Showing results for tags 'mess'.

-

Hi everyone. A few years ago me and my wife got an application form through the post for a Vanquis credit card. She applied by post and I applied online. We were both accepted. They used to mess us about saying we had made late payments or gone over our limits despite them taking a direct debit successfully they chose not to take enough money. they ended up spiralling out of control with fees and as I had just started a new business cash was tight and we couldn't pay. I sent both of them this letter- CCA request. then sent FORMAL COMPLAINT/ ACCOUNT IN DISPUTE letter Again they completely ignored it! Stupidly I didn't follow this up as I was snowed under with a new business and a subsequent house move. I have just checked my credit report and its on there as Lowell Portfolio I Ltd. Default balance is roughly £2800 and IIRC the credit limit was around £2000, that's £800 in fees! Default date is September 2014 and to my old address. Last update was March 2015. Its the only bad thing on my credit report. The business is starting to do well and we will want to get a mortgage in the next 2-3 years. I'm not sure how to proceed. I cannot afford to pay this off in a lump sum, although I expect I'll be able to afford to settle next year. However, I want to dispute the entire thing especially as they went ahead and defaulted it whilst I was disputing it. I could afford some monthly payments but I'm trying to think long term about my credit file and ideally want to get the default removed. Some pointers in the right direction would be appreciated. Thank you

-

Hi all, Below I have attempted to outline my dealings with Pounds to Pocket. Agreement No:7166*** Interest Principal 14/06/13 £1150 borrowed 28/06/13 £173.79 repaid 061.75 112.04 31/07/13 £173.79 repaid 131.38 042.41 30/08/13 £173.79 repaid 114.55 059.24 14/09/13 LOAN REFINANCED £155.00 disbursed to my account £1145.18 new loan amount (no idea how this was calculated) Confirmation email: "Please note that the status of loan #7166*** will be "paid off" as it's been rolled into your new loan #7734***" Agreement No: 7734*** Interest Principal 14/09/13 £1145.18 borrowed 30/09/13 £172.89 repaid 070.27 102.62 09/10/13 LOAN REFINANCED £065.00 disbursed to my account £1145.84 new loan amount (no idea how this was calculated either) Confirmation email: "Please note that the status of loan #7734*** will be “paid off” as it’s been rolled into your new loan #7857***" Agreement No: 7857*** Interest Principal 09/10/13 £1145.84 borrowed 31/10/13 £181.29 repaid 101.65 079.64 29/11/13 £181.29 repaid 124.70 056.59 31/12/13 £181.29 repaid 122.15 059.14 31/01/14 £181.29 repaid 119.89 061.40 14/02/14 LOAN REFINANCED £235.00 disbursed to my account £1147.59 new loan amount (no idea how this was calculated either) Confirmation email: "Please note that the status of loan #7857*** will be “paid off” as it’s been rolled into your new loan #8427***." Agreement No: 8427*** Interest Principal 14/02/14 £1147.59 borrowed 28/02/14 £172.36 repaid 061.62 110.74 31/03/14 £172.36 repaid 123.28 049.08 30/04/14 £172.36 repaid 113.66 058.70 30/05/14 £172.36 repaid 106.90 065.46 30/06/14 £172.36 repaid 102.68 069.68 31/07/14 £172.36 repaid 094.40 077.96 29/08/14 £172.36 repaid 079.63 092.73 Repayment becomes erratic at this point - my stepson took his life. P2P sympathetically charged me £24 in late fees, which I did not pay. Interest Principal 31/10/14 £172.36 repaid 076.49 095.87 01/11/14 £172.36 repaid 062.70 109.66 29/11/14 £172.36 repaid 044.86 127.50 The final two payments were not made: Interest Principal 31/12/14 £172.36 036.73 135.63 30/01/15 £172.36 017.78 154.58 I received a "notice of default sum" (i.e. a £12 late fee) on 01/01/15 and again (a further £12 late fee) on 31/01/15, plus a "notice of arrears" informing me that my "customer status has been changed to In Default". An actual Default marker landed on my credit record on 02/02/15 (for loan 8427***). This was accompanied by 2 emails, both with the subject "Notice of Acceleration", one for loan 8427*** stating "your entire loan amount of principal, accrued interest and fees of £404.72 is now due", and one for loan 7857*** stating "you are in default of the above referenced loan and have failed to take corrective action as detailed in the Notice of Default Sums sent to you at least 15 days ago" (which did not "reference" loan 7857*** at all), and "your entire loan amount of principal, accrued interest and fees of £181.29 is now due". Both emails stated - for the first time - that "We may notify the credit reporting agency of your default on this loan", but, as the default was registered the same day, there wasn't much I could do about it... My loan summary for the final loan only is as follows: Total borrowed: £1147.59 Principle repaid: £0857.38 Interest repaid: £0866.22 TOTAL REPAID: £1723.60 Principle outstanding: £290.21 Interest outstanding: £054.51 TOTAL OUTSTANDING: £344.72 DEFAULT FEES APPLIED: £060.00 DEFAULT AMOUNT £404.72 It has taken me months to piece this together, partly because P2P advised me that I had been defaulted on the 3rd loan (even though I hadn't - that's when I gave up paying - what's the point if I've been defaulted anyway?) due to an amount outstanding (even though there isn't, because it was refinanced into the 4th loan). The information presented online is very confusing. In my account overview it says: 7857*** IS IN DEFAULT, DUE ON 30/09/14 (it was rolled over/paid off 14/02/14) 8427*** IS IN DEFAULT, DUE ON 30/01/15 I OWE £576.01 (which could be the £181.29 from loan 7857***, plus £344.72 from loan 8427***, plus Default sums of £60.00, total £586.01..eh??) In my loan history it says: 7857*** £122.15 OWED FROM 31/12/13 (a full payment of £181.29 was made on 31/12/13 and the loan was refinanced on 14/02/14 - I assumed and was told that all payments due on the loan had been paid off due to being rolled into the new loan) NO LATE/DEFAULT DISHONOUR FEES AMOUNT DUE £0.00 8427*** £36.73 INTEREST/£0 PRINCIPAL OWED FROM 31/12/14 £17.78 INTEREST/£0 PRINCIPAL OWED FROM 30/01/15 £60.00 LATE/DEFAULT FEES AMOUNT DUE £0.00 In summary, according to my online account, I owe £576.01. This consists of £122.15 + £36.73 + £17.78 + £60.00 = £236.66. However the amount due is £0.00, against a default amount of £405 (!!!) I'd like to reclaim the interest charged, default fees + interest, and have the data wiped. I'm particularly annoyed with P2P as if they hadn't told me I'd defaulted when I hadn't, I would have paid them off, and then NOT DEFAULTED! More than anything I am disgusted with their attitude. I did contact them to explain I was having difficulty paying due to a child suicide (which isn't an easy call to make from an open-plan office) - their reply was "right, so can you make a payment today?". I sent a SAR on 12/04/16. However, if the above is any example of the quality of information I can expect from them, should I bother waiting, or just press on with a claim based on my own evidence? Thanks in advance! P.S. Sorry about the tabs completely and utterly not working - I did try!

