Showing results for tags 'request'.

-

Hi, My partner has been paying off a nominal monthly amount to Link Financial since the card debt was sold to them by MBNA. Sent Link a CCA in June but have had no reply. Sent a SARN request to MBNA and had a reply with only the attached request form copy and a second page with the terms and conditions. From reading other posts I think that this is invalid and therefore unenforceable. Would one of you more experienced people be good enough to have a look at give me your opinion. It seems to refer to paragraphs that don't exist and there is no lending limit or interest rate shown. We have since (last week) written to Link re their failure to supply a valid CCA and await their response! What is our next move please? L CCA Request Load.pdf

- 3 replies

-

- application

- mbna

- (and 4 more)

-

We have had numerous issues with a caravan purchased from a dealership in less than a year we have had approximately 44 issues with the caravan with several issues being serious. Four of the issues resulted in the front and rear panels being repaired and then replaced. The advice I got from a lawyer was as follows; Although I appreciate you approached XXX Caravans to supply you the caravan, as you took out a hire purchase agreement with Black Horse, they are the retailer of the caravan. T herefore any rights you have under consumer law are to be exercised against Black Horse and not XXX Caravans. Under the Consumer Rights Act 2015 Black Horse have an obligation to ensure the goods supplied to you under a contract are of satisfactory quality. This means they should be fit for their purpose, free from minor defects, safe and durable. For the problems you have described in your email it would appear this is not the case, as a result Black Horse are in breach of the contract between you. I have always been under the impression that the supplier is the retailer and that the contract is between the consumer and the supplier and if there are any issues I need to approach the supplier and not the finance company although the finance company do have a responsibility. As we have had so many issues with this caravan which appears to be a Friday afternoon lemon made from left over pieces of other rejected caravans, we are considering rejecting the caravan even though we have had it since July 2016. The £1000 deposit was paid using a credit card with the balance financed by a trade in and HP. The caravan cost in excess of £30000. We have had approximately 100 days usage from the caravan. The question is whether the advice from the lawyer is correct or not? Thanks.

-

In October 2015 we ordered a new Buccaneer Cruiser caravan and paid a deposit of £1000. The caravan is due to delivery within the next few days. We chose this caravan as it is wider and has self levelling making it easier for me as I have rheumatoid arthritis and therefore mobility problems. Between the time we paid the deposit and now we raise a few issues about the rear panels on these caravans as there was an issue with some developing cracks. The caravan is advertised with a 10 year water ingress warranty and one would assume that this covers the outside panels however on reading the owner's manual which cna be obtained online I found out that the panels only had a 1 year warranty. I emailed the dealer on a few occasions with our concerns about the rear panel and they replied and gave us re-assurance and I left it at that however on Saturday someone went to take delivery of their 2016 Cruiser and foudn crazing on the rear panel. I raised this with the dealer as we were have 2 units fitted onto the caravan and requested if we coudl view the caravan when it was delivered and before they did any fitments to the caravan. This was their response; Martyn is on holiday at the moment and won’t be back for a few weeks .I have just been looking through your email with the concerns you have with the buccaneer cruiser 2016. I then started to look though the rest of the emails you have sent us over the past few months. You have great concerns with the caravan . On a personal level ,this occasion we feel this would cause you a great deal of stress to yourself and the company if a problem was to happen in the future with the buccaneer cruiser. with this in mind on this occasion I obliged to return your deposit and cancel your order. we feel this is the best course of action for you .can you please call us to return your deposit asap . Can they cancel the order and issue a refund bearing in mind that they have had our deposit for 5 months plus I have had to paid £425 for the air con on our current caravan to be transferred and another £99 deposit for a Paintseal treatment? The wife is absolutely livid as she has been looking forward to us taking delivery of the caravan.

-

Some years ago, Cabot acquired five credit card debts I had with BOS/Halifax/IF/Barclays/Lloyds. This amounted to a substantial sum and was the result of 'getting my fingers burnt' in property development. There is no entry in my Credit report for any of these amounts, or from Cabot. For the past several years I have been paying an agreed £1/month on each account to Cabot, no payments missed or late. They seem quite happy with this and don't bother me. This amounts to the princely sum of £60 / year in reduction of the substantial debt, less whatever they spend on administration/letters etc. I am almost seventy and have negotiated substantial debt write-offs with NatWest, Capital One and Tesco directly. Cabot would not write their debts off. With my sisters help I have tried to negotiate a settlement of £2000, (ok the total debt is around £40,000), but they keep saying no. I have pointed out to them that if I live to 80 they will only get £600 and to 90 they will get £1200... ..and I will have no assets to leave, but they are adament I keep paying £1/month each account. I could simply keep paying this and let it die with me, but I want a 'clean sheet'. I have requested a SAR within 40 days. 1) Assuming they respond in the timescale but do not send any signed novation agreement or original /certified copies of the original agreements bearing my signature, can they actuallly DO anything if I stop payment? 2) I am selling the modest house I have in the UK (no equity) and going to live with family in France. If I just leave the UK and don't give any French adress what would/could they do? 3) If I did either of 1 or 2 can they retrospectively place entries on my credit report? thanks

