Showing results for tags 'rights'.

-

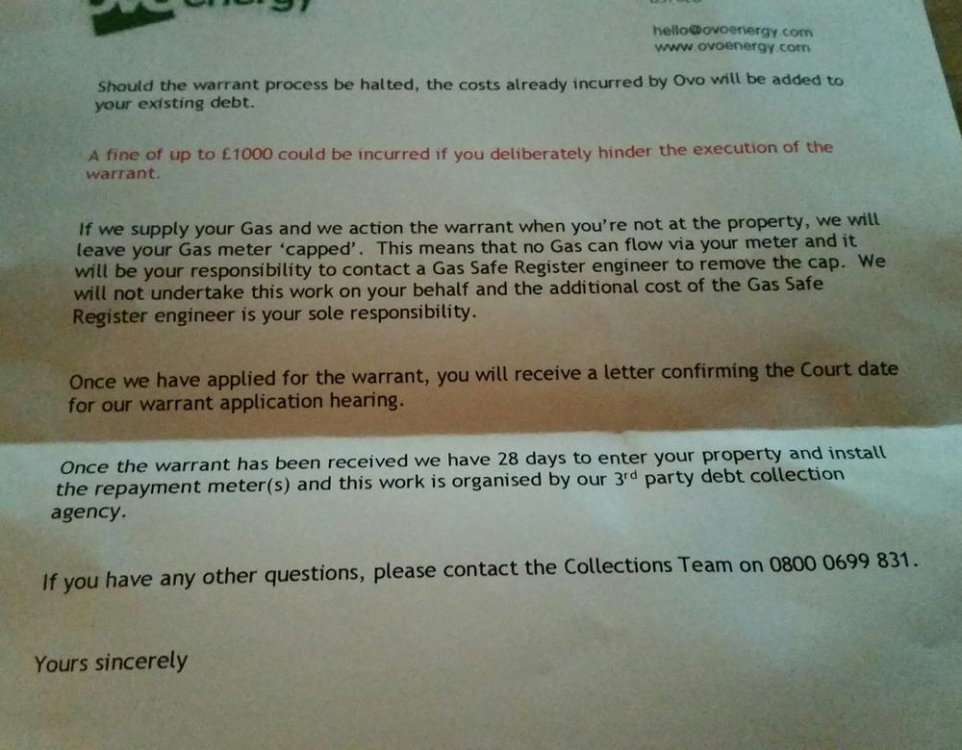

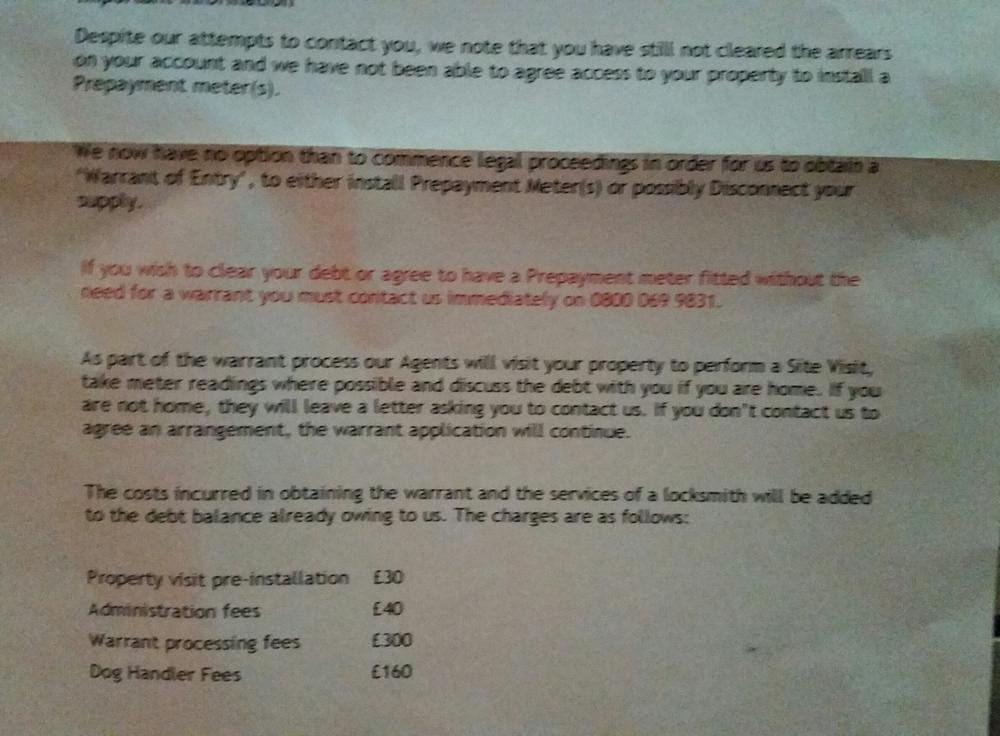

Supply start date Feb 2014 Dispute raised March 2014 based on start of contract meter reading and inaccurate bill. September 2014 Court date set for warrant application and stated to court the warrant process was being misused and the account was in dispute warrant declined as there was no need to attend my meter for any works or service. After the declined warrant application I agreed to have smart meters fitted and debt would be refreshed due to inaccuracy on contract start date. Debt has never been wiped as agreed, so account remains in dispute. The engineers came and declared it unsafe to sit a smart meter due to age of current gas meter, they wanted to replace the meter due to age but due to location would need to consult with national grid as walls needed to be knocked through etc etc and pipes re piped. Nothing materialised, I changed my supplier however as I have discovered today only the electric went through. I was unaware that the supplier was still supplying me and assumed I was on a dual fuel tariff with new supplier however it's electric only. I have today been issued with a notice to obtain a warrant due to debt of £3500. Last meter reading was September 2014. Have bot been provided with an accurate bill in this time. The meter still awaits replacement. Any advice on how to proceed? Upon phoning them They are adamant they either need 50 % payment or they will fit a pre payment meter and deduct 20% of every top up for the debt. I'm happy to have a repayment meter however the amount of debt is not correct

-

Hi All I'm a long-term debt struggler, but I've made good progress over the past 5-6 years, some paid off, one written off, some on arrangement etc. Just when I thought I was getting on top, Lowell tell me they're sending the bailiffs round The original debt (Capital One) hasn't been paid towards, or acknowledged for a very long while (less than 6 years though!). I wasn't in a position to pay, due to other arrangements in place, so chose to ignore it. The idea was to eke things out until April this year, when two of my existing arrangements come to an end, then go to Lowell with an offer / agree a repayment plan. The bullet points of my issue are below, any advice would be hugely appreciated... 1. Moved house May 2015. 2. Lowell wrote to me at my NEW address September 2015, November 2015 and other letters. 3. Heard nothing until last week, when I received a Notice of intention to enforce, warrant of control etc, due to non-payment of CCJ registered July 2016. 4. I knew nothing of the CCJ, no letter before claim, no claim forms, no court papers, no nuffin whatsoever. 