Showing results for tags 'barclaycard'.

-

Firstly I have been reading through your site and must congratulate you on a wonderful service and website. If only I had put my thinking cap on earlier and paid more attention! This is a big one and I have followed your advice so far... here go's.... I had loads of debt in 2006 when my company went into a CVA, I have kept a lot of the information and letter replies including an experian report dated may 09. I had numerous debts up to about 100k, with a remortgage I paid around half and tried and have succeeded in removing another 25k to date. Lowell then wrote to me saying I had a debt of £16k with barclaycard, I am being honest in this forum to hopefully get the best advice I did have a barclays select account which was owed around 15K and one small barclaycard for around 1k , I also had two MBNA cards, 2 Capital One's, blah blah you hopefully get the picture I did speak to them and said that I thought they had it wrong and that they were chasing the barclays select account which I had paid off with my remortgage, in-fact most cards were cleared at this time, they were however also chasing a small debt for capital one £678.00 of which I didn't clear - naughty I know Every three days or so I had a call and gave them the same response, asking for original proof, the last payment to barclaycard that I can find on any statement is in Dec 04 - I believe this is for a barclaycard which i'm sure didn't have a big limit. Lowell's keep moving the debt between all their companies - Red, Lowell's, Hampton's etc for about a year. I gave them the same response and they say they will put the account on hold and look into things - they then move it to another collector in their group. Good news I hear nothing for a year or two then in 2009 they are back in contact and a little more upset. Again I tell them the story, they have tried to catch me a couple of times as I have this other account with them, which also floats between all their companies. In may 09 I decided to get a credit report via Experian to try and clarify things, I have kept this report as well, I notice Lowell's have their £678 debt listed but the Barclays listings are as follows: Barclays Bank Default Barclays Bank PLC Woolwich Account - Bank Default Balance - £14,964 Current - Satisfied Defaulted on - 16/05/07 Barclays Bank Default Barclays Bank PLC Woolwich Account - Bank Default Balance - £2,530 Current - £1,437 Defaulted on - 13/02/07 Barclays Bank Default Barclays Bank PLC Woolwich Account - current Default Balance - £2,890 Current - Settled Defaulted on - 27/06/07 Barclaycard Credit Card - Satisfactory £0 10//05/09 Entry number C15 Barclaycard Account - Credit Card / Store Card Started 23/01/1997 Current Balance - £0 Credit Limit - £1 Credit Limit History - £1,000 (12/08; File updated for the period to; 10/05 2009 Summary of payment history - in the last 36 months account activity 1-2 is 0 - 3+ is 0 Balance £0 £0 £0 £0 etc etc Payment Account as above Payment statement as above Cash Advance 0000000 Payment code .. .. .. .. etc Promotional Rate n n n n n etc I wont bore you with the other bits I sent a letter to the effect as above saying what did I owe, I then heard nothing I got two different reports yesterday including Equifax - This stills shows the £678 opps, it now shows that I have cleared a lot of my debts and more importantly the Barclays accounts are all still on there apart from the Barclaycard that they are chasing?? I had thought this had gone away, no excuses now but again into huge problems again with the business, some massive legal actiion against close finance (bless them) which I lost for the tune of £35k Ready for the huge mistake... I didn't like the letters from Lowell's so I left them to last to pay up, I had a recent telephone call about the £678 amount which I did really owe and agreed £10 a month, I finally got fed up with them insisting on raising the amount so only paid a few payments. Started having letters again about Barclaycard, I was advised to just ignore it, which I did, then had some really nasty letters from Hampton's a few months ago threatening to send people to the house and bankruptcy, insolvency, and the latest saying they know we have equity in the house, therefore they will get judgement and charging order and sell the house to get paid in full - also send we should contact the local housing association to discuss alternative housing - this really panicked the wife as we have children, one on disability. It seems I accidentally paid a few payments on this Barclays account as they moved the other one elsewhere ((((( - we're talking about 50.00 paid and I did ring them after cancelling saying that they had put payments to the wrong account - which was 50% my fault for not checking their account codes. I could have easily walked away from my debts but have worked hard to clear them ( if owed ), having cleared 75% and gone through a company CVA many of our files which were kept at work have vanished, I do have around 75 letters from all companies and a few that I wrote to them. Having looked at your site and the OFT report it seems they have broken nearly every code in the collection guide! They have started legal action and I told them by phone that I was recording the conversation and that I disputed the debt, and always have, I reminded them that the payments were incorrectly put against the wrong account, I also asked for the following : A true copy of the assignment* A true copy of the default notice* A true copy of the termination notice* I have got a claim form from the Northampton CCBC court and have today sent a AOS and sent online, here is the claim they are making: The defendant entered into an agreement with the assignor, regulated by the consumer credit act 1974. The defendant failed to comply with the terms and the agreement was terminated in accordance with the statutory notice of default. The benefits of the agreement were assigned to the claimant. Debt assigned on 21/05/08 by Barclaycard. The Claimant claims: 1. 16841.62 2. Statutory interest pursuant to section 69 of the county courts act ( 1984 ) at the rate of 8% per annum from 21/05/08 to 20/10/11 4595.69 and thereafter at a daily rate of 3.69 to date of the judgement or sooner payment. Agreement xxxxx ; 21/05/08 ( my agreement with them? ) Claimed £21,437.31 Court Fees £310.00 TOTAL £21747.31 I did have debts, A lot! Due to our paperwork and no help from barclays or lowell's, I have no idea if this is right, honestly if I thought I did have the debt then I would go after them for harassment, I really don't remember, I did have a Barclaycard and did pay it off, If I can remember rightly.... also the credit file makes sense listing it as paid and a limit of £1000. Really sorry to hit the CAG with such a biggy on my first post, will send some pennies and hugs and even a happy bonus if you can finally help me out of this nightmare I hope all is included... The deadline for the AOS was today and this has been done, so I have 14 days but want to jump sooner rather then later (jump onto getting this sorted out, not cliff Dave