-

Hi everyone, as suggested I am posting each of my debts separately so I sent a CCA letter to Allied International Credit regarding my Egg credit card (now Barclaycard), I should have received an answer by 22nd July '14 but have today received a letter on Barclaycard headed paper saying they have enclosed a "reconstituted copy of your agreement". it is saying that they are "currently unable to provide a copy of the terms of your credit agreement" and go on to say "they are therefore prevented from enforcing our agreement with you". However they also say "we can and will continue to take any action short of enforcement, which includes reporting to credit reference agencies without telling them that the agreement is currently unenforceable, demanding payment from you". They refer me to a case of Philip McGuffick v The Royal Bank of Scotland (2009) EWHC 2386 in which it was held that none of these steps constituted "enforcement" for this purpose. What do I do now, is there another letter that I should send in response? What they have sent me is just a printed copy of a credit agreement which anyone could print off, no signatures. I would be grateful of any advice on this guys, I have other debts that I have sent CCA's to, should I have sent a different letter asking for original signed copies?

- 12 replies

-

- answer

- barclaycard

-

(and 3 more)

Tagged with:

-

I find myself in murky waters like many others claimming this new benefit. Having worked most of my life, and cared for family member, then returning to work following the loss of family member, my GP signed me off work and to cut long story short, I resigned from my job due to employers pressure. I was only on probationary period so cannot claim unfair dismissal. I investiagted my entitlement to benefits and was directed to claim ESA which I did. 3 weeks later receiving a letter rejecting my claim, not returning my 'fit notes' and advised to claim UC. I immediately claimed UC and attended first security appointment. I was handed my 16 digit security number (which I feel breaches data protection having it printed, but wouldn't remember it anyway) and requested my claim be back dated to 2nd September due to the above. As UC is all dealt with online, via the journal process I have found this process confusing and frustrating as I am unable to speak with someone initially to find out what benefits I could claim. The 0845 numbers in my area charge additional fees when calling from mobile phone, fees which my provider advise are not charged by them, but are charged by DWP. The rejection to back dating my claim will obviously cause severe hardship and arrears with rent /council tax. I am genuinely looking to return to work and have been applying for many jobs which I am more than capable of doing, without success but in the meantime I am totally stressed about my current situation and do not know how I am too proceed, not having been in the position before of having to claim JSA/ESA etc. I'm not wishing to sound derogatory but I have never lived off benefits and find myself in unknown territory, but extremely scared of the prospects ahead. I have done some research about benefits and it mentions 'Mandatory reconsideration', prior to appealing their decision but I have no idea how to go about doing this, as it appears the wording of the rejection letter (via UC Journal) seems to be coming across as saying 'ignorance is no excuse'............................ I have a meeting with my workcoach at the local jobcentre this afternoon and would like any information you can help me with to go armed with to get this MR moving along please. I have requested an interim payment but the UC Journal advises that I call them to apply for this! If they will take phone calls for interim payments then why can I not talk to anyone regarding UC on the phone about benefit matters? This is so confusing and frustrating but surely they can't reject a request for back dating of claim when all their rules are so complex? Or can they? I will be homeless by Christmas if they don't agree to back date this :-x:-x:-x Any help or guidance would be very much appreciated.

-

The Parking Prankster has posted a very interesting and helpful case where the Judge stated that the Witness statement included facts that were were "tantamount to perjury"-strong stuff. http://parking-prankster.blogspot.co.uk/2017/09/ In the Blogspot summary the PP points out that PE and others quite regularly send out Witness Statements that are a tissue of lies and can get away with it because they have no intention of having the witness appear in Court . So there is no comeback on those parking companies or their tame legal advisers who mislead the Court. The PP thinks this is wrong and urges all defendants to call for the Parking Company's witnesses to attend Court thus putting an end to one of their disgraceful practices. Obviously any current members who are having problems with PE should fire off a letter to them stating the above case and advising them that if they issue Court proceedings against them, not only will their witness be called to give evidence, the reason why that is being demanded will be included so that the Judge will be forewarned of the type of company they are dealing with. One imagines that PE will decide that it may be wiser to find some other motorist to take to Court.

