Showing results for tags 'request'.

-

Early last year my husband received a county court summons for £11,500 for a credit card debt sold on to a DCA. He replied and defended the action on the basis of the limited information on the summons and that he was awaiting a reply to the CCA letter sent to them on the day the summons was received. He never received a copy of the CCA, just a letter from them saying the debt was no longer enforceable and they could not proceed any further through the courts, but would he please call them to discuss a repayment plan. They also promised to forward the copy of the CCA. That was over a year ago and we are still haven’t received the CCA, but what he did not advise them was the debt would not really be statute barred until last October , three months after their letter. Move forward to now, and I have received a letter from the same DCA and they are chasing a debt for £8.250 for a card of mine. This will become statute barred in the middle of August when it will be 6 years since the last payment. I received a letter from them dated 6 April but not received until 12 April, saying if I did not contact them within 14 days they would commence legal action. My understanding of statute barred debts is they expire six years after the last payment or admission of the debt and the creditor has until this time to obtain judgement. Is this correct and can the DCA request to the courts an extension this period for the time it takes to transfer to a local court and to a hearing? The default for this will expire soon and I am l keen to keep as clean a record as possible after eight years of financial misery. I appreciate I am morally wrong but this DCA will have purchased the debt for peanuts,

- 169 replies

-

- –questions

- answer

- (and 17 more)

-

I paid them for a couple months via Monthly Standing Orders which i set up, this was after the Debt Management Company I used folded, I then stopped paying all of them recently ... I have just received a true copy of my original CCA from Halifax, back dating to 2001, so will now need to sort a repayment offer with them They are the only 1 from 5 to provide thus far, so tbh i still had a great result This is very true, i assumed info from a company like StepChange would be best i would get, not a mention or suggestion of doing CCA's came from them Sometimes their hands are tied to give certain aspects of advice and as I say CAG was a blessing in disguise when i read what people were saying about making CCA requests I have just received a true copy of my original CCA from Halifax, back dating to 2001, so will now need to sort a repayment offer with them, they are the only 1 from 5 to provide thus far, so tbh i have still had a great result ! Better late than never, very true

-

Hi all. New to this and please excuse what is no doubt my own naivety thats got me in this situation. Last week, I concluded my search for a new car, Volvo V50 SE Lux 2008. Lovely car, tidy inside and had a very high spec. The own of the local dealer I bought it from may have spun me a bit of a yarn.... The car had a high level of road noise which he said was down to the tyre tread being a bit low. This seemed fair as it is a problem on these vehicles. I changed the to front tyres at £90 each and this made no difference to the noise at all. I knew also that front breaks were due soon hence I knocked his price down to cater for this. I have put new discs and pads on the car and that has made no difference. £170 for that. The next possibility is that it is the wheel bearings that need replacing which will be another £400. If it is not the wheel bearing then it could possibly be a gearbox problem which will cost a fortune. The car is otherwise perfect and I love it so I am inclined to replace the wheel bearings but if it turns out to be something else can I still reject the car and am I in a position to also claim back the cost of the above bearings, brakes and tyres? When I test drove the car, the seller said that when it went for MOT, "the mechanics had given it a thorough check over and they assured me the road noise was simply tyre related." Any thoughts or tips would be gratefully received.

-

Hello All I made this SAR request to the Energy Ombudsman (E-O) as I wanted to see what Npower submitted to them as evidence to back up their response to my complaint with them. Npower are reknowned for saying they have done everything correctly but not substantiating anything with hard evidence. My questions are: 1) There are some emails between Npower and the E-O where the NPower's persons details (name number email etc) have been redacted. Is this permitted? Why? 2) The E-O hasn't sent me any evidence from Npower to substantiate their response to my complaint (but they did include the emails I sent them as evidence) . Should they withhold this from me in SAR request? As this was the purpose of me making the request in the first place. 3) Can I do anything about the above to get the info I was after in the first place? Many thanks in advance Jimbo

-

I know that my telecommunications provider has been overcharging me but not by how much and over what period (they acknowledge as much but are being awkward in (not) helping me arrive at the amount they have overcharged, for me to reclaim and have said they will arrive at "an arbitrary sum" of their own if I am unable to provide them with full details of dates and amounts). So I sent them a properly worded SAR but they have replied with an in-house "SUBJECT ACCESS REQUEST FORM" for me to fill in (which suggests they receive a few requests) and told me I must return it to their "Legal Team", directly. 1) Do I have to complete their form or can I insist they respond to my formal SAR, as already provided to them? 2) Is it for me to approach their legal team or is it for them to pass the request over to it? Thanks in advance for any help and advice.