- 92 replies

-

- barclaycard

- hamptons

-

(and 2 more)

Tagged with:

-

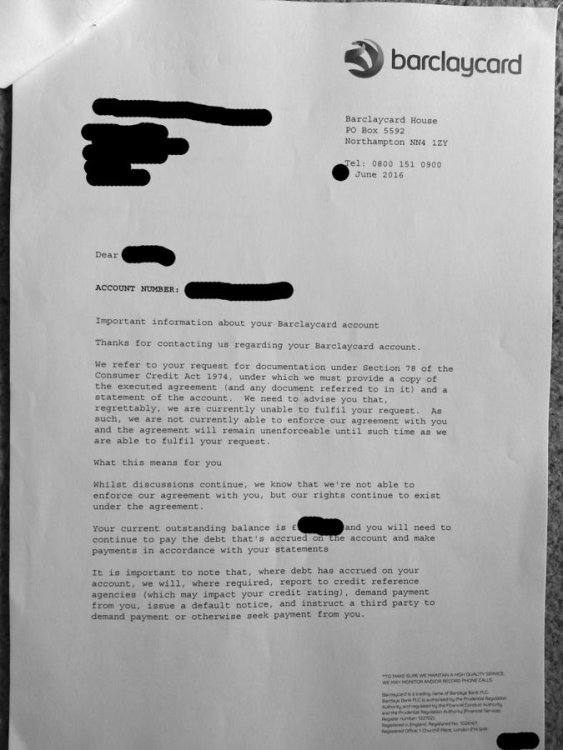

Hi Wescot have written to me about a barclaycard debt which they and Barclacard have written to me confirming the debt is unenforceable. They both claim however that collections can continue and they threaten more contact from the recovery team. Despite writing on sevreal occasions requesting all correspondence to be in writing they continue to phone. If it is unenforceable i am not going to pay , i think they recognise that . How do i go about either finalising this matter or at least prevent endless telephone cals from Wescot please ? Thanks

- 56 replies

-

- barclaycard

- cabot

-

(and 1 more)

Tagged with:

-

Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – . 01 March 2016 what is the claim for – the reason they have issued the claim? 1.Claim forr the sum of £7600 in respect of monies owing under an agreement with account no 5301************ persuant to the consumer credit act 1974. The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 2.The defendant has failed to make contractual payments under the terms of the agreement. A default notice has been served upon the defendant persuant to s.87(1) CCA. 3.The Claimant claims 1. The sum of £7600 2. Interest persuant to s69 of the county court Act 1984 at a rate of 8.00 percent from the 27/04/11 to the date hereof 1765 is the sum of £2900 3. Future interest accruing at the daily rate of £1.67 4. Costs What is the value of the claim? total £11100 (all figures rounded) Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned Were you aware the account had been assigned – did you receive a Notice of Assignment? Don’t Think So Did you receive a Default Notice from the original creditor? Don’t Think So Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Dont think so Why did you cease payments? Redundancy in 2006 but maintained payments until savings ran out in 2010, then entered into a payment arrangement until I think 2011 What was the date of your last payment? Not sure, sometime in 2011 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into plan? Yes .................. I have filed my acknowledgement of service (07/03/16) and sent a CCA Request to Hoist and a CPR 31.14 request to Howard Cohen, no response to either yet (received 9th and 8th March respectively). I am hoping for some help in filing a defence which needs to be by 1st April 2016, I think. I’m sorry if I seem to have left this late, but I thought I had this all under control and was getting my defence ready today for submission later this week. I was reading through the forums for advice on how best to word my defence when I came across a post describing my exact experience, which was the return of my postal order for £1, rejecting my CCA request, stating the request had been passed on to Cohen’s solicitors who would respond in due course. Whilst I wasn’t fooled by their granting of a 14 day extension to file my defence, I still felt I had fulfilled my requirements to place Hoist in default under S.78. Based on advice posted on the other thread, I am now going to send another copy of the CCA request with a copy the letter rejecting my original CCA request to Hoist and the payment. In the other thread, the advice given was that it is no longer appropriate to state that " the claimant is in default of my request pursuant to section 77/78 and is therefore not permitted to enforce or request relief of the alleged agreement", and instead the defence should be along the lines of the claimant has continually refused to comply with my request by returning the statutory fee in an attempt to frustrate and avoid its legal responsibilities with this request and I therefore request that the court direct their compliance in this matter ". Based on the info I have given below, would you think that this advice would apply to this case also? Once again apologies for leaving it so late. I have been caught out by this unexpected and underhand tactic. Thanks in anticipation