-

Happy New Year to all and thank you for taking the time to read this. Myself and my husband have always struggled financially but always managed to keep our heads just above water but now we are in over our heads and not sure what to do. Without giving the whole story, due to no work, mental health issues and a huge amount of wrong decision making we have got ourselves into a mess that we dont know how to deal with. We have racked up loads of debt on credit cards, Loans and Payday loans just to try and survive and we are sinking. I know we have to deal with this and Bankruptcy could be an option but I am so scared of the implications and stigma. LTB

-

I am hoping someone could offer some advice, it is a little complicated and will try my best to explain. I moved to an address in Jan 2009 and left April 2014, during that time I had EON energy. I have not used then since. I checked my credit files today (first time in years) and found it was showing three accounts from E-ON - two in default but settled, and one still running (ALL GREEN) 1. Public Utility from Eon Uk Plc (I) / XXXXXYYYY Account Opened June 2012 and closed October 2013. Its all green until October 2012 where it says I had (5) missed payments and then November where it states (6) missed payments and then December a default notice. It then says settled October 2013. I admit I had a couple of missed direct debits during that time and was on a monthly payment plan and quarterly bills. they are lying about 5 and six missed payments and issued a default for two missed payments which are prepayments before the bill. They then did this again 2. Public Utility from Eon Uk Plc (I) / XXXXXYYYY (the 4 Y are different account numbers) Account Opened = October 2013 and settled December 2014 Its all green until March 2014 where it says (5) missed payments, April (6) missed payments and then a “default” in May 2014. I have emails for March that payments were made - where the credit file says that are missed. My final bill was generated April 2014. I paid £65 in March and April as part of a per month basis - but on my credit file that marked as unpaid (5). And (6) unpaid. I then did not pay as I raised a complaint - nothing happened. After a while, a debt collection agency chased in December 2014, and I paid them the £XXX outstanding, and it all went away. Until today. Then and this is strange, they opened a new account when I no longer lived in the property. I assumed this was a fraud from a new person in the property. 3. Public Utility from Eon Uk Plc (I) / XXXXXYYYY opened December 2014 and still open today!!!! I have not lived at the address since April 2014! No missed payments - all green! I called up customer service today (2.5-hour phone call) and was told I only have one account with them, and this has an outstanding balance of £XXX!!! How would I like to pay it! Not helpful at all. I am now expected to dig through 3-year-old bank statements to find the final payment - even though my credit files says it was paid in December 2014 and SETTLED. They are now saying this settled is a mistake with Equifax. Their EON billing system does not make mistakes. During this time I have heard nothing from EON or agents, no one chasing me and they had my new address and email details. I guess have two issues. 1. How EON have issued default notices on my account - does this follow any law / process at all ? I understood that default notices were issued between 3-6 months of missed payments under the credit consumer act? Is an energy supplier under the credit consumer act? If you came to some agreement, you could hold off the default or your account is terminated and you have to pay your balance. In this case, none of this happened, I never got a default notice warning letter etc. Multiple defaults for which is the same account. 2. I have a settled account, and now saying they are going to un-settle it unless I can prove I made a payment in the next seven days from 3 years ago and issue a NEW default notice on the account they created in December 2014 when i was not even at the property!. Am i screwed unless I find the payment? Yes, I had a couple of late DD payment notices and not saying I am at not totally at fault. Life is hard sometimes, and we try our best, but this just seems unreasonable and no way as harsh as any bank, credit card etc. EON seems to be using credit files in an incorrect way. Its a side point, but I also remember I was paying around £169 a month for electric in a one bed flat which I raised a complaint about - but was told that's what the meter says. I am now in a four bed house paying £70 with four people rather than 2! Any suggestions on next steps or who I should claim to ? I am sure i cannot be the only person this has happened to; any advice ?