-

Bit of a long one but I wonder if you guys can help me out a little please. I'm writing on behalf of my wife. NB: My wife is Spanish and works in a call center for a major airline here in the UK with people from other countries. In Nov 2015 an incident happened at work in which she was racially abused and intimidated by an Italian male co worker. A meeting took place with my wife and HR and she trusted them to resolve. She asked that they be moved away from each other. The company supervisors immediately sat the man right behind my wife which made her feel under pressure and then further intimidation and bullying began from this man. The intimidation was not always directed to her face but it would include shouting negative comments right behind here about her home country and talking about sex. Maybe 6 months later and after my wife spoke to her supervisors several times and emailed explaining her issues and asking for the situation to be resolved she became ill. Next, Her Dr, Company occupational health and now counselor have written reports to the company stating that my wives illness is a direct result of the issues at work. Company HR and Supervisors have promised on several occasions to move the man to another area and then done nothing. This has had an additional negative effect on my wives stress. She is on medication. My wife is working with the union official and union solicitor to resolve this and the solicitor has advised (rightly I think) that a process must be followed before further action against the company. We have documented everything in case we needed to take further action. We have copies of emails, incidents etc. In my wives last meeting with company HR it was agreed that the man would be moved permanently to another area of the business and as they have promised and changed their minds several times my wife asked for this in writing. The company agreed. Within 24 hours the company took back this offer and told my wife the man would probably be back in her group. This has added to her stress levels and she panics. This has all taken a little over 12 months now and we feel the company should be pressured into resolving the matter. My wife is now off work sick on SSP and worried about going back into the same situation. Should we continue with the union or maybe seek outside legal help which could be expensive. Any view would be good please Thanks

-

hi has anyone had any experience re a cca request re an overdraft subject to the amended consumer credit act which now requires an agreement for o/d's ie no 'exemption'.

-

Has the UK got the continuing-violations doctrine in its Laws. I was under probation with a company and I raised H & S issues. A lot of documented bullying occurred. My employment was later terminated and the director cited the contract I signed in which they have the right to terminate my contract without reason. Much later after the expiration of the time limit for the Tribunal I made a Subject Access Request. I discovered that my line manager has been telling lies about me all this time. And these are lies that are easily disputable (Like I was found sleeping while on that day I was over a 100miles away on training). In a personal review list done six months after I left the manager still wrote down a lot of easily disputable lies. Now if the UK has a continuing-violations doctrine or something similar, I will still be in time to take the case to the Tribunal. Please I would be grateful for any advice. Regards

-

Good day all Just one question I have emigrated to SE Asia. I wish to get all my charges back from the bank but I will need to SAR them. I know it is 40 days from the date of posting but the post takes about 21 days to arrive from this country. Do the 40 days rule still come into it and when I request the SAR should I ask them to include the Proof Of Posting slip with the SAR to ensure they don't get more days than they should. Might seem a little petty but the bank have been very petty with me over the years and I estimate around £3,000 of charges from Bank accounts, Loan Accounts and Mortgage Many thanks in advance.

-

Made a subject access request to Santander. One of the acknowledgement letters they sent says this (in bold): If anyone here has made a subject access request to Santander, can you please check the Acknowlegement letters to see if it says the same. If it appears can you include a scanned copy of the letter on this forum. The ICO has told me: Santander acknowledgment letter also says this about call recordings: Santander did send me call recordings, but one of the recordings had a bit missing from the dialog. I've reported it to the ICO. They've just got back to me after 2 months and said I need to ask Santander for the missing data. I'll probably do that, and let everyone know if Santander does locate the "missing data". BTW, about storing call recordings under telephone advisor's login (and not by customer name or account number). I'm pretty sure the Data Protection Law says if a living individual can be identified from the data, then it's classed as personal data. Here's the quote from the ICO website:

- 2 replies

-

- access

- acknowledgement

-

(and 7 more)

Tagged with:

-

Hi, An internet payment fell on a time when I had no money in my account to cover it because of work situation. Santander felt the necessity to charge me for an "instant overdraft request fee" and because I did phone and get it cancelled earlier this year (it happened before) they are "unable" to do it. they want to steal £25 off me this time because... NOTHING actually happened: the money never came out of my account, the internet company didnt get paid (because they sent me another invoice), my account has no overdraft capability, and santander feels I owe them £25 now for effectively "requesting" and overdraft on some account that never has an overdraft facility which I never did. Seems to me this is a good way of creaming on people that are most likely to have bouncing direct debits But I thought if there is no money in your account then it is declined and.... that is it: the company I owe then contact me to get their money, no charges or fees or some punitive cropping from the bank. What options to get back the money do I have? If a direct debit cannot be paid then what is all the deal with overdraft requests. Sounds like a bit of tricksterism to me, I never would agree to having this changed on my account. Thanks in advance

-

Good Afternoon CAG Firstly i would like to thank the people that helped me in my first two issues that are now resolved you know who you are much appreciated. I have another issue that involves opos limited in 2012 i was being contacted constantly bu this company they were even harassing my employers switchboard trying to contact me. in July 2012 I was asked to attend a HR meeting with my employer to discuss informally the nuisance calls that there switchboard was receiving from Opos Limited asking for me and being very aggressive with staff, I was asked for this to stop as company switchboard was not my personal secretaries and if it continued we would be coming back for a more formal discussion. Immediately i contacted the ICO who advised me to send them a section 10 notice for them to remove my details and i did state they should correspond with me in writing, I also sent an email as well stating the same thing Everything stopped for 3yrs 5mths, Then December 2015 i received an email at work from Opos followed by harassing calls to my mobile, I once again asked them to remove my details and they were in breach of the section 10 notice sent to them in July 2012, They once again removed by details and said they would only correspond via Letter as requested. You would think this was the end sadly not Roll on March 2016 once again start ringing me sending emails to my work wouldn't stop, I contacted Opos which i am very lucky to have a call recorded on my phone which records all out and inbound calls and has been very handy in the past, I wanted to make a complaint which i was told i couldn't and they wouldn't take one , Spoke to a manager who also refused to take the complaint same time also refusing to remove my details stating they sent me a letter to an old address saying that if i do not reply to them via letter they would re-instate my details and start contacting all over again, I sent an email to Opos expressing my dissatisfaction on what was happening they responded via letter to say they would investigate my complaint and would supply me with a final response, Many weeks had past and approaching the 8 week deadline, I called them to be told it was sent out on the 27th March and still in the post, I asked if they could sent a copy to my email. Next day they started harassing me once again two calls 8.00am & 8.01am Yesterday morning i answered second time the agent from Opos was so aggressive and rude i asked to make a complaint and be put through to her manager, I explained to her manager very clearly i wished to make a second complaint in relation to the agent i had just spoken to, They once again like the first time refused to take the complaint stating they had already sent a final response and i should take it up with financial ombudsman, I explained that this second complaint is nothing do do with the first complaint and is in relation to whats happened on the call today, Once again manager refused to take complaint and hung up on me, I email Opos complaints team after this, They responded saying the manager may have be confused by what i want to do and want me to send them the complaint again, I will be refusing i have made it very clear twice on that call in great detail of my complaint so should have to do it all over again they have already sacked somebody over this the first time as you will see from final response. Now there repeating the same thing all over again Here is Opos Limited's Final Response --- I have removed identifiable contact numbers and email addresses Further to your recent communications with our office, I am concerned to hear that you have been dissatisfied with the service that has been provided. At Opos Limited we always welcome customer comments as it helps us to review our processes and where necessary put things right for you. Please note that this debt was purchased in December 2014 by Kapama Limited and as a result is now being managed by Opos Limited. My understanding of your complaint is that: 1. You were contacted by email to an employee email address which you had previously requested was removed from our systems 2. You were unhappy that a complaint had not been logged on the first occassion that you expressed you were dissatisfied In reference to the contact information we held for you, the email address of @bri was supplied during the application process for this loan, along with a second email of @live.co.uk. On the 10th July 2012 we sent an email to both of these email addresses requesting that you contact us to resolve the above balance. At this point we were acting on behalf of Mini Credit and both of these emails were supplied as a contact method for yourself. Following this, we received an email from you requesting that the contact emails were removed and that we contact you only by post. At this point we did remove all other forms of contact, which included both email and telephone numbers. We did send information to you by post as requested on three separate occasions; 