Showing results for tags 'cca'.

-

Received this in the post today Along with my original CCA letter. Any advice? I dont know what details they have as I have moved a number of times since then. If it was a credit card I would have thought capquest would have the details Just double checked on my Noodle account. It is listed in my closed accounts (if it is that one) and is shown as settled in Dec 2010 with no missed payments. Edit: it cant be that one on the account as my card limit was £1000 and have been paying £6.52 for years and my outstanding balance is shown as £1211.14 and the account is settled properly. Edit 2: Is it worth doing a SAR with CapQuest to see what they have on file and amounts?

-

Hello I am new to the site always been a watcher and reader. Recently requested a CCA on account that is managed by idem (previously EGG) because it was pre 2007. They have sent through a copy but I am unsure where I stand to whether it is enforceable. I have a scanned copy in PDF Please can someone help me I have been quite successful on negotiating F&F on other accounts and am trying to finalise on others with Barclaycard (Link), PRA Virgin Active. RS1.pdf

-

I have been with Step Change (CCCS ) for over ten years now, they have recently threatened to close my account with them and would seem to be wanting me to take out equity release to clear the remainder of my debts as they say they are now licensed to do this . They also wanted me to contact my debtors by telephone ( all now with DCAs ) and to start to go through the security process just to see whose debt belongs to who ? Either me my wife or jointly if I failed the security checks then it would be my wife's etc. So instead of this I have sent a CCA request to each one. Today the first one has come back from AMEX via NCO. They have sent their terms and conditions from 2003 ( reconstituted ) with no signatures or dates ( credit agreement regulated by the consumer credit act 1974 ) They have also sent my latest statement showing the last payment from Step Change and my current balance and a summary of Credit Card Benefits Section 1. Finally a photocopy of a 60 second application form. This does contain my signature and is dated but where it says authorised by Amex nothing ! They have not signed or dated the agreement. In their letter they say These documents form the executed agreement between me and american express. We trust this resolves your request. Is this valid as I need to know what to look for ? Or what is legally correct ? BTW I did an experian credit check and nothing is showing and my credit score was 997.

-

1. Bought audi on balloon CCA agreement It ended Feb 2012 Requested vehicle to be collected They ignored request and then from then until now all default notices incorrect All their paperwork shoddy 2. Kept vehicle in storage for first 8 months Actually bought a lease Audi thinking they would collect. 3. They wrote to me Jan 2013 saying they wouldn't pay storage charges Had to remove and asked garage where it had been kept to leave their awaiting audis collection 4. Wrote to audi numerorus times They failed to collect. 5. Had a court date booked 19th oct which I was happy to attend Their sols cut a very late deal with my sols Tuesday 18th Oct I told sols I wasn't happy that t's would net be crossed and i's dotted they weren't. 6 My sols agreed that I would deliver up vehicle Had told her it hadn't been used for 4 years and would be unusable due to the amount of time lapsed 7 Audi collects keys for vehicle and sign off log book 24th oct They go to collect at address given some 27 hours later Audi not there Have reported to police but my solicitor says I am still now liable and in breach of agreement Feel like my solicitor just wants to get rid of all case and me pay for everything ! because its been totally messed up I had a really good case prior to this rushed agreement Can anyone help my solicitor doesn't want to!

-

Hi It seems that Cabot Finnace has brought both mine and my wifes credit card debts from Lloyds, they have not provided a CCA in the 12 +2 days. What do I do next?

-

Hi, I sent a CCA request to the DC/Solicitor in feb 2016 Just received a response in October which is basically a copy of the online application? no agreement on terms or repayments just my address details, job details, credit limit, no signed agreement Is the above enforceable? is there a letter I can send back to this? the amount is for £6k+ - any help much appreciated

-

HI I sent CCA to Lowells for 3 different accounts. I had no response this was in 2014. I have now received pre-legal assessment letters. I have kept the post office recipts as I sent recoreded with 1 pound postal order. I also sent to Bryan Carter as well. (he respoded was on hold until could get info) never heard back from any of the creditors until now??? How do I prove I sent CCA if it goes to court? and do I need to send another CCA as its been 2 years?? Any help thanks