-

Morning everyone, Hoping you can help with another Harland’s mess. Tru gym- first joined 28th April, £19.95 p/m. As per sign up email; “You are committing to a single £0.00 Admin Fee payment and £19.95 per month for a minimum of 1 months. After this minimum term your membership payments will continue on a monthly basis.” First payment came out on 12th May- £19.95 Second payment was taken on 30th May- £19.95 Monday 12th June, notices went up around the gym saying they were closing down and would ‘cease trading on Wednesday 14th June 2017’. My direct debit was then cancelled by the gym/Harland’s on the Tuesday 13th June, without me having to do anything. Later that Tuesday/Wednesday the gym announced they were then staying open. I had found a new gym to join by this point and went ahead with joining this new gym so I didn’t reinstate my DD with Tru Gym. I thought that was the end of it until 13th July when I noticed I had been charged another lot of £19.95 on the 6th July, from a direct debit for Tru Gym that had been reinstated around the 4th July. This direct debit was reinstated on my bank account without any approval from myself. I signed up to the first DD, but not this second one. I spoke to my bank and raised an indemnity claim for this unapproved second direct debit. I emailed Tru Gym explaining what had happened and that this email should be taken as a cancellation notice of my membership with immediate effect. I then have an email from the gym manager claiming a refund would be processed for the mix up, and my membership would be immediately cancelled. I was refunded on the 14th July for a total of £19.95. I have spoken to HSBC twice on the phone who have confirmed the indemnity claim has been fulfilled as the gym have been refunded me directly. Harland’s are claiming this indemnity claim still shows as valid on their system, and as the bank are chasing them for it, if Harlands pay the bank, I will have to refund Harlands, plus the admin fee of £25. Harlands confirmed over the phone if I could prove the indemnity claim was cancelled by the 16th Aug this would close the case and I would owe them nothing. I spoke to the bank on the 8th August, who said they could send a letter to confirm the indemnity claim would be cancelled, I’m still currently waiting for this letter but will be ringing the bank later to chase this up. I’ve now received an email from Harland’s stating that as I have yet to clear my account I now owe them £69.95. “Under your Membership Agreement, you have promised to pay this debt. If you continue to refuse to honour that commitment, we will have no option but to take further steps to collect the outstanding balance. We want to help you resolve this situation but you must call us. Ignoring our letters is only resulting in further charges being added. Please call the HARLANDS HELPLINE on 01444 449025 to clear your arrears by Debit/Credit Card and reinstate your Direct Debit. If you are unable to clear your arrears in full then we may be able to help you but you must call us to discuss this. If you do not contact us by 30th August 2017 your balance of £ 69.95 will be passed to a Debt Recovery company who will add their fees to your account.” Where do I stand with this? As the gym was closing down they cancelled the direct debit with me in the first place, do I owe them anything? Can anyone advise how best to proceed? Thank you, Jo

-

hi all after getting my latest credit report i think its time to try and sort it all out my debts total about £4000 probably a bit less i also have one ccj and have just recieved another one of the claim form things , other debts are still being paid because when i fell on a real bad patch with health and work they helped while some just refued to try any help . i know i should pay every single one of them but i cannot i thought i would ask some advice on where to start seeing if any of them are enforcable any help is appreciated

