Showing results for tags 'cap'.

-

Hello all, My very first post ever on here. Please can I bend ears, pick brains as I'm confused about the letters I've had today. Letters in my maiden name, I was married in 2003. Debt amount 943.43 I understand the letters are stating they are a statement from year 2012 right through to 2018. Stating they haven't applied interest or sent statements and I do understand this with an apology. Original debt citi financial Then it's saying passed or changed to arrow and now cap quest have got the debt. I do recall cap quest contacting me on my mobile a few weeks ago, I didn't recognise number so did a Google search. Didn't ring them back and thought nothing of it. Today came home with letters with different dates from 12 to 2018. Every single ccj or default has been lifted off my credit file 2 months ago. Following a painful debt paying process I can honestly say this has blown me. I'm worried. I have paid everything and now I've got this. On one of the statements in May 2013, it appears I've paid AND I do not recall me ever paying this, but a 15.00 payment has been made..... This has thrown me and no idea what it means. The start of letter reads, fixed term credit agreement, with ms E Maiden name and citi financial. If you require further info or for me type out what they say, each letter is the same, just different years. However, each year is dated 1st May 2012, then 1st May 2013 etc. Checked out the days unless they work on a Sunday.... The only letter that's different is one printed this week. It's ref is remediation of account. It is from Arrow and makes no ref to cap quest apart from saying if wish to discuss at bottom. Stating under rules cca 1974 stating required by law to write and noticed that we haven't written to you. Further saying that a full review of my account and failed to provide me with statements since May 2011. To remidy this, we have compiled all your statements. On the what does this mean to you. It states, this exercise does not affect your account, repayments or your obligations to repay. If anyone knows what it means and what I need to do. Not sure about this payment In 2013 either. Not sure the action to take on this Not sure the action they can take on me. Thank you

-

Hello all, Mods please move if in the wrong section? About 8 years ago I had a Debt Relief order against me. I've recently decided to contact all the financial companies I had dealings with and see if I was miss sold PPI any form? I have had Barclays admit they mis sold PPI and compensate me £1075 Hsbc I've not had a reply from yet? However capitol one have stated that they are making a redress payment to me of £ 60:45. Today I got a letter from capitol one saying that they have refunded the full amount and that it was Added to my account to reduce the debt owed to capitol one .....? Can they do that? I thought the debt was written off when I got a DRO ? Any advice appreciated

-

Hi again. in relation to my debts here https://www.consumeractiongroup.co.uk/forum/showthread.php?485755-From-Fee-Paying-Twinpier-DMP-to-DIY I have received these replies from Frederikson/CAP1 following a CCA request, and wondered if you could give me any advice? Convert Fred.pdf CCA return .pdf

