Showing results for tags 'required'.

-

Heres one for you. Am i able to give more than the required length of notice to inform a company I am leaving them? IE 2 weeks instead of 1?

-

Hi all, first post and looking for advice/plan of attack. Parking Notice relates back to 15 May 2012. I was registered keeper but not using the vehicle at the time (I was in bed after a night shift!) The car park in question is free for 1 hour and no option to pay. The notice relates to an over stay. The original paperwork from June 2012 showed photo evidence of the vehicle, but no image of the driver. I don't have this anymore. binned it 6 months ago thinking this had gone away. BW Legal are now involved and I've sent them one denial letter. I did state I was going to complain to the CSA and SRA but got sidetracked and didn't get round to it. BW have responded with 2 letters. 1 dated 31 Oct. The main point being "We can confirm that our client does not intend to rely upon the Protection of Freedom Act 2012. as such we do not accept your assertions regarding payment. In the absence of driver details we are instructed to recover the suns due from you". The second letter looks to be a bog standard Final Notice letter dated 2 November. They have tried to call me once, but ignored it. Would be grateful for advice on my next actions and pointers to any CSA and SRA templates if needed. In this case, I genuinely wasn't the driver!!!! Thanks in advance

-

Hi there, I (like many others) am in the same situation as Ginger - handed a PCN from ES for parking /stopping in the Spinningfields area. Letters of complaint / information requests have been ignored, Gladstones involved and the case referred to County Curt Business Centre. I'm pretty anxious and have never dealt with anything like this before. I am seeking some urgent advice as I returned from holiday to find the county court claim and now only have 2 days to respond... I obviously want to appeal and thinking along the lines of (pls forgive the lack of legal terms etc) : I am disputing this claim for the following reasons : 1) I have written to ES Parking and their legal representatives (Gladstones) several times to ask for more information and complain about their imposed fines. No acknowledgement or response has been received. 2) No evidence of wrongdoing / an offence being committed has been provided. They have sent me a photo of the front of a car - it is not evidence that an offence is being committed as you can only see the front half of a front end of a car in the photo (not the location or that the car is stopped). In the photo you can clearly see the two hands of the driver at the steering wheel, which suggests that the car was being driven at the time of taking the photo (i.e. not parked). 3) The charge they have applied is excessive, disproportionate and not commercially justifiable. Was £100, then £150, now £227. The original £100 is excessive and the subsequent increases and escalation to court whist ignoring my requests for more information and letters of complaint is wholly wrong. I suggested to ES parking that the original £100 charge was excessive and outweighs any cost to the landowner - I have asked for a breakdown of actual costs and subsequent increases. (No acknowledgment or response received). 4) The photo evidence provided is time-stamped with a different time to that of the alleged offence (the photo was taken at a different time to that of the alleged offence). Moreover as per point 2 - the photo is not evidence of any offence being committed. Their letter states that "the 'period of parking' to which the charge relates is the period immediately preceding the incident time" (the photo evidence is taken after the incident time). (the incident time is 12:00, photo is time stamped at 12:03) 5) There was no/insufficient signage on site at the time of the alleged offence. I have asked ES parking to confirm that there was signage on date of alleged offence - no response received. There is now signage onsite (months later) however this signage is inadequate as it's too small (roughly A4 size with lot's of very small text written on it), it is difficult to read from any distance and certainly cannot be read from a car, let alone a moving vehicle. There are no signs or anything to suggest that you are leaving a public road and onto a private one (the site of alleged offence is Manchester City Centre) - this is very confusing, perhaps deliberately so. It is not clear that the signs are referring to the road - it looks like they are referring to the adjacent pedestrian areas in front of some flats / offices, not that they are referring to the road - which you would assume was a public highway. 6) There were no road markings at the time of the offence to suggest that parking was prohibited (can evidence via google maps). 7) I have a 24/7 365 day a year parking space in my office underground car park at the site of alleged offence (so I have no reason to park outside, when I have a space inside). This can be evidenced if required. Does the fact that both drivers hands are at on the wheel in the photo provided suggest that the car was being driven into work car park ? (if indeed the photo was even taken at the site of alleged offence). 8) I have asked ES Parking and their solicitors (Gladstones) for more information to confirm who is the legal landowner and that ES Parking has their authority in this matter and also to confirm that the road where the alleged offence took place is in fact a private road. I have also asked for full details of the alleged offence and how long the car was parked for. No response or acknowledgment received. It is just not credible or fair that ES Parking can send members of the public a picture of half of the front end a car, showing only that the drivers hands are at the wheel and not the location where the photo was taken or that the car is illegally parked (or even parked at all) and demand payment of £100. They have not provided any details or evidence : - Of any offence being committed. - Details of the offence and how long the car was parked for. - That the vehicle was on site at the time of offence. - That they have authority from the landowner to pursue costs. - That actual costs to the landowner have occurred. - That the site of alleged offence is not a public highway. - In addition the time of offence is not the time the photo was taken. With the above points in mind, you write back to ES Parking to ask for more information and to contest their parking charge, they ignore you and ramp the costs up to £125, a further letter from you is ignored and then costs ramped up again to £150, you write again, which they ignore and then escalate the matter to a court. I believe that this demonstrates that ES Parking are operating in an aggressive, predatory and disproportionate manner which is designed to bully and intimidate innocent members of the public in order for them to obtain money. Are points 2 and 4 valid ? I'm (very obviously) a lay person but I'm hoping these are important from a legal perspective. Would really appreciate any help and guidance you can offer - thanks so much Roo