- 108 replies

-

- barclaycard

- cohen

-

(and 2 more)

Tagged with:

-

I've only just found this forum and need help regarding a County Court Claim from Hoist Portfolio details as follows: Name of the Claimant Hoist Portfolio Holding 2 LTD Date of issue – 22/08/2016 What is the claim for – the reason they have issued the claim? Please type out their particulars of claim (verbatim) less any identifiable data and round the amounts up/down. 1.This claim is for the sum of 2537.85 in respect of monies owing under an Agreement with the account no. 4929 XXXX XXXX XXXX pursuant to The Consumer Credit Act 1974 (CCA 2.The debt was legally assigned to MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 3.The Defendant has failed to make contractual payments under the terms of the Agreement. A default notice has been served upon the Defendant pursuant to s.87(1) CCA. 4.The claimant claims 1. The sum of £2537.85 2. Interest pursuant to s69 of the County Court Act 1984 at a rate of 8.00 percent from 27/10/10 to the date hereof 2120 is the sum of £1179.14 3. Future interest at the daily rate of £ .56 4. Costs What is the value of the claim? £3981.99 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Crecit card - Barclaycard When did you enter into the original agreement before or after 2007? Before 2007, 29th July 2002 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Claim issued by Hoist Portfolio the debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? Many letters of assignments over the years, no record of any mention of Hoist Portfolio Did you receive a Default Notice from the original creditor? I can't remember, I have no record of one Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Financial problems due to business failing What was the date of your last payment? I rang Barlcays and they state the account was put into Default on 2/12/2010 but are saying a payment was made on 14th of September 2011 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? No I would be grateful for any help regarding this. It is not my own debt, it belongs to my girlfriend who is not very computer literate and I'm trying to get help on her behalf. I have filled in the answers above for her. She is sick with worry about this and any help would be much appreciated. Do I need to send off a request to the lawyer acting for Hoist for documentation? Does she have defense that we can put up for this? Thank you.

- 30 replies

-

- barclaycard

- hoist

-

(and 1 more)

Tagged with:

-

Barclaycard AP Markers from 2010 **WON/REMOVAL/COMP/INTEREST**

bazinga posted a topic in Barclaycard

Hi, Looking for some advice. Back in late 2010 my finances hit the skids somewhat and I've been trying to recover ever since. I had large debts mostly on credit cards and negotiated reduced repayments on all of them. 4 of the credit card companies defaulted - these defaults will drop off my credit file over the next year or so once six years has passed. However Barclaycard never defaulted either of the two accounts I have with them. Initially I made token payments of £1 for 3 months on each account and then agreed a reduced monthly payment after this. My credit report on Noddle shows 1 month late, 2 months late, 3 months late and then AP markers from January 2011 until November 2014 when I attempted to start making normal repayments again. I have since reached another agreement with them for reduced payments from January 2016. My question is whether or not Barclaycard should have registered a default with the CRA's back in 2010/11 and in that case these accounts should have dropped off my record within the next year or so. Instead of which they will go forward for years to come and affect my credit rating in the future. Can I get Barclaycard to issue a backdated default and put me in the same position I would have been if I'd paid them nothing in the last 5 years, rather than the more than £10,000 I have repaid to them. Any comments or advice gratefully received. J- 45 replies

-

- arrangement

- barclaycard

-

(and 1 more)

Tagged with:

-

I've had a letter from Cabot for an old barclaycard I took out last century, and have been paying a small nominal amount since I left my previous job. What does prescribed terms mean? I also read elsewhere, asking for a copy of the CCA was an admission the debt was correct, is this true? I was considering asking them for this, as currently I am off work recovering from a serious illness and really do not want the stress of this. They have also credit searched me recently, I'm pretty sure that's not legal as I have certainly never given them permission to do so.