-

Hi I have recently sent a CCA request to Capital One for a credit card. I have been paying until recently on a DMP via Payplan. I have stopped making these payments and have recently received the documentation back from Cap One stating that the agreement that they have is enforceable. I have scanned what they have sent, the copies are not great but the originals are legible. I would appreciate any assistance in establishing whether it is enforceable and if so what are my options. Thanks CAP1 CCA Retiurn.pdf

-

Created a new thread for all correspondence I receive from Capquest and any questions relating to it that I can't find answers for. I hope this is OK. I sent Capquest a CCA request on 20th July via recorded delivery. They received it on 21st July. My understanding is they then have 12 working days to provide the CCA (+2 two days for delivery). with that in mind, unless they provide that CCA the account would be in dispute on 10th Aug, yes or no? I received a letter Friday 4th Aug dated 3rd Aug saying they have forwarded my request to Vanquis and will send it to me as soon as they have it. I also received a letter today, dated 4th Aug saying I've recently raised a query on my account, and they've placed my account on hold for 28 days and have contacted Vanquis for further information. If they haven't had a response by 31 Aug they'll write to me again with an update. at what point is the matter in dispute/default/unenforceable? Does it matter that they write and say they're still looking for it? Or do they literally have 12+2 days to provide me the CCA and if they don't (regardless of them writing to say they are still waiting for Vanquis) the account is in dispute/default/unenforceable? Many thanks.

-

Well into first first few weeks of not paying my 4 lenders. Couple of sent dd forms bin. MBNA phones me and asked me to ring them deleted. Awaiting for official letter in response to my hardship letter no payment till December for a DMP to kick in. all debts are newer then 2007 except the MBNA as suggested I will wait the others to go to DCA before using any other CCA requests. using the template for MBNA is the address the one to use for sending this letter off to. The MBNA account was open 2006 and ive also read that most MBNA accounts pre 2007 are pretty much unenforceable. I owse 42k, MBNA is 6k. Be a small win in a big pool but a starts a start eh. Customer Advocates Office MBNA Limited Chester Business Park Wrexham Road Chester CH4 9FB Thanks Russ

-

Dear All First of all, thank God for Forums like this and people who care enought to devote precious time to assist others in debt. A Debt collection firm, issued a claim, the progress of which was halted by a CCA request. It has finally come back, after a year following request, with what appears to be a copy of a signed agreement and t&cs and statement of account. Amount seeking is over £3,150. Can't claim time barred, owing to previous payments. They say they can proceed to seeking judgment unless payment arrangement is set up. They trade under three very very similar names. The claim was issued under a name the authorisation of which by the Regulator has now lapsed. Should I give in and set up arrangement? Can I apply to dismiss their claim? Should I request copy & details of assignment or ownership of the debt? Can they come back and reissue a claim under one of their authorised names? Please tell me what option I have. Very grateful

- 16 replies

-

- cca

- challenging

-

(and 5 more)

Tagged with:

-

Hello Today I needed to cancel order on floor panels that had value of around £2000 there was nothing wrong with them, well beside the fact I found similar quality panels for half of the price so it was obvious I would need to cancel my order with Carpetright as I'm not made of money just like most of the population. I went to the store with my order confirmation where I paid for the panels with cash(the panels were supposed to be delivered next week) I told the manager of the store I wish to cancel my order and that's where all of it starts. I've been told that I can cancel but I will be charged 20-25% of the order value which added to over £400 just for the cancellation and the explanation for this was the panels were ordered specially for me(Special Order) and the store wont be able to sell them now. I was rather unsatisfied with the fact and said this is too much which was countered with the response that even offering 25% charge is a sign of good will as the store has right to refuse cancellation. I would like to add that they failed to show me any term and conditions that stated charge of 25% but only a short snippet from a leaflet that says I can only amend order within 24 hours. After few minutes of arguments and call to regional manager by the shop manager they offered me a check for £1800 which I accepted as I felt I had no options left.( it will be sent by post within 7 days) My question is was actions of the store justifiable? Did they have the right to charge that much? Is there anything else I can do? Do I have right to a full refund? I can understand paying for handling but the price they came up with was ludicrous.

- 7 replies

-

- carpetright

- did

-

(and 3 more)

Tagged with:

-

Hello everyone, I have applied for current accounts with Natwest and RBS which have both been denied (even though I was originally accepted) I want to know why they have refused me as my credit file is in good condition, no defaults etc so do I need to send an SAR? if so, is there a specific template? Any help or advice would be appreciated.

