Showing results for tags 'arrow'.

-

Hi I'm new to this forum and was referred here by another member. I really need some help with a court claim I received through Northampton Court. After speaking to Northampton Court who advised me to make the Acknowledgment of Service and whether to defend or not. I made the Acknowledgment of Service on 19th April. The claim was issued on 10th April and I think I have until this Friday to respond. This is for a credit card debt that I have not used for over 7 years. Many thanks in advance.

-

Dear all, I am new to the forum and in a bit of a panic. I just don't know what to do. We have been in a debt management plan since 2008 and so since then I of course have not had any credit. I've had a letter from Shoosmiths and now a Court Claim via Northampton County Court Business Centre about an Overdraft I supposedly had with M&S. I thought this strange as I have never had a bank account with M&S. The Particulars of the Claim actually state: The claimant claim is for the sum of £4219.76 being monies due from the defendant to the claimant as a consequence of the defendant incurring an overdraft whilst operating a bank account. It says the debt was assigned to them on 30/1/13 and it says they notified me of that but i have no record of that. I pay another debt to Arrow Global though so I may have received something and assumed it to be part of that. I just don't know. I did have a Personal Reserve with M&S but this was operated like a loan. There was not a bank account. The sum of the Personal Reserve was approximately £3000 but this has been part of the Debt Management Plan so I have no idea what this refers to. I sent a letter to Shoosmiths stating I din't know what they were referring to and that if it is true it is a very old debt so queried their legality in asking for it. I think we crossed post with this court summons though. I've said to the court I will defend all of it but I have to write a defence and I don't know how to do that. Can my defence be that I have no knowledge of that account and have asked for them to prove it is genuine? Losing sleep over this and have that awful sick feeling in my tummy. I don't shy away from my responsibilities and have paid back over £20,000 in debts. I would really appreciate any advice you could give me.

-

Can anyone please advise on what I can do about a HSBC overdraft. I have recently lost my job and currently unemployed.A few bills, mortgage, credit card and a car loan will very quickly eat up what little savings I have. I have sent a template letter to the loan and credit card asking for 6 months interest free grace and I am hoping that they will agree. My HSBC overdraft is currently at circa £2,200 - the limit agreed is £2,000. I have £1,000 in a savings account. Should I write to HSBC and explain the situation and then use the savings for this months mortgage and food. Or should i stay within my overdraft first and foremost? I know that no one will be happy but there is little else that I can do other than being honest and try to get a job. Any advice gratefully recieved.

-

Dear all, I have found these forums an excellent resource and would like to thank all the contributors! I hope I am posting in the right subsection of the forum. I have posted back in Feb 2012 when Halifax registered defaults. I complained to the FOS. The outcome was an apology, £500 in compensation, about £250 in costs and about £2000 to accout for the additional cost a higher mortgage rate over 2 years. I as satisfied with this and moved on. However problems have continued but with other companies piggybacking on the link Halifax/NatWest created. Most I have dealt by writing strongly worded letters and forwarding previous correspondence/experience with the banks. However CapQuest and Arrow Global have been stubborn and I still have two defaults from CapQuest which do not belong to me. They have conceded that a mistake has been made but have failed to amend the records on one CRA. I again sought review from the FOS who advised them to amend the data and offer me £200 in compensation. They have still not amended the data. I spoke to a Solicitor who quoted £2500 just to start looking at the case and issuing the initial letters to the companies involved! I have now gone on to issue a Claim via MCOL. Please see attached document. I now feel I should have sought some help here before pressing the button and going ahead with this as I have just pain £980 in court fees, having no legal background. I think this was more out of frustration. I will try and update this as I go along. Thanks for all your help CapQuest for CAG.pdf

