have a CCJ made by default judgement '"set aside" This is a really long story going back 12 years!!! My brother was victim of a car buying [problem] which went on some years ago which resulted in him receiving a fake cheque for the sale of his car. He took this cheque (unaware it was 'rubber') to HSBC Bank who cashed the cheque credited the £10k into my brothers bank account. My brother withdrew the money and paid his debts off. Over a week later, HSBS contacted him to advise that the cheque had bounced and he now owed the bank £10K After much debate HSBC ended up calling this cash an overdraft and ultimately the debt went to debt collection. My brother ignored the debt, paid nothing against it and made no contact with the debt collection company. He cannot remember whether a default ever appeared on his credit file for this as it was 12 years ago, however, his last credit report with Experian before the CCJ appeared did not show any record of the debt. In July 2016 he updated his credit file with his new address and registered on the electoral role suddenly he began receiving letters from Robinson Way about the debt. Unfortunately he ignored the letters and eventually he was issued with a threat of legal action. He did contact the debt recovery company asking for proof of a credit agreement but this was never received. To get to the point, a CCJ has now been issued as he did not respond to the County Court notice. I am aware that there may be an option to dispute the CCJ by way of requesting it be 'set aside 'if he can prove he was not liable for the debt. I believe he may have a case due to: The original debt being 12 years old He did not make contact with the company within the last 6 years He did not receive the credit agreement he requested I am also not sure of the legality of the debt in the first place given that the debt only occurred due to the bank releasing funds on a fraudulent cheque and then asking for it back -I would have thought the security of cheques would have been the banks responsibility? I am now wondering of we can dispute this CCJ and if so where on earth do we start!? Any advise would be greatly appreciated

-

I raised a complaint with safeloans - directly with them - re irrisponsible lending - I only had one loan with them way back in 2012 - but defaulted - didnt respond to their letters and eventually got a ccj - but after writing an email complaint to them which was responded to very quickly and they agreed to get the ccj set aside - I have spoken to northampton bulk centre who have confirmed this - yipeee!!!

-

The following statement was released a few days ago by the Government. This is in response to a Daily Mail campaign earlier this year regarding individuals who have found themselves unable to get a mortgage or credit because of the existence of a judgment against them that they were unaware of (usually because all correspondence had been sent to a previous address). Depending on the outcome, this consultation could have far reaching consequences for bailiff enforcement. Currently, in relation to council tax arrears, a local authority are permitted to issue a summons to the 'last known' address. In relation to an unpaid penalty charge notice, correspondence must be addressed to the address held by DVLA at the time of the contravention.

-

Hello all Thank you for your help I received ccj court order but I didn't receive the court papers before the ccj There is no date of birth on the ccj and the second initial is wrong How do u apply for set aside There is no credit agreement and debt is over six years Is there any chance to win Do I need a defence How to do set aside Any help please The ccj issued over 2months

-

It seems most debt collection agencies know when you have started making an effort to pay back debts. I have been able to agree reduced settlements or reduced monthly payments for some of my wife's debts, starting with the smallest and working upwards. It seems lenders that have made no contact in months previously are starting to threaten legal again and in one case , sending debt collectors to our house. I check our credit reports monthly through Noodle, Credit Score and also Check My File and decided to check our file also with Trust Online for any CCJs. No CCJs even on the Trust Online as at 30/08/16. My wife's latest report now shows a CCJ from 23/08/16 for a default that shes had a while. It was for a HP Car finance from Blackhorse She told them in 2014 that she's moved to husband's address and wanted to negotiate a way she could either hand car back or pay reduced amounts. I am self employed and was the sole earner. I was in hospital for quite a while after a motor accident and couldn't make payments on wife's behalf. Blackhorse decided to collect the car in the middle of the night rather than negotiate and wrote to her at my address (current address) that £480 owed. A period of two years, she has received letters from 5 debt collecting companies claiming that debt has been sold to them all at the right address. I feel the debt collectors have intentionally sent the CCJ to old address for £586 so that we will loose out knowing that it takes a month to show on credit reports. The courts claim a month has passed and said i could pay £255 to set aside but warned that the lender doesn't have to agree to a reduction of lump sum payment or monthly payments even after it's set aside. Can i get the debt company to agree to set the CCJ aside by consent so that i only have to pay £100 to the court and a full amount to them? Is there any point paying £255 + £586 for a debt of £480 that seems to have been intentionally sent elsewhere? I read also that the Court takes timing seriously, is it a disadvantage to contact the lender instead of complaining to the court first? Whatever happens , i don't want her to get a CCJ, not even a satisfied CCJ. Am i better getting it set aside and waiting for the response or is it easy to just get a judge to throw it out entirely since there's no justification for Blackhorse or any of the debt selling firms not to have my current address? If she's told the lender of her current address, lender has repossessed vehicle from the same address, lender has written to confirm debt sold at same address and five different companies have written to that address... Can i get the court to penalise their solicitor or perhaps even cancel the CCJ all together?