-

I really need some help with a problem I have. I was on a 4 day touring holidayicon last week in Scotland in my second hand motorhome which I only purchased around 4 months that I have been saving up for years to buy. On the second day in Scotland the service light came on. With only just purchasing it I wanted to get it seen to quickly I booked it into Arnold Clark, Falkirk Road Grangemouth. I told them exactly what type the motorhome was and they said it wasn't a problem they could sort it out for me the following day which was the Wednesday. I took it into them and waited from 10:30am until around 3:30pm then went to the service desk and asked how the service was doing. I was informed the service had been done but they were having an issue resetting the service light and they would have to take the motorhome to another garage up the road for the light to be turned off. I agreed to wait so they took the motorhome. Over an hour later I returned to the service desk again for another update. They said they still were having an issue turning the service light off and it must be a problem with my motorhomes body computer. they said they couldn't do it. I immediately called the dealership where I purchased the motorhome from in Lancashire and they said they could turn the light off for me if I bought it into them on the Saturday. I paid Arnold Clark for the service as I wanted to get away as by this time it was about 5pm and going dark because its winter and I was booked into a campsite in Edingburgh. I got into the motorhome and drove off. I got about half a mile down the road when I noticed that now not only was the service light illuminated but the airbag fault light was also illuminated all the time, which Arnold Clark hadn't mentioned anything about. I returned to Arnold Clark immediately. They initially denied all knowledge of the airbag light and said it must of been on when I brought the motorhome in as it was impossible for them to of caused it. after a lot of heated talk they finally ask me to return the following day so they could attempt to rectify the issue. However, knowing the garage in Lancashire could turn the lights off I didn't return the Arnold Clark the following day and instead had a days holiday driving around sight seeing, which is why I was in Scotland in the first place. Plus as Arnold Clark were unable to turn the light off on the service day, it was logical to assume they wouldn't be able to turn it off the next day either and I would waste another day of my 4 day holiday for nothing. The weather from Tuesday through to Friday was mostly terrible with torrential rain and high winds, plus I was smothered in a cold. on the Friday morning I decided to drive down to my parents house in Lancashire which was mid point on my way home to Hampshire and also only 10 miles from the garage in Lancashire where I bought the motorhome from. I arrived at my parents early on Friday, it was still raining and windy I decided to immediately take the motorhome into the dealership. However, on the way from my parents house to the dealership the motorhome started to make a strange engine noise. on arriving at the dealership I popped the bonnet with the service guy standing there. We found the oil filler cap was missing from the engine and the engine bay was coated and dripping with oil from the engine. The oil filler cap was found in the window screen wiper well above the engine. I had driven in excess of 600 miles with no oil filler cap in place and oil squirting all over the place. I was smothered in a cold and with the rain and wind I hadn't noticed or smelt anything wrong. I immediately called the Arnold Clark dealership to complain. The head service guy there spoke to me and informed me it was impossible for it to be their error has after servicing all vehicles are inspected by someone else prior to returning the vehicle to the customer. Yet from the point the motorhome was returned to me after the service, I had either been driving, cooking or sleeping in it until it being parked outside the front window of my parents house for 10 minutes before driving it down to the dealership and finding oil everywhere. Arnold Clark as informed me they will investigate the issue but they seriously doubt its anything to do with them. The investigation will take several days and I must not have the motorhome worked on by anyone else in that time. they expect me to stay at my parents house 250 miles away from home and miss work until they finish their investigation. The dealership in Lancashire has had a quick look at the engine and have found the turbo has been damaged due to lack of engine oil as it is now making a strange noise. Luckily though, they don't think there is any other damage to the engine, but they can't really tell properly without taking the engine apart. All they have done is fill the engine with new oil and made sure the oil filler cap is in its correct place and apart from being noisy it seems to run. From my initial conversation with Arnold Clark I know all they are going to do is fob me off saying its nothing to do with them I will be left with, at best, a damaged turbo that needs fixing, probably at my own expense I just think it is wrong and I am absolutely disgusted. I think Arnold Clark should own up to their error and I should be refunded the £224.96 for the service, the £61 something pence I have had to pay for the engine to be quickly inspected, refilled with oil and cleaned, plus whatever the cost of fixing the turbo and whatever else is wrong with the engine will be. Incidentally, The dealership in Lancashire turned sorted out the dashboard lights in no time. So what were Arnold Clark doing??

-

Evening We took out cap one card in 2002 and have put in a mis-sell complaint that's been rejected. We did receive cheque due to Plevin side of things. Cap one said we ticked the box during the internet application I swear it was application from magazine and tbh I don't even think we had internet but anyway. They say PPI was requested by tick box and if the relevant sections were blank PPI would not have been added to the account. They say no interaction with a cap one representative when PPI was purchased. I had already sent SAR to them and copy of application they sent me has no tick. We would never have ticked for PPI can anyone advise us on whether we can carry on as I'm thinking shouldn't they be proving they box was ticked ? Any help is appreciated.

-

Hi folks, i have posted on the forums before and successfully won in a claim against me. This recent claim against me for an alleged debt of 3,815.60 inclusive of their so called costs..(which to me are ropey). .please bear with with me as i need to refresh my knowledge of certain aspects in compiling my defence... In the claim form particulars . .. there is no mention of when this alleged debt was instigated , i.e. when i am supposed to have defaulted . It is my understanding that this should be there on the claim form..by default...(help with this appreciated). the claiment states that i have been notified of the assignment from "shop direct" by letter.. . i have received no letter . i would require proof of this... but such a letter is not the deeds of assignment.. if i am correct? i intend to counter this claim and request the necessary 28 days. . rather than the 14... been through this before and which forms to fill in. .. so it is not this info. i seek... just a refresher would be good at this stage on what ammunition i can avail of. i think these people sent me a letter months ago offering me to only pay 80.00 pounds. .. and i am given to wondering should i have tried to settle it at that stage... Any advise greatly appreciated..