-

I have a few student loans taking back from 1997, 98, 99 and 00. I went Bankrupt in 2010 but was told my student loans would not be included in my Bankrupcy. I spoke to SLC and they backed this up. I was still receiving deferment forms from SLC and I kept deferring the payments but have now received a letter from Erudio who say they have now bought the debt. I have now read that certain student loans could be put under Bankrupcy so could be written off. Would these loans have been written off when I was declared bankrupt? Was I miss-informed? Any information would be great

-

Hi For a while Arrow and now Drysden Fairfax have been irritating me with a Capital One CC account which was defaulted on. Taken out in 2001. Last payment approx 3 years ago. In May, I CCA'd them, eventually received the attached document. They say they've sent a Recon, quoting a high court decision in 2009. This document is all they sent, despite their letter saying that they have also sent a copy of the terms & conditions. Does not sending the accompanying t&c's mean it's failed CCA reply? More importantly, is the attached CCA enforceable? It's termed as an Application Certficate? Prescribed terms? (I'm not too clever on this aspect) Thoughts and advice appreciated. CR cap one recon cca.pdf

-

We currently have about £6k outstanding of a DMP we have with Stepchange. We have been repaying for about 11 years and had 1 year left except my wife lost her job which knocked the payment right down and now some of the creditors are starting to harass us. BIggest concern is Barclaycard. My parents have offered us £1800 to act as a full and final settlement but looking around I came across this forum and 'Cash cowing'. Now i'm concerned what the best way forward is. Debts are: WESCOT CREDIT SE... £1,331.49 LLOYDS BANK PLC £1,245.25 LLOYDS TSB CARDS... £1,106.58 MOORCROFT DEBT R... £457.56 CABOT FINANCIAL ... £365.77 WESCOT CREDIT SE... £339.64 WESCOT CREDIT SE... £325.57 BARCLAYCARD £324.52 Wescot Credit se... £261.24 What is the best way forward? I remember CCA'ing Barclaycard previsously and they have the original agreements as do Lloyds.

-

Just had a letter from Robinson Way for IDEM Servicing (ex HFC Bank) regarding my CCA request. "Idem Servicing have advised they are unable to provide an agreement for this account.. Please note, this account is no longer being serviced by Robinson Way. Please direct any queries to Idem Servicing directly" It now says the amount due is £0.00 - I assume thats just for their internal systems and I do nothing more with this and if I get another letter from some other DCA regarding this I should just send off a CCA request to them?

-

Hi Everyone, i have requested a SAR on Natwest Bank and also Barclays, so far Natwest have replied back with their first letter. The objective of my SARS is to attain my old statement, fees, transactions and charges to claim back on and also for PPI. I know I have had a lot of bank charges as I used my Natwest account when i was a student and really bad with my money! I have attached the letter which Natwest have sent back, i was hoping someone could shed some light on what I could reply via email with? They have mentioned statements now can i say I just want ALL the information and statements available or I remember reading somewhere to specifically state i want all bank charges and fees? I typed up the below to send them, unsure if it is any good? Thank you for your letter of acknowledgment to my SARS request. As my letter states, I require ALL relevant documentation linked to my name, therefore I would like all statements including bank charges and fees to be provided to me, from the date my account was opened till it was closed. If you are concerned about the environment I will consider having it emailed over to me from an official source along with a written letter confirming what has been or will be provided via email to me, this is to ensure its authenticity, it is also proof for me should matters escalate due to any data violations and unlawful SARS violations. I should be informed of any documentation that cannot be provided to me via writing or email correspondence.

