Showing results for tags 'myjar'.

-

This is a thread to contain my payday loans, my original one is here: HERE Here is a list of the payday loans i taken out from 2011-2014 (ish) The last contact i made with them was December 2017 as instructed by Redbridge Finance a company who was "supposidly" going to help me claim compensation from them. Wonga Quickquid Payday express Mr lender Myjar The money shop The cheque centre To name but a few, there are probably more but it really hurts my head when i try and think back. I am not being chased for any of the above debts at the moment, and not all of them are on my credit report. The only ones that are on my Noddle credit report are: Lantern: a debt collection agency wanting £262 default date 11/08/2014 Advance against income Active securities LTD a debt collection agency wanting £442 Default date 07/09/2014 I'm not sure which company they are from (original creditors) , i haven't heard anything from them ever although all of my debts were taken out at my old address. There are probably more than the ones i listed at the top of the page, but it's going back a long time and feel free to read the thread linked in the top for a short back story going back to 2012. I was hoping for some advice on where to go from here, redbridge tried to put a claim in against Wonga, filed a complaint against the FCA to find they went bust. Thanks so much in advance.

-

Hello I got a £100 with my jar in 2014. Looks like I never paid it back, and the balance currently sits at £258 on my credit file. However since then they have only been marking my account as a 1 – as in payment is late, there is no default shown on my credit file. What can I do about this? oh just to add i sent them an irrespondible lending complaint, which they rejected

-

Morning All, I have an issue with an old txt loan that shows as appeared on my credit file around 2014/15. Original loan was taken out 2012, a time when my partner was unable to work through illness, we both took out payday loans, wonga txt loan and provident etc. All of these debts have now gone, but this one remains as a reminder of those days. The details were always a bit weird on my file as it was made to look as though I had made a payment towards it but never did. The debt is very close to being statute barred but now it has disappeared from my file, it's registered at one of my old addresses and I'm concerned that a CCJ will be issued at the old address. I really don't know what to do about this, should I make contact and open up an old wound, make a payment plan or take a chance and leave it? Any advice would be much appreciated, Thank you

-

Hi I am after a bit of advice on whether it is possible to ask for a default to be added to a settled account. I initially took out a txtloan ( now Myjar) Payday loan for £100 on 23/02/2012, this was repaid on 08/03/2012. I then took out another £100 loan on the same day which then went into arrears due to financial difficulty, I had multiple payday loans which were taking up the majority of my wage on payday. I entered a dmp later that year with the lenders receiving their first payment in December 2012. All of the loans are now either settled or satisfied. I am looking to move house next year so have been checking my credit report. I have noticed that the other payday lenders marked my account as default between March 2012 - September 2012. This would mean that they are due to drop off my credit report later this year. The exception is Myjar who never defaulted me, the only thing that shows up on my credit report is arrangement to pay and the account was settled in November 2015. I was wondering if I would have a case to ask myjar to add a default when I was initially 3-6 months in arrears as per ico guidelines. I was 9 months in arrears by the time they received their first payment through my dmp. As it stands the settled account will not drop off my credit file until November 2021. Thank you in advance for your help.

- 11 replies

-

- myjar

- retrospective

-

(and 1 more)

Tagged with:

-

I have an ancient Myjar default from 2012 from when they tried to pursue £1055 against £50 borrowed. It went through a few DCAs who sent standard threat letters which were easily seen off with section 77 requests but no court action was ever taken, and it should have gone SB in March. I was looking forward to it being gone from my file on today's Noddle update, however instead I've found that 1 week before the default reached 6 years, it was suddenly marked 'satisfied' and it now appears as a satisfied closed account rather than having dropped off my file altogether, where presumably it will sit until 2024. Obviously it's new status is far less damaging than the active default, but not as good as it having disappeared and when I'm so close to having a clean sheet on my credit file I don't want this thing hanging around on it in any form. How can they mark it as satisfied when it has never been acknowledged?

-

I have just read a post with a very similar story to mine about a company called myjar. I have just checked my noddle report and see that this company have listed a default in 2014, I have never heard of this company but from the other thread on them it seems they may be txtloan who I did at one time have a loan from. I don't remember the specifics of the mess I got into with payday loans in 2009, mostly because the names seem to constantly change making it hard to keep up with them but I am fairly confident I paid this one off as it was taken from my bank. Even if its not paid, it originates from 2009 and should not be defaulted last year. Does anyone know anything about this company so I can put in a complaint? I have been working so hard to repair my credit file and next year all the bad info will be gone so I am really quite upset about this. It only shows on noddle and I have disputed it with them but experience tells me that they wont do much about it and will reply in a few months telling me to contact myjar directly. If it helps the details from noddle are: Account start date 08/12/2009 Opening balance £ 246 Regular payment £ £ 100 Repayment frequency Periodically Date of default 15/07/2014 Default balance £ 246 There is no monthly data before November 2014 and this is the first month it has shown up on noddle which I check every month.