-

Hi everyone, it's been a while since I've been here. I'm dealing with the above for a family member. I have already acknowledged service on MCOL and ticked defend all. Am I correct in thinking the next steps are CCA to Cap One and CPR31.14 to the solicitor? Do I need to SAR anyone? Name of the Claimant ? Lowell Portfolio Ltd Date of issue – 07 April 2017 What is the claim for – 1. THe defendant entered into a Consumer Credit Act 1974 agreement with Capital One under account reference xxxxxxx (the agreement) 2. The defendant failed to maintain the required payments and a default notice was served and not complied with. 3. The agreement was later assigned to the claimant on 26/09/2013 and notice given to the defendant. 4. Despite repeated requests for payment the sum of £3xx.xx remains due and outstanding And the claimant claims a. The said sum of £3xx.xx B. Interest pursuant to s69 County Courts Act 1984 at the rate of 8% per annum from the date of assignment to the date of issue accruing at a daily rate of £0.076, but limited to one year, being £27.xx C. Costs What is the value of the claim? £46x.xx Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? CREDIT CARD When did you enter into the original agreement before or after 2007? I am unsure of this. After Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Lowell Portfolio ltd Were you aware the account had been assigned did you receive a Notice of Assignment? No notice of assignment was received Did you receive a Default Notice from the original creditor? Family member doesn't recall Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? One was received a few months ago but none prior to that Why did you cease payments? He was made redundant from his job and was struggling with a few debts he had at the time What was the date of your last payment? Sime time in 2011 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? No Thanks in advance

- 11 replies

-

- cap

- county court

-

(and 2 more)

Tagged with:

-

Hi there I am trying to find out if Lowells did buy the debt are they liable to pay the PPI or is it the Cap One as the Original creditor who is liable to pay this back. I have read it somewhere it is the original creditor who has the right to PPI. Any advice would be greatly appreciated. I have a Cap One card with a small balance which would be SBd in a few months. Lowells claimed that they bought the debt but I had a dispute with Cap One for a long while. I have some PPI on that card which I want to claim. Lowell had put a Default Note in my CRA and the account is in their name although I had a dispute with the original creditor. Are they allowed to do this? I am going to send them a letter so would be grateful if anyone has had similar experience and has got a letter so I can send Lowell's a similar letter. Many thanks

-

Hi All, I'm sorry to return but I again need a little bit of advice regarding a letter from Mortimer Clarke in relation to an alleged debt with capital one... I received a claim form from Cabot Financial via Mortimer Clarke.... Details below Claim Form Issue....18/11/2016 Received.... 21/11/2016 AOS Submitted... 29/11/2016 Defend all AOS Received... 30/11/2016 CCA request sent to Cabot...28/11/2016 CCA request received by Cabot and signed for.....30/11/2016 CPR request sent to Mortimer Clarke... 28/11/2016 CPR request received by Mortimer Clarke and signed for... 30/11/2016 POC... 1.By an agreement between capital one and the defendant on or around 01/07/2009 (the agreement) Capital one agreed to issue the defendant with a credit card. The defendant failed to make the minimum payments due and the agreement was terminated. The agreement was assigned to the claimant.. 2.. THE CLAIMANT THEREFORE CLAIMS XXXX... As of todays date the following has happened.... 1) No response from Cabot for the CCA request 2) Mortimer Clarke responded to the CPR request with the following letter dated 01/12/2016 received 07/12/2016 Dear XXXX We acknowledge your request for documentation pursuant to CPR 31.14 We Confirm our client is willing to agree to the extension of 28 days, for you to file your defence, Pursuant to CPR 15.5(2) please notify the court in writing of the agreement.... CPR 31.14 relates to a right to inspect a document and can be distinguished from standard disclosure of evidence during the course of proceedings. We believe that you may have already "inspected" the documents to which you make reference because on various dates in the past they would have been sent to you by another party such as the original creditor. We would be grateful if you could confirm what documents you have in your possession or control relating to this matter to avoid duplication over document inspection. We will then take our clients instructions... So my question is.... Do I ignore the letter from Mortimer Clarke? reply to Mortimer Clarke with something along the lines of.... not interested in your beliefs, supply the documents requested in the CPR 31.14 request... As always your help/advice is greatly appreciated