-

Hi All, To provide a bit of a backstory: the company where I work has made no significant pay awards (beyond inflation) for around 8 years and for the last two years nothing whatsoever (not even inflation). After a bit of calculation my wages are now below what they were in 2008 when adjusted for inflation despite now performing a significantly more senior role. I have found something which could be performed one day a week which could significantly supplement my income and to this end put in a request to cut my working week to 4 days (not working for the company on a Friday i.e. doing my own thing). To be clear I have offered significant mitigation: pro-rata reduction in holiday, being available on the phone on a Friday where possible, possibility of coming in to the company on a Friday if they're desperate and fits in with me and the option for either party to cancel the agreement after 3 months trial period. Needless to say this request has been refused. The letter contains the statement "You requested a reduction to your working hours without an corresponding reduction in your salary" As I understand it this is not a statutory or material consideration. The letter then goes on to state that they have "considered my flexible working request against each of the statutory grounds....... The reason for this refusal is that to grant the request would impose an unreasonable burden of additional costs for the business. We consider your position to be full time and we would have to cover your absence with additional resource at extra cost to the company". When my manager presented me the letter I put it to him that the reality is they would never cover my absence on the Friday with someone else as there is (a) no one else in the company who can do my job (b) the business would not employ an outside contractor for one day per week. My manager basically agreed with me and said "you're probably right" My question is (a) have the company provided evidence to reject under the statutory reason of burden of additional costs, (b) Does the statement "You requested a reduction to your working hours without an corresponding reduction in your salary" hold any validity or rather does it invalidate their reasonaing as it could be construed that they would have accepted has I offered a salary reduction. Thanks in advance. PS. For clarity I am a man and the request had nothing to do with looking after children

-

I have a cc claim form dated the 27th Oct for a cc debt that is being pursued by Lowell. About 18 months ago I requested a consumer credit request, sent it off recorded delivery but did not receive any further response to this other that the usual demand payments. Fast forward to now and i'm wondering what to do about the cc form? Although I've kept all my letters I can't find the receipt from the post office for the recorded delivery and the £1 postal order as proof that i sent it and they never acknowledged it… Am I toast? Thanks in advance PB

- 33 replies

-

- cca

- county court

-

(and 3 more)

Tagged with:

-

Hi, I am looking for some advice/opinions... In January 2011 I purchased a car with finance provided by creation. The price of the car was £2995, I paid a cash deposit of £800. I was made aware of charges/fees totalling £450 (ish), which would be added to the finance agreement. All was going fine until around 6 months ago, when a change of bank account led me to registering for online account management (so that I could arrange continuing payments). The amount outstanding didn't appear to be correct so I contacted the company and requested all of the relevant figures. It turned out that the set-up/admin fees had been added twice, the representative I spoke to said that the dealer was wrong to add these fees at the point of sale as they are always added afterwards. A rather in-depth conversation led to me being informed that creation don't actually hold any physical paperwork, and that they would be unable to amend the loan amount without notification from the dealer. After some detective work I managed to locate the dealer (who had now leased his forecourt to someone else, but I found him in the end!). I explained the situation, and asked for a copy of our original sales document. A week of telephone calls and me harrassing him brought no joy. He told me that all of his paperwork was in storage and that he'd been unable to locate the document. Well, of course he couldn't find it - it would prove that he had actually received £450 more than he should have from creation, which they would obviously want back! For me, the actual cost of the £450 would be much greater due to the associated interest. Fortunately, I did find my copy of the sales document, and emailed creation again, informing them that I had a physical, SIGNED document showing the correct amount. I explained that I would be happy to send them a COPY, not the original - this was all the proof I had, it wasn't going to be lost in the post! They did not reply. On to the more pressing concern now... during all of this I noticed that creation had the wrong registration number for the vehicle. I informed them of this, without giving them the correct number. Again, they were unable to amend the details without verification from the dealer. I sent a final email informing them that this needed to be corrected (as did the loan amount) as I was hoping to sell the vehicle, with their permission of course. I was hoping that this would set alarm bells ringing for them - the vehicle did technically belong to them. No joy. after a couple more months, it became apparent that the car was going to need a lot of money spent on it - which I didn't have. I did a hpi check and, surprise, it showed no outstanding finance. So I traded it for another car at a local dealership. I now find myself in no position to continue with repayments - I am just setting up a debt managemnt plan, and have just been visited by bailiffs and had to agree a repayment plan with them (which I can't afford, but will have to find if I want to keep my possessions obviously!). I am in this position through my own actions - I was earning a good salary until a year ago but had to give up the job. This really is no-one's fault but my own. My question is this - what can creation do to me? I no longer have the car so they can't repossess it. Actually, I NEVER had the car with the registration number they hold, although the make and model are correct. I am willing to come to some arrangement with them if they will accept a much reduced payment, my concern is that they won't accept it and I have sold a car which didn't belong to me . But then, it didn't belong to them either maybe? I know I shouldn't have sold the car, but in my defence I did inform them of the mistakes with the agreement. The only document I have ever signed is the original purchase order with the dealer (which he can't find). Any ideas?! Thank you.

