Showing results for tags 'halifax'.

-

Hi I made a claim for Mis-sold PPI to Halfifax for my CC. Initially used the FOSCI spreadsheet. Wasn't expecting any uphold, however, just received a letter upholding the claim. However, the offer is 1/4 of the amount. I've now got all the statements, so going through to use the FosRunning spreadsheet instead, so I can back up my reasons for their offer being too low. My issue is that over the life of the CC, the interest rate has changed 10 times. How do I incorporate that into the FosRunning spreadsheet? Thanks in advance for your help. CookieRocks

-

i sent a cca request to the halifax i have a personal loan with them which was taken out online in december 2011 i have some concerns what they have sent me tbh on the front of the "agreement" it states "BANK COPY" there is an incorrect address on the agreement, i know the interest is incorrect but most importantly of all the agreement has not be signed by hand or has not been ticked electronikally in fact there is no signature box at all the default for this is due to come off credit file next year i've not made a payment since july 2015 i have sent the bank a detailed income and expenditure and asking to write the debt off on hardship grounds, the bank has not replied they are aware i am a vulnerable household due to various medical problems, so i can't work to pay back the monies owed any advice please?

-

Hi I sent a SAR to Halifax on 13th December but have so far received no reply. Is it advisable to send them a letter regarding this? Other creditors were sent SAR's the same time and I have received them. Many thanks

-

Hi, I have an outstanding £6000 debt on a Halifax credit account which I've been paying £5 a month towards consistently for the last 5 years via standing order. Just before Christmas I received a letter from Hali stating that Lowell Financial are now the debt owners and that payments they receive from me for this debt will be forwarded to them (Lowell). I then received an introductory letter from Lowell saying pretty much the same and that they will continue to accept my current payment plan, unless I can afford more. They asked me to contact them via post, email or phone. I didn't feel the need to touch base with them as I've continued to make payments and I had nothing to say. I've recently received another letter asking me to get in touch, again saying they won't ask me to pay more but now asking me to pay them directly. On the back of the letter has their bank details so I could just amend my standing order to pay them instead of Hali (I've not done that yet). My questions are, should I write to them? Although I don't actually have anything to say, and should I pay them directly? Instead of waiting on Hali to forward my payments? Ultimately at some point in the future I would like to be in a position where I would be able to make them an offer in full settlement of the debt. At the moment that's not an option but something I plan on working towards. I hope I've covered all bases. Any advice would be greatly appreciated. Thanks x

-

Hi all, I took out a fixed rate mortgage with the Halifax a few years ago. I had previous been on a fixed rate with them which came to an end, but decided to renew based on their advice. At the time I specifically told them I would be looking to move house before the end of the fixed rate and they assured me this was not a problem as I could port the mortgage. Low and behold when it came to moving they wouldn't allow me to port the mortgage as I didn't meet the additional lending criteria. As a result I had to go with another lender and incurred £3k + in ERCs. I complained to the Halifax and the financial ombudsman, on the grounds that I took out the product on the promise that I could port. Unfortunately my complaint was not upheld. I now feel I am left with no other option but to make a claim via the courts. Can anyone offer any advice as to whether my claim stands any chance of being successful? Thanks in advance

- 1 reply

-

- claims

- county court

- (and 4 more)

-

Hi I defaulted on an overdraft with Halifax about 4 years ago, the account kept going round in circles with Halifax charging me for going overdrawn which was putting me back to be being overdrawn or no access to funds. I tried to fight them on it, but they were not budging and i got tired. I stopped using that account and got a new current account and have never looked back. However, Halifax have never contacted me about the debt, I have moved twice since and looking at my credit file it seems they have sold the debt to Cabot and has my current address. Cabot have never contacted me either, no emails or letters. I was thinking of sending a SAR to halifax to see what charges have been added on, what correspondence they think they have sent and the balance when it was sold to Cabot. Before I do that though, i wanted to ask if anyone else had any better ideas of what my stance should be. Thank you in advance

- 3 replies

-

- apparently

- cabot

-

(and 1 more)

Tagged with:

-

I took out a Unsecured Personal Loan with Halifax online in December 2011. I was NEVER asked questions like, can you afford the payments, are you employed/unemployed, and I certainly was not asked about my income. This have got so bad I am currently on an IVA - Halifax increased the IVA from 5 years to 6 years forcing me to pay for longer. I am now wondering if bankruptcy is the best option. Do I have a claim that Halifax lent to me irresponsibly without going through my finances first?