-

Greetings.. Hi, I am new to this forum .. ITS REALLY A GREAT SITE. I would like to get some advice from your great service for my claim case . I explain briefly below; I am the Claimant and a judgment was given DEFAULT in favour of me in a county court for my unpaid wages as Defendant did not come to the HEARING. As defendant did not pay me , I was about to make an application to the court for the service of Bailiff , then Court Notice arrived with the copies of judgment set aside application and a witness statement of defendant , saying as follows; '' TAKE NOTICE that the application to set aside judgement Hearing will take place on 1st November 2016. 30 Minutes has been allowed for the Hearing '' please kindly help me to answer the following; 1. Should I take my eye witness along with me to this Hearing to prove my case which I hope will help not to set judgment aside ? 2. Can I send my witness statement with my REPLY to the court for the defendantst false details? 3. Actually what will happen at this Hearing and what will the Judge ask me ? 4. What is the consent order ? I coundnt understand it fully .please give some details.. 5. How to write to Judge to make an Order to the defendant to bring some documents for the HEARING , I many times had asked for from defendant which he did not serve me yet? hope you will find some time to answer me kindly.

-

Hi all, I live in a property rented from a housing trust under a licence rather than a tenancy agreement. When I took on the tenancy about 7 years ago I was informed that the clerk to the trustees would hold a set of keys to my home and it would be stored in a locked safe. I have recently discovered that keys have been used to enter properties owned by the trust by workers employed by them without the tenant's permission or presence. One particular maintenance worker often calls unnanounced to carry out small jobs and has been asked on numerous occasions by various tenants to make an appointment but he refuses to do so. He often works until 8pm making this awkward for people coming home from work or with children to get meals etc. This person has entered a neighbour's home without her permission. He also entered another person's home without her permission and moved personal items which I assume was to enable him to carry out a repair job. He has also questioned me because my daughter has fitted a secondary lock to her door saying he's reported her to the trust clerk as he checked that she hasn't provided a spare key. My questions are: a) has the clerk to the trustees got legal rights to hold a spare key b) does the male maintenance worker have legal rights to use this key without permission of the tenant (all mainly female living alone) c) can tenants have secondary locks fitted (leaving the original lock in place), without having to pass a key on to the clerk to the trustees as some of the tenants have been told. As you probably gather most of the tenants are females living alone and are very nervous that the male maintenance worker rocks up at any time without an appointment and seems to be able to access keys to gain entrance when the tenant isn't present. Unfortunately any complaints to the trust clerk about this man seem to fall on deaf ears and he seems to be very highly thought of by the trustees. Any legal advice welcome with pointers towards legislation to quote if possible. Thanks in anticipation.