-

I was having difficulty with my debts which are around £12K. I am on benefit, and so I foned up Debt Free Direct to see what they could do. I am very upset that all they could offer me was an IVA - 7 years paying £130 a month. Naturally I had to sign up because I was getting constant harassment of one of my creditors Halifax who kept foning me up every day demanding money I didn't have. I am now wondering if the IVA really was the right solution; they didnt offer me a Debt Relief Order which is what I would have prefered. Is there anything I can do besides letting the IVA fail (which I dontwant to do because Halifax will harass me again). Very distressed by the whole thing; Debt Free Direct knew I was on benefits; I really cant see myself paying £130 a month for 7 years, especially as I could loose my benefits at any time anyway, they failed to take this into account. Because of being on an IVA no company would give me advice as I have rung around several this morning; they said the IVA would have to fail before anyone could help me!! NOT happy can anyone please help

- 148 replies

-

- argggggggggggggghhhhh

- bankruptcy

- (and 14 more)

-

Hi All I have opened a claim for refund of Additions account fee's and have received a questionnaire to complete; which I would like some advice on how best to proceed. Here are some background details first: I first became aware of Package Bank Accounts last year when a colleague at work told me that he had reclaimed some money. I was shocked; having only ever banked with barclays for the last 24years I genuinely thought that I had to pay for my bank account and that the insurances etc. were free perks. I decided to pursue a claim myself; I only have statements from 2011 I did an SAR request on the internet in around May last year. After 45 days I had not heard or received anything I rang the number given on Barclays site; the telephone banking agent gave me a number to ring for the SAR team. I rang the number several times but it was a dud number. Made an appointment at the Bank, spoke to an advisor who gave me an SAR request form to fill in; I filled this in and sent it recorded delivery with my cheque for £10. They received the form but again after 45 Days nothing. At this point I gave up. In December I recieved the letter from Barclays saying Additions was being removed and offering the Fee Free Account; In January I went to the bank and cancelled the Tech and Travel pack. This spurred me to look at claiming again. I read on the internet that even with an SAR they only go back 6 Years; so I thought well I won't gain much from it anyway. Is this true that they only go back 6 years? this is what I know: I opened my current account with Barclays in March 1993 at the age of 21; this was my first current account and to this day is the only current account I have ever held. Through research I found that the Additions account wasn't introduced until 1996 I must initially have had a fee free account? I do not recall ever agreeing to the Additions account; I do not recall agreeing to iot being upgraded to Additions Plus. I do not recall agreeing to the cost of the account being hiked up over the years. As long as I can remember I have paid a fee; I definitely remember it being £6.50 a long long time ago it may have even been £5.00 but not sure of this. I remember it being Additions then Additions Plus; before I opted for the Fee Free account without the Tech or Travel pack in Jan this year the fee was £16.00. Over the years the fee increased; I rember it being £13.50 at one point. I think I may have had it from the beginning before Breakdown cover was included; I know I had CPP card protection and I have a vague recollection of having a tag to go on your keys incase you lost them? I suspect that my account was upgraded to Additions from my original fee free account without my knowledge. Initially I did not have an overdraft with the account; I asked for one at some point many years after I had opened the account somewhere between 2000-2005. I only asked for a small overdraft for emergencies only and it was only a small one I would have only wanted £100 and probably wouldn't have used it in the beginning. Maybe I was conned into having additions at this point; but I am sure I already had it. Regarding the insurances; I have only ever used the Breakdown cover and only once bcause I thought it was a free benefit to an account I had to pay for anyway. I have never had any expensive gadgets or a mobile worth insuring I have never used gadget insurance. I only holiday in the UK and would never use travel insurance. Over the latter years I have used my overdraft but again only because I thought it was a free perk to an account I had to pay for. If I had had a fee free account I would have managed my money differently and could have done without the overdraft. On January the 24th I this to file a claim: Packaged Bank Account Claim: Barclays Sort code or branch name: xx-xx-xx Existing complaint reference: N/A xxxxxxxxxxx I am writing to you as I believe the packaged bank account which I have had since some time after March 25th, 1993 was mis-sold/inappropriate for me. This is because... - I don’t remember ever agreeing to having this account. - I was upgraded without my knowledge Additional information: - The addressess that I have lived at whilst holding the packaged bank account are: xxxxxxxxxxxx I have no recollection of ever having opened a package bank account. I started banking with Barclays on 25/03/1993 when I opened a current account; I think that the reason for opening the account was that I needed an account to have my wages paid into. You are the only bank that I have ever banked with and this is the only current account that I ever held. At some point it seems, my current account became a packaged bank account but I do not remember ever agreeing to this; I remember along time ago on my statements paying a £6.50 account fee which has been risen over the years to £16.00 without my consent! I thought that this account fee on my statements was exactly what it stated; a fee for my account that I had to pay to have a current account; I did not know that the fee was for the additional benefits such as travel insurance, breakdown cover etc.. I thought that these came FREE with the account and that the account fee was for the account itself and NOT to pay for these benefits; which I never requested anyway. Upon receipt of your recent letter informing me that Additions is being removed and giving me the option of removing the benefits; I have cancelled the tech and travel packs and now have a fee free account whilst retaining my overdaft facility which is all I have ever required from my bank account. [removed template details - dx] Today I recieved a reply and a questionnaire to fill in. After researching on this site; I think that my strongest complaint is that Additions was applied to my account without my knowledge or approval rather than it being mis-sold. I think that this is reflected in my Complaint letter above. Reading the questionnaire: Section A asks for details of my Package Account. Section B asks - Am I complaining about the sale of the account. - If NO go straight to Section F Selecting NO here skips all of the questions in the questionnaire and takes me to Section F - any additional information Section G - Your declaration. End of Questionnaire. Should I select 'NO' in Section B and skip all the questions. Can anyone advise what additional Information I can give? Also If the question is asked of when I became aware that I could have a fee free account and could make a complaint; should I say December 2016 when I received the letter which is simpler ( But will they be suspiciouse of my earlier SAR requests and visit to the bank regarding them). Or should I be honest and say that I heard through a colleague early in 2016 ( They may ask why it took me so long to switch to a fee free account and to make a complaint - which was because I was waiting for my two SAR requests). Any advice on how to proceed with my claim will be gratefully accepted; I will keep an eye on my thread, respond to any replies and update my progress. If I am succesfull I will make a donation to the the forum in thanks. Thankyou in advance. Alice