-

Hi All, Firstly, apologies if something like this has already been discussed. I have seen similar posts but I think my predicament is slightly different...it's a long story but I hope that some of you will take the time to read it and have some advice for me... So, some years ago, in my clearly very naive and gullible early 20s, I met my ex husband. We got married in 2010 when I was 23, less so because we thought it was the best thing to do, more so for 'financial reasons'. About 6 months before we got married, my ex had started to have some money problems and I noticed some unauthorised transactions on my credit card totally about £800. The transactions came under Victor Chandler and I reported them to my bank's fraud department. On learning that I had done this, my ex decided to tell me that I needed to withdraw my claim to the fraud department as it was to do with him and he could get into a lot of trouble! (He's in the RAF and works in the armoury...I believe being in debt and having gambling problems would be something that's frowned upon in his position...). He explained that he had used a online gambling site to 'transfer money' as he needed it to help his mum... the story was more elaborate and seemed to make more sense at the time.. .anyway I was young and stupid and decided to give him the benefit of the doubt and believe him. I suspected he had a gambling problem, but every time he'd spin me a story and I stupidly tried to believe him. As things progressed, I buried my head in the sand and we got married and as soon as that happened, everything went from suspicious to disaster... The guy had all my bank details, all my personal details... he memorised my bank account numbers and card numbers off by heart! He'd put on a girls voice and call up my bank pretending to be me and all sorts. He took over my accounts completely and in a bid to stop me from finding things out he'd stop me going online by tampering with the phone lines, etc. One day I found he'd taped a small piece of clear tape over the phone plug so I could check my bank online or call them! My life and my finances got to the point where I was working full time and each payday, as soon as I had been paid, literally within an hour all my available funds would be gone. My bank statements from the period which I was with him are just full of transactions of money (mostly) going out and coming in from various online gambling websites. . Despite my feelings deep down and my instincts telling me everything was wrong, I tried whatever I could to just stick it through and hoped he would change and everything would eventually go away! I mean, he went to such lengths to prove to me that things were being sorted...! By May 2013 I finally decided that I was not going to take it anymore. I wasn't going to let him continue to ruin my life and I left him. We separated in May 2013. I moved back to Hong Kong for 8 months to get away from him and stayed with my parents. During this time, my ex husband and I still had some contact as I was still having major issues with my bank and I was desperate for him to sort it out so that, even if I couldn't get any of my hard earned money back at least the black hole of debt would stop getting deeper! Eventually, he told me that a solicitor had managed to get some money back for us, but it was being paid into my account via a payday loan company. As I was out of the country and wasn't up for speaking to him much I didn't pay too much attention to this. Some money did appear in my account from a payday loan company, but the money soon disappeared again. I thought it was just the same old same old. It wasn't until some time in 2015 when I had returned to the UK and got officially divorced from him that I found out that the money that went into my account was in fact a payday loan that he had taken out in MY name. And here in my predicament lies.. .the loan was taken out online, so he used all my details and signed electronically and the money did indeed go into an account that belonged to me. The money then left my bank account going to various gambling websites, and I'm taking a wild guess that all of those accounts to all of those gambling sites were probably in my name as well. This is a debt that I don't feel I'm responsible for at all after all the punishment and the financial ruin he's left me in. In the time I was with him I lost ALL my wages plus some money my parents had gifted me in the hopes we'd settle down and have a decent deposit to put on a house. All in all, I would hazard a guess at losing somewhere between £60-70k in the time I was with him. Not to mention his own salary on top of that! But, now I think I'm stuck with this loan of around £1200. I am now being hounded by the PRA group who have bought the debt off QuickQuid and are sending me letters saying that I need to pay them. I can see on my credit record there is a default against my name under the PRA group for this unpaid debt. It's causing me a lot of stress now as I have finally settled again, with a most amazing man and we are expecting our first child together and would like to purchase our first home but my finances are making me very uneasy. In all this time, I have never contacted the police as I did what I could to try to come to a civil separation from him. I didn't want to get him in trouble as I wasn't sure if it would affect his job and whatever ill feelings I had toward him I tried to stay fair and settle things with as little trouble as possible. Seems though, that the only person suffering is me! Is it too late to take this to the police now? Have I left it too long? My ex husband, to name the things he's done.. .gambled our entire marriage, made up solicitors and created fraudulent email trails. He's taken money from me that should have gone into my bank and brought me home a 'receipt' of paying it in to my account then turned a story about how the money went into the 'wrong account'. He's taken out numerous loans in my name. Opened up accounts to gambling websites in my name. He moved into military married quarters after we were separated using a marriage certificate that was no longer valid, ran up trespass charges for a late march out and slapped me with a bill of nearly £1500! He'd steal my purse... I've never lost my purse in my entire life.. .in the 3 years we were married I managed to lose it THREE times AND every time it's miraculously turned up back on camp.. .minus the couple hundred pounds emergency cash I had in it! He cheated on me. He's even lied to me now about his current girlfriend being sexually assaulted and suffering panic attacks because of it. ..and his poor girlfriend. ..he steals money from her kids...! I apologise for all the excess info and I understand it's all a bit jumbled. I just find it extremely difficult to put what he did to me in words but felt that some background on all the things he got up to might help me get some advice... Thanks.

-

My current mortgage is with capstone/preferred I didnt keep up with my order and now I have an eviction notice or pay £3700 Can anyone help me on this?

-

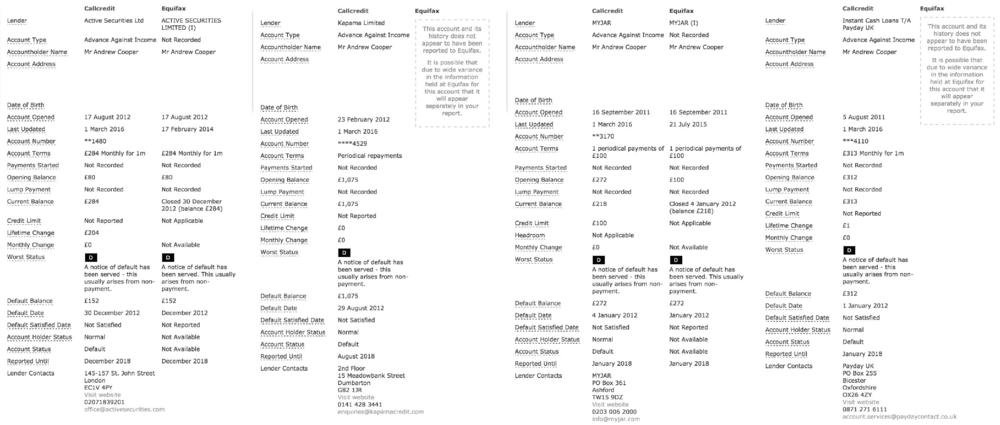

Hi, I was unfortunate, some may say silly to get involved with Pay Day Loan companies over the last few years. I am trying to clean up my credit report and have found four registered on my report. One for over £1000 on what was only a £100 loan. I have attached a copy of the information from my report. Can anyone help me sift through this and advise on the best route. I think the Kapama debt was from Mini Credit who have ceased trading. Just need to know what is the best way forward with these . Many thanks.