-

Whilst i have a little experience with reclaiming charges etc this was some 7 yrs ago so i just wanted to make sure i follow the correct procedure for this one. Old Barclaycard debt with current balance of £696 against £500 limit, BC wrote yrs ago closing the account for no apparent reason. A/C opened march 2008 and no activity since at least 2009. PING PONGED with various DCA's for a good few yrs, latest was with MKDP LLP until letter recd from both MKDP LLP and Robbers way regarding account being re assigned to HPH2 LTD and Robbers way will be collecting on their behalf, both the MKDP and RobbersWay letters came in the same envelope. Checked noddle and default regd by MKDP on 17/9/2014, account reassigned 21/9/2015 to HPH2. I have no statements. Some of the balance will definately be charges, late fees etc so i know i can work with this, just wanted to check where to start, is it CCA or full SAR? Many thanks in advance guys

-

Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – 19 May 2016 20th June 2016 to submit defence What is the claim for – 1.This claim is for the sum of £3755.27 in respect of monies owing under an agreement with the account no. XXXX pursuant to The Consumer Credit Act 1974. This debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 2.The Defendant has failed to make contractual payments under the terms of the Agreement. A default notice has been served upon the Defendant pursuant to s.87(1) CCA. 3.The Claimant claims 1. The sum of £3755.27 2. Interest pursuant to s69 of the County Court Act 1984 at a rate of 8.00 percent from the 18/1/12 to the date hereof 1580 is the sum of £1300.50. 3. Future interest accruing at the daily rate of £ .82 4. Costs What is the value of the claim? . Total £5565.77 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit account When did you enter into the original agreement before or after 2007? Before. 1981 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? We would have but can't guarantee we have kept it. Did you receive a Default Notice from the original creditor? As above, we would have. Kept some of the early letters. Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Probably, no reason to doubt we haven't. Ashamed to say we haven't actually been reading them but am sure we would have. Why did you cease payments? Business failed very suddenly due to recession, stopped payments to all creditors as my husband couldn't manage the debt. My husband intended at that point to go bankrupt but as moved into low paid employment, he needed to save bankruptcy fee. We then had to prioritise moving house due to being harassed by a neighbour and then always something else came along that needed money. Classic burying heads in the sand then followed as we seemed to be getting life back together. What was the date of your last payment? He last paid around April 2011 but Noddle says defaulted in Sept 2011. Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? No I will send off a CAA request and CPR31.14 Loan letter to see what Hoist/the solicitors hold BUT I recall back in around 2008 we went after PPI charges from Barclaycard. At this time they did provide us with a copy of the signed agreement. I would have it somewhere in the loft. Notably the copy was a terrible one, hardly legible but interestingly, the box where you would tick to opt out of PPI was bright white, as if the copy had been doctored. I raised this in our letters, that it looked very obviously as though it had been doctored. Barclaycard did not respond specifically to this, but did refund all the PPI charges going back to when the account was opened. I guess what I am wondering is that if Barclaycard had dug out the agreement in more recent years, are they more likely to have passed a copy onto the purchasers of the debt? Am I still right just to put the onus on Hoist to show they have the relevant paperwork to prove the debt? I would be grateful for your thoughts th Hello, Back in December 2105 I received some great advice when my husband was pursued by Lowells for an Argos credit card debt. It seems that another creditor has now taken the same course of action. I plan to follow the same steps as before, acknowledge and defend, using the advice given previously but there are some changes in the circumstances which I would be grateful to be able to check out on here first. Please see info below. Thank you, r710

- 17 replies

-

- barclaycard

- claimform

- (and 4 more)

-

Hi, I've been a customer of Barclaycard since April 1996 - so a very long time! A couple of years ago after a messy divorce , I found myself in a bit of a financial mess to the point where I had to enlist the help of StepChange to sort things out. Until now, Barclaycard have been fine and were happy to accept the payments from StepChange. Unfortunately I missed a payment which "broke" the agreement but they were happy for me to continue on an "informal" arrangement and indeed back in March this year when I contacted them they assured me that there were no plans to default the account as long as I kept up with the reduced payments, and that I should contact them in a few months time. What they did so is that they had no "formal plans" available for me at that time. Yesterday I received a letter from them stating that if I didn't clear the arrears within 60 days, and then resume my standard contractual minimum payment (with intrerest) they would default the account. I contacted them today to query this and say that they were effectively moving the goalposts as they had previously said that they wouldn't default the account, I also made the point that the minimum payment would be more than I am paying via StepChange and therefore I wouldn't be able to do this without manually topping up the payment and thus being in breach of my plan. They were adamant that there was nothing they were prepared to do , although I have asked for this to be escalated as a formal complaint. They did tell me that these letters and change in heart is a new policy of theirs and they have had a number of similar complaints.. Any thoughts as to what I can / should do? Is the fact that the account is sold old of any relevance?

