Showing results for tags 'aware'.

-

The Veterans Covenant Hospital Alliance is a group of NHS hospitals that are leading the way in caring for veterans. The first 25 hospitals are: Brighton and Sussex University Hospitals, Sussex Armed Forces Network; Cambridge University Hospitals NHS Foundation Trust; City Hospitals Sunderland NHS Foundation Trust; Doncaster and Bassetlaw Foundation Trust; East Suffolk and North Essex NHS Foundation Trust; Guy's and St Thomas' NHS Foundation Trust; Hull and East Yorkshire Hospitals NHS Foundation Trust; Leeds Teaching Hospitals NHS Trust; Newcastle upon Tyne Hospitals NHS Foundation Trust; Norfolk and Norwich NHS Foundation Trust; North Bristol NHS Trust; North Tees and Hartlepool NHS Foundation Trust; Northumbria NHS Foundation Trust; North West Anglia NHS Foundation Trust; Portsmouth Hospitals NHS Trust; Robert Jones and Agnes Hunt Hospital NHS Foundation Trust; Royal Cornwall Hospitals NHS Trust; Royal Devon and Exeter NHS Foundation Trust; Royal Edinburgh Hospitals, NHS Lothian; Royal National Orthopaedic Hospital NHS Trust; Salisbury NHS Foundation Trust; South Tees Hospitals NHS Foundation Trust; Cardiff and Vale University Health Board; University Hospitals Birmingham NHS Foundation Trust Wrightington, Wigan and Leigh NHS Foundation Trust The recognition means that patients who have served in the UK armed forces will be cared for by frontline staff who have received training and education on their specific needs and who can also signpost them to other local support services e.g. Mental Health.

-

Hi all Just wanted to make people aware of an underhanded way the EA tries to make you default. History I finally took the general advice from BA and Dodgeball, and come to an arrangement with the EA company dealing with the 3 historic LO's. Which in the main is advice After alot of barriers put in my way, I was passed to the welfare department. I sent in an I & E with at the time a surplus income of £12.00 per week. Rossendales in there wisdom wanted £16.00 per week. Again speaking to the welfare and in turn them speaking to the council , it was agreed that I would pay the minimum £3.75, on one and the others put on hold. I was informed that the arrangement would be reviewed in 12 months, quite happy with this. Moving forward to today Today I received, two letters stating that they have not received my latest payment under the previously agreed arrangement. Checked the bank statement online and money has been paid as agreed. I have since found out that without any communication to myself, from either the council or Rossendales that they had lifted the hold on the other two accounts. They could not have taken any extra as on Standing Order, so they could not have collected any more without informing me. When speaking to one of there operators, I was lectured in a demeaning way, and after explaining the agreement that had been put in place, finally he spoke to the welfare department, and the operator explained the above. Then threatened me with enforcement if I did not come to an arrangement. If I had been away I would not have known and further fees would have been added. I have now come to the agreement that I will send in another I & E, and the account is now on hold until 6 september. So Please Be aware of this tactic to make you default. Leakie

- 2 replies

-

- arrangement

- aware

-

(and 1 more)

Tagged with:

-

Hi All, Just a word of advice....... If your ever are unfortunate enough to be hit by a driver insured with Royal Sun Alliance, Please make sure you DO NOT LET them try to resolve it even if they admit full liability..... Our parked car was hit by a RSA Client and you wouldnt believe the hassle we have had and is still on going...... * Failed to provide a loan vehicle due to various reasons (staff shortages / Needing to see the original cover note before letting you take car away but they couldnt confirm details of loan vehicle until we got to their pick up point, which meant you couldnt arrange cover note in advance so no chance of having the original when you collected the car...........) * Returned our car after 12 days with more damage than when they collected it - RSA cant explain what happened??. * Returned the car after another 3 days , 90% repaired but still not perfect - refused to let them have a 3rd attempt (Arranged proper repair ourselves and done in 1 day and looks like new again). * Total losses for the period was £2312 but only offered £650 in compensation.. ..., now going to legal dispute (lucky we had legal cover). * Refusing to supply documentation in respect of what work had been carried out on our vehicle. my advice is if your unlucky enough to be hit by a vehicle insured by Royal Sun Alliance DON NOT LET THEM REPAIR IT... ....., USE YOUR OWN INSURANCE COMPANIES 3RD PARTY CLAIMS PROVIDER..... Regards Jdmave NB Please pass onto your friends / colleagues as wouldnt want anyone else to have to have the same experience