-

Hi All, It's been a long time since i've posted here, as I've heard very little from various DCAs after they failed to produce CCAs for various accounts. In May, i'm looking forward to defaults getting removed from my credit report and finally starting with a clean slate... or so I thought. At the end of last week I received a letter from Blake Lapthorn Solicitors, on behalf of Arrow Global Guernsey (so they use foul tactics to squeeze money from cheaply-purchased debts... then store the cash off shore? Classy). They claim I owe over £4k. Before this letter arrived, I had never heard of Arrow Global. The letter gives me seven days to stick over £4k in the post or they'll issue court proceedings. After receiving the letter, I set up an Equifax report, to find that Arrow Global entered a default for this account at an old address in 2008. As far as I can tell, it's an old Mint credit card that has been in dispute since 2008 (dodgy cca and non-response to full sar, the ICO and FOS were involved). However, this account defaulted back in 2006, meaning Arrow Global have incorrectly added the default (and effectively given me 8 years worth of default in the process). I'm usually pretty good at seeing DCAs and their Solicitors off, however I can't find anything in CAG re: Blake Lapthorn. I have read a few threads that show Arrow sneaking CCJs through with help from Bryan Carter, so I'm trying to establish if I should write a prove it letter to them (ready to go but not posted just yet), or to file under 'ignore' like so many of these letters before. The manipulation of my credit report has realy got my back up, mind. I don't have a copy of the original default (there might be one in the garage if I search extensively), however the default was definitely May 2006 as I went into a DMP at that time. The only creditor that dragged out the default was MBNA. So, CAG, what should I do next? Thanks in advance for your help...

-

Hi, Be really really grateful for any guidance. Some years ago , -2007/8/9 we got into big debt trouble, lost our business and the only thing we were able to keep, amazingly, was a 1 bed flat in my wife's name which at the time didn't really have any equity in it so wasn't much point in selling. CAG helped enormously, RMA from Amex dropped amongst other things and over time most have stopped pursuing us. However while I know there are sadder stories out there than ours the stress added up and we also split up with my wife keeping and living in the 1 bed flat. In 2014 MBNA produced a CCJ against my wife for €14000 on a credit card she had back in 2002. She made an arrangement to pay £100+ per month and understood it was interest free etc, doesn't seem to have had paperwork on it. She has never missed a payment and the balance is now £11,000 odd. They only assets she has in the world is the flat (interest only mortgage but a low interest rate) - about £40k equity and next year at 65 she must retire from the NHS (4 years service won't amount to much). So, having got through everything she is in pieces having received a letter from the Land registry saying that they have placed an interim charging order on the flat in favour of Arrow for the £11,000 balance. The letter seems to read that they automatically place the charging order if anyone asks for one and it is up to the owner to challenge in the courts to get it removed - Fait accompli! Or is it? Please can anyone help with advice because looking for information on the forum and elsewhere it seems the way the Land Registry is presenting the information is along the lines of - Its already done and dusted and no chance mate in getting it removed if you have a CCJ, where I am reading that the is a timescale where you can challenge the interim order and there are grounds for a challenge such as there being other creditors whose claims would be unfairly denied (not sure that is necessarily a good way forward) and another one which is that we are in the process of getting divorced, with solicitors instructed, having lived apart for more than 4 years (I am not claiming anything but nevertheless it might be grounds to put a spanner in the works). Finally, are we worrying too much about it? I don't at all like the idea of them making unsecured into secured but as long as they don't move to repossess and the £100 a month agreement stays in force interest free should we twitch too much? Is that naïve? By the way if anyone is wondering why I am writing on behalf of my wife when we are getting divorced we are still friends/care/and although the debt is in her name it came about when we were together so is joint really anyway. Thanks in advance and time for your replies.

-

Hi all, I CCA'd an old EGG loan that had ended up with Arrow/NCOEurope last July and had a "we're looking for your agreement, please keep paying" letter in October, although they did say they didn't accept the were the creditor and returned my postal order. I had been paying them on a payplan agreement from August 2004 to August 2016, stopping after sending the CCA request. Today, they've finally provided something and it looks pretty genuine to me, although it's prefaced by an "OFT deems reconstituted agreements acceptable" cover letter. Two yearly statements are also attached covering 2008-2010. The loan was for £6000 and taken out in April 2004. I defaulted in August 2004, and the amount left is £2753.25. They now want me to provide a proposal for repayment. do I try calling them on the agreement? It's got my signature on it, but doesn't include the full terms and conditions. Or do I bite the bullet and offer them a full and final? I've no wish to be drip feeding them money for the next few years... Thanks in advance for any advice.

