Showing results for tags 'holdings'.

-

Evening all, Since around May this year I've received a shocking amount of post related to alleged debts against my name, I binned most thinking the sc@mmers would get bored... tonight I've just had somebody knock at my door saying he was from Robinson Way debt collectors, I played dumb and said we were not who he was looking for (with a mouth full of tea and my youngest on hip). He said he'd have my addressed removed from the system, I know he wont, I also received a call from them a number of weeks back... where they got my number I'll never know. Now... when I was 19'ish (wrong side of 30 now) I did run up some debts, paid the majority off but moved up and down the country alot with college/uni etc and not heard anything since, in 2010 I bought my own house, with only myself on the mortgage, never been denied a credit card/loan and not heard of anything for YEARS. I've googled the companies in the subject which has led me here... I have three seperate account numbers 'owing' three separate amounts.. .strangely the lowest amount one has had the most mail, some dated the day after the previous letter was dated?!?!? having read alot of the links google has supplied from here, there's alot of dead links to letters i should be sending to ask said companies to prove the debt is mine... .I'm sure the forum gets alot of these requests, and I do apologise. also, I've checked my statutory credit file with 3 agencies and none of them have a record of these alleged debts. Had I been prepared for this visit I could have handled it better and found out whats going on but, i didn't - and i don't want my wife having to deal with these people - whilst he was non threatening/abusing/confrontational - its not what I want. attached 3 letters with all barcodes/details deleted. any and all help appreciated and will update as and when...

-

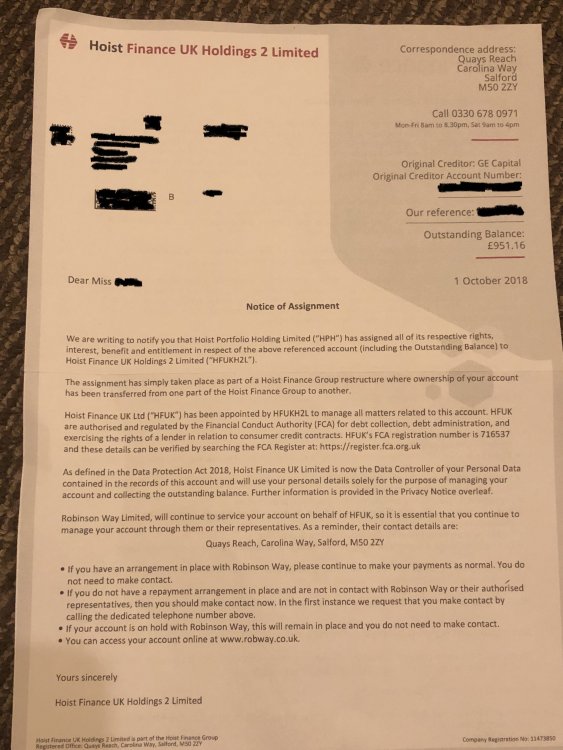

What is the difference between Hoist Finance UK Holdings 2 Limited and Hoist Finance UK? I have already a repayment plan set up via Robinson Way but got letter of it transferring from Hoist Finance UK to Hoist Finance UK Holdings 2 Limited (I dont know the difference???)

-

My Wife received a letter from Hoist Financial UK Holdings 2 Ltd concerning an alleged debt that my wife has with GE Capital. I have attached a copy of the letter and there are a few points I would like advice on in terms of how to proceed. 1. My wife has got no recollection of the debt in question, although she did say she once had a debt relief order, this order is coming up to 20+ years ago. 2. The letter was addressed to her in her maiden name (we have been married for 5 years and in a relationship for 6 years) and in all the time we have been together she has never had any letters from Hoist or Robinson Way who are mentioned in said letter. Should we write to them asking for proof of alleged debt, or should we just ignore the letter as it is likely to be a phishing exercise. Also should we report said companies to the ICO for being in breach of DPA as their information is very out of date as they wrote to her using her maiden name. Many thanks

-

Our son owes many fines and court fees etc. He hasn’t lived at our house for 6 years but always gives our address. Today two people from Marston Holdings came round today with a court warrant to take goods to value of £550. They accepted that he doesn’t live there but said as our address in on the warrant they will come back in the next two days (with a locksmith) and take goods to that value which will be stored for 5 days and returned only if we can provide receipts. They said the only way we can stop this is to pay the fine. Any advice on how to deal with this would be gratefully received.

