Showing results for tags 'offer'.

-

Simple terms: Lloyds overdraft, defaulted mid 2011 balance around £600. Had a claim open for bank charges on same account which I was hoping might of cleared the od was of course declined with court ruling. Had been paying Lloyds £1 a month till 12 months ago when I moved from HSBC to Santander, have not paid since. Lloyds have now passed debt to Cabot who are telling me they will accept an offer. I am absolutely in no position to repay at more than £1 a month, self employed, private renter, skint... but could maybe pull a bit together in order to get them off my back. Now considering the debt is made up i'd say of mostly bank charges at some point between 1996 and 2008 when I banked with them how much would be a reasonable offer?. Otherwise its a pound a month for the next 20 years. I was thinking of going in really low, like 10% which is now about £58. Any advice would be appreciated. I know the numbers are all pretty small really and not enough for me to lose and sleep over but it would just be nice to get this out the way if possible. Ps have debt collectors gone soft?, the tone of all letters compared to 5 years ago is very gentle.

-

Hi Everyone Good news regarding my complaint against Quickquid. I referred it to the Ombudsman after receiving their standard response they did all the necessary checks etc, etc. I loaned from them constantly from Dec 2008 to Sept 2013 when I requested a repayment plan. Had a call from my adjudicator at the Ombudsman to say Quickquid are willing to refund all interest paid from October 2010. Just waiting for her to confirm the figure. My initial loans were fairly small so I can accept they were affordable but from 2010 onwards the amounts escalated each month. If their figure is anywhere near mine then I will probably accept it. This is the last payday loan company I have a complaint against. Had a 100% record against the 10 claims I made and am happy to say have been debt free for 2 years. Just want to give encouragement to others just starting their claims, its a long process but keep at it, it will be worth it in the end.

-

Last Wednesday, completely out of the blue I was called to a meeting at my HO and told that due to restructuring my job is at risk, the company produced a settlement offer and has given me a week to think about it (unlike 10 days as in ACAS guidelines) They refuse to announce the nature of the restructuring, just that I don't fit within it and if I decline the offer then I have been told in no uncertain terms that I will be made redundant and end up with less money than they are offering. Although I don't know (and probably never will) I am almost certain based on noises from the past few months that the restructuring involves paying off half the people that do my job, and then replacing the job of the remaining people with a new one with a bigger remit to cover the loss of those of us that are gone, and they are doing this entirely arbitrarily without any due process or allowing me to reapply for the new job. Given that there are already a small number of people doing this bigger remit job, and they have always said I would be suitable to do this if the opportunity gave up, I believe I am being constructively dismissed, and they are relying on the fact that I won't be able to claim that if I accept the offer. A few hours after the meeting I sent an email to the people that were in the meeting (my line manager and her line manager) asking firstly for an extension of time to consider the offer, secondly for a fuller explanation as to what is going on and why I won't fit into the restructure, and thirdly asking if they will revise the sum offered. I did stress that I had not made any decisions and nothing in the email was intended to constitute a decision or limit my options. That evening I got an off the record phone call from my line manager stating that I shouldn't have done that, I should have just taken the money and because I am seen to be arguing with them they might now just withdraw the offer and make me redundant. Can they do that? I thought if the offer is open then it remains open until the window closes or I accept/decline it. Negotiation and asking for an explanation is surely not declining it? I also don't think they would be that stupid, because if I stay I will get to see what they are doing and retain all my employment rights including the right to take them to a tribunal. I ask because I have now been offered another (better) job and if they want me gone I'm just happy to take the money at this point!

- 10 replies

-

Is it possible as a claimant to make an offer to only one defendant and not the other? Or is an offer to one automatically an offer to all?

-

My employer recently (four months ago) ran a day (8am - 5.30pm) and night shift (5.30pm - 4am). They gave notice to end the night shift, offered the night shift employees options of jobs on the day shift or redundancy. My employer is now discussing whether to change our current day shift to a double day shift of 6am - 2pm/2pm - 10pm. Will they have to offer us redundancy if some of us cannot work this new shift for family/childcare reasons?