5. Papers were presumably sent to my old address, as that's where the CCJ is registered. In short, LOWELL pursued legal action without my knowledge, affording me no right to defend their claim, and no opportunity to pay within 30 days of the judgement, thus removing it from my credit file. The key point here, is that they had written to me on more than 2 occasions at my new address, then reverted to my old address when it came to the legal shenanigans. Can't see that this was anything other than deliberate. My credit file had been starting to shape up (slowly), but now it's got a shiny new CCJ on it. I'd be very grateful to receive your suggestions...

-

Hi all Hope you can help me with a few questions. My father passed away last week we are currently in the process of sorting out his affairs. He left a will and a small amount of savings. So far we are on top of everything after taking legal advice regarding an ISA with just over 5k in it have been informed that due to the small amount of savings and the will... probate isn't needed. But there is a loan outstanding that was unsecured and taken out in March/April of 2015 to have solar panels installed on their house. This loan was done soley in my late fathers name. Once the funeral expenses have all been paid out there isn't enough left over to clear the remainder of the balance.. . It won't even come close to putting a dent in the remaining £8.5k or so (I think the original amount was 10k) after about 15-16 months of paying £126 a month. He co-owned a house (they'd done a separation of tenancy to cover any potential problems should my dad have to go into care if my mum passed first) and my mum inherits everything. .. Which is the house and a small amount of savings (less than 7k total) and funeral expenses that are expected to be a little north of 5.5k. The loan in unsecured with Icanobank... but we need to know if my mum will be expected to continue with payments, or if a demand for the balance will be made (which cannot be paid in full) or if they may try to make a claim on the house when it's sold (my understanding is that they cannot try to force it's sale as it was an unsecured loan). There is a small mortgage remaining on their house of about 18k We are still in the process of sorting out my mums finances, she will retain 2/3 of my dads pension each month and the DWP are currently calculating her state pension but have said that my dads NI payments (mum only ever worked part time) can be used to top off my mums, so she should be getting the full £155 per week. This means that her income would be enough to cover all of her outgoings.. . unless she has to keep making payments on this loan in my dads name. Your advice would be most welcome as I want to be fully aware of legal rights and responsibilities before contacting them to inform them of his passing.