-

Hello, im after some advice if possible. CAG has been helpful to read but im now stuck. Following redundancy I got into a bit of credit card debt, im now in a position to try and resolve the debt but don't know where I stand. One of the credit card debts is now with Idem servicing. I sent the a CCA request and they replied stating they had no agreement, should one be found they would send it. Foolishly maybe, I offered a full and final settlement offer just to move on. They rejected the offer and sent a credit card agreement (13 days after they said they didn't have one). They say the agreement was signed in 2001, however the address on the agreement is the address I moved to in 2008, so a different address I was at in 2001, secondly the credit limit states 1500£, with an APR of 27.9%, I cant prove it but the original credit limit was 950£ and the APR 15.9%, it only went up to 27.9% when I closed my current account at the Halifax and moved to Barclays around 2005/6, I remember that because at the time as I was annoyed to put it mildly - Just to add the credit card was with the Halifax. Idems letter keeps referring to LLoyds Banking Group are they linked to Halifax? The agreement also says bank charges were 12£, again I remember paying 35£ when one of my first payments was a few days late. Some pages of the agreement are blue, some white and all different fonts. Idem claim they own the debt, but terms in the agreement only state they can transfer the debt, but another clause in the terms says only We or You (meaning Halifax or me I assume) can enforce any part of the agreement. The agreement also state that interest will not be charged on defaulted accounts, however Halifax continued to apply interest when in the debt management plan and the account had been defaulted. Where the signature is supposed to be for me is blank, and the agreement contains no dates. Can anyone advise where I stand with this agreement. I can scan in later if it helps? It all just seems dodgy to me, and incorrect for the terms I remember. The debt is also 5481£ which is significantly higher than I recall ( I did bury my head in the sand for a few years, I had no money and no way of dealing with the debts, contributions were made through a dmp, it has been defaulted but the 6 years has now passed) The agreement just isn't correct from what I can see, but if anyone could advise further, it would be greatly appreciated? Chris

-

Sent a CCA request and this was the response, what do you recommend i do next? They have said they didn't send me the notification letters as they didn't have a confirmed address? the address is the same as the one on the CCA that they have sent these letters to? HFC, CCA request response.pdf

-

Hello all, I'm new to this forum and need help. I have a court hearing to set aside a store card debt which is of £174.34. The judgement was made against me as I didn't get the claim form , now I have a hearing on Monday. This morning I received a witness statement from Lowell solicitors who are Lowell portfolio 1 ltd's solicitors and they have attached a CCA agreement copy with my signature on it. The contract was taken in November 2006. It is not a full agreement on the page with my signature on it. I'm panicking as I have hearing on Monday, plz can anyone advice on CCA section 127(3-4) is in enforceable on my agreement. Any help would be appreciated, I'm nervous and very scared.

-

Hi guys, I CCA'd Lowells about a credit card I had in 2010. I received a response from them, however, the name and address entries are blank and the credit limit is incorrect. There is literally no personal information held about me. So, as this is clearly an attempt at using a correct CCA, assuming i'm stupid, what's my response? Cheers

-

I have had a reply from MBNA/Link to my CCA Its 16 pages long along with a statement of all the payments made (I have had to split it into 2 parts so not to reach the max file size) (I have paid £1500 off the total so far) Its not in my credit file at all I would be grateful if someone could have a look over it and give me their opinion. Thanks

-

Can someone please offer me some advice on ths matter please, i have some registered defaults on my credit file from credit card companies for the last 3 years, i am in a dmp with payplan with who i make a token payment to all companies as i am unemployed. I have written to all card companies asking for my cca, some have replied that they cannot find any paperwork and that the account is unenforcable, and others have said they cannot find the cca and will suspend payment to the account until the cca is found. 1, what is the position on this, do i carry on paying them or just stop until they find the paperwork,if they ever do? 2, if they dont get back to me until after the 6 year time period for the defaults has elapsed, and the defaults are removed , what then? 3,if i was to be given a cash sum to make an offer of a f+f payment to all is there any benefits to pay them off now,before the 6 years, if accepted, or just keep paying the token payments until the 6 years has passed and defaults are removed anyway, am i still liable to keep paying after the defaults are removed, until the total debt is repaid, as at this rate it would take me 25+ years to clear with the token payments, i make to them. THANK YOU FOR ANY ADVICE ON THIS MATTER

-

I asked for a copy of a CCA agreement from Drysdens / Max Recovery recently. A letter dated March 2016 stated that they were unable to fulfill my request. A letter today from Drysden attached a "copy of the credit agreement conditions". It has none of my details on, nor my signature. The letter says " our client considers the debt due and owing" What do I do now?