- 217 replies

-

- 2007

- adjudicator

-

(and 45 more)

Tagged with:

- 2007

- adjudicator

- agency

- agreement

- agreements

- april

- cca

- collection

- complied

- disappeared

- dispute

- don

- enforceable

- evidence

- financial

- found

- halifax

- harassed

- has

- incorrect

- irresponsible

- lending

- letters

- limited

- moorcrof

- ombudsman

- personal

- recovery

- reply

- response

- rossendales

- say

- section

- service

- shows

- sign

- space

- stance

- still

- stitched

- template

- unaffordable

- unenforceable

- was

- waste

- whats

- write

-

HI ! ADVICE PLEASE I have a secured loan with the Halifax, currently owing approx £15k Until approx 9months ago, I had no problems with my repayments, which were £176.00 per month. Due to the current economic climate, I found I could not make these payments as I should on a regular basis. I wrote to them explaining my circumstances, using the letter templates on this website and enclosing a budget sheet. I offered them £41.00 per month; to which they refused to accept and told me that they would accept £160.00 per month. I asked them to reconsider and in the meantime, I`m paying them £10.25 per week, I`m still awaiting their response. I have just had an "agent" of theirs at my door - so I told him that I do not discuss such private and confidential matters on the doorstep and that I would only communicate in writing. I then reminded him that since he was on private property uninvited, he should close the gate on his way out. :???::???:What should I do......more to the point, what can the Halifax do:-?:-?:-?:-?

-

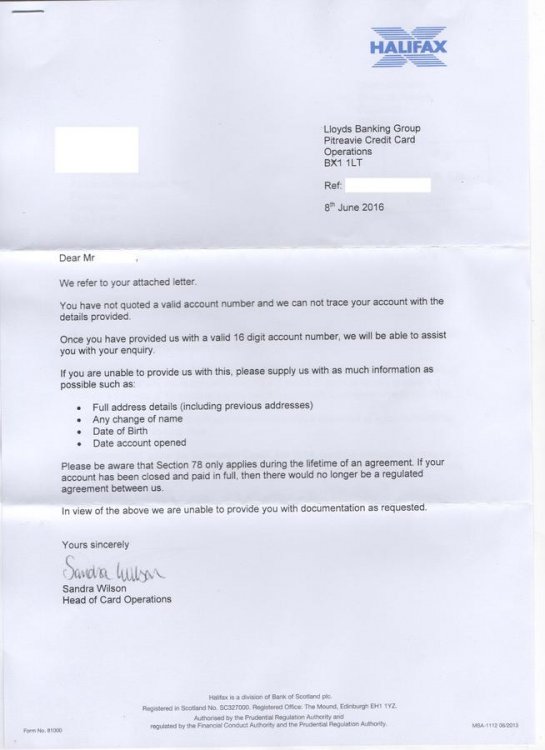

Received this in the post today Along with my original CCA letter. Any advice? I dont know what details they have as I have moved a number of times since then. If it was a credit card I would have thought capquest would have the details Just double checked on my Noodle account. It is listed in my closed accounts (if it is that one) and is shown as settled in Dec 2010 with no missed payments. Edit: it cant be that one on the account as my card limit was £1000 and have been paying £6.52 for years and my outstanding balance is shown as £1211.14 and the account is settled properly. Edit 2: Is it worth doing a SAR with CapQuest to see what they have on file and amounts?

-

Hello, its been a while since i've been here. Just looking for some advice. An old Halifax debt which was being handled by DrydensFairfax Solicitors and which I have been paying at £5 a month for ever, it seems, has been passed by them to Westcott. I just wanted to know if it is reasonable to send a CCA request to them before I change where I send the payment?

-

Hi, hope someone can help me. My dad passed away the end of august with nothing, no estate or anything, only £300 in his bank account. He had 2 accounts with halifax one with an overdraft of £300 which he had maxed and the other with £300 of his own money. We had the funeral and applied for a dwp funeral grant which they have given us £815 for the cremation and £700 for everything else but have taken £300 off because that is what he had in his bank account. the thing is halifax took this money to pay the overdraft on his other account. When we applied for the grant we included cofirmation from halifax to say that they were taking his money to pay the overdraft. Dwp say they shouldnt have taken it because the funeral is the first thing to be paid off and not his debts. now we have to find an extra £300 on top of what we already owe to the funeral director. Can halifax do this, are dwp right in what they are saying? Thanks for any help in advance

