Showing results for tags 'ccj'.

-

Hits all, I have a CCJ issued in January last year for a Capital One Credit card via Cabot / Shoosmiths. The Balance is around £1200 and I am paying it off at £50ppm. Unfortunately I hadn't found this site back then and didn't defend it. I don't have a problem paying the £50ppm I recently found some original capital one statements, it would seem that there might be some unfair charges. If I SAR Capital One and find this to be the case can I make a claim directly to Capital One for these charges, despite the balance been sold off and CCJ'd?

-

A friend of mine had a CCJ that was satisfied after he sold his house, we were talking about it and it seems there were £200 a month admin fees were being added to the account before it went to CCJ. The question is can he go back and SAR the company and claim back the Fees or is it too late. He settled the CCJ earlier this year, the CCJ was over 6 years old and attached to his house. Thanks

-

CCJ Issued wrong identity wrong address

MagicE999 posted a topic in Private Land Parking Enforcement

Hi there, hope someone out there can help. About 6 months ago I received a letter at my current address, which is a property I have owned and lived in for 2 and a half years, chasing payment for a parking ticket for a car that I do not own. The car is and was owned by my brother who lived with me briefly at my old property, which I sold 2.5 years ago. I contacted the company and explained that the car was not mine and explained the situation. My brother and I have the same initial and surname. Today, I checked my credit file and saw that a CCJ has been issued to me for £275 in respect to the ticket. I did not receive any correspondence at all in relation to the court action, and see that it was issued in my old address which I have not lived at since I sold it in 2015. I contacted the court and it was for a parking ticket issued in late 2016 for a car that I do not own and never have. I did not keep the correspondence I received a few months ago so do not have the details of the company that contacted me previously but this action has been taken by Gladstones. As the CCJ was issued less than 1 month ago I have paid it so it gets removed but can anyone point me in the right direction with regards to getting this money back and bringing Gladstones to account for their error? Any help would be much appreciated. Thanks in advance -

Back in 2016 we commissioned a builder to undertake extensive renovation works in our house. He originally was a limited company but this company was dissolved in June 2016. He then started work for us as a partnership. His father has been involved with our job in that he came to our house a couple of times and the kitchen supplied was in the fathers name and address on the invoice. To cut a long story short, the building works went on far longer than they should and weren't completed until we sacked them. We asked for a partial refund and this was refused. In May 2017 We employed a solicitor stating our claim. The son said he did not owe us anything and was going to go bankrupt anyway. The father said he was never involved. We couldn't afford any more solicitors fees so we decided to lower our claim and decided to issue a CCJ to both father and son as joint defendants. The date of issue was the 24th November. Today was the deadline to "Acknowledge Service". The father has acknowledged service but the son hasn't. Now I don't know what to do. Can I request judgement against the son? Or do I have to wait another 14 days as I'm assuming the father is going to defend his part. The son isn't on the insolvency register yet so again I'm assuming he hasn't actually applied for bankruptcy. Many thanks oldpoyntz

-

Hey, Got a bit of a strange one here - I have today received a green letter from Lowell Solicitors saying that I have not paid the £50 instalment on a CCJ they have obtained on a VERY old Orange mobile phone account. This is the first letter I have ever received about this naturally, it made me check my credit file where low and behold - a CCJ has been placed under my old address (not lived there in almost 7 years). This letter says that I have got until the 11th December to make the £50 payment or they will recommend enforcement action. My issues are as follows. 1) This is the first thing that I have heard about this (genuinely) and did have an old Orange account at my old address back in 2008 after falling on hard times. No payments have been made on that account since we moved in Feb 2011 and I have not knowledged anything. 2) The CCJ which was obtained in Oct 2017 is under my old address so does that mean that any papers I would have needed to see for challenging etc have gone to that address? 3) Can a CCJ be obtained and enforced on a statute barred debt? Hopefully, someone can help me out here and give me some advice. Cheers Scott

-

I was just checking my Noddle and notice I have a CCJ a few months ago from a debt from 2014, admittedly I have moved a few times so had no idea about this or received any paperwork, can anyone please advise how I should proceed with this? thanks