-

Hi all, I could really do with advice on this: This morning I received an email from UCLAN citing unpaid tuition fees from 2010. I called them as I believed it to be spam because my fees were paid and I didn't stay longer than 1 year. From the conversation with UCLAN and looking at my online info it turns out I was overpaid £2500 by Student Finance... 6 years ago. Student Finance have never contacted me about it and I am currently a student again elsewhere but UCLAN have said they're getting in touch with SF to make them aware of the overpayment. I contacted SF myself but they couldn't give me any info at this stage and I would be contacted by their collections team in due course Is there a length of time by which SF would have to have notified me by? 6 years of not knowing is a pretty long time... Many Thanks Kx

-

I have 3 payday loans showing on my credit file as these are in a DMP. I made the mistake just over a year ago of borrowing money from them to help pay for my mothers funeral expenses but then it kept rolling over. The companies are Quick Quid £361, Think Finance £782 and instant cash loans T/A Payday UK £557. The credit file for these loans show monthly periodic payment amounts for not what I am paying them but for amounts varying from £782 / £1440 and £557. Surely this is incorrect information ? Is there any way I can get rid of the payday loans off my credit file as when I borrowed from them it was an instant online decision and they kept allowing me to roll it over. I admit it was a very big mistake to use these people in the first place but I was in a bit of a panic I hope someone can help and advise me please as its really worrying me now. Thanks in advance

-

Hi, im sorry this is a rather long story but i really need some legal advice... my husband had a tenancy in his ltd co name with a pub company. when he passed away 2 years ago the pub co regional manager asked if i would continue with the pubs, he had another one at the time with them. Both pubs were struggling and i told them i wasnt sure. They assured me of financial and business support. Obviously they didnt want two closed pubs on their hands and i felt a responsibility to my husband to keep them. i struggled to manage both pubs without my husband and trade suffered due to various different factors. The rent support never happened and they often held me to ransom refusing to release orders without full rent payments. At the time the rents were over £1000 per week on each pub and we were trading at just over £2,000 a week so not hard to work out why struggling. I ended up putting around 50k of my own money in as each week unless i paid the rent on both, i couldnt have any beer and if bought from somewhere else they would fine me then refuse the next weeks order until that was paid!!! They never so much as kncocked a penny off anything, i paid full cost on rent for both pubs for the 15 months it took them to transfer in to my name despite having my name on nothing. they lied to me about what rent deal they would do on the new lease and also refused to give me proper credit terms etc. as a result and having at their insistance put a brand new deposit down on what was already my pub my cash flow took a battering and im now on the brink of closing altogether. various people i have spoken to have told me that they should not have let me trade for the 15 months it took to transfer then pub into my name as the tenancy was in my husbands ltd company name which legally shouldnt have traded after he died since he was the sole director And my name was not on anything. Is this true and if so can i do anything about it now? thanks...S

-

So I upgraded about a week ago as my upgrade date was 1st August and the plan ended 15th October. The first upgrade advisor said I had to pay an upgrade fee of £210 because ; I didn't necessarily mind as I thought I must have got my dates mixed up and new my current phone would have paid that off. The advisor discounted this down to £168.67 so I wasn't too annoyed with that. The more I thought about it though, I felt I shouldn't have paid anything so I got back on to the chat and was told ; Obviously I thought that was quite a nice offer so I agreed to continue ( I had already paid £43.67 as they told me the bill couldn't have a charge higher than £125 added at one time?) So, the upgrade arrives and all seems to be well....... until my bill arrives! £138.94 charge! No idea where this figure comes from as it doesn't add up to what the chat advisors had even said. Going onto the chat I have been told I have to pay this ; trying to return the device is a nightmare as I keep getting passed from pillar to post. Then other advisors are just simply saying All well and good saying that but not when a bill of nearly £200 is on the line :mad2:

-

Hello all, I am very new at this so would appreciate any help available. The long and short of it is, that I have just found out my wife has run up debts by taking credit cards out in my name, without my knowledge, and has been paying the minimum payment on all of them, thus incurring interest, to the extent that my account is maxed to the overdraft limit every month. She finally told me about this as my mortgage finishes in September and I will be unable to pay it off. As I was unaware of this until this week, am I liable for all the debts (including past interest paid) or is there anything that can be done to solve this mess? Having read through these forums it does seem I am in a better position that many as I do have employment and am bringing in an income each month. My wife is not on my account, in fact does not have a bank account herself. She is also not on the mortgage. I am due to retire in three years, and there is no possibility of repaying all the debts in that time. I can sustain the minimum payments, but the debts will not be cleared in my lifetime and it is making me ill with worry. Can I explain to the credit card companies what has happened without penalty to my wife? What to do??? Any help appreciated.

-

Hi guys, I went to the hospital today with my heavily pregnant wife and spent 10 mins queuing first of all to get into the car park, then 10 more minutes to try to find a space after being let in at the barrier... there were like 5 cars circling the car park looking for a space and I found it ridiculous that the barrier (usually would say FULL and not let anyone in) would let cars in without actually having any spaces available. By this time (after 20 mins!) I was already late for my wife's appointment and my wife was alone making her way upstairs. In the end I had to just find a space next to a car that's not obstructing anyone and parked there. Obviously it wasn't a proper space, and I came back to find a ticket... I then didn't know about this forum and sent an angry email to the parking operator, foolishly admitting that I was there and parked not in an allocated space. I then got an email back saying sorry, obstructive parking, pay up or appeal... My question however is that if anyone else has had the same problem? What are the chances of appealing to POPLA? I just feel really gutted that I would be let in to the car park if there were no spaces, and that I also had to pay full parking fees only to find that I'd be penalised further for their inability to provide parking facilities after beckoning me in by opening the barrier... surely that's wrong no?!