-

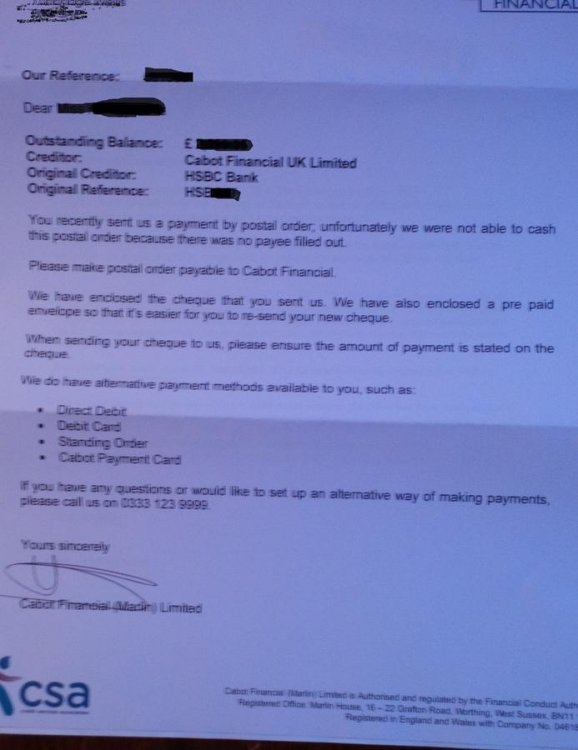

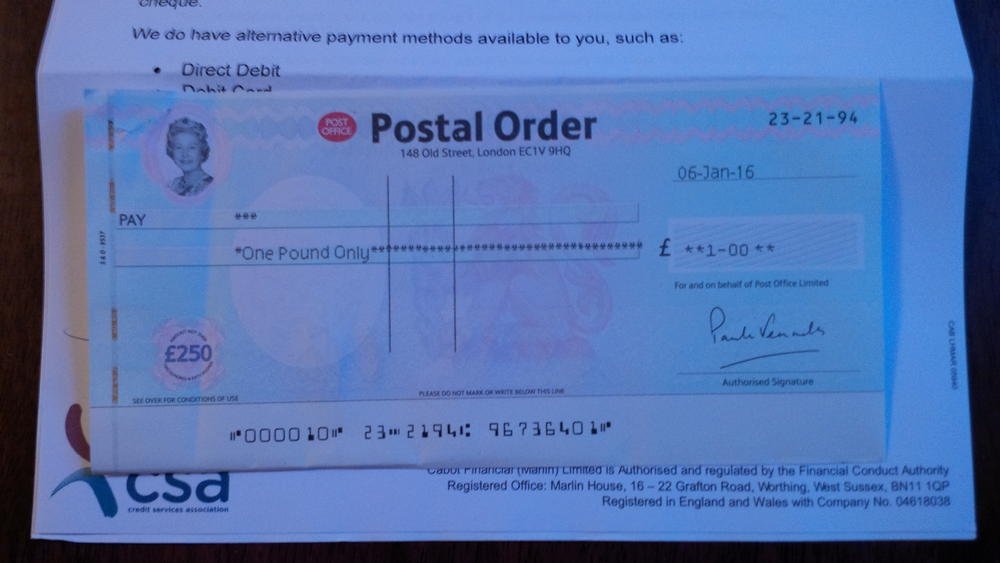

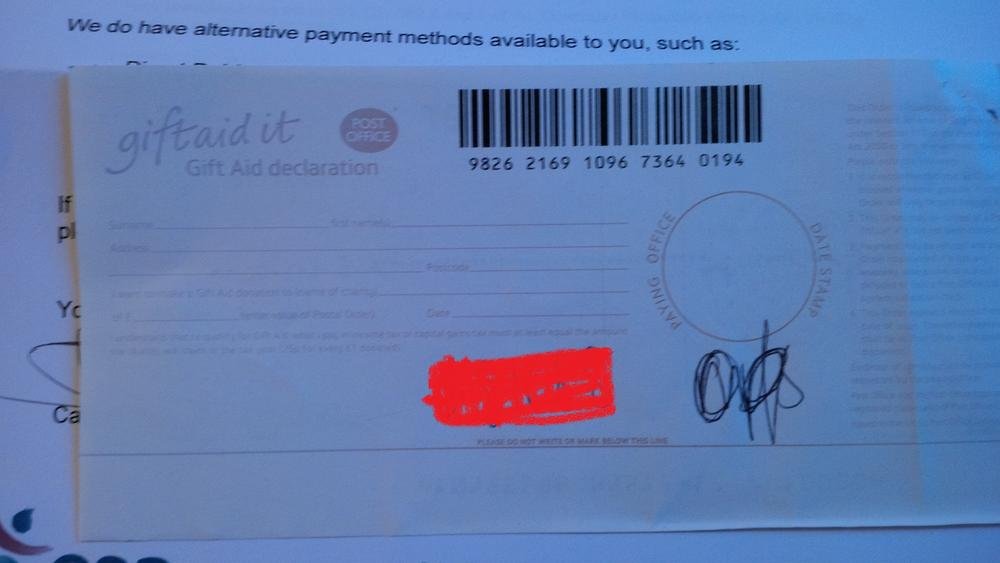

Hello everyone, Credit Card-HSBC Bank, currently with Cabot/ Marlin Account Start Date: 01/2007 Opening balance:£2700 Default balance: £2700 Date of default: 06/2010 I think this probably was an online application.. After defaulted in 2010 Metropolitan Collection Service Limited contacted me and demanded high monthly payments while I was in the hospital- everyday calls etc. .. In the end reduced payments were agreed. I was paying them reduced payments (£10 or £20 I don’t remember exactly) on monthly basis until 2013. They agreed in writing in 2013 a monthly £1 payment : Commencing Date 29/06/13 Finishing date 28/08/2096! A few months after the agreement I was contacted by Marlin (Cabot Financial) advising me to start paying them the £1 monthly and providing me with their details. Noddle currently shows owing of £2400. I was contacted by Marlin over the phone recently for a review -I explained that my financial situation is even worse than it was in 2013. They were fine-still happy to receive the £1 .They also mentioned that a full and final settlement can be arranged at 65% discount but they would consider a lower offer if I go to them with one- they said. I sent them a CCA request on 08/01/16 and a change of address letter. They have received my letters on the 9th. Today I received the following letter (file of the letter attached) advising me that unfortunately they were unable to cash the postal order because there was no payee filled out. Please see the attached letter from Cabot. Apologies for the poor quality of the file- I think it is readable. ..but if it is not let me know an I will try again. They also returned my original CCA request letter and the change of address letter??? So I guess I should return these to them. They have written on my CCA request letter with pen: 'ops req £1' and also attached the sticker for sign for service from the post office (I sent the letter recorded)... I have also attached the file of the postal order. Please tell me what is wrong with the postal order? I asked for a postal order and in the post office they told me that the best is to buy a crossed one if I am going to send it to a company, so I agreed!? I did not ask them to put a name on the postal order... Although I left the postal order completely blank at the back- Cabot has written on it my Ref number and something like a signature next to the ref. number??!!!! Please advise on the above? Very much appreciated! Uploaded PDF files -post 3 .