-

Name of the Claimant ? Cabot Financial (UK) Limited Date of issue – 31/10/2015 What is the claim for – The Claimant claims payment of the overdue balances (set out below) which the Defendant(s) have failed to pay as required under contracts with the following particulars acc no XX9 and acc no XX0, between the Defendant(s) and Halifax dated on or about Jan 30 2006 and Jan 13 2002 respectively. The contracts were assigned to the Claimant on Aug 31 2012 and Aug 31 2012 respectively. PARTICULARS – a/c no XX9 a/c no XX0 DATE ITEM VALUE 01/09/2015 Default Balance 8500 01/09/2015 Default Balance 7500 Post Refrl Cr NIL TOTAL 16000 What is the value of the claim? £17000 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? 2 Credit cards with the Halifax When did you enter into the original agreement before or after 2007? Both before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Account assigned to Cabot who issued claim in October 2016 Were you aware the account had been assigned – did you receive a Notice of Assignment? Unknown Did you receive a Default Notice from the original creditor? Unknown Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Ran out of money so stopped DMP What was the date of your last payment? June 2014 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? Yes, I was in a debt management plan from 2008 to 2014 I submitted my defence in November 2015, as follows :- “The Defendant contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR 16.5 (3) in relation to any particular allegation to which a specific response has not been made. The claim is denied with regards to two amounts due under two agreements. On receipt of this claim I requested by way of CPR 31.14 and Section 78 of the Consumer Credit Agreement Act 1974, copies of any documents referred to within the Claimants particulars to establish what the claim is for. To date they have failed to comply to my Section 78 requests and remain in default with regards to my CPR 31.14 requests. Both requests were delivered by recorded post and signed for. The Claimant/Solicitor has been unable to disclose any agreement or statements on which its claim relies upon. It is therefore denied with regards to the Defendant owing any monies to the Claimant, the Claimant has failed to provide any evidence of assignment/balance/breach, therefore the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreements; and (b) show how the Defendant has reached the amounts claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim; (d) Show how the agreements were legally terminated to allow the claimant to request relief. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed. On the alternative, as the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the Consumer Credit Agreement Act 1974. By reasons of the facts and matters set out above, it is denied that the Claimant is entitled to the relief claimed or any relief. “ Yesterday, almost a year since I submitted the above defence, Restons have written to me threatening to Strike out my defence. A Credit Card Agreement photocopy from one of the Credit Cards has been attached to their letter, as well as a thick wad of computer printouts. RESTON OCT2016 PAGE1.pdf RESTON OCT2016 PAGE3.pdf RESTON OCT2016 PAGE2.pdf

-

Halifax loan TWO Loan amount then was £12,500 repayble at £263.81 over 86 months total repayable £22,687.66 This loan was taken out to repay other loans and credit cards/overdrafts built up my gaming machines. Managed to keep repayments up for a very short while, due to gambling and other financial difficulties. Defaulted 2010 which drops off my credit files next month after six years Paying reduced amount via debt collection campany Marlin group. Wrote informing of pending problems, interest was STOPPED straight away, and few charges for late payments collection fees were refunded, lowering balance. Balance due dropped to less than £13k after interest removed, now stands at £9,729 after six years no problems with debt collection companies, all accepted reduced payments without hassle. None of the Halifax loan accounts have threatened court action, infact very little contact from them at all, just yearly statements, during the last six years. SAR will get posted as per other threads written tonight to Halifax in relation to all accounts held, and up dates will be added when arrives. Thats all debts on threads tonight and will be up dated after getting replies from all CCA's and SAR As DX100uk mentioned in other threads written by me, irresponsible lending due to issues of gambling and accounts show such, possible route of such will be looked into over next few weeks. cheers DX100uk

-

Have had 3 or 4 calls recently from cold callers working for Halifax. When you answer phone it goes dead or they ask for you by name and then ring off. Has anyone else had these calls which are to get your feedback for service received. Are Halifax allowed to give 3rd party your contact details ?

