Showing results for tags 'bailiff'.

-

Hi All, I could really do with some expert help here! A Bailiff visited me on 29/11/16 to collect money for an issue that i had no prior knowledge of. The bailiff told me it was for driving without insurance (something i have never done and can prove), and that is all the information i have. I want to do a section 14 statutory declaration, but have no information about the court hearing / date / court etc. How do i find this out without contacting the bailiff? I dont want them to find out im trying to stop them, and put further effort into recovering the money!! The only information i have on the final notice is a reference number and the client which is HMCTS London NW. Any ideas?

-

Hi guys. The other night I had the misfortune to have bailiffs from Marston's attend my property. I was asleep on the sofa my partner went outside to see what the noise was as we live on a partly industrial site and we have locked gates to the shared access. My partner came in frantic and woke me up to tell me that men who identified themselves as Law Enforcement Officers were here to see me.. I went out to greet them and instructed my partner to lock the door behind me. Stupidly neither of us had the good sense to video any of this because if we did then the following events may not have happened. I asked them what their business was they said they were there to exercise a warrant for unpaid fines. I replied that this was fine and I offered myself for arrest as they had led us to believe that they were Court Bailiffs and not Private Bailiffs. Whilst I was talking to them, one of them said they had the power to force entry yet never showed me any warrant.. .whilst I was being distracted by one Bailiff the other opened my rear gate and the next thing I hear is my partner screaming that the other Bailiff is forcing the French Doors open. Anyone that knows French doors will know that unless you have very thick bolts top and bottom that they are fairly easy for a 14 stone thug to push open regardless of how good your Chubb lock is on the handle assembly. Unfortunately I just have 2 little bolt locks at the bottom of the doors and they are only attached by half inch screws. I immediately rang 999 and asked for Police to report a case of breaking and entering.. .but once I told the operator that they were Bailiffs she said there was nothing they could do??? is that the case? All you need to burgle a house is a uniform and a bundle of lies. Now that they are both in the house they start just going through our things saying that they would be taking everything unless they received full payment of £700. To try and settle with them I offered them either of 2 cars, a 1 ounce gold chain or my Rolex watch left to me by my Grandfather.. .and they refused each of them and instead began to dismantle my computer and the 7 year old plasma TV I use as a monitor for it. My partner and I at this stage were terrified as the Police had turned their back on us, the Bailiffs didn't really seem to want to take goods.. .more like create a sense of fear, disruption and panic in our house. I told them I would happily surrender what I owned. ..gold chain, Rolex watch and 2 cars but as it was my partner's rented (furnished) house and not a joint tenancy nearly everything else belonged to either my landlord or my partner and I offered receipts to prove. They then said that they would be taking everything anyway and we could use the receipts that I had just offered to show them to claim what they had taken by applying to the Court. Then we get to the what they really want. .I said I had just given up my job through illness before Christmas and we simply didn't have that kind of money but I could get £300. They said "You must know someone who will lend it to you" and my partner then rang her Mum who paid it on her Credit Card. Now what this fine related to was a car I sold over a year ago to a car dismantler who was supposed to have applied for a new logbook informing the DVLA he was the new keeper but clearly he didn't. Now because the vehicle was neither SORN nor taxed apparently the DVLA can now 'do' you for no insurance. Now here is my guilt...I foolishly ignored their letters thinking that eventually the DVLA would be updated eventually. I then exacerbated things by ignoring the Court letters too. In my defence I suffer from PTSD and other mental health issues not to mention physical ongoing Pancreatic problems so I know it's bad but I do bury my head in the sand and hope everything will all go away. Not the actions of a perfectly mentally sound individual. Now what I have done so far to try and remedy the situation is send the DVLA a copy of the bill of sale for the car.. .and naturally they say it's not their problem now. ..so my next step is to deal with the Court. I also reported it this morning to the Police as a crime and let me tell you that is no easy task as the operator this time said she would pass it along to their crime team who would get back to me within a few days....no crime number or reference of any kind. I fully intend to help my partner's mother instigate a chargeback on her Credit Card although it seems to be ill advised on this site. ..as this payment was obtained solely under duress. Any advice or imput would be gratefully received. Thanks so much in advance

