Showing results for tags 'fraud'.

-

Hi, This is my first time on here so sorry if this is not in the correct thread. I took a loan out in my partners name in 2015 and he's only just found out. I had a massive gambling problem then, I have tried repaying some of it but my debt spiralled out of control due to the gambling issue and I've stopped paying it! I just need some advice on how to fix this? I know probably some people will judge me for what I did and I suppose it's fair enough but any advice is appreciated. The loan was for £2200 taken with AvantCredit, they did not ask me to prove my identity either, that might've perhaps put a stop to that (I'm not blaming them). Thank you in advance

-

I just received a Personal Health Report from Blue Crest Health Screening following a medical with them. The report stated I was very overweight had a Body Mass Index of 40.5 (which is high) and blood pressure as stage 2 hypertension 189/101 but the lung fuction of a 22 year old? Surprisingly they stated I had a zero risk of heart attack or stroke in the next 10 years. I couldn't believe that I read the report in detail and found they listed me as 5'4 instead of 6'1 which of course increases my BMI and risk ratio. I called Blue Crest immediately 7 days ago 6 days ago emailed the managing director Peter Blencowe on the email address he gave on the brochure asking for feedback. In the absence of a response I called three more times and was given the name and number of Lisa who apparently deals with customer complaints on 01903 253 173. Its an answerphone and despite leaving three messages she has not responded. The only contact I have had from Blucrest was from their accounts department who stated I owed them £29 . I insisted I had paid in full and on checking my receipt number they agreed I had paid in full. The issue is, this personal health company cant even get their payment process accurate, they have sent me someone else's report or they can't take and record measurement properly. There are two issues, if I believed their report which stated I had a zero risk of heart attack or stroke I could have been at extremely high of death risk considering the data listed above. What is even worse is that after 7 days they have not returned any communication or attempted to put things right. Should everyone who has had one of these medicals revisit the results and double check the results and advice ?

-

my ex husband is now and has been for years paying a woman to work for him "unofficially" cash in hand. He left me for her, they are now married. Before this I believe she was on benefits for years, never told anyone she was earning. I now want revenge, should I report them and if so how do I do it anonymously ??

-

Hi, I have a few disjointed questions about benefits fraud - specifically relating to universal credit. Are all Universal Credit benefit fraud cases looked at by the Single Fraud Investigation service? And is it correct that they can only sanction you with an Administrative Penalty now for lower monetary amounts - and not a Formal Caution? And does this Administrative Penalty appear on the PNC/a enhanced CRB/DBS check? Also, who would the Investigation Under Caution take place with? Is it still local authorities or has the Single Fraud Investigation Service taken over?

-

Hi, I've got an issue I need advice on please. My brother has lived with his girlfriend and their daughter for five years. I was talking to her the other day when her dad came round with a DWP letter for her. She cheerfully explained she claims benefits as a single parent living with her mum and has been all the time she has been living with my brother! She says she does really well from this and even gets free healthcare. I tried to discuss it with my brother, who seemed to be oblivious to what was happening. So now my dilemma, do I Report her to the DWP, I hate benefit fraud but this feels underhand plus it could affect my neice. Ignore it, again this doesn't seem right. Tell her I'm going to report her, this could cause family problems as she has a dreadful temper. Write to her anonymously saying I'm going to report her but then dont. Any thoughts? Cheers Dex