-

Hi, Hope someone can give some advice or ideas on how to proceed. We bought an ex-farm last summer directly from the council. The property was advertised with a covenant on the attached paddock but not on the barns. We got an email to say we could run our business from the barns and didn't question anything else until we signed the contract - which the solicitor didn't give us time to look through and just said it was all boring stuff and no need to read through - end of the day, wants to go home?? Didn't think twice as we thought we had all the info. Fast forward to November and the Land Registry paperwork comes through with details of covenants on all the barns and outbuildings, which we knew nothing about! I know we should have been firmer and looked through the contract but we trusted the solicitor and thought the sales particulars given by the estate agent was complete. We've spoken to neighbours who have had a similar issue and have been told by the council that they want 5k to remove the covenants! Can we argue that we were not made aware that the covenant was still in place at time of signing and our solicitor never made us aware, and that the covenants were never on the sales particulars? The solicitor claims that the email from the council saying we can run the business from the barn is enough, but if we want to convert one of the barns into a holiday home in future, will we be stuffed? Solicitor is shying away from the issue and I could do with some advice on who to approach and how to proceed the get this sorted with as little cost as possible. Thanks.

-

Hi, Last October my 14 yr old son was after a new game for his PS4. He found a website called G4k.me. As he wanted to pay with my Paypal he showed me the game on the site etc (as I always double check with him using my Paypal), Thing was I was on way to work, quick glance website seemed fine and said ok get it ordered. I later asked if he got game and he said yeah they send an PS4 account with the game on and I just login. Fair enough I thought seemed an odd set up but as Im not a PS4 user i thought maybe thats how it works with online purchase and company "seemed" legitimate enough. But I was a little confused he needed a new "account with the game on" The game activated fine and loaded ok etc - my son followed the activation instructions at the website. As I work away and upon my return, some 2 month later my son tells me the account just came up banned / suspended for no reason when he went to login. I kinda know my son well enough to know, he pretty sensible and wouldn't do anything to cause a ban on this extra account. He been on Playstation years with no issues at all. So as I had details of the account, emailed Playstation and queried. They advised contacting G4k.me . So I emailed their support and after many open support tickets (as they never replied) I got a response that they do not deal with banned accounts. Called PlayStation support and they said they can email reason to the account email but cant discuss on phone. But the email attached to this account is locked and cant be accessed, so basically I am stuffed. £25 lost basically. I have raised a Paypal dispute, although at this stage purely with g4k.me - hasn't escalated to Paypal as yet. Although g4k refused refund, so next step is escalating to Paypal. I may also contact my bank, its my debit card which funds Paypal. Since my dealings with this company I have searched the internet and found numerous similar situations, particularly with PS4 games. The company Facebook page is full of complaints with the exact same issue I have, as well as review websites. Its seems so many people with exact same issue to be more than just coincidence to me From what I have learned this company opens a PS4 account, buys game and then sells on, however they then charge-back the payment (which takes about two weeks so I hear to take effect) and as a result your purchased game & account are banned. A very clever money making racket from what I have read...Mind you I don't know exactly how they but these games and sell on so cheap or if a "middleman" is involved. Obviously, In hindsight, I wish i checked them out properly before my son bought it, but hey hoo.. was in rush etc.. At the end of the day its £25 - not end of world, lesson learned.... but just how many people have lost money with this company?? Just a warning to others, my advice stay well away from this company..

