Showing results for tags 'cca'.

-

CCA received after 47 days - but is it valid?

WorriedGirl posted a topic in Debt Collection Agencies

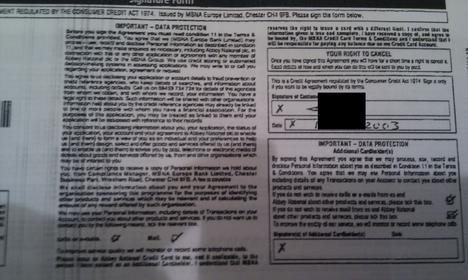

Hi There, Connaught collections sent me a copy of my credit agreement that I requested on 7th October 2010. I received it on Tuesday 23rd November 2010. It is exactly what 1st Credit sent me 2 years ago when I requested my credit agreement from them, before they passed the debt on to Connaught - a copy of the application form I filled in. The application form does, however, say on it beside the signature area "This is a credit agreement regulated by the consumer credit act 1974 etc etc" Below the signature area, these is a section entitled "Financial and Related Conditions" and this has sections on "Credit Limit" "Credit Charges" and "Payments and Interest Charging" . They also sent what looks like a computer print-out of Terms and Conditions. The interesting thing is that I recently applied for my Credit Report and this was not on it? I'm very confused as I haven't paid a penny of this debt in about the last 2 years since I first requested my credit agreement. I do have another credit card that was with Halifax that I have been paying religiously every month since it went to default years ago, but this showed up on my credit file Anyway, I digress Connaught said on the letter that they sent along with my credit agreement, that payment must be made in full within 7 days. Should I send them a letter offering them £40 a month or something like this? Thanks for any advice at all - just not sure what to do next- 12 replies

-

- cca

- credit report

-

(and 1 more)

Tagged with:

-

Hi there, This is my first post, so please be easy on me I have a small little problem, a CC debt of around 500 GBP (sorry, I don't have a pound sign on my laptop ). The situation is the following: I lived in the UK for about 5 years. I had a bank account and CC with HSBC, which I reguralry used, but I left the country in April 2009. On current account there was an overdraft of about 250 GBP and on my CC a debt of about 500 GBP. (I also had a Lloyds account with an overdraft of about 250 GBP, but that is ok, the online banking still works and I will pay it back, since I don't want to loose the account.) So I left the country not really caring about all those accounts, I thought I'd paid them back when I had money and a job. I am in Austria now, and since I finally found a job and will start working on Monday, I wanted to check what the situation is with the banks. ( I know it took me long to find a job, I guess I had a long holiday ). HSBC has closed my current account and canceled my CC. I still have my Savings account with 0 GBP on it. I called the bank, they said they closed the account and transferred my debt to their collection agency, Metropolitan. When I called Metropolitan, they told me that the debt was now with Moorcroft and I need to give them a call. So when I called Moorcroft, I told them what the situation was and that I am not living in the UK any more but I will be able to pay back my debt in a month or two. According to their records I have an outstanding balance of 555,11 GBP. Now my question and problem is: How do I know where this 555,11 came from, and if this is the amount I should be paying? What about that other overdraft of about 250 ? Did that just disappear? Is that possible? (I wouldn't mind ). And what is the guarantee that I don't need to pay anything more than this when I paid it? I read around the forums and found that I can request a CCA. So I called them up (Moorcroft) and asked for one. The lady started asking for my details and address and everything, but I explained to her that I don't have an address in the UK any more, and I would like this CCA to be sent to my new address in Vienna, Austria where I live now. She told me that it's not a problem, just send the letter and 1 GBP. Should I send cash in the post? Do you think it was a good idea to get a CCA? I wonder if anyone has experience when it comes to this situation? Eg. left the country, but would like to settle my debt. Any help or advise would be appreciated! I did search the forums but didn't find anything that would resebmle my situation. Thanks a lot

-

Hi, I wrote to HFC on the 16th November requesting the CCA. They replied with "cannot send out the CCA without a signature" which i replied with roughly the same letter pointing out that by law a signature is not required but here is my signature and used a digitalsignature like the digital signature onthe consumer action group website.Although i did just use a font as my signature and not my actual signature scanned in-imvery paranoid when it comes to this company. Why isn't this sufficient? It is highly frustrating. How can i get my CCA?