- 27 replies

-

- death

- responsibilities

-

(and 2 more)

Tagged with:

-

Hi everyone (apologies in advance for length), I finished a fixed term contract on Tuesday, and the next day put in a claim for Universal Credit. This is my first time on UC and I have my initial meeting this Monday. I last claimed in April when it was still a case of JSA/separate housing benefit, so having it in one lump sum monthly will definitely be more convenient. However, I do have a couple of minor concerns about what may or may not have changed since UC came into effect. 1) When I was on JSA, one or two members of staff tried to put pressure on me to give access to my Universal Jobmatch account. I wasn't happy to do this for the same reasons as lots of other people - I'm an adult who can and should be trusted to do my own jobsearch and don't appreciate being monitored like a naughty child, so it's mainly out of principle. Also, although I have an account and don't have anything against the site per se, it is not the only method of jobsearching and so wouldn't reflect the full amount of jobhunting I had actually done. Therefore, I prefer to write it all down on paper and was able to quote the necessary lines from the Toolkit to back up my right not to allow access. 2) Again, while on JSA, a different advisor threatened to "take action against me" if I did not lay my jobsearch out in the exact format ("What I will do", "what I did") in the A4 booklet. I preferred to do it like a diary, as this gave me more room to write down every employer I had applied to, whereas he wanted me to cram a week's worth into half a page (it did say to be as specific as possible!). Basically I'd have been writing the same thing twice every week but in different tenses, which is plain stupid. Anyway, I spoke to the Jobcentre manager (again quoting the bit from their Toolkit where it says they can't specify to jobseekers what form their evidence takes) and the manager confirmed that as long I was keeping a record, that was fine and that they do allow flexibility. Now, to my concerns regarding Universal Credit. I notice in my confirmation email about Monday's meeting, it says: "Please make sure you've registered with Universal Jobmatch on GOV.UK and bring your login details with you to the meeting." I'm fuming at this! Even the most militant advisor/coach under JSA never asked me for these! What I want to know is, can I still use those nuggets from Chapter 3 of the Toolkit to defend my right to privacy? I notice they all say "We cannot mandate/specify to a JSA claimant..." I don't want to be caught out by semantics. I know it would be illegal under Data Protection law to do this, but I also know that wouldn't bother some DWP staff. I can't find any evidence this has changed, but can anyone confirm that those quoted sections from the Toolkit are still valid under Universal Credit? I have written them down to take with me on Monday in case anyone gives me a hard time, but need to make sure it's still correct. Thanks in advance.

-

Specifically relating to personal correspondence. Work program provider wants me to bring a list of agencies I am registered with along with phone numbers and ring them while they listen and or record the conversation. Am I right that without my permission that is an unreasonable request and I can tell them to do one ?

-

A first post, so hello. My home was repossessed six months ago and the estate agent’s website shows a notice saying Mortgagees in possession are now in receipt of an offer for the sum of £240,000 for [property]. Anyone wishing to place an offer on the property should contact [Estate agent’s details] before exchange of contracts or within the next 7 days whichever is sooner. This replaced a previous notice, first seen on 29 September 2016, specifying 28 days instead of the current ‘7 days’. What does this notice mean? Does it actually mean that a sale is proceeding but contracts haven’t yet been exchanged? The house isn’t advertised ‘Sold subject to contract’. I think this notice is meaningless as it doesn’t say when ‘the next 7 days’ runs from, it’s just an advertising gimmick. Isn’t the mortgage lender supposed to pay some attention to the defaulting mortgagor’s interests, and accept a reasonable offer? The asking price for the property is £250,000 so the offer, if it exists which I doubt, of £240,000 should be accepted. The outstanding loan is £65,000 and of course there will be costs for anything they think they can pile on. The agents refused to speak to me when I phoned to ask if a sale was proceeding. I’m housed by the Council and they can’t find out either. What are my legal rights in this situation? I made an appointment to see a solicitor in my local town but after going into their office and actually speaking to the man, I got the very definite impression that this new client (who also needs other services like a Will and executors of my estate as I don’t have family, and will pay for work done), wasn’t the kind of client they want. Any help would be very much appreciated. TIA. Ginger Mog

-

Please can you help confirm something for me regarding a back garden boundary with my neighbour of 35 years. The boundaries were old stlye and marked out by hedges, not long after we moved in we asked the neighbours if we could cut them and put a fence in instead. They understandably wanted to keep the hedge. So we put the fence up on our side. Now my beautiful neighbour is moving. I have started getting anxious over the boundary because my deeds are not ckear on that side and show nothing. I do not want the hedge row cutting down because it offers a countryside feel, height, privacy. We have been maintaining the hedge on our side throughout the 35 yrs. If I recall correctly from the party wall act, puttung that fence up does not mean losing the shared boundary? Is this correct? I am only interested in truth, not trying to claim anyting that is not mine or be awkard, only peaceful. If this is correct was wondering what folk do. Ask their neighbour for a letter stating these facts? Ask them to make it clear to new owner? It is important that I minimise stress due to health and I am not bothered about a foot of boundary but the privacy the hedge currently privides if cut will make it difficult to enjoy my garden anymore. Peace Clear33 thanks in advance