-

Asked for a copy of agreement, a CCA. A Santander credit card, being chased through Robinson Way, solicitors. They have sent a reconstituted agreement. This has NO date, nor my SIGNATURE. In fact, it is just a normal looking letter. I thought it should be at least a photocopy of something I would have signed. Is this a valid response to my request? Should a CCA request mean they send something with a datestamp, and a signature? I can upload their letter if it helps.

-

Credit Card-MBNA -Account start date 05/2006, defaulted -06/2010 at £6550. Noddle currently shows that I owe : £5250. I found a letter dated 01/09/2010 from Experto Credite advising me that Varde Investments(Ireland) Limited has bought the interest of MBNA Europe Banks Limited and they are legal owner of my account. ‘Under the terms of assignment Experto Credite Ltd has been appointed by Varde to recover any and all outstanding sums.’ I paid Experto Credite £20 on monthly basis until Aktiv Capital contacted me to inform me that they have taken over my account. They agreed to the £1 monthly payment in 2013 (which was agreed with Experto Credite already I think) and since then I have been paying it. I noticed just recently that on my Noddle report instead of Activ Capital, PRA Group UK has taken place as a lender.The last letter I received before I moved away in 2013 was from Aktiv Kapital ltd. I have been paying them £1 for more than 2 years. Now I want to update them about my new address and request CCA but they are no longer Aktiv Kapital ltd. They are PRA ltd. They probably sent me a letter to notify me at my old address... Their bank details are still the same so my £1 has been going to them and they update my Credit record file regularly. I called the Aktiv Kapital telephone number from the letter I last received in 2013 but PRA answered. I did not introduce myself - just asked them to who to write and they explained to write to PRA in Scotland not to Aktiv Kapital in Bromley. Who should I address the letter to: PRA or Aktiv Kapital or both? What do you think? My address: Their address: Aktiv Kapital(UK)Ltd/ PRA ltd 2 The Cross Kilmarnock Scotland KA1 1LR Date: Dear Sir or Madam, .................. or My address: Their address: Aktiv Kapital Ltd 2 The Cross Kilmarnock Scotland KA1 1LR Date: Dear Sir or Madam, .....................