-

Hi guys, hoping someone can assist with the latest letter received from DLC... Below is a long-winded background to the simple question - "What do I do next?" I wrote on the 27th July 2016 requesting my CCA: Template removed - read our rules dx And received a statutory response on the 9th August 2016 stating DLC had requested it from the original lender, MBNA. I heard nothing until today, opening the attached scanned (and redacted) letter from DLC. In summary they state: Due to the age of the account the original executed agreement is currently unavailable; & Whilst we may not enforce the agreement, the monies remain outstanding; & They go on to quote McGuffick vs. RBS using it as a precident as to what is considered "enforcement" Thanks in advance one & all DLC Letter.pdf

-

i sent a cca request to the halifax i have a personal loan with them which was taken out online in december 2011 i have some concerns what they have sent me tbh on the front of the "agreement" it states "BANK COPY" there is an incorrect address on the agreement, i know the interest is incorrect but most importantly of all the agreement has not be signed by hand or has not been ticked electronikally in fact there is no signature box at all the default for this is due to come off credit file next year i've not made a payment since july 2015 i have sent the bank a detailed income and expenditure and asking to write the debt off on hardship grounds, the bank has not replied they are aware i am a vulnerable household due to various medical problems, so i can't work to pay back the monies owed any advice please?

-

I have finally heard back from CapQuest regarding the CCA Request issued in January, they have provided a signed copy of the CCA together with a statement of account from prior to taking over, which causes some questions, primarily the balance has not reduced from the time I went on to the DMP. They have also failed to send any further documentation (such as a deed of assignment) which I requesting in my letter. Please would someone advise what my next steps should be? I am able to post a copy of the CCA & statement on here if that will help?

-

I have sent Halifax a CCA request several times over the past year, which they seem to be ignoring! This card was taken out in the late 1980's I'm guessing they are having difficulties retrieving any documentation. I have spoken to the Financial Ombudsman and they say they cannot force a company to produce documentation they do not have. If I raise a complaint with them they can only ask the same way I have. They have not sold the account, they have passed it on to a DCA to manage the account who are now demanding a massive increase in the monthly payments. Without the contract I do not now what my rights are. So, what should I do next? Thanks in anticipation sidley