- 17 replies

-

- county court

- manchester

-

(and 3 more)

Tagged with:

-

I have just discovered that my elderly mother inlaw (73) who is on income support has been getting regular loans from a local agent for provident. It would appear that a neighbour is drug dependant has been regularly getting money from her and so she has borrowed to support herself. There are two payment books in her possession which have a total of 5 different account numbers across the two books and are very difficult to understand. I can see on one occasion she was given two separate loans for £1000 each over the course of twenty days ( total credit £4200) surely the agent from provident would be starting to ask questions. How can an elderly person who gets income support be expected to pay over 50% of their benefit on loans. I have since moved her away from the area she lives, so the neighbour problem is sorted for now, just need to get my head round this provident stuff. Any help advice anyone can offer would be greatly appreciated. I have asked my mother inlaw what documentation she was asked to provide as evidence of income / benefit of which she informed me that it was all verbal, the agent asks how much and that was that. I also asked how she found out about them and she said she got a card posted through the door. Posting loan cards through old age pensions bungalows is disgusting. I am happy to provide

- 12 replies

-

- irresponsible

- lending

-

(and 1 more)

Tagged with:

-

first of all to say hello to all users. i am new here be gentle . i have read the forum rules etc . feel free to say hello and if i can help i will. right down to the nitty gritty. i have recently discovered i had ppi with mbna on 3 accounts out the 6 they told me i had in total (possibly linked cards) they are investigating the 3 they have told me about. is it worth me sending sar requests for the others. just read some old posts regarding dishonest mbna online. or am i barking up the wrong tree here. grateful for any help or advice all the best

-

Hello, I would like to find a solicitor that would act to defend me in a litigation case - I would hope that mediation or a 'round table' discussion could be held prior to litigation. The case has had a Barristers opinion and that is 65% chance of success the claim value including damages and fees to date is circa £200K. I have previously had a large firm of solicitors dealing with it and felt frustrated with delays and lack of help. I want a small sole practitioner or similar. The claim is backed by DAS and paid for via insurance, the rate agreed previously was £201.00 ph. Please message me if you feel you can help and have the time to deal with this, a note the other party has sufficient funds to pay the damages/fees.