-

i wonder can anyone help me? i had notice of court action from lowells debt agency for an alleged debt of capitol one dating to 2012. this happened around mid september ..i subsequently complied with the court procedure but have asked for proof of debt plus a cca. . i seem to have received . . a statement of the account.. from capitol one... but nothing else.. here is what they say has been enclosed... it says "statement and notice of assigment received from client. agreement and default notice been requested... ..with respect to Deed of assignment . this is an agreement between our client and the original creditor containing confidential information. .. and you are not entitled to the information contained in it".... As stated, i requested a cca ... and now. . the court want me to mediate with these people.. but as i say ... i wrote stating .. only on the requested documents being produced... what should i do?

-

Early exit charges for people taking money out of their pension pots will be capped at 1%, the financial regulator has confirmed. The new rules will affect anyone taking money out of a personal pension from 1 April 2017. The Financial Conduct Authority (FCA) said providers who already charge less than 1% will not be allowed to raise their fees. Those taking out new pension contracts will face no early exit charge at all. Workplace pensions will be subject to the same rules, but these will not come into effect until October 2017, http://www.bbc.co.uk/news/business-37985525

-

Just a thought. If you are on ESA and you have not got savings above the threshold of £6000.00. Is it possible to try and save by the help of family members to save for an old age pension, not to be touched until your official retirement age? This is just a general enquiry on behalf of my friend who is already worrying for her retirement, if she lasts that long! Any advice would be welcomed. Thank you, and if it's in the wrong place please move the post to where it should belong. I put it here as she is on ESA. The silly thing here is, she can hardly live on her ESA as it stands at the moment, never mind save e bean!

-

Hi For a while Arrow and now Drysden Fairfax have been irritating me with a Capital One CC account which was defaulted on. Taken out in 2001. Last payment approx 3 years ago. In May, I CCA'd them, eventually received the attached document. They say they've sent a Recon, quoting a high court decision in 2009. This document is all they sent, despite their letter saying that they have also sent a copy of the terms & conditions. Does not sending the accompanying t&c's mean it's failed CCA reply? More importantly, is the attached CCA enforceable? It's termed as an Application Certficate? Prescribed terms? (I'm not too clever on this aspect) Thoughts and advice appreciated. CR cap one recon cca.pdf

-

Hi, Morning everyone, it's finally the weekend! I am looking for some advice regarding this upcoming benefit cap as I want to know if I am going to be affected as I claim Universal Credit. I am single, 29, I live in Burnley, Lancashire, North West and I live in a 1 bedroom flat with an housing association and my weekly rent is £80.62. My Universal Credit payments is as follows: 1. Standard Allowance for me: £317.82 2. Housing Element: £352.56 So, by going of this, will I be affected? I am just worried! Any advice / help would be great, cheers.

-

I am about to move to an area where my rent will be nearly double what I am paying now. (I get HB) I have just been told I will get the severe disability allowance as I live alone. ( I did not apply for this) This means I will receive in combined benefits...ie: Support group, PIP and housing benefit, which will be more than £350 per week including housing. Am I affected? Can anyone advise? Thank you.