- 8 replies

-

- barclaycard

- goalposts

-

(and 1 more)

Tagged with:

-

Hi, I'm new on here so please forgive me for asking questions that I have no doubt have already been asked. First of all I like to say thank you for this forum. I have started to check for PPI (not through a management company) but keep getting problems which I don't know what to do next. I wrote to Barclaycard to see if I had PPI (I have no paperwork as the accounts go back 20 years and was closed around 10 years ago). I got a response saying I have 2 products with PPI and was given account numbers. I then went on to fill out a form online. I get a response saying that my claim has been rejected, reason being that I did it by post so was given all the information I needed. So my question is what next? Do I except their decision or do I still have a case? I cannot recall asking for PPI so I'm presuming I must have ticked a box but probable did not know what I was ticking. Any help will be gratefully received

-

first of all to say hello to all users. i am new here be gentle . i have read the forum rules etc . feel free to say hello and if i can help i will. On a more positive note i have recenly been paid out in excess of 7k from barclaycard ppi. how do i confirm they have calculated this correct, i assume a sar would be needed here and can i still do this even tho they have recently paid me out?

- 7 replies

-

- barclaycard

- sought

-

(and 1 more)

Tagged with:

-

Hi Had a bit of a shock when i opened the post a few days ago to find a County Court Claim form, hope you can help. Its from County Court Business Centre Northampton from the above claimants for an old Barclaycard debt that goes back to 1991 that was passed to MKDP and then Hoist Portfolio Holdings 2 Ltd, the debt collectors managing it are Robinson Way. The claim was issued on 02/03 The POC is as follows: The Claim is for the sum of £4395.98 in respect of monies owing under an Agreement with the account no. XXXXXXXXXXXXXXXX pursuant to The consumer credit Act 1974 (CCA). The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. The Defendant has failed to make contractual payments under the terms of the Agreement. A default notice has been served upon the Defendant pursuant to s.87(1) CCA. The Claimant claims 1. The sum of £4395.98 2. Interest pursuant to s69 of the County court Act 1984 at a rate of 8.00percent from the 1/07/10 to the date hereof 2067 is the sum of £1991.85 3. Future interest accruing at the daily rate of £ .96 4. Costs Total Claim over £6800 I sent barclaycard a CCA request few years back but only ever received their T&C and what looks to be a badly photo copied application form ! Any help or guidance on what to do next, and what forms i need to send to who would be well appreciated.

-

Hello, I am looking for some help please. I currently have 2 credit cards, one with capital one and one with Barclaycard, owing approx £7,000 on each. Whilst I have not defaulted on any payments and have not reached my limits, the monthly payments have become a struggle and I can't afford the requested minimum amount anymore. I have been looking at contacting them to request a lower payment arrangement and an interest freeze. By all accounts and looking through the library letters and other posts, my chances of them agreeing are pretty much nil, as most companies seem to simply refuse straight away. I was advised that I should stop paying and that may force their hand, but I suspect I will just end up with charges and increased interest rates, something I know Barclaycard definitely do. I was also under the impression that they cannot put a charge against your home, as this is jointly mortgaged with my husband and credit cards are unsecured borrowing, but I have received contrasting advice from someone at the CAB (not sure of her experience) who said if you end up with a ccj they can put a charge on your home? Any offers of advice or tips would be so much appreciated. Thank you all.

- 16 replies

-

- any

- barclaycard

-

(and 2 more)

Tagged with:

-

After nearly 2 years with the FOS - Barclaycard have now finally suggested the following redress:- Total PPI payments = £534.00 Associated Fees = £808.00 Associated Interest = £1038.00 Statutory interest = £1351.76 My redress covers the following periods :- Nov 1989 - Dec 1998 ( No statements - so account is reconstructed) Jan 1999 - March 2007 ( Full statements provided - PPI cancelled March 2007) I can upload the Barclaycard calculation schedule however in the meantime i cannot understand why the associated interest is lower than the 8 % statutory interest. Is this another Barclays PPI underpayment ? Would appreciate initial observations.

- 28 replies

-

- barclaycard

- ppi

-

(and 1 more)

Tagged with:

-

Hello Caggers, I have been having a discussion with Barclaycard because I noted, in May 2016, that the period between the date my bill was issued and the date my payment was due had been shorted by several days. This very nearly caught me out as the payment is had always before and since (I now realise) been due on the 15th working day of the month. In May it was "due" on 11th working day of the month. I had a look on their website, it says: "Your payment date is fixed to a particular working day of the month...". I take that to mean it is fixed - in my case to 15th - working day of the month. So, for example, this month (August 2016) the 15th working day of the month would be 19th August. Am I wrong in my understanding of this sentence on their website?