-

Hi Everyone, Looking for some help. My partner made an application via a PPI company to claim back any PPI he had on his old accounts, They found we had 1 from Welcome Finance on a car we had in 2004. they sent away to claim it back, Welcome instantly declined it and the management company dealing with the claim for him decided to send it to the FOS. 2 Months ago the FOS found against Welcome and advised them to reimburse in a proper manner. But now this is where we need help. Welcome has sent us a letter which I will attach for you to see. they have stated that they are going into liquidation in the next year so have been advised not to make any payments to people?? Can they do this? Or is this another way they are trying in order to get out of paying people there money. I have attached parts of both the letters they have sent. Any advice would be great

- 12 replies

-

- information

- ppi

-

(and 3 more)

Tagged with:

-

I moved into a new rental property 5 weeks ago. When I moved in I realised it was a pre-pay meter. I hadn't had one before and immediately called to ask to change to a DD account. I was told I would have to wait a month then have a credit check and then if approved move off. I called today to start that process and whilst I was on the phone the customer service rep performed an Experian credit check and told me I failed and I could not apply again for another 60 days. I logged onto Experian to see my report which is a 989 score out of a possible 999 - an almost perfect excellent rating. It shows a 989 because a couple of months ago I took out a small loan out but I am paying that off as I should and I hope to clear it early in a few months. The only other thing I can think of is it had not updated my electoral register information despite my council telling me on the phone today I am definitely on their list and they have said Experian should update their records this week. So I called British Gas again to enquire further why I had failed their check and they refuse to tell me....well in fact I was told they themselves do not know because she said it was all down to algorithms. Yes computer says no. So, can anyone let me know if British Gas demand a 999 scoring for Experian? And why the do I have to wait 60 days if all it is my electoral registration data had not updated as quickly as it should have? I mean...is that even legal that they force us wait so long? It seems to me just a flimsy excuse to extract more money out of me because of a previous tenant's failure to pay on time. Agh....

-

Hi I'm hoping I am posting this question in the right forum? My cousin who turned 50 in March passed away from a short cancer related illness. She was an only child and her mother, my aunt, is in her 80's. They had a joint savings account which they both contributed money into for more than 10 years and when she passed away the account had approximately £19,000. The estate has gone to probate and when the building society were informed, they sent a cheque direct to my aunt for the full amount. We assumed that as the account was in joint names the money would automatically be hers. However, the solicitor that is dealing with the probate has advised my aunt that the £19,000 should be included as part of the overall estate, which I understand exceeds £350,000. Question: As my aunt contributed to the savings account and as it was in joint names, should this still be included as part of the estate?

-

Hello 1st post and I hope I'm posting in correct forum. if not could Mods please move post. The wife of a friend of mine has walked out a couple of weeks ago. Shes has walked away and left everything in limbo. Friend phoned the bank and arranged an appointment where they froze the joint account , opened a new account in his name only so he can have his wages paid in, pay bills / dd/so and mortgage etc Wife had a gym membership, He phoned the gym to tell them she had left, bank acc closed and they told him he was liable , so he set up new direct debit from new account and was going to pay. 1st payment from new account already been paid. Is he liable, can he cancel. any letter templates available Ideas or advice appreciated Many Thanks