-

The Consumer Rights Act (CRA) will apply in full to all transport services, including mainline rail passenger services, from next month, allowing passengers to challenge the amount of compensation they are offered by rail companies. From the start of next month, under the Consumer Rights Act, passengers will be able to ask for their money back by going to a local county court if they are not happy with the way a rail operator has dealt with their request for compensation. Long-suffering commuters will also be allowed to demand that compensation is paid in cash rather than train vouchers. Under existing guidelines most train operators only offer a ‘delay repay’ deal which allows passengers to claim the cost of half a single journey for delays of more than half an hour – or the full one-way ticket price if held up for over an hour. It is only if a train is cancelled, or a vital connection missed, that a full refund of a return journey will be paid. These refunds are not automatic – you must fill in a form first – and they are currently paid in train journey vouchers. The new rules will allow passengers to demand all their money back if they believe the compensation offered is inadequate – or they believe they deserve a full refund as the service fell well short of what they had expected. Read more: http://www.thisismoney.co.uk/money/news/article-3783016/Delayed-leaves-line-train-company-court.html#ixzz4KtQ6t3ff

-

I own a property in a small development of 7 houses. There is a tarmac access area and some paved footpaths around the houses for which ownership has been retained by the developer but over which the residents have right of access, subject to our each paying a share of maintenance and upkeep expenses. The developer has appointed an agent to act for him and this agent has issued invoices for expenses annually, typically in the amount of £250 per property i.e. £1750 per year in total for the whole development. As far as we are aware little or no maintenance work has been carried out, and none is really needed, but there is a possibility that someone has visited occasionally for the purpose of sweeping and general tidying. No substantiation of the amount claimed has been provided despite request but the agent has stated that, as well as actual maintenance cost, we are liable to pay for insurance, lighting, management and accountancy fees for the whole estate. The residents acknowledge liability for maintenance costs actually incurred and have agreed to pay a nominal amount of £100 each (making £700 in total), which should be well in excess of the costs actually incurred. The agent has responded by issuing a "Formal Demand" and stating that unless we pay the amount claimed in full either the account will passed to a debt collection agency who may issue court proceedings or a first charge may be added to any applicable mortgage. We are also informed that the developer can place a charge over our properties, and that we will be liable for any legal and financial administration costs incurred. The question is therefore can the developer or his agent carry out any of these threats? How? Do they have to go through the courts? If it were a one-off charge we would probably pay the amount claimed, but it is annual and so would accumulate in perpetuity. Also, any registered outstanding claim would have to be settled if any of us wished to sell. And there may at some point be some genuine maintenance or repair work that is required to be done.

-

Hi. I'm totally sick to death of this, and wanted to know where I stand. I'm sure a few of you will have been in the same situation at one time or another. I recently bought an Xbox controller from Argos. It was the Elite, which costs £120, a lot of money for a controller. Less than 4 months later it's broken. I contacted Argos and all they'll do is give me Microsoft's number. Microsoft want me to post it to them at my expense, this is unacceptable for a number of reasons. Firstly, I paid for a working product, I don't want to shell out any more. Secondly, I don't want to be without a controller for several days or even weeks. Lastly, it should not my responsibility to do any chasing around, I just want to return it to the store and get a replacement. Where do I stand with this? This isn't the first time a store has fobbed me off with this and I'm sick of it. Posting my broken electronics to some obscure industrial estate in Europe is just unacceptable, are these stores breaking the law? I'm tempted to just issue a court claim right away, but I know I have to give them a chance to fix it. So I've sent a strongly worded email notifying them that I want it fixed, and that I will pursue it through MCOL if necessary. Hopefully it won't come to that. I don't always go nuclear, but like I said this has happened so many times. These large chain stores sell you a product then just wash their hands of it. "Broken is it sir? Past 30 days, not our problem, you'll need to call this number..." etc. I'm sick of it! Thoughts and advice?

- 15 replies

-

- manufacture

- return

-

(and 1 more)

Tagged with:

-

Apologies if this is a common theme on this board but I haven't found an answer that fits my case. I've worked in a factory on a temp contract for a couple of months with the expectation of working there about six months. The first month all was great. My colleagues are all all seniors over 55 who have worked together and never had any temp colleague to deal with. At one point one of the manager pointed out that I could fit as a permanent replacement for one the seniors (which I don't want by the way). One of seniors did not take it well and since then has started taking exceptions at pretty much everything I do, in doing so he verbally humiliated before my colleagues. At one point I couldn't take it anymore and I verbally complained to the manager, which minimised the issue and didn't do anything serious to make it stop. Now my other colleagues have started complaining to the manager about me for petty issues. In other words they would rather want me out. The manager says he's on my side but refuses to take sides and said the workers have been there long and I shouldn't kick up a fuzz. The company is very small and there's no grievance procedure. I don't think I should be bullied into leaving but it looks like it's going this way. What can I do apart from walking out and sucking it up? I was thinking of writing a formal letter but I don't know what I should write. I'm at loss. If I leave I'll get no benefits and never mind any good references. Thank you.