-

I won't go into details, but 10 years ago i was in financial straits and ended up with a ccj for a personal loan. i offered, and the court accepted a payment of £10.00 per month. as i began to get straight i voluntarily increased this to £20.00. hoping to clear it quicker. the loan company( universal credit) was then taken over by paragon finance who continued to accept the £20.00. I have received a letter from them saying it had been passed on to another company. the letter they sent me showed a balance owing of nearly £6,000. as the original ccj was for only £3,000 and i have always paid every month, i can only assume they have been charging me interest, without informing me. Are they within their rights to do this? is there anything i can do about it? by the way, the new company want me to take out a secured loan to pay them off.

-

Hi everyone at CAG I received a claim form from Dryden’s Fairfax solicitors acting for a collection agency called arrow ltd the letter dated 10th October about a credit card I had with Sainsbury’s bank I took out in 1998, I took the claim form to the CAB on 4th November to help me, the CAB contacted the court and was told no judgement had been made yet by Dryden’s, CAB rang Dryden’s and spoke to them and told them I wanted to send the admission form and set up a monthly payment, but I said all correspondence must be done only by letter, the person who was speaking to CAB on the phone asked us to wait and she will speak to her supervisor, she came back on the phone and said they were pushing the CCJ through to which CAB was surprised, I received a CCJ a week later. I had been keeping up my payments with Sainsbury’s until I got into difficulties in 2008 and asked to pay less and agreed a plan with them, I fell into more difficulties and asked to make a lower payment I was told by Sainsbury’s my debt was being passed to a debt collection service, I protested at this because I said the debt was between me and Sainsbury’s to which I was told the interest would be frozen by using a debt agency. I cannot remember receiving a default letter at all, but I was moving around a lot, I set up payment plans with debt collection agencies when they had contacted me. I found out my debt had been sold on a couple of times, I made most of my payments by debit card, some payments were made at banks across the counter, two payments were missing on the statement I saw (because yet again my debt had been sold to another agency) I have one receipt I found. I stopped paying because I fell ill and was trying to claim benefits and the lovely pips (which I got a year later), I do think I paid ppi in the early part off having a credit card with Sainsbury’s. Any advice would be much welcomed please.