-

I am currently investigating the enforceability of two credit card accounts which were held with Royal bank of Scotland They merged both cards together at one point, Classic Visa with Gold visa to give one card with one credit limit as opposed to two cards with two limits. I have requested a subject access request report from RBS over a period of several months so that I can fight the case. They have eventually come back to me with some statements for the initial account however they have admitted that they cannot obtain the credit agreement for the first card (RBS Classic Visa). My issue is that this card was cancelled when they transferred the credit limit over to the other card as there was a zero balance on the card at the time. They have supplied me with the following information which I am now quoting from there letter received by me on Friday 5th March 2010 “Our records advise that we have completed a subject access request on the above account which has been sent to you. However whilst investigating this I have been able to trace statements for you other credit card account **** **** **** ****, I apologise that this information was not sent to you with our previous response. The Fifth principle of the data protection act 1998 states that personal data shall only be held for as long as is necessary to carry out the purpose it was collected. Therefore the Bank holds personal information which is necessary for maintaining your account. As the account **** **** **** **** has been closed for some time, the only information we hold in relation to the account is copy statements. It appears that the account was opened around May 2003 as the statements only date back to June 2003 and shows a zero starting balance. I have enclosed the statements and I confirm that we have been unable to obtain a copy of the signed agreement for this account “ My issue is that they merged the two accounts around July/August 2007 when the credit limit increased from £6800 to £9100 (£2300 credit limit used to increase the value on the initial card which was then cancelled) GThey also offered a 0% balance transfer programme at this time as an incentive to merge both cards. They have only supplied me statements from the initial card up to July 2006 even though there was a zero balance up to approx April 2007 when the card was used then cleared again so they are clearly not giving me all the necessary statements in the SAR Request. I am also investigating the fact that the interest rates have dramatically increased since the time the card was taking out and looking at the possibility of an unfair relationship claim if the Unenforceable credit agreement claim fails. Where do they stand with merging the cards since they have now admitted that don’t have a CCA for the card??

-

Hi All, Need some Advice please from you knowledgeable bunch. Back in Sept 2007 I defaulted and stopped my payments on an Argos Store Card which i had due to financial issues, I had the usual debt collection letters for approx 1 year which i ignored and made no payments on due to not being able to. The default was registered on my Credit File as Nov 2007 and disappeared off my file in Nov 2013, by which time the debt was Statue Barred, During this time no contact was made with any DCA and NO payments were made to the account, and none have been made since. To my shock, last month i received a letter from a DCA stating that the amount was still owed (Approx £1200) and that i should contact them to make payment, I sent them a letter stating that the debt was statue barred since no payments were made since Sept 2007 and no acknowledgement has been made of the debt. They have now written back to me stating that the debt is NOT statue barred, they have confirmed that they have owned the account since 2009 and that in 2010 they claim i made 7 payments of £15, hence taking away the statue of limitations, they have provide a spreadsheet showing the payments and dates of payments. I know for a Fact that i made no payments and have just requested old bank statements from 2010 which prove that i have made no payments equalling these amounts on the dates they have stated. They have not sent any copies of agreements or letters of assignment. Not sure now how to reply to them on this as they state legal action will follow if I don't contact them and arrange payment. Any advice for me please ??? As trying to put my bad past behind me. Thanks

-

Hi, For good reasons i fell behind with my payments on my Water account back in 2008, in 2010 the company obtained a CCJ against me, i accept this - we hadnt paid and nothing they could do. Nothing happened until December last year, when our financial position changed so i made a re-payment arrangement with the water company. Ever since we have made a good dent in the debt. However, I have checked my Equifax account today and the water company registered a default against me in 2015, frustrating as the CCJ has JUST dropped off - they have also not shown the payments i have made to them since. My question is, as the company already had a CCJ - and nothing had changed since 2010, can they then also register a default for the same debt 5 years later - surely the default occured before the CCJ? Its frustrating as i have worked really hard to clear our credit records and things are just looking up! Now i have a Default in place for another 5/6 years!!! Any help would be most appreciated.

-

Hi, would appreciate advice/comments on my situation. I have lived in the USA for over 3 years and have no plans to return to the UK (except for holidays). I own a house in the UK that has mostly been rented out but this year I have attempted to sell it - 5 months ago I accepted an offer and its been a long an protracted sale but I thought it was going to finally complete but have now been told that my buyer has been refused insurance due to the properties flooding history (last flooded in 2007!). Now I am faced with the very real possibility that I stand no chance of selling the house - yes I could rent it again, but will surely be faced with the same issues in the future and I thoroughly dislike renting long distance. There is a little equity in the property but that is meaningless with no prospect of selling it. What would happen if I just walked away from it, considering I do not live there and have no intention of returning permanently? Thanks.