-

Hi guys My son is coming to buy a house and hes just got a copy of his credit report and there is a CCJ on it that he knows nothing about. He has moved addresses a few times in the last 5 years so the paperwork must have gone to an old address. According to the credit report (we get the full version tomo) Lowells *boo hisss* now own it. The report hsows our address as he used to live here but we def havent had nay paperwork for him. my questions are: a) how can we find out what this was for - can we contact the court and ask them for copies of the paperwork? b) as he needs to get a mortgage he wants to pay this debt off whats the best way to do it? I said that as lowells dont have his number or address the chance of them getting the money is very slim he should phone them up and offer to pay half (the debts around £230) just to get them to close the debt for the sake of his mortgage application. would they be able to send an email (we dont want to give them his address) saying that they agree to accept X in full and final settlement of the debt and if they did that are they likely to close it or still chase the remainder? i dont trust them He would have paid the bill if he knew about it before court but too late now thanks

-

Hi, I've just returned to the UK after being abroad for 5 years studying, I moved into a new flat and tried to get electric moved to a credit meter and was denied. I requested my staturtory credit file and have found that Arrow Global have registered a CCJ against me with judegemnt by default (date 20/07/2017). I had no warning or knowledge of this and they used an address that I moved from at least a year before I left the UK. I've no clue what it is for, and have no idea how to go about dealing with this properly. Ideally I'd like the CCJ set aside but first I have to find out what it is for? Thanks

- 12 replies

-

Hi All Received a letter from Mortimer Clarke today regarding a debt to Cabot Financial. Letter claims their client obtained a judgement against me on 04/02/2016. First paragraph says "Because you have failed to pay the judgement debt in accordance with the terms of the judgement our client is now entitled to take action to enforce the judgement order against you. Our client has instructed us to apply to the County Court for an Attachment to Earnings order to be made against you." Final paragraph says "If you do not contact us within 7 days , then our client has instructed us to apply for an Attachment of Earnings Order against you." Notes: 1. I have checked Trust Online for my current and previous 3 addresses and there are no ccjs registered against me. 2. I did not receive any correspondence threatening to take me to court, advising I was being taken to court or asking if I wished to defend and finally I did not receive a judgement. 3. The letter makes no mention which court they obtained the judgement from or any judgement reference number. 4. The debt is from 2007 and I believe it may well be statute barred now. Can anyone provide any thoughts or advice on how I should proceed at this point? kind regards

- 57 replies

-

- application

- aside

-

(and 7 more)

Tagged with:

-

Ok all, im in need of help, i have asked on another forum but just wanted more advice if possible i started a LTD company less tham a year ago it was going well, but some bad business decisions have quickly turned the good to bad i have a 3 debts with suppliers, one at £2.5k one at £3k and one at £2700 the £2700 got a ccj against the company i was paying 500 a month but cant afford to pay it, now i have received a notice of issue of warrant of control. The registered office address was my home until recently when i changed it, i now use one of the online registered office services things sorry not sure what its called exactly, so its now different to my home the issue of warrant letter came to my house as it was sent before i updated the details with the supplier which i have now done im worried that bailiffs are going to turnup and start taking my families stuff, we dont have much, an old car in my partners name, the usual tv sons xbox and a few other bits, nothing of great value just hoping someone can tell me what i can do, i really couldnt face the family if the bailiffs came and took stuff im finding it hard to look my kids and partner in the eyes now as i feel like a total failure many thanks