-

Hello, I am in a very difficult situation with Wandsworth council over council tax. This started back last year with when I moved into a shared property with some other people and for some reason the Council tax was put under my name and the name of someone else that didn't live here. The council never sent me a bill or any correspondence until I received a summons for none payment of council tax. At this point I emailed them and explained I live in a shared house with other people and I had not received any bill and the bill should not be in my sole name. I was then informed that someone would look into this and get back to me. The next thing I heard was a Bailiff coming to my door threatening to take my stuff away or I have to pay the full amount plus over 20% of fees on top. I contacted the council again asking about any appeal or the fact that the bill is not solely mine, it took them 2 weeks to reply by email which they told me that I have had the chance to appeal and that they sent me a multiple occupancy form, which they never did. They also told me to contact the Bailiff from now on. The worse thing about this is I suffer from PSTD and extreme bouts of depression and I have recently been laid off because me taking time off because of this situation to go back on medication and into therapy. Before this I had been medication free for over a year. I feel I have been treated most unfairly and all I wanted was the chance to pay the bill in installments and for the bill not to be solely my responsibly. Is there anything I can do? as the situation seems to be getting worse no matter what I try. Thanks!

-

Two policemen radio into their station "Hello Sarge?" "Yes?" "We are at a house where a woman has shot her husband forstepping on the floor she had just mopped clean." "Have you arrested the woman?" "No sir. The floor is still wet."

- 2 replies

-

- dont

- houseproud

-

(and 2 more)

Tagged with:

-

A little bit of a complex one this but I am really hoping that someone can advise! We are managers at a pub. We work for another company who hold the tenancy, deal with all of the utilities etc and organise the TV. Basically, we are responsible for the day to day running with no responsibilty or say so on finances, contracts etc We get paid for this (self employed basis), along with our accommodation as part of the deal. We organise TV, broadband and 'phone for the private acommodation only. As we are only managers, we have to abide by our gaffers decisions and rules or be out of a job and home. We've had Sky for years in various pub jobs around the country and the varied private accommodations that go with that. Our gaffer chooses to use an alternative supplier for the commercial areas and here the problems begin. A Sky inspector visited and saw a match being allegedly being screened (we were not aware of this until a week later when our domestic Sky TV service suddenly ceased without warning late one evening). We rang Sky the following day and were initially told that we had telephoned them and cancelled it. As we had not, we told them this. Several people later we were told of the above and that it had been passed to the Business Compliance Team and that broadband and 'phone was going to also be disconnected on 3rd March, and that Sky had also cancelled our direct debit as we have broken terms of the contract by using a domestic card in a commercial setting (which we haven't). At this point we were also told that the inspector had seen our viewing card number on the screen in the bar. This is 100% NOT the case as our cards have not moved out of the boxes and our gaffer, whatever our thoughts on the matter, has chosen to use an alternative provider. We have informed Sky that we do not deal with the commercial side, and that it is absolutely incorrect that the card # was on screen, and that we will refute this all the way. We've also informed them that we have a letter from our employer stating that we do not control the TV supplier and that if we refuse to show what we are instructed to that we will lose both our job and home. They are not interested. The broadband and 'phone was eventually cut-off on 2nd March ( a day earlier than it was supposed to be) and we have now had various letters and calls from them, mostly asking why we have chosen to leave and asking if there is anything to do to keep us as we are longterm customers!!!!! Also 1 letter demanding payment of £97 outstanding (despite THEM ancelling the DD that fell due 2/3/15 and despite the fact that no adjustments have yet been credited to the account. The advisor early in the row told us that next month, when the computers caught up, credits would be applied to the account to reflect the fact there was no longer a service being supplied, confirmed that Sky had cancelled the DD and told us we didn't owe anything). We this morning got a signed for letter from Acumen Investigation Services. It states "One of our enforcement officers has attended the above premises and witnessed Sky Exclusive Programming being shown in commercial areas that are accessible to the public. " Then the bumpf about the relevant legislation then it continues "may result in a criminal conviction, fines of up to £5000 per offence, legal costs and forfeiture of your personal license. Our clients also have the right to take civil action against you. Previous civil actions have resulted in payments of up to £65000 being made. Our client requires that you do one of the following within 14 days: 1. Enter into a pubs and clubs agreement which permits the broadcasting of [sky] in the commercial areas of your premises 2. In the event that you do not wish to continue to broadcast [sky] ...you are required to complete the enclosed cease and desist form and return it to us or 3. Return any and all Sky Domestic viewing cards being used to facilitate these broadcasts. (Sky's viewing cards remain the property of Sky at all times). We will continue to monitor your premises and will also be sending an enforcement agent to speak with you about copyright theft. If we do not hear from you within 14 days we reserve the right to take further action without further notice to you" The cease and desist form and various bits of bumpf including a Sky contract was pubs was enclosed. Now we are a bit stuck here. At no point has our domestic Sky been used in the commercial area and we have no say in what the supplier is nor what is broadcast in the commercial area. We've lost all of our domestic Sky services. If we refuse to broadcast what our gaffer says, we will be chucked out of our job, and our home with it, along with our kids. He is the one who controls the tenancy, finance, contracts etc and has told us to continue broadcasting, using equipment supplied by someone he has contracted, as it's him that Sky should go after, and it's his risk. He has given us a letter stating that it is him who controls it and that we will be terminated if we disobey direct orders. Sky simply aren't interested and have chosen to go after us instead. We can't sign a commercial agreement as we do not have the authority (and doubt the gaffer will sign one, though the paperwork will be given to his agent on Monday), we are unable to sign the cease and desist notice (part of the wording is "not to assist any person to use any apparatus or device not authorised by [sky]") as we have to turn the TVs on daily and would obviously then breach this and we cannot return any Sky cards "being used to facilitate" as none have been! (Obviously we will return the Sky cards without this proviso, but are not going to at present as it then looks like we have used them commercially!) Obviously doing none of the 3 leaves us open to prosecution, but equally we could be without a job and home if we disobey our gaffer. HELP!