-

I have been in dispute with Eon for some time now regarding my bills. My emails fall on deaf ears as Eon have responded stating that they will no longer discuss my dispute. As this thread depicts on many occasions, the inevitable Warrant of Entry was applied for by Eon in Portsmouth Court. I am from Derby. Now, as a Justice of the Peace, I am sure you are aware of the Magistrate Court Act 1980 (and in turn the Civil Procedure Rules 1998/9). These are legislation set in place guaranteeing the rights of citizens in regards to court processes. One major flaw in the letters all these bloggers receive is that these invites to courts are NOT actually from the court themselves, but from the Utility Companies. The Magistrates Courts Act is clear on the fact that only a Court can summon a person to a hearing, not a company and therefore the utility company's letters are NOT summons'. Therefore, without the court actually summoning you to court personally, there can be NO court hearing?! When I had the 'Human Rights Letter,' a term of which I had never seen written in law before, I immediately wrote to the said court to ask if they had my name down for a hearing on that date at that time. The response I had was negative. Hence, there never was any official hearing. Now in order for any warrant to be issued, the more recent (1980) Magistrates Courts Act, (which therefore has precedence over the outdated Right of Entry act (1954), is clear that there has had to have been a hearing, to which the court has an obligation set in law to invite you to in order to give you the opportunity to defend yourself (i.e have a fair trial, a cornerstone of British law first mentioned in the Magna Carter!). Therefore, if the court itself hasn't actually summoned you to court for a hearing then there is no official hearing. Secondly, even if there was a hearing, the court is obliged to inform the defendant (us) that the claimant/creditor (Utility company) has been successful in their claim. All correspondence from the Utility companies are not official court documentation and thus are fraudulent when impersonating the courts. When a warrant is issued the courts, again, have to notify you of the warrant, and this could only ever be issued following a court appearance at a hearing which we potentially were unsuccessful at. I have never been invited, by a court, to any such hearing and thus any warrant of entry made against me by a court is in dereliction of duty, i.e. the court / judge has not followed the correct, legal court process in which it is legal to issue such warrants. Furthermore, if we leave the Magistrates act aside and concentrate on the Rights of Entry act, in combination with the Electricity act 1989, 'if there is ever any genuine dispute between the consumer and the utility company, a warrant of entry CANNOT be issued. I wrote to the court regardless of their lack of protocol stating clearly that a warrant cant be issued for my property as there is an ongoing genuine dispute. At the supposed hearing that Eon (not the court) invited me to, the judge has an obligation, by law, to scrutinise and consider all evidence set before them in order to be completely clear that there decision on issuing any judgement (or in this case, warrant)(Magistrates act again). In these 'rubber stamping' situations it is almost guaranteed that the judge seeing the applications can never be beyond any doubt that they have considered all aspects of the case in order to issue their verdict. Especially when the courts haven't even summoned the defendant to the supposed hearing to put over their case. In short, all Warrants issued under this old Right of Entry Act are issued illegally, as the Magistrates Courts Act, which protects us to a more fair trial, takes precedence over the 1954 act and has been disregarded. Now I conducted all correct enquiries to the courts to make certain that there was no hearing, and they agreed there was no hearing. Yet still Eon turned up one day and broke in claiming they had a warrant of entry?!?!?! I threw them out and now face conviction through two counts of battery that the Eon staff alleged I inflicted upon them. I was defending my home from the elitist Big Six companies, by following the letter of the law, and still face conviction. These warrants are all illegal and it is about time these courts/judges are convicted themselves of fraudulent activity and of dereliction of duty, as well as the perjury crimes of the utility companies by providing misleading information to the magistrates.

-

Any help would be appreciated. I am trying to establish whether my solicitor has acted negligent by not following the pre-action protocol in respect of a Disrepair claim which has now been settled, after 6 years of my local council denying liability under the OLA 1957. I had an accident during the period where liability was being disputed but my solicitor is claiming that he did not have the funds to pursue a PI claim but never advised me on this, and on checking the pre action protocol under Disrepair claim there is reference that would suggest that in any event, a claim for PI arising from a Disrepair claim could and probably should have been made by a qualified legal representative as the Disrepair procedure makes reference to a PI claim if an injury has occurred because of the disrepair, in this case a out-house flooded everytime it rained.

-

Free Land Registry service helps prevent fraud

Michael Browne posted a topic in General Legal Issues

More than 50,000 homeowners have signed up to receive fraud alerts in a bid to stop [problem]mers stealing hundreds of thousands of pounds by taking bogus loans against their properties. The property alert service, offered free by the Land Registry, helps people detect fraudulent activity on their property by sending them email alerts when, for example, a mortgage is taken out against it. They can then decide whether they think the activity is suspicious and can act quickly to alert the the Land Registry, their lender and the police. Property fraud is where fraudsters try to steal a property, most commonly by stealing the homeowner’s identity and selling or mortgaging the property without their knowledge. They then disappear with the money leaving the true owner to deal with the consequences. Since 2009, the Land Registry has stopped fraud on properties worth more than £92million. http://www.thisismoney.co.uk/money/beatthe[problem]mers/article-4000954/Land-Registry-service-helps-prevent-property-fraud.html Sign up to the scheme here: https://www.gov.uk/guidance/property-alert -

Lloyds customers should be on the lookout for a new sophisticated fraud that involves fraudsters sending fake bank letters. The convincing letters being sent are a replica template from Lloyds and include their logo, address and signature from a customer service representative. The letter tells recipients that there have been some “unusual transactions” on their personal account and asks them to call a number highlighted in bold to confirm they are genuine. When victims call the number, an automated welcome message is played and the caller is asked to enter their card number, account number and sort code followed by their date of birth. Victims are then instructed to enter the first and last digit of their security number. http://www.actionfraud.police.uk/news/sophisticated-fraud-involving-convincing-bank-letters-dec16

-

- convincing

- fraud

-

(and 3 more)

Tagged with:

-

Please help, I'm so scared that i'm going to prison I'm on ESA and have been for the past 3/4 years. In that time, i've have 3 part time jobs all 16 hours and under and i've declared all of them with a permitted work form. The only reason i can think this has come about is that at the beginning of July this year i was offered a job for 16 hours but was told i'd have at least 1 day extra as overtime. I rang up ESA and told them i wanted to stop my ESA claim. A few days later my mental health went to crap and i told my new boss that i wouldn't be able to do it. She then agreed to me doing only 16 hours and i thought i could handle that (i hadn't even started the job when i told her i couldn't do it). I then did an ESA rapid reclaim and was told that everything would be the same as my old claim, Income related ESA in the support group. Turns out that i'm now contribution based ESA in the support group, i didn't even know until my housing benefit stopped a few weeks ago. I'd also started a claim for working tax credits as originally i'd be working 25 hours a week on average. i sent in my permitted work form for 16 hours a week and started my new job at the end of July. By this time my mental health was getting worse again and i didn't realize it, i was getting all these letters from people for changes in income, the dwp health assessment letter for my esa and i just couldn't cope. About 4 weeks after i'd started work, i realized i hadn't even stopped the WTC i spoke to an online adviser and told them that i needed to stop my tax credits and thought nothing of it as at the beginning esa was deducting the WTC amount from my ESA and i had to wait for a letter to come through to send to ESA to prove i had ended WTC. I didn't think anymore of it. On October the 1st, i had to send in a sick note to work because i just couldn't cope anymore, i couldn't leave the house, someone knocking at the door or the phone ringing terrified me and i had to go back onto anti depressants and anti anxiety medication, and on October the 12th (i think) i was dismissed from work. I went to the post office to get my money for my child tax credits on the 10th or the 11th of October, i normally get it out on a wednesday but i was short on money so i got it out on the tuesday instead, and i realise that there's too much money. I thought that because i was getting my money out on the Wednesdays every 2 weeks and the amounts were the same, that WTC had informed ESA about me stopping WTC and ESA were paying the amount they said they would when they had notification of my WTC stopping. i logged onto my online tax credits account, and there was a live claim for WTC! I immediately stopped it online and as the end date i put the 12th of October as this was my dismissal date. I've sent them a letter about over payments (my phone and internet were cut off) because i wasn't entitled to that money, but i've not heard anything. Will they get back to me about it or am i going to have to call them or speak to them instead? The payments i received for my job was £380 at the beginning of September, about the same at the end of September, £250 at the end of October and £150 holiday pay at the end of November. I'm so scared that i'm going to prison. I have a partner that i have to care for and a 3 year old. I didn't mean for any of this to happen. I sent in my permitted work form and told WTC to stop my WTC, then ended it myself when i saw it was still a live claim. I really don't know what to do That's the only reason i can think of as to why they think i didn't declare my employment status, but i thought that if it was under 16 hours a week and less than £100 a month, then it's classed as permitted work. Now i'm wondering if it was either of the other jobs i did. I don't even know anymore as the letter only states undeclared work and nothing else. My interview is the 21st of December and i've told them that i'm going to attend. I'm too scared of police turning up to my door if i don't go. I'm really scared as i've never been to court, i don't even have a criminal record! I've never done anything illegal let alone got in trouble for a crime. What happens now? I've messaged a few people at the local solicitors but not heard anything yet and the CAB in my area is only open for about 5-6 hours every Thursday, but i'm not guaranteed an appointment. I feel so sick, i can't eat, i can't sleep, if the door bell rings or someone knocks on the door, it sends me into such a state that i'm having panic attacks. Even the phone ringing petrifies me and i'm shaking whenever the post man comes because i'm scared of what post may come through my door. What do i do? Sorry for being a baby and for my post being so long. I'm nearly 30 and should be able to cope with this but i can't

-

Hello, I've read several cases on this forum and found most of them similar to mine, except the amount of money DWF wants from me. So I'll start from beginning. A month ago I found out how to trick self-checkout I've used this "trick" 4 - 5 times tops, and only to buy necessary groceries to survive until next paycheck and totally regret my actions. The amount of money barely would reach £70. I suspect, that they have tracked me down, by noticing repetitive entries on their system Since I am employed in a restaurant which is situated inside ASDA's premises, security informed police where to find me. Police then came to my work with pictures from CCTV asking to confirm that this is me in that photo. Police also told me that I am under suspicion for shoplifting and therefore I am banned from the store. As a result of that, I've got suspended from work for an indefinite time, until this matter with ASDA is resolved. Several days ago I spoke to my managers and asked if they heard anything back from ASDA or police about the progress on the case, they said that ASDA has collected all the necessary evidence and passed to police which will probably prosecute me for fraudulence or fraud. Also, I've been told to expect police visit at my house soon, but it's been a month, since 2nd November. And I have never been interviewed neither by ASDA or police about this matter. On 25th November, I have received a letter from DWF stating that they are solicitors acting on behalf of ASDA and asking to pay an enormous amount of money for stolen goods and standard amount for security costs(£125). Of course, 7 days to pay the outstanding balance to avoid further actions. Second sheet has FAQ and the last sheet says that THEY are waiting for payment or response. I have not replied yet and I am not planning to. I am shocked! It's physically impossible to steal goods for such amount of money. I think they have a roulette with amounts of money to beg for. I suspect, it might be influenced by a poor relationship between ASDA and the restaurant I'm working for and they are trying to rip their rival's employee. My main concern is the amount of money, which is £10 000. On what grounds? And should I wait for a response from police or court before even thinking of replying to DWF? So, I assume this might be an interesting case for you, guys. Thank you in advance for any feedback.