19th July 2012, 24th July 2012 and 9th September 2012. This account was then passed back to Mini Credit in 2012 as we were unable to contact you. In December 2014 this debt was purchased by Kapama Limited, and the account was then reopened with Opos Limited on 16th October 2015. We again attempted to contact you by post, however had no response. As a result of this we reinstated the contact telephone number of 07 and the email addresses we had on the system, as we had no other way to contact you to discuss your outstanding balance. We spoke with you on 7th December 2015 and again you stated only to contact you by post. Our agent advised you at this time that if we had no response via post then we would reinstate other contact methods, as we had an outstanding balance to resolve with you. Again, we had no response from you by post and no payments were made towards your outstanding balance. As advised, the contact information we held for you was reinstated as we had an outstanding balance to discuss and had been unsuccessful using the contact method you had stated you would respond to. In terms of the annual account statement, this is a document we send out in line with the regulatory oblilgations set out by the Financial Conduct Authority. These were all set out by email and it was appropriate to send this to you as we had no contact from you to resolve this balance. I understand that you called in on 15th March 2016 as you were unhappy you had recieved this. Our agent did advise why this was the case and explained why the contact information had been reinstated, but at that point you advised her that you wanted to make a formal complaint. Although you did end the call, this complaint should still have been logged and I can only apologise that this was not done at that time. This was down to the human error of the particular agent who dealt with you. It is unfortunate that in this instance we have not achieved the high standards we set ourselves and can confirm that the right level of feedback has been given to the individual concerned. In addition, further steps have been taken to ensure that this cannot happen again and the individual concerned is no longer employed by Opos Limited. Feedback has also been given to the collections team using your case as an example of how human error can negatively impact our customers’ journey. For the record i did not hang up i was transferred to a manager who also started stating i could not raise a complaint backing up here colleague, So looks like they sacked the agent and not the manager even though both equally responsible, Here are some other points they make not relating to my complaint do not know why they included it since i have never acknowledged this debt and never will, The credit agreement sets out the borrower: your name and correct address, the duration of the credit facility, the amount of interest charged per day and the APR, the charges applied should you not pay back the amount in time, as well as all terms and conditions associated with this information. According to the information provided by Mini Credit at the point of sale, the default date of this accountis 5th July 2012. Unfortunately, a copy of the default notice issued to you was not included in the documentation provided but it should be noted that whilst it is good practice and should ideally be done, lenders are not required to issue default notices before recording defaults on a credit file. Because of this, I have to tell you that I am only able to partially uphold your complaint. I appreciate that this is likely to come as a disappointment to you but I hope that my explanation has been helpful in setting out clearly why I have taken this view. That said however, in an effort to put things right for you and by way of apology for any inconvenience caused, I propose to remove the debt collection fee from your outstanding balance, which will reduce Opos Limited Registered Office: 2nd Floor, 15 Meadowbank Street, Dumbarton, Dunbartonshire, G82 1JR Registered in Scotland: SC338837 Telephone: 0141 428 3990 Email: [email protected] Secure Website: www.oposlimited.com Authorised and Regulated by the Financial Conduct Authority: IP616281 Calls may be recorded for training and quality purposes your balance by £100 and leave an outstanding balance of £1,089.00. Upon repayment of this balance, this will also be reflected on your credit file. If you wish to accept my proposal as final resolution of your complaint, please complete the section on the bottom of both copies of this letter, retain a one copy for yourself and return the other to me within 30 days of the date of this letter. If you fail to respond to this offer within the given timeline my offer of resolution will not be binding and the full outstanding balance will be due. To date i am in the middle of taking my complaint to ICO as a Section 10 has no time limit and feel my data is not been processed correctly. I need somebody help me put a case together to send to the financial ombudsman, Also is what they say correct lenders are not required to issue default notices before recording defaults on a credit file Thank you for taking the time to stop by and thank you in advance for any advice you can give me as the harassment is non stop, Regards PCR

-

Hi, I sent a CCA request to the DC/Solicitor in feb 2016 Just received a response in October which is basically a copy of the online application? no agreement on terms or repayments just my address details, job details, credit limit, no signed agreement Is the above enforceable? is there a letter I can send back to this? the amount is for £6k+ - any help much appreciated

-

I have a few student loans taking back from 1997, 98, 99 and 00. I went Bankrupt in 2010 but was told my student loans would not be included in my Bankrupcy. I spoke to SLC and they backed this up. I was still receiving deferment forms from SLC and I kept deferring the payments but have now received a letter from Erudio who say they have now bought the debt. I have now read that certain student loans could be put under Bankrupcy so could be written off. Would these loans have been written off when I was declared bankrupt? Was I miss-informed? Any information would be great