-

Hi I have late loan monthly payments recorded on my credit report from Nov 2014 up to now . I haven't paid but want to clear the loan now that I can afford to. Myjar charges a late monthly payment fee if you are 3 days overdue on your monthly payment. I have had no record of them asking for late payment charges from me. Can I ask them to accept the loan repayment in full without any charges and is it likely that they will register a default anyway? Look forward to your response

-

Look at this response from Myjar, 2010 loan defaulted 4 years late. We write to advise you that we are now in a position to provide you with our final response. We take all complaints very seriously and we are grateful to you for having taken the trouble to raise this matter with us. We will use the information you have provided to try and prevent similar issues arising in the future. As you are not contacting us from your registered email address, please let us know if you wish us to update your account with this new email address. If you do not wish to update your email details, please note that we would need to ask you security details every time you contact us from an unregistered email address. Relevant facts Your complaint relates to MYJAR entry on your credit file. You have explained that you discovered our entry on your credit file and are concerned that the date of the entry is incorrect. As a resolution to your complaint, you have requested us to either amend the date of the credit file entry or to remove it entirely. Investigation You took out your last loan with us in February 2010. You have claimed that you settled the last loan you had with MYJAR. Please note that according to our records, you have not made any payments towards the balance and as such a default notice was sent to the email address you signed up with on 15 July 2014. Since no repayment was received within the given timeframe, a default was registered against you. We note that on 17 May 2016, the loan was set aside due to the age of the debt and the credit file entry was updated to Satisfied. Please note that at the time your loan defaulted, MYJAR did not share data with any credit reference agencies. As we only started sharing data with credit reference agencies in 2014, it was not possible for us to have issued the default notice before. Nevertheless, we can confirm that the registered default date reflects the date of the action of the default and the date when the loan was marked as Satisfied reflect the date when it was set aside. Due to reciprocity agreements between us and the credit reference agencies, we are obliged to provide them with accurate information regarding all of our customers’ accounts. Decision In light of above, despite our empathy, we are unable to uphold you complaint. Due to the age of the debt, it has been set aside, meaning that you do not have any financial obligations towards MYJAR. Please note that we are unable to remove the loan entry registered against you as we believe that all creditors need visibility of true account behaviours and how their accounts have been managed, removing them would only put the client at greater risk. You have the right to refer your complaint to the Financial Ombudsman Service, free of charge – but you must do so within six months of the date of this letter. If you do not refer your complaint in time, the Ombudsman will not have our permission to consider your complaint and so will only be able to do so in very limited circumstances. For example, if the Ombudsman believes that the delay was as a result of exceptional circumstances. You can find information about how to do this on the Financial Ombudsman Service website: http://www.financial-ombudsman.org.uk. There is helpful information about how to complain in the leaflet Your complaint and the Ombudsman which you can find at: http://www.financial-ombudsman.org.uk/publications/consumer-leaflet.htm. Kind regards,

-

Hi All, My brother has had 8 loans setup in his name, 4x Wageday Advance and 4x Myjar, my brother suffered a brain hemorrhage about 6 years ago and since then he has found it difficult to read and comprehend things, his daughter is the one who setup the loans, we have proof of this by her making a transfer into his account when the payments are due, unfortunately she has also been found out for other fraud to other family members and the payments for the loans have now stopped, leaving my brother a tidy sum against his name. I have spoken to Wageday Advance and they requested a signed letter from my brother giving me permission to act on his behalf, which has been done and emailed back to them. I tried to talk to Myjar who also said they cannot talk to a 3rd party but would need a letter and a copy of this passport or driving license so they can match the signature, 1) the thing is, we have not been able to find out if the loans are in his name or simply his account details used. 2) my brother does not have a passport or driving license so they cannot have been used for the application of the loans so how are they going to match the signature ... Between us (the family) we have reported 11 instances of fraud to Action Fraud, but it would appear only 10% of the reports are investigated. We have reported it to the police, a PC came out, asked a few questions and went away saying he would need to talk to his sergeant, and we have heard nothing since. We also have other proof of bank accounts being emptied, ebay [problem]s and paypal [problem]s, the list goes on. Can anyone offer any advise on the above and how we can get a conviction?