-

Hi, I am looking for some advice, having received a court requisition this morning, having been previously blissfully unaware of any issue (not having received any warning letters) I am the registered keeper of a car, that I 'loaned' to a friend of my husbands to use during a troubled patch in his life. The car was taxed by DD monthly, paid for by my husband, and insured by the driver, until January 2016 when he wrote the car off in an accident. I am being charged that on the 5th April 2016 the vehicle was taxed, and not insured. Firstly, the car was taken away by the insurance company on the 25th January, I naively assumed at that point that they would inform the DVLA (apparently not - they only received disposal notification on the 25th April) I had been paying monthly tax by direct debit, and had forgotten to cancel it, and having never had a car written off I didn't realise I needed to inform the DVLA mysef. DVLA tell me I would have had 2 warning letters, I didnt. But they cant do anything about it as its with the court now. Apparently the enforcement team wont speak to me because there is a previous offence on the car, which incidentally was the 'friend' speeding in it, which has been settled. The court is in Crawley, I live 150 miles away. Yes I could go, at great time and monetary expense, but I dont understand why when the vehicle didn't even exist I am being made to feel like a criminal. Can anyone suggest what I should do? Am I guilty? there was no car!

-

My husband had a contract with Three Mobile for his IPad. He noticed that payments had stopped going out, this was in January 2016, so rang up to check why. Three told him that the contract ended last November, so that was fine and we thought no more about it. Until, a debt collection letter appears, claiming that the last two payments were never made, totalling £50, and that they now want £341! Never had ANY letters or emails or texts to say that payments weren't paid at the time, no reminders or bills, nothing. And no mention of this when my husband called to query why payments had stopped, only that the contract had ended months before. He rang the debt collection agent, who sounded like they'd heard this complaint many times before, and immediately handed it back to Three. He called Three who are digging their heels in, despite my husband offering the last £50 there and then to resolve. What do we do about these disgusting underhand tactics - and would strongly advise against anyone using this disreputable company.

-

I have a query relating to a situation my partner finds herself in. This is happening in Scotland if it makes a difference. A little background first to let you know why we find ourselves in this position: My partner rents a house at the moment and the tenancy is managed by a letting agency. She has lived in the property for around 6 years, slightly more, and in January this year renewed her tenancy for a further 6 months. She did this knowing we were about to begin looking for our first home together, however we both felt it was a good idea to give ourselves some time without having to worry about a roof over her head. At the time of renewing she inquired with the letting agency whether a shorter-term lease might be available but was told 6 months was the minimum they would offer. She agreed to that, however she was told that at any time she could pay them £180 to readvertise the house. If they found another suitable tenant the tenancy would transfer and she would no longer be liable for the remaining rental period. We thought that seemed a bit steep but agreed. Move forward a month and we have quite unexpectedly found a house we love, we've bought it and get the keys in a few weeks time. As a consequence my partner popped into the letting agency, paid the £180 and they readvertised the house. Within a day they found someone who wanted the house and paid a holding deposit. As far as we know they haven't signed any formal agreement yet, however the letting agency are no longer advertising the house. I'm finally getting to my question you'll be delighted to hear. We checked with the letting agency about what would happen if this new tenant pulled out. We were more than a little shocked to hear that they plan to hold my partner liable for the rent up to the end of the 6 month period. That probably seems quite reasonable, except that she paid her £180, they readvertised for less than 24 hours and found a new tenant. Can they really take her money, essentially not readvertise the house, yet continue to hold her liable?

- 10 replies

-

- advertising

- agency

- (and 8 more)

-

On Sunday I booked a holiday through love holiday which came to £300 for the two of us. Today I got an email requesting for me to call them and when I did they said that the holiday that I had booked was overbook and I now must pay £1000 for the next room up. I have already paid £130 to the previous holiday. Can they do this to me? What rights do I have? I must phone them back within the next hour please help