-

Today 07/01/2017 my partner and i had a visit from a marston holdings bailiff demanding payment from my partners daughter who no longer lives with us and is not on electoral register and proceeded to show him our tenancy agreement and that she has not lived here for over four years since going to university. None of us at the address is named on the so called court order which he would not confirm also we have not had any notice that any enforcement agent would be visiting. As the person on the enforcement notice was not in residence we informed him that he was allowed to demand payment or remove goods he was insistent to the point of bullying saying he had the right to do what he wants and seize any cars or goods my partner and her second daughter and her granddaughter 8 years was getting upset frightened and angry still he would not go and my partner was at the point of handing over her cameras to him until he said he would allow 10% of what they cost new to which i got angry and insisted he leave but he was fueling an disagreement between my partner and i to the point i angrily and under duress i paid on my credit card. This agent had proof that she no longer lived at this address and turns out no longer owned the car and was paying said penalty notice. Take note Marston's agents do not take notice of their legal limitations and will do anything to take money off innocent people we did not incur the debt but will hound anyone to get payment.:mad2:

-

The following statement was released a few days ago by the Government. This is in response to a Daily Mail campaign earlier this year regarding individuals who have found themselves unable to get a mortgage or credit because of the existence of a judgment against them that they were unaware of (usually because all correspondence had been sent to a previous address). Depending on the outcome, this consultation could have far reaching consequences for bailiff enforcement. Currently, in relation to council tax arrears, a local authority are permitted to issue a summons to the 'last known' address. In relation to an unpaid penalty charge notice, correspondence must be addressed to the address held by DVLA at the time of the contravention.

-

When my husband died last year we were in arrears with our Council Tax. I went to the Council and an arrangement was put in place which I've adhered to. Until yesterday, no problem. Yesterday, two letters come through the post from Ross & Roberts addressed to my husband. They were pay up within 7 days or we will take you to Court letters. Being somewhat bemused by these letters, I had a vision of letting them take my husband to Court, me going to Court to "represent" my husband and asking the Judge if the Court could employ the services of a Medium so my husband could state his case from beyond the grave!!! Being serious now. Someone, has slipped up - badly. I don't know if this is the fault of the Council or Ross & Roberts and I'm not sure whose cage to rattle first about this but cage rattle I will. I haven't had anything from the Council themselves, just this DCA. I'm wondering if I can sue them for harrassment and causing distress. It would be nice to turn the tables on them for a change. Any advice welcome.

-

Unfortunately, many people consider that because, they have problems with mental health that a local authority should not pursue them for road traffic debts or refer cases to bailiffs. The following recent decision from the Local Government Ombudsman is therefore of importance: PS: The following is a short version of the LGO's decision. Please refer to the link at the end of the post to read more. London Borough of Hounslow. The complaint Mr A complains the Council harassed him and discriminated against him by using bailiffs to collect a debt relating to two unpaid Penalty Charge Notices (PCN) when it already had notice of his mental health problems. Mr A maintains the Council should have treated him as a vulnerable adult and told the bailiffs of his condition. He seeks a refund of the enforcement costs he has paid and compensation. What I found Council parking enforcement officers issued Mr A with two PCNs. As Mr A did not pay the charges the Council followed its usual enforcement procedures to obtain payment of the PCNs and the accrued costs. In February 2015, following the Council’s actions in sending out Charge Certificates to Mr A in relation to the PCNs, he wrote to the Council explaining he had mental health problems and enclosed a letter from his GP and the Jobcentre. The Council responded by advising Mr A that while his medical condition had been noted it was not accepted as mitigation to cancel the PCNs. An Order for Recovery was then issued in April for the two charges. As the debt remained unpaid, the Council passed Mr A’s case on to bailiffs acting on its behalf and they wrote to him at the beginning of June. As no response was received, an enforcement agent, Mr X, attended Mr A’s property. Having taken control of Mr A’s vehicle, Mr X spoke to Mr A who informed him of his mental health problems. Mr X told Mr A he had no knowledge of Mr A’s condition but declined Mr A’s request to call his office or the Council to confirm it. Instead, Mr X told Mr A he could seek legal advice. Mr A offered payment by card but made clear he believed he was doing so under duress. Mr X told Mr A it was his choice whether or not to make the payment and Mr A paid the outstanding debt in full. Mr A then made a complaint to the Council about its and the bailiffs’ lack of understanding of his illness and vulnerability and that he had been forced under duress from Mr X to make payment. Having contacted the bailiffs and sought their comments, the Council responded in August 2015 but did not uphold the complaint. It concluded Mr A’s case had been dealt with in an appropriate manner. The Council confirmed it had been aware of his mental health problems but, having considered matters, decided that his particular circumstances did not warrant the cancellation of the PCNs. Because it had decided to pursue the charges, and refer his case on to enforcement agents, it did not consider it necessary to make the agents aware of Mr A’s correspondence about his mental health problems. It did not uphold his complaint. Analysis When Mr A told the Council of his mental health problems, it considered what he had said, and the evidence he had provided, but decided his condition was not sufficient mitigation to stop collection of the charges. It informed him of its decision. The merits of this decision are not open to review by the Ombudsman no matter how strongly Mr A may disagree with it. I have viewed the recording of Mr X’s visit to Mr A’s property. In it Mr A tells Mr X his condition is such that the Council should be working with him to which Mr X replies he can make a payment arrangement with Mr A. He did not doubt Mr A when he was told of Mr A’s mental health problems and told him he could seek legal advice. I saw nothing in Mr X’s behaviour which amounted to harassment or discrimination and he reasonably took the card payment which was offered to him by Mr A. http://www.lgo.org.uk/decisions/transport-and-highways/parking-and-other-penalties/16-000-771