-

Our landlord is revenge evicting us after we pushed for repairs to the property. On reviewing our tenancy documentation it is clear the agent he used did not provide all the prescribed information required. We want to sue for the deposit return plus penalty award. We are aware the landlord is ultimately responsible but the agent signed the deposit scheme forms and managed the process. We feel the landlord may suggest it was therefore not their fault and minimise the penalty whilst the agent deals with many properties and our expectation of going thru them was for due diligence and process to be followed which warrants a higher penalty. So we want to sue both parties . Is this advisable and if so, how would any award by the judge be applied? As a relevant factor, we are suing in respect to the original deposit against a tenancy agreement for 12 months in 2013-2014. We signed another 12 months 2014-2015. From what I've read elsewhere it appears we can sue twice ie for the failure to comply with the PI of the 2007 Order for the first agreement then again for the second agreement . Indeed that 2nd agreement then rolled over to monthly renewable so is that a 3rd instance of noncompliance? So the deposit amount is£1200. We wish to apply for the maximum penalty of 3x 1200 being 3600 plus the deposit of 1200 making a total of £4800. And if this apples for both 12 month terms then the total settlement is £9600. Is this correct?

- 19 replies

-

- access

- information

-

(and 5 more)

Tagged with:

-

Good afternoon, First post on here and it might be a long one. I am in a bad situation with a car I brought, and need some help At the end of July I brought a used car from a company in Derby (I live in Dorset) everything was great, easy to talk to etc etc could not be more helpful. On the 14/08 I noticed a massive rise in running temp, i assumed faulty water pump etc, called the trader they said we need a proper diagnosis, this was done at my expense and the mechanic confirmed the head gasket had gone called them, told to get quotes for repairs again, in my time and at my expense I did this cheapest quote I got was £1200 (Boxer engine) they then said they wont pay this and to ship the car back to them for repair. I did this, this time costing me £265 and half a day off of work to get it picked up. it arrived to them 01/09 since then they have had it in for inspection to see whats wrong with it (not like that was already done!) and it is still being inspected... I am no mechanic but when you see water and oil mixing in the reservoir its pretty obvious. We were told to call Saturday afternoon to find out what was wrong and a lead time, we called at 1315 and was told they workshop had gone home and to call back Monday morning. We called got told to call back Wednesday... I sent an email to the owner who has said he will get back to me either today or tomorrow morning. That is the current state of affairs Here is a log of emails I have sent and responses I have got... 23/07 firrst email sent regarding the car problems no reply 24/08 email sent to owner of company as we could not get him on the phone, with quote 24/08 *reply asking for car to be sent to them 30/08 email sent saying car will be picked up 31/08 delivery 01/09 01/09 email sent asking for lead time 05/09 email sent asking for lead time 05/09 *angry email from owner saying he will get back to me What should I do about this? My wife is about 10 days off giving birth and were about 20mins drive away from the hospital with no car!

-

Good Afternoon, Apologies if this is in the wrong forum. I'm about to send off a SAR with regards to a problem with AMEX and Allied International and a breach of DPA, amongst other issues. Allied International are purporting to be representing AMEX as an agent and as such are effectively working on behalf of AMEX. With this in mind, will a SAR sent to AMEX be enough to gain access to Allied International actions taken on behalf of AMEX? Thanks in advance.