-

Good Morning to everyone here at CAG, another one of the many issues we've had to face at least it's not a council issue as before. I'm here to warn everyone and I have been a bit lazy and not searched the forum for any related articles, but I do feel this information needs to be passed on. This information concerns several business's and so I will Bold each one and to why I'm warning people of this. I will also provide as much information as I can, including links "BUT PLEASE DON'T USE THESE COMPANIES" The reason I'm posting this, is due to my wife. I run my own Small Business and by small I mean we currently only have one client, I also have a very bad credit history (though we are trying to resolve this) so trying to get the business of the off the ground with no money and no financial help is very hard work (Especially when you can't get credit). My wife works in order to bring in a steady income enough for our family to survive while we sort out our financial situation and get the business running. Now this concerns several business's in the "PayDay" loan sector and the mistake my wife made (Though not through any fault of her own), so I would like to pass this information on to everyone. So due to it coming up to Christmas, we have been short on money and so my wife looked at some loans and this is where it starts. Hypercross Limited: CN: 07720400 - Trading as Just Lend Cash They sent out a text message to my wife This appealed to my wife, as it was offering the loan to be paid back over 3 months. So she went to the website and saw it was a form for a loan and filled out the details. My wife being my wife, didn't think anything strange of this and so she hit the apply button and waited. This is where it all went wrong, as rather than tell her yes or no she's got the loan it redirected to the following site. http://www.loans-directuk.net/ Now if you look at the site, it tells you that it's a membership site and will cost you £69.95 to sign up. However this was not the case for my wife and it had automatically signed her up to the site. Though I have been through the email account in question and cannot find any emails from either company to confirm this, the only email I have is from me advising them that this was done fraudulently and advised if they take any money from the account it would be reported as so. So they did take the money from the account and subsequently been reported for fraud to the police, Action Fraud and the bank. We are just awaiting on the pending transaction to go through, at which point the bank will claw back the funds. DO NOT USE JUST LEND CASH - THEY FRAUDULENTLY OBTAIN MONIES BY DECEPTION Ok so the next one has got me very angry, even to a point I'm half tempted to visit this companies so called office of registration I only live 30 minutes from them. Frontier Finance Limited: CN: 06081861 - Personal Loan Finder (PLF) This was a cold call from the company PLF, I was around at the time of the call though not during the initial stages of the call. During this call they took details from my wife, including Debit Card details. I caught the call at this point and asked my wife to tell the lady on the phone that I wished to speak to her, she rang off as I said hello. My wife advises me that they had asked her to go to the website once she received the login details to approve the loan, so the text came through and this time I did the website information and looked at it. So I logged into the account with the details they provided and the first thing I noticed was the fee required, which was £39.99 at this point I said to my wife that there was no chance as I'm not paying a fee and we left it at that. Now my wife went to work and came home at 9pm, to advise me she had been paid a day early. So with the first part of this topic, I logged onto the account with the intention of removing all funds from the account to stop any money from leaving if it did. To my amazement, there was a discrepancy of £158.27 this rang alarm bells straight away. The £69 had been taken by Loans Direct for which was the reason for login into the account in the first place to make sure fund were not available to this company. There was however another £89.50 missing that was not accounted for, so we contacted the banks fraud department who have now advised that the £89.50 was taken by a company called Elite Loans Limited. This rang further alarms bells, as my wife had not had any dealings with this company and so I investigated and what I found is shocking to say the least. Elite Loans Limited: CN: 7179840 I've checked their website and also done a Companies House check on the company to see if they are a sister company of Frontier Finance who operate Personal Loan Finder and this is what I found and according to the details on companies house and on company check, they don't appear to be related but I know they are because it's the only other company that has taken my wife's debit card details.. Frontier Finance has in the last 24 hour since I raised a complaint to them (as the only way to contact them was through an email address, as the telephone numbers don't work) and advised I have reported them, have now removed their company number from their website or it's not at the bottom where it was last night. Since all this has happened, we have raised this with the police as fraud who have passed details across to Action Fraud. I've also contacted Action Fraud, who will be contacting me at some point today to discuss further. It has also been reported to the bank, who are going to claw back the monies and dispute against both companies. Now my advice to anyone and everyone, including those of you who feel you would know better. Investigate a company first, if it sounds to good to be true it most certainly is. Do all the necessary checks first and under no circumstance give out you Debit/Credit Card details over the phone especially if they require you to approve via a website and even then make sure you read the fine print. I've listed some links of useful site to use below. http://companycheck.co.uk/ - Check out the company first http://wck2.companieshouse.gov.uk//wcframe?name=accessCompanyInfo http://www.actionfraud.police.uk/ I will post up more information on how we get on, as and when we get it.