-

Hi All A company called GhostArk last year put a device on the market for pre-order called a GhostArk. If you pre-ordered the device you got a discounted price and two models were available. Orders were taken around August last year and we were told the devices would ship in December. In December they told on a post on Facebook in a video comment the unit would no longer have a built in speaker and would come with an external speaker at no extra charge. This upset a lot of people as the device is no longer an all in one as you have to carry the speaker around with you. They also informed us there would be a delay and the first 200 units would ship by the end of January 2016. People have started receiving their units but most of them are faulty with various issues below: Switches breaking Off (Poor Quality). Switches actually stuck (Seem to be glued?) Units not powering on (On/Off Switch Issues). An SD card needs to be inserted in the unit for it to work but most units do not recognise the card. Overheating Issues. There are lots on complaints on their Facebook page requesting refunds and the company common response is email tech at ghostark.com People have done this and some get no answer or silly answers not relevant to their question? I wish to get a refund the reason being it is no longer the item I ordered as it no longer has an internal speaker and have emailed tech at ghostark.com but have not had a reply which is very common? The company have just announced a statement on Facebook. Their page is GhostArk. All those customers who have received the first batch of GhostArk devices and who have reported problems related to the shielding system or box assembly can kindly send the defective devices back to Moko Technology in the form of registered letter at this address: Moko Technology 4F, 2nd Building, Guanghui Technology Park, Mingqing Road, Longhua, Shenzhen, China 518109. Phone: 86 13128850716 and inform us by writing an email to tech at ghostark.com in order to communicate shipping and the problems encountered; we will send you another, perfectly functioning, GhostArk device. However the shipping is expensive ( I was told around £46 by royal mail insured up to £250.00). My wife paid for this using her credit card company (was going to be an xmas present) and they (her credit card company) have informed her that I must send it back and get a receipt of posting so my wife can then make a claim with them. I then have to fill out a form to send to her credit card company with attached posting receipt. The question is how do I proceed? Do I pay the postage to progress the claim through my wife's credit card company? Any help appreciated TimbreWolf

-

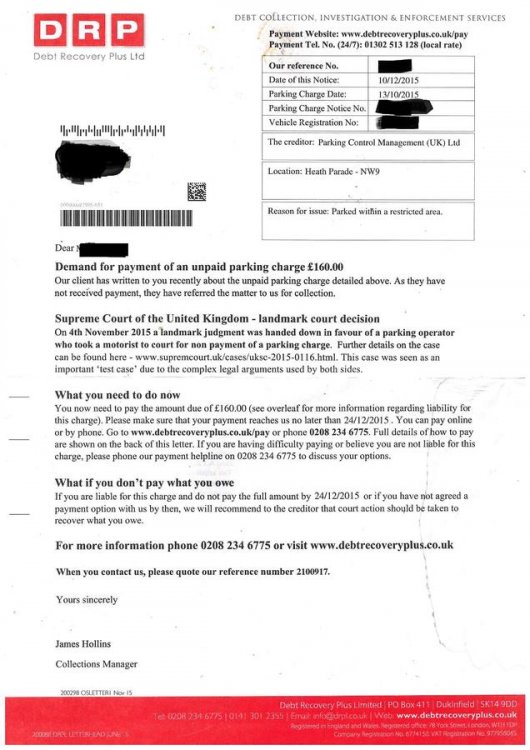

Hi, A friend of mine receive a Parking charge through the Post, i have attached a copy of the ticket they have received by post. No ticket was issued on the vehicle and there is no CCTV camera or ANPR system The driver said that they were inside the car and were trying to read the information on the signage and they moved after they read the sign. Having looked at the ticket it stated that the ticket was issued at 18:34 but the evidence on-line shows that the ticket was at around 17:40. Can the driver fight on the grounds no ticket was issued to him and that the time is wrong... Well What I can say. they have not responded at all and then suddenly we received another letter from DRP dated 10/12/2015, demanding payment for unpaid parking charge. However this letter was received very late. I contacted UKPMC to find why they have issued this letter we we have not received a response to our appeal, they stated that they have issued response. I have informed no response was received. they told me to contact the DRP. I have requested copy of the letter and what grounds it was rejected, they refused to give me this info,. I also contacted the DRP, they also said they cannot issue the copy of the letter and they have refused to give me the letter and that they insist that I was parked in Loading Bay. This week I received a letter before referral for legal action and I bit concern regarding this issue. Any advise ion this matter would be much appreciated. PCM UK.pdf