-

I have tried searching on this thread to see if someone else has posted this query before but have not been able to find anything. So apologies if this issue has been raised before. I recently made a complaint for the mis selling of PPI on my mothers Barclaycard which she had between 1998-2011. Now barclays has written to us with a final decision letter stating they are upholding the complaint and have offered £768.41 as a refund. I know that this is nowhere near enough the money my mother is entitled to as in the early 00s she was using the credit card like nobody's business and did actually run into a lot of debt because of this, but thankfully that has been payed off. On the final decision letter barclays have stated that they have been unable to accurately calculate the refund because their investigation has been unable to find any record of the premiums she paid. So they have used an average value for the premiums paid based on someone who was sold a comparable policy. They have said they are happy to to recalculate the refund if she is unhappy with it. How would I go about proving that this refund a lot less that what my mother is owed. I have read up on SARs is it true the banks can only go back 6 years for any statements? My mother herself has not kept any statements for the card. How can I go about disputing this offer if i have no proof of the payments made? Also I didn't get a chance to read the final response letter from Barclays until a week later but by then they already put the money into my mums account, does this mean that barclays see this as acceptance of the refund and the case has been closed? Any help regarding this would be much appreciated! Thank you.

- 9 replies

-

- barclaycard

- offer

-

(and 2 more)

Tagged with:

-

Hello Everyone, I am new to this website so please bear with me if I am babbling on..aplogies in advance I recently stumbled accross my old Woolwich Opeplan mortgage statements from 2000, noticed Add Ins in the narrative and made a quick call to Barclays to see if this was PPI. The gentleman on the phone took the account number and replied "the bad news is No this was PPI on the mortgage however the good news is you did have it on a Barclaycard taken out in 1998" I was a little taken back but didn't let on, he proceeded to gie me the policy number and the last four digits of the card, advised me to fill out the questionnaire online and wait for a reply. A few days later I received a letter confirming no PPI on Mortgage and a second letter advising me that my claim was being investigated for the Barclaycard and I would hear within 4 weeks. Two weeks later and I got an estimated refund of £2056 I am very happy with that, although I am worried that I should ask for more details regarding the card, I cannot for the life of me remember applying for the card. ..I know i was working all the hours up the city but surely i should be able to remember this?! The letter says that they have estimated the refund amount as they have no records of any premiums that I paid, this has been calculated over 85 months, plus interest plus 8%... Any suggestions to what I reply back to them please Thank you

- 7 replies

-

- barclaycard

- offer

-

(and 2 more)

Tagged with:

-

Hello and thank you in advance for any help you are able to offer. My complaint for mis-selling of a Principles Card in 1989 was upheld by Santander, but an offer of £1 has been made as they have no records prior to 23 July 1996. Does anyone have any advice about how I should proceed? Do I refer to FOS? I doubt I can obtain evidence from Nat West as I do recall payments were made by DD. I also recall I took out a loan in 1996 from M & S to repay this credit card, but I doubt that would be of any use. Advice needed - thank you.

-

Argos are going to be offering same-day home delivery service, for all seven days of the week. This new service allows you to order something by 6pm, and have it delivered by 10pm for a flat fee of £3.95. http://news.sky.com/story/1565354/delivery-wars-argos-starts-same-day-service

-

I was advised my employed position was being filled by a more qualified person and that I was no longer required, however I was offered an alternative role verbally. I had a meeting with my employers and accepted the alternative role in principle, but asked for further information. I 4 days later received a letter of redundancy, stating I had turned down the alternative position. However I have the minutes from the meeting, where I clearly state, "I am not declining the position, I would like more information, do you have a job description. They now state they subsequently decided I was not suitable for the new position...... so here i am redundant, with 2 weeks short of 2 years employment and no redundancy offer.

-

Just sent SAR off for some missing statements but I do have about 90% of them from 1998 to 2005 when the account was settled and closed. I cannot find anything on my agreement details with my signature agreeing to PPI as it was automatically added when I took out the card. My questions are, will I be able to reclaim from 1998 and what are the correct redress spreadsheets that I should be looking at in the meantime ? Is there one for all of statements and one for some missing statements ? Thanks for any assistance.