- 7 replies

-

- barclaycard

- fixed

-

(and 2 more)

Tagged with:

-

Name of the Claimant ? Hoist Portfolio Holding 2 Ltd Date of issue – 01 March 2016 what is the claim for – 1.Claim for the sum of £7015.01 in respect of monies owing under an agreement with account no >>>>>> persuant to the Consumer credit act 1974. The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. 2.The defendant has failed to make contractual payments under the terms of the agreement. A default notice has been served upon the defendant persuant to s.87(1) CCA. 3.The Claimant claims 1. The sum of £7017.01 2. Interest persuant to s69 of the County Court Act 1984 at a rate of 8.00 percent from the 11/04/12 to the date hereof 1416 is the sum of £2177.10 3. Future interest accruing at the daily rate of £1.54 4. Costs What is the value of the claim? total £9702.11 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? Before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. Assigned Were you aware the account had been assigned – did you receive a Notice of Assignment? Not sure Did you receive a Default Notice from the original creditor? Not sure Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? Dont think so Why did you cease payments? Divorce and lack of funds What was the date of your last payment? Not sure June 2010 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into plan? No I have filed my acknowledgement of service (10/03/16) and sent a CCA request to Hoist and a CPR 31.14 request to Howard Cohen, no response to either yet (received 18 and 17th March respectively). I am hoping fo some help in filing a defence which needs to be by 2 April 2016, I think. Thanks in anticipation

- 67 replies

-

- barclaycard

- county court

-

(and 2 more)

Tagged with:

-

I have an old Egg credit card which went into default a number of years ago after I had to close my business. I have been paying £1 per month for a couple of years now. The payments are going through Capquest. Last time they asked for a financial update i asked for a copy of the original loan agreement. As I understand it Barclaycard took over Egg cards a number of years ago. I have attached a copy of the letter with details blanked out - the outstanding is around £3000. In the letter B/card state that they cannot currently fulfil my request, and as a result the outstanding is unenforceable. What should I do now? Should I stop payments until they can prove the liability? Should I offer them £100 in full and final? The default obviously still shows on my credit file. Many thanks TW

- 8 replies

-

- barclaycard

- egg

-

(and 1 more)

Tagged with:

-

Some way down the road with this already having sent letters and schedule of charges etc. Got some money knocked off twice. Sent a Letter Before Action but have not been on top of things and not followed up at 14 days. Weeks have passed. Am now going to file for court in earnest after sending a revised Letter Before Action. I'm not really happy with the way I am calculating interest in my prior documents and want to get it right and proceed with vigour. THE PROBLEM: Historic charges were applied on particular dates and did or didn't attract interest for varying amounts of time depending on how Barclaycard decided to play it i.e. A charge goes on, there is say 28 days when it does not have interest charged on it then it falls into the main balance and then charging of interest commences as if it were a purchase. When payments are made it is the first, second etc amount to be paid off and then it ceases to attract interest even if you still have a balance which was formed by purchases. THE QUESTION: Do I need to give a monkeys about the nuances of the above dates, payment thresholds etc? Is it OK to just say it attracted X numbers of months of interest which corresponded to the next time I cleared the balance? The money that paid it off would have paid off an equal amount of the "real" purchase balance if the charge had not been applied in the first place wouldn't it? ALSO: I am finding a lot of what would appear to be dead links to spreadsheets, letters etc. The ones I do find seem to be out of date for one reason or another and the forum/wiki seems to be very hard to navigate in terms of finding appropriate documents/attachments. Is there a page which has all the most up to date forms on that I am missing. I'm particularly needing a restitutional interest spreadsheet and good/recent Particulars of Claim texts. Hope someone can help. Best Regards DatumX

- 12 replies

-

- 2001

- barclaycard

-

(and 4 more)

Tagged with:

-

Hi all , I have a defaulted barclaycard account which was sold to MKRR recently, ouststanding balance about £4500. I have been passed from one dca to another over the number of years that i have had this account set up payment plans then things have happened so they havent been stuck to, it then goes quiet for a few months and then seems to get passed to different dca i have received 3 letters to date first 2 were to inform me that barclaycard have assigned and transferred my account to MKDP LLP etc the third one i received today from MKRR asking me to contact them to set up payment plan quite a nicley worded letter and very non-threatening actually ! Having read all the posts on MKRR im slighlty curious about exploring the possible loopholes that might be avaliable to me not really sure about what is the first letter to send to them and quite nervous about what is the impact of going down this route if it is unsuccessful

- 53 replies

-

- barclaycard

- hoist

- (and 6 more)

-

I had a Barclaycard roundabout 2005 - I have only one statement as proof which shows a balance of £2,156. Account closed due to non payments and sent to 1st Credit debt collection agency in Oct 2006 with a balance of £2,541.90 outstanding. The debt was never settled as I had to leave my job to become a full time carer for husband with motor neurone disease. got a letter recently regarding 'Payment Break Plan' attached to this Barclaycard which showed first 4 digits of the account number, my name, address etc I am totally unsure of how to answer the questions to be successful in getting a refund. I can't remember any details at all BUT what is more annoying is that some time ago, I applied for a refund of PPI charges on this Barclaycard and they told me that they no longer have my account information so cannot investigate any PPI claim. If this is the case, how can they now be asking me about the PBP? Are they lying about the PPI claim? Should I reply with this PBP questionaire (but please can someone help as I cannot remember details - are they trying to catch me out by wanting me to slip up?) If they are asking me about PBP, do they know the details of my account? And should I then challenge them about the PPI claim? I started loads of claims for PPI back in 2006-7 but when our world fell apart with the diagnosis of MND everything just went by the wayside and they were all left half done. .is it worth pursuing them all again? Should I start completely afresh? What are my chances after all this time? It's PPI for 3 store cards (now owned by New Day), bank charges with Lloyds and Santander, PPI with Lloyds and Barclays.... ....help please! Thanks