-

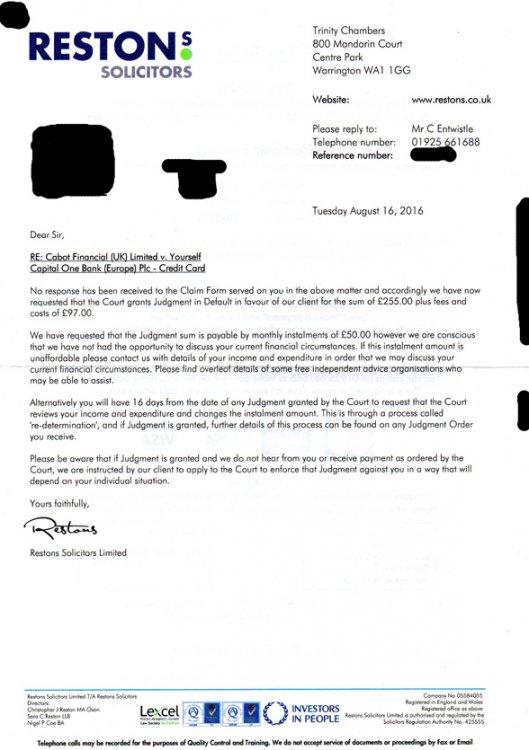

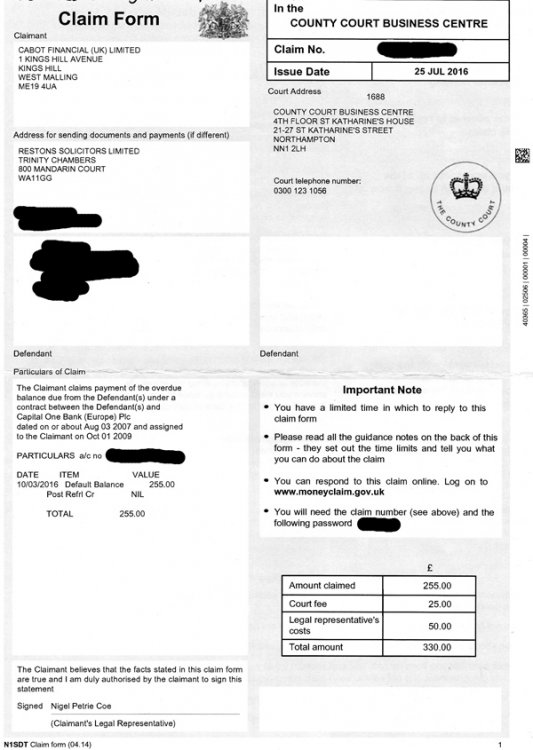

Hi there, Thanks for reading. I'm new to the forum, and hoping I may be able to find a little help with my current situation. I'm in a bit of a tangle!. Essentially I received an N1SDT CCJ claim form in the mail, too late to reply, and subsequently received a CCJ. I believe the debt to be statute barred, and intent to have it set aside if possible. I'm currently trying to claw my way out of long term unemployment by starting a small business (via the JSA/NEA scheme. I'm in the very early stages), so this is pretty awful timing. On the 18th of August I received a claim form dated 25th July. Obviously at that point it was too late to submit a seemingly simple defense, and the court ruled in favour of the claimant. I have received a 'Judgment for Claimant' notification, and correspondence from the claimant. The debt is from a capital one credit card dating back to August 2007, and was apparently 'assigned to the claimant' in Oct 2009 (this information is taken from the 'particulars of claim' section of the claim form that I received). I have no records of the debt, but have had no contact with anyone regarding the debt/account since the point were I stopped making payments (which I assume is 2007). I'm hoping that I can have this CCJ set aside, owing to the debt being statute barred. I'm currently claiming JSA, have no savings/additional income, live in my father's home, and I believe that I meet the requirements for a full remission of court fees, should I be able to go down that route. Though I'm not really sure how I go about doing that. Also I'm not entirely sure what kind of evidence I would have to supply. I have no records from the time, and assume I'll be needing them. Any advice with regards to my options at this point would be greatly appreciate. My understanding's pretty limited, and time is of the essence it seems. Thanks for any help.

-

back in jan I received a cc claim from Cabot for a debt I had with Capital One i responded to the claim i did the income expenditure and admitted the 235 debt i owed but disputed the added solicitors fees etc .I contacted the court to see what was happening and was told the judgement had been set aside. Today nearly 6 months later I rec a letter from Mortimer clarke , which reads as follows we refer to the admission form filed in response to the claim form our client has considered your admission very carefully and is prepared to accept your part admission of 235 , from the figures provided however your total monthly income is 100 and expenditure is 100 as your expenditure is the same as your income they indicate that you may not be able to afford your proposed offer of payment of 5 pounds please confirm how you will be able to afford the propose offer in light of the above. if we do not receive a response within 14 days we are instructed to accept your offer and make an application to the court to enter judgement for the admitted amount payable by your proposed monthly installment of 5 pounds . alternatively if you confirm within 14 days that the offer is not affordable and sustainable by you we will refer this matter to our client for further instructions .if judgement is granted by the court we will write to you again with the judgement terms and ask you for further details of your financial circumstances so we can review if affordable for you any thought help advice please??

-

Vehicle Control Services issued a non- display of ticket 2 years ago by the evidence on an ANPR camera they then left it 14 months to start demanding money through the usual DRP/ZENITH and finally the bottom of the barrel B W Legal. They issued court proceedings when I refused to communicate with them as they had in my opinion broken data protection regulations in contacting me by telephone warning me what costs I could expect if going to court. I made the mistake of trying to fill in the court form online but on making a counter claim for intimidation the plea did not get entered so I received a court judgement in my absence. I applied to have the case set aside which I had found in my favour the judge was well in her words displeased with the conduct of B W Legal using unsolicited telephone calls to persuade people to pay up. I got a disapproval for not disclosing that I had in my possession the parking ticket, but in my defence I said that I was charged with not displaying and not non- payment. No costs were awarded to either party. I am now providing the court with the details of my case in case B W Legal wishes to continue the case or drop it (i expect they will drop it now they know I still have the ticket). The main issue I have is that they should not be issuing parking notices on the evidence of ANPR cameras only I asked for photographic evidence in the beginning but heard nothing I think they left it 14 months hoping I would not have the evidence to prove them wrong. Does anyone have an opinion on winning a case and maybe setting a legal precedent that ANPR cameras can't be used for evidence of not displaying a valid ticket without photographs for proof. This in my case shows that ANPR'S are flawed.

-

Hello I consented to a set aside I had against a company who didn't reply at all to the claim from 12/12/15. I understand that the claim will now go back to the beginning but I now need to amend my particulars. I need to know - 1 Will there be a new issue date for the claim, or does the original date of the issue of claim, 12/12/15, stand? 2 Due to the claim now going back to the beginning I need to amend my particulars as things have changed, will I have that opportunity or are my original particulars from 12/12/15 still valid? 3 If I have to apply to change my claim will I have to pay? 4 I gather that the other party can consent to my new particulars, do I need a consent order for this and draw one up and file with the court? Also paying a fee? Thanks in advance. Brenda

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)