-

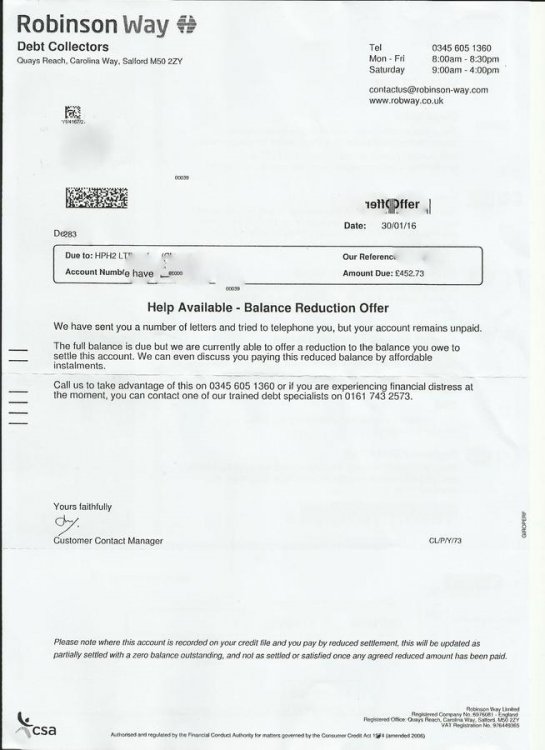

Hi all , read quite a few of the robinson way threads on CAG and it seems it can be a minefield getting a full and final offer "wording" correct . My wife had a small repayment arrangement with RW but they took a repayment that was 4 times the agreed amount she cancelled the direct debit , many many phonecalls and letters from RW she received this letter .What would be a reasonable starting point offer be ? Total debt is just over £450. Thanks Andy.

- 14 replies

-

- offer

- reasonable

-

(and 1 more)

Tagged with:

-

hi, (back from a while ago) One of my creditors has offered a settlement figure, which is within my reach. (done all the CCA stuff, etc, as per earlier advice) The letter I received seems quite generic in its wording. Is there a specific wording I should look for / ask for? If I pay the smaller amount, can they still sell on the remainder to another company? What wording should I ask for, to ensure the settlement means no further sums are due, to them, or anyone else? thanks. (for info, a debt of 4400: offer 1200 accepted)

-

letter today from Lowell offering reduction on an old catalogue debt, they said it is equivalent to charges and interest previously applied. do I accept?

-

I have been on a DMP with the charity Step Change for a number of years, the original debts being a Lloyds Bank loan I was encouraged to take on as a "consolidation" during a bad patch back in 1999, and a credi card still with Lloyds going back the same period, totaling about 20.000 plus couple of "minor" cards and an overdraft, totaling around 25k. After few years of re-payments, I managed to bring back the balance which currently it's around 12.000, however I have recently separated from my wife and this has had a pretty devastating effect, on the financial aspect of things as well as everything else, I have 3 children and things just don't add-up. I currently have access to a relatively small amount of money which is the result of a share of the sale of an old property, about £6'000 and rather than seeing it disappear as they will I am thinking of trying to offer a settlement to the various creditors, who are Akinika Debt Recovery (5.500.00) Pira Group Barclays (1000.00), Npower 707.00), Lloyds PLC (397.00) plus Cabot Financial, who just took over from Allied International Credit and is not currently included in the DMP. As I haven't test spoken to them but they are writing about their acquired balance of £6'321, it seems a bit of a long shot to put an offer to each of them totaling £6000, but the truth is I will have to ty, failing that, due to my new circumstances I wouldn't be able to keep up the £357 monthly payments to Step Change and the only other option I can see would be filing for bankruptcy. With all the consequences of the case on my job etc, in any case I wouldn't know where to start with offering settlements, and above all without risking losing the sum, or how to make sure that they would actually agree for it to be a final settlement and not just an extra payment, and would it be better to approach them myself, as I suspect Step Change wouldn't enter any hard- negotiation of this sort on my behalf? Is there a template letter I could use to get me started? Have I got any real chance here? any help would be greatly appreciated, sorry to be so long

-

Hello Folks, I have about 4 Defaults on my credit report. A friend told me i can negotiate by offering 10% of the money owed to each of them. In turn, they will remove my name from credit agencies. Is this true? Please assist.

-

Hi, i was speeding on the motorway and wish t plead guilty and pay the appropriate £100 fine and take the 3 points. I have been waiting for the [/b]conditional offer of a fixed penalty notice[/b] It never came on the post?! Then I receive a postal requisition to be heard in court. Can I not contact NYP and state that i did not receive the offer of a fixed penalty notice? surely this is unfair to go straight to court if I haven't received the offer to pay via the fixed penalty notice. Any tips or forms or letters i can send as my response guys would be most appreciated? i want to pay plead guilty and have done with this but haven't had the bloody chance. We also live at a new house and our address is proving really hard to locate for many org/co. Lots of mail goes to another house half a mile up the road! Genuine reason and I want to clear this up and pay.