-

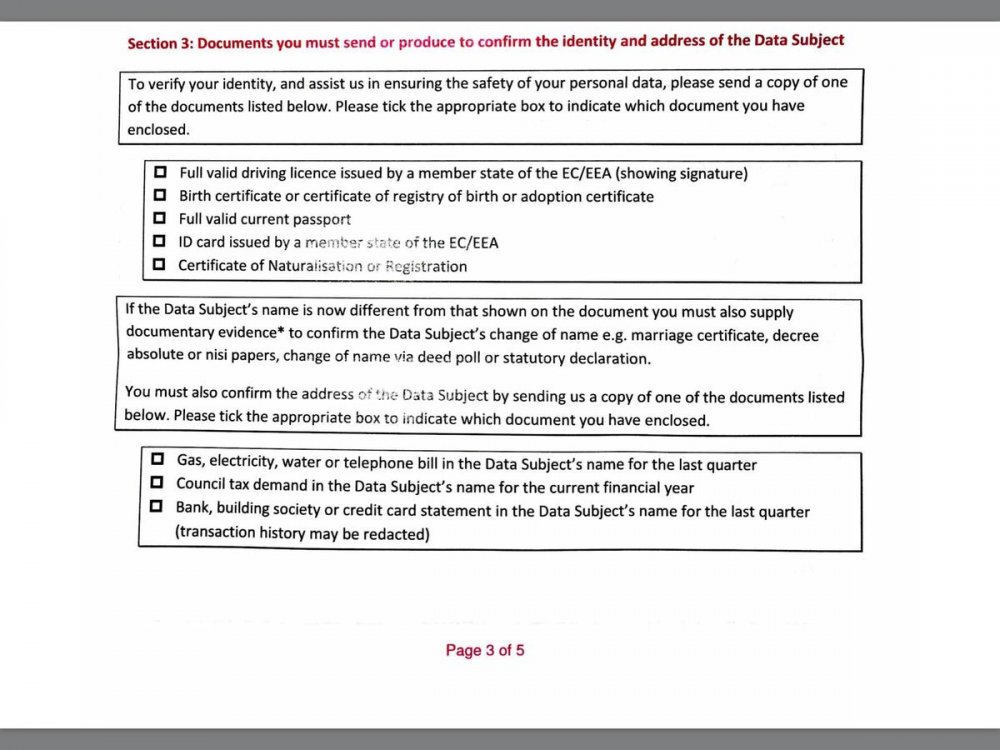

I've just sent off (with the £10 postal order) a Formal DSAR request to 1st Crud. All info required to be supplied, including a signature was provided in my formal and detailed letter. I've just received one of their 'please fill out this 5 page form' before we are obliged to do anything, however I'm not happy with what they are requesting I provide. There is no way I am ever going to provide them a copy of my driving licence, or bank statements and I'm back on here for some advice. I've been completing DSAR requests for approx 10 years, and apart from (almost) starting legal action with BC whilst some have been a struggle to get all info from and in a timely manner most have been compliant and not made me jump through too many hoops. (Oh apart from the DWP completely ignoring me for over 2 months! Still ongoing - but I class them in a different category to the CC companies and DCAs etc). Have the rules changed? I am now legally obliged to provide any of the following on the attached picture? Considering I've lived at the same address for over 10 years, and they've contacted me for 3-4 different companies at this same address, and threatened legal action to me at the same address, and supplied alleged CCA agreements, I would think that they should be fairly confident of my identity? Can I take this route, or will they likely play up and delay provision even though I don't (I think) have to legally provide the documents they have requested I send? Thanks ME_TOO

-

Hi Guys, Need your advice on this unusual problem. Sorry story is a bit long. I’ll spilt it by bullet point to make it easier to read: 1. 23 Dec 2016 – went to the store made small purchase requested £50 cashback. Was deep in my thoughts. Felt a bit awkward at the end of interaction with cashier who started behaving strangely by completely ignoring me and started chatting with colleague. After packing few purchased items I was waiting patiently not realising what for. Felt as something did not finish - no eye contact from cashier, no thanks / goodbye. I’ve felt a bit strange and waited for much longer that socially acceptable in such situation and then left the store without exchanging a word with cashier. 2. Few day later realised I did not had my cash. As I was not out of the house since visiting store I could not have spent it or lost somewhere. 3. Waited for store to open again and went to speak with manager on 27 Dec 16 to ask them for my cashback and checking CCTV to confirm it was not given. Duty manager said he cannot view CCTV but checked till for that day and there was no extra cash in the till. He also found small receipt with my signature that confirms I’ve received cash. Signature seemed to be mine but I do not remember signing it nor receiving cash. 4. I’ve got my receipt with cashback on it. I am guessing I was asked to sign small slip confirming I was given cash and then was given my store receipt. That triggered me into thinking I got what I needed and made to forget about my cash by cashier starting to completely ignoring me. 5. I’ve spoken to customer services and same manger again who were pointing at each other saying I need to request CCTV footage and pay for it and that only store manager / area manager can view CCTV. 6. 6 Jan 16 spoke to customer services who then spoke to store manager who then checked till records again stating no extra cash was reported on that day. 7. Managed to speak to store manager in person on 6 Jan 16. Did not get much was just fobbed off making it sound it was my fault and I should have checked cash in store and they conducted their investigation. This person was quite elusive did not wanted to talk. Said nothing I can do. Both managers felt a bit arrogant almost as if they were saying good luck with that! If you know what I mean. 8. 6 Jan 16 stated electronic communication with customer services sending all above information via web form. Starting message with I am making formal request for CCTV footage under Data Protection Act 1998 confirming I am happy to pay for it. Providing all relevant details timing till number etc. 9. 18 Jan 17 sent them all above information in registered letter. 10. Did not get any response for around 10 calendar days and called them again to chase up for reply. 11. Received reply on evening of 20 Jan 17 (Friday) stating they passed for investigation to area manager. Provided instructions for requesting CCTV and how payment should be made. Advised that I need to contact police if I felt there was theft. 12. 20 Jan 17 I replied via e-mail and asked to place hold on the footage to ensure it is not overwritten as I’ve read somewhere that their retention period is 30 days. 13. 21 Jan 17 (Saturday) send request for footage as per their instructions. 14. 26 Jan 17 received letter stating request is outside of system storage capacity. 15. Chased them up for finial outcome of area manager investigation knowing what they will say. 16. 16 Feb 2016 Received response stating CCTV has now been overwritten they conducted till review and no extra cash was found. Nothing else they can do and I can contact the police. My view on that is that they ignored my initial request under Data protection act sent to them on 6 Jan 17. Purposely delayed providing instruction for requesting footage and timed it so that I have 0% chances of making it successfully and that it reaches them before 30 days retention period to cover up for their employees. I’ve seem to exhausted my option to get this resolved with the company and looking for advice on taking this further. I feel up to taking them to small court claiming for postage, petrol cost for number of trips inconvenience and original cashback. Just wanted to get your views on chance for success and some help with small court procedures if will be going that way. Thanks for reading!