-

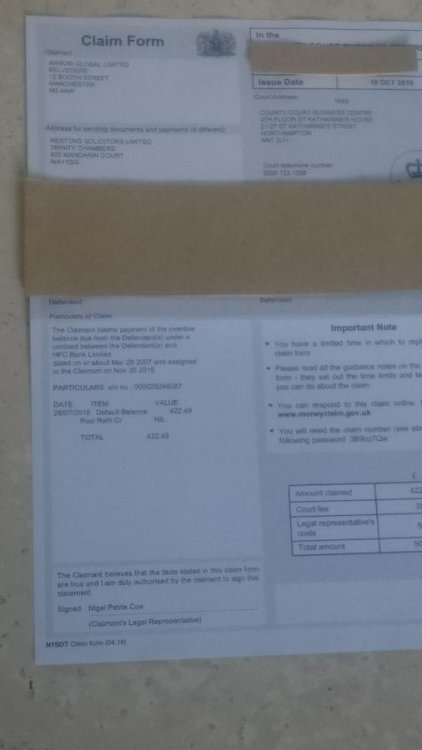

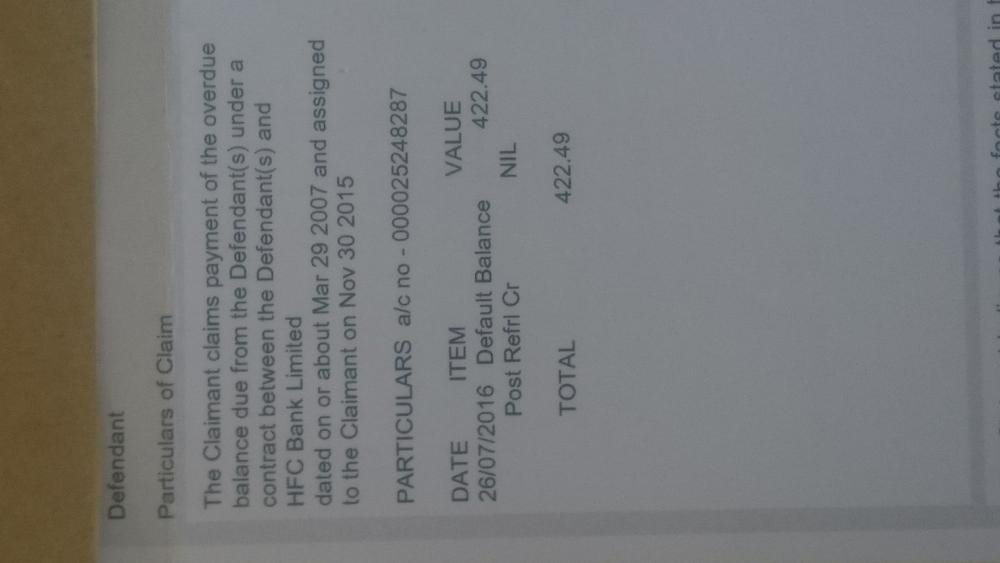

Afternoon Folks, My wife in the post this afternoon has received a County Court Claim Form from Arrow Global/Restons Solicitors and despite reading the forums, I'm a bit stumped on how to proceed. I've attached images of the whole claim form(minus personal information) and also an image of the particulars of claim(which I think is statute barred). My wife has never heard from them until recently and has never responded to them, the Claim form is addressed in her maiden name despite us being married 4 years. Could I have some help on this if possible please. &

-

Hi, I wonder if anyone has had any dealings with Viking collection services working on behalf of Santander? I am currently sorting out DMP's with all my creditors as a result of a drop in income. Most have accepted it, one has just ignored it, one just keeps sending duplicate letters every so often, bmy Asda card that is owned by santander have now passed it on to vikings who are demanding full payment of the outstanding balance. I wrote to santander a few times telling them my situation and what i could afford and i have been paying that. I have now sent another letter explaining this to Viking. My experience is telling me that Viking is in fact just another part of Santander. Am i right in thinking this and does anyone know what they are like to deal with, will they take me to court sooner rather than later? Is this just a scare mongering letter to make me pay up? Any advice on how to deal with this company would be much appreciated. Many Thanks Gem77

-

Name of the Claimant ? Arrow global Guernsey Ltd Date of issue – 24/10/16 Date to submit defence = 4pm 25/11/16 What is the claim for – 1.The claimant claims the payment of the overdue balance due from the defendant under a contract between the defendents and hbos dated on or around Jan 17 2002 and assigned to the claimant on Oct 11 2006 Particulars a/c no - XXXX Date Item Value 11/12/2015 default balance 2000 Post Refri Cr NIL TOTAL 2000 What is the value of the claim?2000 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account?credit card I think When did you enter into the original agreement before or after 2007? before Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. debt purchaser Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? don't know Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? no Why did you cease payments? on debt management plan but stopped payments because most of the debts had been sold on and the dcas had not responded to my cca requests What was the date of your last payment? Oct 2013 Was there a dispute with the original creditor that remains unresolved? no Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt management plan? yes What you need to do now. Answer the questions above If you have not already done so – send a CCA Requesticon to the claimant for a copy of your agreement - done (except for Overdraft/ Mobile/Telephone accounts) Send a CPR31.14 request to the solicitor named on the claim formicon for copies of documents mentioned/implied within the claim form. There are two different versions - one for Loans/Credit cards the other for Current accounts Request 1 - Loans/Credit Cards - done I have acknowledged and said I intend to defend all the claim.

-

Hi First post here. I have an old debt with Egg from around 2000 for roughly £2900. I was on a CAB plan paying £1 token payment for a while at the time but stopped paying , I never heard anything for years and now Capquest own the debt . I think I might remember paying them £10 a month 3-4 years ago for a while but due to financial hardship stopped paying. Though I cant be certain on this as I cant seem to find any details at the moment. They have recently sent me letters again and have refered it to Drydens Fairfax who have given me to the 30th Nov to offer a payment proposal otherwise court action. Which means I`ll have to send them a ltter either today or tomorrow .What should I do , offer £5 a month or something or play hardball. I don't really want a CCJ as I already have one from Drydens at £10 a month for another card debt. I wish I had know of the Statute Barred act before I may(possibly) have paid Capquest 3-4 years ago as it was probably unenforceable back then. thanks Tired and Weary