- 5 replies

-

- action

- conditional

-

(and 8 more)

Tagged with:

-

Hi, Looking for some advice, will try and be as brief as possible. I received an offer of PPI from Capital One out of nowhere. After checking the figures were correct I accepted the offer for approx £1100. Received a letter saying a cheque for £350 was in the post with the rest kept by Capital One to cover the arrears of the previous account as stated in their offer letter. Firstly, at no point was this stated in their offer letter. Second, not only was the debt statute barred but I had reached an agreement almost 6 years ago for the outstanding amount with a DCA. My question is, do Capital One have a right to any money since it was passed to a DCA. If not, does anyone have a template I can send off to Capital One disputing their latest correspondence. Thanks in advance

-

Hello, I am working my first real full-time job after graduating from university in 2014. I started on December 1st 2014 and have so far taken 10 days off on holiday. I have another 4 days booked off. My employer has indicated that he is unable to give any further holiday and I will not be paid for the remaining 14 days holiday this year. I have tried to make an arrangement with my employer whereby they offer a day off here and there (as my employer has stressed that they cannot be short-staffed for black periods) so that my 28 days holiday is reached however this seems unlikely. I say this based on the fact that my colleagues have suggested that in the past, they have generally not been given anything more than 10 days or extra pay to make up for the holiday not taken. If I am honest, both the owner and general manager of the company seem shady over the issue of holiday pay. The owner has also previously made me feel guilty about wanting to take the full holiday. Whilst I understand that since I have not worked a full year here yet I have not fully accumulated the 28 days holiday. I am posting this in advance so that I may be fully informed about appropriate procedure in this case. If anyone has any advice as to what I should do please let me know. No employment contract has been signed and there is no real process for dealing with issues in our workplace. Thank you. Useful information: Currently nothing in writing No employee handbook No contract signed

-

Quick outline of case first. My girlfriend had a secured second load taken out with Firstplus about 9 years ago in joint names with her and her then husband for his debts (yes she is aware this was not ideal) they then split not long after. She has continued to pay this debt with Firstplus. She then started struggling with the debt £400 per month on top of her Mortgage single parent etc. Case defaulted, got a CCJ and a reposession order now Suspended re-possesion order or something like that. She then started to repay and again began struggling with it so First plus then marked it as defaul and passed the debt to Credit Solutions. They have been tootally unhelpful when she tried to negotiate lower monthly payments stating that this wouldn't even pay the interest and charges so £400 was the minimum she could pay. So a few weeks ago I got her to ring Credit Solutions to ask for a redemption figure. The latest statement from them stated the balance to be £5200. They said they had to go back to First Plus. We then received a letter from "Eversheds LLP" reason for quotations will become clear. Panicking she ran Eversheds as the figure in the letter was just over £13000 stating "this includes our charges up to the redemtion date". So panickinng she rang them (Eversheds) who stated " we do not hold an account for you relating to First Plus and have not dealt with them in over 3 years. So confused she rang First Plus who stated yes this included interest and charges from Eversheds . The reason CS held the balance as £5200 was because the interest and charges had been frozen?? Confusing. She advised that she had been offered a bit of cash from her father and was wanting to make an offer. The Firts Plus agent advised to write in explaining her circumstances and with an incomne and expenditure sheeet and this would go before managers. So we did that, explaining that she has been struggling, detailing stress and problems at home as she has a disabled child too and sent an offer of £3000 for full and final settlement. we hear nothing for just under 2 weeks when yesterday a letter arrives from First Plus saying following your correspondence the debt has been passed to Credit Solutions????? And to contact them. your correspondence has been passed to them also she rang Firstplus stating she had sent a letter offering a full and final settlement as THEy had asked. The agent said that it looked as if proper process had not been followed, explaining it should have gone to a manager etc. Again my gf pointed out the Eversheds, Oh yes that will include their charges again she says. To which my gf advised of the call to Eversheds who had nothing to do with it. The agent than said yes the debt really should not have been handled like this but you will have to contaft CS. This all sounds to me like they have really messed this up and leaves us open for a complaint. Also we do not know if they have passed the letter to CS reegarding the F+F Offer. Does anyone have any advice on what we should do, and if we have decent grounds to get CS to accept the F+F offer? I also think CS will bounce it back to First Plus. All very confusing . Writing this just before leaving work so if it is a little rushed this is why. But we are foaming and just wanting to clear this debt with the £3000 we have sitting waiting for them. Any advice appreciated. Many thanks

-

Hi there everyone! This is my first post so apologies if its in the wrong place. I brought a car at the begining of july, 8 weeks on and its developed a very serious fault that requires the car has a new engine. we have priced the engine at 600-700 then whatever the labour will be to fit it. having discussed the matter with the garage they have said they will offer me 500 pound back towards the cost and i do it myself. the car was purchased for 1300. i can fit it, i have someone that will do it for me but should the dealer be sorting this? Do i accept his offer and put the rest in myself? or should i continue to pursue the matter with trading standards? how long would i be looking at to sort this sort of issue? im in the position now where i cannot afford to pay for the work to be completed and i cant be without a car for much longer. i put everything i had into getting the car, making sure it was serviced, low mileage etc, good condition. thank you in advance for any help!