-

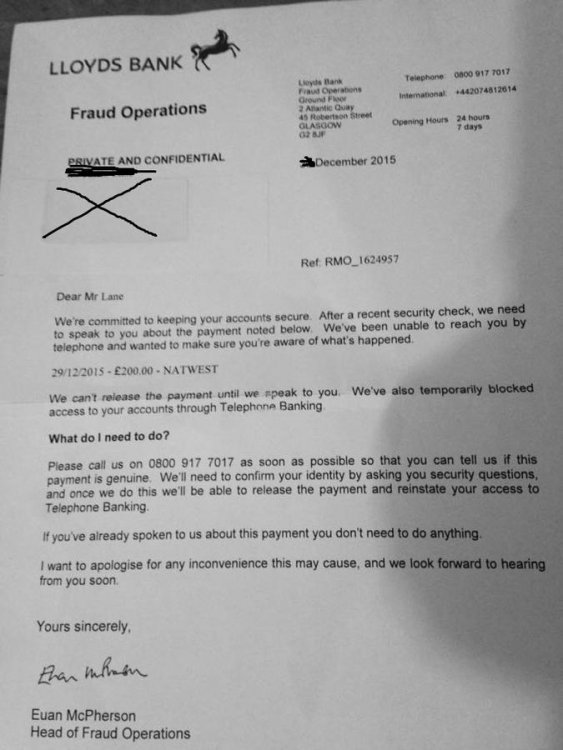

Just to let you know that there is a con going around at the moment. People receive the letter attached below. The free phone numbers in the letter don't belong to Lloyds. If you call them they will try to con you. Ignore or report if you receive one of these CON letters. Not sure if similar letters have been sent 'on behalf' of other banks.

-

I have been doing genealogy and a great and enjoyable experience it has been as well. Amongst the few genealogy sites I use, Find my Past have been advertising 1939 records and claim; In this, the richest record set ever released by Findmypast, you will find: "Interactive maps showing how your neighbourhood has changed over the past 130 years Photographs documenting life in 1930s and 1940s England and Wales, all of which have never before been available online Handwritten Register - View the original register document and see who lived in the surrounding houses in 1939" So I paid £17 and what did I get, my mum and dads name and birthday, a bit of a blurry OS map and a picture of 1942 nothing. Was I disappointed. I emailed them and they said 'Thank you for the feedback" What a bloody waste of £6, I already knew my parents birthdays and what use is a 1942 picture, it doesn't even refer to the year in question. So be cautious that you might not find what is claimed and what you were hoping for.

-

Good Afternoon All and thanks for your help in advance. This is my first post, so apologies if I haven't followed the correct format etc. On 30th April 2015, I came home to find a Claim form from the CCBC Nothampton dated 28/04/2015 regarding a debt to the Cooperative bank for £858.63 which has been assigned to Lowell and for which I am being taken to court by Bryan Carter Solicitors. On 2nd May 2015, I received a letter from Bryan Carter Solicitors dated 29/04/2015 stating that as I have failed to repay the debt, they have now issued litigation proceedings. The problem: I have never banked with the cooperative bank!. I have viewed my CRA file and can see that this account appears as a default and dates back to 02/03/2010. I have lived in a number of shared occupancy accommodations in the past and mail is often intercepted and personal belongings stolen. My suspicion is that this account may have been opened fraudulently. From the 16 digit reference number on the claim form, it looks like a credit card and again, I have never applied for one through The Cooperative. What I have done so far: After doing battle with the MCOL website for 2 days, I finally filled in the acknowledgement form and returned to the court by 2st class signed for post (No defence included) As soon as I received the claim form, I dispatched a prove it letter to Lowells and a CPR 31.14 Request to Bryan Carter Solicitors. These went out by 1st class signed for post on Friday 01/05/2015. What next: I have acknowledged the courts claim form, but I don't know what my defence is? Do I wait 7 days for Lowell / Carter to provide the required paperwork before composing my defence? As it is bank related, I would assume the bank hold ID documents for KYC reasons. Can I contact Cooperative and ask for these? ****I don't know how long this post allows, so I will include the CPR 31.14 Request and Prove it wording which I sent. Again, your help is greatly appreciated.

-

Hello, I privately rent my house thought a letting agent and told them on their last inspection last month that the lock on our garage was broken and the goods in side were not secure, the garage is not attached to the house but about 30mts from the house. we moved everything we possible could from out there to the house but could not fit in all my sons expensive fishing gear as the rods were too long and a moped (for obvious reasons although it had a lock on ) About 5 month ago we had stuff stolen from our garden, about £1500 worth of profession fishing gear that was soaking wet and had been propped up against our patio doors to dry out, they were there for all of half an hour before being stolen , we have a 6 foot fence and also a gate that locks. so this was why I was anxious the landlord fixed the garage asap. As to if the letting agent passed this on to our landlord I do not know. Am I wrong in thinking that the landlord has a responsibility to repair and make secure the garage ??? I feel he should compensate for our loss from the garage this time......we claimed on insurance for the theft last time as I guess we were responsible for leaving out even though the garden was secure. Any advice is appreciated. I am thinking they will keep coming back so am in the process of looking for another house and I can't sleep well because of the worry and anxiety.