-

Hello all. I have debts that are approaching 6 years old (next March - 2016), from credit cards. I defaulted during the crash as I was made redundant and career effectively ended. I went into default immediately after a period of hassling from creditors I moved house a couple of times (to chase work) and the hassling died down to a trickle. Now suddenly I have a letter threatening CCJ if I don't pay the full amount (near 10k) in two weeks. It looks serious to me too; I've not had a letter like this before. What can I do? I've put a little money aside (around £3k) which I could try to use to keep them off my back, but that would then acknowledge the debt and I'm so close to the 6 year statute bar. And would this satisfy them or just give them the taste of blood? If I send a CCA letter will this put the CCJ action on hold? Any help gratefully accepted. chris

- 49 replies

-

HSBC credit card. Opened 22/10/2012. Defaulted 14/04/2015. Sold to Westcott then to Arrow then to Moorcroft then finally to Capquest!! CCA request sent 28 October with no reply yet. Yes, my partner is in a bit of a pickle with his finances!!

-

Good morning all, I have a question, I have been utilising the information on this group, to try and fight Restons, to no avail. They were awarded judgement by default, due to my stupidity, I asked them to prove I owe them the money, they never replied, and then the date to submit a defence passed. I then asked for it to be put aside and used a defence, stating that they have failed to provide me information to defend against. Today I had a letter saying my application to put aside has been dismissed. What do I do now? Thanks for any help. Andy

-

Hi guys, It's been a while but things are starting to affect my day to day living once again... Here is the background. October 2007 I purchased a laptop from PC World under HFC agreement. July 2013 HFC transferred an account to HSBC Bank plc. In October 2013 this account then got sold to IDEM Servicing. During this time I was in a fee charging DMP paying various debts off, but I killed them off to attempt my own free repayment arrangement, but due to various reasons, I struggled and put it to one side. On 6th January 2014 IDEM served me with a default notice, with a written intention to terminate my loan agreement. I sent a CCA request on the 10th January enclosing £1 and included the revoke access for sending someone to my home address etc. With no response... Sure enough on the 22nd Jan, a "Notice to Terminate" letter came through demanding full payment of balance. I should have kept chasing for CCA but certain issues at home meant it took a back step and i got distracted. .. unusually hearing nothing from IDEM, until just recently. 1st October 2014, a letter comes through the door from "resolvecall" referencing the Idem account with me. But claiming they were contacted by "Arden credit management" to make contact with me to arrange contact with them (Arden.) I have never had any correspondence from Arden Credit Management. This is an Idem account. the letter from resolvecall stated if i did not contact Arden, one of their reps would make a personal visit within 28 days from the date of the letter (1st Oct). Today is the 8th of October and this evening at roughly 5:30pm, a rep arrived at my door... my Dad answered, the guy asked for me, my Dad advised I was unavailable. (I was upstairs in the bathroom at the time but I could hear him talking.) -- this is where I need your help too guys -- I heard the guy, after being told i was unavailable at the time, tell my Dad that he has been instructed by HSBC to make contact with ME so he could then put me in touch with someone over the phone that he held in his hand, to discuss an account I hold with them. Before I could get downstairs, the guy then started to ask if I held any debts at all.. . my dad at this point simply shrug his shoulders, I went downstairs and kindly asked him to leave the property. His response "Do you not want me to put you in touch with anyone then?" I repeated myself. He then said "ok" and closed his ring binder and left. I got his name.. but I have to admit , I am a little shaken up, my heart was doing that fight or flight pounding in my chest. Where do I go from here guys?? Who the hell do I send letters to now? I am still only in a position to offer £1 for any debt that I owe, there is no special treatment here. But did the doorstep guy from Resolve call breach any rules by talking to my dad and asking him questions? I really hope, after all that typing, you find time to offer your advise... Regards David