-

Basically my completion date was set for next Tuesday. I am buying the house off my mum and dad. House is valued at just under £60k and they are selling it for £36k which is fine to me. Mortgage was agreed with Halifax, they credit scored me several times and I passed. There were a few amends to the offer but they amended and made another followed by credit scoring etc. I passed them all. Mortgage adviser phoned me today to tell me they had withdrew the offer after they credit scored me today. I have checked my report on all 3 credit report sites and absolutely NOTHING has changed. I have no outstanding debt, I have never had a missed payment, I do not owe anything. I recently closed a bank account and that is showing as a negative on Experian. I changed bank from one to Halifax after we had agreed on the mortgage offer. I asked Halifax if this would be an issue in branch and they informed me it would not affect my mortgage application whatsoever, but that is the only thing I can think of. Nothing else has changed. The house is being sold below its actual value. Everyone is making money here. Can anyone please advise me? Everything had been set up with the Halifax to release the funds on Tuesday and they had agreed to do so, but they have pulled out at the last minute. They have said it is due to a credit score, but again they have repeatedly credit scored me and been fine and have told my adviser that I had passed their scoring criteria. I am at my wits end here.

- 3 replies

-

- buyer

- completion

- (and 4 more)

-

Hello, there I've been making token payments to a DCA for a while now and recently made a settlement offer to them, fully expecting them to either reject it or start negotiations. A few weeks later, to my shock, I received a letter in response from them confirming that my account was settled in full and my credit file would marked as satisfied. Note that I had paid nothing to them other than the regular token payment that was due while I waited for a response. I then received a second letter dated 3 days after the first one in which they refused my settlement offer. I stopped making the token payments but they are now threatening me with court action and say they have put the default on my credit file. What is my legal status here? Should I: a) send them a copy of their own letter confirming settlement and tell them to buzz off? b) send a letter disputing the account and make them prove I owe it? c) continue to ignore them and send the settlement letter to the credit agency when they post the default? d) something else? Many thanks in advance for your advice.

- 18 replies

-

- contradictory

- offer

-

(and 2 more)

Tagged with:

-

Hope someone can help with a 50% discount offer I got from Lowell last week on a credit card account they purchased from HFC some time ago. "Once payment or the final instalment is received, we will update your credit file to show the account as partially satisfied and we will close your account." The account was marked with a Default Notice back in 2010. At one point, in response to my request, HFC provided a copy of my signed application form which, reading other threads here, does contain all the prescribed terms, despite being from before 2007. I'm thinking that I can either settle for 50% now and let the DN drop off my credit report next year, or else take my chances and hope that they don't go for a CCJ for the full balance before the statute barred date. 1. Pay nothing (if I don't accept the offer, and they don't go to court before SB date - is this wishful thinking?) 2. Pay 50% (in response to this offer) 3. Pay 100% (when presumably that's what they win in court if their ducks are all in a row) Am I missing anything?

- 17 replies

-

Some advice needed. I have received an offer of redress from RBS regarding PPI on an old Natwest credit card. I used the FOS Running sheet to calculate the amount due. I have all the statements for the card (1989 - 2006). I sent copies of the statements to them along with what I have calculated to be the amount due - just under £14000 in 2006 plus stat. interest since then of approx £10000. A total of £24000. They seem to have ignored what I sent them and made an offer of under £3000. From the small amount of information they provided, it appears they haven't even been able to add up the PPI premiums correctly or calculate the compound interest that they charged me. They say that it's their final offer. I asked them (over the phone) to send a breakdown of their calculations and they refused to provide any more detail. I have spoken to the Ombudsman and I have to say that I'm not filled with confidence in their abilities. She seemed confused about compound interest being re-funded, which is the biggest part of the claim. I've also heard of 9 - 12 month processing times. Any advice on what to do next would be much appreciated. Thanks in advance.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.