-

Found this on the Mail where people are being hit with default CCJ even for a penny they know nothing about until the bailiff knocks or they are refused credit. It seems Crapita AKA parking Eye are getting default CCJ on alleged debts of a penny, as in o 0.01p. http://www.dailymail.co.uk/news/article-3784421/Stranger-s-40-parking-ticket-cost-family-new-home.html

-

I'm assuming there is a precedent to this. I have a debt to the Council for back Council Tax which I have been paying back as and when I can afford it. Today Bristow and Sutor sent an enforcement agent (who told them he was a bailiff) while I was out and luckily they did not let him in. Nothing, apart from a few items such as my bed and an old stereo which is worth pretty much nothing, on these premises belongs to me as I am just a lodger here and the room is furnished by the landlords. I have never denied that I owe something but the amount is in dispute I have told B&S this previously but they have ignored all my letters. The bloke cleared off when it became clear he wasn't being allowed in but I suspect he will be back. Apparently he was eyeing up their car and I would obviously hate for them to become involved when it is nothing of their doing. Do these people have any claim to anything on the premises and where do we stand if they return in the future? I have spoken to the Council but they say it's out of their hands now although I suspect they could do something about it if they wanted to. Thanks in advance for any help and advice

-

In the first instance, don’t delay…but whatever you do….don’t rush into issuing an injunction (more on this in my second post). Why has my car been taken? In most cases, the vehicle would have been taken because it had been identified by a bailiff using ANPR (Automatic Number Plate Recognition) in relation to unpaid penalty charge notices owed by the previous owner. Why this happens is because the warrant carries upon it the vehicle registration number of the vehicle involved in the parking contravention. Will the bailiff company give me my car back? Unfortunately, without documentary evidence being provided to support the sale, the vehicle will be unlikely to be released. Why is this? Bailiff companies frequently come across cases where a vehicle has ‘allegedly' been 'sold’ in order to assist the ‘real owner’ evade payment of their parking debts. In other words, it can be fairly common for 'sales’ to be ‘bogus’. It is vehicle owners such as these, that are to blame for genuine purchasers being required to provide so much documentary evidence. What do I need to do? In the first instance, ask a question on the bailiff section of the forum. If your car has been taken, you will need to contact the enforcement company as soon as possible to make a Part 85 Claim . This claim must be submitted within 7 days . Almost all companies will ask you to provide the following five items as evidence. Most of the larger companies have their own set Questionnaires. V5c Log Book If the purchase was a recent one, this document can be difficult to provide as it can take up to 4 weeks for the new V5c to be processed by DVLA. If this document is not available, you should provide the tear off New Keeper supplement from the Log Book. Proof of Purchase. If payment for the vehicle purchase had been made by bank transfer, this is ideal. If payment had been made by cash….this can be problematic. Most enforcement companies will request evidence by way of a bank statement showing cash being withdrawn a few days before the purchase. You will also be required to provide a copy of the sales receipt. How the purchase came about. If the car was purchased via eBay, Gumtree, Auto Trader or a garage etc, then a copy of the advert and receipt will be required. If the purchase has been via a friend or relative, this can be problematical. Once again, please post a question on the forum. Copy of vehicle insurance. This will be one of the most important documents. It is a criminal offence to keep a vehicle on a public highway without insurance and all enforcement companies will require some evidence that the new owner has obtained insurance within a day or so of the purchase. If the vehicle is not kept on a highway, evidence of SORN registration should be provided. Evidence that road fund licence has been purchased. Most new vehicle owners will tax their vehicle online with DVLA and will either make a one off payment or monthly instalments. A copy of the bank statement evidencing that road fund licence was obtained around the time of the purchase will need to be provided.