-

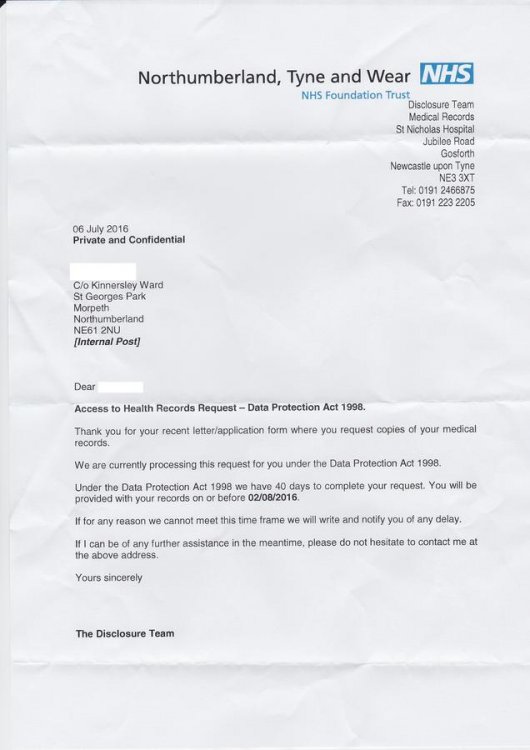

I am a detained paitent in a hospital and I am eeding to get access to my medical notes. The hospital wrote to me and said the DPA request I sent was valid and that it would tae them 40 days to respomd. But the hospital wrote to me again and said they wouldnt be able to meet the deadline . They gave no excuse at all. I would like a copy of one of my reports Please can you help me?

-

Hi i want to request medical records from both my local NHS Trust and my GP. Would this result in two different charges or can you relate them in some way to make it all one request? Many thanks.

-

We further requested recording / true copy of a particular transcript of telephone conversation giving date and exact time from a Loan Broker. Previously received some sort of print / scratchpad notes of conversation with SAR but important part of dialogue seems to have been omitted. Now my OH was told it was being recorded and she said that the person at the brokers was talking to her and typing up notes at same time. They have now refused our further request and stated that they are not obliged to provide any other format / CD or telephone call transcriptions. Can someone kindly confirm if this is correct ? Thank-you

-

Just had a letter from Robinson Way for IDEM Servicing (ex HFC Bank) regarding my CCA request. "Idem Servicing have advised they are unable to provide an agreement for this account.. Please note, this account is no longer being serviced by Robinson Way. Please direct any queries to Idem Servicing directly" It now says the amount due is £0.00 - I assume thats just for their internal systems and I do nothing more with this and if I get another letter from some other DCA regarding this I should just send off a CCA request to them?

-

To cut a long story short.... I worked as a freelance contractor for a firm for 6 months in 2015. The long term contract was eventually cancelled by mutual consent and in October. In December I was sent a letter from my client stating that they strongly believed that I had not fulfilled any of my duties under the contract and wanted £4,000 withn 30 days or were threatening to take me to court for £12,000 + I spoke to a solicitor who advised me that unless it was a letter from a solicitors on the clients behalf, then I should not respond as the client was probably "fishing" to see if I would pay up. I received another letter in March, stating the same thing, at which point I requested a Subject Access Request (I did this as everything I did was controlled by work email I had no access to, including my contract and other personal documents) I received the SAR response as a set of transcripts of emails and other documentation (which according to the SAR code of practice is totally acceptable), HOWEVER also included was personal notes inbetween the emails, one of which states that due to a situation that occured the client thought I was going to use certain information to blackmail them. Yes they actually wrote that on the SAR response paperwork, twice, in two different places among the 36 pages of response I received. Now, my question is, are they allowed to comment with personal opinion and notation on an SAR response or should it be just the facts taken from documentation? I cannot find anything in my searches and thought one of you fine people on here would know. If not, what would be my next step in responding to it other than to ask for the information without the notation? Thanks in advance

-

Not sure which forum to post this in. I signed an estate agent agreement this week and have since had a friend who wants to rent my house with a view to buying it in the future. The agreement I signed is as follows: typr of agreement - sole selling period - 20 weeks then 14 days notice to terminate and I see that I also signed a waiver of my cancellation rights. Do I have to keep it on the market for 20 weeks even though I don't want to sell it now? Many thanks.