-

Hello, ive had a claim from mmf for an alleged debt to lending stream, ive sent the cca and cpr requests and logged into mcol to prepare my defence, which I think is due in next two days?? details as follows. Name of the Claimant ? motormile finance Date of issue – 16/10/2017 What is the claim for – 1.The defendant owes the claimant £217.50 under a regulated loan agreement with lending stream ltd, dated 23/07/2013 and which was assigned to the claimant on 23/12/2014 and notice of which was given to the defendant on the 23/12/2014 (debt). 2.despite formal demand for payment of the debt the defendant has failed to pay and the claimant claims £217.50 and further claims interest thereon pursuant to section 69 of the county court act 184 limited to one year to the date hereof at the rate of 8% per annum, amounting to £17.40 What is the value of the claim? £309.90 Is the claim for - a Bank Account (Overdraft) or credit card or loan or catalogue or mobile phone account? payday loan/ lending stream When did you enter into the original agreement before or after 2007? after according to claim, 2013. Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. mmf Were you aware the account had been assigned – did you receive a Notice of Assignment? no Did you receive a Default Notice from the original creditor? no not that I recall Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? no not that I recall Why did you cease payments? alledged date is 2013? What was the date of your last payment? 2013 Was there a dispute with the original creditor that remains unresolved? no, don't recall Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? I may have done as this is the year my husband and I split up so really am unsure. my defence?? Particulars of Claim 1.The claimant claims payment of the overdue balance due from the Defendant under a contract between the defendant and lending stream? Motormile finance? 2. The defendant did not pay the instalments as they fell due & the agreement was terminated. 3. And apparently its been assigned to the claimant, for the sum of £234.90 with possible court costs = total £309.90 Defence The Defendant/s contends that the particulars of claim are vague and generic in nature. The Defendant accordingly sets out its case below and relies on CPR r 16.5 (3) in relation to any particular allegation to which a specific response has not been made. 1.Paragraph 1 is noted I have in the past had a contractual relationship with lending stream, however the claimant fails to reference any agreement number on which it claim relies upon and fails to comply with CPR 16.4. I have requested the claimant verify the exact details of this claim by way of a CPR 31.14. The claimant has refused to provide me with a copy of the agreement, stating they are not obligated to do so by virtue of the consumer credit Act 1974. To date, no statement of the alleged account has been received. The claimant has failed to provide any evidence of agreement/contract/breach as requested by CPR 31.14 and a Section 78 request. 2.The Claimant alleges that I the Defendant did not pay the instalments as they fell due. The claimant is put to strict proof to evidence such breach by way of a Default Notice pursuant to CCA1974 section 87 (1) 3. Paragraph 3 is denied. I am unaware of any legal assignment or Notice of Assignment allegedly served pursuant to the Law of Property Act and Section 82A of the consumer credit Act 1974. The Claimant has yet to provide a copy of the Notice of Assignment its claim relies upon. Therefore the Claimant is put to strict proof to: (a) show how the Defendant has entered into an agreement/contract; and (b) show how the Defendant has reached the amount claimed for; and © show how the Claimant has the legal right, either under statute or equity to issue a claim. 5. As per Civil Procedure Rule 16.5(4), it is expected that the Claimant prove the allegation that the money is owed, if the Claimant is an assignee of a debt, it is denied that the Claimant has the right to lay a claim due to contraventions of Section 136 of the Law of Property Act and Section 82A of the consumer credit Act 1974. 6. By reason of the facts and matters set out above, it is denied that the Claimant is entitled to the money claimed. do I also add this new part now for this claim? The Claimant has not complied with paragraph 3 of the PAPDC (Pre Action Protocol) Failed to serve a letter of claim pre claim pursuant to PAPDC changes of the 1st October 2017.It is respectfully requested that the court take this into consideration pursuant to 7.1 PAPDC. thank you for any help and id appreciate if someone could let me know if this defence is ok to submit today? thankyou again

- 14 replies

-

- ccj

- ledningstream

-

(and 1 more)

Tagged with:

-

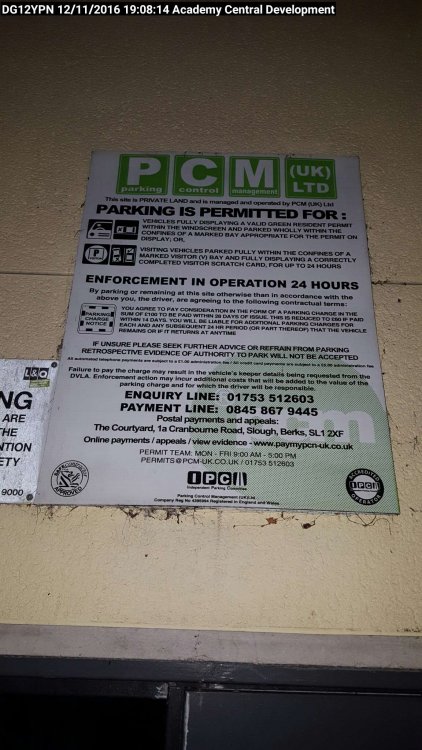

Hi all, need some urgent help please, have been asked to post here by suggestion. Noticed CCJ issued on my credit report prior to applying for mortgage. Found out that it is for PCN issued on 12/11/16 by PCM UK LTD in Academy Central Development. Passed onto Gladstones and onto DCBL. I recall this moment where I parked near my friends apartment and was not aware of signs or did I know I needed to pay. I did not update my DVLA or V5 until recently which is very stupid of me. I moved out of my apartment on 01/12/16 to temporary accommodation. 01/03/17 I moved into my permanent apartment, all utilities etc set up since move in day. Never went back to collect mail at my old address. Default Judgement passed on 16/06/17. I have no trail of any letters at all to date. DCBL are requesting I pay debt of £353.53 and they can mark the file as satisfied. However, to me this is same as having CCJ and this is not an option I will accept. I genuinly was not aware of this situation otherwise I would have resolved if I knew about it. I can prove via my statement that I had money to pay PCN. Below is the information that I have collected :- 1. Court Case reference number 2. PCM UK - PCN reference number 3. DCBL reference number and amount owned (£353.53) 4. Gladstones reference number 5. Images of vehicle from evidence & sign (attached) Out of panic I have directly called DCBL, Gladstones & PCM asking how I can settle, not sure if this was right thing to do. What are my options and next steps to have it removed off my file completely? I do not want it to sit on my file for 6 years, even with satisfactory? I need to resolve this as soon as possible as I have made a house offer and now cannot get a mortgage. Look forward to your advice and any help is very appreciated! Best wishes Mindaugas

-

I'm tryin to help the mother in law with her debts. .today she received a letter from 'Mortimer Clarke Solicitors' advising they are working on behalf of 'Cabot' allthough i believe mortimer clarke are part of cabot? They are saying if she doesn't contact them within 30days they have been instructed to apply to the court for a ccj, The account was assigned to cabot in 12/2016 and started in 08/2013 its a catalogue debt. They enclose a questionaire type form with do i owe the debt ,i agree i owe the debt, i don't agree etc the form goes like that etc and a expenditure form they want her to tick the relevant box and sign it which i said no... .would it be right to contact them and ask for the signed contract if one exists. .statements...notice of assigment etc.... would this then seeing as contact has been made the ccj threat put on hold for now? She is on the basic benefit so got nothing ...the address is her friends house not her own address ...shes divorced but stays at her friends house and used that address but don't know how cabot have it.. ..obviously she doen't want a ccj going there so what's the best way to procede.

-

Hi, I am looking for some advice please. I checked my credit file today and saw a CCJ has been registered against me in October 2017. My credit file was 100% clean in September 2017, no debt or defaults were showing at all. I am currently living in temporary accommodation due to a fire at my main residence I went to see if there was any mail that I missed. I found a letter from the county court business centre, sent in September saying that as I have not replied to a claim a judgement has been granted. The letter quotes CPR 23.8© and that the court will deal with the application to lift the stay without hearing. The accompanying paper work shows that Marlin claim that proceedings were issued on 26/05/2015 and that I failed to respond. I have lived at my current address for over 10 years and I have received no correspondence from Marlin regarding a debt or any claim form. I do not recognise the amount either. History The only debt I am aware of is an egg card from 2008 when I got in to some financial difficulty. The amount from memory was about half of what the CCJ is for (£5k). I have not had any correspondence from anyone regarding this debt since before 2010 and certainly not made any payments. As of September 2017 my credit score was perfect with no outstanding amounts or defaults. I know I can apply to have the CCJ set aside, the only reasons I have at the moment is that I did not receive the claim form, I have not heard anything from Marlin and that I do not recognise the debt amount. The delay between receiving the letter from the court on the 7th of September and now is that the letter came while I was away and in my absence we also had a house fire and lost access to the building. After seeing the default today I gained access and found the letter. Do I apply to set aside first or contact Marlin to ask for details of the debt? I am in a precarious situation because we (wife and children) are currently homeless due to the fire and I am trying to arrange a tenancy. I don't think I will pass a credit check as it stands. If I have missed any key information then please let me know.

-

Looking for advice on behalf of my partners daughter. She and her partner have recently rented a small house and during the letting agents checks she was informed that she had a CCJ registered against her. This is not surprising as she has been diagnosed with Borderline Personality Disorder and one symptom is not being good with money. She has moved around a lot and I suspect that letters and court papers were delivered to an old address and she has received the CCJ in her non-response. As I understand it someone will still be chasing this debt. What is her best course of action please? Thanks.

-

Hi all I need advice. 2 years ago we had a minor car accident which we believed had been resolved by our insurers!! Last week we received a letter from the court asking for £1556 as the insurance company had not paid the total amount we now have a CCJ. I have spoken to the insurance company who have assured me that they will resolve the issue ( they have admitted fault) someone forgot to pay some of the fees and they have not responded to any letters sent to them!! Now to me even though they have promised us that they will resolve the issue I can't help but feel that this is negligence by the insurance company - getting to this stage to me is totally unacceptable unfortunately only now we have received a letter about it otherwise I would have been on to them a hell of a lot sooner. Any advice on this situation would be very much appreciated.