-

In the past couple of weeks I have received reports of six cases where a locksmith had been used to enforce a debt for magistrate court fines after a debtor had relied upon misinformation on the internet and believed that paying the amount only of the court fine (minus bailiff fees) to the court (as opposed to the enforcement company) would mean that the warrant had been satisfied. In four cases, payment had been made to the court on receipt of the Notice of Enforcement (when bailiff fees of just £75 had been added). In the remaining two cases, payment had been made following an enforcement agent agent visit (fee of £235 had been applied) In each case, the person had relied upon the following statements featured on social media sites (with close links to the Freeman on the Land movement). The warrant for court fines only enables the enforcement of the "Sum Adjudged". Section 76 of the Magistrates courts Act 1980. Pay the fine online. That extinguishes the power to control of goods. The warrant only gives a power to take control of goods for the "sum adjudged". In each debtors case, after making payment to the Magistrates Court they had received notification from the court that their payment had been forwarded to the enforcement company so that the company could properly deduct their Compliance fee of £75 and apportion the balance on a pro rata basis in line with legislation. By following the inaccurate advice, each debtor had incurred substantial additional fees. In four cases, an enforcement fee of £235 had been added and in each case locksmith fee had also been applied.

-

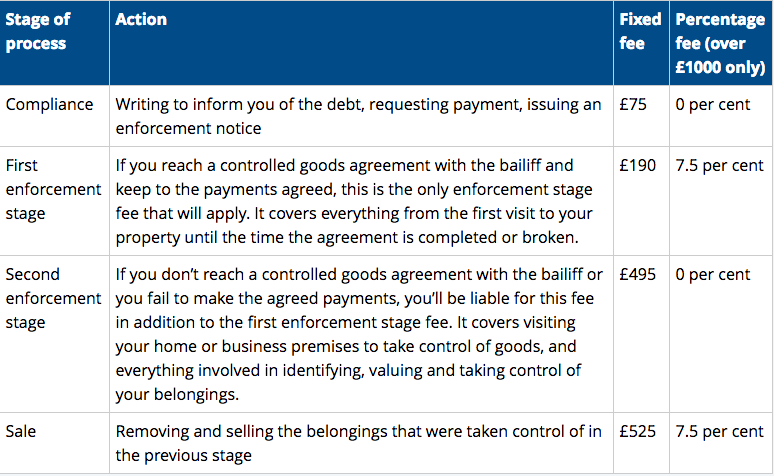

Hi all, I would really appreciate some advice. My business partner and I run a small business, and cashflow is very delicate. Some time ago we got in some money trouble and an invoice was sold to a debt recovery company. We managed to pay it off (or so we thought), but unfortunately my business partner is a bit scatternbrained with numbers, and paid the incorrect amount. The total outstanding debt was £5,723.96. My business partner sent them a transfer of £5,700, accidentally leaving off the £23.96. My business partner had some fees he wanted to dispute - The debt recovery company then sent a follow up email saying all prior fees are legitimate, and that "I have checked your account and can see we are still awaiting a payment of £23.96. I am assured this will be paid in due course, and this case can then be closed.". My business partner forgot to respond to the email (stupid, I know), and three weeks later (yesterday) they send a hired thug to our place of business, while customers were there, demanding the £23.96 plus a £1111.87 enforcement charge. He said that unless we paid that to him on the spot, he would confiscate goods that he valued to the sum of £8000. The £5,723.96 sum had a high court writ, which comes with a cap on fees of this nature that can be charged, as illustrated by the table below: The bailiff claimed to be able to charge for both stage two and three whether or not he actually had to carry out stage three. I pointed out that I was perfectly willing to pay the debt and the enforcement fee on the spot, which meant that he did not have the right to charge a "sale" enforcement fee, but he refused to drop it, saying I either pay exactly what he is demanding, or he starts ripping equipment out of the walls there and then. I had no choice but to pay the entire sum, and did so. There is no doubt in my mind that this is illegal and extortion, and in fact the bailiff himself used the very word "extortionate" when explaining the situation he was putting us in. My question to you is which regulatory body can I bring this to the attention of, are there any court cases setting a precedent in these situations, and are there guidelines that prevent bailiffs from charging huge bills for debts as low as £23? Even the £495 bill is entirely unfair, and clearly taking advantage of an admin error made by a small business. The law was not written to allow them to do this, and it puts our business at risk. Any advice on putting this right would be massively appreciated. Thanks a lot.