-

Just a very quick question, I am trying to establish who is collecting one of my debts, over the past year this debt has been passed through four companies, listed here, Westcott, first source, cap quest, Debt Managers, I have been paying monthly to clear this account, when suddenly no one wanted to own up to holding this account, so I sent a letter stating I wanted this account placed on hold until such time someone stated in writing they are collecting on behalf of the original creditor Halifax. I sent all the companies the Credit agreement request and £1 postal order, non compiled with this request, The company Debt Managers Limited TODAY wrote there have sent the account BACK to cap quest and that they have closed the account at they end. I am now in the process of penning a letter to Cap quest to establish if they in deed do have control of this debt, and if payments should be sent to them. Is they any letter/template that would be suitable to send them, without costing me, as total is adding up in postal orders and recorded delivery postage. I just want to know which company is collecting this debt and who to send payments to ? cheers

-

Halifax Loan ONE Took this loan out at my loacl Halifax branch back in 2008 Amount of loan was £8,000 amount repayable £13,126.08 over 98 months at £136.73 per month £5,126.08 interest on total loan This loan was to repay another Halifax loan and credit card that was outstanding at the time (the money cleared the balances) Racked up by gaming as per pervious threads. Within a period of 8 months i started to struggle with repayments, before the account got defaulted in 2010 After letters back and forth, with respect charges for late payments default sums I was refunded part of all charges, which lowered the balance repayable through various debt collection companies. I on serveral occassions wrote seeking why the interest hadnt stopped been applied even after informing them of financial difficulties, The reply from HALIFAX was very confusing to say the least ad STILL remains such. The balance remains at £9,200 even after repaying £6,996 over the last six years. The Halifax state that the full interest is applied on opening of the loan account, however the statements i receive break this down monthly ?? confused yet... I have been for years. They continue to state no interest has been added since informing them. The last contact with Halifax, I wrote informing them I would repay the loan amount only £8,000 via the debt collection company, I got NO reply back. For the first year the payments been made didnt even cover the monthly interest, have statements showing such. Have been paying Iqor since 2011 and get yearly statements from Halifax No threatening letters or discounts offered, just odd reminder when i miss payment. Far as i am concerned i have nearly paid £8k amount borrowed and when such figure has been reached, The supposingly £5k interest well see what they do when payments stop. Although this account defaulted in 2010 I still managed to abtain another loan from the Bank of Scotland (see next thread) just before this one defaulted SAR request will go in post in morning and up dates will follow as when reply arrives. CCA also going to Iqor just starting afresh now SAR etc going in as per reasons explained. Default leave credit files next month after 6 years.

-

After discovering that I had PPI attached to an old Halifax mortgage, I put in a claim for miss selling. Today I had a telephone call from the Halifax in connection with another PPI with them that I knew nothing about. I ventured to enquired about my Mortgage PPI claim and they said that a letter was sent out to me on the 12th July 2016 explaining everything. Today is the 25th July 2016 and I have NOT received any such letter. The lady on the phone then read me the contents of the said letter outlining the reasons for the decline of the PPI. The ones that stood out were :- You had NO savings to support your mortgage payments in the event of sickness or redundancy. You needed PPI to cover sickness, redundancy etc. When the aforesaid "sale" took place I had been in my present employment with Royal Mail for 9 years and continued to work for them for a further 10 years until my retirement. (19 years in total). It doesn't take a genius to work out that a letter sent on the 12th of the month does not take 13 days to arrive at its destination even if it was 2nd class. This letter is still to arrive. At the time of the sale I had cover for sickness (6 months full pay, 6 months half pay) redundancy (12 months pay) and also death in service through my Royal Mail Pension. As far as I was concerned I DIDNT need PPI, being covered through my employment. I have the original paperwork in connection with this PPI and in my Personal financial Report it states :- No recommendations nee4ded From the information you gave me it seems you already have plans in place to meet the following or no need in the particular area * Protecting your financial security * Protecting for critical illness over and above the mortgage debt * Saving for the future * Investing your capital I had a secure job with Royal Mail and a statutory pension plan in place for my retirement which included a payment for death in service. Sick pay and redundancy pay. Why did I "NEED" PPI Was the Halifax right to decline my PPI claim. I understand that it was underwritten by Lloyds. Any information greatly accepted. Thank you