-

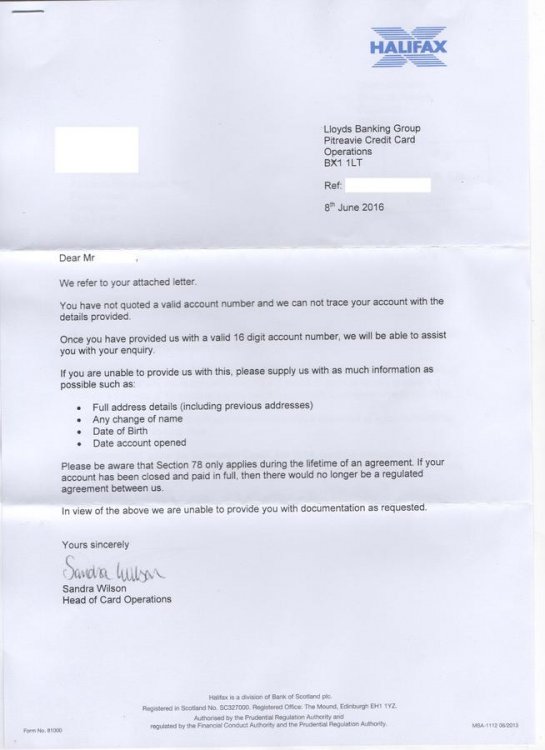

Hi all, I'm new to this so unsure how to get this into the correct forum? any help is appreciated. To cut a long story short, 2 alleged Halifax debts were sold to Cabot in 2012 and I have had nothing but problems from the start with them. in Sept 2014 I sent 2 CCA requests for the alleged debts and got the standard response from them and these accounts were on 'Hold', however in Jan '15 I received a letter from Cabot stating that they were no longer going to pursue ONE of these debts. I have heard nothing about the other one since, I have since sent a letter to Halifax to see if they actually have a copy of the original CCA (dating back to May 2005) but their response was for me to send for a SAR and I needed to put my signature on the letter to prevent fraud?? (I have not done this). Should I send a follow up letter to Cabot asking what is happening or should I 'just let sleeping dogs lie' any suggestions on next course of action?

-

Many years ago I had serious financial difficulties. One of my loans was defaulted and terminated within the default period (nice). the account was sold over a year ago to a certain Crusoe brain trust I requested a copy of the CCA. This was a year ago after several letters saying they were trying to get a copy from the OC (good luck with that). Finally a letter arrived last week saying a copy of the original or a reconstructed CCA was enclosed which it wasn't nothing was enclosed not a sausage. It looks to me to be an automated letter. I know for a fact that the CCA does not exist as I requested it from the original OC a long time ago and also requested a full SAR it wasn't in there either. My question is do I just leave this as the account is very close to be SB? Would you contact the idiots or just let it ride? Thanks in advance Mr P

-

Hi, I have asked Robinson Way for a CCA request. But can I just clarify something please. The card was a Barclaycard which defaulted, sold to MKDPP who sold to Hoist/Robinson Way. The card was taken out in August 1993. As part of the CCA should I be sent a copy of a "true signed agreement" or can they send me a reconstituted one. I am not sure which one applies to my card or if in fact they could send either. Any help would be greatly appreciated. Also, is there legislation to say which one I should receive, if so what is that legislation. Many thanks

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.