-

Hi, Im new to the forum and have picked up quite a bit of advice concerning defaults but im still a little unclear on a few things. Id really appreciate some advice in relation to my own case Ill try to keep it short - basically,l i got into a bit of financial difficulty over a year ago and in order to stop any defaults/late payments affecting my credit history, I consulted a company called gregory pennington. Then it all went to pot - i wished i never used them although they did help me get back on track. Ive since stopped using them and manage my own payments now, but when i first started with them, it took around 6 months for them to set up an agrrement with the lenders (lloyds tsb and capital one). This resulted in me ending up with 3 shiny defaults on my credit file. Im slowly trying to repair the damage, but from what ive seen and read, it look slike i have to wait the whole 6 years - HOWEVER - I want to check a few things, if I may: I recieved default notices, and they have given me some time to pay - however one company didnt default me, the other did - when do defaults get applied to your credit file? Is it a certain period of time AFTER the default notice or at the time the notice is issued to you? The Default Notice i recieved was served under section 87 (1) of the CCA. If your paying via an IVA company, are companies still able to issue you with a default? I thought a default warning was to force you to settle the debt or make a suitable arrangement? Id really appreciate your advice on this - do let me know if i need to supply more info...! thanks..

-

Hi all, I have been a member of the CAG for a while now and have in the past successfully sued Nationwide for my bank charges but it has been quite a while since I have been here. I also have a credit card with them and they have been nothing but vindictive ever since I recovered my bank charges. I have been studying for a degree which I have had to give up, partly due to ongoing financial problems and depression , all exacerbated by the ridiculous and, I would say criminal, behaviour of Nationwide. For the past 2 or so years I have been trying to pay the card off, but due to the nature of living off student loans etc. it has not always been possible to maintain these payments. I had been proactive and advised them in advance that I would be experiencing difficulties but they did absolutely nothing to help! Now I find myself in a position whereby I have had to give up my degree and therefore am no longer in receipt of any finance, I am in the process of job hunting but this has not affected Nationwide's stance either. They have passed the debt, a measly one at that, to their in house collections dept. KPR. I have been to the CAB recently and they have arranged for me to see one of their professional debt counsellors, but in the meantime they also phoned some of my creditors to ask them to 'lay off', at least until I have seen this counsellor. They all obliged EXCEPT for Nationwide who refused point blank to the CAB guy down the phone - he was aghast! Sorry for the length of this intro but I felt it better to lay a good foundation, so to speak. What should I do? Should I send a CCA request as I have been reading and if so, who to? Nationwide or KPR? Any advice would be greatly appreciated as I can't handle this treatment anymore, I have enough on my plate without the corporate greed and bullying tactics being demonstrated by the Nationwide. Kind regards

-

A few months ago, Capital One served me with a default notice and passed my debt with them to Capquest. I have been paying token payments on this and several other debts since becoming unable to work 10 years ago after suffering a serious form of cancer. They had started demanding to see copies of my bank statements etc and it was when I refused to do this, having submitted the usual statement of expenses, that they issued the default notice. I requested a copy of the CCA from Capquest, who passed it to Capital One. They have now sent me what they say is a "reconstituted copy" and a rather threatening letter advising me that the document is valid and the debt must be paid. I wondered if someone would kindly look at the documents if I scanned them in with (personal details removed)? I have no idea as to whether the agreement is enforceable!

- 32 replies

-

- capital one

- cca

-

(and 2 more)

Tagged with:

-

I wondered if somebody could pass their eye over the following CCA. Currently part of a huge DMP so I'd really appreciate the advice.

-

I've been doing quite a bit of reading on here about CCA Requests and, swamped by debts I thought I would give it a try. I've read some conflicting opinions on whether the 77/78 letters work or whether they give rise for banks to provide a modified copy etc. First I'll tell you a little about my situation: I have most of my debts with Natwest - 2 credit cards, 2 unsecured loans, 1 overdraft and a mortgage. I've moved my main bank account to another provider to protect my income. I also have credit cards with Capital One and Tesco (also run by RBS/Natwest I believe). Could you please advise me on the following: 1. Would I be better sending a Subject Access Request or one of the CCA template letters to Natwest? Can anyone point me in the right direction of a good example of a letter to use? 2. Can anyone tell me of their experiences/success/failures following this process with Natwest. Tesco and Capital One? Many thanks

- 2 replies

-

- capital one

- cca

-

(and 3 more)

Tagged with:

-

Hello all, need a bit of info here hope someone can help. I've owed the bank some money for over a year now firstly i tried to resolve matter with them but they started adding charge after charge and wouldn't reply to my letters. then they get Lowell finance involved who sent me a rather strongly worded letter with various comments typed in bold, sure you know the one's, i was angry and sent them a CCA request and a pound, nothing back not even my fee. sure enough then Moorcroft got involved (don't like this firm full stop) so i did same again, they tried to say they felt the matter didn't fall under CCA request. so after a long laugh i wrote to them again with a CCA request and that went the same as Lowell, no response no returned fee. now it's iQor who is on my case together with GPB solicitors. i have sent them both a CCA request and just today resent with there duties highlighted (after they sent me printed statements of the account) and again ask them to provide a signed copy of the credit agreement . anyway getting to the point! surely it is wrong for me to have three companies chase me for this money and all three fail to provide a credit agreement? are they allowed to pass on the debt when the first request with the first DCS has not been fulfilled?. if they cannot fulfill my request what will happen and what should i do? whilst i wait for your help i'm gonna send a letter to Lowell and my best friends Moorcroft as they owe ME money thank you.