-

Default Myjar/TXTLoan Screw up

Wilcouk posted a topic in PayDay loans and Short Term loans - General

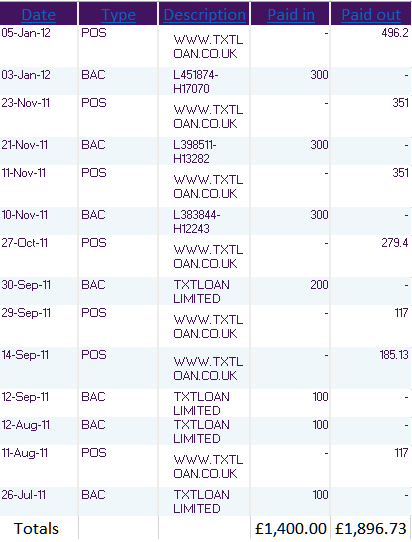

Hi there, just looking for abit of advice here, i have no idea why i didn't know anything about this at the time/how i didnt clock on or what have you but the following is this - in 2011-2012 ish i took out the following loans with TXTLoan (now MyJar) which all paid back as you can see which is attached to this post . Confuses me here, the dates of when the loans were paid and taken out seem to be weird and it doesn't add up, i kept paying them back more than i ever borrowed in such short space of time, i.e £51 interest over a day?! in one case i apparently seem to have paid £196.20p in a few days interest alone! in total it seems i have paid out £1,896 from a total of £1,400 over the course of 6 months, that's alot of interest. Looking back in my emails / bank statements, all i have are correspondence from the very date i first took out the loan with txtloan (26th July 2011) till the last payment was taken, then in 2012/2013/2015 i had threatening emails trying to get me to pay, there were no further loans from txtloan after i repaid £496. this email in particular i find amusing how does one loan go from £300 to £692 within 15 days? not to mention the fact that it looks like they already took a payment of £496 in January! they defaulted me in April 2012 which still exists on my credit file and it had affected my ability to get credit and eventually spiralled me into another payday loan hell circle in 2013 as i was unable to gain any affordable credit (another story i guess) a few things this looks to me like is 1. unaffordable lending to the extreme 2. unfair default charges 3. extortionate interest rates 4. taking money without me apparently realising (not sure if this is one?) i've lodged a complaint against MyJar now with the FOS but i've yet to include all this information which i found today.. . the only reason i looked into it again today was that MyJar replied to a complaint letter i did to them (and many other payday loan lenders) What are my options here along with the complaint to the FOS, what do i reply to Myjar? Thanks for the help. -

Evening all. Today I checked my updated Noddle and MyJar have entered a default from an old TxtLoan from a loan taken 02/12 - default date is 05/12. I was taking payday loans from 2 different companies, I had defaults already on my file and a couple of credit cards maxed out. I currently have a Wonga case with the FOS, would I be sensible waiting for the outcome of this one before tackling the MyJar one? Thank you

-

Hello, I got a copy of my credit report from Noddle, and say a default for a company called MyJar. I had no idea who they were, and the address registered I moved away from 2 years ago, so I was a bit confused. I wrote to the managing director, and he said that a colleague would be in touch. No one was in touch, so yesterday, I emailed back to ask that as they had not provided the information, could they remove the information from my credit file. Naturally, I got a reply within the hour. Oh they emailed on 30th December, have I checked my junk file? Anyway, the email reads as follows; Thank you for your e-mails. Please note that we sent you an e-mail on 30 December 2015 to advise you of the account and it’s status. In case you have not received it, it may be in your “Junk” inbox. Your loan was formerly with TxtLoan Limited but was transferred to MYJAR Limited on 28/02/2015. The loan was originally for £100 requested by you on 18/03/2011. Your loan reference number: 18### Your current outstanding balance: £200 I have attached to this e-mail a breakdown of the balance and your electronically signed credit agreement. The previous balance was £247, which was also used to register the default. However, recently we have removed the debt collection fee as our debt collection partners were unable to come to an agreement with you for the outstanding debt and the outstanding balance is currently at £200. Please let us know if wish to repay the loan as a single instalment or if you would prefer a repayment plan with monthly or weekly payments you deem affordable. Additionally, you can always get free independent help from a number of sources such as: ... I look forward to hearing from you. Best regards, Now, it is possible that I did get a loan from TxtLoan at the time, I honestly don't remember. I know for sure I haven't heard anything from them or MyJar over the past 4 years. The agreement sent over by email is with MyJar (a company I had never heard of until I checked my credit report), is not 'signed' and is dated 18/03/2011. Is it possible to have an agreement with a company that didn't exist at the time that the agreement was supposedly 'signed'? As I say, the agreement doesn't have my name at the bottom part, where it should be signed... I'm basically just really confused about who these people are that have registered a default on my credit file, and are now after £200!