-

I started an 18 month contract with vodafone about 12 months ago. I lost my phone and asked for a replacement sim card twice (via online live chat) and was sent nothing. For months now I have been charged for this contract even though I haven't been sent a sim card to use the number I'm suppose to be paying for! Absolutely nobody from vodafone will speak to me via any support channels and still, every month, without fail, I am being charged for my contract! Now listen to this part. I receive 2 e-mails from vodafone a few weeks ago saying the barr on calls abroad and calls to premium rate numbers have been lifted. For 6 months my monthly bill increased, on December 3rd it was £188. January 3rd (since the foreign calls being lifted) it is now £366. Surely this is some sort of fraud right? Some sort of criminal activity is going on here???? I've even tried calling my number and it doesn't exist, I am unable to log into my vodafone account either lol. I'm a logical guy and can only come to a single conclusion but I would happily be corrected if another explaination comes to light. It would appear one or both of these live chat employees have hijacked my account. They have sent a replacement sim card under a different phone number to one of their friends and because they are vodafone employees they will have been able to access my account to lift these 2 account barrs for calls abroad and premium rate numbers which they have spent December abusing. This is the only logical thing I can think of which explains the series of events that have unfolded over the past 6 months and I'm pretty sure this is fraud and cyber crime.

-

Some time ago my partner and myself received a letter from HMRC stating that we were no longer entitled to claim working tax credit due to information from Concentrix, we had never heard of Concentrix at this point. Apparently the information that was disallowing us from claiming was that on the forms submitted it states I worked just 5 hours per week last year 2015. The forms we submitted did not state 5 hours / week but rather 30 plus hours per week, concerned by this I got in touch with HMRC through the HMRC website online chat system and an employee at HMRC informed us that Concentrix in Belfast had made the alteration to the form The action taken by Concentrix is clearly fraudulent, so that information has been passed on to the serious fraud office in London. I spoke to a solicitor who said yes I did have a case and yes he would pursue that case when I could get the £200/hour fee he would charge for handleing the case, sadly I do have that kind of money at this time mostly due to being off work with a serious gastric disorder, and as I am no longer entitled to work tax credit due to Concentrix fraudulent action I am also no longer allowed free prescriptions which meant last week I had to go without medication as we could not afford to get the precription filled at that time. The solicitor suggested I get a group of people together who have also been mis-treated by Concentrix in order to begin a class action lawsuit against them but I have no idea how to go about that currently so am looking around for advise on how I can either get enough people together to get that underway or alternatively find a kind wealthy person to support a private case. If you think that Concentrix have mis-used information to make a case against you or outright changed information you sent them the number for the serious fraud office is... 02072397272. The more people who kick up a fuss about this company and the methods they use then the sooner these issues can be dealt with properly and this company brought to rights.

- 8 replies

-

- 2017

- concentrix

-

(and 3 more)

Tagged with:

-

In a bid to warn you against money [problem]s, Financial Fraud Action have said that, in the first half of 2016, there's been over a million cases of card fraud, phone fraud, cheque [problem]s, and online fraud from January to June, which is a 53% rise from the same time last year. That's one every 15 seconds. The FFA, backed by payment card businesses and banks, want to raise awareness in a bid to stop fraud. Along with the police, they're backing the The Take Five campaign, which looks at helping people who think they're too busy to sidestep financial fraud. 1. Never disclose security details, such as your PIN or full password – it’s never right to reveal these details. 2. Never assume an email request or caller is genuine – people aren’t always who they say they are. 3. Don’t be rushed – a bank or genuine organisation won’t mind waiting to give you time to stop and think. 4. Listen to your instincts – if something feels wrong then it is usually right to pause and question what’s happening. 5. Stay in control – have the confidence to refuse unusual requests for information. https://takefive-stopfraud.org.uk/advice/

