Showing results for tags 'issue'.

-

Hi there Im new to this forum and need some advise please. Heres the story My friend has received a "Issue of warrant of control" letter a few days ago , hes confused as to why this is, we checked on his credit file and noticed a ccj that has been placed by Lowells, how surprising! its weird as some guy knocked asking for my friend a week ago he said he was from resolve call! not sure why as i said he isn't here s the guy just walked off. Not sure if he was connected to Lowells or the same debt. he has never received any court claim forms at all prior to this the debt is with littlewoods online catelogue. Please can you advise on what is his best action. Hes on a low wage only works part time hes worried now as we dont want bailiffs at the door , they would go straight for the car! Any help is much appreciated.

-

Dear all, I mistakenly filled in a credit application for Screwfix in 2013 for a trade account (for a company I used to work at). This company has recently gone into administration and I have been sought after to settle the outstanding amount (nearly £1000) - as apparently the credit application doubled up as a "personal guarantee". Their credit app was not clear to me & it was blurred out and photocopied on a number of occasions. (yes I know I shouldn't have signed something I couldn't read) In addition I resigned and left the company in 2014. How can two different legal entities sign a credit app (as director) but also as personal (for a guarantee - without it being made clear?

-

Hi all, Myself and two others were due to sign contracts to move into a 3 bed flat this Saturday, but one of my prospective housemates quit his job and pulled out last minute. Me and the remaining person can't find a replacement, nor do we want a random off of spare room. Problem is, we paid a £338 holding fee each and have now lost this as a result. The person that pulled out originally said they would pay me and the other person back the £338 each that we'd lost, but has now gone AWOL. The other person is furious (I tend not to fret) and we were wondering if there was any legal action we could take to get our money back off the person who caused the move to collapse? Thanks

-

Hello, I have received a number of letters from DRP (the debt recovery company that NE Parking Ltd use). My car was parked outside a hotel that has been closed down for over a year from 8-11pm at night. put a ticket on the windscreen so far down that I didn't notice it was even there until 3 days later when I turned my wipers on to wash my windscreen. The picture they included on the original letter shows my car but doesn't have the ticket on the screen in the window. I have ignored about 6/7 letters from them and now have received a 'final settlement offer to avoid court action'. Has anyone else got this far with them? Do they actually issue in Court? Thanks in advance.

-

hi guys this is my first post. I appoligise if I accidently break rules. Background I been using a waste disposal broker for my sandwich bar. All was going well until I received an over loading invoice which had 2 dates that i had apparently over loaded. Charge amount 69.05 10/01/2018 overload by 25kg = £5.25+vat was using 660ltre bin allowance 42kg 31/01/2018 overloaded by 249kg = £52.29+vat was using 1100ltre bin allowance 70kg Total = £69.05 between these 2 dates I had actually received a larger bin so when the collection happened on the 10/01/2018 i was using a 660 litre bin which had a 42kg allowance then on the 31/01/2018 I was using a larger bin which is a 1100litre bin which has an allowance of 70kg Grounds for dispute My dispute is if I only went over by 25kg on a 42kg allowance how have i gone over by a Wapping 249kg on a larger bin which has a 70kg allowance. Also that is a lot of weight to put in a 1100 litre bin please my own rubbish there’s clearly a mistake when i raised this issue with the broker all they kept telling me is they have tracking records from the bin collection. However that’s not what I’m disputing (if that not what they had on their records then they wouldn’t be charging me in the first place). I’m disputing the legitimacy of the charge IE did they register the correct bin when they did the lift, I know they collect multiple bins from the same location maybe they lifting another bin by mistake. How do I know they didn’t receive a back hander from someone to throw there bins away and decided to place it in mine Now they have basically refused to credit the charge although I have had one of their own member of staff admit the figures do look off. I feel there just trying to bully this amount out of me. As brokers the waste company they are contracting to collect the waste are the ones provide them with the collection/lift info. I feel they can’t be bothered to investigate with the waste company what’s gone wrong Actions taken I am still using them to collect my waste as I am contracted to them till April 2019 and pay my waste invoice but u haven’t paid the over charge. So I have received a letter stating 1. they now will add a charge of between £40 to £60 to the charge ( haven’t actually stated amount) 2. the next course of action is to commence county court proceeding to recover debt and will result in added interest and fees I know in my gut there just trying to bully me into just shutting up and paying. Can anyone advise what action I should take? Thank you