-

Hi All, I'm after some advice and opinion A while ago I fell into debt with various Payday lenders which was totally my fault no excuses. I have now sorted them all out with the last one being MYJAR formerly Text Loan with the last payment being paid this month. A few months ago I received an email from MYJAR saying I owed the debt and if I didn't pay or make an arrangement within 14 days they would register a default. I called them up and made arrangements to pay over 4 months (Last payment this month) which they accepted and I was told no default would be registered as I had come to an arrangement within the 14 days. First payment was made and two weeks went by and when I checked my credit file on Noddle there was a default registered by MYJAR three days after the arrangement was made and first payment paid. After contacting them they emailed me to advise the default had been put on by mistake and this would be removed but would show as "Late Payment" due to the original debt occurring. I could live with the "Late Payment" after all I did fall into debt. The default was removed and I continued to make payments on time as agreed. It has now come to my last payment and I have just checked my Noddle credit file and the default is back along with the mark for late payment. I have just emailed them again but I'm concerned in case they try to keep it on and I'm not sure what action to take. I'm thinking was this just a tactic to get me to pay Can they legally do this? Thanks for any advice offered

-

Hi, I was checking my Noddle report and noticed a default by MyJar dated March 2015. At first I was confused as I had never heard of this company. Anyway after a quick google search they were related to txt loans with who I did have a loan with back in August 2011. I checked my old email account that I no longer use and noticed that they had sent me a default notice December 2014. The amount was for over £600. The original loan was for £300. What really frustrates me is that I did have serious financial problems in 2010/2011 however they have since passed. I was kind of seeing the light at the end of the tunnel with the defaults now becoming 4/5 years old. This newly registered default will now be on my credit file until 2021 which is a bit upsetting. Is there anything I can do about it? I sent them an email threatening ICO, trading standards, financial ombudsman and all sorts but they just replied back with.... The reason that the default has not been registered before now is that we have only recently begun sharing data with a credit reference agency. It was not therefore possible for us to register defaults before that time. Now that we do share account information with CallCredit, we have become obliged to send them updates and, where an account is seriously in arrears, to register a default.

-

Hi there, I am looking for advice on whether i have any chance of getting a default removed that was been placed on my credit file last month, 4 years after the account was opened and no payment was ever made. The company is a PayDay load lender, MyJar (formerly Txtloan), and at the time (2011) I was in financial hardship. The original loan was £100. Now at a balance of £272. I have record of sending them an email in early 2012 requesting they freeze the interest due to my money struggles. I did not receive a reply. During this difficult period I was juggling many payday loan lenders and as a result this particular one was forgotten about. I never received any letters or emails from them regarding a statement of intent to issue a default. I have not changed any of my personal information but I have moved and my mail is redirected to me. I received 1 email from Lucas 12 months ago offering me options of payment but i only found this by searching my inbox so i must has missed it at the time. Since then I have turned over a new leaf financially and have managed to pay my outstanding debt in order to rebuild my credit and ensure that it is not harmed any further. Feeling like i will be in financial jail for a fresh 6 years is devastating as I was hoping to buy a house in the coming years after the last of my known defaults dropped off. Can i dispute this based on the length of time and the fact that I have not received any fore warnings? Advice much appreciated! Jen

-

Hi, i have a query regarding not being defaulted yet by MyJar. I decided recently that after 3 years of trying to fix my credit and debts i ought to inspect my credit files. I took out a txtloan (now MyJar) of £300 end of 2011 and had difficulties so it didn't get paid.The majority of borrowings i had sadly all defaulted by start of 2012 and CRA's reflect this . However the MyJar Loan is showing as 6 months in arrears ( a Red 6) and it says not defaulted.It shows as being initially overdue from around Nov 2012 . I assume if i just leave it even when my defaults go i'll be 6 months in arrears forever .Is there any way i can fairly request to repay the amount owed over a few installments and the account just goes to settled with no default. Or realistically do i need to ask they default me so it''ll atleast start the 6 year clock.If they default me in retrospect to 2012 i'd not have an issue with that but wondered where i stood after all this time.I know there seems to be a lot of default timing issues with them currently.