-

My PCN situation: I did not pay a PCN issued in Houslow, London for a bus lane contravention (dated 8 June 2015) in the agreed time as I was unaware of it. The first I knew of the PCN was an email from Collect Services Ltd. (13 June 2016) about warrant issued against me for an undisclosed sum owed for a bus lane contravention. I thought the email was spam or phishing and ignored it (I do not live in the area etc. and get spam from various 'companies' asking for money'.) On September 8th I was emailed a bill (again from Collect Services) for £512. I got in touch with them to ask what the bill was for. Collect Services responded, explaining they were collecting a driving fine debt on behalf of Hounslow council (where my grandmother lived). I realise I moved house in June 2015 and had omitted to change the address with the DVLA. Additional info: I sold the car in Oct 2015 so never updated the car's registered address to my current address. I called the DVLA today and the new owner omitted to register the car with DVLA to his address. so the car is still registered at my 2015 address I would have addressed the September emails before now but I was working away with limited access to email. I have proof of travel etc. When I called Collect Services I gave them my new address I am looking for advice on the following: I know that I made a mistake in not registering my car to my new address but want to avoid paying some of the fine which I believe is disproportionate to the offence (The PCN has spiralled to £202 / the initial Bailiff Fee was £75 and the most recent bailiff fine was £235) I am petrified (single woman) of a bailiff arriving at my door. Is sending off the TE7 and TE9 form the correct action for me? The TE9 seems only for parking offences. If so, have I completed the TE7 form correctly manner? (TE& attached) and how would I complete the TE9? My Dad suggests writing to Collect Services and offering them the original fine doubled. He says they are very unlikely to take me to court. I do not have a car anymore so have no public goods that an be taken. te007-eng.doc

-

The Taking Control of Goods Regulations 2013 came into effect in April 2014. A significant change to the regulations was how bailiff fees are to be deducted from any payment made. This is explained in detail on the following STICKY: http://www.consumeractiongroup.co.uk/forum/showthread.php?453047-Bailiff-enforcement-Setting-up-a-payment-arrangement-and-whether-you-can-pay-the-court-or-the-council-direct Almost as soon as the regulations were introduced, local authorities around the country were inundated with Freedom of Information requests to ascertain whether or not the council would properly deduct the bailiffs fees in accordance with legislation in cases where the debtor defied the instruction on the Notice of Enforcement, and instead, paid the council the amount of the liability order only (minus bailiff fees). If nothing else, these FOI requests have highlighted to the councils the way in which the regulations had changed. With the regulations having now been in place for 20 months it is now the case that paying the council direct (minus bailiff fees) rarely ever succeeds and instead, is leading to debtors being in a much worse financial position than ever before given that by the time the payment has been processed by the local authority, the 'compliance stage' outlined in the Notice of Enforcement would have ended and with it, the opportunity to enter into a payment arrangement without the need for a personal visit from the enforcement agent and a charge of £235 being applied. Given that this is a discussion thread, it may be useful to debate this subject but please.....no arguments or squabbles.