-

Hi guys, I recently went to open a business account to start a new busines . I was rejected so joined experian and found out I had a ccj dated back to 2013. Couple of things. I wasn't aware of this ccj which is registered to my old address (which my ex wife lives at). I didn't get my post for the first year or so due to bad relations with her (2009-2010) but since 2010 I've been getting all my post and have no recollection of this. Should they send the ccj paperwork recorded delivery? I contacted Northampton county court and got the details. Then called the solicitors. They gave me some details saying it's for a credit card and the amounts etc. I said I don't think this is mine can you get me a copy of the credit agreement. Roughly 8 weeks after my request and many many phone calls I got a copy of statements (just plain and no details or specific marking of original creditors) but no agreement. I spoke to them again and they said they have requested agreement and are still waiting a response. I also received a letter from a dca saying they have put it on hold due to my request and won't chase till I have received relevant paperwork. I know in hindsight I should have really done all this via letters but was panicking and trying to sort quickly. If they can't find the agreement do I have a chance if setting this aside? Should I send a letter stating about the phone calls and again requesting the agreement, giving them a time limit? How can I prove I haven't received any paperwork? What are my options? Sorry for being long winded and hope someone can help. many thanks.

-

I was reading scoop today and saw this story that could affect many pensioners that can draw their pensions aged 52/55 or older with large debts, has anyone else seen this? look here http://debtcamel.co.uk/pension-reform-bankruptcy/ Sorry if in the wrong forums as I was going to post in the debt forum as well so please move if needed

-

I was reading scoop today and saw this story that could affect many pensioners that can draw their pensions aged 52/55 or older with large debts, has anyone else seen this? look here http://debtcamel.co.uk/pension-reform-bankruptcy/ Sorry if in the wrong forums as I was going to post in the debt forum as well so please move if needed

-

I own a Vauxhall corsa vxr nurburgring edition. Vauxhalls flagship. the car is 2 years old on a 62reg the mileage is 4000 car cost is £18k I started to notice a clunk from the gearbox I went to my local Vauxhall dealership in July .Penfolds Lewisham South East. and Left My Car In Penfolds Repair Garage to be Diagnosed. I got a call the same day from Chris the service desk at penfolds and he told mey car has low compression cylinder 4 and a Vauxhall engineer has to be send out to inspect my car. and penfolds was sure is was due to engine remapping - decided to Void my warranty on my Standard Car. I decided to call Vauxhall customer care department/ Vauxhalls head office in Luton and spoke to a representative I Explained the problem my car has and the dealership voiding the warranty and they could not help me and stop the dealership from voiding my warranty I decided to call them again the following day and I managed to speak with the regional manager Vauxhall Luton. he told me my car's warranty should not be voided on a car with such low millage and with no signs of modifications he assigned a engineer to inspect my car and told penfolds to continue diagnosing the problem. 3 weeks later no engineer showed up and Vauxhall customer care representative called me and said iv got to sign a disclaimer for Vauxhall to send off my ECU Unit To Germany to Be Inspected and can take 2 weeks to come back with results to see if the ECU is standard and not remapped. this is outrageous because all Vauxhall wanted to do is find excuses not to fix my car because im a young lad with a vxr and the dealership automatically say the problem is due to the way I drive or that I have remapped my engine. it is terrible the way Vauxhall have dealt with me and the time It has taken to get things moving is just not good enough. 5 weeks later my Ecu Arrived at the dealership from Germany when it should of only been 2 weeks and the test results was CLEAR ECU STANDERD Vauxhall was very embarrassed and assured me my car will be fixed but they have still not accepted the warranty claim and fix my car and they have to send a engineer out to inspect my car what I would say they mean find more excuses to not fix my car. now after 7 weeks my car being in Vauxhalls dealership I had a phone call from Vauxhalls customer care and she said I have to sign another disclaimer for the dealership to strip my engine and they will send a engineer to inspect my car. now its the end of September my cars been in the dealership near enough 3 months and Vauxhall do not have a clue what is wrong with my car and they have rejected my warranty claim to fix my car. and have put me aside now because of all the steering reclaims Vauxhall. are to busy to talk to me let alone fix my car. after 11weeks I have had nothing but Vauxhall to tell me false lies and excuses to get out of paying to rectify the problems and fix my car avoid this company with all means my car is 100% standard with 4000 genuine miles and still in manufactures warranty and still Vauxhall will not fix a common problem of cylinder 4 low compression/misfire also engine oil is leaking from engine head and Vauxhall do not have no clue what is wrong with my car and refuse to honour my warranty please email me for any questions on this and I will be happy to help [removed]