-

Hi, Like most posters, I'm having an issue with Harlands over cancelling my DD prior to filling out their online form. I received a letter in the post today demanding the £19.99, as well as a £25.00 admin fee. I'm not going to pay the admin fee, but am happy to pay the £19.99 as I recognise that I cancelled the DD within the 30-day period. I am going to use the letter template below, which I found on another post with exactly the same issue. However, I'm a recent graduate who is working nights to save for travelling, which means I have all the time in the world to deal with these people. Given the widespread nature of this issue, would it be worth contacting a TV Programme such as Rip-Off Britain to try to nationally shame these bullies? It makes my blood boil that they are effectively spoofing more vulnerable people out of their money. "I refer to my membership at Xercise 4 Less gymi in XXXXXXXXX which was a month to month agreement. I cancelled my direct debiticon mandate in September but realise now that I should have given 30 days’ notice to cancel. Cancellation of the DDicon mandate was adequate notice of my wish to cancel. I now offer to pay £19.99 for the notice period. I will not pay you any administration or cancellation fees. If you confirm in writing that you will accept the amount of £19.99 in full settlement of all that I owe, I will pay you promptly. If you fail to accept my offer within 14 days or you demand any higher amount, I will pay you nothing and my offer will be withdrawn. Yours Faithfully, XXXX" Edit: Forgot to say.. First direct debit went out of my account 18/09/2017, I cancelled shortly after as I wasn't impressed with facilities. They tried to take the next monthly £19.99 payment on 04/10/2017 which obviously got rejected.

-

Hello Everyone I started getting letters from Nolans probably around 2 months ago about a Personal Loan debt that was from years ago. The debt is not on any of my credit files so it was a surprise to get a letter from a sols about it. Its a Sainsbury's Bank Loan for £16k that i took out on 9/7/09, very shortly after (around 6 months lost my job). I had been making token payments of £20 per month to originally Blair Oliver & Scott who after around 1 year, passed the debt to Cabot around Nov 2011. I continued the £20 per month till around Jan 2016 then I lost my job again, and couldn't pay at all. If I am being honest, i thought due to the time since i took it out (8years ago) and the fact that it was off all 3 credit files (equifax/Experian/Callcredit) It had been written off by the creditor. Im always weary with debt letters as the terminology is always "we may" and very rarely "we are doing" but being so close to having a clean credit file the letter has came as a bit of a scare. Any advice? I can post a copy of the letter with personals omitted if it helps?

- 33 replies

-

- cabot

- county court

- (and 6 more)

-

Hi All, This is my first post here, so hi in advance. I am seeking some guidance on a issue I am currently experiencing. I purchased a used vehicle from a local, well known, dealership just shy of two months ago. I went to get the vehicle serviced yesterday from a garage I have used for many years, only to receive a phone call stating due to the car not having a service for a prolonged time, the oil had become tar and has affected some pipes, and the turbo is dead, or almost dead. The advice received was to get rid of the car or seek repairs through the seller. I have contacted the garage, only to be assured I would receive a phone call from the manager (has not happened). I have spoken to CAB Consumer Protection and have been advised to use their templated letter and allow 14 x days. As above I have involved CAB consumer protection and have been advised I am entitled to something (repair etc), so I guess I am just seeking further reassurance? Just wondering if anyone has any success stories, has their bank assisted (I paid with my savings via direct debit card) Thanks

-

Need a bit of advice here for a friend who cannot afford a solicitor. Quick run down. Friends is a masseuse, working in many different areas including hot stone massage. She is very professional and has done many years in training for what she covers. A client has decided to sue her using one of these no win no fee companies and has lied stating that my friend didnt get her to sign a disclaimer etc, well I know for a fact she had signed and she has the paperwork to prove it. Now this client has stated that she had a torn ligament from this hot stone massage, now if anyone has had the pleasure of one of these you would know its nigh on impossible to get a torn ligament, Ive had one myself and its the most relaxing form of massage, not to mention when you tear a ligament which I have its bloody painful and the pain is instant and this client showed no signs of being in any pain when having this procedure. Now this friend of mine has no liability insurance, only does this part time and has literally no assets to her name, she is also a single parent. We feel that this is either someone trying to discredit her because she is a new business or they have some other vendetta against her. Why we have no idea as my friend is the most loveliest lady you could ever meet plus extremely professional. This is a bit out of my comfort zone but she has requested that I help. There is no way she can afford a solicitor and she is scared that this will reach the court stage and will lose what little she has if this woman wins. Any advice at this stage would be greatly appreciated.