-

Hello, Today someone from Marston Holdings came to our property for someone who no longer lives in the UK. He was a family friend of ours and used our address without our permission nor knowledge. They are after a Magistrate Court fine. My mother answered the door. Mother doesn’t speak English so she woke up my brother up who was unaware what was going on and shut the door on the person telling him that he doesn’t leave here. A removal notice was left behind saying that they are now going to take our stuff from us. I called the number from the removal notice and spoke to the person who authorised the entire thing and after explaining to them what happened and he said he can’t doing nothing but prepare for our stuff to be taken. His giving us 72 hours from Monday to prepare... He was rude and unfriendly and wasn't trying to reason to with me. He said that because my brother shut the door on him and didn’t provide ID’s, he nows has ‘enough evidence’ that the person does live here. Now we are going to lose all of our stuff because a) someone used our address without our permission and knowledge and b) my brother shut the door on the bailiffs telling him that he wasn't living in the property. We don’t have receipts for most of the items. What can I do? We do not know where this guy lives and we do not have any contact details... We are a family of 6 and this will cause a lot of stress. This is the first time we are dealing with bailiffs.

- 43 replies

-

- county court

- enforcement

-

(and 4 more)

Tagged with:

-

I've trawled through the threads and got some information, but I could do with something more specific now. The story is fairly long, but perhaps if I ask the questions in the right order, then depending on the answers, much of it might become irrelevant. I got a claim form from Howard Cohen Solicitors, acting on behalf of Hoist Portfolio 2 Holdings Ltd. (I gather both are well known to caggers) for a dubious old bank debt, much of which is fees and statuary interest. They claim to have had the debt legally assigned but have not furnished proof. As a second point, I have mental and physical disabilities (I won't detail here) and have written to the court for an extension of time. They have effectively granted me another 7 days to file a full defence (ie 13th March) and this is now triggering anxiety responses. Quick question: can I do anything straightforward in that time? (if not, I'll go into more detail)

-

Can you help ? My daughter has been informed by our old next door neighbour that the current occupants of our old address have passed to them a Final Notice which was delivered to the address yesterday by an enforcement agent from Marstons. It states that their client is Highways England. The notice states that "despite previous notices and attendances I shall attend to take control of goods and remove for sale by public auction"............ Balance due £425.50 My daughter left that address probably two years ago and I left about eighteen months ago. Neither of us have received any other mail / notifications / phone calls or any such contact relating to this unknown issue. I had mail forwarding for three months but received no related documents. As it mentions Highways England I presume it relates to a traffic offence maybe ? On checking my daughters vehicle documents I can see that she has over looked the updating of the address on her vehicle log book, which would explain why they have approached that address. Presumably there has been previous correspondence which has not been forwarded. The notice although addressed to my daughter and sealed, has been opened so that the owner of my old address as well as my old next door neighbour have viewed this document prior to it reaching us. Before we make contact with these people, what should I be aware of and what are our rights regarding the final notice ? Any help would be much appreciated. TIA

-

Hi all I am so stressed and with nausea right now please help!! In 2009-10 a 10 yrs relationship broke down badly leaving me with a heap of depression, fallen company, stress and debt which was mostly under our personal names. Sorted some of it out such as car debt and mortgage but this credit card debt was completely untouched and i never responded to any letter/call what so ever from the beginning. The debt was a barclaycard...apparently the value is £4867 plus interest etc claim form arrived for £7197....I am beyhond worried. This barclaycard debt is now around 6 yrs of no payments except i dont know exact dates. I have not kept any paperwork of the debts at all. I have literally moved about 6 times since and over the last few years the mail for debts has stopped soming through. In 2010 around this time would have been my last payment .It says the debt was legally assigned by MKDP LLP but i could swear ive seen a letter about a year ago saying it had changed over and offering a lower payment i think about 1000 or something but i didnt keep the letter and it was not from this company either it was lowells i think. There had been hundreds of letters from various debts and although the others have definately fallen past 6 years this is the only one i kept on paying the minimum on direct debit for longer until end of 2010. I then cancelled all the direct debits and left the account. The name on the form is not my full name either its my first name and one of the surnames. My surname is composed of 3 diferrent words. Having moved several times and changed to a basic bank account due to not wanting credit etc ive lost all the information. On top of that i have since gotten married and added my husbands surname to my existing name. Help there is no way on earth i can pay this £7k even with a decent job, after maintaining my house and family (have a toddler) 1. Im assuming this is not a fake letter it's not in blue its all white and poor quality - it says in the pack is admission form N9A - defence and counterclaim N9B - acknowledgement of service 2. How would i even know these figures are correct...they are claiming interest since 2012? 3. I have never received a notice from them they are supposed to serve this right? 4. None of the letters have said anything about this company Hoist Portfolio this is the first i heard from them....many other companies ie lowells but not this one 5. Can they really own the debt i think various other companies have written to me about the barclaycard Please help with some advise where from i go from here?