-

Hi, please excuse me if I'm in the wrong forum, but I am completely new to CAG and am looking for some help. My home was repossessed in 1999 by a loan company, who then pursued me for the "shortfall" between the outstanding loan and the sale price of the house. I am wondering if this debt is enforceable if the solicitors who are now receiving payments cannot produce a copy of the original credit agreement, or if they can, can it be rendered unenforceable if the agreement doesn't comply with the Consumer Credit Act? Thanks for your patience.

-

- cca

- consumer credit act

-

(and 2 more)

Tagged with:

-

I am writing this on behalf of my father and would appreciate any feedback and answers to my queries. Here is a detailed history of the correspondance, please bear with me: He recieved a letter in Oct 2008 from Turnbull Rutherford Solicitors claiming to be acting on behalf of HFO Services (I have since found out these companies are linked) with an outstanding account of over £1,000. He ignored this letter having never had a debt with HFO. HFO contacted him by phone and told him they were collecting on behalf of Monument for a credit card he had. At no point has either Monument, Barclays (monuments holding company at the time) or HFO informed him in writing that the debt from Monument was purchased by HFO. First question - Is that legal? should they have informed him of this or not? About a year later after phone harrassing he agreed to pay £50 a month DD (over the phone), they sent a letter in Oct 2009 detailing the direct debit with a direct debit agreement attached, he did not sign the agreement but the letter does state that he doesnt have to take any action and the DD will go ahead. What is strange is that in this DD agreement letter the debt has decreased from over £1000 to £662 before any payments have been made. Sensing this was a bit suspicious he spoke with the Citizens Advice Buereau who gave him a template letter asking for a copy of the creditor agreement under the Consumer Credit Act 1974 within 12 days. This was sent to HFO 10th November 2009. They responded over the 12 day period on 3rd December 2009, however they only provided copies of 5 statements of the credit card and not the CCA. The letter states: "Please find attached copy statements that we have recieved from Monument. As soon as we have recieved the rest of the documentation this will be sent to you." Again is this legal? I have read in many places regarding this 12 day rule for CCA requests but am unsure what it actually means. If they dont respond within 12 days does this make the claim unenforceable or does it only make any further interest charges on the debt unenforceable? He finally recieved a CCA dated 10th May 2010, however this does not appear to be complete. Firstly they have only sent the application for credit to Monument. This does not detail the full terms and conditions and the interest rate for the card. Secondly they have seriously breached the Data Protection Act by sending him the wrong application form from someone who applied to monument a year later than he did. To clarify they have sent two pages - one is an application for someone else detailing their address and bank details the second is a 'Rapid reply card' (not a full application) detailing his name and address and asking for him to complete the following details on employment, income, contact number and to sign a credit agreement declaration. The declaration states 'I am applying for a Visa credit card issued by Barclays Bank PLC, I have read and agreed to be bound by the Terms and Conditions...etc' There are no comprehensive terms and conditions attached. Does this make the CCA unenforceable? He then recieved a letter dated 8 days later (18th May 2010) from HFO claiming to be a final settlement and closure notice informing him his debt now owing £670 will be charged at %12 interest per annum, he ignored this. He has now recieved a letter in Aug 2010 claiming to be a 72 hour notice of litigation. He says he doesnt mind going to court as he can bring up the several failings in the debt collecting procedure - Firstly he wasnt informed of the debt being sold, he has since spoken to Monument and Barclays who have no record of him. Secondly the CCA wasn't provided in adequate time and containing the correct information. Thirdly HFO Services have breached DPA by sending out information on another applicant. I would appreciate any feedback on this matter as to whether we can expect to get this debt written off or not and how to approach the issue. Thanks for your time. Chris.

- 21 replies

-

- cca

- debt collector

-

(and 2 more)

Tagged with:

-

Hi all, I recently cca'ed Fashion world on 5th August 2010. I received a reply from them dated 17th August. I do not have access to a scanner right now, mine has just broken but here is what their letter says: Now, the agreements they have sent me have my details filled in, in biro and is not my handwriting, nor is my signature on them. This is what I expected as i have never received, nor signed an agreement with fashion world. What worries me is the last paragraph they wrote - are they lying or not?:? Where do i go now?-?