-

Hi do not buy AA repair and cover warranty its a big [problem] the insurer is brc please be aware my car a 2005 Peugeot 407 broke down last Friday car was vibrating really bad as man came and said it was flywheel he towed me to local garage where they stripped gearbox they found that the flywheel dual mass had broken and seized so wasn't moving and not doing its job brc phoned and said it was not covered as its wear and tear now how can be that if its broken the flywheel has no wear on it they then stated that the clutch plate was worn down to rivets this is not the case there is thousands of miles left on all parts and if flywheel had not broken it would be still going car was not slipping at all just really bad vibration they say in there terms it is not covered for wear and tear but it doesn't say we do not cover cars over a certain age it is a big rip of so any part that fails they can say its down to wear they refuse to pay car is below average milage and fully serviced please helpa

-

Just a story concerning my partner and her experience with these people. 6 years ago due to ill health she had to give up work. She couldn't meet mortgage payments and sold the house and rented it back through the private landlord. All was fine until a year ago when the landlord went bankrupt and mortgage express appointed w/singleton as receivers .Early April she received a phone call from them wanting a copy of the tenancy agreement. Alarm bells started ringing with me as I have read the stories on this forum about this company. Sure enough, two weeks later a letter arrived giving notice of termination of agreement and she was given 2 month to vacate. After much stress she found a place with a housing group but on the day of the move a guy came to change the locks at 9.30. Luckily I was there and told him that he would have to come back late afternoon which he was ok with. Half an hour later a guy from w/s called her shouting and making threats that they were going to charge her £75 for not getting out!!. Not being intimidated she told the guy where to go and by all means send the bill- the guy hung up. I just wanted to tell this condensed story and that any one dealing with these muppets should be very aware, all they want is to make a swift buck and have no morals when messing with peoples lives.

-

I have recieved an account balance today that has been sent to my old address where I have not lived for 4 years, for an amount of £141.50. I do not know who this is for as there is no reference. I do not wish to contact them by phone, but would like to know what this is that I am supposed to owe. I regularly check my experia report and do not see any late payments or defaults on my account. What would be the best way to deal with this? Thanks in advance.

-

My account with Virgin (MBNA) has always had payments paid on time. I cleared the account of all debt in full during September 2010. This was in preparation of moving home and starting a new life. Shortly after clearing the debt from my account, I moved home. It was not until March of this year 2012, after completing an Equifax credit report that I even knew this default was on my account. It seems that an interest had been applied onto my account ‘after’ I had cleared the account of all debt. This interest was for as little as £25. I had no reason to ever check that account once I had paid off all of the debt. I had no reason to use the card and never used it again. My account was originally set to ‘paperless’ so I never received post for any statements even from the beginning of my account with the card. I moved home approximately a week after the debt was paid and was not expecting any post. I received no post at my new address. I did not receive ANY emails from MBNA alerting me of any charges to my account. I did not receive ANY phone calls alerting me of charges to my account. I did not receive ANY post or mail alerting me of any charge to my account. The only emails MBNA had ever sent me during my entire term with them were the regular “Your bill is ready to view online” emails. I would have no reason to believe any problems were on my account or charges were due. I attempted to access the account in March 2012 when I discovered the default and my details no longer allowed me access to the site. I cannot believe that I was not telephoned. When telephoning MBNA the number that was stored for me was completely incorrect yet the mobile number they had for me was correct. I received no calls or attempts to correct the situation. The debt was so low at first, of course I would have paid it. I had just paid off £2000 in full, why would I avoid a tiny debt of £25. After talking to MBNA I discovered that the debt increased to £145 before the default occured. The second I discovered the default and contacted MBNA I paid the debt in full instantly. Money here was not the issue. If I had known there was a debt on my account I would have paid it immediately. I'm totally stuck, I've sent this through to the FO and they have contacted me to let me know they will be looking at it but they don't really feel there is much of a case. They said unless there is something concrete they can use to remove the default they wont. Anyone had a similiar problem? I'm so stuck, my score is terrible and it's messed up buying a house!

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.