-

Hi All, Yesterday whilst I was out at work, I had a surprise visit from a bailiff who handed over a letter to my boyfriend stating that if I don't complete the means form & return it, I could be sent to prison. This came totally out of the blue to me as I haven't had any court order letters & I was confused about where this had come from or what it was related to. Quoted on the letter was Phoenix recoveries which also means nothing to me, I have had no correspondence from this company I called the bailiff and all he could tell me is that it was from a debt in 2005 and it is for collection charges. The original debt was £4300 and the amount they are now seeking is £1400. I did default on a loan around that time and was subsequently given a CCJ which has now been cleared from my credit history as 7 years has passed since the CCJ was issued. The bailiff gave me the number of the solicitors (Mortimer Clark) to call and ask them but I just wanted to ensure that I have all the information I need prior to discussing with them. I'm sure this can't still be chased 11 years after the original debt, especially if I have already previously been issued a CCJ I really am not sure about this and could do with some help with facts prior to calling the solicitors. Sorry for long winded post but I wanted to get all the information in & hopefully someone can give me some guidance. Thanks in advance Rach

-

Hi all, I have a question or two related to court issued Bailiffs... Yesterday I was sat here (at home) doing some work (I work from home) and I hear a knock at the door ...A chap says he is a bailiff and ask for my step son (who is 26yrs old btw). He was not in at the time, so I told the chap this, and he asked me if step son lived here, I said yes. He then handed me a letter and said please give him this and he would call another time. I have not really looked at in detail as he has taken the letter with him to work, but on one of the paper it definitely says something about the court and bailiffs. my missus is in a right panic and freak moment because she is convinced the bailiff can take my stuff, her stuff, break in if there is no one here, force entry into the premises etc etc... Now as far as I can gather, this is for debt owed to Cabot (Though I can’t be sure cos haven’t had a chance to talk to him properly has he was at work at 6AM this morn) but I believe it said something about credit or credit cards, who the original credit card is I do not know. About 5-6 weeks ago, we had Lowells calling 3-4 times a week a nd I got to the point I thought, that they thought, I was my step son because when they called he is never here, he works 12 hours shifts 5 days starts early and home after office hours… I told him to call them and do not know if this is related, but a couple weeks back, the calls stopped. He ignores letters that come through the door, and despite me telling him he needs to sort it out, read the letters, call folk back, he has clearly no done so, one of these issues he has created for himself has finally arrived to collect their dues. So, my questions, and all please understand, I am encouraging him to sort this out, not run away from or pretend it’s not happening or looking for a quick get out of free card. I am looking to ease my other halfs tension about the whole situation. So, first, with regard to entry to the premises, I understand if the court has given him (the bailiff) right of way, and accept to some degree this is not negotiable as it were, my issue is this, my step son does not own these premises, his name is nowhere on the properties official documents in other words, for the purpose of simplicity, he resides here as would someone renting a room (though of course without a contract). So how does this affect the bailiff with right of entry and how does this affect us as the residence owners? I understand my step sons name is on the paperwork but like I say I am worried that if there is no one here, or he is not here, they will decide they are coming in anyway though I want to encourage him to deal with it, at the same time I see no reason why me and the missus should be subject to allowing them in without proper consen t and only at a time it is convenient for us as the property owners (for example if he won’t deal with it I will absolutely let them him to take his TV and Xbox, but only if he is here or I decided it reasonable to do so if either myself of missus is here)… The other issue I have and that my other half is really getting upset about, is whether the bailiff can just take stuff willy nilly as it were. I had originally said to her , that I don’t think this is how it works, but then she pipes up, well what if asks up to prove this stuff is ours? Which of course is a pertinent question, and of course some stuff is easily provable other stuff not so, for example, I do not know where the receipt for my 5-year-old laptop is, or the HUDL2 I bought for her Christmas pressy 3 years back, or whenever it was… So my second question, can the bailiff just take stuff from this address? How are we to make sure there is a clear demarcation between our stuff and my step sons stuff? And how do we make sure he takes only the stuff he is entitled to take? Thanks in advance and I look forward to some valuable input from the CAG members and crew…

-

Hi all Can an Enforcement company add all there fee's on after the compliance stage (£235 and interest) before they try to enforce? I know it would be irrelevant if they take control of goods just curious if that was allowed. leakie

-

Ok, some more questions for clarification on this. From what I understand, a bailiff cannot clamp your car on private land. Would this include a bed & breakfast car park that you were staying at? Because sometimes I have to work away and just wondered the legality of the situation. The only reason I ask is because I know they use ANPR, so theoretically if they're looking for my car they could get lucky, although this is unlikely I just want to be sure. Secondly, they can't take your car if it's worth under £1350 and is used for work? So, how do they value the car? And how do you prove that it's essential for work? What happens if they clamp it anyway? The car I use is a cat d write off. I was paid out £3250 a few years back, and bought the car back off the insurance for £325. So does that mean it's worth £325? Or will it be the book price for a cat d, or just any price they decided?