-

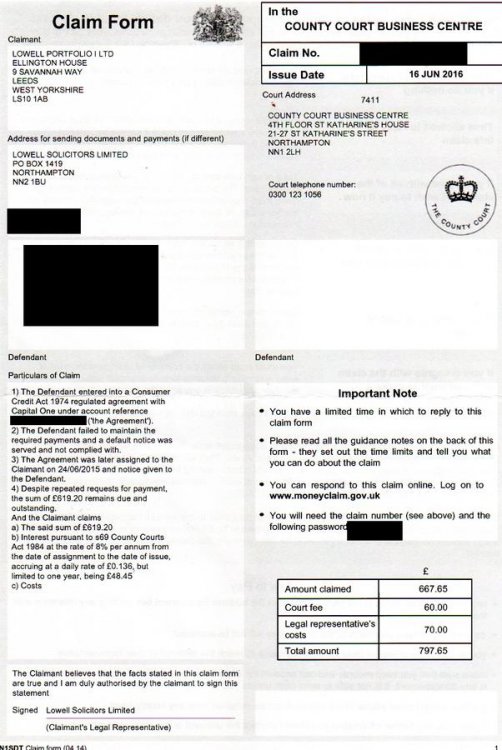

Hi all A couple of years ago I left my work after being diagnosed with 2 neurological illnesses, this meant I could no longer work and am now on a long (3 year) ESA award and am awaiting a PIP assessment in a couple of weeks (thats another story sigh) I owed £300-400 to Capital One and due to the illness, depression, hospital stays and lack of money I just stuck my head in the ground and ignored everything. Today court papers arrived from Lowells (attached) apart from filling them in online what else do I do here? The debt is only 2 years or so old so not statute barred and probably half of it is fees and interest I think as the original debt wasn't that high. Thanks for the help

- 9 replies

-

- cap

- county court

-

(and 2 more)

Tagged with:

-

Name of the Claimant ? Cabot Financial UK Date of issue – . 12 Feb What is the claim for – ? 1.The claimant claims payment of the overdue balance due from the defendant under a contract betwen the defendant and capital one dated on or about april 18 2013 and assigned to the claimant on sep 28 2015 22/01/16 default balance 305.70 What is the value of the claim? 305+costs Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? credit card When did you enter into the original agreement before or after 2007? After 2007 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Yes Did you receive a Default Notice from the original creditor? Yes Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No, I have Notice of sum in arrears 5/10/14, Notice of default 2/11/14, Statement of default 4/12/2014 All sent directly from Capital One Why did you cease payments? Repayments got out of hand & I did not seek help when I should have done. What was the date of your last payment? Unsure, all statements were online, I have no paper statements for reference Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managemnent plan? No I have acknowledged service & believe there are many default charges in this balance which I would like to contest. The POC is now incorrect as I made a payment on 10th Feb & I'm due to make another on 11th March as per a letter I sent letter which I sent to Restons prior to receiving their claimform, this letter has been returned to me stating they will not acknowledge receipt or respond to any letters without my signature claiming they must be sure who they are corresponding with, after they were sure enough of my identity to issue court paperwork to me of course! I'm assuming I need to send a cpr.13.14 now but can I simply initial the letters rather than using my signature? Also how will I tackle the charges issue? Thanks for reading this, all help is greatly appreciated

-

I would be grateful to know if anybody who has been successful in a claim against Santander on the 2008 svr/cap margin issue could explain the grounds on which the claim was made; was it on the basis of breach of contract on the bank's part or the longer-term financial implications of Santander's application of the cap margin increase. Cheers

-

I received a Northampton generated claim form on Friday for an old capital 1 credit card debt. The total including court fee and legal costs comes to some £800. The claim has been issued by Dryden via Cabot, both of whom i have no direct dealings with but have in recent months received threatening letters and demands for payment etc, i have not acknowledged any of them. The claim states that this account was opened in 2005 and i have failed to repay. I cannot recall when this account was last used but it would of been some considerable time ago and i would imagine around 2007 at the latest. I have obviously to do something with the claim form within the time allowed. I'm minded to defend the claim as i would imagine it was subject to fees etc. At around that time i was in serious financial difficulties and battling to save the family home so i have little doubt the money or at least part of it may well be owing. What is my best approach to this and how do i determine if this is too old to chase. I have looked through a fair few threads but must say im a little overwhelmed by the sheer volume of information and threads so don't want to jump in and go down the wrong route. Any assistance would be greatly appreciated.