-

Hi my first post hope I do this right Ok I have had 2 letters from 2 different DCA about credit cards from MBNA(RED) and EGG(Cabot) The letters from DCA have have my name and address but for a female (mrs) instead of Male. (I am male) I quickly requested a CCA. Red were unable to provide one and after a while sent me a letter saying I am not the correct person and so apologised and said I would not hear from them again. Someone has been using my details with a different gender to do credit card fraud between 2005 - 2007 by the looks of things. I received a CCA from Cabot about the EGG card. They have sent me a CCA from 2005 for a Female (MRS) but with my name and address. This person was drawing cash in large amounts daily from cash points. I live in a place with a mail room and there has been alot of cases of people stealing mail from them in the past. Any recommendations for people more knowledgeable than me. I am not used this kind of thing and I have been worrying deeply. As a side note the CCA looks very brief and had no mention of cash charges etc Thanks in advance.

-

Hi all, thanks for helping. I have been lurking here for a while, waiting for MBNA to come up with my SAR, which they did, on the 40th day! SAR Reply 08-10002.pdf It came with all statements since MBNA took over the account from HBOS and a copy of MBNA's current agreement which doesn't even have a signature page, let alone a signature! (It does have my address printed on it tho!) I had been having problems with Allied International over this one and sent THEM a CCA request first, which they replied by admitting that they had not been sold the debt, but were "acting on behalf of MBNA". Heard nothing from them since replying with a statement of their legal duty to comply and asking them to contact me by post only. My question is, what do I do now? I have not previously done a CCA request directly to MBNA, should I do it now, or take it that they do not have a copy of the original as they have admitted and send them an 'Account in Dispute' letter? I really would appreciate some guidance. Many thanks RobboM

-

About 18 months ago my wife claimed PPI back from HSBC. They were very quick to offer the money and also to get her to accept. I didnt think it was a lot but we accepted. Recently we did a CCA and lo and behold it looks like both our application forms are not valid or enforceable. No wonder they were quick to sort it out. She accepted as full and final settlement I think. My question is can she ask for a breakdown of the PPI she paid over the years and check if they have screwed us over with the payment and if they have can we put in another claim against them?

-

Hello all first post here but in a real pickle. On the 14th of June I received a Default notice for £49.07 from Argos Cards. On the 22nd of June I paid the default sums in full (£49.07) and was told no further action was required. After months of battling with the administrators of the company I used to work for they managed to get the money owed to me (roughly £4k) so on the 28th June again I called argos up and advised when I get the payment within the first 2 weeks of August I will pay the full balance, the advisor took an additional £5.99 payment from me and said that no payments would be due on the account until August. Anyhow today I rang up to pay the full balance to be told they cannot talk to me the account will be transferred to their debt collectors and any concerns should be made in writing as they have terminated my agreement, however they could take the payment. After 20 minutes of arguing with the dizzy woman she checked with her manager who advised they generated the letter of default on 04/06/2010 and even though it takes up to 14 days to be printed and delivered they start the 14 days from the date the collections advisor decides do issue the default notice. I advised this is contrary to the consumer credit act, and the default & subsequent termination of the arrangement are illegal the advisor checked with her manager who advised that their company policy superceeds the consumer credit act and this does not affect any of my rights. Now I have paid the balance in full, however checked on credit expert and sure enough my account shows 2 missed payments a green 0 and then default. Please help what do I do? Aaron x

-

Hello all first post here but in a real pickle. On the 14th of June I received a Default notice for £49.07 from Argos Cards. On the 22nd of June I paid the default sums in full (£49.07) and was told no further action was required. After months of battling with the administrators of the company I used to work for they managed to get the money owed to me (roughly £4k) so on the 28th June again I called argos up and advised when I get the payment within the first 2 weeks of August I will pay the full balance, the advisor took an additional £5.99 payment from me and said that no payments would be due on the account until August. Anyhow today I rang up to pay the full balance to be told they cannot talk to me the account will be transferred to their debt collectors and any concerns should be made in writing as they have terminated my agreement, however they could take the payment. After 20 minutes of arguing with the dizzy woman she checked with her manager who advised they generated the letter of default on 04/06/2010 and even though it takes up to 14 days to be printed and delivered they start the 14 days from the date the collections advisor decides do issue the default notice. I advised this is contrary to the consumer credit act, and the default & subsequent termination of the arrangement are illegal the advisor checked with her manager who advised that their company policy superceeds the consumer credit act and this does not affect any of my rights. Now I have paid the balance in full, however checked on credit expert and sure enough my account shows 2 missed payments a green 0 and then default. Please help what do I do? Aaron x

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.