-

Hi, please can someone help me? I signed up to join DW on a staff discount 'plus one', on 06 June, as my friend was working there for 6 months only. I paid £12.75 approximately for the rest for the month and was told verbally it was a 6 month contract. Then JUST OVER 14 days later, I rang DW Membership Line to state I could not get to the gym as the council had just started a load of roadworks from my village to the gym area, therefore, totally making it impossible to get there, or be queuing for about 45 minutes to get there. I asked if I could defer it for the 3 months the roadworks were there for, I got this abrupt lady on the phone who said no, and I asked if a suspension of some sort could be placed on my account, therefore, only costing me £5 per month, and again the abrupt lady said no. I wasn't happy with her lack of customer service skills, I got irate and said I can't pay for something I can't use, then she started shouting at me, saying I had to pay no matter what as I signed an agreement. I put the phone down. I spoke to the manager at Selby Gym, explained the situation and he said he would try to sort this out for me and get back to me, I had to chase him 3 times as I hadn't heard anything, I still didn't hear the answer, it was getting close to the Direct Debit date and I cancelled the Direct Debit out of my bank. I haven't attended the gym at all, even when I signed up. 2 week's later I broke my toe in 2 places and the nurse at the hospital advised me to not attend the gym for the period my toe would heal...5-7 weeks. I rang the membership line to inform them I hadn't heard any response from my previous calls and to inform them of my new injury, therefore, I wouldn't be able to attend. They still said I couldn't cancel or suspend and that I had to pay up. I am very unimpressed with DW's Customer Service skills. I refuse to pay for something I physically cannot use, for 2 reasons. I appreciate that the main reasons are not DW's fault, however, they have shown me no attempt to help me, and just given me abuse or ignored my calls nd now demanding emails to pay my month's membership fee. I wish to cancel my membership with DW and report the very bad customer service I have received! I was previously a happy DW member for years at Selby, and only cancelled my membership as I moved jobs and wasn't working in the area anymore. The Customer Service of this gym have considerably gone downhill in my estimation! I've emailed DW Customer Services and ask for a reply to my email and not to be ignored...as a matter of urgency. Still haven't heard anything. If anyone could help it would be most appreciated. I've received 3 emails now asking for me to pay otherwise they will refer my case to the collection department. Regards Emma.

- 3 replies

-

- cancellation

- gym

-

(and 1 more)

Tagged with:

-

For tickets received through the post (Notice to Keeper) please answer the following questions. 1) Date of the infringement: 20/05/2016 2) Date on the NTK: 27/05/2016 3) Date received: 30/06/2016 4) Does the NTK mention schedule 4 of The Protections of Freedoms Act 2012? Yes “On the 20 May 2016 vehicle ‘reg correct’ entered the Marriott Huntington car park at 11:18:00 and departed at 13:36:24 on the 20 May 2016 May 2016. The signage, which is clearly displayed at the entrance to and throughout the car park, states that this is private land, the car park is managed by Parking Eye Ltd, as a permit only / paid parking car park, what parking tariffs apply and the parking charge applicable without the appropriate permit or payment of the appropriate tariff when parking, along with other terms and conditions of the car park by which those who park in the car park agree to be bound. By either not purchasing the appropriate parking time or parking without a valid permit, in accordance with the terms and conditions set out in the signage, the Parking Charge is now payable to Parking Eye Ltd (as the Creditor). You are notified under paragraph 9(2) (b) of schedule 4 of the Protection of Freedoms Act 2012 that the driver of the motor vehicle is required to pay this parking charge in full. As we do not know the driver's name or current postal address, if you were not the driver at the time, you should tell us the name and current postal address of the driver and pass this notice to them. You are warned that if, after 29 days from the date given (which is presumed to be the second working day after the Date Issued) the parking charge has not been paid in full and we do not know both the name and current address of the driver, we have the right to recover any unpaid part of the parking charge from you. This warning is given to you under paragraph 9 (2) (f) of Schedule 4 of the Protection of Freedoms Act 2012 and subject to our complying with the applicable conditions under Schedule 4 of that Act. Should you provide an incorrect address for service, we will pursue you for any Parking Charge amount that remains unpaid. Should you identify someone who denies they were the driver, we will pursue you for any Parking Charge amount that remains unpaid” 5) Is there any photographic evidence of the event? Yes 6) Have you appealed? Not directly to Parking Eye. I contacted the owner of the land Marriott Hotels on the 08/06/2016 and they contacted Parking Eye confirming I was a guest at a meeting and requested the charge be cancelled. Have you had a response? No 7 Who is the parking company? Parking Eye For either option, does it say which appeals body they operate under: Independent Appeals Service (POPLA) If you have received any other correspondence, please mention it here I received a further notice from Parking Eye on the 30th June stating the charge had now gone from £65 up to £100. And I had/have 14 days to pay it from the 30th June I assume. The Marriott Hotel advised me I didn’t need to contact Parking Eye as they would deal with it. After the second letter I contacted the Marriott again and they again emailed Parking Eye asking them to cancel the parking ticket. I am seeking advice on whether I should contact Parking Eye directly, what have other people experienced when the landowner attempts to cancel the parking charge? I am in the wrong in terms of the parking ticket I missed the multiple signs (new arrangement with Parking Eye and I just didn’t realise) Thank you for your assistance. Audrey

- 6 replies

-

- apprear

- cancellation

- (and 6 more)

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.