- 19 replies

-

- cap

- county court

-

(and 1 more)

Tagged with:

-

Hi guys. Can you help me with a problem we're having? OH is sorting out a family member's estate and Cap One aren't helping much. So far they've sent the same letter about five times and not and not answered any of his questions. Who can we escalate this to please? HB

-

A while ago now, my husband received a Claim form issued by Lowell in respect of an old Cap One debt. I acknowledged receipt and the submitted defence at last minute - using standard haven't got a cue what your talking about defence. We had received no paperwork in respect of this for a couple of years or more. The amount they are claiming is less then £400 and to be honest I thought they would just go away as in often the norm with Lowell/Bryan Carter. We agreed to go through with a mediation call, however that never happened as they called the day that we were going away. Then received letter from court to say that they had advised that Bran Carter must produce all docs by a given date or they would dismiss claim. To my amazement they have actually sent some paperwork. As a result I now have until 15/10 to submit a defence again. I have read a zillion threads but I'm lost and would be grateful for some help. Apologies for leaving it until the last minute, I just honestly thought that they wouldn't fight for such a small amount. We have received a copy of an online agreement, a statement of the account, an assignment notice and a letter introducing Lowell. Don't remember ever having seen any of these before. There is no copy of a default notice. I was wondering if I could I some way bring the PPI into the defence. The box has been ticked on the online application - but PPI would have been no use to husband as he was self employed

-

Christmas advertising Insight comes early The themes and images surrounding and associated with the festive season provide ample opportunity to create memorable and impactful ad campaigns. But some yuletide words of warning, the ad rules are for life, not just for Christmas. For instance, promoting a casual attitude to using a loan to fund Christmas spending is likely to be seen as irresponsible. Be good for goodness sake, read on to find out how. So if we see anything we think could be irresponsible we should report it to the ASA.

-

- advertising

- against

-

(and 3 more)

Tagged with:

-

Name of the Claimant ? Lowell Portfolio LTD Date of issue – 19/05/15 What is the claim for – The Claimants Claim is for the sum of £400 being monies due from the defendant to the claimant under an agreement regulated by the consumer credit act 1974 between the defendant and Capital One under account reference XXXXXXXXXXXXXXXX and assigned to the claimant on xx/07/2014 notice of which has been given to the defendant. The defendant failed to maintain contractual repayment under the terms of the agreement and a default notice has been served which has not been complied with. and the claimant claims £400 The Claimant Also claims statutory interest pursuant to S69 of the county act 1984 at a rate of 8% per annum from the date of assingment of the agreement to date, but limited to a maximum of one year and a maximum of 1000 amounting to 25.00 What is the value of the claim? £510 (400 + 25 interest +35 court fee + 50 Solicitors cost) Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? Not to the best of my recollection Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Husband became unemployed What was the date of your last payment? unknown, quite possibly over 6 years Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? yes, they weren't interested

-

Hi Everyone, After some advice please if you have the time, please reply. My situation as it stands: Court papers received from Lowell Portfolio 1 LTD (assigned from CAP 1) claiming the full amount owed on the credit agreement. I was three weeks off being 6 years since defaulted so clearly this is a final ditch attempt. Had to stop paying 6 years ago as was unemployed with no income and huge debts. Previously requested SAR & CCA from CAP 1 and all they have ever provided is a new copy template agreement, no signed documents. They have repeatedly stated 'this is your credit agreement with us' and that is it. Requested a PPI reclaim from CAP 1 in 2009 which at the time with 8% interest amounted to just under half the debt amount overall. PPI and unlawful charges claim resulted in an offer of £16 for unlawful charges. I was self employed at the time of the card application and PPI would not have been suitable for me. So what is my next step? I can counter claim, which I am happy to do if required, for the PPi and unlawful charges. Can I go down the road of non-enforceable because of no Credit Agreement? or is there another way forward? I am currently a carer for my disabled child and whilst I own my own home it is in negative equity. Thanks for reading. Bobby I should also point out, having looked again at my SAR response from them: 'We are not obliged to send an original signed copy of the a credit agreement. However, under section 78 of the Consumer Credit Act 1974, we can provide you with a copy of the credit agreement as varied, upon receipt of a £1.00 payment' So they have never sent me any signed CA with my signature on it. Is my next step to do a CCA to Lowell asking for this? Can they continue onto court and have a judge enforce this 'agreement' if they dont have any signed paperwork? I am panicing now as I am not sure if the correct thing is to contact them and acknowledge the debt at all. Thanks.

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.