-

Evening All I have received a rather weird email from MYJAR today regarding an account which I can confirm I will raising the Fraud flag against (Think struggle with MMF) Anyway... MyJAR have sent an email advising that a loan was taken on 09/08/2011 and was due back on the 24/08/2011. However the email i received today included is listed below and attached were 3 attachments. (Obviously this isnt mine otherwise it would have been settled by now) Now my question is, shouldn't this account have defaulted in 2011? Yet they are going to issue a default notice in 2015?!?!?!?!?! Wasnt there something against that? Also this debt hasn't ever appeared on my credit profile with EXP or CCRED, So if they issue a default against it, surely i should have grounds to challenge it on that basis? The PDFs have been filtered for personal info so please feel free to give me advice on this one... I am stomped... FKO

-

Hi all, Need some help please. Been sent a Default Notice by email (nothing in post) from MYJAR dated 19/12/14. Served under section 87(1) and giving me until 02/01/14 to "pay the total of the arrears of £247.00". The problems are: 1) I don't have this money to pay before then. 2) This is from a txtloan back in 2011. I had one loan with them in May 2011 which i repaid back on 03/06/11. I then took out another on 10/06/11 which i could not afford to pay back as was in a spiral of debt with other payday loans. The original amount was £100 and i needed to pay back £117 by 25/06/11. The loan then went off to Lucas Credit Services who started chasing this in 2013. Now MyJAR have sent me a default. 3) Can they send a default notice more than 3 and 1/2 years after the loan was due? There is nothing account of this loan on my credit files. 4) I only have a few days before the default date.. .if i send a CCA request in, can they still put the default on my credit file during the time they have to respond to the CCA? 5) On the DN, they refer to "Under clause 1.14 of the running agreement...." but there are no numbered clauses at all on the agreement. Furthermore, the agreement is not signed (just says tick the box on the screen). 6) The agreement as i see it is generic. It does give the credit limit, the APR, late payment fees, etc....but the actual amount payable and repayment date are in the body of the emails which TxtLoan used to send out. Not part of the agreement. Is that valid? 7) Do i send the CCA to the PO BOX address or the registered address for TxtLoan?

-

Hi, I have been very grateful for the advice of the CAGers on this forum, and I wonder if I can ask once more for some advice. Having gone from having 14 outstanding payday loans I am now down to a final 4:smile: ( I pick a lender to deal with each month and then devote my efforts to negotiating with them until we agree a full & final settlement. I am really struggling with CRS who have taken over as DCA for MYJAR(formerly txtloan), originally I was dealing with Mackenzie Hall who agreed to my repayment offer of £1 per month (after mediation with my mortgage company & help from National Debtline). I wrote to MH back in May asking for a statement of my account and they emailed me back with some nonsense about them being unable to produce a statement, so I left it and went on payng £1 per month. In August I was contacted by CRS who sai they have taken over from MH. I have repeatedly emailed and asked for a statement and a copy of the original agreement and they still haven't responded or acknowledged my request. The original request I sent was on 11 Sept, it was sent again on 15th Sept, then I chased on Oct 2nd, when I recieved a reply saying they had asked for a statement that would be forwarded once they recieved it. I have still not got a statement and they have taken to ringing me daily even though I have told them via email not to contact me until they have my statement. HELP!!! What can I do and where do I go from here? This is the chosen PDL I want rid of next because they are causing me so much stress. Can I contact the FOS about them and how long will that take?

-

Hi, Please can someone help I'm worried that my bank account will go way overdrawn tomorrow and leave me in an even worse mess than I already am. I am setting up a debt management plan at the moment and as everyone knows, it takes a bit of time. Before going into this, I emailed all my creditors and cancelled the CPA that was set up and I also wrote to my bank to cancel. Nobody has taken any money since and so I am guessing this was actioned properly. Myjar, emailed me on that day to confirm the CPA had been cancelled and when I log into my Myjar account, it says card details as **** **** **** no numbers at all. If anyone reading this has a Myjar account please can you log on and see if this is what it says on your "my details" page or whether it does show a few numbers? I'm just trying to work out if they have actually deleted the card details and that this is just a threat. I thought that if they had confirmed that they had cancelled the CPA, then they could not take any payment from that card as it was then illegal? Am I right? I feel quite sick at the thought of my bank being overdrawn tomorrow morning by over £200 so any help would be great. It does say on the text to ring them if I can't pay but I don't want to be ringing anyone, I'm trying to sort all this out the correct way and they're just being impatient.

-

Hi does anyone have upto date bank details please for myjar?? no debit card at moment and want to pay them something this week but don't want them to know just yet I cant pay in full. many thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

.thumb.jpg.bf2f59e5260173230834ce3ad8015900.jpg)