-

Hi I'm a sole trader, and at the moment I'm busy paying off a council tax debt. The council were round last week doing a load of work next door, making noise from 8 in the morning and stuff, didn't bother to inform me despite the fact this is their legal responsibility. Anyway, the path I share with my neighbour is now a mess, it's not that bad but the guy didn't hose all the detritus off right which has left it in a worse state than it was before. I have been keeping very clean this summer, and now I have to sweep it and hose it again. As a sole trader, if I was to perhaps go out and clean it up, how much would I be in my right to send the council the bill for it?

-

Hi, I have been a sporadic user of payday lenders, primarily WDA for about 6 years now. Anyway, my latest borrowing was £750... a repayment of £937.50. Now I won't trouble you with the usual sob stories, I accept ultimately this is my own fault but... This level of repayment is too much for me, indeed it is >50% of my income. In the first instance, I have contacted my bank. They said "unusually", in their words, it is a Direct Debit set up, not a CPA, so I can (and have) cancelled it by myself...I simply can't afford to have that amount of money to come off in a given month. Where I need help...what should I do next? I intended to write to WDA, inform them I have cancelled, advise of change of circumstances (with budget sheet) and offer some sort of repayment plan? Does this sound right? Can I insist they do not attempt to use a CPA, add further interest, etc.? Also, what is the lowest £ value or % of my available funds would they likely accept as a minimum? I'm not looking to blame the Lender but my living costs have spiked due to higher work related expenses and childcare recently so I would really like to stop the rot. Many thanks for your help!

-

My sister has applied for a mortgage and has been declined due to a debt with a collections agency that was sold to them by Lloyds TSB. She had a bank account with few pounds in credit that had been dormant for a few years she moved house and forgot about it. Apparently a cheque was written (she says it wasn't her) it bounced resulting in a charge this has then increased + interest + more charges etc and turned into a £200 debt. All correspondance went to her old address as she moved and didn't give them her new address as she'd forgotten about the account. I think maybe they sent a cheque book in the post and the new tenant wrote one out to himself? -just a possibility Lloyds won't tell her anything ie date of cheque amount etc they say as account is closed they can't talk to her and she has to write in? Her main concern is getting the mortgage, obviously though she doesn't want to pay the £200. How can she get it off her credit file? What's her first step a complaint letter with a SAR?

-

Another one from Scoop, bailiffs sent to collect from a pensioner who owed nothing, this time it was the council who messed up, and sent bailiffs to collect the debt from an innocent pensioner. who was worried anout their threats to seize goods whether he was in or out, the usual implied threat of forced entry. http://www.somersetcountygazette.co.uk/news/11477720.Bailiffs_threaten_to__break_into__innocent_pensioner_s_home/?ref=rss " Somerset County Council has since admitted there was an error due to an incorrectly registered vehicle and apologised to 85-year-old Michael O’Loughlin. It said a bailiff had called to ‘take control of your goods’ and that if I didn’t respond they’d get my goods ‘whether I was present or not’ – which sounds like they would force entry into my home to take things. “Although it had my address on it, it was someone else’s name and the postcode wasn’t mine. “I was frightened of going out in case they came back and broke my door down." Wonder who would be blamed if a pensioner dies as a result of wrongful action like this from a stroke or heart attack? The bailiff who knocked on the door and the victim dropped dead in front of him, or the council official who got the wrong details?

-

Basically I had a period of unemployment and started work 18th May (Sunday). I called the CSA on Monday 19th and informed them of a change in circumstance. At the time I was on a zero hours contract so didn't have guaranteed hours. I soon got 40 hours per week and informed them all the way of the changes. I calculated an average over a month of 15% of my salary and paid every week from my first pay packet. Basically they sent me a letter saying I was in arrears as I had not paid for the weeks commencing the 7th May. I explained to them I didn't start work until the 19th but wouldn't have any of it. They even said they had reason to believe I had worked cash in hand as my bank statements didn't back up their claims. I thought this would be easy to sort out so I called the DWP who confirmed my claim didn't stop till the Friday 16th. I asked for a letter to confirm this and then made the School boy error of saying why I needed it. Immediately I was put on hold and the lady returned to me saying she couldn't confirm when my claim stopped. I was baffled as she had just read it all out to me. It seems my entire file was lost as they no longer had my address, bank details or contact numbers. I was left with being told they would investigate why they could not get my information up. A letter will be sent confirming when my claim stopped but they could not tell me over the phone when that was. I feel I am being really stitched up. The CSA take nothing I say or the evidence I give. They just take my ex's verbal claims as gospel. The CSA even want £37 out of a pay packet of £42 I got for an afternoons trial. Is there anyone I can take this too?