-

Hi does anyone have any email contact details for he aqua credit card - i want to contact them about a debt I have with them and try and sort things out but they only supply a postal address or phone number on their site

-

Hello, I am writing to ask advice about an issue with O2. I have noticed similar issues pop up on this and other forums. I checked my Experian credit rating in Nov 2015 and had an excellent rating. I then started to arrange a mortgage. Looking back now the credit file changed in Dec to show I had a default from O2 in 2011. The default is due to moving accounts from a O2 consumer account to an O2 business account. It looks like the people on this forum are very knowledgeable about this and I would like to ask for your advice. I had been told on the phone that I had paid the bill in full. O2 are claiming that £32 was issued when I had not paid the final bill. If I had know about this bill I would of paid it. I has moved to another O2 account and had the same number. To my knowledge I did not receive any emails for letters, or default letters about this amount. The default was for £32 and is now affecting my application for a Mortgage. I have contacted O2 and spoken to someone in the Executive Relations team who have said that they cannot help. I had paid the amount in Dec 2012, when a credit agency contacted me for the payment, I called O2 about the amount and paid it with them straight away. I was not told that they had issued a default against my name. This amount of £32 has not been changed on my Experian report and is still showing as un settled, which is also affecting my credit rating. O2 have issued an apology about this and have mentioned that they will mark the bill as paid but will not remove the default. They have told me to contact the Communication Ombudsman and Financial Ombudsman Service Any advice will be appreciated. Best

-

Hi, A very good friend of mine is to help me out by renting a room from me and living with me to help with the garden, house etc. He also cooks meals etc due to my disability. My health is much improved, I still have to be careful to avoid a relapse. He is in full time work and I do not claim benefits. However occasionally he does get a small top up of UC when his wages are very low. Therefore I think I may need a formal template since he has just left his bedsit?? I do not know.

-

hi all on 24th dec 2015 i received papers from northampton court from cabot financial ltd and drysden solicitors relating to a capital one credit card debt. i acknowledged service of claim online but as yet havent entered a defence. i have sent cabot a cca letter and £1 postal order sent recorded which i have proof off, giving them 12+2 days to respond its now 12 + 3 days from signing for letter and still nothing. at the same time i sent drysden a civil procedure rule 31.14 letter which is now 10 days since signing for and again still nothing where do i go from here regarding submitting my defence?? my defence was going to be the debt is statue barred as i have not made a payment or spoke to anyone about this debt since at least 2008 ( cabot claim 2010 by the way ). but can my defence be statue barred plus non compliance with requested documentation?? any help would be muchly appreciated cheers

-

Hi all, I have been look around taking in all the information, but I could really do with some help/advise. I am currently on a DMP with step change (4-5 years). CCCS now StepChange have & were life savers, but I now feel advice contradict what I have read on theses and other forums I send off CCA request letters to some of my creditors. Long story short Capquest 1st reply stated they were waiting for HSBC, 2nd letter stated that HSBC could not provide CCA paperwork therefore the debt was unenforceable, but I was expected to continue to pay. 12+2+30 days has now pasted. I contacted StepChange as I do want my DMP payment to go towards this debt. StepChange said this was not possible and that I have to contact HSBC myself the gain clarification.. .They would not remove this debt from DMP either. the CapQuest debt is 9k outstanding already paid 4k, all other debt amount to roughly 3k. The debt is also so old if does not show on credit report. What should I do? - End DMP /stop payments to Capquest - Go it alone - Contact other creditors and pay direct (some are at f&f offer stage) Any help pointers would be great Many thanks Also forgot to ask , can I just ignore CapQuest now or is it good practice to send the failed CCA letter???

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)