-

Hi All, Having the same run around as a lot of other members it seems, I used a claims company for some credit card PPI claims and saw it was an easy process so I decided to go after Halifax myself, I had records that we had three mortgages with them: 1) 1994-1997 2) 1997-2000 3) 2000-2007 June 00 - July 07 I didn't have all the details so called halifax - they first said we didn't have any mortgages with them!! I gave all addresses and dates. I had to go through some old credit files which gave me one roll number, then they found them all! what a surprise - at that point they confirm all three had poi - I asked for them to setup a complaint - I then had to prove who I was and supply other details.. This was done and they went forward with a complaint - I also found a document from our house purchase (3) which had a redemption figure and confirmation of the mortgage repayments insurance figure - £140.84 a month After about 8 weeks we got a cheque for £16,800 which already had tax deducted - the rate on interest is at 8%, they have said they the overall amount we paid towards the MPPI is £9,539.24 although I have the letter stating £140.84 a month ( just mortgage 3 ) maybe it increased as the years went on. They have put the interest at £9,270.90 based on the amount above and mention this takes into account the date we get paid back, maybe I have used the wrong PPI calculator but the figure I'm getting with interest is near £27k based on their figure of £9539.24, when I put in £148.284 a month its at £33.5k. Am I getting the working out completely wrong? The unbelievable thing is the wife said that doesn't sound right for all three mortgage's - we rang them up and they said, you have only made a complaint about the last mortgage - I said why would we go through everything listing all mortgages then only complain about one, they again confirmed the two previous had Mppi and set a new complaint process going - they even took our account details to hopefully make the payout quicker. 10 days later we have a letter dated 12th saying that they cant find any PPI on those two mortgages, the next day we have a questionnaire asking about why the PPi was taken out, did we claim etc. I called and said we had it confirmed that Mppi was across all mortgages and said we were even given a rough monthly cost when we put in the original claim, the lady let it slip that in the last few days all systems have been updated and old records could have been lost as its so old, I asked her to confirm that this could have deleted the details she said yes. I then said we have been in contact for two months and there must be a record somewhere, she asked me to send in any paperwork to the complaints dept! Great! Thanks for any advice.

-

Can anyone advise me please - if I fall out with Lloyds (which I am likely to do) and I have an overdraft outstanding - will funds in a Halifax Current account be at risk of Lloyds grabbing?

-

Can anyone provide the most up to date address for CCA & SAR for HALIFAX CREDIT CARD Not sure if the addresses i`ve found are up to date Many thanks in advance

-

Hi all, first time poster but long time lurker and admirer! I am a former Bank worker (not Halifax) so know a little about complaints procedures but now need your help. For background - My partner was formerly in an abusive marriage. Her ex was emotionally, financially and physically controlling. All of this is documented in court papers and he is not allowed to see my partner's child and has no parental rights. During the course of the relationship, the two of them opened a joint bank account with Halifax (before he became completely abusive). My partner's debit card was at some point confiscated from her by him so she had no access to the account. During this time he attended a branch, obtained a form and forged my partner's signature in order to obtain a £2750 overdraft limit on the account without her knowledge. She had no knowledge of this overdraft (which he maxed out in really short order) until after the divorce proceedings had begun and he had had a restraining order placed on him. Halifax began sending chasers for payment to my partner. She put in a formal complaint which was rejected by Halifax and followed it up to the FOS which was also rejected. Naturally she wasn't best pleased attended the local Halifax branch where the Branch Manager managed to bring a copy of the document she had allegedly signed up on his screen and showed it to her. She then showed him several other documents with her signature on and he confirmed that it was clearly not the same signature or even close. He promised he would look into it and get back to her. Unfortunately he never did. After she chased him twice by email, he just stopped responding. My partner suffers from severe anxiety and depression as a result of the marriage so naturally thought this would be the end of it and simply put it to the back of her mind. This all happened before I met her. The current - Fast forward nearly two years with no correspondence from Halifax to March of this year. My partner received a letter from Halifax confirming that the account had gone past its OD limit and they were now expecting payment of the £86.54 arrears from her. We wrote a formal complaint email to the CEO and requested a DSAR so that we could have a copy of the signature. This was picked up by someone in the executive complaints team and we've been going back and forth with them requesting confirmation that my partner is not liable for the debt (as it was taken out fraudulently by her abusive ex) for the last 4-6 weeks until yesterday when we received what appears to be their final decision. they've completely ignored our request for a copy of the signature (although we are still due to receive the DSAR within the next 4 weeks), completely ignored any points we've made regarding the financial abuse, completely ignored everything - and now the account is being passed to collections, a default is to be registered against my partner and she has been issued with a formal demand for repayment as the account is "jointly and severally liable". As a former bank worker myself, I understand this point but surely this is invalid if we can prove that she did not sign for the OD? WHAT DO WE DO NOW?! I feel like we did the right thing by only corresponding via email/letter and emailing the CEO direct but I just feel like Halifax are completely steamrolling us and insisting she pay this debt. We've tried the local paper (and told Halifax we are contacting them) but so far nothing. Any advice you guys can give would be really appreciated

- 16 replies

-

- abusive

- fraudulently

- (and 4 more)