-

I have been having issues with the cancellation of my Xercise for less membership. I completed the online cancellation form on 14th November 2017. At the same time, I cancelled the DD with my bank. I realise now that they do state on their cancallation form that you must give 30 days notive, so in hindsight I did cancel my direct debit too early. After this date, I started to recived email/txt/letters stating that I owed money. I initially read some posts on this webpage and I ignored the correspondance. It went through the usual form: Harlands adding admin fee / CRS txting saying they need to speak to me urgently. I noticed that each correondance from CRS was getting higher in the amount owed. Finally landing at around £180. I decided to try and sort it with Xercise for less. I spoke to them on the phone last week. They saif they could reduce the pice to about £60, which was for my months membership that I didn't give notice for and the buy back fee for the dbt off CRS. They said that would "stop me getting issues with my credit rating, and make it all like it never even happened". I refused, I told them I would accept the £14.99 1 month membership for cancelling my DD too soon but I will not pay anything extra. I also asked why, if they received my cancellation reques form, did they ignore it and coninue to rack up dept on my account. He said because I did not follow the terms of cancellation and cancelled my own DD. I then sent an email (copied in parts from one I saw Slick write on here) about my change of address - as letteres went to my old one - and also regarding the nature of the intimidating letters. I reiterated that I would pay 1 month membership and nothing else. I recieved a phone call a few days later which I ignored and emailed them to tell me to put anything they have to say in an email to me. I have now received an email to say that as a good will gesture they will remove all CRS charges, however as I did not update my address upon relocating they will charge me a £25 admin fee plus my £14.99 outstanding membership payment. So £39.99. Should I refuse this? - also, I moved house AFTER I submitted my cancellation form so it is irrelevant to them where I live at that point. Any advice I what I should reply to them with would be very much appreciated. Thanks

- 6 replies

-

- cancellation

- issue

-

(and 1 more)

Tagged with:

-

Hi, My partner had two credit cards between 2001-2008 - both of which she defaulted on when her husband left - leaving her with two young kids. Unable to pay the mortgage she was forced to move into Council Accommodation. Today, She received a Notice of Issue of Warrant of Control. Creditor: Cabot Financial (UK) Ltd The letter states that if the debt (£857) is not paid by 2nd Feb 2018 then Bailiffs will be call to remove goods for sale at public auction. I work as a bar tender and my partner is disabled and on benefits. No attempt was made to contact my partner in the last 8 years regarding the debt (we still don't know which CC it applies to.) by mail or telephone. She is terrified that the bailiffs will turn up and start ransacking the house. Can anyone give me a clue as to where to begin fighting this?

-

Hi Three months ago we parked at Bygone Times in Chorley - there was a parking sign saying sign in at reception. At reception there was a huge queue so we bypassed mistakenly thinking you had to sign in if you werent a member. we showed our gold cards and entered the place. we bought several itsms - unfortunately don't have the receipt as it's all second hand goods/ antiques etc so tiny little till roll. week later parking eye £100 fine arrives with picture of car entering and leaving the car park - searched and ignored accordingly. have had a couple of letters since and again researched and ignored. today however a county court claim from Northampton has dropped through the door what do we do now? thanks in advance

- 21 replies

-

- county court

- eye

-

(and 2 more)

Tagged with:

-

Banks have admitted that thieves are able to use contactless cards even if they’ve been cancelled – sometimes months after being reported stolen. RBS, Lloyds, HSBC, Barclays and Nationwide admitted that a ‘weakness in the system’ can allow fraudsters to use cards after they have been reported lost. The ‘tap and pay’ cards allow purchases up to £30 without requiring a PIN number. The problem stems from the fact that some shops complete purchases ‘offline’, without checking with the card issuer if a card is valid. Instead of checking ‘live’, some shops store transactions and check batches at the end of the day, meaning that stolen cards can sometimes be used. The FCA says that if customers fall victim to this kind of fraud, they are entitled to get their money back. https://uk.yahoo.com/finance/news/thieves-can-still-use-contactless-cards-theyve-cancelled-banks-admit-103749226.html

- 9 replies

-

- cards

- contactless

-

(and 3 more)

Tagged with:

-

Good Afternoon everyone, Like many before me, it appears I have run into a few issues dealing with Harlands and CRS. It all started when I tried to cancel my membership with Xercise4Less. Having naively believed they had accepted my cancellation when I filled out a form in my gym, I got a nasty surprise some months later when I found they continued to take £14.99 a month out of my account. I then found a way to cancel online and cancelled my direct debit too to ensure they couldn't take any more money from me. Six months later, and I start getting emails from Harlands and CRS demanding £186 and, while I have no intention of paying and am well aware of their limited powers. I'm unsure what to do next. I have moved house since i took out the gym membership so I'm yet to receive mail or a phone call directly to my house but I'm quite keen to nip the emails in the bud before it gets out of control. I'd be eternally grateful for any help or advice that could be offered on this forum. Kind Regards, Joshua

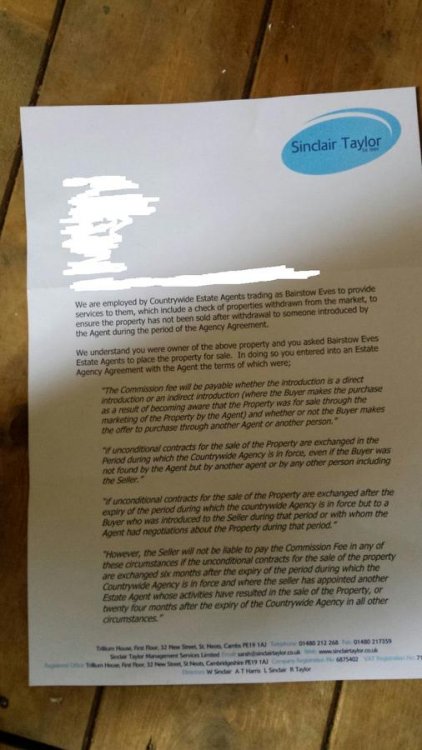

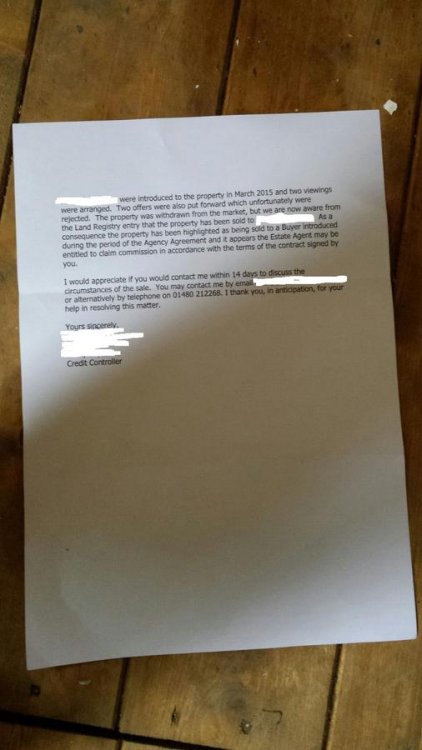

-

Friend of mine put his house up for sale with Bairstow Eves after they promised him they had plenty of people on their books looking for properties like his - Ha! He did receive a couple of offers early on but these were declined as too low. He then accepted an offer but the buyer pulled out due to not liking something on a Homebuyers Report. No other offers were received. After the 3 month contract was up he gave notice then put the property up for sale with another agent. Not long after this the person that put the original (declined) offers in came back. The buyer was told to go through the agent the property was now for sale with. Offer was accepted and sale completed. A letter has now been received quoting parts of the contract that was apparently signed saying that Bairstow Eves could be entitled to commission - letter attached. Has anyone come across this before. My friend done what he though was right by telling the buyer to go through his agent, he was not aware of the terms that said that the original agent could also be entitled to commission.