-

Hello, I hope I can get some help here about the worst case I ever had with a Bank. One month ago, exactly few days when I got married, my debit card details were compromised and more than £6000 were stolen from my debit card and paid into some online gambling site in Gibraltar. I found out about these transactions the day after the were made and immediately called my Bank - TSB. I had two accounts with them - a personal and a business one for my limited company. I spent hours on the phone with their customer service, then the fraud team and even they have some "complex" investigation team. After explaining them about the fraudulent transactions, they accused me that either me or someone that lives with me ( my wife ) has made those payments, becuase in their system nothing looks suspicious and event the fact that these payments were made over night every 30 minutes £1000 were taken of my account...really??? and they did not send me any message to confirm that I am making those payments..not a call..nothing. After a long conversation I was told that they will start an investigation and will come back to me and in the mean time I should contact that gambling company. this is what I did and I called the gambling site and the company behind Cassava Enterprises Ltd. I had to write to their security team, which answered me every day and at the end helped much more than my TSB bank, because Cassava's Security team found out, that there was an account registered on my name and also my debit card along with debit card on some other people's name on the same gambling account. they told me there is definitely a fraud activity and all transactions made from my Debit Card will be voided. I had to wait and hope I will have money back and be able to pay for my wedding. On the next day TSB calls me and tells me their Investigation team does not find again anything suspicious and even while those payments were made, address verification passes and 3ds security was not invoked from the merchant, so nothing can me done. Not only that, but they told me that I am the one who needs to keep my debit card details save and they are not responsible for not alerting me, for not detecting any fraud activity, because these payments happen over night to some site in Gibraltar...just ridiculous .. But I told them that I already spoke to the Gambling company, which found something suspicious and will void the transactions. ..They "Investigation team" even did not believed me and told me that if that is actually true, I should get my money back , they decided to block my accounts. After exactly 3 days even that my accounts were blocked I was able to access my internet banking and I noticed that all money were refunded and at least I was more relaxed. But of course TSB made the situation more painful for me, becuase I spent hours again with their fraud and investigations team on the phone and as I was abroad for my wedding, my only choice was to get my money with ID into a branch. After asking them isn't that action by the Gambling site clear enough that there was fraud activity and they returned my money, the TSB representative on the phone did not know what to answer me . In a week I went back home and I found check for my business account in TSB, which was already closed and after I went into a branch I got my money in cash from my personal account and they closed it too. After all what happened I was thinking that this is a bad story with a happy end. But of course not. I opened a personal account with Barclays online when I was still abroad and I got my cards and internet banking and etc. when I got home . I deposited my money there, after I got them back from TSB in cash. I had to open a business account and I went to Santader, where my other nightmare began - I was declined, because of I was told " They see some flag in CIFAS database about me" and I have to find out what and this is the reason they cant open me an account. I need my business account as soon as possible, because I am awaiting payments I went to another bank, where the same happened. My credit score is not perfect but is not very poor, so I was told to check my credit file and to look for CIFAS data, because its not about bad credit score. I went into TSB branch ( my accounts are already closed and I cant get any help over the phone anymore) and the lady on the till tried to call "someone" and told me to check Experian . I registered for Experian, Equifax, Callcredit and Checkmyfile and I find no CIFAS records on the file. After researching CIFAS website ( I never heard of CIFAS before) I found out that I can send a Subject Access Request Form so they can send me all the information about me within minimum a week or max 40 days. I don't know now what record has been held on my name in CIFAS I sent their form today. I opened a case with the Financial Ombudsman and I am awaiting their answer too . I do not know what else to do and how can I find our more information about this Flag in Cifas and as I generated a credit file in all possible Credit agencies and no information about CIFAS is there, I am out of ideas. Also from Satander told me to ask the gambling company if they sent maybe something to CIFAS, so I wrote their security team and I am waiting for an answer. Did anyone of you had any similar situation and do you know how can I resolve it? I was a Victim of Fraud and not only that but now I am experiencing all these problems and I am more than frustrated. My only fast option now is to add my wife as a director and to remove my name from the company, so I can open at least the business bank account and to make VAT and salary payments on time, until I resolve the issue with my name Thanks, Ivan

-

Hi, New here and any help will be appreciated! i've recently discovered that Shop Direct have taken out 2 CCJ's against me for an account that i never owned. One of the CCJ's even has the wrong DOB on it - crazy to think the court never picked this up! i need to know what actions i can take to get rid of these CCJ's - ive just got off the phone with Shop Direct who say they will not treat the accounts as fraud as the items were supposedly delivered to my house and a few payments were made. I had never even heard of Shop Direct until a couple of weeks ago and certainly never had any goods off them or paid them anything! First CCJ: Recovery Agent - Lowell Amount - £2976 Account Start Date - not know as its not on my credit file however on the phone i was told it was in 2008 CCJ Date - 12/08/14 Second CCJ: Recovery Agent - Capquest Investments Amount - £1038 Account Start Date - 13/05/2008 CCJ Date - 11/09/14 Has wrong DOB on it What i need help with is the best course of action now as ive heard by filling in a Subject Access Request Form and requesting the information held on me, this means i am admitting the debt and can open up a can of worms. ive reported the fraud to the police but Shop Direct were not interested in that when i told them. i dont want to call up the debt collection companies as again they are extremely unhelpful and unless i know exactly what to tell them that will open up a can of worms too. Thanks