-

Hello hopefully in the correct section and there is a Scottish expert for this soap opera I will outline the scenario and my understanding of the law. First the not too complicated part (I believe) Mrs X died without leaving a Will Mrs X is survived by Mr X (20 years separated but not divorced) and 3 Children. Mrs X owns 100% property A (that was signed over legally to her from Mr X 20 years ago.) My understanding of Prior Rights: Mr X is the widower and thus on the face of it has prior rights. However he does not live in property A, so does not "qualify" as the survivor. Therefore he has no prior rights. Then property A would become part of "the remainder of the estate" and the 3 Children inherit the house (33.33% each), as the intestate estate devolves according to legal rules. Basically "The Children" are at the top of lists to inherit, and well before the surviving spouse. So if I am correct so far then please read on. Mr X lives in property B. Property B deeds are still in joint names for Mr X & Mrs X Mr X qualifies as "the survivor" as he lives in property B. Hence under prior rights Mr X claims the house (Value below £473000 etc). Again hopefully correct and not too complex. Heres the fly in the ointment. Mr X also rents out property C to a tenant. It appears that property C deeds are also still in joint names for Mr X & Mrs X. (Mrs X would not have realised and never got half rent etc. Not worried about this part). Following the same rules/pattern it would appear that property C would also not go to Mr X under prior rights, but that 50% of property C would end up being split to the 3 children !! Can anyone tell me if this all looks correct ? There is no in family fighting going on here but rather just trying to ensure all is correct in my head before engaging legal help.

-

A family member decided 10 months ago to replace his ageing car with a factory-ordered brand new one. He opted for a PCP deal having first undertaken extensive homework about total interest payable and likely future value etc. Of all the options open to him, the PCP deal together with further incentives he negotiated with the supplying dealership most suited his circumstances. Until recently, he had no cause for complaint. But then the symptoms of one or two faults (or a single inter-related fault) affecting engine and auto transmission became evident. The car has been into the supplying dealership which immediately sought the manufacturer's involvement. Some preliminary work was then undertaken according to the manufacturer's guidance, pending further work which will be carried out two months' hence at its first service. The car, which has one 9,000 miles from new, is said to be perfectly usable until the time of that service and that in any event, anything and everything is covered under the manufacturer's warranty. Fair enough. Except: delving into the Internet to research his car's emergent problems, he has discovered dozens (literally) of posts on motoring forums going back over several years, all of them complaining about the same problem(s) and about the hoops it was necessary to go through to get them fixed. In some cases, the manufacturer replaced the engine and transmission under warranty -- though only at the end of protracted arguments where some consumers were concerned. Also in some cases, the vehicle was off the road for up to a month while those repairs were completed. What isn't clear from any of those Internet posts is whether or not the posters had financed the purchase of the car outright from their own funds; whether it was with a bank loan; whether it was hire purchase; or whether it was a PCP. That actually strikes me as being of crucial importance. Currently, my relative's car is still showing symptoms of inherent faults, albeit those symptoms are now less noticeable than originally. He is resigned to living with them and to abide by the dealership's / manufacturer's guidance. However, he is worrying about what might happen if it turns out that the vehicle becomes unusable due to failure, or if he is ultimately told that it will be out of his possession for a lengthy period due to the possible scale of repairs required. The word 'possession' prompted me to post this query on here, because it seems to me that he doesn't 'possess' the vehicle in a strictly legal sense (i.e., of ownership), rather that he and the manufacturer entered into a contract -- brokered by the supplying dealership -- via which he pays a monthly premium to the manufacturer's finance company and the manufacturer in turn supplies a car fit for purpose and usage. Am I right in thinking that in the event of -- and I must stress: 'in the event of' -- the situation becoming worse and the vehicle failing to perform / being unavailable to him for short periods or an extended period, the essence of the issue here is as more about breach of contract than anything else? Advice appreciated; though things seem to be under control at the moment, it's surely as well to be fore-armed by being forewarned of a consumer's position when it comes to the PCP of a new car and what happens if that car develops problems early in its life. Thanks.

-

Hi Im writing on behalf of my brother in law who bought a used van via his limited company in November last year. Recently its been diagnosed that the injectors in the engine are defective and require replacement. This could be a costly repair. The trader he purchased the vehicle from gave him a 3 month return to base warranty which has obviously now expired. After initial queries the owner has come back and said the sale was a business to business sale and not subject to general consumer laws and the rights associated with this. Im not sure how to respond and could do with some help. So i guess the be all and end all is does my brother in law have any rights that would allow him to request a FOC repair to the van (my thinking is the 6 month consumer rule may be relevant in some form?) or does he just have to suck it up because he is not afforded the same consumer rights because the purchase was made via his limited company (which if relevant is very small i.e. 2 directors and sub-contract labour). Finance is with Moto Novo if that is relevant at all? Id be grateful if you could help me out with this one. Thanks Shane