-

Hello, I'm new here so not sure if I'm doing this right! We recently took our 7 year old house Rabbit to the vets as we thought she had gone blind in one eye. They did a quick eye test, confirmed that she had in her right eye, and prescribed antibiotics for an ulcer in the same eye. I went home that night (Friday), went to put the drops in and realised they said ear drops. They were already closed, I called in the morning and the Receptionist said they are ear drops for humans but eye drops for animals so they are fine. I went to put them in straight away, 5 minutes later they phone back questioning if I've used them the vet tells me they are wrong, she needed 0.5% and was prescribed 5%. I was told to wash her eye out, and come back to pick up the new drops "at no charge as a gesture of goodwill". Since having the drops, she stopped eating, drinking and going to the toilet. I took her to another vet (for an additional £60) on the Tuesday, who said she needed painkillers because her eye was swollen and her gut wasn't working, and that antibiotics should never be prescribed without a full body check (Which she did not receive at the original appointment). On the Friday, I took her back to the other vet (Another £60) because she still wasn't eating and dropped from 2.4kg to 1.9kg in a week. Luckily, she's made a recovery but that's just the back story. I emailed the original vet the day the wrong drops fiasco happened, complaining that she had been given a 450% overdose and that I wanted an explanation as to how it happened and how 2 separate professionals informed me the drops were ok before I used them. The manager called me, and said that although it was their mistake that she had been given the wrong drops and they were sorry, it's ok because it was a benign mistake. I then took my complaint further as no one was accepting that it could of been a real issue, to the complaints department, who wrote me a letter saying that they spoke to a Rabbit expert, and the drops were fine anyway so it didn't matter that the mistake was made. My opinion is, they were very lucky that these particular drops did not affect her, but they could of. No one checked them at the time, and if I hadn't of noticed the label I would of used them twice a day as instructed. For a Rabbit who has already gone blind and is vulnerable, it is undue stress. If it was a painkiller she had been administered at a 450% overdose, she probably would of passed away. All I really want is my original £57 back that I paid for her first appointment and eye drops, because I think they have been careless and negligent towards her well being. Does anyone have any advice?

-

I'm new - just registered. I'd be grateful for your advice. Mid last year I called to renew my car insurance with LV. At the conclusion of the call I was asked to pay the £40 deposit I was told that their payment system was 'broken' and that I would be called back for payment to be taken later. So far so good. My car insurance renewal was completed.... So I assumed. LV never did call me back As LV had all my details (I had been insured with them the previous year) I thought nothing of it. Several months later I received a DVLC letter informing me I was NOT uninsured. I immediately called LV and discovered that they had not taken the payment (not through any failure on my / my bank's part) and consequently I had NOT been insured for the previous 4+ months. LV have offered compensation of £100, considering the potential financial repercussions to me of their administrative failure (had I been involved in an accident) I am wondering if there are any informed views on precedent in such a situation. I am no lawyer while it is the driver's responsibility to ensure his vehicle is insured, one can equally argue that it is reasonable given the telephone conversation (of which I have a recording) to assume that the onus would be on LV to call me back as promised or to assume they would complete the transaction given they had all my existing details. I would be interested to hear what people think. Many thanks. Mav

-

Sent my appeal off with some brief details of why i was appealing , Had a Letter from DWP confirming that they received my appeal, and about how much ESA i will get until it's heard, But so far over 1mth since requesting the full written statement of the Atos wca Form IB /ESA85, But so far i have not been sent it, The person that i recently spoke with from DWP ,Confirmed that they could see that i had previously requested it, but could not understand why i had not yet received it, What can be done to force them to supply this info,(assuming it actually exists) ?