-

There has been much debate on the forum regarding the important subject of 'vulnerability' when a debt (usually council tax arrears) is being enforced by a bailiff. Many posters have different opinions as to whether or not, when vulnerability is identified, the account should be returned to the local authority and bailiff fees removed, or managed by the enforcement companies in house Welfare Dept etc etc. Whilst opinions will no doubt vary on this very important subject, it may be of interest to know what the Local Government Ombudsman's view is of this subject. If a debtor wishes to have a complaint considered by the Local Government Ombudsman, they must first take their complaint to the relevant local authority and exhaust the first stage and second stage complaints procedure. The complaint may then be considered by the LGO. All Local Government Ombudsman's decisions are reported on-line. These reports are made public 3 months after the final decision. The local authorities name is revealed but the complainants details are not.

- 20 replies

-

I am wondering where I stand with this. I have been told that Dukes Bailliffs made a visit to my workplace today. They handed a letter to one of my employees. However this letter had my contact name but another companies address, which is just around the corner, said employee thought it was for them and they had got names mixed up. the company opened the letter which they found was from Dukes Bailliffs but was infact for me. I had my name and personal address inside, saying the same old thing. We have visited your home today and you have 7 days to get in contact. With how much I owed in Council Tax. They immediately returned the letter to me, but wanted to know why their address was on it. They contacted Dukes and asked them, they were told that my council had given them the business address along with my details as a director of that company, as they were unable to get a hold of me at home. They said their company must have something to do with mine. Can they actually visit a place of work and harass one of my employees, and also this has caused quite a bit of embarrassment, on both my part and the company who the letter was addressed to. Isn't this a breach of data protection.

-

This is a long story so quick summary is as follows; In oct 2014 i got a ccj for unpaid business rent made against me it went to a collection agency and i set up monthly payments then defaulted in jan this year it went to court enforcement services ltd and finally an enforcement officer visited on 6/7/16 I told him i couldn't pay he then managed to get me to sign a controlled goods order on my husbands car(stupid i know) and told me to pay £500 the following monday. i rung payplan debt charity and after going through my finances they advised a DRO but i cant get it until the CGO is removed as is counted as a secured debt they said this should be easy to do as the car is my husbands property and not mine and the debt is in my name only. Turns out this is not easy to do at all! i have spoken to countless people and all have given me conflicting info. on my adventure to remove this CGO i have found that some of the debt the claimant wants is not actually mine as somebody else rented the shop i owe for during my tenancy but i am struggling to find actual proof. A couple of people have said to get the judgement set aside with an n244 form but i now don't know what it is i am asking to have set aside the bailiff or the whole judgement from the landlord. hope this makes sense to somebody any help would be appreciated