-

Need guidance: Purchased the following three days ago, from a store: http://www.pcworld.co.uk/gbuk/phones-broadband-and-sat-nav/broadband/mobile-broadband/ee-osprey-2-mini-pay-monthly-mobile-wifi-10132535-pdt.html Personal Hotspot Device - £9.99 + 30 day (rolling) data contract (I choose the 32gb tarrif - £28pm). At purchase - I had to put my debit card in the pay machine to pay twice - 1st - £9.99 for the device, 2nd - for the 30 day rolling data contract validation (£5). I've been using both for the last three days (The device box & the separate data sim were both sealed when we left the store). I opened and used both. I want to return and get a refund for the device + as much as possible for the contract. I have friends that have warned me 'not to trust this high street retailer - and to understand that they 'game' customers to avoid refunds as much as possible'. What are my consumer rights - and how should I approach this to get back as much as possible? My sincere thanks to any and all that help and contribute. Libertas

-

I got a laptop from Currys on 15.8.2015. At time of purchase, it had windows 8 and was prompting to upgrade to windows 10. Windows 10 has grown larger in size in recent months now and has currently reached 29 GB. I think soon windows 10 will be larger than 32 GB which is supposed to be the size of my hard drive. Programs cannot uninstall because they need writing space while they uninstall, thw laptop keeps crashing. Currys keep taking it for "repair" which takes 3-4 weeks a time. They say they are just doing a system restore when they have to also reinstall the bios options which have disappeared. I feel this model is a defective one because the hard drive is too small for windows 10. I asked them if they would replace the hard drive with one having more space for money and they said they wont do so under any circumstances. I dont feel as time goes by windows 10 doing all its updates will grow smaller-it is already too big to fit in my hard drive. This is a new model with only usb input and incompatible with older versions of windows. Yet the hard drive is too small for the windows it is supposed to carry. As its become obvious the model is a defective one having too small a hard drive to run the windows it is supposed to run, what are my rights? I am for all purposes wihtout a laptop What are my rights anyone?

-

Hello good people I hope this is the right thread to post this query... I need assistance as to how to go about filing an appeal against the ET judgment i lost for ''unlawful dismissal''... ..This is an NHS matter ..the judge was bias. ..her written judgement even shows her helping the other side to clarify their case.. My question is... . in a situation where it can be easily be shown and proven that the accusations which led my suspension and later dismissal was NOT properly investigated ..can a judge still get away with using points of law like (Post Office v Foley and also HSBC v Madden (Iceland Frozen Foods v Jones BHS v Burchell case, As reasons for ruling against me?.. .I was under suspension for 6 months and virtually NO investigations was carried out. ..for exp..the main Charge nurse who leveled the accusation which led to my suspension was not questioned. .in fact she refused to give further statements. ..persons whom i identified as being involved in the situation were not questioned for 4months. ..it was only AFTER the appeal which was 7 months later that statements were sought from these people. ...and one of them claimed he was in Australia when i saw on FB that he still living in the UK... . I brought these facts up throughout the whole process ... and even in court and judge noted this. ..my Solicitor didn't really do much... there is so much more i can go into. .but this ET judge's decision and reasoning is the most ridiculous i have ever read... I was fired under capability rule... I dont know how to make heads or tails on this matter as it has been going on for a year. ..i do not want to waste money on consulting a barrister if i am going to get screwed around like my current solicitor did... thank you.. This is my first time on here and i will clarify if need be for anyone who can help.. .I am at a loss and i am willing to take this case far as i can.. .as i did nothing wrong ..i was ganged up on an bullied on the job. .then set up... I am from America and i am not familiar with UK employment laws... If need be.. .i can email the Judges decisions to anyone who wants to read..

- 109 replies

-

- appeal

- asisstance

- (and 8 more)

-

Hi, I was hoping someone could help me. Basically in April I bought a used car from a trader. The car broke down pretty much straight away and now wont start up at all. I had spoken to consumer direct who told me to write to the trader and tell them as I have had the car under 30 days I am rejecting the car and seeking a refund because the car was not fit for purpose and was not as described (the trader when I bought it said the car was perfectly ok with nothing wrong with it, it infact had a serious fault). The Trader who sold me it as a result of my letter has came around to my house today shouting and swearing and being abusive. He offered me a lesser car than the one I bought from him, valued at the same price on his website. But he was wanting me to pay him £300 more for it. And it would be classed as a private sale not trade so no comebacks if anything is wrong with this other car. Obviously I rejected this offer. He has told me to take him to small claims and all he will do is leave the country and so I won't get the car or the money, or if I do it will not be until a year has passed as he wont be in the UK for many months so I will be out of the car and no money for all this time that he deliberately messes me and the court about to drag this out as long as he can (I know this is an empty threat as the courts wont allow this to go on). But anyway. I am now in the situation I need to draft up my particulars of claim for a consumer rights 2015 claim on the basis that the car was both not fit for purpose. And not as described. I have looked over the Consumer Rights Act and I am not sure which sections of the Consumer Rights Act apply to used car purchases under the above two scenarios. Can anyone help and advise which sections of the consumer rights act I would bring my claim under. i.e section 22(4) or something like this. Thank you in advance.