-

Hello, Main details summarised for easy viewing: Issue: Car is in limp mode with a check DPF light showing, Main issue is that car does not automatically regenerate, this happened on the same day I bought the car on my drive from Manchester to the Scottish Borders. Honda diagnostics find no fault codes. DPF has been replaced, issue still exists. Car has had 3 diagnostic appointments (2 via Honda), none find fault codes. Car has had 2 manual regenerations, one worked and within a month was back in limp mode. Car purchased on - 07/07/2016 Issue first presented - 07/07/2016 Issue first reported - 08/07/2016 (by email and phone to dealership) First intent to reject - 06/01/2017 (by email to dealership) Rejection raised with finance company - 10/01/2017 Car purchased for ~ £7,500 What I've done so far: Raised the issue to the dealership from the day after I found the fault. Have it in writing that they will commit to sorting this issue beyond the 3 month warranty. After a lack of communication from the dealership, refusal to pay for some of the diagnostics and refusal to accept rejection of the car, I contacted my finance company (as they still own the car). What has happened since purchase / complaint: Took the car to Honda to get diagnostics and regeneration, which did fix the issue for around 1 month. I raised the issue with the dealership again 29/08/2016, noting that this issue was present again. The dealership asked me to take it to a local dealer (not Honda) to get diagnostics. All local dealerships said they could not carry out the diagnostics and it would have to be Honda. The dealership did not agree to this then cut communication. I have email chases from myself asking for a response. It took until 26/09/2016 with constant phoning before they spoke to me again. The response reads: "Should they (Honda) find any underlying issue as to why the car is not regenerating itself, then we can address that, possibly with a local VAT registered garage, if that is the case, should the fault fall within items covered under warranty Dace Motor Company will cover the cost of repair within the terms of the warranty, even if the repair takes place outside of your warranty expiry date." Diagnostics were carried out 04/10/2016 and found no fault. Honda suggested replacing the DPF. After speaking with Dace, they told me I had to price getting this done. I did this and got no reply. I then emailed on 23/11/2016 stating: "I've tried calling you several times now and have had no reply from you despite you telling me you would get back to me weeks ago and reception informing me you would phone back when I've called in." I only received a response via phone at the start of December stating that Dace had found a much cheaper alternative and wanted to send a DPF to a local garage for them to fit. I was reluctant to do so, but this was the only option offered. The work was carried out 20/12/2016. Replacement of the DPF did not fix the issue, the light was still on and the car still in 'limp' mode. I was advised by the garage that the DPF may auto-regenerate after driving for a bit and clear this fault. After several attempts at this under the recommended Honda guidelines for DPF regeneration, the problem still remained. The garage then performed a manual regeneration to see if they could clear the fault and were unable to. Further diagnostics were done and again, no fault found. I emailed and called several times again before getting to speak to someone, I requested that the dealership take responsibility for the car and repairs, noting if they did not I'd be looking at getting the car rejected / refunded. Their response was that this would not happen, and that I should take the car again to Honda for diagnostics, but that I should pay for it. I emailed again 09/01/2017 refusing to pay for diagnostics, and again asking them to do so. They replied saying they would pay for the diagnostics but only if there was a fault code relating to the DPF. They also noted that if there was not a fault code for the DPF they would not pay for the diagnostics or any subsequent repairs as it would be something new that has happened to the car and is now outside my warranty. At this point I immediately filed a rejection request with my finance company, who suggested I take it for diagnostics and they would pay if Dace wouldn't. They don't seem to want to help, and keep bringing up reasons that I shouldn't reject the car. Their latest correspondence notes I only had 30 days to reject the car and I've only raised it with them after 7 months. Sorry for the length of this and if I missed anything, I tried to be thorough. I just don't know what to do now. I figured the finance company would help me with this process but it doesn't feel that way. Apart from going down the legal route, I'm not sure what I should and shouldn't do. Any advice would be very much appreciated! Thanks

- 3 replies

-

- dealership

- rejection

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.