-

Hello. I am new to this and sure not what i am doing. I have never used a forum. I have recently recieved a letter from the above which has now followed by a statement of means for £8, 506.74. This i believe has something to do with Abbey National which is now Santander. I originally had an overdraft for £250,only. How this has got to this is through i guess bank charges. I have no records of the original overdraft or any paper work as i no longer bank with them. I have ignored them as i was told that the letters are just threats. I could never pay this back as i work parttime and feel that they have taken advantage of the situation. The court letter seems weird as it comes from local court in my area and then has big red stamp saying return to basildon. Really worried and stressed as i have only a day to send it off. please could someone advise as i dont even know if i am doing this right and where to find the reply should someone advise me. Very new to this Regards and thankyou.

-

Hello I signed up, many years ago, for a tradepro account/ credit card. I was approached in the street and signed a credit agreement in March 2006. The amount i spent on this card was approximately £2800. I made payments and then unfortunately lost my job. This is when the fun began. I tried to be reasonable with this company and they eventually took me to court in 2010. I stupidly didn't attend although i did try to defend by letter and judgement was granted. They then proceeded to place a charging order/ restriction on my house. They then passed the debt on to Marstons debt collectors - who added charges, costs, visits to this debt and it totalled approx £6000 in the end. They threatened to take my car, frightened the kids to death . I managed to get tradepro to call them off and the last letter i had from them was in june 2011, a statement of account saying i owed £4100. I have not had any contact since and have been too scared to do anything other than worry about the charging order and then all of a sudden i get a letter of assignment from Hoist Portfolio and a debt collection letter from Robinson Way asking for payment. Im not sure where to go from here. Please could i have some much needed advice?? Thankyou in advance.

-

Hi all, I am hoping someone can kindly help here. I received a Northampton County Court Claim form today from the above claimants for an old Barclaycard debt that has been passed to MKDP and then these guys. The claim was issued on 01/03 I filed the AOS online today via MCOL, with the intention of defending the claim in full. The POC is as follows: 1.his Claim is for the sum of £9699.45 in respect of monies owing under an Agreement with the account no. XXXXXXXXXXXXXXXX pursuant to The Consumer Credit Act 1974 (CCA). 2. The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 3. The Defendant has failed to make contractual payments under the terms of the Agreement. 4. A default notice has been served upon the Defendant pursuant to s.87(1) CCA. The Claimant claims 1. The sum of £9699.45 2. Interest pursuant to s69 of the County court Act 1984 at a rate of 8.00percent from the 7/02/12 to the date hereof 1480 is the sum of £3146.33 3. Future interest accruing at the daily rate of "2,13 4. Costs In total, they are claiming over £13k.... Long story short, I was made redundant from my job and I was out of work for over a year - as a result I ran out of money to keep up my credit card payments and ultimately could not keep up the payments and stopped paying altogether. I buried my head in the sand somewhat and hoped the problem would go away, stupidly. If someone can guide me through what needs to be done next and what letters/forms need to be sent next, I would really appreciate it. I am so worried that bailiffs will come knocking on my door - I don't even know where to start with defending this.... Any help or guidance you give will be most appreciated.

-

Good Afternoon guys, Im in need of some assistance if anyone has a moment? I recieved a hand delivered 'Marstons Holdings' Notice this morning, but information was very limited. I spent the morning calling around all my utilities, as I'm not aware of any debt! In my calls, I had discovered that I owe Income tax for last year, which comes to £545.20, but the HMRC are 'unable' to tell me if the debt has been passed to collectors, and that I should contact the enforcement agency directly to find out if it is indeed for income tax. (being that its the only debt I managed to find today) Now if it is related, I am more than willing to pay! Just I have not recieved any correspondence. No collection warnings, no prior notice. Just an outstanding amount from the enforcers for £855.00 ( with a implied £210.00 Charge for a locksmith!!) So HMRC will send my Paperwork again, In the meantime, I am unsure of what to do? I obviously would like to keep the Enforcer out, and pay the source. But I'm pretty sure it doesn't guarantee they will go away Does Anyone have any advice on next steps? Kind Regards Sim

-

Hi I am the executor for my late mother's estate and we are in the process of selling her house. We have hit an obstacle in that there is a secured loan which was paid off in the early '90s but it is still listed as outstanding on the title deeds. The loan was with Cedar Holdings Limited, which is now a dormant company and comes under Black Horse Finance Management. I have called them today and been given a number for their secured legal department in Cardiff, but the number is constantly engaged. We are trying to get proof that the loan has actually been repaid, can anyone give me any advice on the best way to take this forward, apart from trying to call them constantly? Any help would be greatly appreciated!! Thank you!!