-

Hi guys, As always your advice is much appreciated. Lowell issued me a backdoor CCJ on 11.11.15 to my old address. However they were writing to me at my current address at that time regarding another debt. In fact they received our new address details on 17.09.15 and wrote to us on that date. Worth trying for a set aside?

-

Hi, I'm hoping for advice, please: We're going for a mortgage. I've just done an Experian search and discovered a problem, namely a CCJ issued on 03/08/17 at Northampton County Court. They say it was from Lowell whom have a solicitor called Cohen/Cramer. I know absolutely nothing whatsoever of this CCJ. I've tried endlessly all morning to speak to the CCBS but the phone just never gets answered. I assume they're tremendously busy. I would very much appreciate help/advice/guidance please. I have a case number off the £4 Government advice website thing, that tells me absolutely sod all that Experian didn't, but they were free. Idiocy. Number I'm calling is 0300 123 1056. The reason I know it's Lowell is I rang an 01604 number which turned out to be the Court but for Northampton residents only and the helpful guy there looked at his computer and said that was whom it was from, but he knows nothing else and to call the useless, pointless, inane, time wasting, and costly to me, business centre number. The Experian entry says, incidentally, that the CCJ was at my current/correct address...

-

Hello, ive had a letter from Northampton court today for an alleged debt for a catalogue, I think I vaguely remember maybe having this but if so it was many years ago, claimant is Arrow, particulars are. .... the claim is for the sum Of £1482.17, with shop direct ( Carval) under account number .... ..... upon which the defendant failed to maintain payments. a default notice was served upon the defendant and has not been complied with . the balance owed was assigned from Phoenix recoveries to the claimant and the defendant has been notified of the assignment by letter. contact drydensfairfax. Court letter dated 13th October 2017? I get 5 plus 14 days to respond to moneyclaim? Sent cca requests etc, as this is the first letter ive received about any of this. many thanks

-

I am a freeholder of a flat where the leaseholder owes me approx £1200 in insurance, court fee's and interest and I have a CCJ for this amount. I have pursued this leaseholder through the County Court, First Tier Court, and back to the County Court and won every time. Recently I have employed the Sheriff's office to collect the money but they encounter the same problem as me - he won't answer the door or acknowledge any callers. When the Sheriff calls they can hear activity inside but get no reply. The debtor doesn't have a car to clamp so the Sheriff is "closing the file" as they say they can't do any more. What can I do? can I contact his mortgage company and ask them for payment? Any advice would be most welcome.

-

Post for a friend Letter from Mortimer Clarke concerning a CCJ issued in July 2017. Please fill out this I&E form within 14 days otherwise instructed to life the stay and request payment of £50 per month. No CCJ on credit report. Requested copy of CCJ. Defaulted back in March 2011. 1st letter knowing about CCJ. My question is does sending stat dec as never received the CCJ paperwork and couldent defend claim, where does it reset it to? Does it take all the way back to 2011 so debt would be SBd now or to the original court date in 2013 and debt not Sbd?

-

Hi there, First of, any help or advice would be very much appreciated. my sister ended up getting into around £1300 worth of debt with orange due to her teenage daughter running up a very large phone bill in one month. My sister, I assume - has just ignore it all. I only found out yesterday due to her asking to lend money to resolve this. She received a county court claimform on the 27th September and a letter from Lowell's to state court proceedings would be the next option on the 2nd of October (after the claimform had already been submitted). Had I have known earlier I would have sent a CCA or SAR I think it is for her but now obviously things are a little more tricky. I told her to hold off doing anything until I had done some research (prior to this she offered them half but they refused). she totally ignored me because she's a royal pain and sent off the court letter saying she intends to only contest part of the claim. I imagine a few will be slapping their foreheads over this haha. what would you advise to do? She is also a new foster carer and has been informed if a CCJ does register against her she could lose her place as a fosterer. So obviously want to avoid the CCJ at all costs Thanks for reading!