-

Hi All, I'm hoping there's someone on here that can help? I'm just in from work and a lovely letter through the door from IRS an investigation and recovery company on behalf of Peugeot Finance. I'm crying as I type this as I don't know what to do, They're not chasing me, but my husband, he has missed 3 payments on his van and due to him burying his head I assume, theyve handed it over to this lot and they've added their charges of £300 for a doorstep visit. My husband is away to a work course this weekend and I won't speak to him till tomorrow. I'm a scared what they will do and I just don't have £700 to give them if they come back. I've never had to deal with debt collectors before and I'm upset beyond words. Advice please as to what I can do to stop them repossessing the van. Can they do that for £400 arrears? Please please help me. Grumpy x

-

Hi folks, Sorry this is going to be a lengthy one. September 2011 After an unsatisfactory experience with Spark Electricity I decided to switch to nPower in September 2011. In the beginning everything seemed to go smooth, monthly payments taken out and meter readings reported timely, everything worked out just fine. Until.. January 2013 We decided to move house in January 2013. Between September 2011 and January 2013 I had been making DD payments on my old address without any interruption. As a result; there was a surplus credit of approx. £230 in my nPower account. We moved to the new house and I had nPower set up as electricity supplier. I phoned up the customer service desk to confirm arrangements regarding the move of properties. The new house was allocated a different customer number versus the old one. I requested a final bill for the old address (which was sent and had already been paid for) and requested the surplus credit to be moved to the NEW account number rather than putting it bank in my bank account (*now wish I had never done this*) Normal DD payments then commenced for the new account with far higher values than was required for the account, eventually leading up to nearly £500 in credit in my account. May 2013 All of a sudden sometime in May, DD payments started to increase (up to 3 a month, with the same monthly fee). I phoned up HSBC to cancel these duplicate payments as they were incorrect. Spoke to nPower customer service, they were aware of a problem and said they would address it. August 2013 nPower DD payments then fully ceased until August, where they attempted to take 3 payments in 1 go which I immediately had denied by the bank. Logging in to my nPower online account, even with the periods I had not paid my monthly DD, I was still well above the zero mark with a positive balance. September 2013 I spoke with the nPower customer service desk asking them to look into this undocumented and unexplained DD payment behaviour. Customer service employee instructed me to fully cancel payments and revoke my DD until they had addressed the problem. November 2013 Several months went by and I received a bill well in excess of £900. By now I am fuming with their incompetence to sort their billing out and lodged a formal complaint. December 2014 I've had enough of their incompetence and request to change suppliers to Sainsbury's Energy. nPower allow to let me transfer and confirmed they will sort me out with a final bill to clear up the confusion. January 2014 Spoke to customer services about the status of the complaint (no news from nPower). They requested me to send my HSBC bank statements to prove all payments made to nPower under the year 2013. I have contacted HSBC, got all the statements and e-mailed them through to them on January 2nd. February 2014 nPower write to me that they are still dealing with the complaint and offer me a brochure to contact the Ombudsman. March 2014 nPower contacts me to mention they have still not received my statements, which I then sent to them again on March 3rd. April 2014 nPower contacts me again to say they have not received my statements. I have transmitted them again on April 19th. After receiving a letter requesting to call them I phone up the complaints team and endure a hefty discussion. It must have lasted at least 40 minutes (on top of a 1h20m wait!). Conclusively this is what nPower states: - I have made payments close to £400 throughout 2013 - They deny of having received certain payments that have 100% been taking out of my HSBC account and I have the statements to prove it - They have an outstanding charge of £1340 (it took me half an hour of pressuring the staff member to come up with this number) What actually occurred: - I have made payments close to £600 throughout 2013 and have bank statements to prove this - I have moved the £230 mentioned in the beginning of this post from the old to the new account - Even if the charges were to be £1340, the outstanding sum would only be around £500 and I am more than happy to pay that - Additionally, £1340 is a ludicrous amount when knowing that our monthly average sits around £80. I consider £1340 outstanding to be fictitious as they can not back it up with figures. Nor do they acknowledge my payments previously made. For the life of me, I can not understand how hard it can be to simply produce a correct bill with a starting & ending meter reading and match that with the incoming payments. I am aware that nPower have changed administration systems during 2013 which may have to do with this massive c**k up ?! I requested them to give me an overall statement from the date of opening the account to the date of closing. The customer advisor denied this request saying that nPower does not do statements of accounts. I challenged him and asked him how they are going to prove the charge, which he challenged in saying that I can log in to the nPower on-line system and download every historical bill. I actually tried this yesterday and the on-line system does not allow me to retrieve any historical bill, but in stead comes up with an error. I terminated the conversation after not getting anywhere with such an inflexible representative. What next steps should be taken? I have not contacted the ombudsman just yet but believe I should do this sooner rather than later as it must be done within 9 months of raising the complaint, is this correct?

-

- billing

- ficticious

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.