-

I mentioned yesterday on the forum that since the new regulations came into effect in April 2014, the Local Government Ombudsman has dealt with 304 enquiries relating to a council tax complaint that involved bailiff enforcement, and 418 enquiries relating to a penalty charge notice (including congestion charging) that involved bailiff enforcement. The following decision has just been released and again, another local authority has agreed to refund bailiff fees an Out of Time witness statement has been accepted at the Traffic Enforcement Centre. The following is an extract of the decision. Bury Metropolitan Borough Council Mrs X complains the Council failed to refund bailiff costs and the parking fine following the decision of the Traffic Enforcement Centre (TEC). Background: 4 The Council issued a penalty charge notice (PCN) to Mrs X. It says Mrs X did not either appeal the notice or pay the fine. The Council continued to take action to recover the outstanding amount which resulted in bailiffs visiting Mrs X’s property. 5 Mrs X says the first time she knew of the PCN was when the bailiffs visited. She says she panicked when the bailiffs attended and so paid the fine in full. Afterwards she decided to challenge the recovery as she had never received the PCN. Mrs X made a late appeal to the TEC. Her appeal was upheld. 6 The bailiff sent a cheque to Mrs X for £310 on 17 February 2016. This was the return of their fees following the decision of the TEC. The Council retained £82 which is the original penalty charge of £50, £25 for the non- payment before the Council sent a charge certificate and £7 for the debt registration. 7 The Council says it has retained this amount because it did not form part of the TEC decision. It says at no time has Mrs X challenged the PCN and so it is still valid. 8. In response to my enquiries the Council says it will reissue the Notice to Owner to Mrs X. This will give her the opportunity to challenge the original PCN. If it is found the PCN was not correctly issued the Council should make a further refund. Final Decision: My decision is the complaint will not be pursued further. The return of the bailiff fees has provided a remedy for most of Mrs X’s complaint. When we spoke on the telephone previously, she said this is what she was seeking. In addition the Council will now reissue the Notice to Owner which gives Mrs X the right to appeal the PCN if she considers it was wrongly issued. I consider this provides a suitable remedy for Mrs X’s complaint so I will not pursue it further. http://www.lgo.org.uk/decisions/transport-and-highways/parking-and-other-penalties/15-017-156

-

My friend I live with owes some council tax which he has been paying back monthly. He owes 246 pounds, and was supposed to make a payment on 15th month. He forgot, it was not a deliberate oversight. The bailiff came to the door, thought he was going to smash the door down. I went running down in my nightie wondering what the hell was wrong. This man just said you are being recorded and can I speak to so n so. I am working for the council, and I am from Bristol and sutor. I replied he's not in. Then he said can you ring him and I said no because I'm waiting for a very important call. This was true btw. I have an autistic son who is very depressed He then gave me the most horrendous look, didnt believe a word I was saying, and no chance to say anything else. Pushed a letter in my hand. Get him to ring me. When my friend got in he rang the man and say I believe you have been to my home, and tried to explain that it was an oversight. THe man just said I want the whole amount by Wednesday ,or I am removing goods and your car if you have one. He asked if I work which I do part time, but my friend said it's nothing to do with you, its my debt, and we were not living in the same property then. My friend then put the phone down on this obnoxious person who was really shockingly nasty in his manner. Rang the council tax to advise them, cant take the debt back. Gave me a number to call Bristow and sutor number office Guess what their computers were down. Though the man on the phone said they can't take goods if they've not been in the house. my big concern is my huge autistic son who has big anxiety issues and will not take kindly to us being threatened. Most of the stuff in the house is mine, nothing of any value. The car is on HP and I need it to get my son to appointments, he never goes anywhere unaccompanied, because he can't What can I do we don't have that money till my friend gets paid again on the 15th i don't have enough to pay it all from what I have left. He had every intention of paying it. any advice in a short time would help 2 days to find this money .......

-

Since the introduction of the Taking Control of Goods Regulations 2013, it has been very interesting to observe the number of forum posts (here and on all other websites) where debtors (and indeed regular forum posters) consider that in cases where a debtor is identified as being ''vulnerable', that the local authority (or creditor) should be obliged to recall the account from an enforcement agent.....and remove all bailiff fees. In the majority of cases, the fees under discussion will be £310, consisting of a Compliance Fee of £75 (applied when sending the Notice of Enforcement) and an Enforcement Fee of £235 (applied when an enforcement agent attends the debtors premises in person). In the following post I have outlined my opinion on the above.

-

All Local Government Ombudsman (LGO) decisions appear on the LGO website six months after the date of the decision. Personal information about the complainant is naturally removed but the name of the relevant local authority is made public. For this discussion thread I have only selected important decisions that concern council tax enforcement where a liability order had been obtained and passed to an enforcement company. Although the following decision relates to events prior to the new regulations taking effect (April 2014) it is nonetheless a very important one to refer to. The decision date was August 2014 and was published November 2014. The local authority is London Borough of Hammersmith & Fulham and the complaint made by the debtor was that: The debtor was vulnerable and the local authority should not have referred to account to bailiffs. That the council forwarded payments to the bailiff company. The council refused to recall debt from the bailiff company.

- 63 replies

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.

3053548.thumb.jpg.6ea05a752ac6bbf38ae4e7be9676053a.jpg)