Showing results for tags 'moriarty'.

-

Hi there, today I received a claim form addressed from the county court business centre in Northampton, which has been filed by Moriarty Law on behalf of JC International Acquisition for a debt on behalf of Talk Talk Limited. I have seen a similar problem to mine posted on here but I can't seem to follow it, so I need help step by step to get me through this maze!! The particulars of claim state: THE CLAIMANTS CLAIM IS FOR THE BALANCE DUE UNDER AN AGREEMENT WITH TALK TALK LIMITED DATED 13/10/2011 WHICH WAS ASSIGNED TO THE CLAIMANT ON 26/03/2014 AND NOTICE OF WHICH WAS GIVEN TO THE DEFENDANT ON THE 26/03/2014 AND WHICH IS NOW DUE AND PAYABLE. THE DEFENDANT AGREED TO PAY MONTHLY INSTALMENTS UNDER ACCOUNT NUMBER 100*****43 BUT HAS FAILED TO DO SO. AND THE CLAIMANT CLAIMS THE SUM OF £167.12. THE CLAIMANT ALSO CLAIMS INTEREST THERON PURSUANT TO S.69 COUNTY COURT ACT 1984 LIMITED TO ONE YEAR TO THE DATE HEREOF AT THE RATE OF 8.00% PER ANNUM AMOUNTING TO £13.36. So with the amount claimed being £180.48 the court fee of £25.00 plus Legal representatives costs of £50.00 the total amount is £255.48!! My response to all this, is that I have never agreed to make monthly instalments because I have never spoken to them regarding this debt and have never responded to any letters. At the time I took out this deal with talk talk I was in a very dark place in my life, not long coming out of a rehab and I was not working! After coming to my senses that I could not afford this because I didn't have any money for food, I contacted talk talk to say I wanted to finish which I believed had been stopped. I made payments to them for the amount which I believed I owed to finish the contract, and unplugged the device not to use it again. I also moved address not long after. I have now got my life on track with work and have got what I believe is a good credit score with nothing against me, so to have this rear it's head against me is a bit of a shock! So please please give me advice on how to tackle this and what steps I need to take!! The issue date of the claim was 29/09/2017 and I received it on 04/10/2017 Thanks in advance for any advice you give.

-

hi guys had a letter from moriarty law stating that i owe £317.02 for a debt i owe to talk talk i did use talk talks services many years ago but paid them in full at the point of cancellation. they are threatening registering a judgement on my credit file if i don't pay by the 28/11, as i have been clearing up my credit file to get a mortgage this would be quite a devastating setback please can somebody help me as although i could pay this to get them off my back, i feel as if im being held to ransom for a debt i don't owe thankyou in hopeful anticipation mark

-

Hi everyone. I have the same issue as antonia26. http://www.consumeractiongroup.co.uk/forum/showthread.php?463115-moriarty-law-JC-International-Claimform-old-Talk-Talk-Broadband-debt-***Claim-Discontinued*** i received a court letter taking me to court as i owe £257.28 As it was advised I have filled the form out and acknowledged of service and said I'm defending the whole claim. I sent a CPR 31.14 request to solicitors requesting information pertaining to their claim . I am not sure if it was done right. I 've received letter from the court about receipt of the Defence. and the letter from solicitors with the text below: we write to acknowledge receipt of the defence filed by you with the Court and in that regard we confirm that our client is processing with their claim. My CPR 31.14 was ignored and now I don't know what to do. Any further steps I should make in this case? thaank you very much for your help

-

Hi all, Today March 30th 2017 i have received Northampton court claim forms for a Talktalk debt of £63.86 its been raised to £68.96. The form is dated 28th march 17. They date it back to 30/10/2009. They also state i agreed to pay this by instalments, but failed to do so (which is news to me). I vaguely remember when we ended the contract with them the paid me money that was owed to me. Moriarty Law are acting on behalf of JC international. Ive checked my credit file and cannot see any closed accounts or otherwise with Talktalk. Im reluctant to call these companies to find out anymore information. After a search on google i've come across statute barred and another situation extremely similar to mine that ended in claim discontinued. http://www.consumeractiongroup.co.uk/forum/showthread.php?463115-moriarty-law-JC-International-Claimform-old-Talk-Talk-Broadband-debt-***Claim-Discontinued*** I cant post link due to less than 10 posts I don't know how to approach/resolve this, any help would be appreciated. Thank you

- 113 replies

-

- acquisition

- courtform

-

(and 4 more)

Tagged with:

-

Hi All, My partner took out a pay day loan agreement with Peachy on 31.10.2013 for £662. She has had sporadic bouts of employment through the following years and the debt was assigned to MMF on 3.01.2014 of which they allege they sent notice. She has been bullied by Moriarty Law and has this very week been sent a letter from them saying she has 14 days to come to an arrangement or they will apply to Northampton for a CCJ. This weekend, she has received the paperwork from Northampton CC. The solicitor has filed for the original debt of £662 plus interest of 52.96 plus their own costs bringing the total to £844.96. Currently she is claiming ESA, although she is trying to start a small business herself and would rather avoid a CCJ, she has no other debt apart from the mortgage and a car loan that is finishing this November. Do I now log on and file an AOS and then have 28 days from then to present a defence? If so, what sort of defence (I am reading through this site as I write)? Would it also be prudent to send a letter disputing the procedures followed by Peachy/MMF for providing the initial loan without taking into account all of her circumstances? I know she buries her head in the sand with these types of things and does not know which way to turn (that's not to say I am a legal expert either!). Many thanks for your help and guidance on this. PB