-

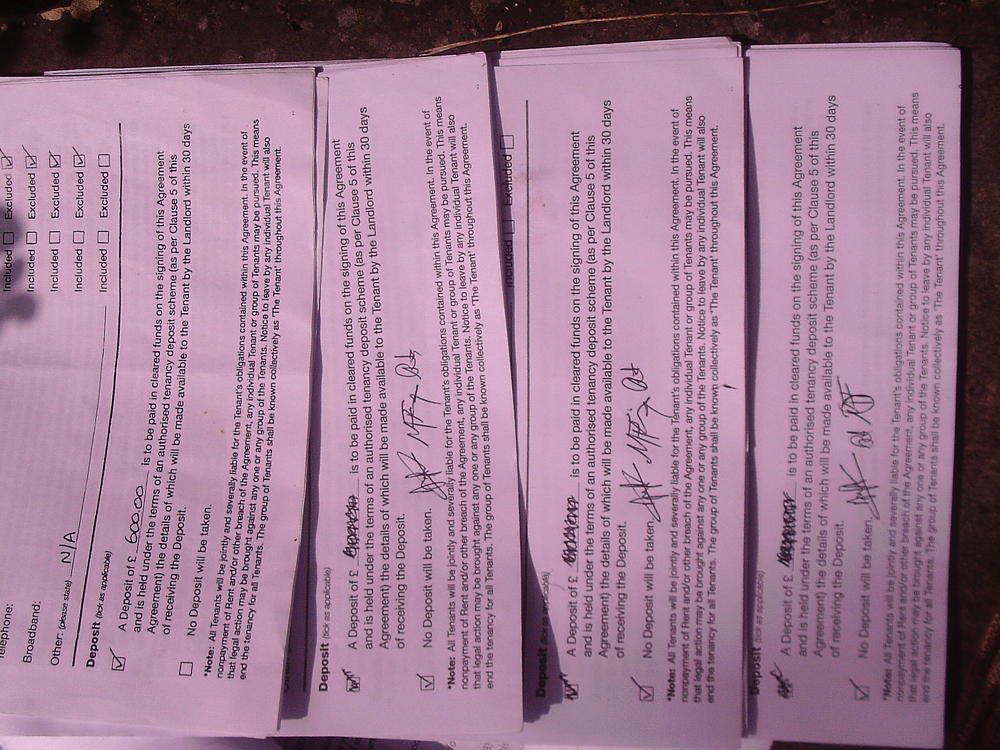

I have just been to court where the landlord tried to use a section 21 notice. at court it was a meeting for a directions hearing. the Judge struck out the landlords s21 claim because he had left important information regrding bonds etc out of the document, he got the dates wrong and the judge also noticed the irregularities between tenancy documents. ie, that there were two tenancy versions submitted to court. the judge mentioned involving forensics and discrepancies with signatures on the documents. there are two more versions of the tenancy agreement/s that the court didnt see. i was represented by a housing charity. we disagreed about the bond and the tenancy/s. I paid a bond and at the time of signing the tenancys, i was lead to believe that I had my own tenancy. i feel that the judge can see the foul play but the housing charity can't, or won't see it. the landlord is now saying it is a joint tenancy. if it is a joint tenancy, i will be liable for huge debts he took a bond from me and did not protect it. his accounting is riddled with errors and inconsistencies. he wount provide me with full accounting, just his made up versions which dont tally. how can it be a joint tenancy when there are multiple versions of the agreement/s?

-

Hi there, Fantastic Forum. Keep up the good work. A while ago my friend has been accused of benefit fraud. She has sent in an appeal at the moment, and she is waiting for them to get back to her. I have helped her by reading posts on the forum, and following some of the advice being given on here. But now I am stuck and don’t know what to do now. Like I said she is waiting for her appeal, but now the housing association are getting tough on her. They are demanding the rent that has gathered up due to her housing benefit being stopped months ago. She has been paying her water rates because her income support has not been stopped as of yet. But she can't afford to pay the full rent. She is due to appear in county court on a civil case in a couple of weeks time. She is a single mother with two children. She doesn’t speak much English. She is really stressed and doesn’t know what to do. Please, please help.

-

Hi all Can an Enforcement company add all there fee's on after the compliance stage (£235 and interest) before they try to enforce? I know it would be irrelevant if they take control of goods just curious if that was allowed. leakie

-

Hi all , I was the victim of mortgage fraud by an ex partner , I thought I was buying a house together, having contributed half of the deposit ( 85 k of a 170k deposit ) in 2010 . It transpired that she used a false address , false declaration of funds , falsely claimed that it was a buy to let property and mortgage and that she would not live there or never had . She used that false address for another three years , and had been living in the house before the mortgage as a tennent and has lived there ever since . I told natwest of the fraud in 2013 , but they have refused to take action . i have recorded calls , and natwest have said that they accept people make false decorations in their applications and as long as the mortgage is paid on time , they don't mind . I now have a charge on the property with the land registry , but , What action can I take against natwest , seeing as they accept that I told them about the mortgage fraud in 2013 and they have knowingly facilitated that mortgage ?

-

Action Fraud / Police a Waste of Space

Conniff posted a topic in Broadband and other Internet issues

Two days ago my niece asked me to look at her 9 year old daughters laptop as it had locked up and was asking for money to be unlocked. She said it happened while she was watching a YouTube video of Britains Got Talent. What she had was a particularly nasty virus known as 'Ransomware'. It locks the computer and demands money to 'unblock' the computer so it can be used again. Like most, this one came in the guise of an official site with lots of police badges and the name Metropolitan Police, it accused her of distributing child porn and wanted £100 to be paid by Paypoint. Luckily at her age, she isn't aware of what kiddie porn is but the police references and the menacing voice demanding over and over that she must pay £100 fine did scare her. I class this as Fraud and Blackmail, but the authorities aren't interested. There are at present a couple of men in the North in prison for doing this sort of thing. On contact with the Police, they weren't interested and said 'we don't have anything to do with that any longer and to ring Action Fraud. I rang Action Fraud, who is the government sponsored department that deals with cyber crime and was given a crime number and then bye bye. No attempt was made to ID the culprit nor any questions asked or requests made to send them details. That brings me to make the statement that this, (like most other Government departments), is useless and not worth the money they are costing us. -