-

I had an assessment for ESA and like 90% of my fellow ESA claimants I have been placed in the WRAG. I suffer from mental health issues (bpd (and possibly schizoid? my social anxiety is not social anxiety...it's a complete aversion) paranoid thoughts, depression, severe anxiety, agoraphobia) and a heart condition that causes me to blackout. I got sick when I was 18 and have never been able to work since. I told them I would ideally like to be self-employed in the future or get back into education - however, I don't know how possible that is. My conditions are very debilitating to the point I cannot leave the house unaccompanied for both physical and mental health reasons. I have an upcoming appointment with Ingeus. I have heard nothing but negative things about this company: how they bully people to take part in programmes and workshops, how they get paid for every person they manage to shove off the list, how they use coercion and social control to get people to sign their rights away, sanctioning people for weeks at a time. Even their employees seem to hate it according to their GlassDoor reviews (an average rating of 1.5 stars out of 5!) In fact, the advisor at the jobcentre told me to apply for PIP and DLA so I can get Ingeus off my back and wouldn't have to go through all this nonsense! He said himself he didn't think it was fair at all: forcing an agoraphobic to attend weekly meetings. Anyway, from what I've gathered, at your 1st appointment, the Ingeus advisor asks you to sign two waiver forms. One of these forms gives Ingeus the right to contact your GP and access your medical records anytime they want. Of course, to someone who already suffers from paranoia, this sounds extremely fishy to me. The person I will be speaking to will definitely not be a registered health professional, so I don't see why they should be granted access to my medical records? To me, that is an incredibly private matter. Why would I want someone who works for a greedy, private, international corporation who has nothing but my worst interests at heart accessing my medical records?! My question is, am I really required to sign this form? If I refuse to sign it, can I be sanctioned? Or am I within my rights? The other issue is, I have seen cases of Ingeus bullying people with severe mental health issues into 'training workshops' and self appointed group therapy workshops, as well as CBT. Apparently there are no real regulations or training when it comes to such mental health workshops and really, anyone can open one and call it 'therapy', and that none of the workshops Ingeus runs are legitimate. I am in touch with my own private therapist and I want it to remain that way - I do not want to attend a workshop where they lump all the unfortunate souls the DWP considers 'nutters' together and force them to talk to each other as if that will magically cure their mental health issues. My therapist has told me my mental illnesses are permanent and can only be managed, not cured. However, I'm worried that refusing will also cause me to be sanctioned. So, do I have the right to refuse any such suggestions made by my advisor? Because I know their knowledge of personality disorders and agoraphobia is going to be very limited. I know a girl who was agoraphobic and her advisor told her that her 'task' for the next week was to go for a 30 minute walk every evening and say hello to 5 people on the way! How ridiculous, an unqualified pencil pusher telling an agoraphobic to 'get out more!' I really don't trust this company, I have read all about how heartless and devious they are, and I want to keep my contact with them to an absolute minimum. However, I also don't want to p*ss them off and end up being sanctioned for it. So how do I work and comply with them while also remaining within my limits?

- 4 replies

-

- appointment

- ingeus

-

(and 1 more)

Tagged with:

-

The government is set to delay implementing enhanced rights for rail passengers by 18 months, Which? has discovered. Earlier this month, it emerged that the government is set to delay the implementation of the Consumer Rights Act in sea and air travel until October 2016. And now, Which? has discovered that rail will be delayed by a further 12 months until October 2017. The Consumer Rights Act came into force across most sectors in October 2015 and was initially due to apply to all travel sectors from 6 April 2016. This delay means consumers will now have to wait another 18 months to be able to claim a full refund or compensation when a train operator does not deliver a service 'with reasonable care and skill'. http://www.which.co.uk/news/2016/04/further-delays-in-store-for-rail-passenger-rights-439947/

-

Hi all, My landlord agreed to break my tenancy early, at roughly the 6 month mark into a 12 month tenancy (which had no break clause to begin with). So it was completely in their power to decide on end dates for the tenancy. I also agreed to pay any re-letting fees. I have finally received the following communication from the lettings agent today. So it seems like the lettings agent is attempting to pull a quick one on me, and charge me an extra weeks worth of rent (roughly £200) when I am not even occupying the flat. In addition to this, they want to charge me £300 for the re-letting fees (which they said would be deducted from the deposit). Is this reasonable? I know I agreed to pay this, but if it is an absurd amount, perhaps asking them for a breakdown of the costs might help? What are my rights in this situation? Many thanks fellow CAGers. EDIT: Also forgot to ask - when am I allowed to cancel my standing order with the bank? My next payment is due on the 3rd of the next month, and I obviously won't be staying for the whole period...