- 8 replies

-

- county court

- law

-

(and 2 more)

Tagged with:

-

Hi, just looking for some advice, about 4/5 years ago I got in a circle of getting pay day loans to pay off other payday loans. Long story short, I paid off most of these about 18 months ago (after they had being passed on to debt collectors) I have since being able to buy a property with a mortgage (even know my credit still isn’t the best). I was shocked today to get a letter to my new address from a company called Moriarty Law acting on behalf of Motormile Finance. They state they even sent me a letter last month (which they definitely did not) this is the first one I have ever received. I don’t even know when this loan was how much it was for, nothing. I’m a bit confused because I owed that many company’s money a few years ago the only way to know who I exactly owed money to was from looking at my credit report and going from there, this wasn’t (and still isn’t) on there is it had completely come out the blue . I’m just looking for some general advice before I phone them? Someone has mentioned the three letter process, I’ve looked that up, would that work for this? Thank you for any help you can give me.

-

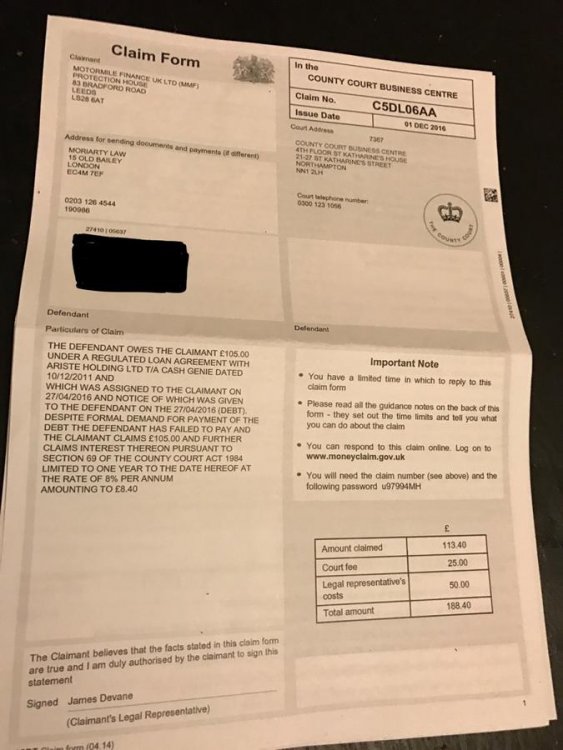

I was gong through bad time financially few years ago and I built up some debts using payday loans such as Cash Genie. Or Motormile finance. I received a letter from Moriarty Law saying they're sending me county court papers for £105 I still owe Cash Genie from 2011. I also received county court claim form and I attached a copy. My main problem that I work for financial institution so if I get CCJ I'll be forced to quit my job. Can they really take you to county for only £105??? Now they increased it to £188 with court fees and theirs. This is looks serious and I'm worried! Any advice is appreciated guys! Thanks in advance Angela.

-

Hi I received the attached claim today for which I know nothing about. I have done the Acknowledgment of Service part online. Can anyone draft me the CPR 31.14 please as I'm a bit confused by it and don't want to use the wrong wording. It won't let me upload or link the claim form. The claimants claim is for balance due under an agreement with talk talk ltd dated 21-10-2006 which was assigned to claimant on 26-03-2014 and notice given on 26-03-2014 wh8ch is now all due. The defendant agreed to pay instalments under account number ......... but has failed

- 3 replies

-

- county court

- law

-

(and 1 more)

Tagged with:

-

Hi, I am looking for advice regarding a claim form I received on March 17th. I have acknowledged the claim and opted to defend all, details of the claim below with comments further below. Claimant - motormile finance Adresss for sending docs - Moriarty Law Particulars : The defendant owes the claimant £728.40 under a regulated loan agreement with Northway Broker Ltd dated 29/05/12 and which was assigned to the claimant on 06/04/2014 and notice of which was given to the defendant on the 06/05/2014. Despite formal demand for the payment of the debt the defendant has failed to pay and the claimant claims £728.40 and further claims interest Theron pursuant to section 69 of the county court act 1984 limited to one year to the date hereof at the rate of 8% per annum amounting to £58.27 Total plus court fees etc. £916.67 I did have PDL issues a few years back but none of the companies mentioned above ring any bells with me at all. I have had letters from Moriarty Law over the past few months which I disregarded as I'd never heard of them or the debt they were claiming for. Advice on further steps would be appreciated? I have also read on other forums that motormile finance had regulations jumping all over them for bad practices? Thanks for reading, Jellybean

-

Hello all, I have received a county court claim form from Moriarty for an old payday debt from 2011(not quite statute barred yet) I have acknowledged the claim and need help with a defence please. The original loan was from Speed loan finance, I recall making one payment via direct debit but nothing more. I have never received an assignment notice from Speed loan and all I got from mmf was the standard threats and phone calls. Who should I contact to see if they can supply any written proof of this loan? Or should I just admit defeat and pay up? Thanks in advance for your help.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.