- 5 replies

-

- barclaycard

- break

-

(and 2 more)

Tagged with:

-

Hi Just received 2nd county court Claim form, within 2 days of each other, have another thread running for first one. Its from County Court Business Centre Northampton from the above claimants for an old Barclaycard debt that goes back to early 90's that was passed to MKDP and then Hoist Portfolio Holdings 2 Ltd, the debt collectors managing it are Robinson Way. The claim was issued on 04/03 The POC is as follows: The Claim is for the sum of £4710 in respect of monies owing under an Agreement with the account no. XXXXXXXXXXXXXXXX pursuant to The consumer credit Act 1974 (CCA). The debt was legally assigned by MKDP LLP (Ex Barclaycard) to the Claimant and notice has been served. The Defendant has failed to make contractual payments under the terms of the Agreement. A default notice has been served upon the Defendant pursuant to s.87(1) CCA. The Claimant claims 1. The sum of £4710 2. Interest pursuant to s69 of the County court Act 1984 at a rate of 8.00percent from the 24/06/10 to the date hereof 2076 is the sum of £2143 3. Future interest accruing at the daily rate of £1 .03 4. Costs Total Claim over £7363 I sent barclaycard a CCA Request few years back but only ever received their T&C. I have gone on mcol and done a AOS with defend all. I have also sent CPR31.14 to Cohen and CCA to hoist. Any further advice much appreciated, i assume i need to file a defence with 28 days is there any advice / links on best way to word it ?

- 24 replies

-

- 2nd

- barclaycard

-

(and 2 more)

Tagged with:

-

Hi there I took out a Barclaycard in 2006 I got into difficulty in 2013 after my mothers death and the account was passed to link financial- I thought they were a subdivision of Barclays so I set up a payment arrangement of £5 per week I was receiving letters from both of them at one stage so was confused who was dealing with the account. I was given new bank details to pay link direct so did so accordingly (mistake I now fear) I understood that I received a default from Barclaycard but on checking my credit file i have been quite surprised The Barclays information shows the account was opened 18/8/2006 and settled in June 2014 for £5601 with no default There is then separate information by link with a different account number (which I use as reference ony standing order) Account opened on 18/8/2006 which is not the case and they have recorded the default on June 2014 £5591 there is no further payment history shown to date just an outstanding balance of £5176 and the terms show 0 I did not start paying link directly until mid August despite them lodging a default in June Are they able to lodge a default when I have not entered into a credit agreeing with them other than to stupidly pay them directly (I didn't want to get into any more trouble) Does this look to potential lenders as two separate agreements given the different account numbers? And does this hinder my credit further? With them not showing any payment history does this mean that if I stop paying them that they will be unable to show a further default or enforce the debt? Please advise me of where I stand.... ..I do not want to impactt credit file further as I am strong desperately to negotiate full and final settlement s with all of my lenders to improve my credit rating Many thanks in advance

-

Hi Everyone, I've tried reading as much on here as possible however I'm now at a point whereby asking might be a clearer way forward. Debt - £2583.32 Creditor - Barclaycard I've had a letter through from Kearns Solicitors informing me that I have to pay the outstanding debt of £2583.32 is required in full otherwise I'll be taken to court in 14 days. I contacted them stating that I was unable to make any form of payment and that I had sent a financial statment to both IDR and Link whilst making an offer of £1pw. I was told that Kearns could either enter into a 12 month payment plan for the full amount of the debt or take full payment now. I said that this wasn't possible in which they said I would receive a summons in 14 days time. To cut a very long story short (as possible) I had to give up work to care for my disabled daughter whom is ventilated 24/7 and requires 2/1 care 24/7 in July 2013. On doing so it meant I was unable to pay my creditors and I also lost my house. As soon as I gave up work I started contacting my creditors informing them of my situation. Whilst most couldn't do anything until I actually defaulted, I was able to deal with all easily enough however this could only be done when my partner was present or the limited nurse cover we have was. Unfortunately I've lost track of who I've dealt with however I did forward a letter to both Link & then IDR along with a financial statement making an offer. I believe I spoke with Link however I can't be sure I spoke with IDR. Apologies if I've given any information not required however I thought some circumstances might be helpful. Any help/guidance would be greatly received. TIA

- 54 replies

-

- barclaycard

- idr

-

(and 3 more)

Tagged with:

-

Hi all, I've just found this forum and I'm seeking advice. My husband and I have barclaycard debts totalling 18k. It has accumulated over years of just paying the minimum payment, and having to use it in times of unemployment and ill health. We are unable to afford the monthly repayments, and I can't see that changing in the near future. I rang stepchange and they are in the process of starting a debt management plan for us. We have our mortgage with Barclays, our current account with Barclays too. I've read that Barclaycard can take money from our account at any time. I have searched the internet, and it's all so confusing. Some people say to write to Barclaycard and offer them what we can afford to pay each month. We have an overdraft facility on our current account. Does anyone know if Barclaycard can use our overdraft facility to take money? I also read that it's best to pay nothing, and then eventually they will give up on chasing the debt? Stepchange have advised us to open an account with a different bank. The thing is, we need to have the overdraft for the weeks when we have no money coming in. I know it's another debt, but our incomings fluctuate so much that we do need to have some access to credit every few months. I'm at a loss as to what to do for the best. I'm 58 and was diagnosed with Rheumatoid Arthritis 4 years ago. I had to stop working. Now I have a job which at times is a massive struggle to cope with, and the stress of not knowing what to do for the best is not helping. Any advice would be wonderful. Thank you.

-

Hello, I've not posted on these forums before but I have been an occasional reader and understand they may be occasionally monitored by DCA staff, so I'mm be intentionally vague with some of my personal info... I have been contacted by Lowell regarding an alleged Barclaycard debt that they have purchased. Although I have had an account years ago with Barclaycard that defaulted whilst in dispute over a number of issues, I do not recognise this debt as mine as the figure quoted by Lowell is much higher than that which I left in default. The amount quoted is a significantly high figure, but is less than £10k. As I did not recognise this debt I thought Lowells might be trying it on, so I ignored their contact as I felt I had better things to do with my time and I'm also something or a procrastinator. I open the most recent letter to find that it reads like this: "Having assessed our options, we intend to take legal action to recover this debt if you do not contact us to agree a repayment plan" "What legal action means" "1. A claim form is issued by the court." "2 Court fees, colicitors costs and interest will be added to the claim form which could increase the amount owed" "3. If you do not respond to the claim form a CCJ may be granted against you" "4. Should a CCJ be granted, this will be registered on your credit file for upto 6 years and may impact your ability to obtain future credit" "We'd prefer to work with you" "Our preference is to work with you without taking legal action. Please visit our website, etc etc." There is also a deadline on the leter by which to contact them, which I noticed was not on their other letters. The deadline is for a date this week (I opened the letter a little late, sadly, but I still have time to mail them) I don't know if anyone else has had this exact letter, but by the assertive "we intend to take legal action" phrase on it, I'm guessing that this is likely what they will do given how close the Stat Bar date is unless I can take some action to prevent them from doing so... The last payment I made to BC was VERY VERY nearly 6 years ago, but not quite. We're talking about a matter of weeks here. Other info that may be relevant is that the BC card itself was originally taken out circa 2002 and I've heard the credit agreement info for BC cards can be hard for them to obtain from that time period? Further; this card did have PPI on it from inception through to more or less the default, although not quite, as I do recall it being cancelled perhaps 6 months prior to that. I've submitted to claim toward this PPI to-date, but given my employment status at the time (6 months worth of full sickness pay as a benefit, and so on) it seems likely this would be considered mis-sold at the time of taking. Just me guessing though. Furthermore, the disputes I had with Barclaycard were regarding penalty charges. Also, they sent me a letter in early 2010 telling me they had been charging me incorrect interest and applied a credit to my account. I feel that this incorrect application of interest at an earlier stage of my BC contract may also have contributed to me struggling to make payments at the time, leading to the penalty charges, and leading to the ultimate default. That last part is perhaps a bit of waffle, but Barclaycard were pretty terrible at handling my account. My last payment was actually to Mercers who took a payment from me on the condition that they would reduce my balance down to he level I felt it should be at from prior conversations. They took my money and reneged on the agreement as no adjustments were made, so I made no further payments. The truth is that I was aware this debt would be statue barred very soon, and wasn't particularly worried about it until Lowells sent me this most recent letter, as they may well file a court claim literally days before the statute bar. I've seen a letter on another site entitled "pre action request for information" which is supposed to mean that action cannot be taken until my request for information is handled. Is this is true, it would make it virtually impossible for a court claim to be submitted prior to the statute of limitations period being reached. However, I want to ensure I'm taking the right steps before I do anything rash. The last thing want to do is somehow occidentally acknowledge the debt when I don't, because I never owed that sum of money! Has anyone had a similar experience to this in terms of the timescales and so on.. . is the pre action request for information a good idea, or would there be a better letter to send? I'd really like to post my response today or tomorrow so any quick replies or reassurances would be greatly appreciated. I'd paste the letter from the other site here, but I'm not sure if that's bad form? I chose to ask for help on this site as it seems a lot more active and I've seen some people get great results here from past readings ^^ Thanks in advance... Sorry, just to clarify froma typo, I have NOT submitted a claim in respect to the PPI... I somehow made it sound like I had (couldn't find an edit option after I'd posted)

- 16 replies

-

- assessment

- barclaycard

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.