- 389 replies

-

- abolition

- account

-

(and 80 more)

Tagged with:

- abolition

- account

- against

- answer

- appeal

- appeals

- asked

- atos

- been

- call

- center

- chda

- claimants

- cofirmation

- complete

- current

- diaries

- discriminate

- dla

- does

- doom

- duplicate

- dwp

- esa

- esa50

- ever

- evidence

- fast

- few

- gave

- has

- hasn

- hmtcs

- hold

- ineptness

- information

- issue

- jsa

- know

- legistlation

- mandatory

- maximus

- med

- mislaeding

- pip

- plan

- points

- possibilty

- programe

- questions

- recent

- recieved

- reconsideration

- record

- regarding

- regs

- report

- request

- results

- rules

- say

- scale

- scored

- sending

- some

- sor

- stictched

- stopped

- template

- them

- thinking

- tracked

- transferring

- tribunal

- tribunals

- tribuneral

- virtual

- visit

- wca

- wrag

- written

- zero

-

Just wondering about this: As a part of an investigation at work, one of the emails sent to me by the case investigator was mistakenly sent to a person in the NHS trust who isn't part of the investigation. Does this constitute a breach of confidentiality and/or data protection?

-

I think my landlord or someone else may have entered my property without my permission and this has made me feel very uncomfortable. Obviously at this present time it's just a suspicion. I think this because I have a coin meter for my electric, it doesn't seem to read the amount of coins entered well but it says not to exceed 80 coins. I have been in this property over 7 months and at a guess I have probably put in 150-200 coins and it doesn't sound anywhere near full, leading me to think someone might have let themselves in without my permission to empty it and I don't know how many times they have done this if it is the case. I have emailed my Landlord to ask what the procedure is with the meter and that it's never been emptied since I have been here (to my knowledge) It will be interesting to see his response. What also concerned me a little was on Monday I heard 2 people talking and they were knocking on the door of the flat that's right next to me and the lady wasn't in, they let themselves in, after that they knocked on my door and I said just a minute as I had just got out of the shower and they said oh sorry wrong door, I found this very odd too. If people acting on behalf of the Landlord or my Landlord have been in here without my prior consent and without giving the required 24 hours notice, I feel it would make it untenable for me to stay here as not only is it a breach of tenancy but I would feel it's a breach of trust and a lack of respect, nevermind not obeying the rules of the tenancy. Thanks for reading.

- 94 replies

-

- accommodation

- entering

-

(and 10 more)

Tagged with:

-

I had the cabin components delivered on 8th January Due to issues with the base we did not start building the cabin 25th January We have now encountered a few issues with the build, and the company will only respond via e-mail and not over the phone which is dragging out the resolution of our queries At the moment the doors will not align correctly and are out of alignment by 8mm. We have now been told to put the glass into the doors as they will hang differently, but we cannot see that this will resolve the situation Now, we have found another problem in that all four panels of glass are scratched. The company have asked for pictures but this is not easy to get as the scratches are hard to see even with black card behind them. The company have advised that I signed for the goods at time of delivery as being in good condition, but there was no way you could check each item as there were hundreds of bits of wood as well as glass and plastic items. I would like to ask for some advice on what to do next? I paid by credit card so should I raise Section 75 for faulty goods if they won't replace the doors or glass

-

I live in a privately rented house. I have been here for just over a year, I recently requested the landlord whether I can install a few fixtures including a TV bracket on the bedroom wall. I also requested that a tap be fitted outside the house so that I can use it to wash the car, water the backyard plants, etc. I have offered to pay for all fixtures as well labour involved. The landlord has refused both of these. I would like to know whether I need to seek permission for every little thing that I want to do in the house, or if such requests only need to be made for major structural changes. Additionally, the tenancy has not been renewed since January 2018, when it was up for renewal. The landlord almost never answers phone calls, or replies to text messages. And the requests for the works that I've mentioned above had to be made through one of his workers who came by the house. Therefore, it seems to me that the landlord is specifically avoiding contact with me. I am not sure where to go with this, and to be fair, I am not sure that I wish to make any formal complaints, etc. He holds my deposit (not in DPS) and the tenancy agreement has expired. Does this mean the tenancy goes on to a rolling monthly contract? Is my deposit safe? Sorry for the long post!