-

my mum recently passed away this month with cancer , but a few months before this a family fued began and really really honestly i have no idea why . at the time of the fued i was away on holiday with my wife and children . when we returned home all our numbers where barred by family ,plus any social media sites . my children ignored by my brother ,sister and nephew etc . as to the point my mother passed away on the 8th of january , not long before this she had christmas dinner at my house ,with me and my family (wife kids) and told me she didnt have long left . she also at this point tried to offer me all her savings , i flately and completely refused any of it , my thoughts were if there was anything i would prefer her grandchildren to benefit from it .(i know how much there was as she showed me her savings account book) on recieving the bad news about my mum i immediately called to her house , only around a hundred yards away . i was devastated , to the point of a mild heart attack and a gran mal fit . my sister immediately took over everything (she was next of kin ,but upto this point work was her priority not mum ) a very good freind of my mums asked if his bank book was around (mum saved it for him) that was found but what was also found is that mums handbag had been emptied completley of everything . i was furious ,upset ,angry ,suicidal . i could not beleive how low my family had become in an instant . i phoned her building society and ordered a stop on the account as i beleived someone was going to access the money , luckily there policy is once accessed by a 3rd party it cannot be accessed again for 30 days by a 3rd party. since mum died , no one has contacted me family wise to update me on anything and i have heard all arrangements via 3rd parties . i even found out funeral times and date via facebook believe it or not i do not want to rock the boat so to speak but i know in my heart this is not what my mother would want . i do know someone tried to access my account , an old halifax one i let my mum use to pay her cable bill . i dont have the card it dissapeared along with the other things from mums handbag , so i have cancelled the card . from a legal point of view , what access does my sister have to this account its a saving account ,i know the funeral has been paid from it ,there is no outstanding bills at all only credits for gas ,electric ,water etc, i really dont care if i get a penny of it ,mum was a single parent and would have starved herself to feed us when we were younger , it just feels like i am been pushed out for there benefit , every other sibling (3) has a key to the house ,but not me . and non speak to me or my children . would i be a bad person to try to take action to stop anything been taken from the estate without been notified first please help its driving me insane .

-

Hi there, New to this forum but it all looks helpful. Im sure this question has been posed here before but im just seeking clarity on my legal position. Bought an £800 sony vaio laptop from Currys (for my sins) in Oct 2013. It was the most expensive windows laptop in the shop, sold to me after I explained I use it for work and it gets lots of use so needs to be a machine which will stand up to it rather than a cheap laptop that will struggle to keep pace... It has been repaired once by Currys already in Summer 2014 (software failure, they reinstalled windows for me and thats about all). Last week, after 2 years 3 months, it has died completely. I have returned it to Currys for them to asses, but I am expecting it could be a motherboard failure and as such pretty much a write off and time to buy a new one. I have a friend who works for Currys repair centre, and he has advised me that Currys are obliged to repair or replace under the Sales of goods act regardless of warranty, something he described as retails best kept secret. Having raised this point with Currys the lady was quite firm in her denial ("in thrity years of working here ive never heard of a free repair to a 2 year old machine" ...etc). She claimed that wear and tear on the key board and case showing it has been used a lot as opposed to someone using it once a week to check facebook has to be considered when assessing what is reasable to expect in terms of the life of a laptop. While I take the point that number of hours use affects overall years of use, I feel that 2 years 3 months is not a reasonable time for a laptop to fail to the point of replacement, especially not for an £800 machine sold on the basis of its durability. I feel the amount of use is irrelevent given the short time frame, as to support that argument is to say that the laptop was not suitable for business use or capable of being used for anything other than light domestic home use, contrary to advice given at point of sale and contrary to the price tag. Having read some other threads here I am under the impression I may be entitled to some compensation if not a full repair/replacement, on the basis that the sales of goods act states it must "reasonably not be expected to have failed" which I think is the case. The issue of "fault being present from manfacture" can only be prooved by virtue of the fact it has failed, and would only fail after time not necessarily when first purchased. If an indpendent report was needed I can arrange it, I certainly havent spilled anything or dropped it, or otherwise caused reason for it to be faulty and the nature of it being inside the laptop means its hard to really break a motherboard any other way. I would appreicate advice on how to approach the issue given Currys known stubborn attitude to these problems and a better understanding of my legal rights. If needs be I will buy a new laptop (elsewhere), but I do feel I am being robbed of at least a couple of years use of a machine and therefore should be compensated towards the cost of a new one. Many thanks in advance Jon

-

Hi there, I am in need of advice. We bought our daughter an iPad Air from Very on 7th Dec 2013 for £399. In November of this year it stopped working and we took it to Apple who diagnosed a hardware fault and not an operator induced error. He even comment to how good the iPad still looked! We went back to Very at the end of November and asked them to sort it under the SOGA as Apple stated that this was good for 2 years. Very originally agreed to a refund minus a 20% usage fee! This has now been on going for 4 weeks and we still have had no resolution. Yesterday they have now stated that the usage fee is £159! Very will only refund £239 into the account but they have already added £159 usage fee tot he account.... What can I ask for, as all I want is a replacement. I feel that we are being pushed from pillar to post and have made no progress after 10 phones calls and multiple emails. Any help appreciated. Russ

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.