-

this is about a Vehicle that needs around 3,500 - 4000 Costs in Repairs or a Full refund. its been over 2 Weeks since I sent the required Extra Information to Claims Team that they asked for . Today I received this email. "I have checked with management and your file is still under review and hope to have a decision to you by next week. Should you have any further queries, please do not hesitate to Is contact us." I Received this email about 6 Days ago "I am sorry to learn of the difficulties that you are experiencing with this merchant. Section 75 of the Consumer Credit Act 1974 covers purchases made using the card costing between £100 and £30,000, where a misrepresentation or breach of contract has been proven. Please be assured that a complete review of your claim is in progress and I will update you as soon as possible. " I was told on the Phone 7 - 10 Days it has been over that. Really not happy about the amount of time they are taking. Is there anything further I should do at this stage ? Its causing a lot of issues in the House and costing us money. I am planning on going Small Claims Route if I need to. as I am pretty sure it is clear cut case It has been just over 4 weeks since Lloyds where made aware of the Issue. .

-

Hi all Just need a clarification around the statutory time limit for responding to a S77/78 CCA Request. Halifax have been chasing for a couple of years on an alleged credit card debt. In the last 2 years this has bounced backwards and forwards between them and Blair Oliver and Scott and is now with our old friends Moorcroft. Moorcroft have sent a fair few of their automated threatograms, from their "Pre-Court Division" and now from their "Home Collections Division". I have responded to that with a "you do not have my permission to send anybody round" plus a S78 CCA request. The CCA request was dated Monday (4th January) and posted by SD the same day. Due to the weather it was not delivered until this morning. (I am getting my money back from the Post Office!). my question is when does the clock start ticking and for how long? Is it 12 calendar or 12 working days? And from when? Monday when it was posted or today when they got it? Thanks

-

I had an outstanding amount for a Halifax Credit Card after I defaulted when my dad died some years ago and I was also made redundant. I paid this off over 5 years only to then be told that I still owed them over £1000 as this was for fees. I disputed this and it was when I disputed it I found out that I had in fact had PPI on the credit card when I demanded copies of my statements. I went into a branch of the Halifax with copies of everything and was told by a staff member that I shouldn't in her opinion be paying the fees (PPI should have covered everything but I was in a very bad place at the time and didn't realise I actually had PPI). She took it to her manager who agreed. I was advised to put everything in writing and told there was no reason I couldn't stop further payments as I shouldn't owe them. I asked what would happen if I stopped any payments and was told they would probably send demand letters s o I decided instead to drop them to a token £1 just to stop any threatening letters in the meantime that the complaint was being looked into as it was too stressful. While I was there, it was also established that a previous loan I had had and paid off had also had PPI on but they had refused to pay out on it when I was signed off with depression as it turned out I wasn't covered. This forced me to use the credit card to try cover repayments at the time. I was advised to lodge a complaint about that too - which I did as when I took out that loan the lady who sold it to me told me it covered me for illness. The Halifax wrote back and accepted responsibility and refunded me the PPI. However, they didn't accept it for the credit card. They have ignored the fact completely that I did have PPI on it until I defaulted when I was made redundan t and dad died and continued to demand the fees were repaid. Had the PPI been used then the fees wouldn't even have accrued. I then took it to the financial ombudsman and am still waiting on that. Now, it seems the Halifax have sold the debt to Cabot Financial who are now sending me letters threatening legal action and CCJ's if I don't reply in 14 days. When i found out the debt had been passed to Cabot I stopped paying the token amount and haven't had any contact with Cabot. What would you do? I'm seeing posts saying to ignore but at the same time there are posts where it seems Cabot have actually taken people to court. I can't understand why the Halifax wouldn't take into account the fact that it turned out I did have the PPI on the credit card which I had been paying from the beginning. You can clearly see just by looking at my account (I had a current account with them) at the time I defaulted when my dad died that I had no income at all and that I had been in real trouble. I literally sank. Had I been in a better place at the time we could have discovered this and presumably the PPI would have kicked in and none of these charges would exist but I barely even left the house. I would really be grateful for advice. The ombudsman is taking forever and I'm not entirely confident in them anyway as they seem to take an easy way out and not uphold claims from other posts I've read. I presume I also need to let them know about this latter from Cabot too? Thanks

-

Hi all, I have send a request and got this agreement back. Can someone please tell me if its enforceable? and if so or not what is the next steps? Is there anywhere a guide on what to look for when its enforceable? Thanks a lot! Halifax agreement Page 1.pdf

- 25 replies

-

- agreement

- enforcable

-

(and 1 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.