-

Hi all, Not sure if this is meant to be on the online retailers as it was bought from Microsoft online but the online area seem to be more for eBay and Paypal issues. The issue at hand is this: Early 2016 I purchased a Surface Pro 4 specced fairly high (i7/256gb ssd/16gb ram). On the whole, it's been ok - there have been the various bugs that MS have been fairly quick to resolve and overall what I wanted has been ticked - a tablet style laptop without all the restriction of performance. Fast forward to December 2017 and the screen startedto play up. At this point I will say the laptop is in near new condition. It's always been in a case when "parked" and when used, it's on a desk at work in a non food/drink environment so not much to go wrong. And despite it being a tablet, I rarely actually use the touch screen functionality. Issue with the screen is crazy flickering/shaking. I ignored it initially thinking it was software related but having done a full reinstall and drivers etc, it was still happening. 2 days ago, it got worse...to the point that it became unusable. So I looked on the forums etc and to my suprise, it's become so well known, there is a dedicated website - no other than flickergate.com Every single example on there is the same as mine and they claim around 1600+ customers have signed to say they suffer from it too. The general consensus is it happens generally after the 12 month warranty MS supplies and is most likley heat related. Sure enough mine has started to warm up a fair bit - especially the screen. As this is a sealed unit, not much can be done to keep the fans clean apart from a blast of air but I suspect this is not the issue as the fans rarely kick in when the screen starts to flicker. So why am I here? Well it turned out I had purchased extended cover on this and so it will most likely be a swap out and everyones happy....or are they. a large number of people have stated the replacement units are also doing this - some immediately and some after a while. With the cover running out at the end of Feb, that does not leave me with confidence. So given: 1. This is a known issue though MS refuse to accept this 2. A replacement in my case will be given but will most likely have the same issue either soon or later on in it's life 3. There is no current fix as this is hardware related and most likely to do with the design What are the options? Surface Pro's are not cheap and this was a £1500 unit + the cover at £150 - Am I looking at potential hell should the replacement die after March when the warranty ends? PS: This was paid on credit card. Appreciate there is the consumer rights especially as this was purchased after the consumer rights act was launched but surely this can't be the only way? I'm not sure what I am asking for really - just advice on what one should do if the problem at hand has no fix and so this could be a vicious circle until warranty ends at which point I have a £1500 brick Is there an option in law in the case of the above 3 points to not get a replacement but get a pay out instead? Obviously not the £1500 ... Thanks all

-

I have a default with QQ dated 16/07/2012 it should fall off my file July 2018. Will it stay on my file after this date if there is still a balance on it or will it be removed regardless. Can they add another default at anytime?

-

I am sole trader beauty therapist who was approached by what I thought was a local doctors surgery rep offering advertising on the back of appointment cards. I agreed to meet with the sales rep who was acting on behalf of the Leisure Medical company handling the advertising and he came to meet Me at my home. The advertising seemed like a good deal at £295 for 2 years advertising & with over 2000 cards being printed I agreed. The rep filled out an order form/contract which was attached to his business folder/notepad. The spring clip covering the wording “This is a minimum Two Year Agreement subject to the terms & conditions herein” The sales guy was ‘lovely’ talked me though what happens next that I would receive full details through the post. I duly signed for £295 & paid £156 deposit by debit card. Now the sales guy filled his name and signed and I was handed a folded piece of yellow paper (my copy) in 4 with a paper clipped business card attached to ‘keep safe’. A couple of days later I noticed the deposit had been taken yet no correspondence from the company, I emailed the email address saying I had not heard from them. A week or so later I received artwork. A few days after that I got a letter from my bank saying they couldn’t set up he standin order as the collection was infrequent, and this rang alarm bells! Next day I get a letter from this company Leisure Medical saying they couldn’t collect Payment £156 was due in 7 days. I didn’t like the tone of the letter I called them & was told you signed a contract you’ve got to pay up and I owed £156 immediately plus another instalment of £156 plus £95+ VAT! This was not the £295 on the contract! I dug put the paperwork only to Find there was a whole list of T & Cs on the back that I was not shown and was deliberately kept from seeing! There was also £195 faintly added on which was not on the contract when I signed I think the sales rep added this on when adding his signature. Ive since stopped any debit card payments from being taken and googled the company only to feel Sick to my stomach that there have bad review after bad review saying they’ve conned people, they change the amount etc. etc. My question is although I’ve signed a contract business to business do I have any consumer rights as A) it was signed in my home & B) I’m a sole trader beauty therapist.

- 4 replies

-

- advertising

- dodgy

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.