- 29 replies

-

On 29 September 2015 I received a Civil Bill for £17,091.52. this was for an outstanding amount on an MBNA Credit Card which i am unable to pay The Credit Card agreement apparently commenced on 20/09/2008 and defaulted on 01/11/2011 at this time the balance was£19,705 In January 2010 i sought advice from Citizens Advice and came to an arrangement with MBNA to pay £187 per month and had the interest and charges froxen MBNA wrote to me on 22/11/2011 and advised that my credit agreement had been terminated. Received phone calls from Arden Credit Management demanding that i pay the full balance or increase my monthly repayment substantially, the Account Balance at this time had reduced to £16,906 Correspondence started to be received from Arden Credit Management, followed by numerous phone calls which i blocked. I did not reply to any letters and refused to accept any calls. Arden were apparently instructed by Moorgate to recover this. Next harassment by phone and mail was from Wescot Nelson Guest and Partners Solicitors now make an off the pay £12,679 to settle the matter Hundreds of call follow fro Moorgate and Wescot along with regular letters. 25/01/2012 Moorgate advise that my account is now owned by Britannica Re Recoveries S.a.r.l , 12/11/2012 Moorgate advise me that my account has been purchased by Arrow Global Guernsey the next paragraph is important for later "The transfer assigns all of Moorgate Loan Servicing's rights as owner to Arrow Global, which has agreed to perform all the obligations of Moorgate Loan servicing under the terms and conditions of your MBNA credit card agreement. The terms and conditions of your credit card agreement will therefore not be affected by this transfer" Correspondence and call continue fro Arden and Resolvecall Arrow Global advise the Shoesmiths will manage my account Continuous letters from them asking for repayment and personal financia details, none replied to Remember the important paragraph earlier!!!!! on the Civil Bill it adds on top of the amount owed "The Plaintiff further claims interest at the rate of 8% per annum in accordance with Article 45A of the County Courts (northern Ireland) Order 1980 on the amount of £16908 from the date of assignment of the debt to the Plaintiff being 31/10/2012 to 25/09/2015 in the sum of £3,918, being 1059 days at a daily rate of £3.70 and continuing at said rate to the date of Judgement or earlier repayment"l The terms and conditions of my cred agreement were to be altered, so how can they claim interest as well. I had never been notified that interest was being added. I have 21 days to defend these proceedings I hope i have given full details So what do i do next, help will be greatly appreciated

-

Hello, I received letter from Arrow global debt, I was shocked to see that it was a refund letter. I thought it was a debt letter, when I phoned, I found out that I had over paid a debt, in 2014 to west scot, the amount to be refunded £325.72 and additional good will interest of £15.74 = £341.46. I received this letter on 15th August 2016, first I checked it out Arrow global, because I never heard of them before. I phoned, I was asked did I want the money put into my account or send by cheque,. I requested a cheque. then I was told there was a backlog to receive this cheque. I have waited 11 weeks, I phoned again, then got told there was no back log. I emailed them on the 29th October asking if this can be resolved. I asked how many more months do I have to wait before the cheque is sent out. I got no answer, I phoned, I was told they sent out a letter on 31st October, that I should have received it. I asked what the letter says, they told me that it can take up to 4 to 6 weeks to get the cheque. this will take up to 12 of December. I now beginning to not believe them, I think, they are no going to send out any cheque. is there away I can get round this?

-

Hello, Can anyone help answer a few questions I have regarding a court claim? Name of the Claimant ? Arrow Global / Restons Date of issue 08th September 2016 Particulars of Claim: 1.The Claimant claims payment of the overdue balance due from the Defendant(s) under a contract between the Defendant (s) and Marks and Spencer Financial Services PLC dated on or about Oct 05 2004 and assigned to the Claimant on Dec 19 2013. 2.PARTICULARS a/c xxxxxxxxxxxxxx DATE ITEM VALUE 07/06/2016 DEFAULT BALANCE 564 Post Refin Cr NIL TOTAL 564 I acknowledged the claim on MCOL 14th September with the intention to defend in full as I believe the debt is statute barred. I have not submitted my defence yet. Actions so far Court claim dated 08th Sept (recieved 12th Sept) Acknowleged claim 14th Sept CPR.31.14 to Restons on 15th Sept CCA to Arrow 16th Sept I believe the debt is statute barred ( last payment/contact over 10 years ago) so should I go ahead and submit my defence now on the grounds the debt is statute barred, or should I wait for paperwork re the CCA and CPR requests? Thank you for any help!