-

As per a previous post Cash Genie/Ariste Holdings are currently close to entering Administration (confirmed by the FOS). On the off chance I complained to FOS stating my loans were mis sold. These dated back to 2011 when I was in a financial mess. Id pay the loan on the 28th pay day and then due to having to pay it, take another one out literally a few days later. I did this 4 times. Now Cash Genie/Ariste Holdings have written my final debt off (I owed £473) as they admitted there was no cooling off period in between loans being paid and re taken out. :-):-)

-

We have received a N149B (notice of proposed allocation to the Fast Track) from the county court business centre with a questionnaire attached to complete and return. We must reply by the 27th April, the debt is for a Sandander Loan taken out in Oct 2006, but we have received a Claim from Hoist Portfoilio Holding (Solicitor Howard, Cohen and Co). I replied to the Claim on moneyclaim, and also wrote to Howard Cohen with the Status Barred letter. How to I need to act as regards to the N149B??? I am completely in the dark now Thank you Molley

- 51 replies

-

- allocation

- fast

-

(and 6 more)

Tagged with:

-

Hi, Looking for advice here as Forrester UK Holdings continually asking for money we do not owe. Basics are: credit card terminal rental/lease in 2003 for a 4 year minimum period from Hypercom and we then continued after the 4 years paying quarterly rental as required. Repeated requests from Forrester UK Holdings to renew for another four year lease with new machine saying machine not compliant and was going to break down and they couldn't service it. As they no longer offered support for the machine. November 2013 the credit card terminal developed an electronic fault which Forrester said they could not fix or repair and we required to hire a new terminal and it would be for four years minimum contract. We told them no thanks and that we would move to an online virtual terminal with other provider and they could arrange uplift of the terminal. Forrester then sent us a request for more payments (for a terminal which was faulty) and that we were required to send it back. We sent it back recorded and signed for and Forrester saying they don't have it despite us having proof of signature at their end. We told them it was now harassment with repeated calls and really rude on phone to whoever answers call. Tonight they then send email now demanding and extra £500 for the terminal as it has been returned and is faulty stating they do not accept faulty terminals back. This beggars belief - so we were renting a terminal from them, it develops an electronic fault they say they can't repair and want us to pay for the faulty goods they have been renting to us that doesn't work. They keep calling every week sometimes a couple of times. How do we get them to back off? Or do we just ignore them? Also read something elsewhere that they didn't have a credit licence to rent us the terminal in the first place -is this right enough? Thanks again -

-

Ok, so I took out a loan two months ago with Cash Genie, (Ariste Holdings), the repayment dates were as follows last day of november last day of december Now, Ariste Holdings has taken out £200 from my account today, 14 days ahead of the scheduled repayment date, which just happens to be the day before my rent is due (how fun) Does this count as an unauthorised transaction? Is there anything at all that I can do about this? Surely they can't just take money as and when they want to? Thanks

-

We have recieved a post card from cfs holdings saying they are doing a home visit tomorow (Weds) is this just a threat or will they it is for my step son who has mental health problems this is for a capital one debt that he cannot afford to pay much to being on benefits.any help would be great thankyou

-

Hi Requested an SAR first week in Novenber usual £10 fee enclosed needless to say Cap One did not honour the request and since then have sold the debt to CFS Holdings. Received a phone call from CFS last week re the debt with Cap One I explaned that an SAR was sent to Cap One in November, when the caller heard this he became anxious and started to stammer and really had no answer. Following this telephone conversation the SAR arrived two days later. I have had numerious calls from CFS and also letters the most recent came this morning in the form of a card informing me that someone will be calling on Wednesday between 9am and 9pm also received a phone call from CFS this morning when I explaned about the caller coming on Wed they knew nothing about this. What do I do I have not had an oppourtunity to go through the SAR. HELP. Dessie

-

Hi all , I have a defaulted barclaycard account which was sold to MKRR recently, ouststanding balance about £4500. I have been passed from one dca to another over the number of years that i have had this account set up payment plans then things have happened so they havent been stuck to, it then goes quiet for a few months and then seems to get passed to different dca i have received 3 letters to date first 2 were to inform me that barclaycard have assigned and transferred my account to MKDP LLP etc the third one i received today from MKRR asking me to contact them to set up payment plan quite a nicley worded letter and very non-threatening actually ! Having read all the posts on MKRR im slighlty curious about exploring the possible loopholes that might be avaliable to me not really sure about what is the first letter to send to them and quite nervous about what is the impact of going down this route if it is unsuccessful

- 53 replies

-

- barclaycard

- hoist

- (and 6 more)

-

Just a heads up that yet another entity connected to the Larholt gang ,Web Loans Processing Holdings Limited also registered at 15 Lyndhurst Terrace has recently been set up with the named directors being the rather unnatractive(solely my opinion as i have seen a photo of the guy----urghhhh) Jordan Taylor and Kim Child. No doubt this will be used to fold another of their entities into once the time comes.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.