Hi all. Really could do with some good advice please. I will try and sum up concisely... A friend and I went through the process of booking an apartment in Brighton with Airbnb. We are both new to Airbnb. We found an apartment and communicated with the 'owner' through the Airbnb site system. When it came to booking we received an Airbnb branded html email. With payment details. I forwarded the email to my friend who made payment... before i could stop him as I realised it was bank transfer details which seemed wrong to me. Long story short... as soon as payment was made the Airbnb user disappeared from the Airbnb site. Removed his apartment and profile. We felt so stupid. The email was so convincing. Fully branded and all links correctly heading back to the airbnb site. I immediately contacted Airbnb and my friend contacted his bank to see if he could halt the payment. This was two weeks ago and all I have had from Airbnb is apologies over the phone and referral to the appropriate team who deal with situations like this... but ONLY communicate via email. These emails have offered nothing more than an apology for my experience and then a referral to their terms and conditions, pointing out they state not to make offsite payments. Then a paragraph informing me this will be their last communication with the matter. When someone signs up to put their property on Airbnb... there must be checks? They must have to give property details, addresses, ID, contact numbers? Airbnb have provided me with none of this! They have washed their hands of the whole affair. As for my friend... his bank are still 'seeing' what they can do' and have stated it maybe too late. Even though my friend contacted them within 12 hours. I do realise we may have been naive. But Airbnb must take some responsibility? New users of their site could easily fall into this trap and the user has been allowed to advertise falls without proper investigation. Does anyone know what rights I have or who i should complain to regarding Airbnb or my friend's bank? Airbnb did say i should inform local authorities. But who? The police cannot do anything! Help please!

-

Hi. I have just registered, although I have been on this forum many times over the years as a guest. I am in a bad place, i feel embarrassed. After my marriage broke down this year my ridiculous reaction to the stress and sorrow was to start gambling online and I am now in a position where I owe £30k. I have taken, all in the space of 5 months, 4 x £7.5k loans and have lost it all on a crazy impulsive online gambling spree. I am absolutely disgusted at myself about this behaviour so please do not act on your urge to tell me how wrong this was. I know more than you can imagine. I have never, i repeat EVER gambled in the past and I am a 52 year old man. I am not and have never been a gambler which is why this is even more difficult to make sense of. I had zero debt just 12 months ago. My question in this instance is this: Given the way this debt was taken out, ie in a very short period, spent on gambling (with the ridiculous hope of making losses back each time) and the fact that I exaggerated my income by about 25% in my loan applications, can this lead to a Fraud or criminal prosecution? I didnt lie about anything else, and I stated my other loans at each new application. Can the banks or the official receiver (i will be going BR ) find this behaviour so wrong that I could be charged? I understand that I will most definitely be having a BRU. The use of the funds is clearly documented in bank statements. ie I didnt take loans out and cash them out or purchase things, or give to friends or go on holiday. It was all used on gambling over a very short period. Please only reply if you are aware of English Law regarding fraud (if this is in fact fraud) and under which section of the Fraud Act? I really need some solid knowledgeable advice as I am extremely stressed. I have been reading about S1, S2 of the Fraud Act and searching online but can not really find something clear to suggest whether this is something that, a) can be prosecuted, and b) is in fact prosecuted. Some posts in other forums state that they have never heard of anybody being prosecuted for lying or exxageratin on a consumer loan application but I find that hard to believe? Why would the CPS have a Fraud Act and why would they not pursue it if a bank requested them to? If anybody has been prosecuted please share your experience or some points, or PM me if you are not comfortable to post online. If this is in the wrong forum please move to the appropriate one. Thank you

- 18 replies

-

- application

- criminal

-

(and 4 more)

Tagged with:

-

[ATTACH=CONFIG]52477[/ATTACH] On 23 July 2014 over 300 people came from all over the UK to show solidarity and support for Tom Crawford and his family, and help in the peaceful resistance to the illegal eviction proceedings brought by UK Asset Resolution Limited. The support on the day was so overwhelming that the bailiff decided not to appear with his illegally drafted warrant. At the moment, hundreds of warrants are being issued and served where a court stamp is used (not an official seal) and there is no official endorsing signature. This is fraudulent and illegal. The petition is merely asking the Government to ensure that courts and the judiciary follow the letter of the law and stop committing fraud. THIS ISSUE HAS THE POTENTIAL TO AFFECT EACH AND EVERY ONE OF US, OUR FAMILIES AND FRIENDS. The petition is aiming to gain 1,000,000 signatures, so please share and spread the word. PLEASE SIGN NOW, THANK YOU. http://www.change.org/en-GB/petitions/uk-petition-in-the-name-of-justice-and-fairness-we-the-undersigned-require-her-majesty-s-courts-and-tribunals-service

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.