-

I had an aqua credit card, which I did stop paying last year. Before I was able to come to an agreement, they sold the debt. I have sort of ignored them, but I did speak to them on the phone several weeks ago, well Restons their solicitors, and I did say I wasn't prepared to discuss anything over the phone at that time, but they did agree to send me a letter with a repayment proposal/my expenses. This did not happen. I have been looking after my sister who recently had an op and came home to a letter from The letter from Northampton Courts, which I opened today. I have until tomorrow to respond. states that the claimant(Arrow Global) claims payment of the overdue balance due from the defendant under a contract between the defendant and New Day Ltd dated on or about Jul 17 2013 and assigned to the claimant on Feb 22 2016. Do I admit to the debt or fight it. Thanks in advance

-

Filed a claim against me last year for an old MBNA credit card debt. I went down the route of filing a defence and requesting all of the documention, which they eventually managed to produce but not before the claim was stayed. In light of this I wrote offering a token £1 per month payment to hopefully avoid them proceeding further with the claim (I'm currently being supported by my partner and have no official income). They have responded to this by sending out a four page financial questionnaire including a payment offer sheet. I'm wondering how to respond to this. Not happy about giving them the level of information they are asking for, nor my partner's employment details. However my main priority is to avoid further court action. Any ideas/advice on how best to handle this would be most welcome.

-

To cut a very long story short, my husband and I have clawed our way out of debt over the years and now I at least have a decent credit rating again. However, there's one glitch on the horizon. We keep receiving letters from Moorcroft about an alleged debt belonging to their clients, Arrow Global. We CCA'd Moorcroft with the usual Postal Order. They sent this back, despite having filled it in so we can't cash it, stating that they have returned the debt back to Arrow Global. A few days later we received a letter from some solicitor acting on behalf of Arrow Global stating that our CCA request wasn't legal as my husband hadn't signed it. We are very reluctant to sign anything, so can we request the information over the phone? We have received several of these letters and have now received a notification that they are taking us to court. What can we do?

-

Hi Everyone I received a County court claim from restons solicitors on behalf of Arrow global for an old egg loan. I sent a CPR 31.14 request to restons and a CCA request to Arrow global. I haven't heard from Arrow global yet however Restons solictors have sent a reply refusing to comply with the CPR 31.14 request stating that i would have been provided with a copy of the contractual terms and conditions at the time the account was opened hence they see no reason why i would now require an additional copy and also the other documents i have requested are not mentioned in the particulars of claim and therefore CPR 31.14 (1) does not apply. Should I wait until I hear again from them or should I send another response to them. Many thanks for all your help and advice.

-

In order for us to help you we require the following information:- Claimant: Arrow Global Limited Issue date 9 / 8/ 2016 What is the claim for – 1.The claimants claim is for the sum off £9500 being monies due under a regulated agreement between the defendant and MBNA europe and assigned to the claimant on **/11/2015 notice of which has been provided to the defendant . 2. The defendant has failed to make a payment in accordance with the terms of the agreement and a default notice has been served pursuant to the consumer credit act 1974. 3.The complainant claims the sum of £9500 4. C has complied as fas as is necessary with the pre action conduct practice direction . What is the value of the claim? £9500 Is the claim for a current account (Overdraft) or credit/loan account or mobile phone account? Credit Card When did you enter into the original agreement before or after 2007? in 2003 Has the claim been issued by the original creditor or was the account assigned and it is the Debt purchaser who has issued the claim. - Arrow Were you aware the account had been assigned – did you receive a Notice of Assignment? No Did you receive a Default Notice from the original creditor? Not aware of this Have you been receiving statutory notices headed “Notice of Default sums” – at least once a year ? No Why did you cease payments? Not sure What was the date of your last payment? Dec 2012 Was there a dispute with the original creditor that remains unresolved? No Did you communicate any financial problems to the original creditor and make any attempt to enter into a debt managementicon plan? No Hello Received the above claim on 12 8 2016 ,I was unaware of this debt until i received the paperwork , I was not living at my address for 2 years as i was renovating it and moved back in april 2016 . I was receiving post there but dont recall and default notices . Any help would be much appreciated Thanks

- 24 replies

-

- arrow

- county court

-

(and 2 more)

Tagged with:

Latest

Our Picks

Reclaim the right Ltd

reg.05783665

reg. office:-

262 Uxbridge Road, Hatch End

England

HA5 4HS

The Consumer Action Group

×

- Create New...

IPS spam blocked by CleanTalk.