- 3 replies

-

- ccj

- detrimental

- (and 5 more)

-

Hi All My partner no longer lives in the UK, but has received a few emails from an old (believe pdl) debt over the last few months relating to a CCJ which was granted after she left the country. The DCA are called TM LEGAL SERVICES They have now sent the following: Following our recent letter, you have failed to contact the office to set up a repayment on your County Court Judgment. We are now in the process of contacting your employer to verify your status of employment. Once we have confirmed the status of your employment, we will complete an N337 Form (Request for Attachment of Earnings Order) and present this to the court. We anticipate this form will be completed in the next few days. After this form has been completed and sent to the courts, we are unable to retract the application and your employer may be informed of your County Court Judgment. Once the Attachment of Earnings has been applied for, the courts will issue you an N56 Form (Form for Replying to an Attachment of Earnings Application Statement of Means). You must fill in this form, giving details of your financial circumstances. These include your employer's details. You are required to include your partner's financial circumstances also. You must return this to the court within eight days. It is an offence not to send back the N56 Form or to give false information within the form. If you do not send back the form, the county court bailiffs will serve you with an order to complete. If you still do not return the form then you will be sent a notice of summons to attend a court hearing. At this hearing you will be required to explain why you have not supplied information about your financial circumstances that you were requested to. You must attend this hearing. If you do not attend the hearing, the court can issue a warrant for your arrest and you may be brought to court or even jailed for up to 14 days. To stop our application, we require you to contact the office by 7.00pm today Friday 29th September 2017 on the number below to discuss the options avaliable to you.. Our contact number is 01253 523460 (option 2) and our opening hours are Monday to Thursday 8.00am to 7.00pm & Friday 8.00am to 7.00pm. Note, we are extending are opening hours to give you a final oppurtunity to avoid the Attachment of Earnings. Pretty scary sounding here, mentioning arrest etc. What is the best way to approach this. She does not live in the UK, is not employed in the UK, but we are willing to potentially set up a payment plan, but are wary of giving them much info. Any help would be appreciated.

- 19 replies

-

- attachment

- ccj

-

(and 3 more)

Tagged with:

-

Hello, Found myself stuck in a bit of a situation and feel over my head. Have just received a letter from Lowell solicitors in the post titled 'Second notice of county court judgment (ccj) arrears - £150' This is from an old debt from orange dated 2013 or thereabouts. i last received a letter from them in 2015 and have never contacted them in-regards to the debt. The letter starts We wrote to you previously regarding your judgment arrears, but we are yet to receive the payment as required under the terms of your CCJ. As a result you currently have arrears of £150.00 This is the first i have heard of any CCJ or any letter other than in 2015, the debt is for a small amount of £590 repayment is no issue, but i wish not to cause further harm to my credit file. I have checked my credit score on clearscore, no sign of ccj or any changed or listed debts etc. Paid and checked my name and address on registry trust,once again nothing registered. My problem is where do i go from here? Who do i contact? What do i ask? Why isn't this supposed CCJ showing on my credit file or the trusts website? My current address i have lived in 8 months and is registered to my name on electoral roll etc. Previous address i lived in for 3 + years. The letter further on threatens county court bailiffs etc attachments of earnings etc. Repaying the debt is no issue, what is important to me is my credit score. having spent the last 4 years rebuilding it i would like to keep it on the up. Ok so i have just checked my credit file in depth, i have just found this. What changed in August 2017 You are now on the electoral roll at your current address •You opened your LOWELL PORTFOLIO 1 LTD (I) •Your LOWELL PORTFOLIO 1 LTD (I) account went into default •You closed or settled your LOWELL PORTFOLIO 1 LTD (I) account When i check on noddle i am greeted by this active court judgment. Judgment date 20/06/2017 Amount £ 587 Court name County Court Business Center On the accounts page it shows an open account with Defaults monthly since the opening of this account. Looks like my credit score is shredded Thanks in advance guy.

-

hi to all im a new user on here and need some advice please! here is a brief description on the matter back in 2013 i signed up with talk talk for phone bb and tv services, after approx 3/4 weeks of no services i rang them up and told them i would like to cancel the contract as they had not provided me what im paying for. after numerous phone calls about the above issues talk talk said the contract would be cancelled and that would be the end of the matter there would be no charges due to early termination of contract etc. although i never received anything in writing from them i left it as the matter was delt with. fast forward to two days ago and i got a claim form from Moriarty law working on behalf of jc international acquisition. they are claiming £572 for non payment of agreement from talk talk I'm confused about this as i was under the impression it had been sorted years back!. i have sent a reply to the court with a acknowledgement of service i can get some information about this as i intend to fully dispute this. how do i get information about this old account ? any letters that was sent to me , phone calls ?? how do i file a defence for the court I'm confused by all the info on this if anybody could help id be so grateful many thanks for your help

- 34 replies

-

- aquissition

- ccj

-

(and 7 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.